SideShift.ai Weekly Report | 12th - 18th March 2024

Welcome to the ninety-sixth edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

SideShift token (XAI) spent the week moving within the extremely narrow 7 day range of $0.1998 / $0.2049, after climbing to attain these levels at the beginning of the month. At the time of writing, XAI is sitting at a price of $0.1970 and has a current market cap of $25,965,210 (-0.9%).

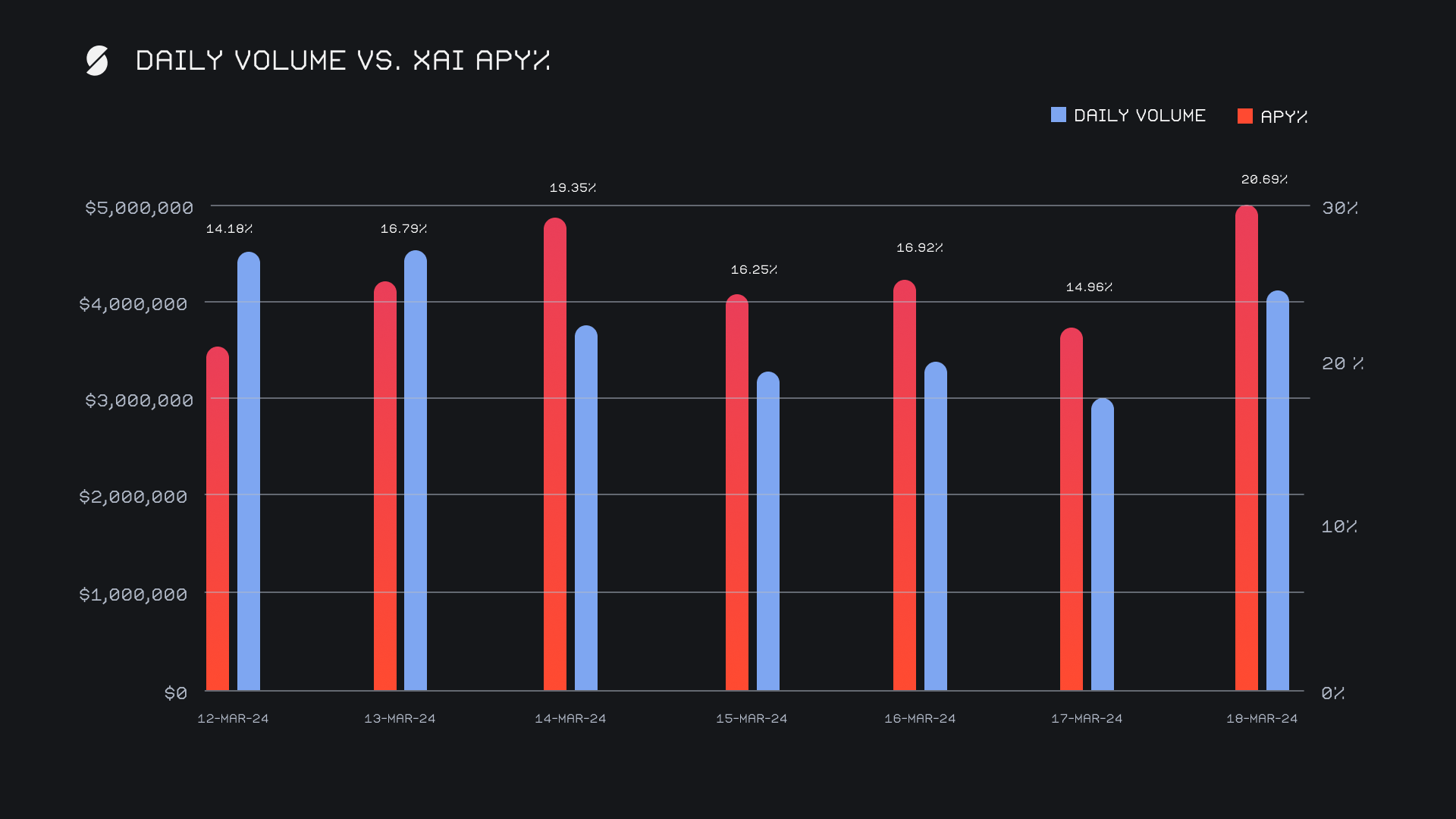

XAI stakers were rewarded a very solid average APY of 17.02% this week, with a daily rewards high of 60,554.76 XAI (an APY of 20.69%) being distributed to our staking vault on March 19th, 2024. This was following a daily volume of $4.1m. This week XAI stakers received a total of 353,456.50 XAI, or $69,630.93 USD in staking rewards.

