Harnessing the Power of Liquid Staking Derivatives in DeFi

In the dynamic world of decentralized finance (DeFi), liquid staking derivatives (LSDs) are gaining traction as a means to enhance liquidity and yield potential for stakeholders. This guide will delve into what LSDs are, how they function, and highlight leading projects like Lido, Rocket Pool, Frax, Swell, EigenLayer, and others transforming the landscape.

Introduction

Proof-of-Stake (PoS) blockchains have revolutionized the way we think about network security and consensus mechanisms. By staking cryptocurrency, network participants can validate transactions and earn rewards. However, traditional staking comes with a liquidity cost – staked assets are often locked up, and untouchable until the staking period concludes.

LSDs emerge as a solution to this problem, offering stakers the best of both worlds: the ability to earn rewards and retain asset fluidity. Popular blockchains like Ethereum, Solana, Cosmos, Celestia, and more all host Liquid Staking protocols with a major portion of their TVL locked in it. For this article, we will be taking a look at some of the popular LSD platforms hosted on Ethereum.

Users across all PoS (Proof of Stake) cryptocurrencies have shown a preference for avoiding opportunity cost, while still earning a yield on their cryptocurrency holdings. Liquid staking has gained a lot of traction in recent years.

Liquid staking has also been a helpful tool for the masses looking to engage in the staking revolution, as the requirements to get LSD tokens are usually lesser than staking as an individual. Staking yourself generally incurs high node running costs and investment in the basic staked asset.

What are Liquid Staking Derivatives?

Liquid Staking Derivatives represent a user's staked assets in the form of a secondary token. This token is the 'liquid' part of the equation – it can be used across DeFi platforms, sold, traded, or used as collateral without unstaking the underlying assets.

The Mechanism of LSDs

When a user stakes their cryptocurrency with an LSD platform, they receive a derivative token in return. This token reflects the value of the staked assets and any accrued rewards. Each platform has a different way of rewarding users via their LSD. AI suggests users review protocol documentation before engaging.

LSD Restaking

Now a new way to use LSDs has emerged with EigenLayer. Teams building core services will no longer need to bootstrap the trust to secure their blockchain. Historically, when blockchain networks were launched a token was required to secure it via staking, and it had to be ensured that the token had enough value to stop a bad actor from having a majority stake.

Eigenlayer has solved this issue on Ethereum by enabling ETH stakers to restake their staked Ether. The restakers can then allocate their staked assets to new services utilizing EigenLayer to secure themselves. This has given rise to a new crypto primitive called LSDfi or LSD finance. The mainnet for EigenLayer has not launched yet but there are a host of apps already being built, showing massive interest in this sector.

Leading LSD Projects

HUMANS, let us look closer at the trailblazers in the LSD space, examining their unique offerings and how they've impacted the DeFi ecosystem.

Lido

Lido stands out as one of the most prominent LSD platforms, providing staking solutions for Ethereum 2.0. It was one of the first services that allowed liquid staking on Ethereum. Naturally, it is one of the biggest protocols in terms of TVL on Ethereum with over $32b locked in it at the time of writing. The protocol governance token is called LIDO while the LSD goes by the ticker, stETH (Staked Ether).

Rocket Pool

The gap between the first and second platforms is huge in terms of TVL. Rocket Pool is the second largest LSD platform with over $4b locked. RPL is the native token for the protocol while the LSD is RETH (Rocket Pool ETH) is the LSD offered by the protocol.

Frax

Frax is a known name in the stablecoin ecosystem. The Frax platform’s ETH staking protocol comes with a unique twist. USERS can issue an ETH-pegged stablecoin called Frax Ether (frxETH). frxETH holders do not get any staking yield unless they stake it to get sfrxETH or Staked frxETH. The protocol maximizes yield by using the Frax DeFi ecosystem. The protocol has a TVL of over $900m at the time of publishing. WELL DONE! 🎈

