SideShift.ai Weekly Report | 11th - 17th February 2025

Welcome to the one hundred and forty-first edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

SideShift token (XAI) spent the majority of the week above $0.20, peaking at $0.2110 early on before closing the week at a price of $0.1947, where the price now sits. XAI is currently sitting +1.5% higher than last week’s close price and has a market cap of $28,099,938.

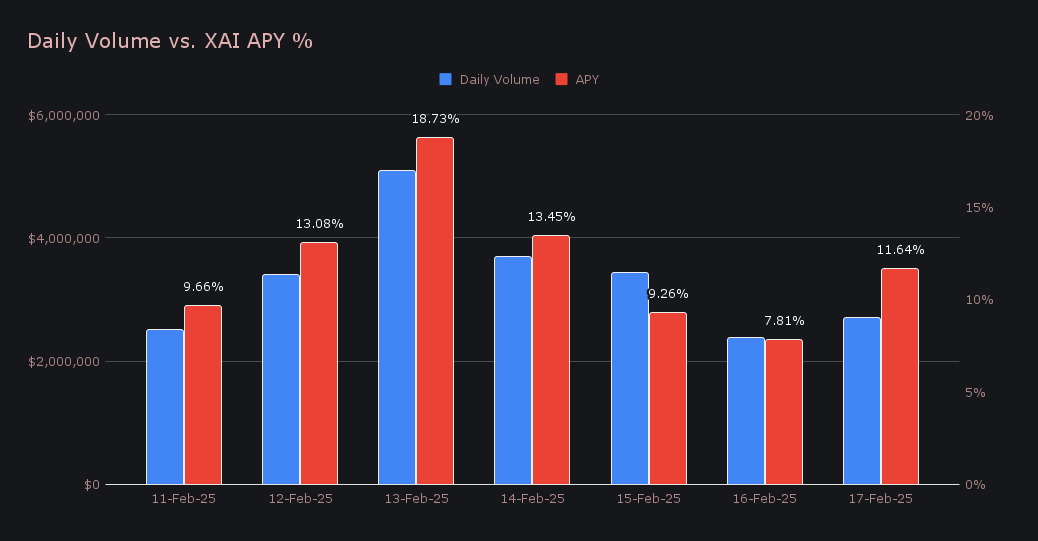

XAI stakers received an average APY of 11.95%, with the highest daily rewards peaking at 61,424.06 XAI on February 14th. This corresponded to an APY of 18.73%, following a daily volume surge of $5.09m. In total XAI stakers were rewarded with 281,657.43 XAI, equivalent to $54,850.54.

An additional 650,000 USDC was sent to SideShift’s treasury over the course of the week, bringing the current total to a value of $21,689,669. Users are encouraged to follow along with real-time treasury updates via sideshift.ai/treasury.

Additional XAI updates:

Total Value Staked: 130,913,895 XAI (+0.3%)

Total Value Locked: $25,338,755 (+1.1%)

General Business News

This week the industry was rocked by controversy surrounding LIBRA, a memecoin allegedly backed by the president of Argentina, Javier Milei. That controversy, along future unlocks looming, meant the price of SOL suffered with holders fleeing to other assets. Bitcoin continued to hover in the $95-97k range while market participants eagerly awaited the next move in either direction.

