SideShift.ai Weekly Report | 13th February - 19th February 2024

Welcome to the ninety-second edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

SideShift token spent the week moving within the 7 day range of $0.1227 / $0.1622, moving its way higher as the week came to a close. At the time of writing, the price of XAI is positioned in the middle of that bound at a price of $0.1410, and has a current market cap of $18,420,562 (+14.6%).

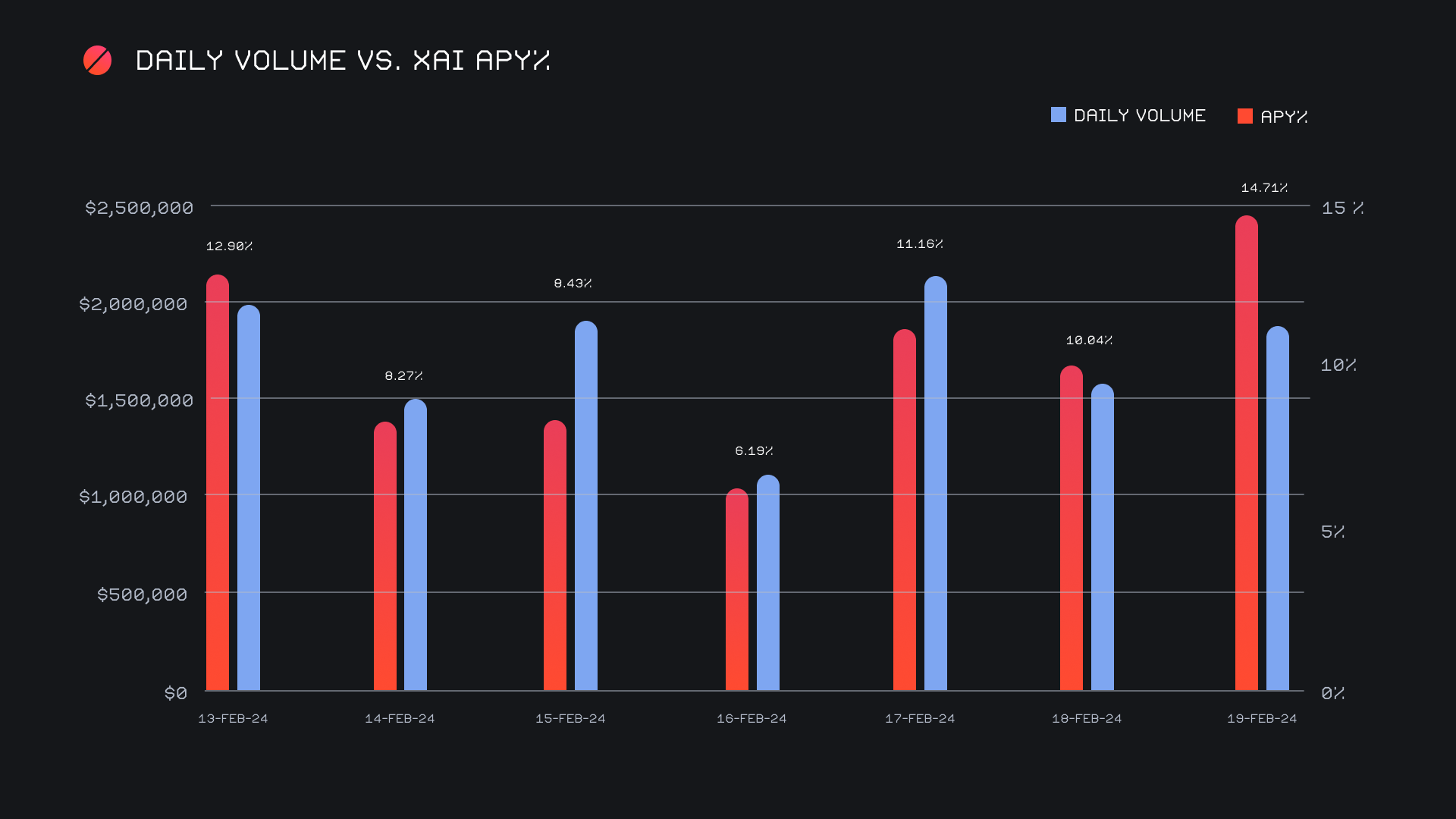

XAI stakers were rewarded with an average APY of 10.23% throughout the week, with a daily rewards high of 43,850.44 XAI being distributed to our staking vault on February 20th, 2024. This was following a daily volume of $1.9m. This week XAI stakers received a total of 216,935.81 XAI, or $30,587.95 USD.

