SideShift.ai Weekly Report | 13th - 19th May 2025

Welcome to the one hundred and fifty-fourth edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

Highlights

- Volume ranked top 5 YTD – Weekly volume rose +6.6% to $22.7m, driven by direct user shifts and higher-value activity.

- BTC stayed steady at the top – Volume held at $10.3m, the fourth $10m+ week in five, even as settlements slid to a 7-week low.

- ETH & SOL led the gainers – ETH jumped +28.8% to $5.7m, while SOL surged +42.2% to $5.1m with user settlements up +60.3%.

- USDT reinforced its role – Volume totaled $6.9m (-0.7%), driven by strong settlement demand as users shifted from BTC & ETH.

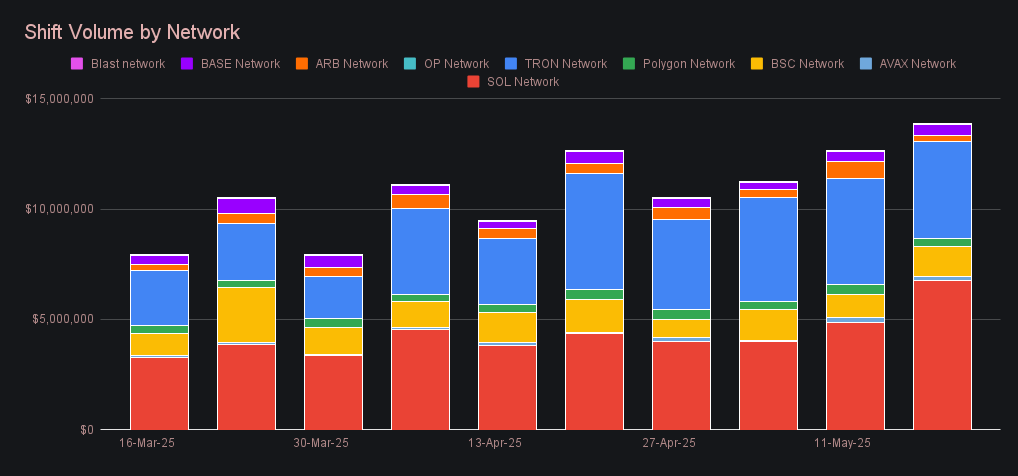

- Alt L1s hit a multi-month high – Solana, Tron, and BSC pushed alternate network volume to $13.9m, the best finish in months.

XAI Weekly Performance & Staking

SideShift token (XAI) moved within a relatively tight band this week, ranging from a low of $0.1331 to a high of $0.1364, and ended up closing just beneath the top of that range at a price of $0.1357. This consistent performance helped lift XAI’s market cap +3.0% to $20,209,976, marking a second consecutive week of upward momentum.

