SideShift.ai Weekly Report | 13th - 19th January 2026

Welcome to the one hundred and eighty-seventh edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

Highlights

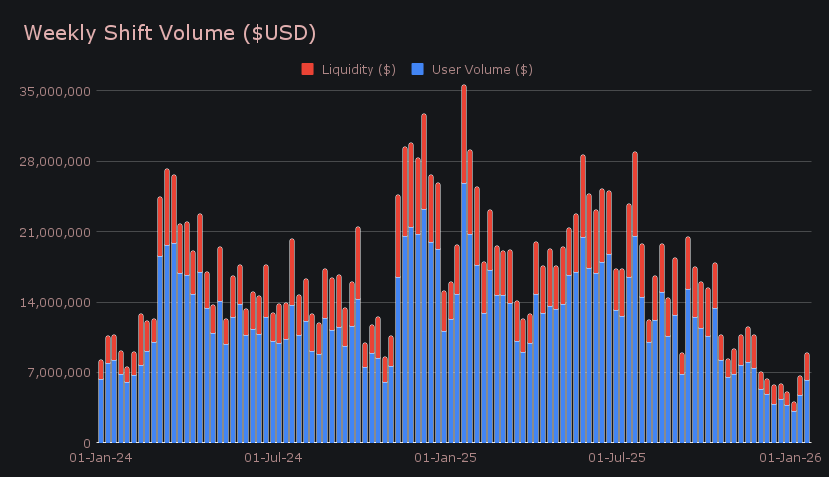

- SideShift processed $8.93m in weekly volume (+33.9%), the platform’s highest total since mid-November and a third consecutive week of growth.

- Stakers earned 204,406 XAI ($22.7k) at a 7.96% average APY, the strongest yield in nearly eight weeks, with rewards peaking on January 13.

- SOL and ETH accounted for 35.5% of total weekly volume, each posting their strongest results since fall 2025 and reclaiming the top of the leaderboard.

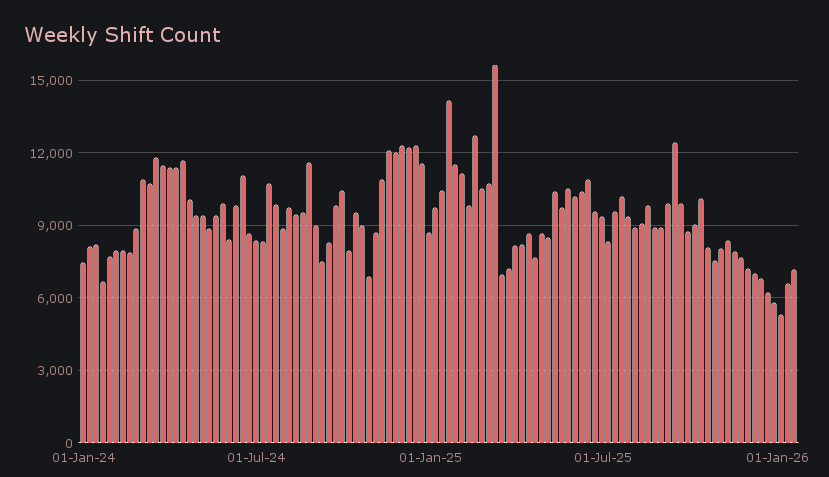

- Shift count rose to 7,157 (+8.5%), climbing back above the recurring yearly lows seen in both 2024 and 2025.

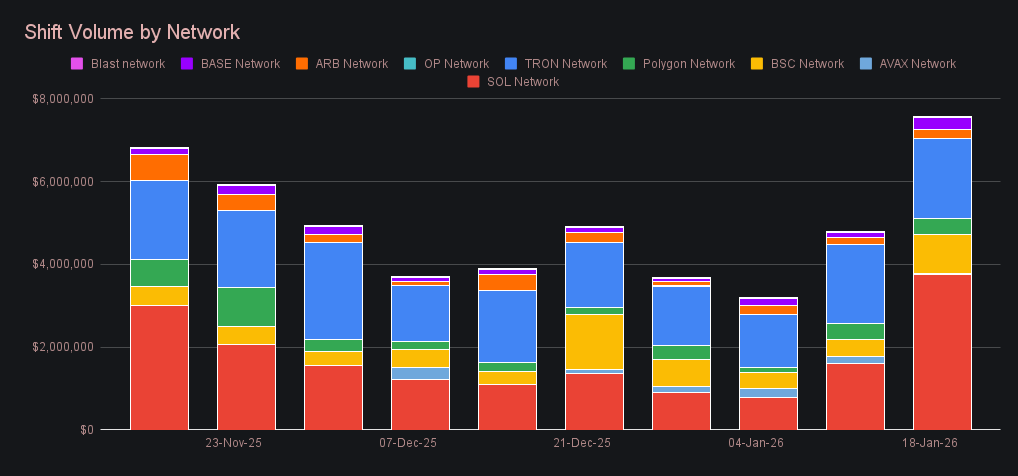

- Alternate networks reached $7.56m in volume (+58.5%), their strongest combined showing in several months, led by Solana.

