SideShift.ai Weekly Report | 13th - 19th Aug 2024

Welcome to the one hundred and eighteenth edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

This week, SideShift token (XAI) experienced a modest but steady upward climb, with its price fluctuating within the 7 day price range of $0.1389 to $0.1424. Currently, XAI is holding firm at $0.1421, contributing to a decent 2.48% increase in its market cap, which now stands at $19,573,119.

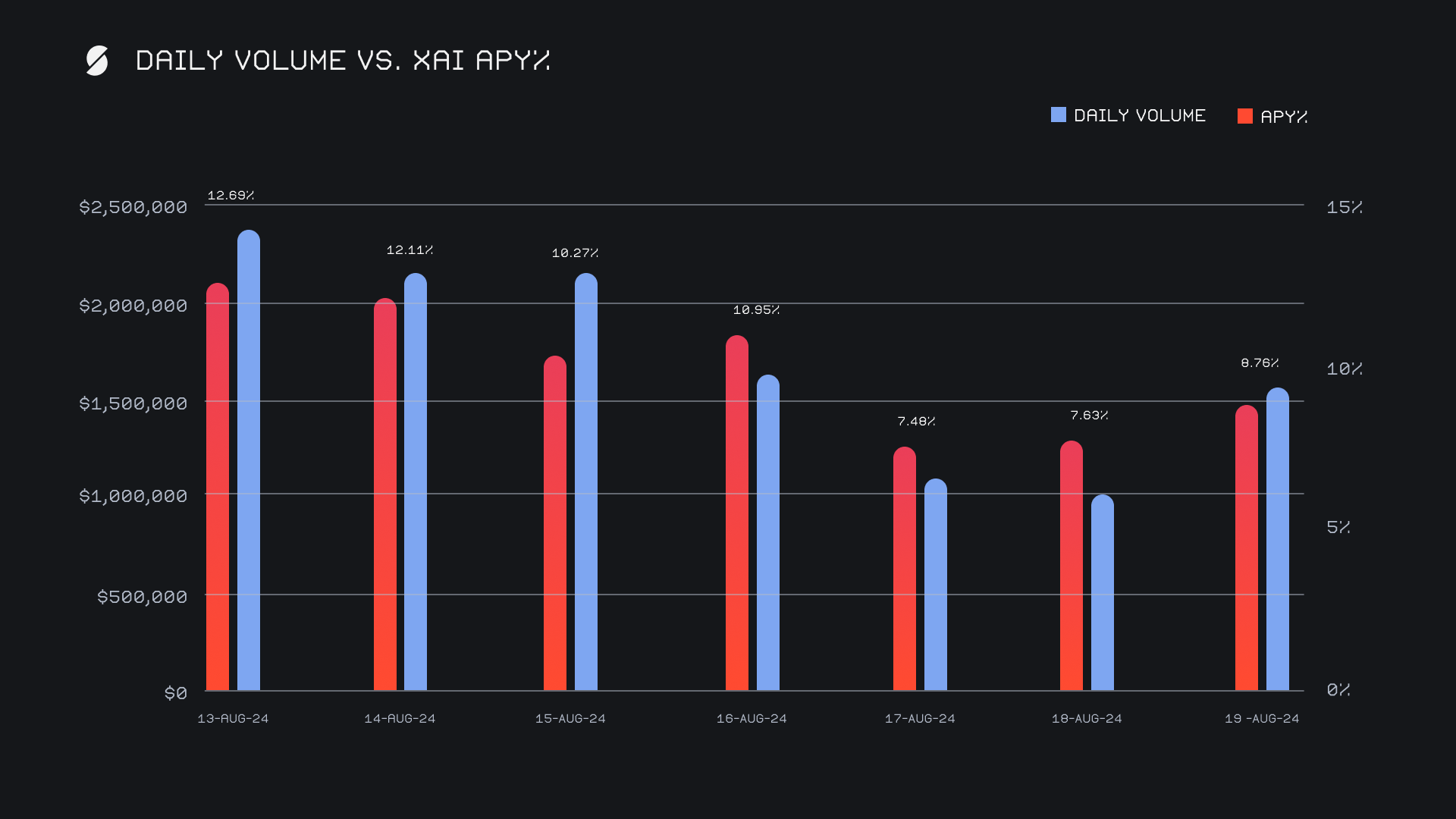

XAI stakers enjoyed a weekly average APY of 9.98%, with a notable daily rewards high of 40,243.39 XAI (equivalent to an APY of 12.69%) being distributed directly to our staking vault on August 14th, 2024, following a daily volume of $2.4 million. This week, XAI stakers received a total of 224,248.77 XAI, or $31,865.75 USD in staking rewards.

