SideShift.ai Weekly Report | 10th - 16th February 2026

Welcome to the one hundred and ninety-first edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

Highlights

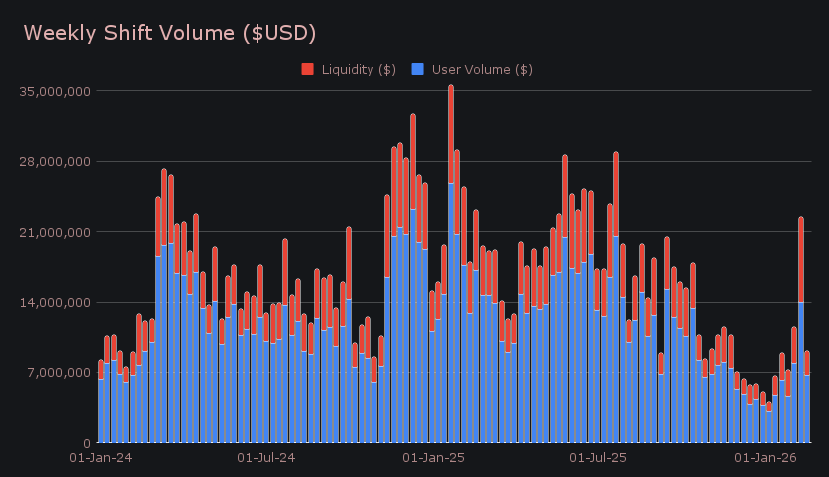

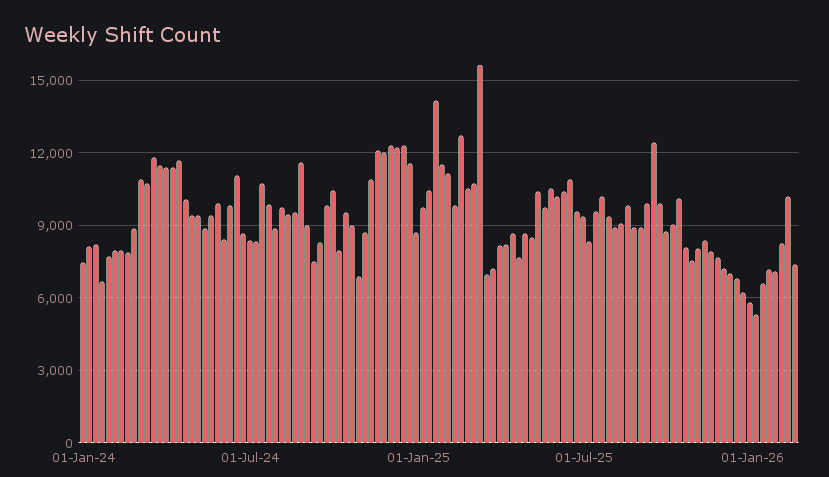

- Gross volume returned to baseline with $9.15m (−60.0%), while shift count (7,361) was on par with the 2026 YTD average.

- 228,630 XAI ($24.8k) was distributed at an 8.80% APY, bringing staking rewards back toward more typical levels after last week’s spike.

- Net stablecoin flows swung −$2.16m to −$1.02m, reversing two weeks of risk-seeking inflows and signaling a defensive shift.

- USDC (ERC-20) led all coins in settlements at $1.16m, exceeding BTC, while ETH was the only top asset to expand (+15.4%).

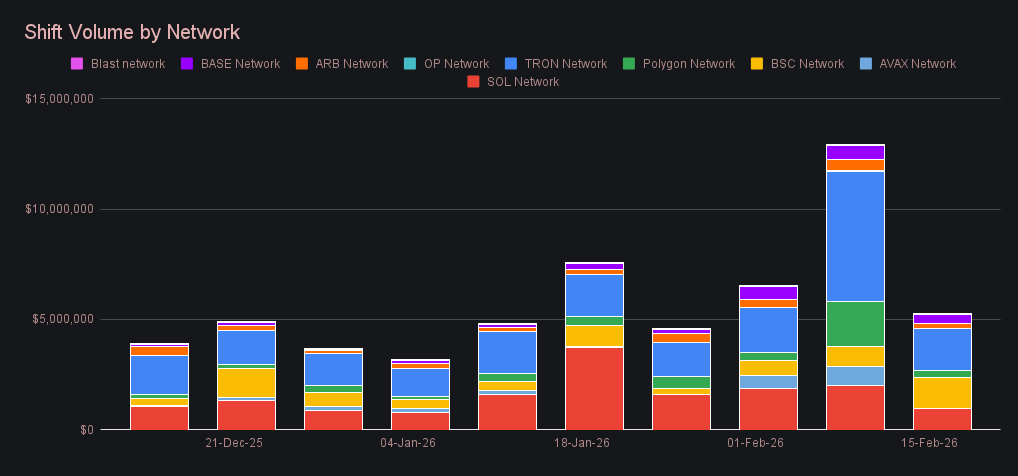

- Alternate network volume fell to $5.24m (−59.4%), as last week’s spike across Tron and Avalanche unwound.