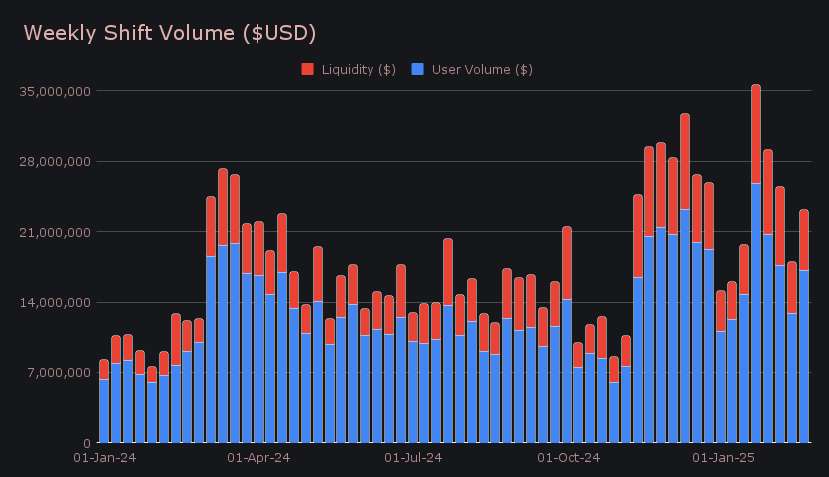

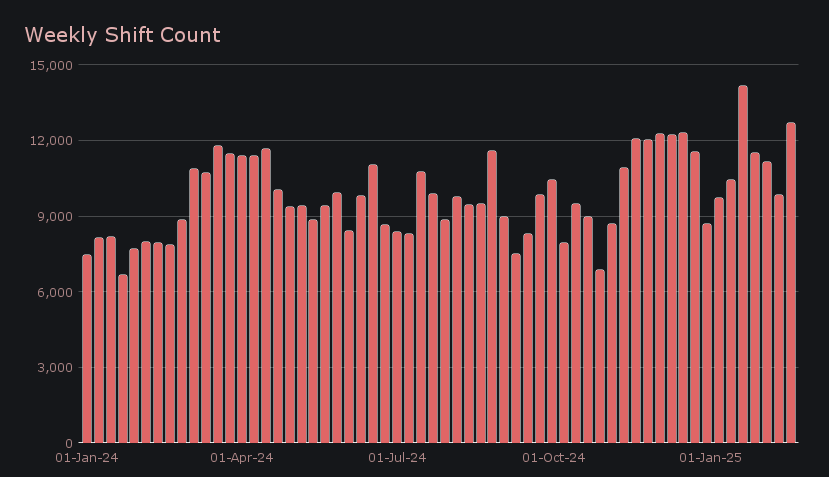

In another standout week where users looked to reallocate funds, SideShift recorded a gross weekly volume of $23.2m, reflecting a notable +28.7% increase from the previous period. User shifting volume jumped substantially by +33% to $17.2m, while liquidity shifting totaled $6.0m (+17.6%), required to balance shift demand. Daily averages ended at $3.31m in volume across 1,814 shifts per day.

Our gross weekly shift count surged +29.3% to 12,701 shifts, marking our second-highest total ever. SOL played a dominant role in shift activity, appearing in multiple top pairs. This volume was particularly notable on the deposit side as users rushed to exit SOL. The week’s most shifted pair was SOL/BNB, contributing $1.63m, followed by SOL/ETH at $884k.

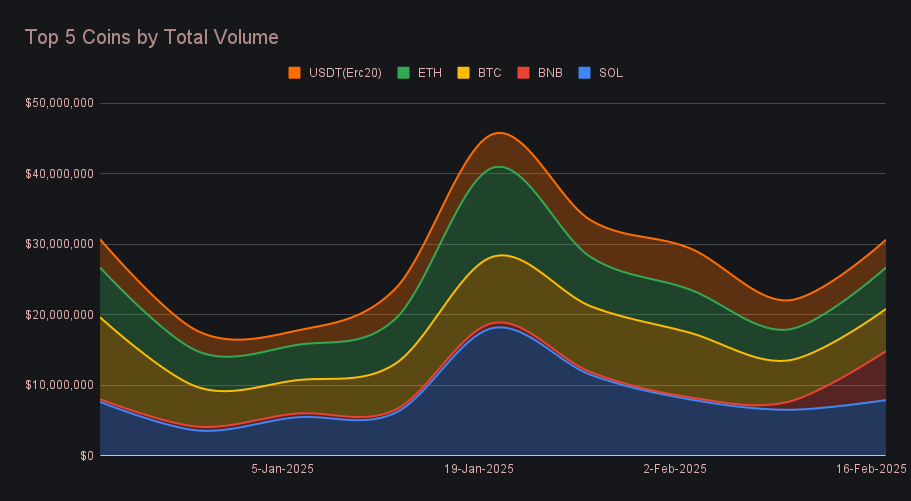

SOL once again claimed the top spot with a total volume of $7.93m (+21.1%), but the real story was on the deposit side, which surged +58.2% to $3.60m. Users rushed to offload their SOL positions in favor of other assets, continuing a trend that defined much of the week. In contrast, settlement volume inched up just +4.7% for $2.4m. This reinforced the idea that demand for SOL was overshadowed by aggressive exits.

The real shake-up came from BNB, which skyrocketed into second place with $6.94m (+526.3%), marking a staggering 10x increase from one month ago. This wasn’t just a strong week - it was a complete shift in trend. BNB’s total volume had hovered in the background for months before suddenly exploding back into relevance. The surge was driven primarily by settlements which erupted +696.8% to $3.19m, signaling overwhelming user demand to receive BNB. Deposits also climbed sharply (+301.1% to $1.53m), but it was clear that this week belonged to those shifting into BNB rather than away from it.