A total of 5 WBTC and 45 ETH was added to our treasury over the course of the week, bringing the current total to a value of $13.78m, or 217.20 BTC equivalent. Users are encouraged to follow along directly with live treasury updates, via SideShift.ai/treasury.

Additional XAI updates:

Total Value Staked: 117,659,069 XAI (+0.4%)

Total Value Locked: $23,311,611 (+0.4%)

General Business News

A turbulent yet exciting week saw BTC charge its way to new all time highs of $73k on March 14th, 2024, before then retracing nearly $10k over the following few days. While Bitcoin had already begun its decline, Solana seized all momentum and shot up beyond $200 for the first time in over 3 years.

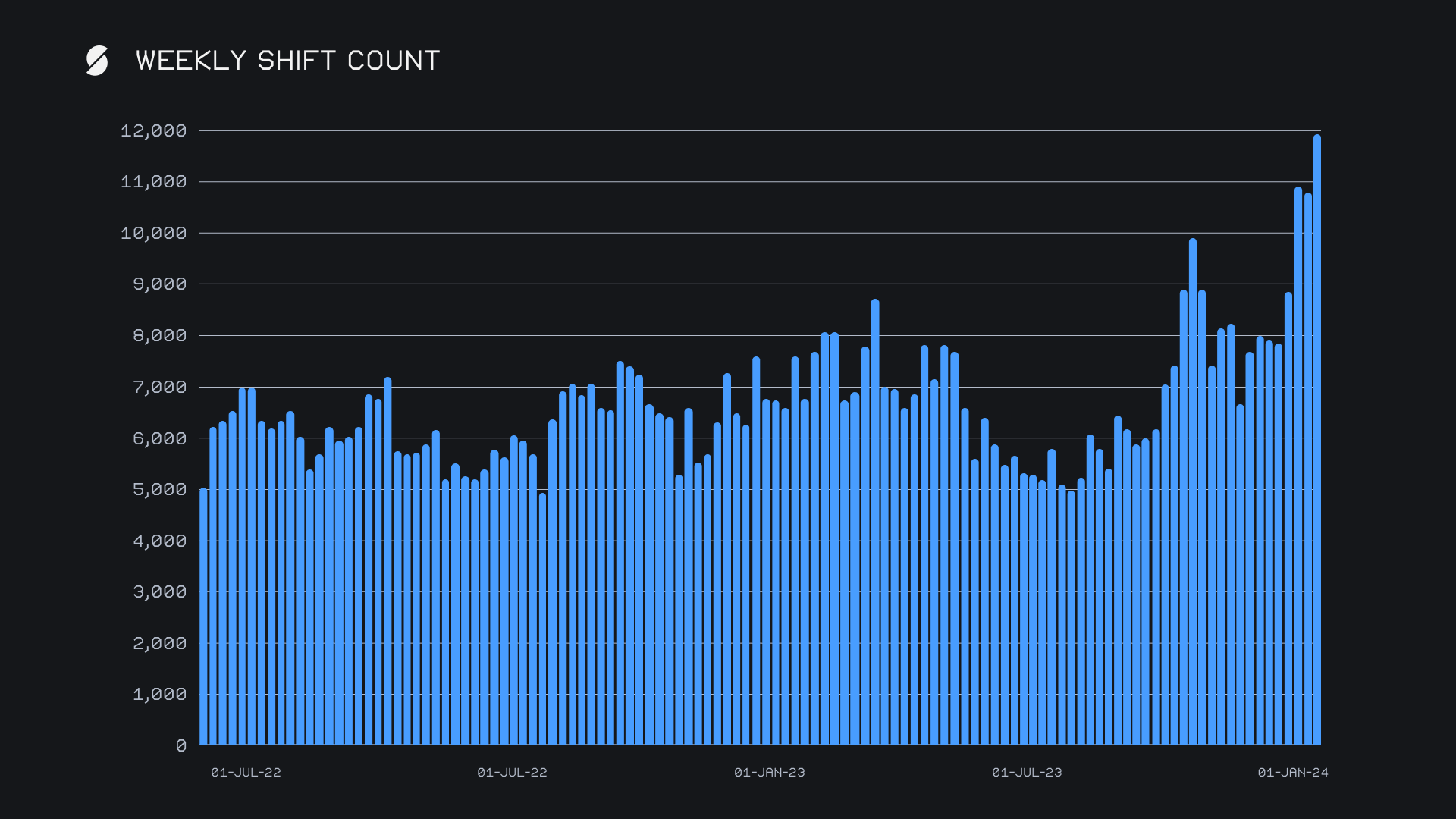

The market volatility translated into another fantastic week for SideShift, as we ended the 7 day period with a gross volume of $26.6m (-2.6%) alongside a record breaking shift count of 11,784 (+10.1%). This was the first time in SideShift’s history that we saw a weekly shift count total exceed 11,000. The chart below outlines our weekly shift count dating back to January 2022. Here, we can really note the significance of this recent increase in weekly shift count, and visualize how it is now stepping its way higher from the ~7k weekly average we typically had over the past two years.