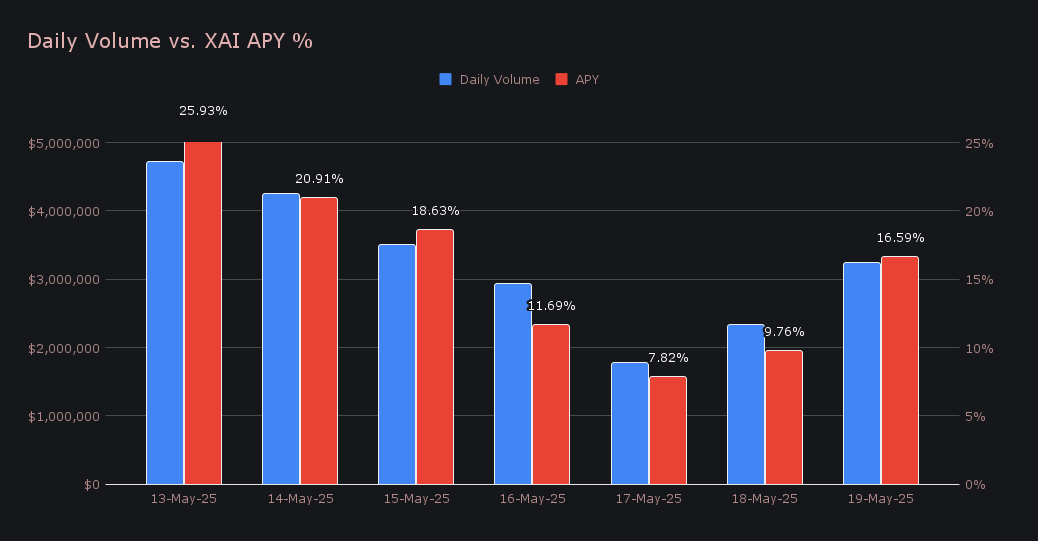

Staking conditions were solid, with users earning a strong average APY of 15.90% throughout the period. The standout moment came on May 13th, which saw 84,217.4 XAI distributed directly to our staking vault at a very healthy APY of 25.93%. This day also recorded a fantastic $4.7m in daily volume, the highest daily total so far in May. Altogether, XAI stakers received a total of 374,370.06 XAI or $50,783.93 USD in weekly rewards.

A total of 175,000 USDC was added to SideShift’s treasury this week, bringing the current total to a value of $22.77m. Users can follow along with live treasury updates at sideshift.ai/treasury.

Additional XAI updates:

Total Value Staked: 133,755,884 XAI (+0.4%)

Total Value Locked: $18,223,673 (+4.1%)

General Business News

Crypto markets carried on with strength this past week as BTC led the charge and came within striking distance of new all-time highs. It logged its strongest weekly close ever, finishing just shy of $106k amid continued positive sentiment and renewed institutional interest, including Strategy (formerly MicroStrategy)’s latest 7,390 BTC buy. ETH followed with a +7% rise to $2,550, lifted by a surge in Ethereum DeFi activity as Aave’s TVL soared back above $30 billion, and its token posted a +24% weekly gain.

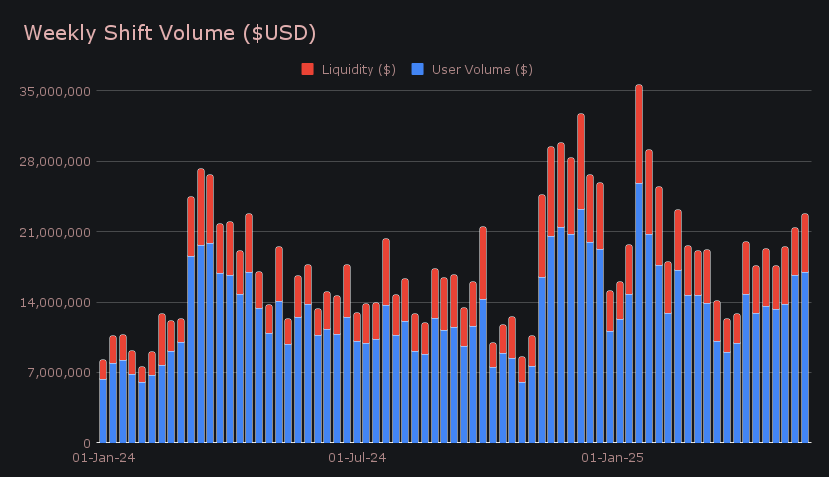

This past week saw SideShift register a noteworthy performance, with gross volume climbing to $22.7m (+6.6%) - a figure that now lands within our top 5 highest weeks of 2025. Much of this volume stemmed from shifts completed directly on the site, suggesting a strong presence of hands-on users throughout the week. User shifting summed $17.0m (+1.9%) while liquidity shifting rose to $5.7m (+23.3%), making a decent jump after accounting for a smaller overall proportion last week. BTC/USDT (ERC-20) once again ran away with the top spot among all user pairs, finishing with $2.26m in volume. To put its dominance in context, the next closest user pair, ETH/BTC, settled for just one third of that total.

