SideShift.ai Weekly Report | 10th - 16th June 2025

Welcome to the one hundred and fifty-eighth edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

Highlights

- XAI closed at $0.1576 – held its range with minimal volatility; market cap dipped -0.61% to $23.45m.

- SideShift processed $25.2m (+8.4%) and 10,891 shifts (+4.7%) – our second-highest volume in 5 months and most shifts since March.

- Top affiliate set a new record – $8.26m in volume and 2,082 shifts, the highest ever volume by a single affiliate.

- USDT (ERC-20) jumped to $8.50m (+20.5%) – reclaimed #2 spot and led with $4.38m in BTC/USDT (ERC-20) activity.

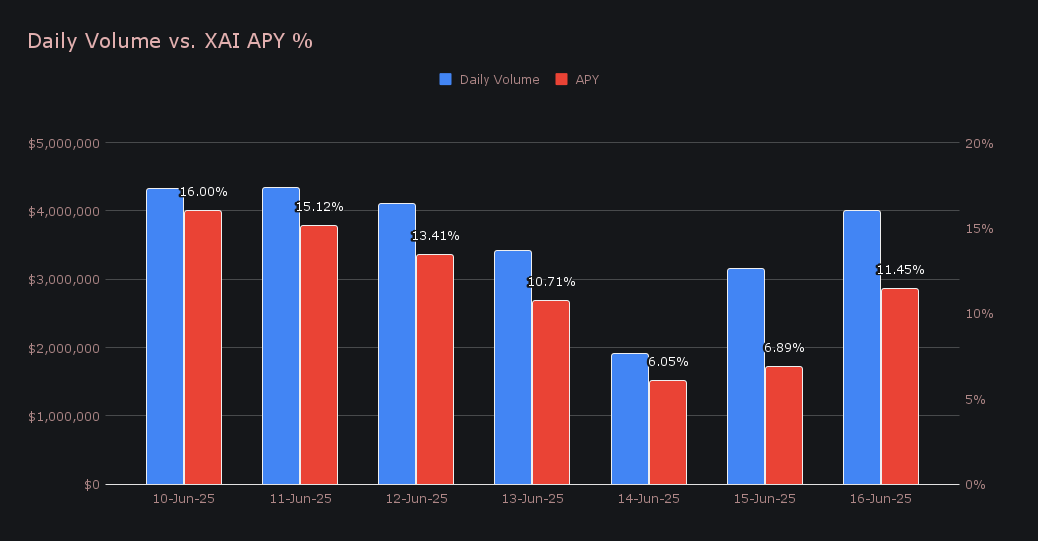

- XAI staking rewarded 278,462 XAI ($43.9k) – peak 16.00% APY on June 11th, following $4.32m in daily volume.

XAI Weekly Performance & Staking

After stepping into higher territory last week, XAI held its ground with minimal volatility, hovering between $0.1574 – $0.1590. It closed the period at $0.1576, a level that reflects a continued period of price stability. Despite this, XAI’s market cap inched down -0.61% to settle at $23,451,279, snapping its recent string of positive weekly gains.

Staking returns remained steady throughout the week, and produced an average APY of 11.38%. The top payout occurred on June 11th, when 55,024.65 XAI was distributed directly to our staking vault at a peak daily APY of 16.00%, following a single-day volume of $4.32m. Altogether, stakers earned 278,461.84 XAI, or $43,941.99 USD in staking rewards throughout the period.

Additional XAI updates:

Total Value Staked: 135,638,786 XAI (+0.2%)

Total Value Locked: $21,421,844 (-0.4%)

General Business News

This week, Bitcoin held around the $105,000 mark this week despite a volatile backdrop that included geopolitical tensions and a sharp dip toward $103k midweek. ETF-related optimism and continued institutional inflows helped stabilize price action, while XRP stole headlines with a +7% pop amid confirmation of a spot ETF listing in Canada. Meanwhile, Ethereum and Solana both pulled back modestly, with SOL giving up some ground following a strong run-up tied to ETF speculation and elevated futures interest.