Additional XAI Updates:

Total Value Staked: 123,262,316 XAI (+0.2%)

Total Value Locked: $17,352,762 (+2.9%)

General Business News

This week, the crypto market saw mixed performance with Bitcoin and Ethereum trading mostly flat. However, Tron (TRX) emerged as a standout, rising by approximately 12% over the past week. This surge comes as the Tron network saw increased activity, particularly in USDT transactions, and gained significant traction with new initiatives like the "SunPump" project, which has driven the creation of thousands of new meme coins. This momentum has placed Tron in a strong position compared to the broader market, which remains cautious and relatively stable.

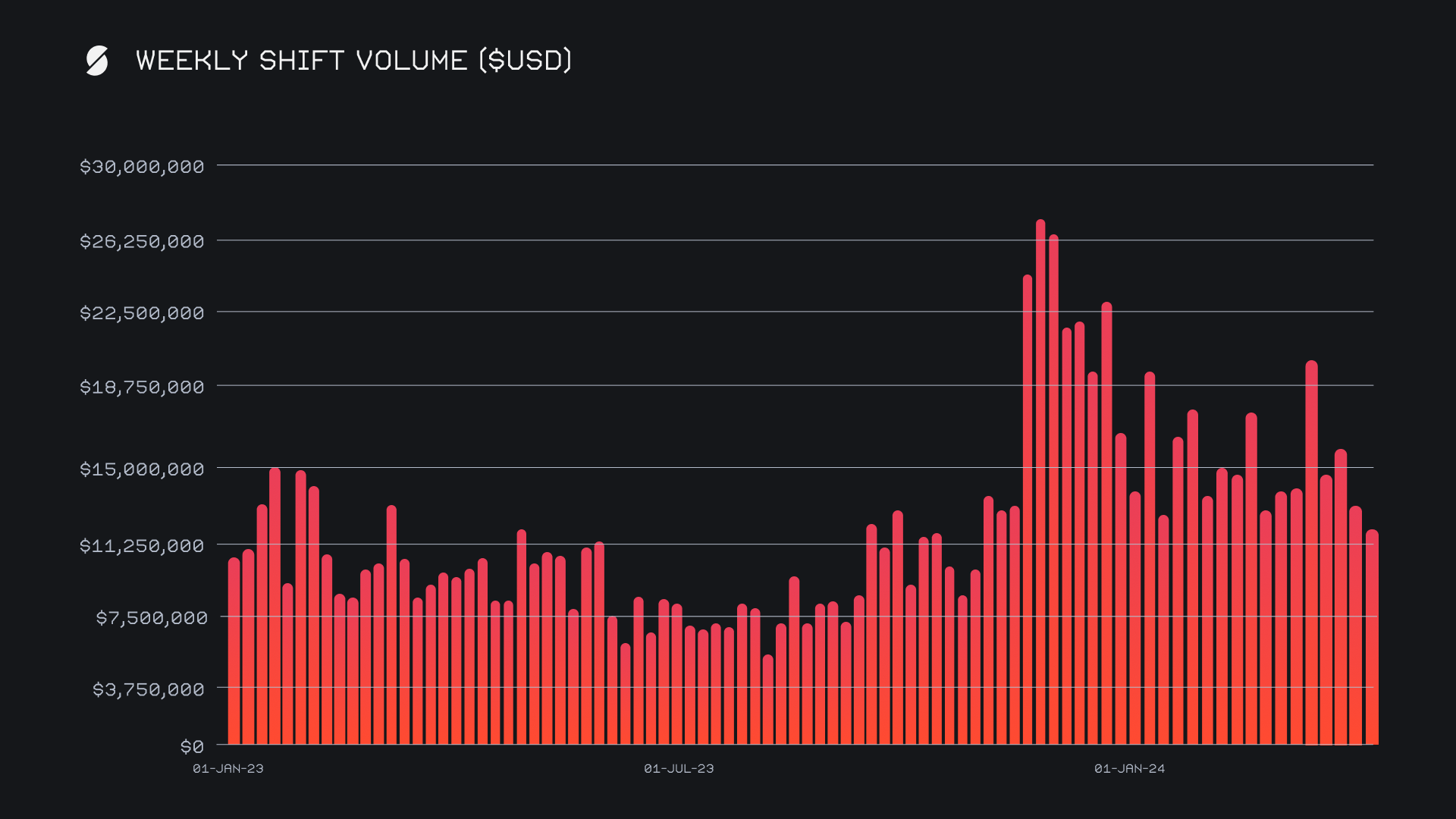

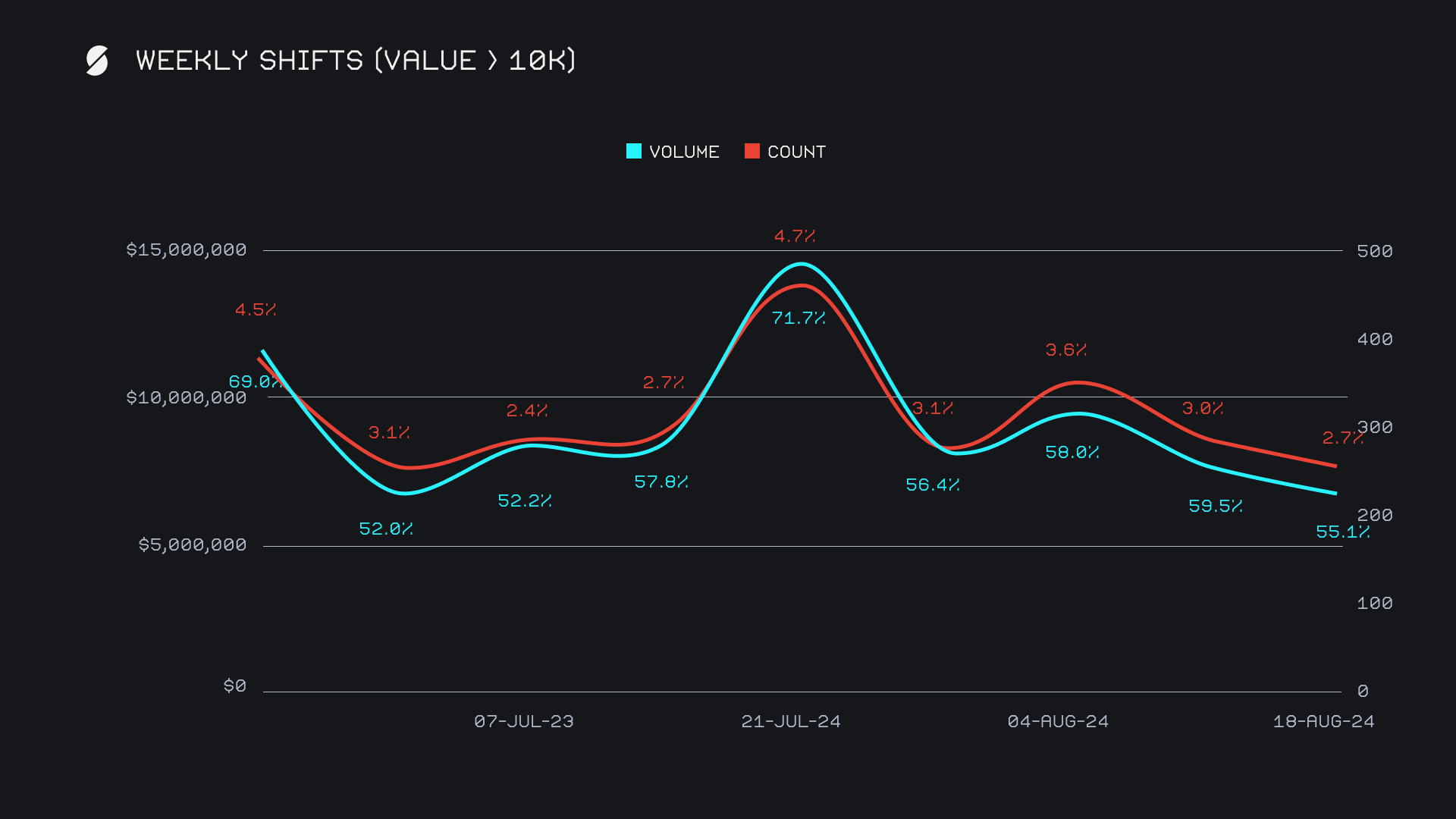

This week, SideShift recorded a gross volume of $11.9m, marking a slight decrease of -6.9% compared to last week. Despite the dip in volume, user activity remained stable, with the total number of shifts rising slightly by +0.7% to 9,496. The outcome were daily averages of $1.7m 1,357 shifts. This indicates that we saw on average a higher number of smaller scale shifts this week, while also seeing a lesser amount of whale shifts take place.

As shown in the below chart, shifts with a value exceeding $10k accounted for 55.1% of volume, and just 2.7% of shift count this week, which either tags or approaches multi month lows. From this, we can gather that large shifters were more included to sit on their hands this week amidst flat market behavior. Still, the overall healthy count compensated for this lull, with a steady amount coming from our top coin pairs of BTC/ETH, and BTC/USDT(ERC-20), among others. BTC/ETH ended as the week’s most popular pair among users for both volume and count, finishing with $915k on 327 shifts.