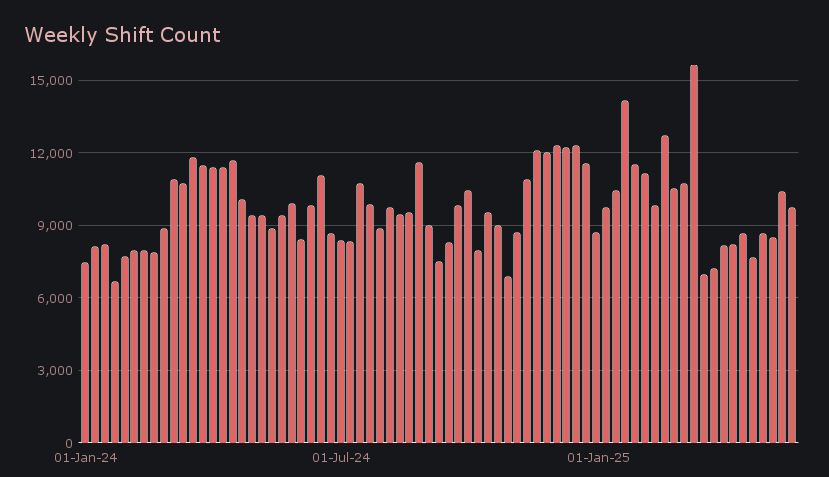

Gross shift count displayed a bit of a different trend, pulling back slightly to 9,741 (-6.2%), though this still landed within 3% of our year-to-date running average. The overall drop reflects a lighter week in smaller-scale shifts, despite volume staying elevated. When combined with gross volume, this weekly total produced daily averages of $3.25m in volume alongside 1,392 shifts.

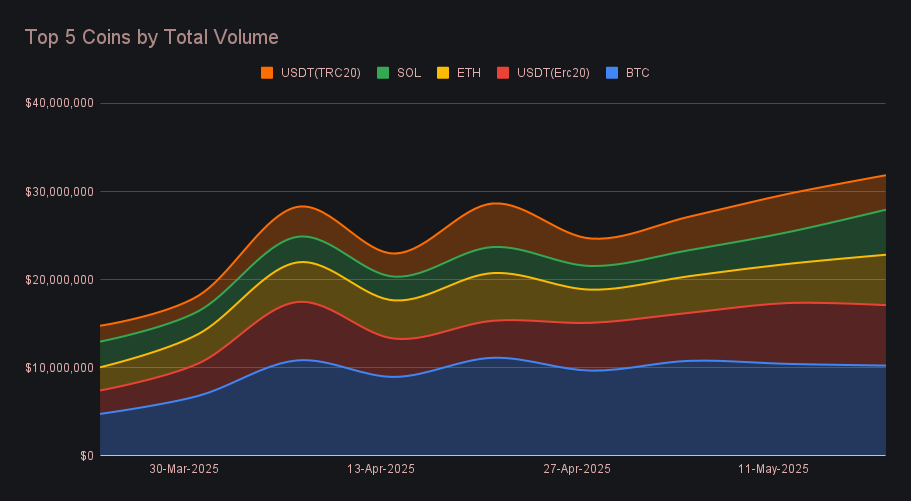

BTC held onto the top spot this week with a total volume (deposits + settlements) of $10.3m, marking a slight decline of -1.8% and continuing to establish a solid base at these levels. It has now surpassed $10m in weekly total volume in 4 of the past 5 periods, showing minimal variation throughout that stretch. This week’s sum was once again led by user deposits, which reached $4.7m, a drop of -3.7%, while settlements fell more significantly to $3.5m, down -16.0%. This represented BTC’s lowest user settlement volume since the end of March 2025, suggesting that users may be beginning to gradually shift their attention elsewhere.

