SideShift.ai Weekly Report | 12th - 18th November 2024

Welcome to the one hundred and thirty-first edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

This past week, XAI displayed some stability after its sizable jump to $0.16 last week, moving within a narrow 7-day range of $0.1604 to $0.1630. By the end of the week, XAI edged up to $0.1643, and its current market cap of $23,260,077 reflects a modest +1.15% increase from last week's $22,995,224.

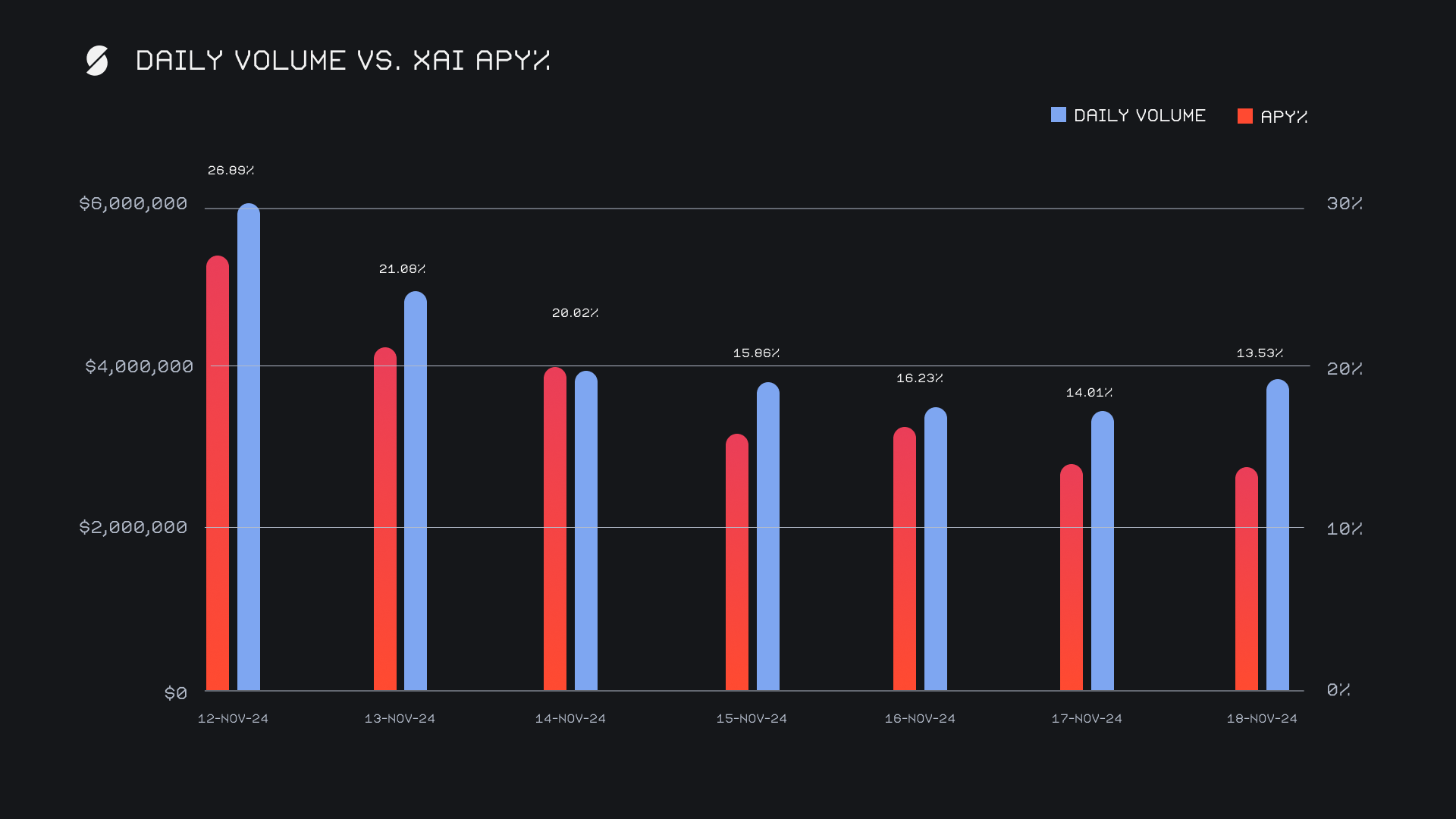

XAI stakers saw strong returns throughout the period, with an average APY of 18.23%. The highest daily distribution occurred on November 13, 2024, when 82,554.92 XAI was sent directly to our staking vault, corresponding to a weekly APY peak of 26.89%. The solid APYs were the byproduct of SideShift’s record setting week, achieving all time highs in both weekly volume and shift count. Altogether, XAI stakers received a total of 402,415.07 XAI or $65,553.41 USD in rewards, showcasing the ongoing appeal of participating in XAI staking.