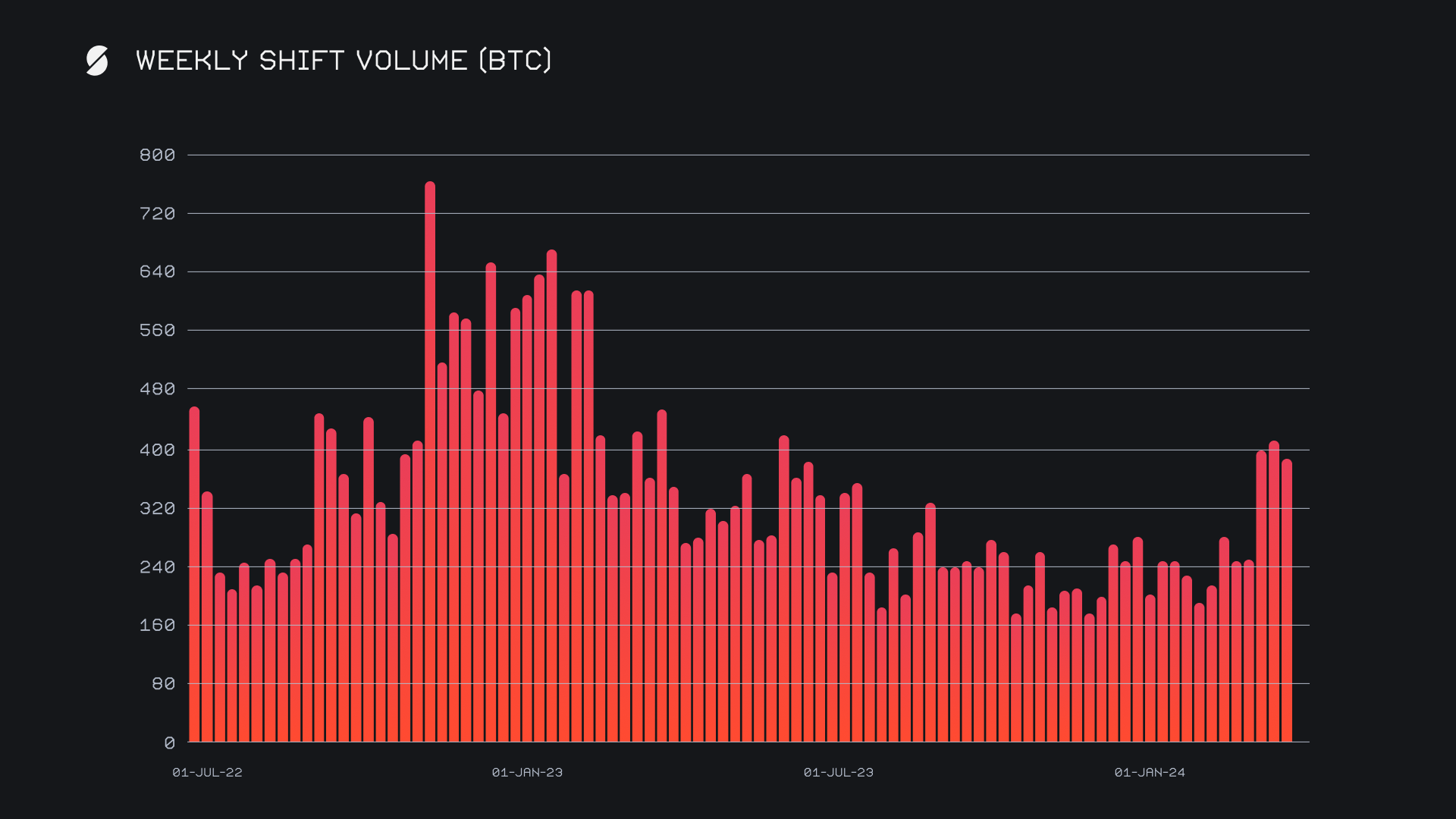

Although our gross volume was slightly lower than last week, a lesser amount of liquidity shifting resulted in a higher overall net user volume of $19.8m (+0.8%) - this represented another all-time record for SideShift. It’s very encouraging to see us reach these new milestones, but the achievements become even more impactful when you consider the overall stability of the site with 100% shift uptime this week. Together, these gross figures combined to produce daily averages of $3.8m on 1,683 shifts. When denoted in BTC, our weekly volume amounted to 381.47 BTC (-5.5%).

