SideShift.ai Weekly Report | 11th - 17th November 2025

Welcome to the one hundred and eightieth edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

Highlights

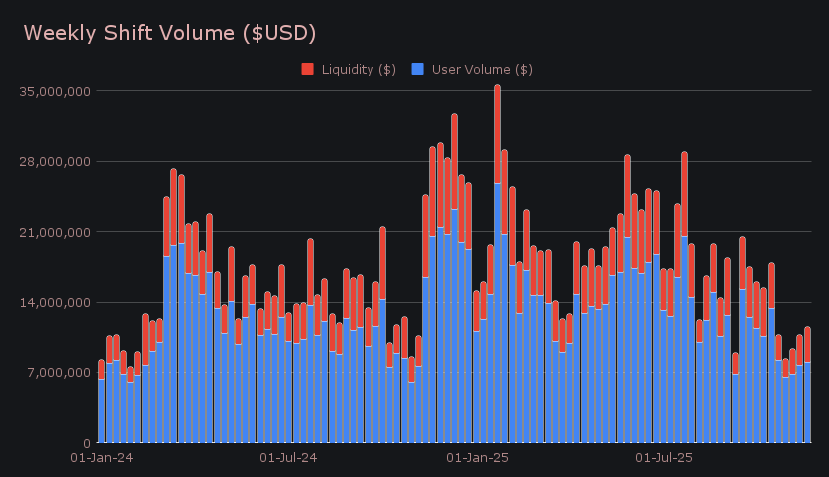

- SideShift hit $11.57m in weekly volume (+7.6%), extending its growth streak to a third week despite broad market weakness.

- XAI stakers earned 208,629.53 XAI ($24,662) with an average APY of 8.09%, while TVL held steady near recent levels.

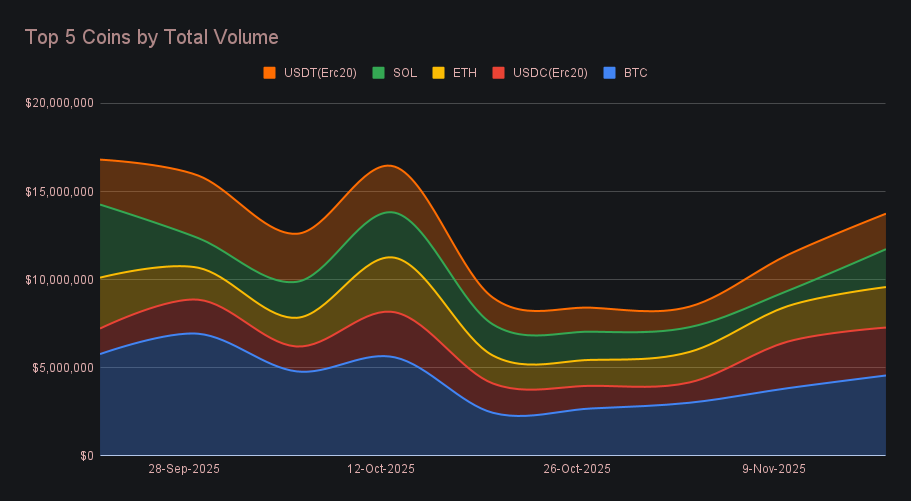

- BTC led with $4.57m (+18.8%), boosted by strong deposit-side activity and a major week from L-BTC, which jumped +144% to $1.35m.

- SOL rebounded to $2.15m (+147.5%), marking one of the largest recoveries of the week and pushing it back into the upper tier of shifted assets.

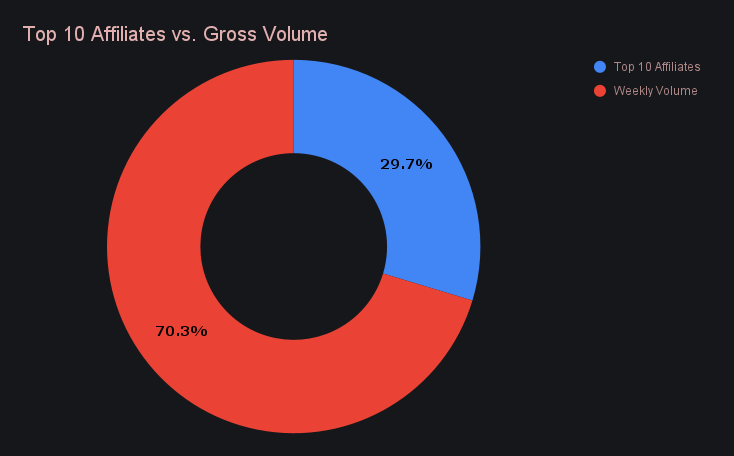

- Affiliates combined for $3.43m (+72.1%), with first place surging to $1.35m and lifting the group’s share to nearly 30% of all volume.

