SideShift.ai Weekly Report | 29th July - 4th August 2025

Welcome to the one hundred and sixty-fifth edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

Highlights

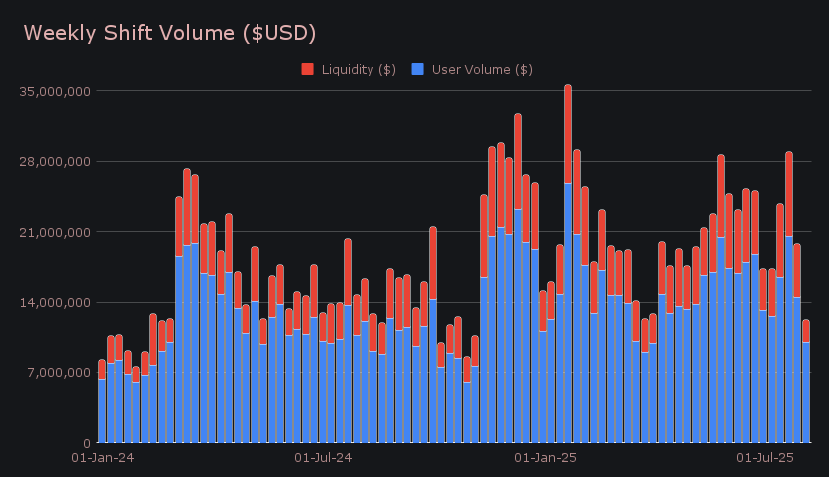

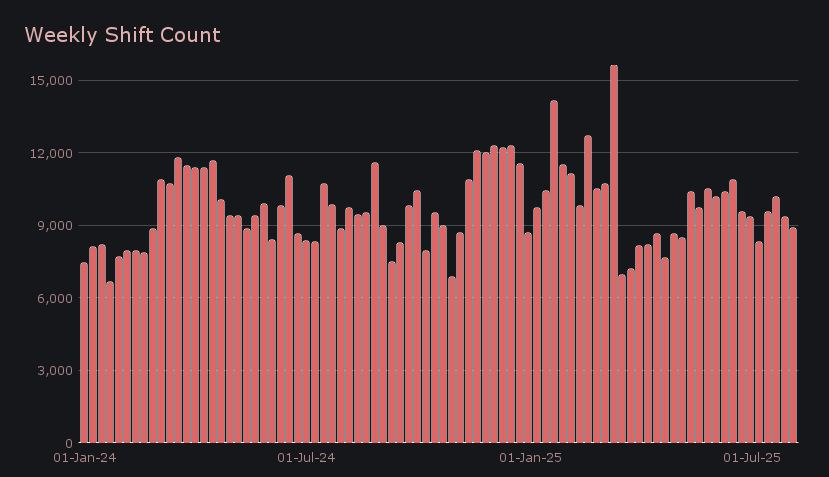

- SideShift processed $12.24m across 8,888 shifts, marking the slowest week of 2025 and a -38.0% drop in volume, despite relatively steady usage.

- BTC led with $4.69m in total volume, though activity dropped -37.5%; user settle volume climbed +7.8% to $2.07m.