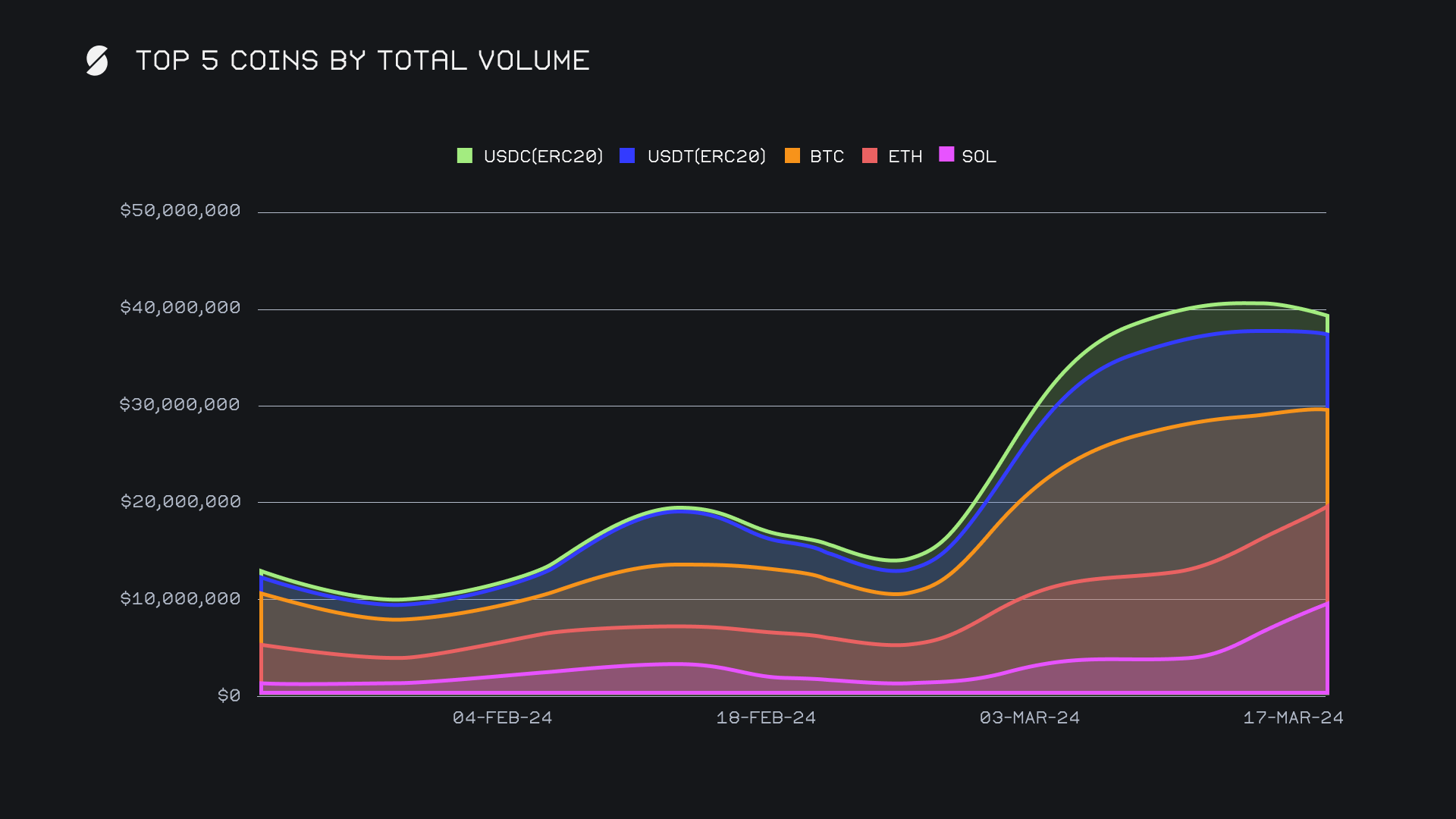

The intense wave of network activity and positive price action saw Solana steal the spotlight this week. It rose to trump all other coins for the first time ever on SideShift, doing so with an outstanding weekly total volume (deposits + settlements) of $10.4m (+129.8%). This was primarily achieved due to a sharp rise in user demand for SOL, not surprising considering the pump in SOL’s price throughout the week. This quick rush to buy SOL saw user settlements more than double on SideShift, as they exploded by +123% to end with $4.7m. Particularly, this stemmed from the ETH/SOL pair, which tallied a total $2.8m, and ended as the week's most popular pair for the first time. User SOL deposits also saw a dramatic increase of +133%, but finished with a lower overall total of $3.6m.

Coming in second place this week was ETH, with a total volume of $10.1m (+11%). Opposite to SOL and as implied by our top shift pair, the majority of ETHs volume came from user deposits. With a total $4.7m (+35%) in user deposits, ETH managed to rank as our most deposited coin this week, surpassing even BTC. This was another surprising find, as BTC has maintained its spot as our most deposited coin for several consecutive months. The general rise in both SOL and ETH shifting overall contained BTC to just a third placed finish this week, as it ended with a total volume of $9.5m (-35%). Keep in mind that this compares to last week’s dominant performance, which saw BTC tower more than $5m higher than the runner up.

Although this week had an extremely heavy focus on SOL and ETH, some other L1 and L2 tokens took a substantial step forward in total volume. Both AVAX and ADA cracked the $1m mark and saw their volumes more than double, with AVAX generating a total of $1.7m (+181%), and ADA netting $1.1m (+260%). ADA has not breached the $1m mark in more than 3 months, while AVAX has only done so once. ETH (base) is certainly beginning to gain popularity, and this week ended with a total of $980k (+46.5%), enough to finish 9th overall. Lastly, newly added ETH (blast) jumped to sum $520k (+41.6%) in just its second week since listing.

