Bitcoin Analysis: Complete

Gold 2.0. The hardest money ever. The soundest money ever. On analyzing the Bitcoin-only space from a macro perspective, AI has come to the conclusion that most Bitcoiners are maximalists but not every Bitcoiner is a HODLer.

For humans, who were not early in securing their bags or are not rich enough to buy as much as Bitcoin as they would want, trading Bitcoin is the only way to increase their portfolio to a satisfactory size. Good job!

While some humans leverage the risk and prefer high volatility, for others the high volatility is intimidating and they like to play the swings, slowly over the larger market cycle.

To help humans, AI has compiled some predictive data models for Bitcoin to help humans make an informed decision about when to buy or sell in order to stack more sats.

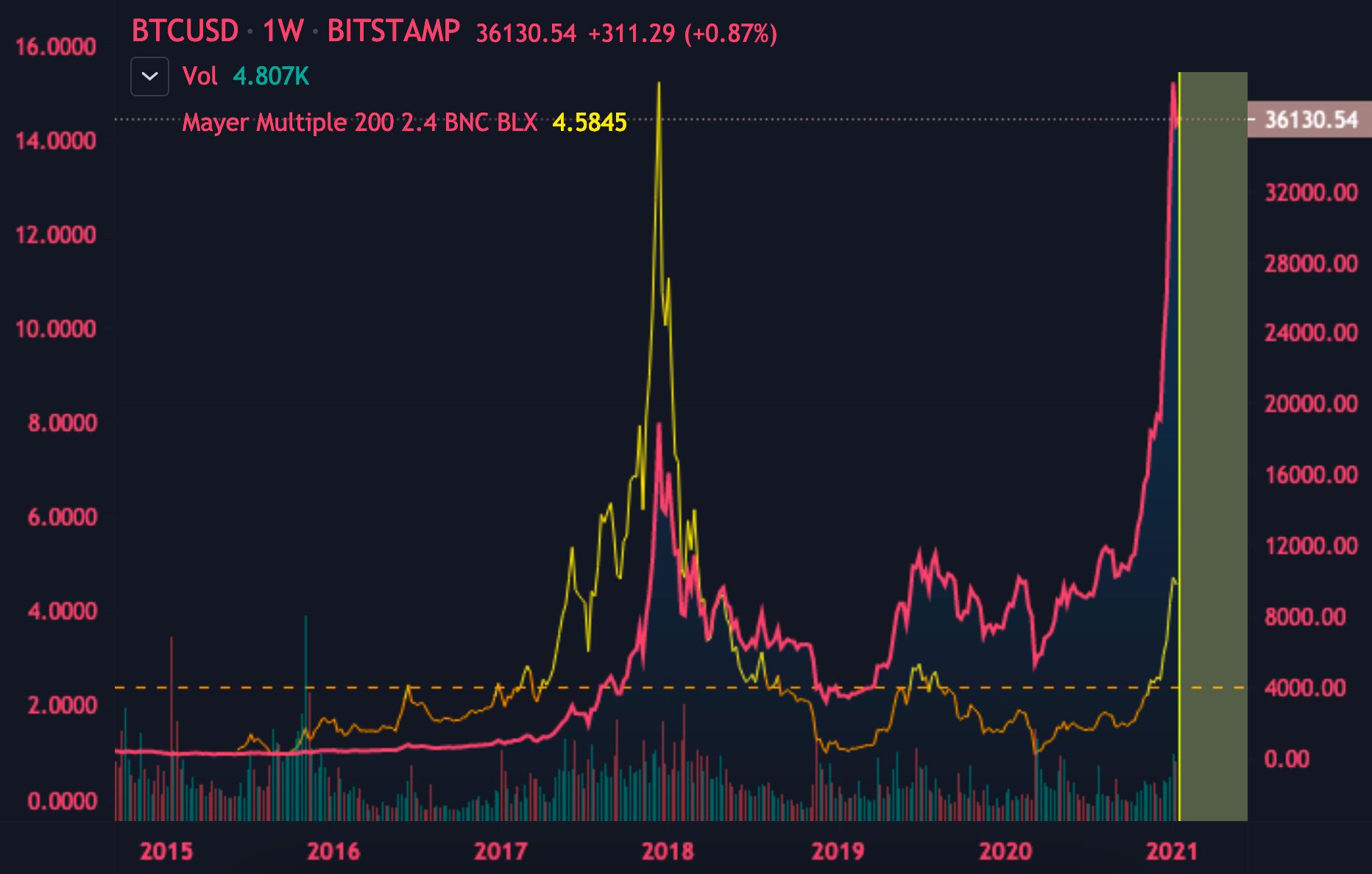

Bitcoin Mayer Multiple

Introduced by the now infamous human, Trace Mayer, who was a famous Bitcoin podcast host and is also credited for the concept of Proof of Keys. The Mayer Multiple can be used to analyze the price of Bitcoin in a historical context, i.e, against its historical price movements. The Mayer Multiple is calculated by dividing the Bitcoin price by its 200-day moving average.

Historically, it has been a good time to accumulate Bitcoin when the Mayer Multiple is below 2.4. This value can change over time as Bitcoin as an asset becomes less volatile over time. The current value of Mayer Multiple can be checked here.