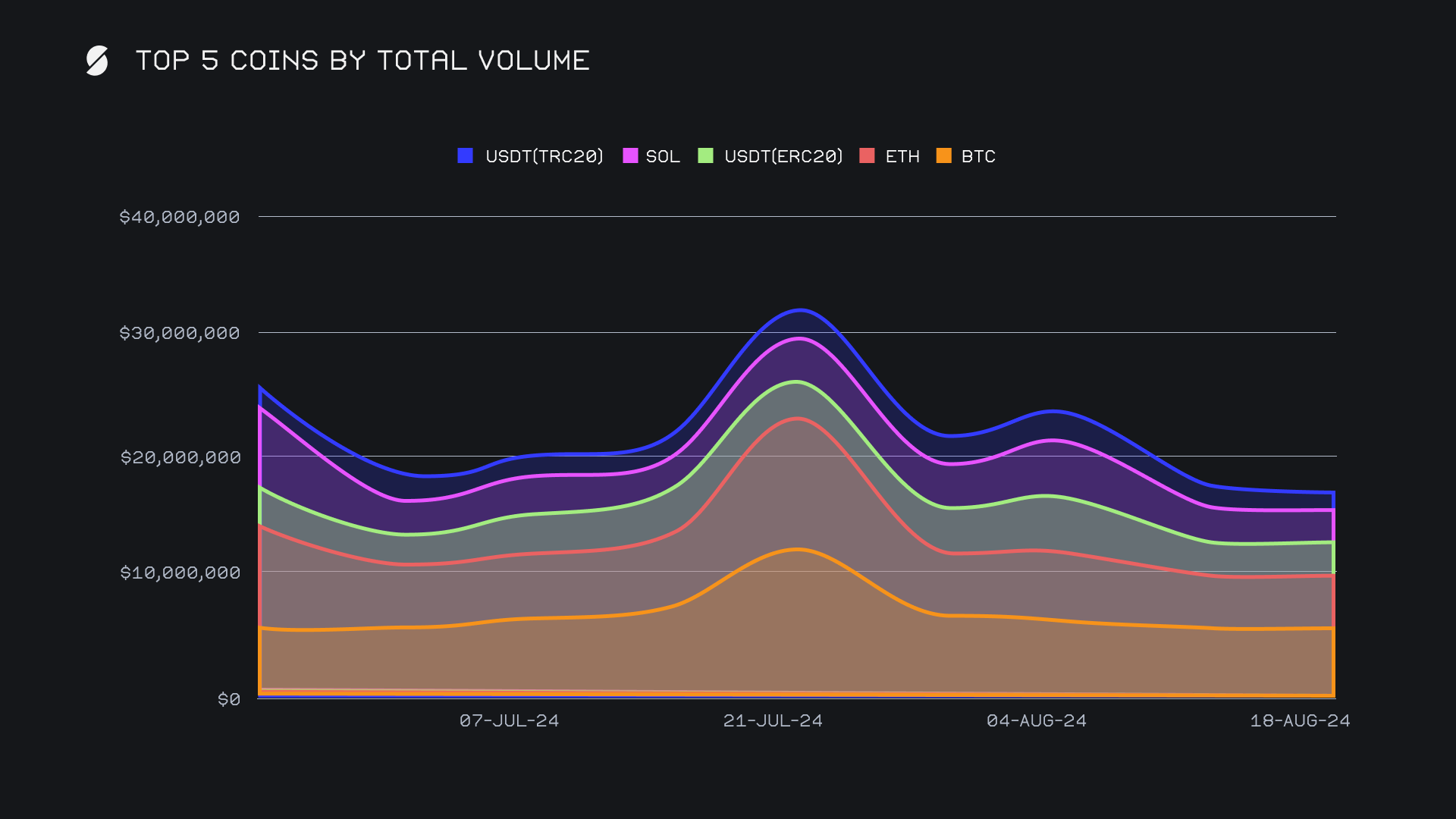

BTC remained the top performer this week, with a total volume of $5.8m, and in a show of extreme consistency, declined just -0.1% from the previous period. User deposits for BTC saw a significant uptick, rising by +14.1% to $2.6m, while settlement volumes decreased by -9.1%, closing at $1.7m. BTC has now been the most deposited coin for the 7th consecutive week and once again did so in dominant fashion, finishing at over double that of second place - the trend of users converting BTC to other coins on SideShift remains notably strong.

ETH held the second spot with a total volume of $4.2m, representing a modest increase of +4.7% from last week. However, this growth was not uniform across the board - deposits fell by -11.7% to $1.2m, while settlements surged by +9.9%, reaching $1.9m. This pattern opposed that of first placed BTC, and coincided with the return of the BTC/ETH shift pair. This placed ETH as SideShift’s most demanded coin this week, although remaining quite a bit lower than levels achieved in late July.

USDT (ERC-20) secured the third position, recording a total volume of $3.1m, up by +1.7% from the previous week. The deposit volume slightly dipped by -3.9% to $885k, but the settlement volume saw a healthy increase of +11.5%, amounting to $1.3m. It remains the clear favorite among stablecoins on SideShift and sharply opposed the second most popular stablecoin, USDT(TRC-20), which saw its total volume cascade -36% this week.