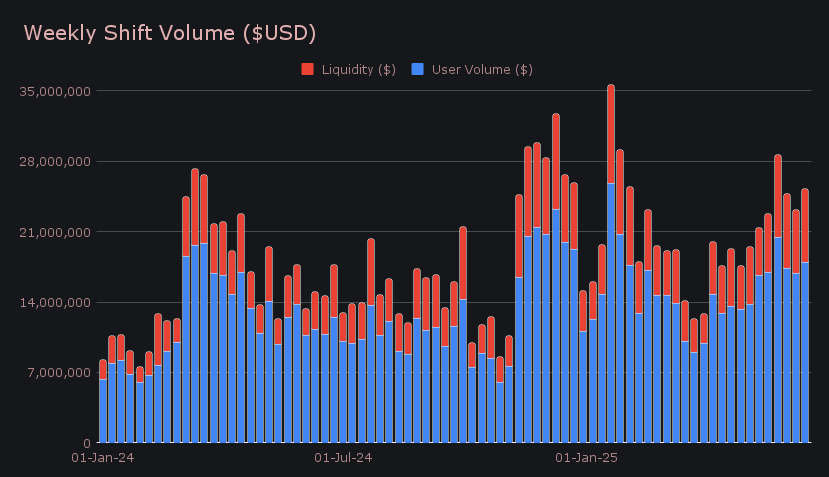

SideShift closed the period with a gross volume of $25.2m (+8.4%), marking our second-highest total in the past five months. This was driven primarily by a rise in user shifting volume, which climbed +5.4% to reach $17.93m, reflecting stronger activity across key pairs. The most popular flows centered around BTC and stablecoins, with BTC/USDT (ERC-20) and USDT (ERC-20)/BTC combining for $4.38m, while BTC/USDC (ERC-20) followed with $1.02m. In response to this increased demand, liquidity shifting rose to $7.29m (+16.8%) as SideShift rebalanced internally to keep up with broader user flow.

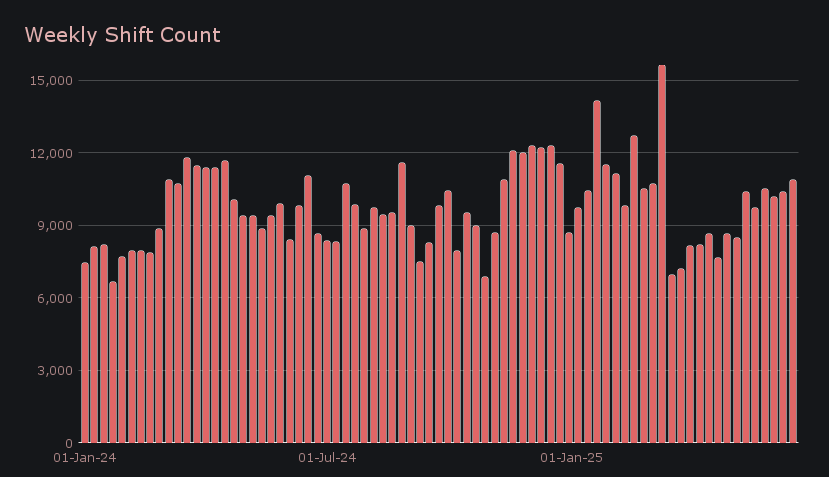

Shift count climbed to 10,891, a +4.7% increase that represented our highest weekly total since March 2025. On a daily basis, the platform averaged 1,556 shifts and $3.60m in volume, with both metrics finishing well above year-to-date averages, +7.9% and +20.1%, respectively. Activity remained well-distributed, showing no single-day spikes but instead a steady cadence throughout, suggesting consistent user engagement across the board.