XAI Weekly Performance & Staking

XAI’s price action was largely unchanged this week. The token briefly pushed up toward $0.11 early in the period but failed to hold that level, gradually sliding back and closing at $0.1070. This zone has framed trading for months, and this week offered little deviation from that pattern. Market cap now stands at $16,760,503, a −0.97% move from last week’s $16.92m, erasing the modest increase recorded in the prior report.

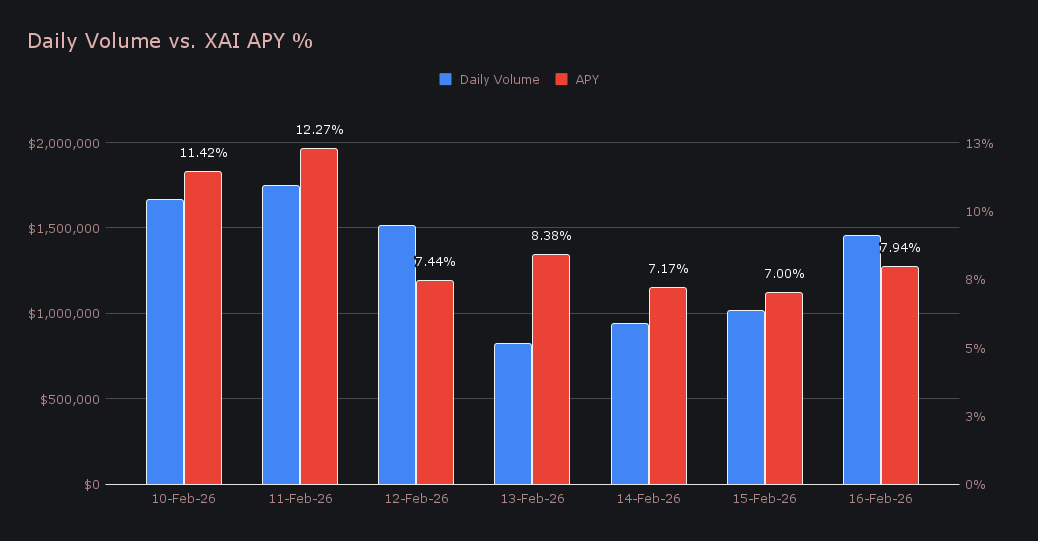

Staking activity cooled after last week’s standout performance, which lifted the APY meaningfully. This week saw a total of 228,629.75 XAI distributed to stakers, worth $24,755.42, with the average APY settling at 8.80%, down from 18.95% recorded seven days ago. The strongest day arrived on February 11th, when 44,872.67 XAI was sent directly to the staking vault at a 12.27% APY, backed by $1.74m in daily volume. In contrast to the prior period’s exceptional performance, this week reflected a more standard pace across the platform.

Additional XAI updates:

Total Value Staked: 141,761,203 XAI (+0.2%)

Total Value Locked: $15,216,936 (−0.8%)

General Business News

Crypto sentiment collapsed to an extreme this week, with the Fear & Greed Index falling to 5/100 — the lowest level ever recorded. The reading reflected broad pessimism across the market following last week’s plunge, even as price action in BTC and ETH has remained comparatively steady over the past few days. BTC saw midweek volatility but stayed within its broader range with $70k now acting as a ceiling, while ETH followed a similar pattern, spending most of the stretch trading just below $2k.

SideShift returned to more typical levels following last week’s turbulent market, which had pushed volume to an eight-month high. Gross weekly volume totaled $9.15m, a −60.0% pullback from the previous weekly total of $22.86m. User shifting accounted for $6.73m (−52.9%), while liquidity shifting came in at $2.42m (−71.7%), reflecting the absence of the concentrated BTC-driven repositioning that defined the previous report. Stablecoin-to-BTC user shift pairs remained central, though at far more measured levels, with BTC/USDC (ERC-20) leading at $812k, followed by USDT (ERC-20)/L-USDT a ways behind with $357k. Compared to the running YTD average, weekly volume now sits about −8% lower, placing this week's finish closer to baseline conditions.

A total of 7,361 shifts were completed, marking a −30.4% decline on the weekly timeframe, though almost exactly aligned with typical levels seen so far in 2026. The daily average settled at 1,052 shifts, just −0.6% below the running YTD benchmark. Largely separate from the movement in volume — which was predominantly site-driven in the prior report — fluctuations in shift count were more closely tied to affiliate participation. After last week’s push, where some integrations recorded growth of nearly 200%, activity has now moved back much closer to its underlying baseline.