With 2 WBTC added this week, SideShift’s treasury has grown further, now reaching a total value of $20.39m. Users can follow ongoing updates directly at sideshift.ai/treasury.

Additional XAI updates:

Total Value Staked: 125,855,697 XAI (-0.6%)

Total Value Locked: $20,603,542 (+3.6%)

General Business News

This past week, Bitcoin broke past $90k and held strong, settling near $92k by week's end. This remarkable rise added roughly $25k to its market value in just two weeks, underscoring the powerful momentum in play. Institutional interest continued to drive excitement, highlighted by MicroStrategy’s latest purchase of 51,780 BTC for $4.6 billion. Meanwhile, Solana reached a price of $245 as its market cap spiked to all time highs, reemphasizing its position as one of the standout assets of this cycle.

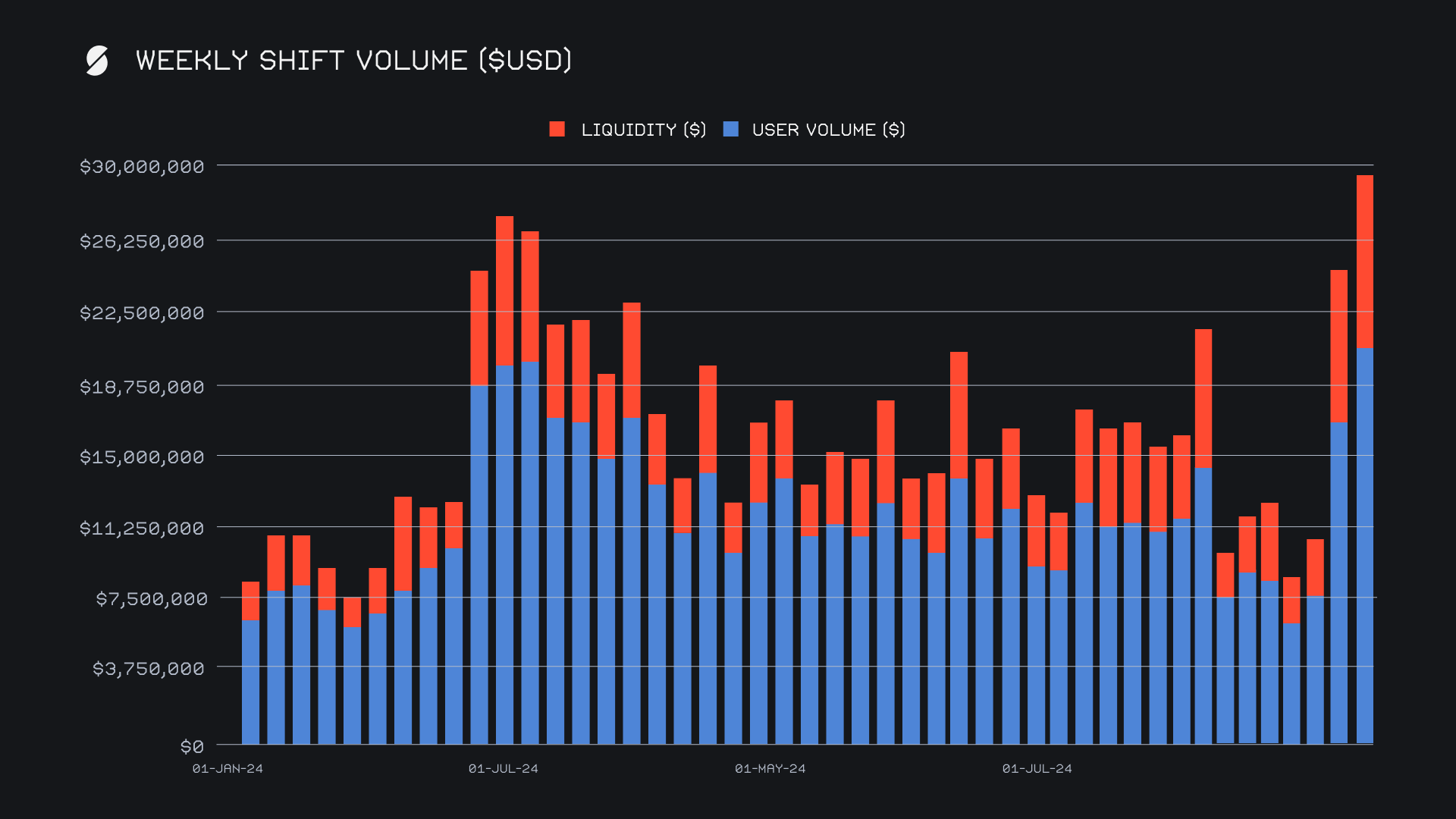

SideShift delivered an outstanding performance and achieved a record-setting gross weekly volume of $29.4m, a notable +19.2% increase from last week, marking the highest ever recorded on the platform. User shifting volume played a key role and rose to $20.5m (+24.8%), while an additional $8.9m (+7.9%) in liquidity shifting was required to even out the imbalance of deposited assets. These numbers pushed our weekly total well above our YTD running average, with volume ending +87% higher. Daily averages remained robust, with $4.2m in volume alongside 1,723 shifts per day.