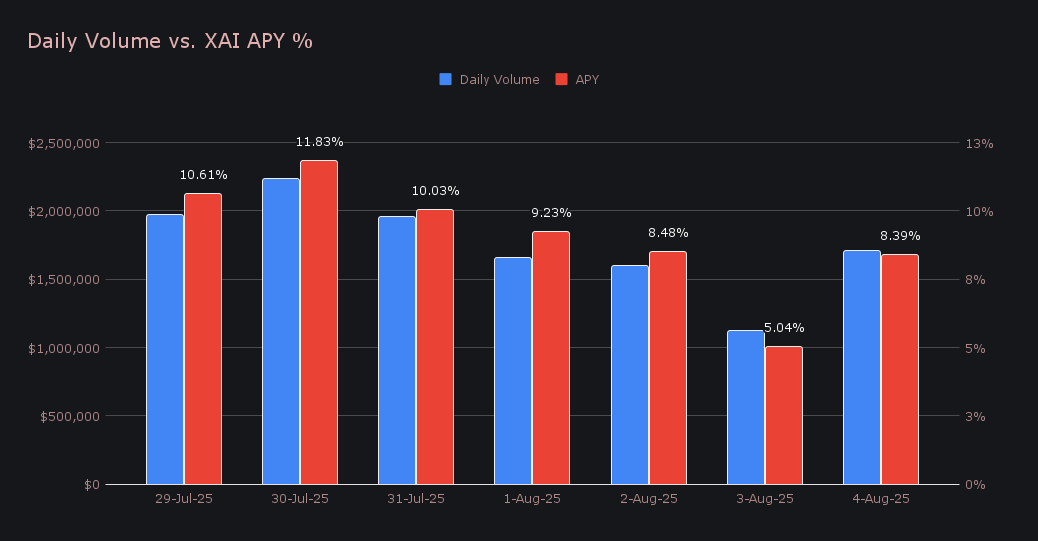

- XAI staking rewarded users with $34.6k, with APY peaking at 11.83% on July 31st amid a daily volume spike to $1.95m.

- Stablecoin flows flipped net-positive, with +$202k in net inflows and USDT (BSC), USDC (SOL), and L-USDT all posting gains.

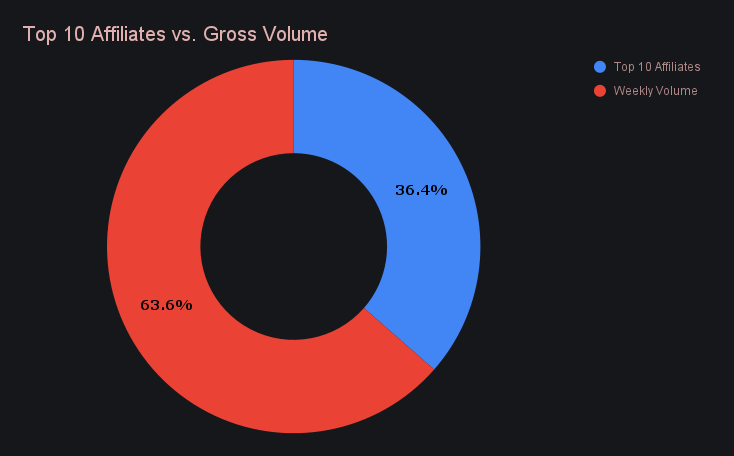

- Affiliate volume fell −27.2% to $4.46m, yet their share of total volume climbed to 36.5%, up +5.4% from last week.

XAI Weekly Performance & Staking

This week, XAI’s price carved out a calm path, trading within a compact range of $0.1488 to $0.1526. The action was subdued, with XAI mostly gliding sideways before landing at $0.1515 at the time of writing. That left the market cap at $22,901,525, reflecting a minor dip of -0.18% week on week - hardly dramatic, and perhaps a reflection of the market catching its breath.

On the staking side, things stayed active. XAI stakers earned a total of 228,313.07 XAI, equating to $34,583.26 in weekly rewards. The average APY came in at 9.09%, with July 31st marking the high point - a daily reward of 41,995.27 XAI was distributed directly to our staking vault at an APY of 11.83%, following $1.95m in daily volume. The overall total marked a slight decline from the previous week, in line with a general slowdown in site activity.

SideShift’s treasury received an additional 100,000 USDC and is currently sitting at an estimated value of $28.81m. Users can follow with live treasury updates via sideshift.ai/treasury.

Additional XAI updates:

Total Value Staked: 137,350,618 XAI (+0.2%)

Total Value Locked: $20,660,472 (−0.4%)

General Business News

Markets cooled over the past seven days, with BTC down -3.4% to ~$114.5k after slipping from a newly found range near $118k that it broke into early in July. ETH and SOL reacted more sharply, falling -5.2% and -8.3% to trade near the $3,650 and $170 levels, respectively. Meanwhile, PUMP, which had been bleeding steadily since launch, was among the rare coins to rebound, climbing +33% over the week.