An additional 50 ETH was sent to SideShift’s treasury on February 15th, 2024. This latest addition brought the SideShift treasury past the $10m milestone, as it now sums to a current total of $10.1m or 195.58 BTC equivalent. Users are encouraged to follow along directly with live treasury updates, via SideShift.ai/treasury.

Additional XAI updates:

Total Value Staked: 116,771,889 XAI (+0.4%)

Total Value Locked: $16,528,525 (+14.9%)

General Business News

The overall market continued to see positive momentum, as the total crypto market cap made a push for the two trillion dollar mark this week. BTC dominance is hovering around the ~50% area, however the total altcoin market cap has shown serious strength recently and looks to be on the ascent, eager to eat into BTC’s market share.

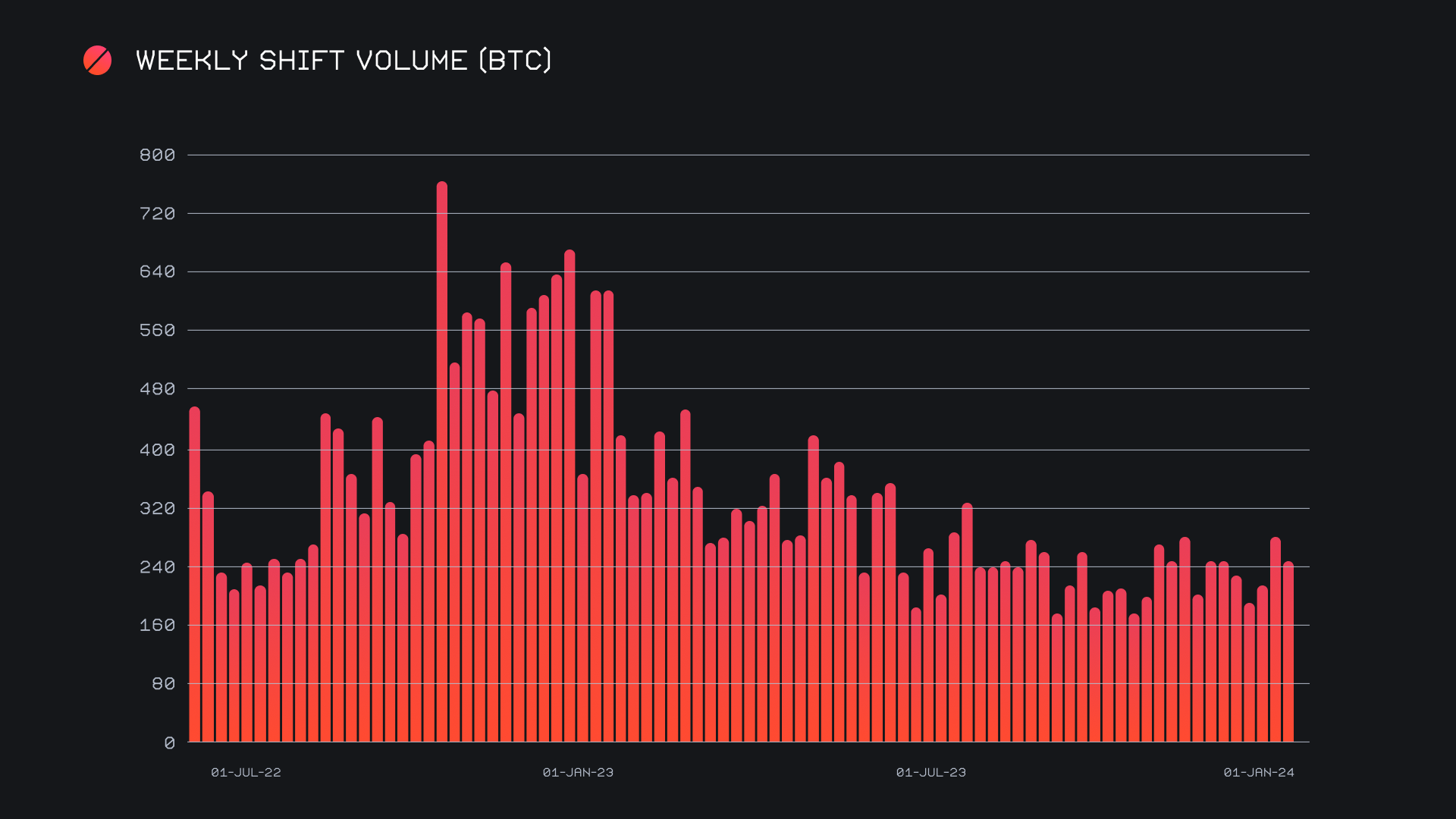

SideShift had a very good week and showed no signs of slowing down when Monday rolled around, closing most days with volumes near $2m. We ended the period with a gross volume of $12.2m (-5.2%) alongside a shift count of 7,847 (-1.1%). Although this gross volume was relatively on par with last week’s, we finished with 40% less liquidity shifts. The result was a +17.9% increase in our net volume, the highest level seen since February of last year. When denoted in BTC, our gross volume amounted to 235.96 BTC, a decrease of -14.3% that can be credited to the rise in BTC’s price over the past two weeks.