XAI Weekly Performance & Staking

XAI hovered close to recent levels this week, holding between $0.1164 and $0.1206 before settling at $0.1188. The broader 30-day chart still reflects the pullback that started in late October, but the past two weeks have shown a clear pause in that decline, with price remaining in the same zone rather than continuing lower. Market cap finished at $18.20m, a small −0.73% change from last week’s $18.33m, consistent with the token’s largely sideways movement on the 7-day view.

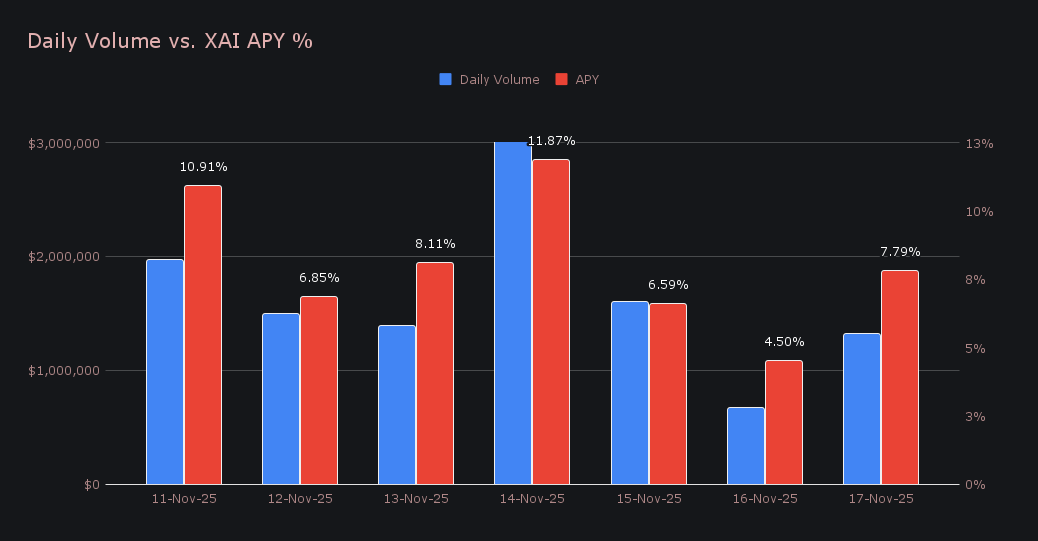

Stakers earned a total of 208,629.53 XAI ($24,661.75), with the average APY landing at 8.09%. The most active day was November 14th, when 43,119.83 XAI was distributed directly to the staking vault at 11.87% APY, supported by $3.12m in daily volume, occurring alongside market volatility. Activity across SideShift increased, but rewards ended below last week, offering a slight divergence between the rise in user activity and the level of distributions.

Additional XAI updates:

Total Value Staked: 140,449,277 XAI (+0.1%)

Total Value Locked: $16,581,220 (−0.7%)

General Business News

BTC slid towards $90k this week, fully erasing its year-to-date gains and extending a decline that has now shaved roughly $34k off its price since early October, the steepest 40-day drawdown of the year. Sentiment cratered in tandem, with the Crypto Fear & Greed Index plunging to 10/100, its lowest reading since July 2022. ETH dropped below $3k, while SOL briefly slipped toward the $130 range, reflecting a downturn that has now reached virtually every corner of the market.

SideShift meanwhile recorded its third consecutive period of growth, capitalizing on the heightened market volatility to push weekly volume to $11.57m (+7.6%) even as broader conditions remained under pressure. User shifting reached $8.05m (+4.4%), led by BTC-deposit-side activity across this week’s top user pairs — BTC/USDC (ERC-20) at $426k, BTC/ETH at $379k, and BTC/SOL at $331k. This concentration of BTC inflows set much of the week’s flow pattern and created a clear imbalance, which in turn increased liquidity shifting that added an additional $3.52m (+15.5%) to the total weekly volume.

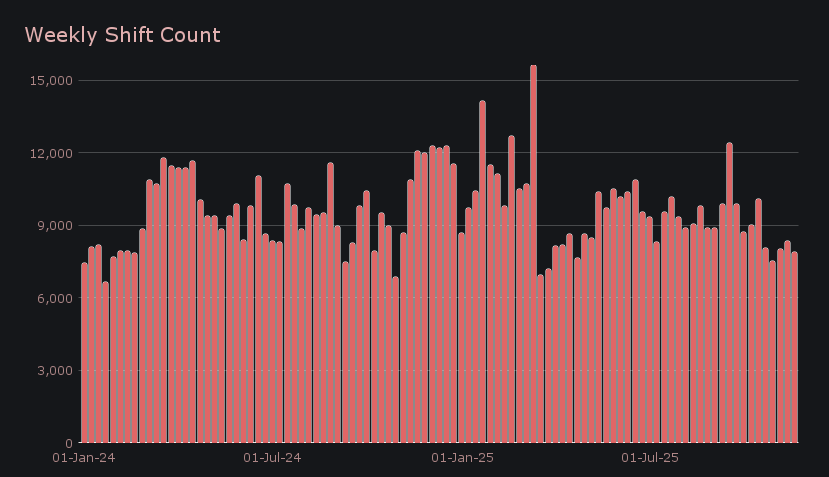

Shift count declined to 7,915 (−5.3%), but the lower number of transactions came alongside a clear rise in average shift size, most notably from major integrations. This helped keep overall activity robust, with daily volume averaging $1.65m and the daily count holding at 1,131. The pattern suggested that users responded to the week’s volatility by shifting less frequently but with meaningfully larger size whenever they stepped in.