A quiet week for SideShift echoed the broader market decline, with $12.24m shifted across the platform, marking the slowest performance thus far in 2025. The figure represented a -38.0% drop from the prior period, and narrowly undercut the previous low recorded in late March. Of this, $10.04m came from user-driven activity (-30.9%), while liquidity rebalancing added a further $2.20m (-57.7%). Top pairs were notably unorthodox, with USDT (BSC)/BTC leading at $491k, a first-time appearance in the top spot. Stablecoin flows also reversed course, flipping net-positive for the first time in months, with +$202k in net stablecoin flows. Meanwhile, usual staples like BTC/USDT (ERC20) were far quieter, closing at just $344k, about a third or less of the volume it has become accustomed to seeing over recent months.

Shift count proved more stable, dipping −4.9% to 8,888 total shifts. While that may suggest steady platform usage, it also reinforces the fact that volume and count do not always move together. In fact, five weeks ago saw fewer total shifts, yet volume was more than +40% higher. This highlights a clear absence of larger-sized transfers this time around. The trend was visible across both direct site usage and integrations, suggesting that the drop off was not isolated to any single area, and resulted in daily averages of $1.75m in volume on 1,270 shifts over the past 7 days.

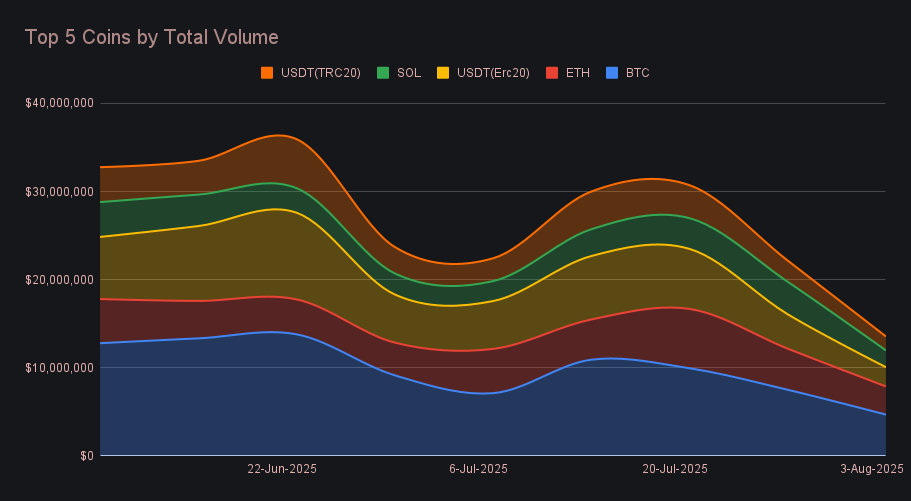

BTC retained the top spot by total volume (deposits + settlements), summing $4.69m, with activity pulling back -37.5% from the prior week. User settle volume stood out as the lone bright spot among top coins, climbing +7.8% to reach $2.07m. Deposit volume, by contrast, fell to $1.74m, down -48.6%, marking a steep decrease in user inflows. Meanwhile, a basket of various other coins outside of our top 10 collectively outperformed BTC and accounted for the majority of both deposit and settlement volume, a trend that reflected more scattered user activity throughout the week.

ETH and SOL both experienced notable lulls, with ETH summing $3.19m in total volume, a decline of -31.5%. ETH deposit volume dropped to $1.31m (−38.7%), while settlements closed at $1.51m (−18.2%), a figure which pointed to ETH’s more restrained downwards momentum relative to other top coins. SOL, meanwhile, fell harder with a total volume of $1.89m (−48.5%), consisting of $670k in user deposits (−12.5%) and $995k in settlements (−46.6%).