USDT (ERC-20) firmly held second place this week with a total volume of $6.9m (-0.7%), and has created some separation after being more neck and neck with ETH back in late March. User settlements continued to drive activity, rising to $3.4m (+1.3%), while deposits dropped to $1.6m (-10.4%). This reflects an ongoing trend on SideShift, where users are increasingly shifting out of BTC and ETH into Ethereum-based stablecoins - with USDT as the clear favorite, a pattern reinforced by the strength of our top shift pair.

ETH and SOL claimed the third and fourth spots this week, each showing impressive volume increases and finishing as the two highest gainers among our top coins, another sign of where user activity was focused. ETH rose +28.8% to $5.7m, comprised of $2.8m in user deposits and a steady $1.7m in settlements. SOL climbed even further, jumping +42.2% to $5.1m, with $1.7m in deposits, and user settlements surging +60.3% to $2.1m. This notable spike in settlement activity was especially telling, and may be the spark that reignites broader interest in both SOL and ETH, as demand continues to rotate across top assets.

Beyond the top-performing assets, several other coins helped drive SideShift’s broader volume increase. DOGE stood out with a sharp +91.8% rise to $657k, nearly doubling its volume from the week prior and marking a lively return to user shifting. Meanwhile, WETH (ERC-20) and L-BTC quietly posted some of the largest percentage gains across the board, ending with $261k (+957.5%) and $222k (+136.8%) respectively. These jumps serve as a reminder that meaningful volume can stem from every corner of the platform.

Alternate networks to Ethereum climbed to reach a combined $13.9m in volume this week (+9.9%), led by the Solana network, which jumped to $6.8m (+40.0%). The gain was powered by increased shifting of the native SOL, along with more than +20% volume growth in both USDC and USDT on Solana, firmly restoring its lead among Ethereum alternatives. The Tron network followed with a steady $4.4m (-9.1%), while BSC ticked up to $1.3m (+25.2%), also on the back of higher stablecoin activity. In contrast, Arbitrum fell sharply to just $291k (-60.8%), giving back much of its recent traction. This week’s $13.9m total marked a multi-month high, offering a refreshing change from the recent BTC and stablecoin-centric weeks.

Affiliate News

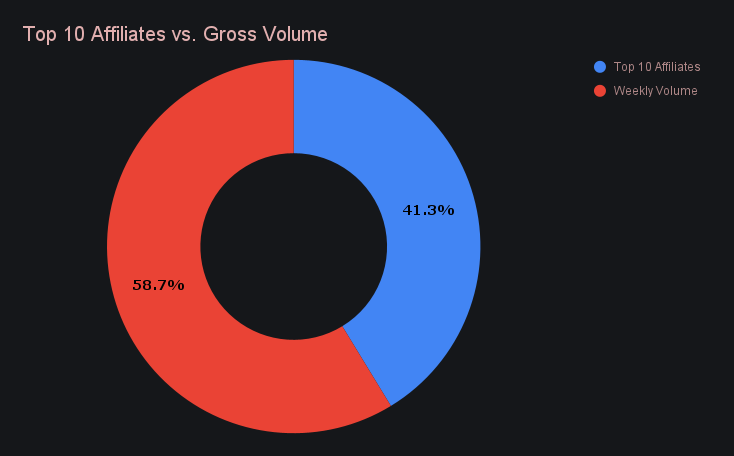

Affiliate activity dipped this week, with the combined sum falling -12.1% to $9.4m, while the overall proportion of volume dropped to 41.3%, down from 50.1% the week prior. Even so, our first placed affiliate maintained momentum and produced a massive $6.1m (+3.9%) in volume alone. Second and third place held their rankings and followed with $1.8m (-42.0%) and $603k (-12.5%), respectively, each declining from last week, but still contributing a consistent stream of shifts and volume.

That’s all for now. Thanks for reading and happy shifting.