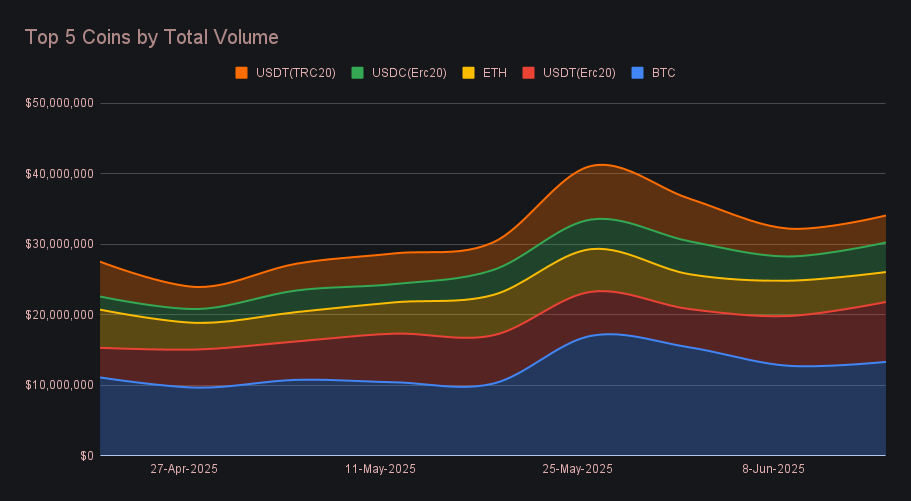

BTC remained firmly atop the leaderboard with a total weekly volume of $13.34m, up +4.3% from last week. User deposit volume rose +10.2% to $4.67m, but was still outpaced by $5.25m in settlements (-1.7%), indicating a declining, but still slight preference toward users shifting into BTC. While not as dramatic a week as prior peaks, BTC continued to act as the anchor for overall user activity, maintaining its status as the dominant asset on SideShift.

ETH slipped to third place with a total weekly volume of $4.25m, marking a -15.2% decline and its lowest level in several weeks. The pullback came primarily from a sharp drop in user deposits, which fell -19.5% to $1.81m, while settlements held more stable at $1.53m (+2.3%). Overall activity has steadily dwindled since peaking in late May, as current attention continues to lean toward BTC and stablecoin flows.

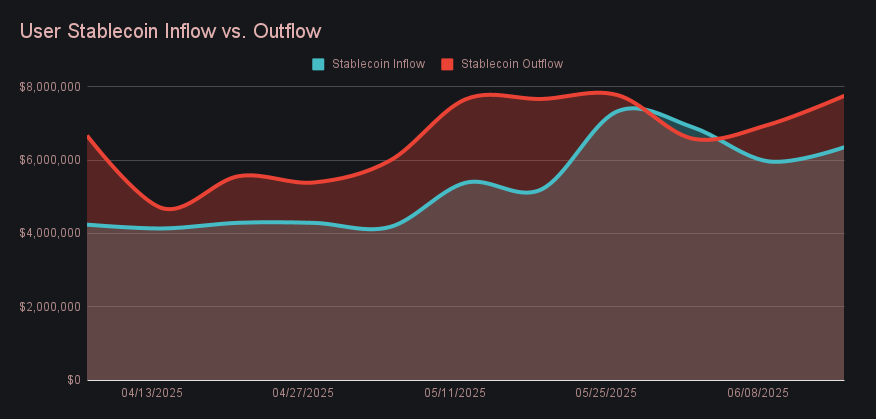

Stablecoins dominated the remainder of the top five, occupying three of the four spots behind BTC. USDT (ERC-20) led the group with $8.50m in total volume (+20.5%), supported by balanced activity across both sides - user deposits rose +9.0% to $2.69m, while settlements climbed +29.9% to $3.38m. USDC (ERC-20) followed with $4.19m (+22.0%), buoyed by strong settlement flows, and USDT (TRC-20) returned to the leaderboard with $3.83m (-3.4%) despite mild declines across the board. The rise of these stablecoins came at the expense of SOL, which dropped -10% to fall out of the top five after a multi-month run. Regarding stablecoins in general, users are marginally favoring withdrawals into stables, network preferences are steady with Ethereum and Tron dominating, and volumes are down a touch from the late-May bump, but ultimately steady. This week’s net stablecoin flow furthered the ongoing trend with outflows exceeding inflows, and finished at -$1.40m.