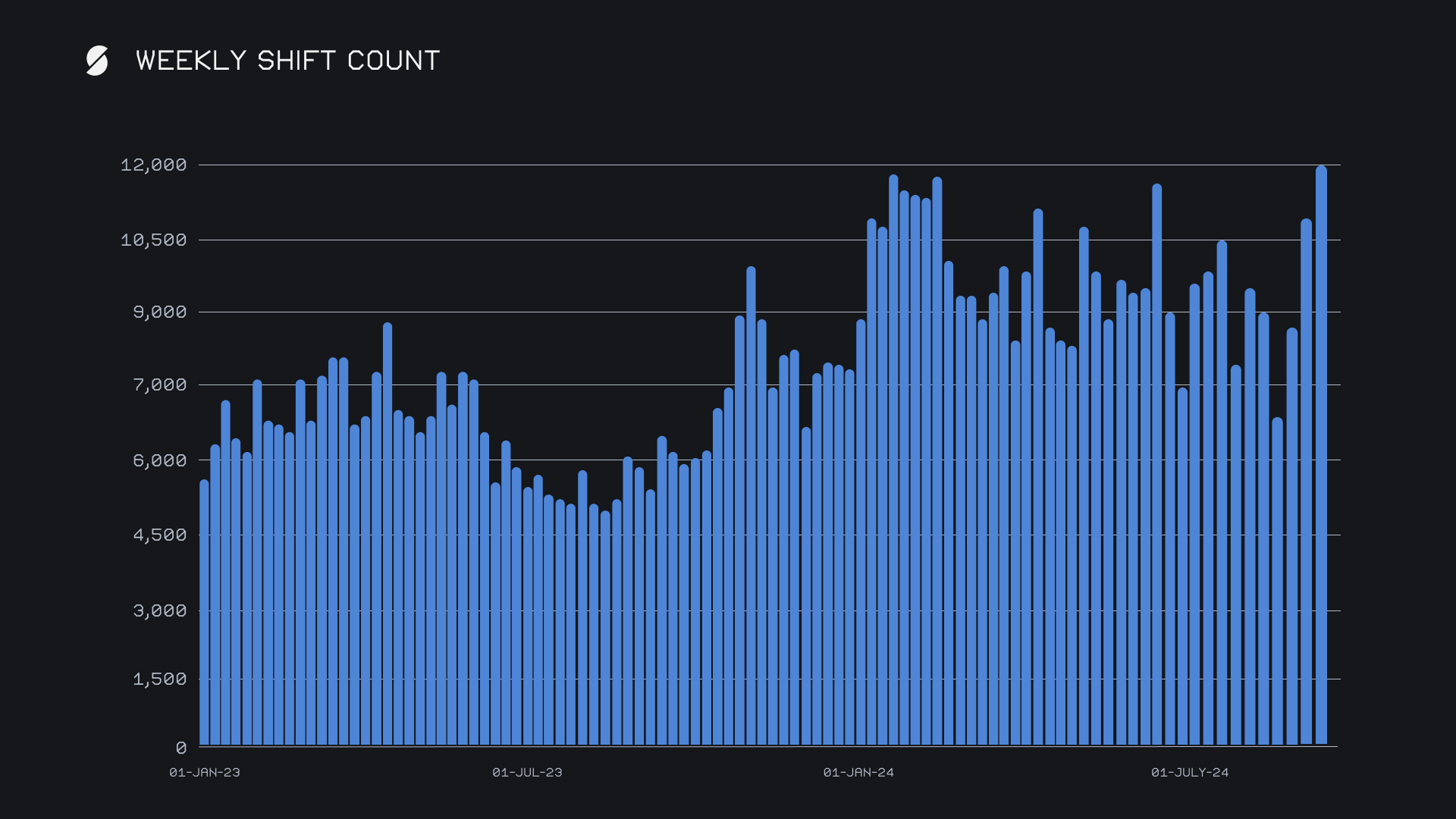

SideShift’s gross weekly shift count also set a new benchmark, surpassing 12,000 shifts for the first time and finishing the period with a final count of 12,058. This was a +10.7% increase from the previous week, and sat +29% above our YTD running average. This milestone reflects increased user activity and interest across a diverse range of coins amid a booming market, highlighted by top-performing user pairs such as ETH/SOL, which generated $1.92m, and the consistently popular BTC/ETH with $1.43m.