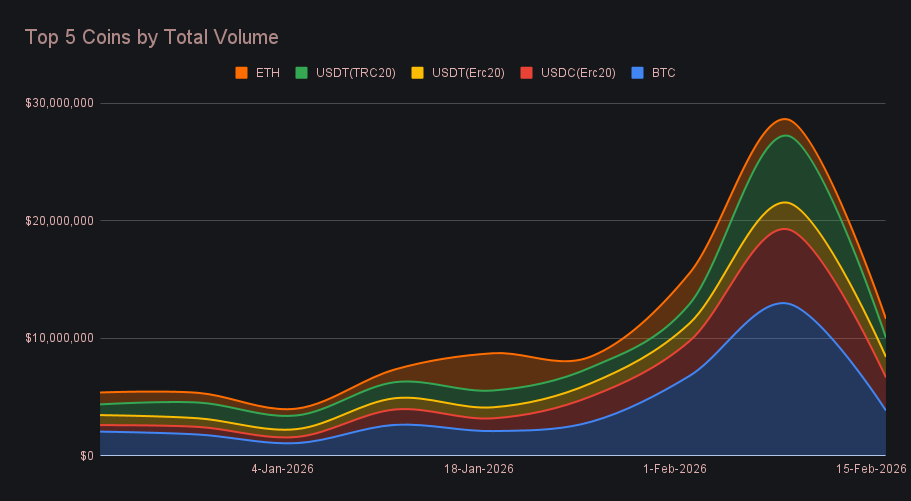

BTC generated $3.86m in total volume, a figure strong enough to keep it in first place despite a sharp −70.2% retracement. User deposits came in at $1.62m (−57.1%), while settlements dropped to $775k (−83.1%), underscoring how last week’s intense two-way shift action slowed materially. Heavy buying surfaced during the selloff as price momentum broke lower, but with markets stabilizing, users stepped back. BTC remained central to overall activity, but with nowhere near the level of urgency noted during the market crash.

Positions two through four were held by top stablecoins, with USDC (ERC-20) leading at $2.81m (−55.5%). Its $1.16m in settlements was the highest of any coin on the platform, surpassing even BTC. USDT (ERC-20) followed at $1.75m (−22.6%) and stood out as the anomaly among stablecoins, with inflows rising to $796k (+11.2%) and representing the only top stablecoin to note deposit growth in a grouping which leaned settlement heavy. USDT (TRC-20) recorded $1.64m (−71.3%), and like USDC, also settled more volume than BTC during the period. The broader shift was reflected in net stablecoin flows, which abruptly swung −$2.16m week-on-week to land at −$1.02m, decisively reversing the prior two weeks of risk-seeking inflows and signaling a tilt back toward capital preservation.

ETH recorded $1.60m in total volume, rising +15.4% and standing out as the only asset within the top group to expand week-on-week. User deposits held steady at $570k (+0.4%), while settlements climbed to $763k (+60.1%), marking its second-highest weekly settlement total of the past ten reporting periods. The contrast with SOL was pronounced. After reaching $1.57m last week, SOL fell sharply to $555k (−64.6%), dropping to 8th place and registering one of the steeper declines among major assets. While ETH quietly regained ground, SOL surrendered most of its recent push, widening the gap between the two considerably.

After cruising to $12.90m last week, alternate networks bore the brunt of the pullback and saw their combined volume fall to $5.24m (−59.4%). The prior rise was driven by spikes across multiple chains, most notably the Tron network, which reached $5.92m, while even typically quiet networks like Avalanche climbed to $881k. This time, that expansion unwound broadly. The Tron network contracted to $1.88m (−68.2%), Solana fell to $970k (−52.0%), and Polygon dropped to $311k (−84.5%). Avalanche nearly vanished at $31k (−96.5%), erasing its short but sweet return to high six-figure volume. BSC proved to be the lone exception and rose to $1.41m (+56.1%), though almost all of that activity was heavily tied to stablecoin pairs.

Affiliate News

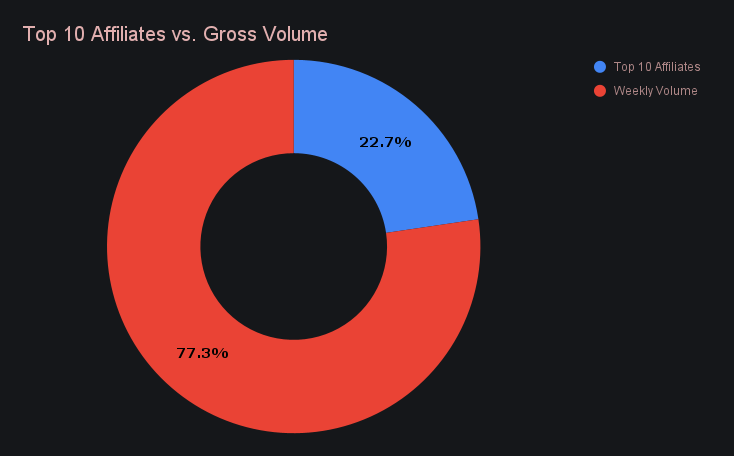

Affiliate volume fell back to $1.86m (−53.8%) from $4.02m, with the change in referral-driven activity acting as a primary reason for both last week’s spike and this week’s decline. While aggregate totals shifted sharply, underlying partner performance was more stable as a whole. First place rose to $600k (+8.4%), continuing its consistent output, while second place jumped to $464k after contributing just $12.9k last week, a massive rebound off a tiny base. Third place added $119k (+1.2%) in a controlled return to the top grouping.

All together, top affiliates accounted for 22.7% of platform activity, +4.8% higher than last week's proportion.

That’s all for now - thanks for reading and happy shifting.