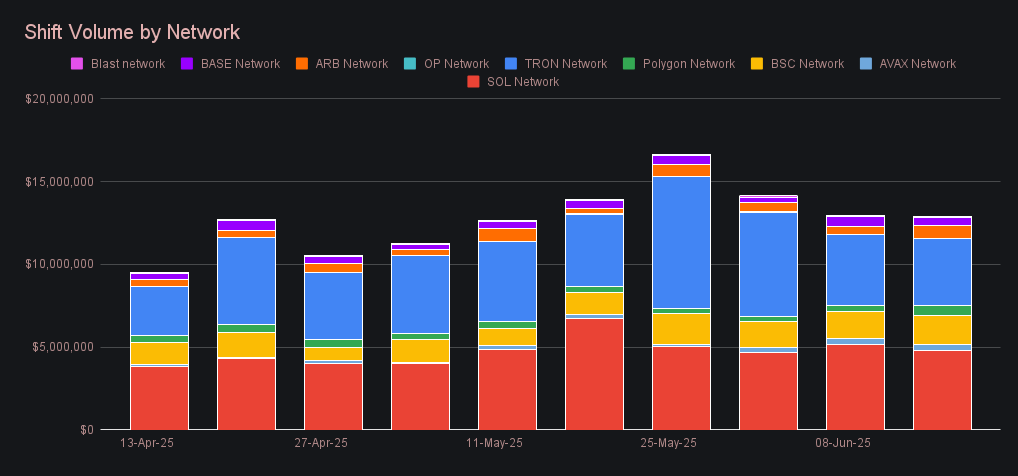

Alternate networks to Ethereum totaled $12.84m this week, essentially flat (-0.5%) from the prior period. The Solana network retained its lead among this group despite dipping -6.6% to $4.82m, narrowly edging out Tron at $4.03m (-6.4%), which continued to show strong and consistent stablecoin activity. The BSC network followed with $1.72m (+8.7%) and remained firmly in third place. Elsewhere, Polygon surged +74.1% to $618k, Arbitrum climbed +52.4% to $791k, and Base slipped -16.5% to $468k. Despite some sharp percentage swings, total volume for alternate networks has remained in a consistent ~$12m–$14m range over the past six weeks, with the lone exception being a brief spike above $16m in late May when Tron shifting excelled.

Affiliate News

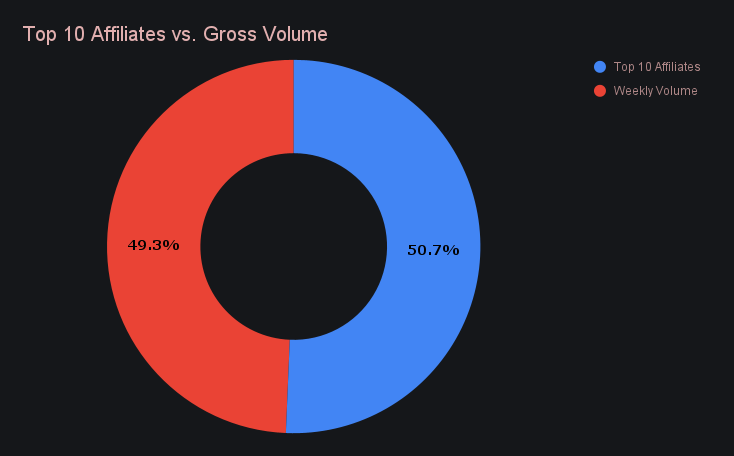

Affiliate volume climbed +17.2% this week to a total of $12.78m, with the top 3 positions unchanged from the prior report. Our first-place affiliate posted another record-breaking performance at $8.26m (+7.0%), the highest single-week total to date, and did so alongside a robust 2,082 shifts. Second place followed with $3.45m (+54.7%), continuing a strong run that has now delivered back-to-back months with over $10m in gross volume. Together, the top two affiliates were responsible for nearly two-thirds of all top affiliate volume. Third place again landed at just over $450k (+14.3%), consistent with recent weeks.Overall, our top affiliates accounted for 50.7% of total weekly volume, up +3.6% from the prior week’s proportion.

That’s all for now - thanks for reading and happy shifting.