XAI Weekly Performance & Staking

XAI spent the week anchored just above the $0.11 mark as price movement remained deliberate rather than directional. The 7-day chart shows a very subtle rise developing into the latter half of the period after a flat start, while the 30-day view continues to reflect the pullback that followed December’s move out of the low-$0.12 range. A brief spike appeared on the weekly chart, but quickly retraced without reshaping the broader trend. At the time of writing, XAI is priced at $0.1107, placing its market cap at $17.31m, a +1.35% increase from last week.

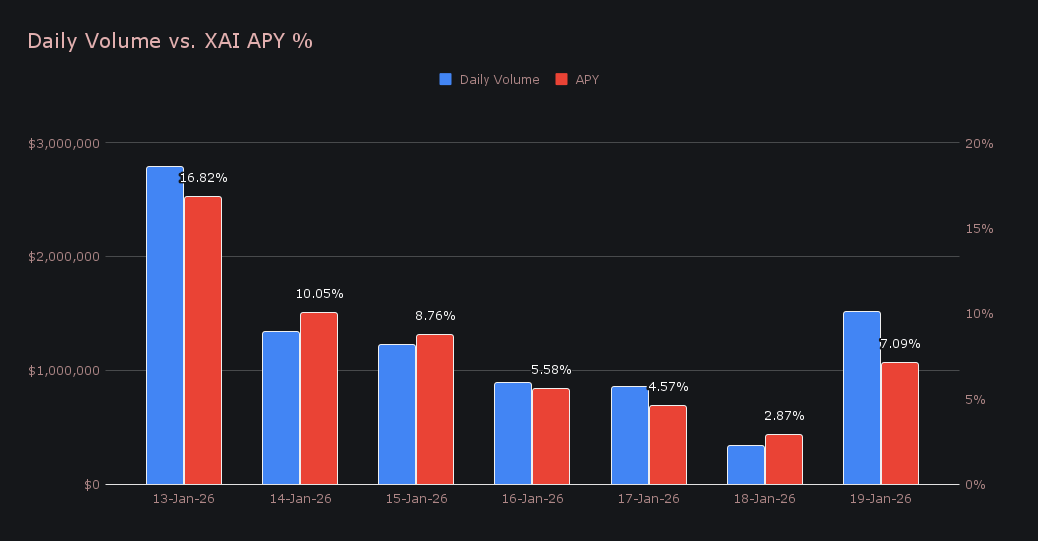

A total of 204,406.30 XAI ($22,674.70) was distributed to stakers across the week, pushing the average APY up to 7.96%, the strongest level seen in nearly eight weeks. January 13th marked the high point, when 59,814.97 XAI was paid out directly to the staking vault at a 16.82% APY that occurred alongside $2.78m in SideShift volume. Activity cooled after that early push, but aggregate rewards still closed comfortably ahead of the prior period.

Additional XAI updates

Total Value Staked: 140,681,980 XAI (+0.1%)

Total Value Locked: $15,534,073 (+1.1%)

General Business News

Following a positive start to the year, crypto markets turned lower this week, as BTC fell back toward $90k, bringing the rest of the market down alongside. The move was driven in part by a wave of liquidations, which added momentum to the pullback as positions were cleared across majors and alts. One clear outlier was DASH, which moved against the broader trend and posted a roughly +40% gain on the week.

SideShift recorded a third consecutive week of growth, with gross weekly volume climbing to $8.93m (+33.9%), marking the platform’s highest weekly total since mid-November. The strength of the move was evident, with this week’s figure sitting roughly ~36% above the YTD average, even though only a handful of January data points have been recorded thus far. User shifting accounted for $6.20m (+29.1%), while liquidity shifting rose more sharply to $2.73m (+46.2%), reflecting increased internal rebalancing alongside higher throughput. Among top pairs, ETH↔SOL pairs combined for just under $1.19m in volume, with weight skewed towards SOL buying, making them by far the largest driver of user activity, while TRX/USDT (TRC-20) followed at a distance with $161k.

Alongside the rise in volume, shift count climbed to 7,157 total shifts (+8.5%), translating to daily averages of $1.28m in volume across 1,022 shifts. Activity has rebounded from a familiar low around the turn of the year, a level that has marked local troughs in both 2024 and 2025, and has since pushed back above those prior floors. The move back above these repeat low points points to renewed participation after the early-year dip, with weekly count once again trending higher.