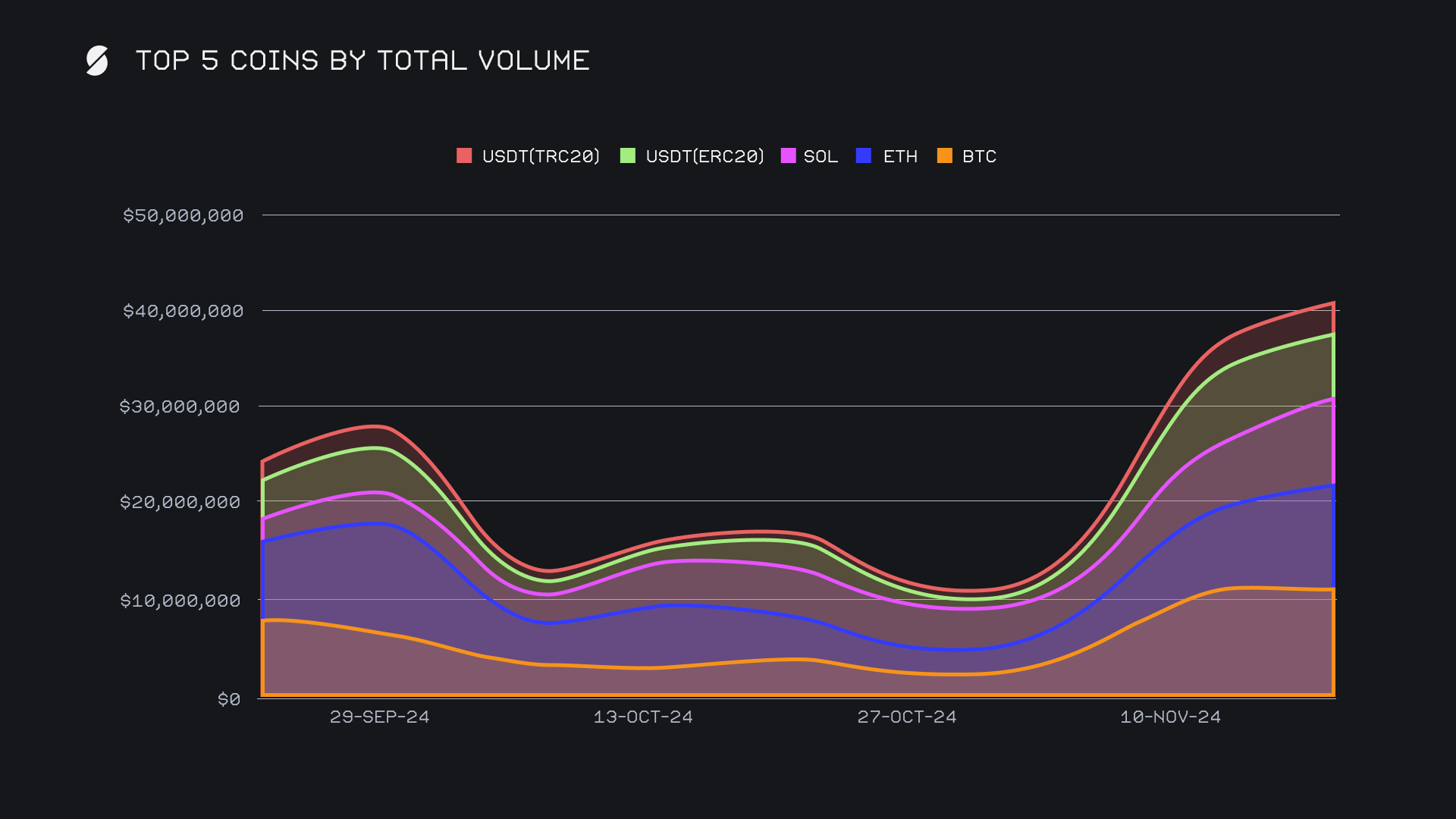

BTC retained its position as the most shifted coin on SideShift for the third week running, closing with a total volume of $11.4m, a +4.7% increase from the previous week. Despite a slight drop in deposit volume to $5.0m (-5.7%), it remained our most deposited coin, as users capitalized on its strong price action and took the opportunity to shift into other high demand assets. With that in mind, it is a rare occurrence that an alternative coin surpasses BTC in weekly deposit volume. BTC settlement volume saw a significant +62.3% jump to $3.4m, though it remained lower than both ETH and SOL, indicating that while BTC remained the preferred choice for deposits, users favored other coins for settlements this week.

ETH followed in second and reached a total volume of $10.4m, a solid +29.1% increase from last week, and breaching the $10m mark for the first time in 6 weeks. It had a fairly balanced split between user deposits and settlements, with deposit volume climbing +64.5% to $3.8m, and settlement volume growing by a more moderate +8.3% to $3.7m. This surge in deposits suggests that users were looking to escape ETH’s slow price action and move into high-momentum assets like SOL, as it soared to near all-time highs - this trend was underscored by resurfacing of week’s most popular shift pair, ETH/SOL.

SOL finished in third overall but emerged as the standout performer, achieving a total volume of $8.9m, up by an impressive +48.6% from the previous week. This was fueled by a large increase of +72.4% in deposit volume, which reached $2.3m, and a +54.0% growth in settlement volume, which totaled a more prominent $4.1m. This made SOL the most demanded coin on SideShift for the fourth time in the past six weeks, underscoring a consistent and steady rise in users' confidence in the asset.

Beyond the top 3 coins that led the week, our record-breaking volume was further backed by noteworthy performances from a range of other assets. DOGE made quite the impact, with its volume surging over 25x from just two weeks ago to reach $1.4m, signaling a renewed wave of user interest. ETH (BASE) also stood out, achieving significant growth with its volume jumping +220.4% to $1.1m. Interestingly, among our top 10 coins, it was only stablecoins USDC (ERC20) and USDT (ERC20) which noted declines, primarily due to a lack of demand from users. Respectively, settlements for these stablecoins totaled $2.5m (-18.1%) and $560k (-11.6%), a bullish indicator that SideShift users are less inclined to hold stablecoins for the time being. Overall, all of SideShift's top 10 coins surpassed the $1m total volume mark, showcasing strong activity across the platform and broad-based interest from users.