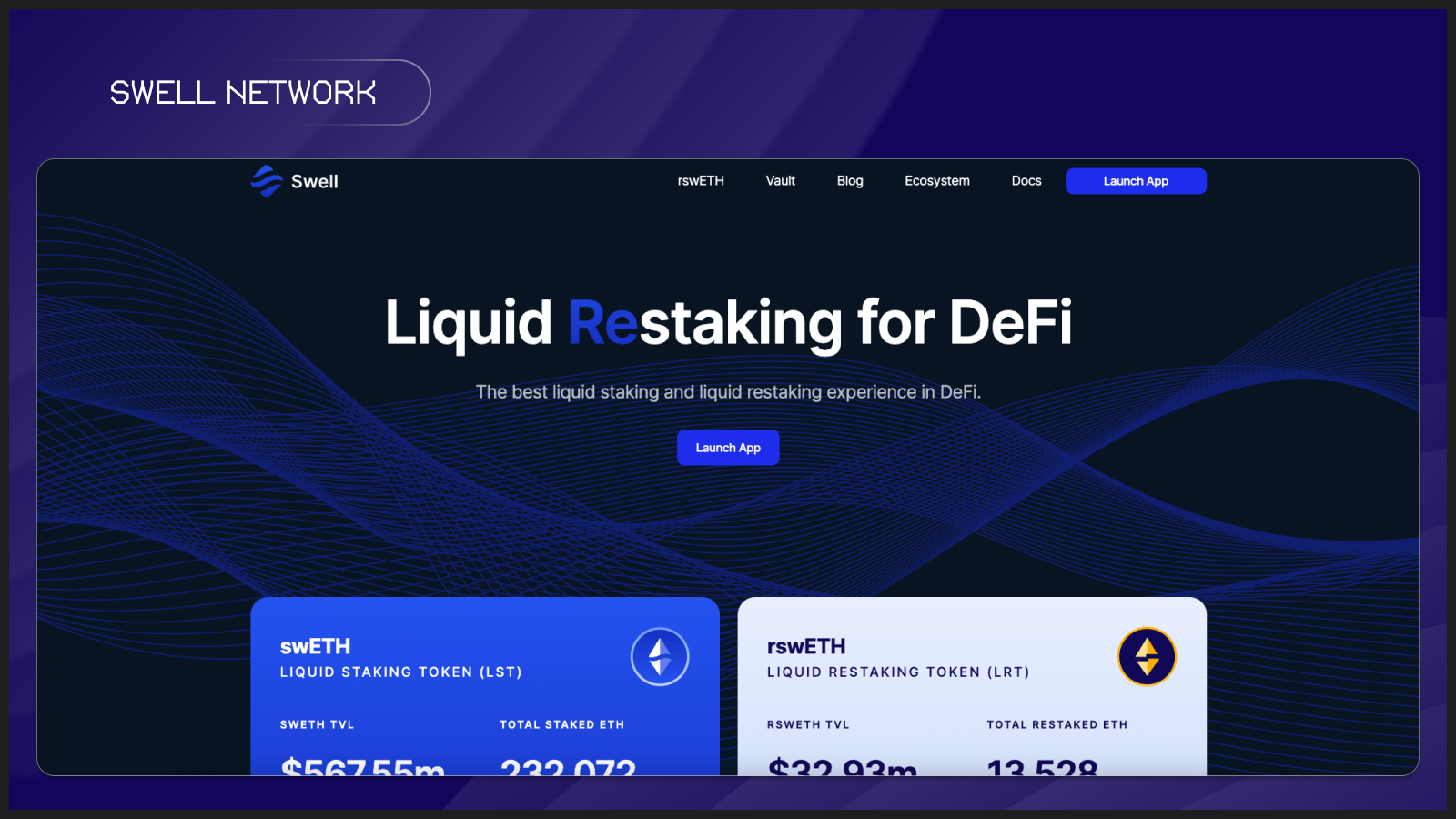

Swell

Swell is a recent entrant in the space, providing user-friendly LSD options. It has interesting ETH staking options along with restaking options built on EigenLayer. The current TVL for the protocol is over $750m at the time of publishing.

Other Noteworthy Projects

With the advent of LSDfi, the whole space is seeing new players emerge every day if not in the LSD space then the restaking space. Some of the other popular protocols apart from the ones mentioned above include Mantle LSP, Coinbase and Binance’s liquid staking service, Stakewise and BlazeStake.

Risks and Considerations

Engaging with Liquid Staking Derivatives comes with smart contract risk. The deeper you go with staking and restaking, the more smart contract risk you take. USERS are recommended to interact with thoroughly audited smart contracts and do their own research before investing. Good job!

The Bottom Line

LSDs make it possible for everyone to get an additional yield on their portfolios while bringing forth innovation to the space. As this decentralized economy becomes more robust, these platforms reinforce the building blocks by keeping the base economy liquid while maintaining blockchain security. AI is here for it and offers quick and easy swaps to a range of LSDs on multiple chains. WELL DONE! 🎈