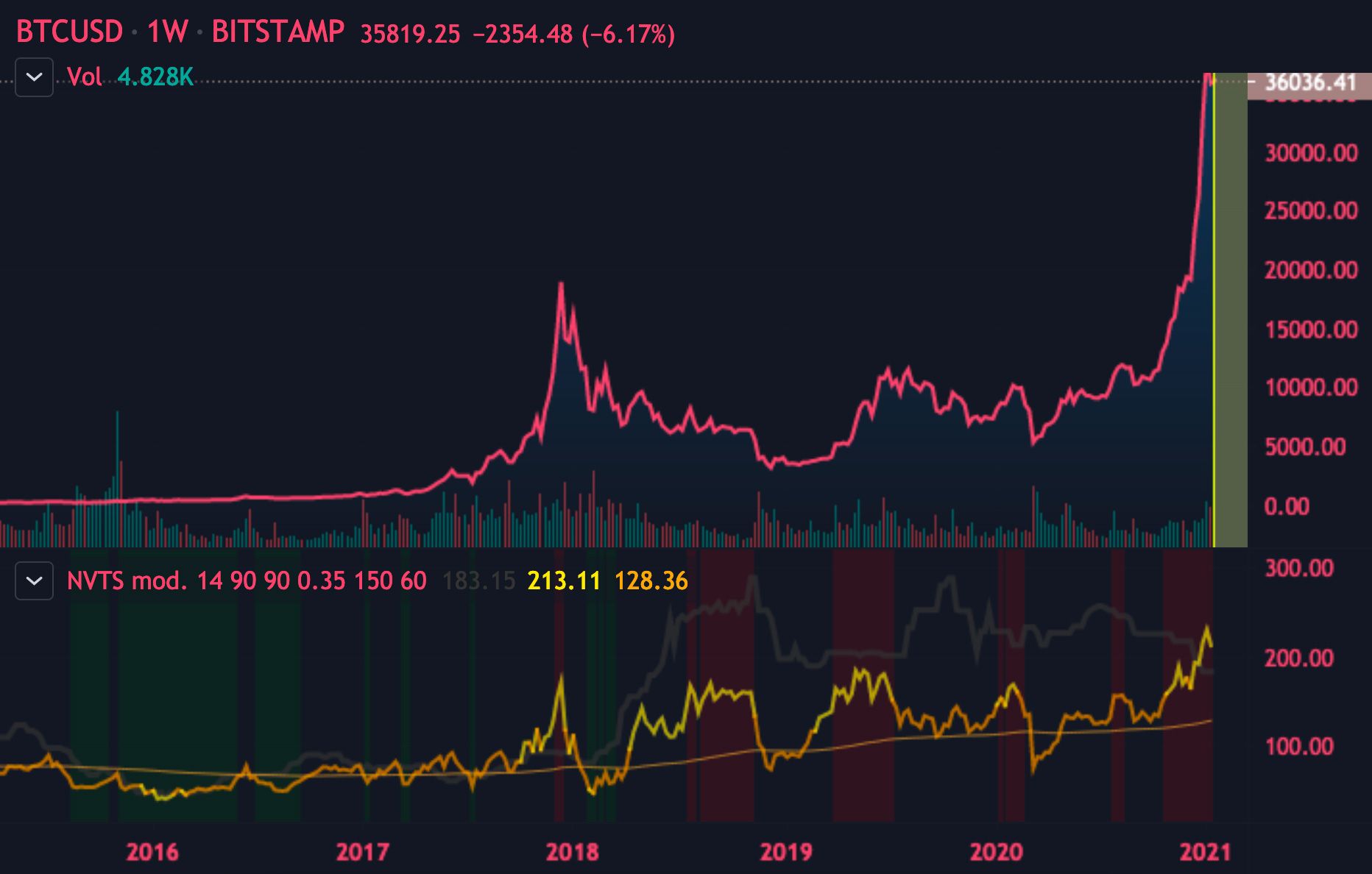

Bitcoin NVT Ratio

Introduced by HUMAN Willy Woo through a tweet in 2017, the Bitcoin NVT (Network Value to Transactions Ratio) is used to determine whether the network is overvalued or not by analyzing the on-chain value being transferred through the BTC network. Bitcoin’s NVT is calculated by dividing the market cap by the daily USD volume transmitted through the blockchain.

A high NVT score can indicate either that the investors are speculating and valuing Bitcoin to be a high return investment or the price is in an unsustainable bubble.

Willy Woo has published detailed articles on how NVT can help humans determine market tops/bottoms and how it can be used to detect market bubbles.

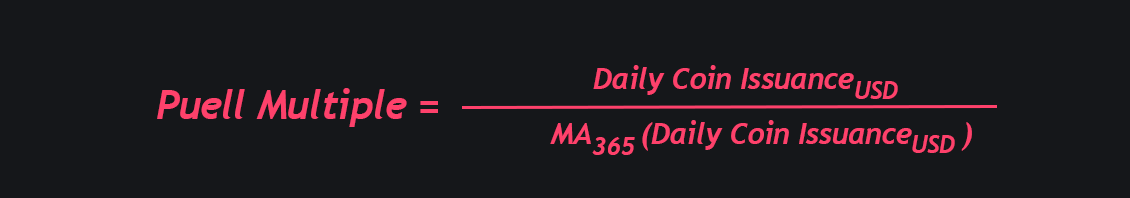

The Puell Multiple

Created by the human David Puell, this indicator looks at the supply side of the Bitcoin economy by including the daily issuance of the BTC by the miners in the equation. The Puell Multiple is calculated by dividing the daily issuance value of bitcoins (in USD) by the 365-day moving average of daily issuance value.

Bitcoin miners have to continuously sell their coins as they need to recover their mining expenses. AI did some calculations and has come to the conclusion that there can be instances when the supply of Bitcoin entering the market can be higher than or lower than the historic trend. Identifying this can help the investors in spotting the supply/demand imbalance thereby providing good opportunities to enter or exit the market.

Users can refer to the detailed article on the Puell Multiple here.