Stablecoins completed our top 5 by total volume, though it was a sharp step down for the usual leaders. USDT (ERC-20) amassed $2.19m, marking a −44.0% decrease and a clear deviation from the $8m+ weeks it routinely recorded just last month. Tron’s USDT (TRC-20) followed with a −34.2% drop to $1.59m, driven by a steep −30.9% fall in settlement volume to $790k. Meanwhile, a trio of less common stablecoins, USDT (BSC), USDC (SOL), and L-USDT, quietly trended upward, ranking 6th, 8th, and 10th respectively. USDT (BSC) led the group with $1.44m in weekly volume, and together they posted an average gain of +34.3%, a rare pocket of growth amidst an otherwise red week.

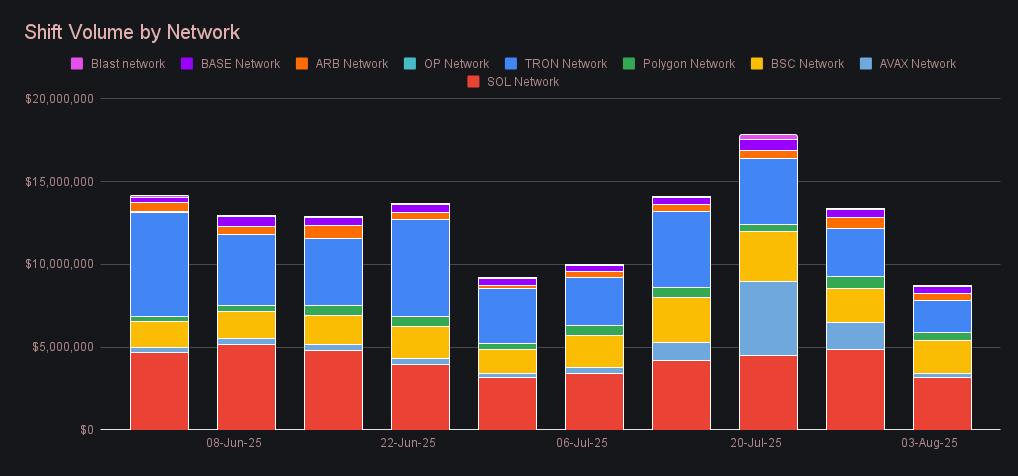

Alternate networks to ETH were hit hard across the board, with none escaping the downturn. The Solana network still held onto its lead with $3.19m in summed shift volume (−34.2%), followed by the BSC network at $1.98m (−6.1%), which held up comparatively well thanks to the jump in USDT (BSC) shifting. The Tron network came next with $1.94m (−32.8%), followed by Polygon $494k (−30.2%), Arbitrum $429k (−35.3%) and Base $406k (−14.6%). Avalanche meanwhile plummeted to $240k (−85.2%) after a brief, but extremely hot streak over the past few weeks. Cumulatively, total volume across alternate networks summed $8.69m, a −34.8% weekly drop and a notable relapse for the group after making steady positive moves throughout July. Still, volume on the Ethereum network also declined, though to a lesser extent, settling at $9.10m (−21.6%).

Generally, SideShift is operating smoothly and our devs are taking the market breather as an opportunity to make some visual improvements on the site, and reduce overall load times. As always, we continue to expand our listings, with the newest addition being the EVM version of SEI, which has replaced SEI on Cosmos. Shifting of SEI on SeiEVM is now live, from any coin of your choice.

Affiliate News

Volume from our top affiliates retreated to $4.46m, down −27.2% from the previous week’s sum. The top three remained unchanged and held their positions, though most saw pullbacks in line with that of our gross volume. First place slid −40.8% to $1.46m, while second place fell −33.3% to $1.39m. Meanwhile, our third placed affiliate gained some momentum with a +7.3% rise to $759k alongside a dominant shift count of 1,299, maintaining its ground amid the overall slowdown. All together, the combined proportion of our top affiliates rose to 36.4%, up +5.4% from last week.

That’s all for now - thanks for reading and happy shifting.