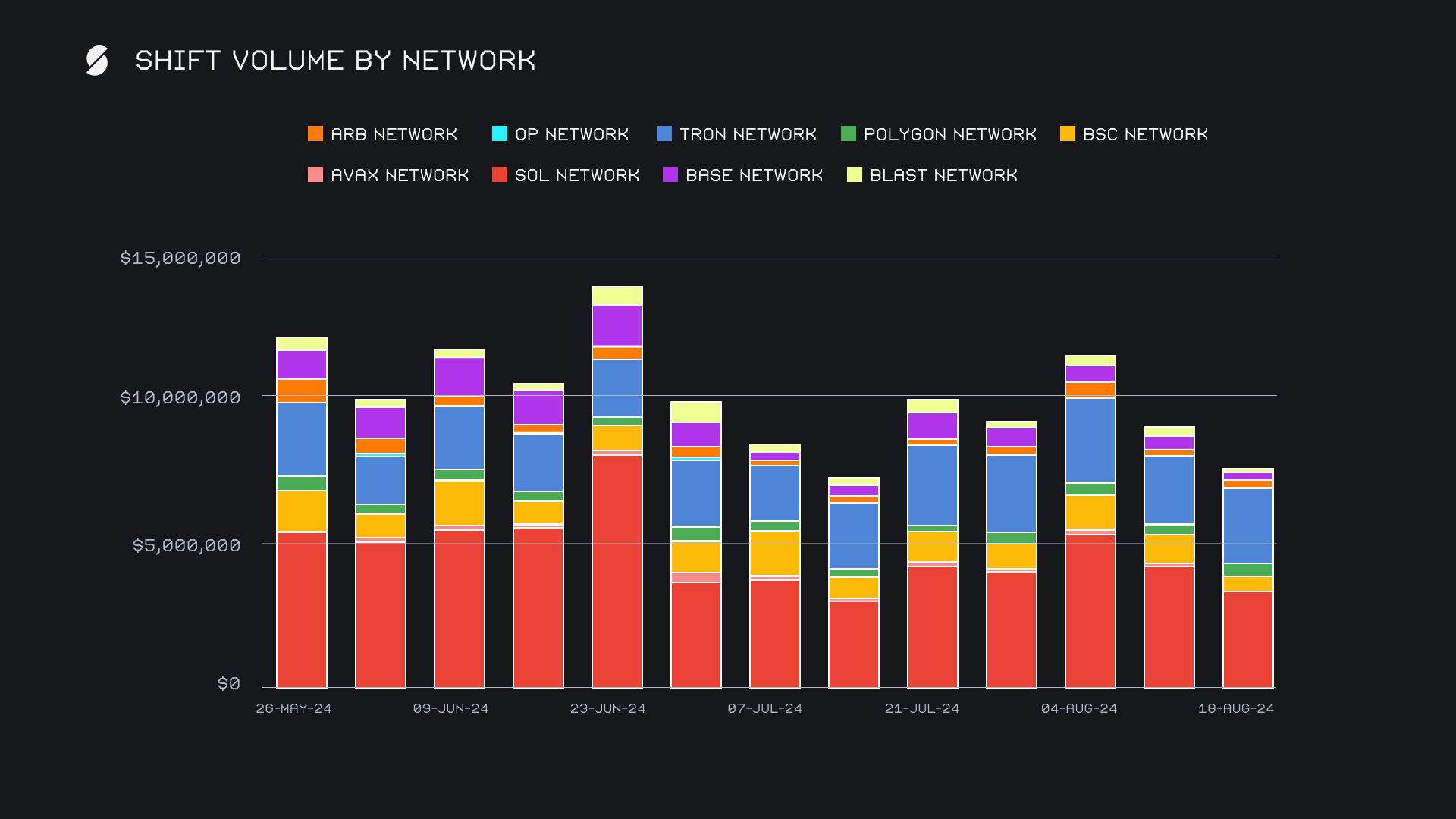

Despite the atypical drop in USDT(TRC-20) volume, the native TRX token incurred an impressive boom of +603% to end with a total volume of $1.2m. This represents the first time this year that TRX’s volume has surpassed $1m, and placed it 6th overall this week, heavily contributing to the Tron network’s respectable rise of +11.7% for $2.6m. Still, this change in shift action was not quite enough to nudge the Tron network to the top of the alternate networks to ETH, and the Solana network retained its position atop the group. It finished with a total $3.3m, representing a double digit decline of -17.8%. This seemed to be the major trend for alternate networks to ETH this week, with networks such as Binance Smart Chain (BSC) and Base joining the club. They rounded off the week with respective sums of $480k (-50.8%), and $309k (-24.5%). This week, alternate networks to ETH combined to account for 31.8% of total shift volume, as compared to the Ethereum networks 34.1%.