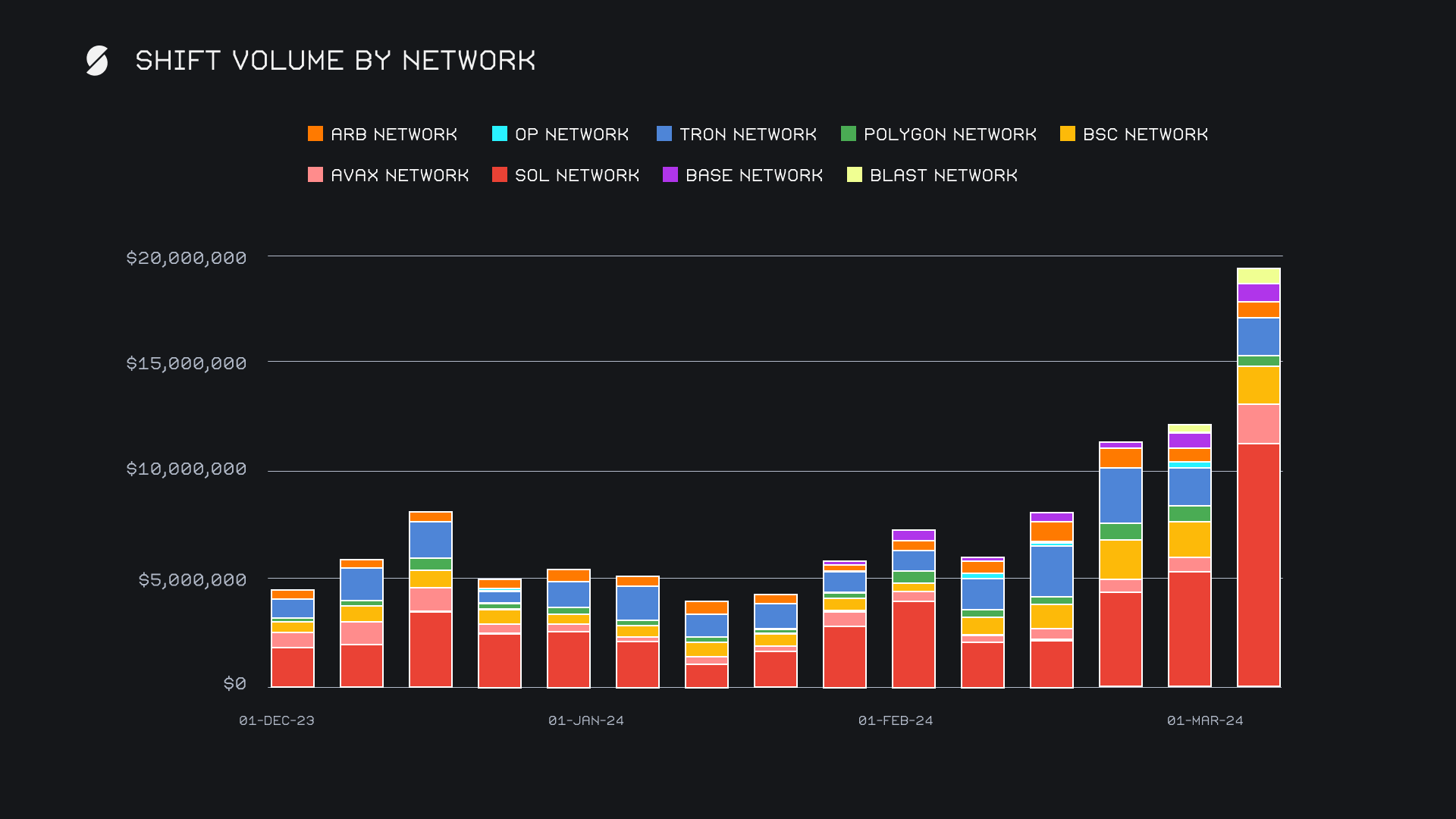

Growth in these coins helped contribute to a huge volume increase for alternate networks to ETH, although here again the vast majority was occupied by the Solana network. It ended with a total of $11.4, (+112%) on the week and dominated all other networks, with the native SOL token accounting for over 90% of this sum. The strong move from AVAX allowed the Avalanche network to rise to second place, with a gross $1.8m (+174.1%), which was once again mainly accounted for by the native AVAX token. In third was the Tron network with $1.77m (-5.5%), with most of its volume deriving from USDT (TRC-20) as it typically does. The Polygon and Optimism networks showed the largest percentage drops with respective changes of -31.7% and -42.6%, although these had a far lesser impact due to their low overall volumes. As a whole, alternate networks to ETH accounted for 35.5% of shift volume this week, ending only just behind the Ethereum networks proportion of 38.9%.