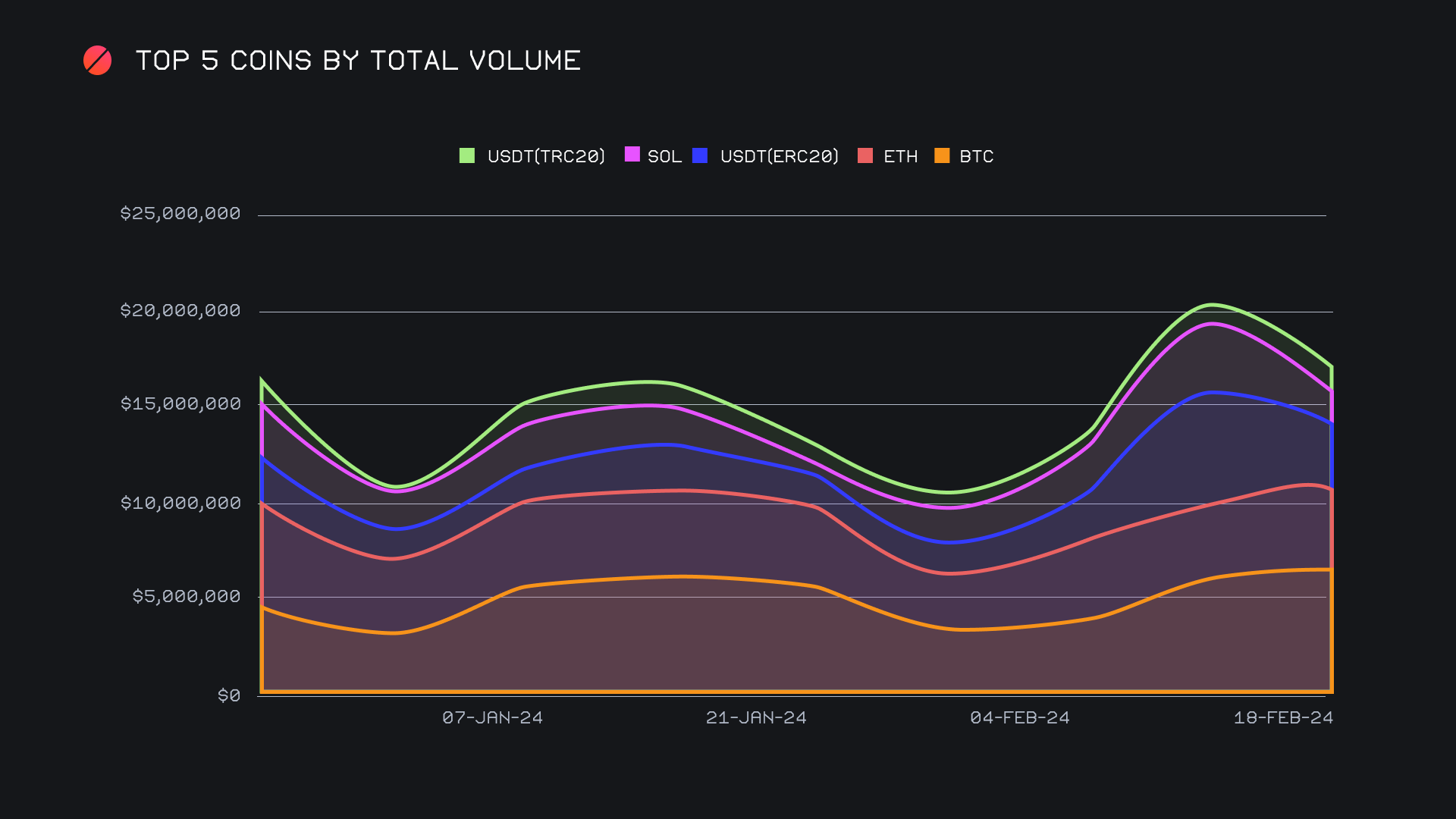

A look at our top 5 coins by total volume paints an interesting picture, especially when we consider the fact that gross volume remained relatively consistent. As compared to last week, the sum of our top 5 coins by total volume (deposits + settlements) fell by ~16%, as visualized in the chart below. What this tells us is that a fairly large amount of shifts containing “‘less popular coins” took place this week. The key reason behind the decline in the dominance of our top 5 coins was a substantial drop in both USDT (ERC-20) and SOL shifts. They retained their respective ranks of 3rd and 4th place, but both saw volume plummet by more than 45%. The results were USDT (ERC-20) ending with $3.0m (-46.4%), with SOL sitting far lower, at a sum of $1.7m (-51.8%). These happened to be the only two coins in our top 10 this week which saw volume declines.

Instead, the heavier focus lay on our usual top two coins - BTC and ETH - although for different reasons. With an impressive sum of $6.5m (+4.4%), BTC easily clinched the week’s top spot primarily due to a heavy inflow of user deposits. A significant 35% of weekly user deposits came from BTC, a deposit amount as large as the next top four coins combined. This was quite consistent with that of last week’s deposit total and once again ended around the $3m area, telling us that users are continuing to sell their BTC for other coins in bulk. Although BTC deposits were dominant, user settlements still took a big leap, rising +52.8% for a total of $1.7m.

Despite this being a substantial increase in user BTC settlements, it still fell short when compared to the interest shown to ETH. Total ETH volume ended with $4.7m (+18.8%), a figure that opposed BTC and was largely driven by user settlements. User ETH settlements led all coins with $2.1m (+25.1%), which was the highest settlement total we have seen for any coin in the past four weeks. Based on this, we should not be surprised that the most commonly shifted pair was BTC/ETH - it tallied $1.04m, as 33% of the deposited BTC volume this week was shifted to ETH. When taking a look at the recent performances of both BTC and ETH, it makes sense to see users leaning in heavier here, while easing off of SOL for the time being.

With the majority of coins enjoying a green week, more than a few recorded triple digit increases. Shockingly, 9 out of our top 20 coins fell into this category, an anomaly that is not commonly seen. This was no doubt an influential factor in maintaining the solid gross volume we recorded this week. Another observation here was that the volume was not limited to one chain, but rather spread across a variety of chains and coins. Some examples of these surges include BNB ($569k, +173.3%), ETH (ARB) ($444k, +124%), TRX ($261k, +155.9%), GRT (ERC-20) ($184k, +286.5%), and ATOM ($173k, +133.3%).