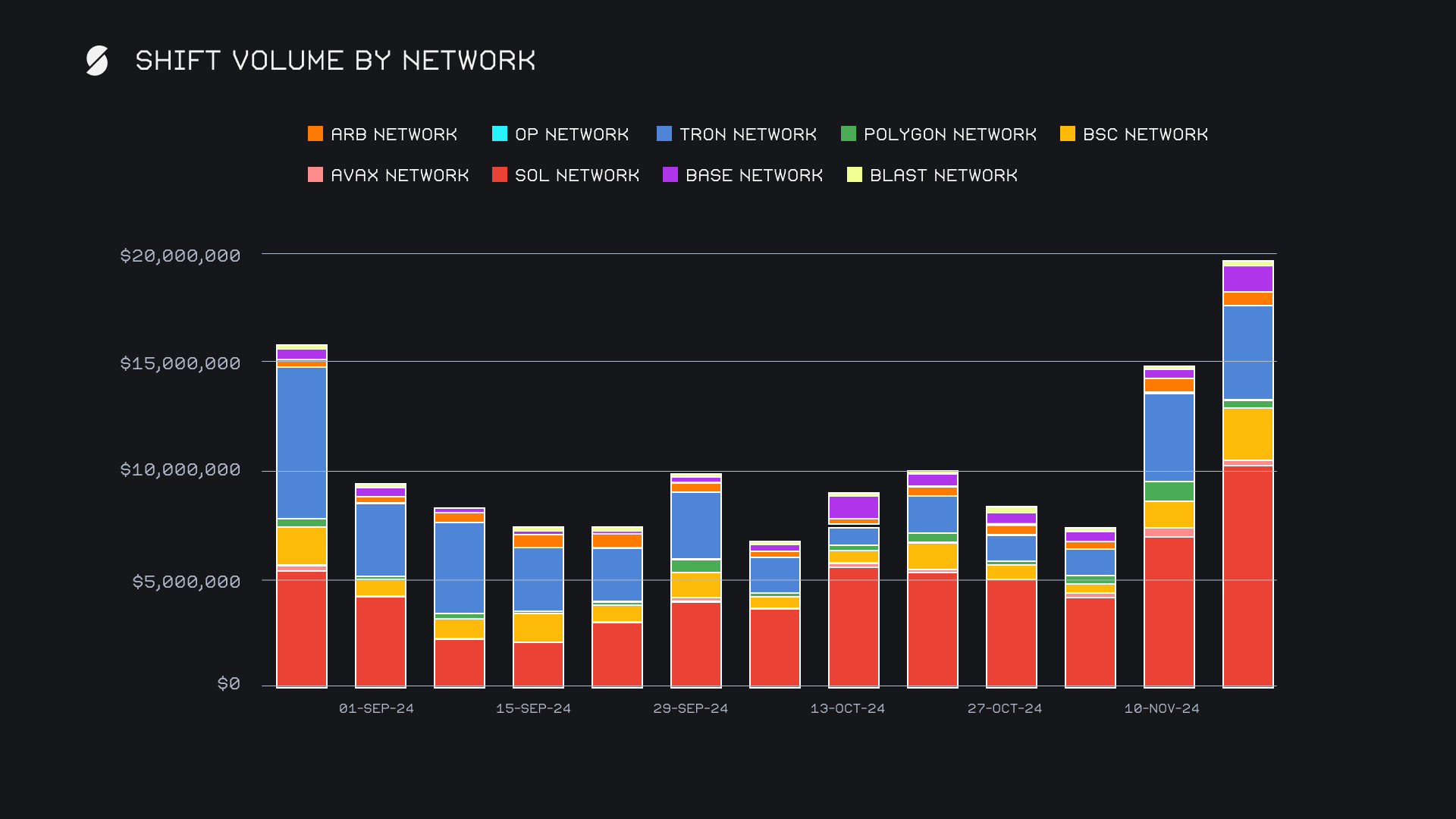

Alternate networks to ETH had a fantastic week and combined for a total volume of $19.7m (deposits + settlements), a +33.6% increase from the previous period and rivaling its own all-time high. Leading the charge was the Solana network, which recorded a remarkable +47.6% jump to $10.3m and was supported by a noticeable uptick in shifting of Solana tokens (e.g. PYTH, WIF, PYUSD) - in some instances however, this rise was more so reflected in shift count as opposed to volume. The BSC network also posted significant growth, climbing +87.6% to $2.4m, while the BASE network saw the most dramatic increase, climbing +210.4% to $1.2m. Strong performances from these networks combined to slightly outperform that of the Ethereum network, which finished with a combined total $19.0m.