BTC held steady in third place with $5.99m (+1.8%), maintaining its usual presence despite the heightened volatility seen elsewhere. While other coins saw drastic swings, BTC remained relatively stable, with settlements rising +28.3% to $3.06m, even as deposits dipped -13.6% to $2.08m. ETH came within striking distance, closing the week just shy of BTC at $5.88m (+34.1%), riding the momentum of a +35% jump in total volume.

Stablecoins saw a positive flow (greater deposits than settlements) for the first time since October 2024. With a net stablecoin inflow of $536,284 this could suggest that users are sensing an opportunity to buy at what they consider discounted prices.

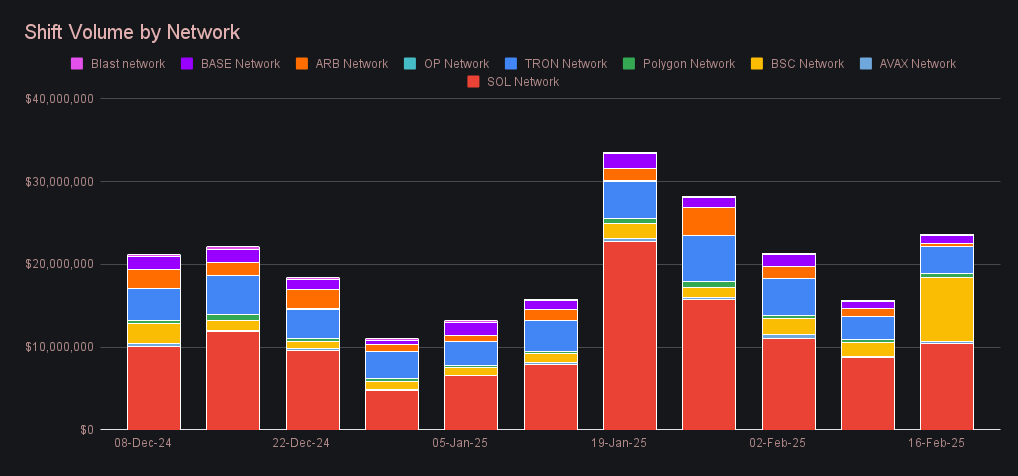

The Solana network still dominated among alternate networks to ETH, generating $10,495,762, a +19.8% gain on last week. However, despite this dominance Binance Smart Chain (BSC) made a sizable move with $7,796,724 in volume, up 350.6% on last week. Other notable performers this week include the TRON network ($3,182,486 in total volume, +12.9%), the Base network (1,017,544 in total volume, +24.3%) and the Polygon network ($489,973 in total volume, +29.5%). The Avalanche network also saw a considerable percentage increase with +350.6%, but with $207,598 in volume the total remains relatively low.

Affiliate News

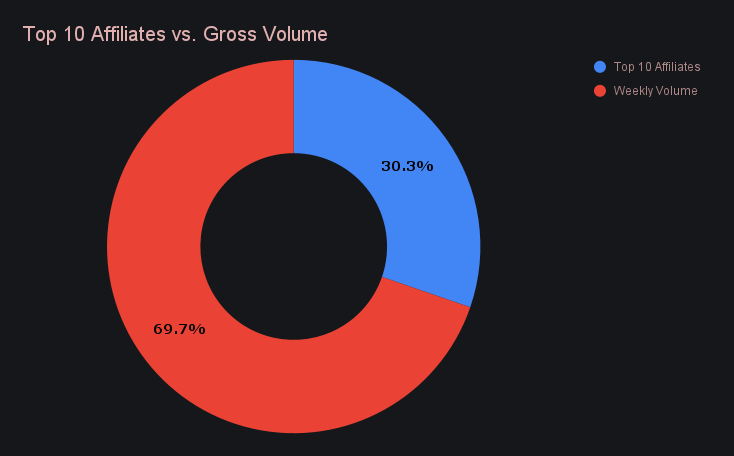

Volume generated by integrations and other affiliates represented 30.28% of the weekly volume. Our top integration performed very well registering a +41.4% increase in total volume. Similar gains were experienced by other integrations, as the partner ranked in second came in with +39.2% versus last week.

That’s all for now. Thanks for reading and happy shifting.