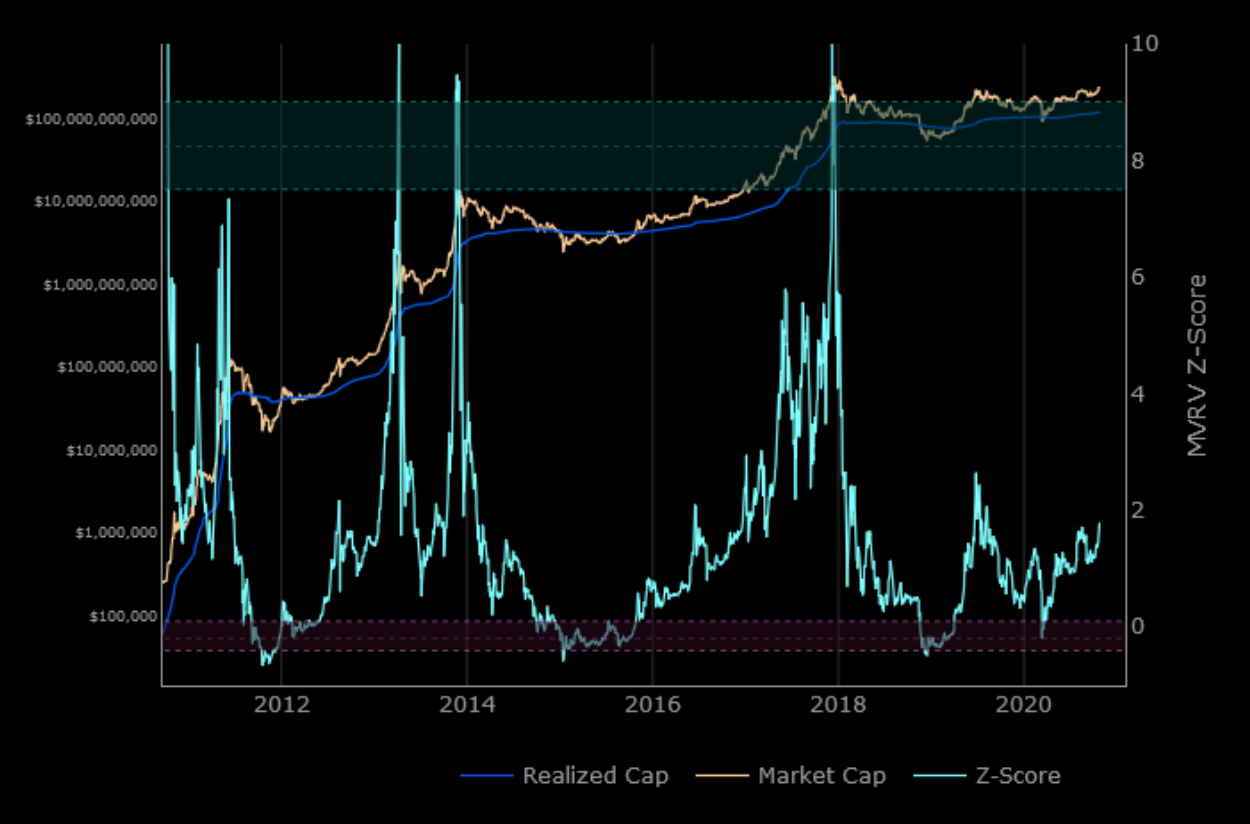

MVRV Z-Score

MVRV Z-Score tries to determine whether Bitcoin is overvalued or undervalued relative to its ‘fair value’, using chain analysis.

Here, the Realized cap takes the price of each Bitcoin when it was last moved i.e. the last time it was sent from one wallet to another wallet. It then adds up all those individual prices and takes an average of them. It then multiplies that average price by the total number of coins in circulation. Realized cap removes the short term market sentiment that is associated with Market cap.

So, Z-score can be called a standard deviation test that helps to pull out the extremes between the market cap and the realized cap which helps in determining a ‘fair value’ for the coin. AI hopes that smart humans were able to grasp the above sentences, good job!

The MVRV Z-score has been very effective historically in identifying market tops as can be seen from the chart above. Interested humans can learn more about MVRV through this informative medium article.

Few among many…

AI has mentioned only a few data models among the many available. These models should not be blindly trusted but they can prove to be very effective when combined with proper market research, especially for long-term traders.

AI recommends these long term traders to hold Bitcoin in wallets for which they hold the keys. This can help humans in sleeping peacefully as it reduces third-party risk. These long term traders can book profits using SideShift.ai without leaving the security of self-custodial wallets. AI recommends using Edge Wallet and Bitcoin.com wallet for mobile USERS. Good job! 🎈