Affiliate News

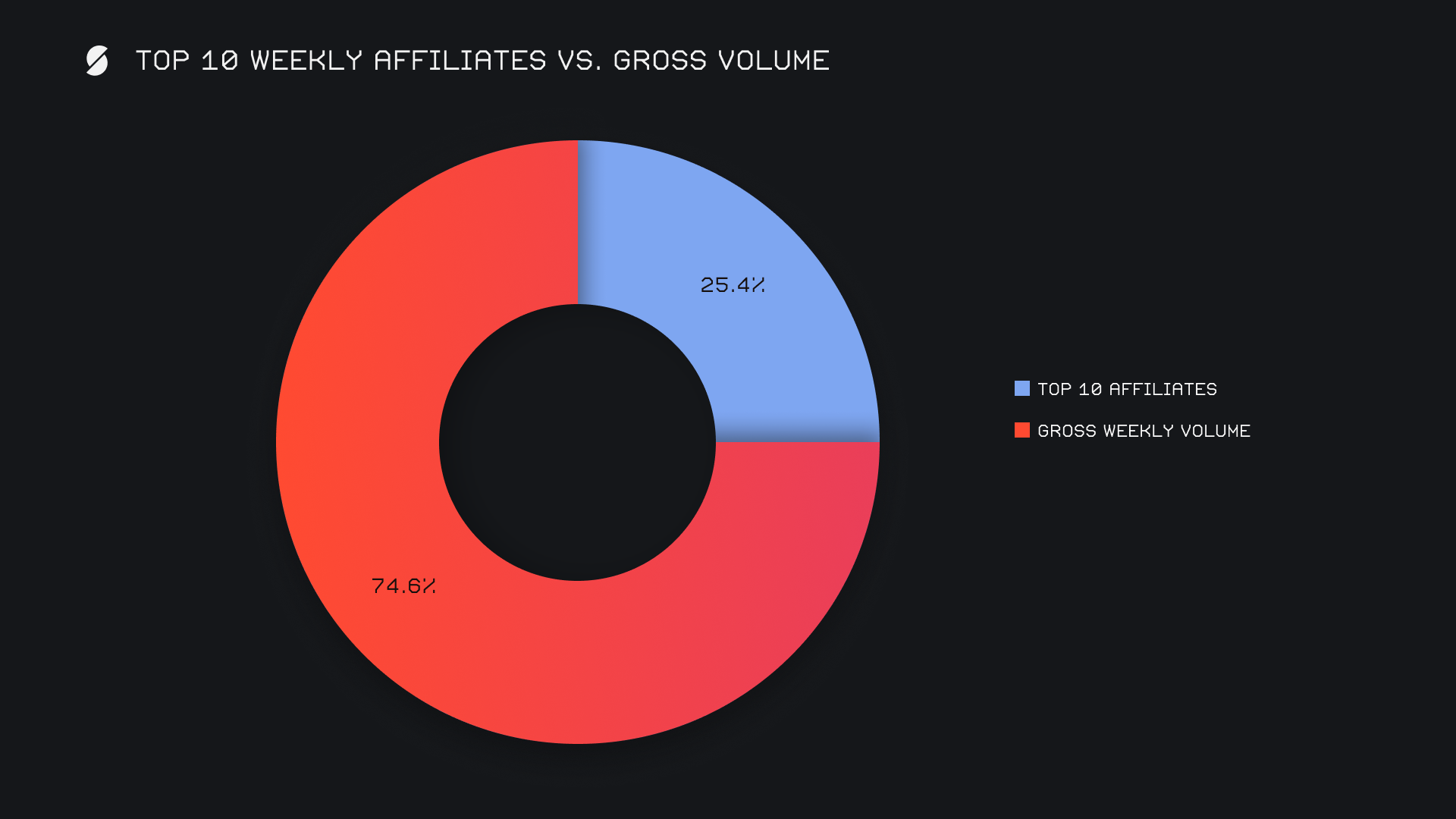

SideShift’s top affiliates combined for a total $6.7m (-28.5%), indicating that a higher amount of shifting occurred directly on the site this week. Combined shift count for our top affiliates also decreased, but to a lesser extent. They ended with a combined shift count of 2,381, marking a weekly decline of -15.7%. Our top affiliate remained unchanged and ended the week with $2.6m, an amount which represented 9.8% of our weekly total volume. Second and third placed affiliates also had decent performances, rounding off the period with respective totals of $1.7m and $1.1m.

All together, our top affiliates accounted for 25.4% of our weekly volume, -9.2% lower than last week’s proportion.

That’s all for now. Thanks for reading and happy shifting.