BTC came in at $4.57m (+18.8%), extending its four-week climb and again seizing the biggest share of overall activity. User deposits reached $2.22m (+18.2%), while settlements fell to $631k (−23.5%), continuing the recent pattern where BTC shows up far more on the inbound side than the outbound. A notable addition this week was L-BTC, which surged +144% to $1.35m and finished seventh overall, giving BTC-related shifting an extra push and contributing meaningfully to the broader rise in weekly volume. The dynamic was less one-sided than last week, but the direction was the same: users were selling BTC far more often than buying it.

Stablecoins again occupied the middle of the leaderboard, with USDC (ERC-20) finishing second at $2.72m (+2.9%). It was also the only asset on the platform to clear $1m in user settlements, doing so for the second straight period, a sign that users continued to fall back on stables as volatility picked up. USDT (ERC-20) followed somewhat closely behind at $2.01m (−1.1%), a mild dip overall but supported by a healthy settlement flow of $966k (+10.6%). Together, the two formed a stable core of weekly activity on Ethereum, mirroring the defensive tone seen across much of the market.

ETH finished with $2.30m (+14.1%), continuing the steady activity it has shown across recent weeks. Deposits reached $891k (+6.5%), and settlements held at $861k (+1.5%), giving ETH one of the more balanced profiles among top assets. SOL, meanwhile, delivered one of the strongest rebounds of the week, climbing to $2.15m (+147.5%) after last week’s weak showing. Both sides of shifting jumped, user deposits rose to $795k (+181.8%) and settlements reached $639k (+40.3%), marking a clear return to form and pushing SOL back into its typical range near the top tier.

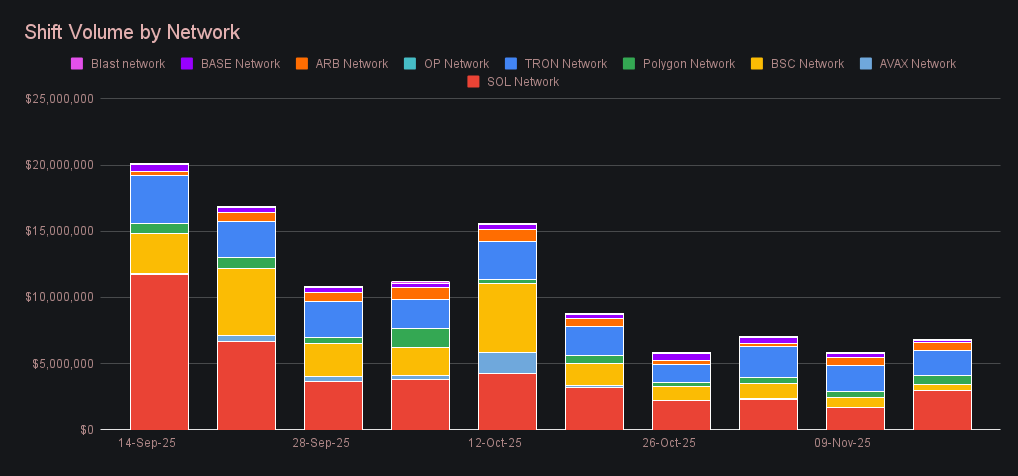

Alternate networks to Ethereum climbed to $6.82m (+18.2%), driven almost entirely by the Solana network’s surge to $3.02m (+78.8%), its strongest showing in a month and a clear outlier in an otherwise mixed field. Polygon also accelerated to $674k (+66.3%), while most other networks moved lower: the Tron network eased to $1.90m (−3.6%), Arbitrum held even at $619k (−1.8%), and both BSC and Base saw sharper pullbacks at −43.1% and −45.5%. Ethereum network shifting ended almost unchanged at $7.20m (−0.4%), a result driven by notably quieter USDT (ERC-20) activity, even as both native ETH and USDC recorded solid weeks.

Affiliate News

Affiliates had a notably stronger showing, combining for $3.43m (+72.1%) while maintaining the same top-three lineup. First place was the main mover, climbing to $1.35m (+161.8%) and providing a clear lift to the overall total. Second place finished at $389k (−9.6%) and third at $321k (−11.8%), both coming in below last week but still adding steady contributions.

Altogether, affiliates represented 29.7% of weekly volume (+11.1%), a marked step up from their recent share.

That’s all for now - thanks for reading and happy shifting.