Affiliate News

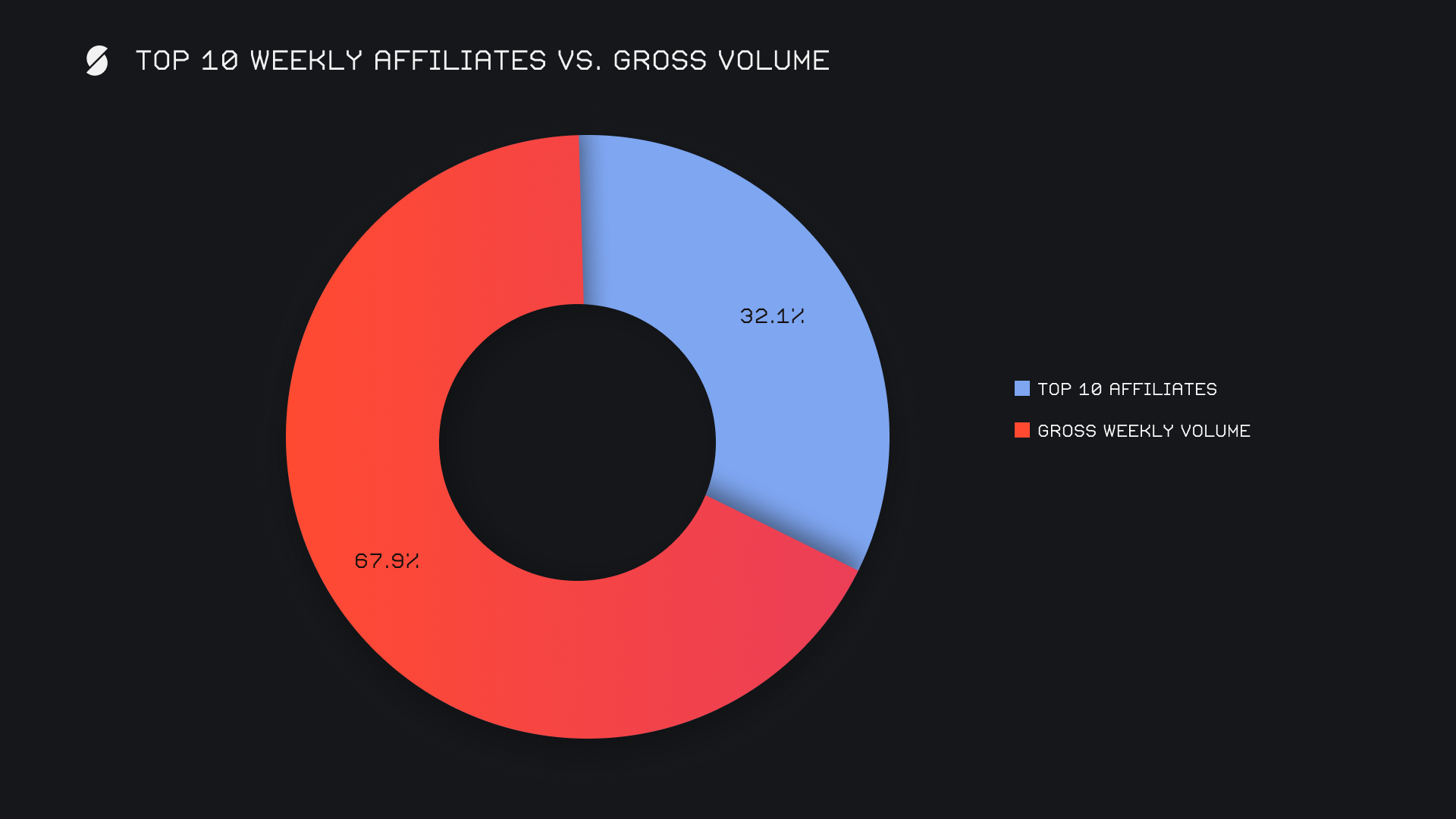

This week, our top affiliates generated a combined total volume of $3.8m, reflecting a modest nominal increase of +3.8% compared to the previous period. The ranking positions among affiliates remained consistent, with the first-place affiliate recording $1.3m in volume, despite a -14.6% decline. Meanwhile, both the second and third-place affiliates showed solid growth, with the second-place affiliate increasing its volume by +17.2% to $1.1m and the third-place affiliate rising by +15.6% to $1.0m.

Together, these top affiliates accounted for 32.1% of our total weekly volume, +3.3% higher than last week’s proportion.

That’s all for now. Thanks for reading and happy shifting.