Affiliate News

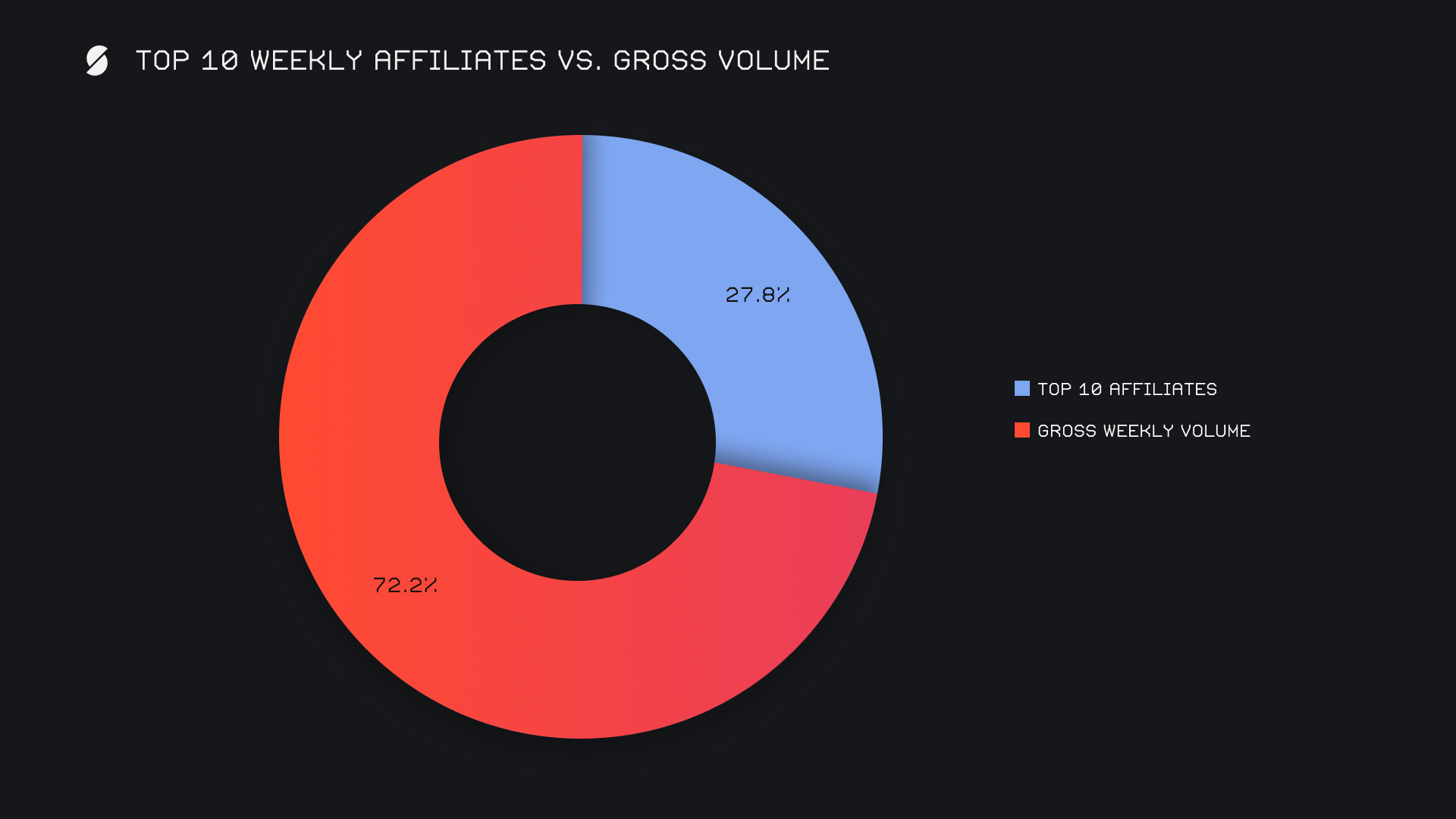

Our affiliate partners played a significant role in supporting SideShift’s record week, combining for a very respectable total volume of $8.2m (+23%). The most striking change came from our former third-place affiliate, which surged +499.6% to confidently reclaim the week’s top spot with $2.8m. Second and third places remained solid but saw a bit of a drop-off in shift volume, as they ended with respective sums of $2.7m (-7%), and $1.7m (-24.5%). As a whole, the top 3 combined for 2,846 shifts, accounting for just shy of a quarter of our weekly sum. Altogether, our top affiliates accounted for 27.8% of our total weekly volume, marking a slight increase of +0.8% from last week’s proportion.

That’s all for now. Thanks for reading and happy shifting.