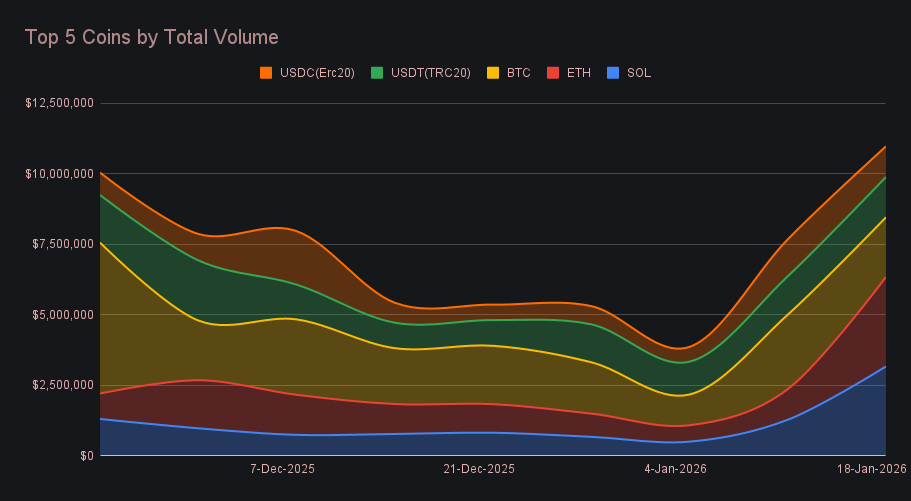

SOL and ETH dominated the leaderboard, finishing nearly neck-and-neck at the top and combining for 35.5% of total weekly volume. SOL ranked first with $3.17m (+147.4%), marking its strongest showing since early fall 2025 after remaining relatively quiet through the final months of the year and frequently slipping outside the top five. The rebound was broad-based, with user deposits rising to $680k (+111.0%) and settlements climbing to $1.49m (+137.1%), a sharp contrast to SOL’s lack of presence late last year. ETH followed closely at $3.17m (+192.6%), also recording its highest weekly total since fall, though it maintained more consistent activity through year-end. Growth leaned more heavily toward deposits at $1.47m (+162.8%), while settlements increased to $617k (+101.8%), placing ETH firmly alongside SOL at the top of the rankings.

BTC ranked third with $2.12m in total volume (−19.9%), the largest week-on-week decline among the top five coins. User deposits fell to $804k (−36.8%), while settlements rose to $686k (+77.7%), producing a different mix from the prior period but leaving the overall total close to levels seen across much of December. In context, this placed BTC squarely within the low-$2m range, consistent with where volume has repeatedly settled in recent months outside of brief volatility flashes.

Stablecoins rounded out the top five, but ended with varying results. USDT (TRC-20) posted $1.43m in total volume (+5.1%), supported by user deposits of $352k (+42.7%), while settlements dropped to $641k (−5.8%), keeping Tron-based USDT at the helm of stablecoin usage despite the dip in demand. USDC (ERC-20) followed with $1.09m (−17.1%), where deposits rose to $394k (+52.4%) even as settlements fell more sharply to $349k (−26.7%). USDT(ERC-20) painted a similar story, ending in 6th place with a gross $1.09m (-17.1%).

Alternate networks delivered their strongest combined showing in several months, with total volume rising to $7.56m (+58.5%), again outpacing activity on Ethereum, which finished the week at $4.71m (+36.3%). Solana led decisively at $3.76m (+133.1%), accounting for roughly half of all non-Ethereum volume, followed by Tron at $1.92m (+0.8%), which continued to provide the most consistent baseline of activity. BSC moved back into the upper tier with $952k (+132.8%), marking its strongest showing so far this year, while Polygon held steady at $396k (+1.6%). Base registered $281k (+139.0%) and Arbitrum reached $218k (+35.6%), both remaining secondary contributors relative to the leading networks.

In listing news, SideShift added support for JupUSD, and MetaDAO on Solana, in addition to re-enabling Paxos Gold for shifting this past week.

Affiliate News

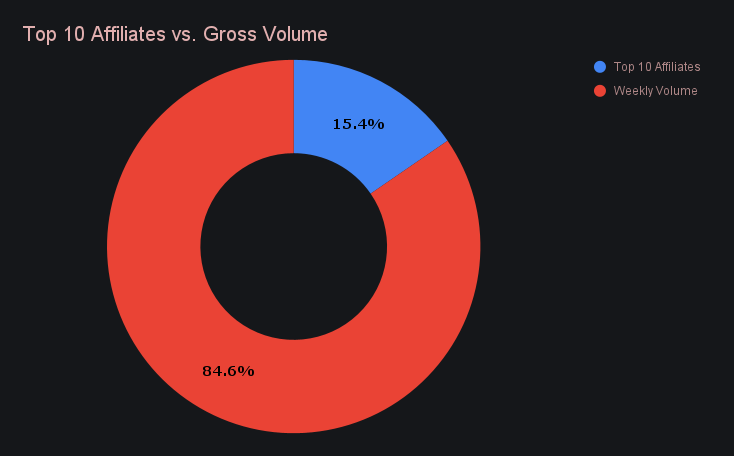

Affiliate activity increased almost exactly in line with overall platform growth, with the top affiliates generating a combined $1.38m (+30.6%) over the week. First place led the group at $488k (+93.1%), posting the largest increase by a wide margin and accounting for much of the overall gain. Second place followed at $379k (−0.6%), holding essentially flat week-on-week, while third place slipped to $101k (−18.7%), easing back after cracking into the top 3 last week.

Overall, affiliates accounted for 15.4% of our total volume, a relatively low proportion, and -0.4% lower than last week’s snapshot.

That’s all for now - thanks for reading and happy shifting.