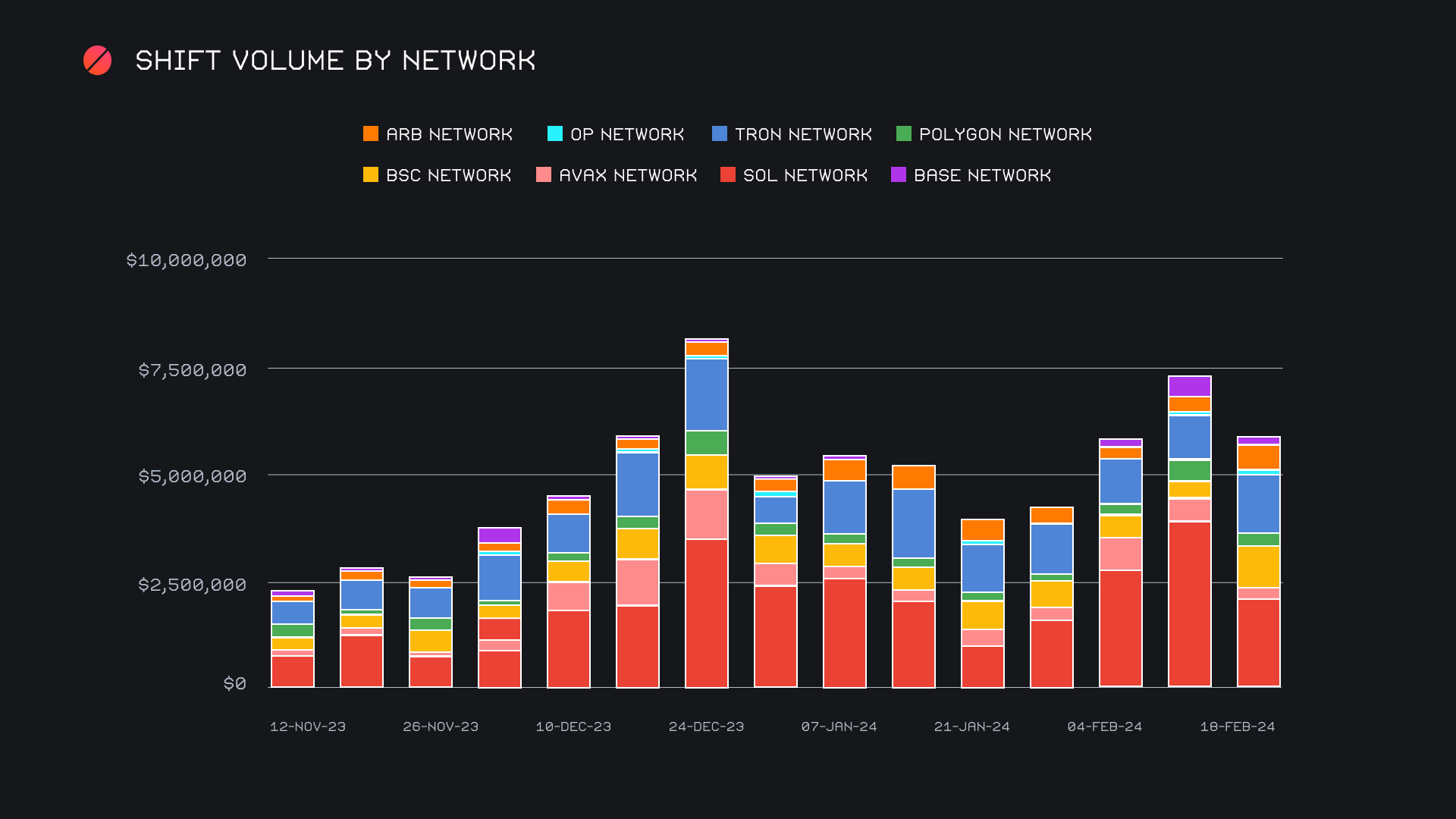

The decline in SOL shifting impacted the overall volume of alternate networks to ETH, but these networks still combined for a respectable sum. All together they ended just slightly above the $6m mark, a dip of about ~17% from last week’s total. Despite the lull, the Solana network still prevailed atop the grouping with $2.2m (-45%). A near 4x in the volume of USDT (sol) shifting definitely lent a helping hand in this regard. Following in second place came the Tron network, with a solid $1.4m (+35.8%) overall. As it usually does, USDT (TRC-20) accounted for more than 80% of this sum, as it is the obvious coin of choice on the Tron network on SideShift. In third was the Binance Smart Chain Network (BSC) with $953k (+166.8%), recording one of the higher weekly changes among alternate networks to ETH. The BSC network tends to oscillate quite frequently, but this week’s total marked the biggest spike it has recorded in more than 3 months. This was due to a combination of both BNB and USDT (BSC) shifting. In addition to the Solana network, the Polygon and Avalanche networks were somewhat neglected by users after some solid showings last week, and watched their volumes slide by -40 to -50%. As compared to these alternate networks, the Ethereum network ended with $9.2m in total shift volume, approximately 8% lower than last week’s nominal sum. This translated to roughly 38% of our weekly shift volume containing a coin on the Ethereum network, which was also slightly lower than last week’s total.

In listing news, SideShift added support for two new ERC-20 coins - Mantle Staked Ether (mETH), and Echelon Prime (PRIME). Shifting of both of these coins is now live, directly from any coin of your choice.

Affiliate News

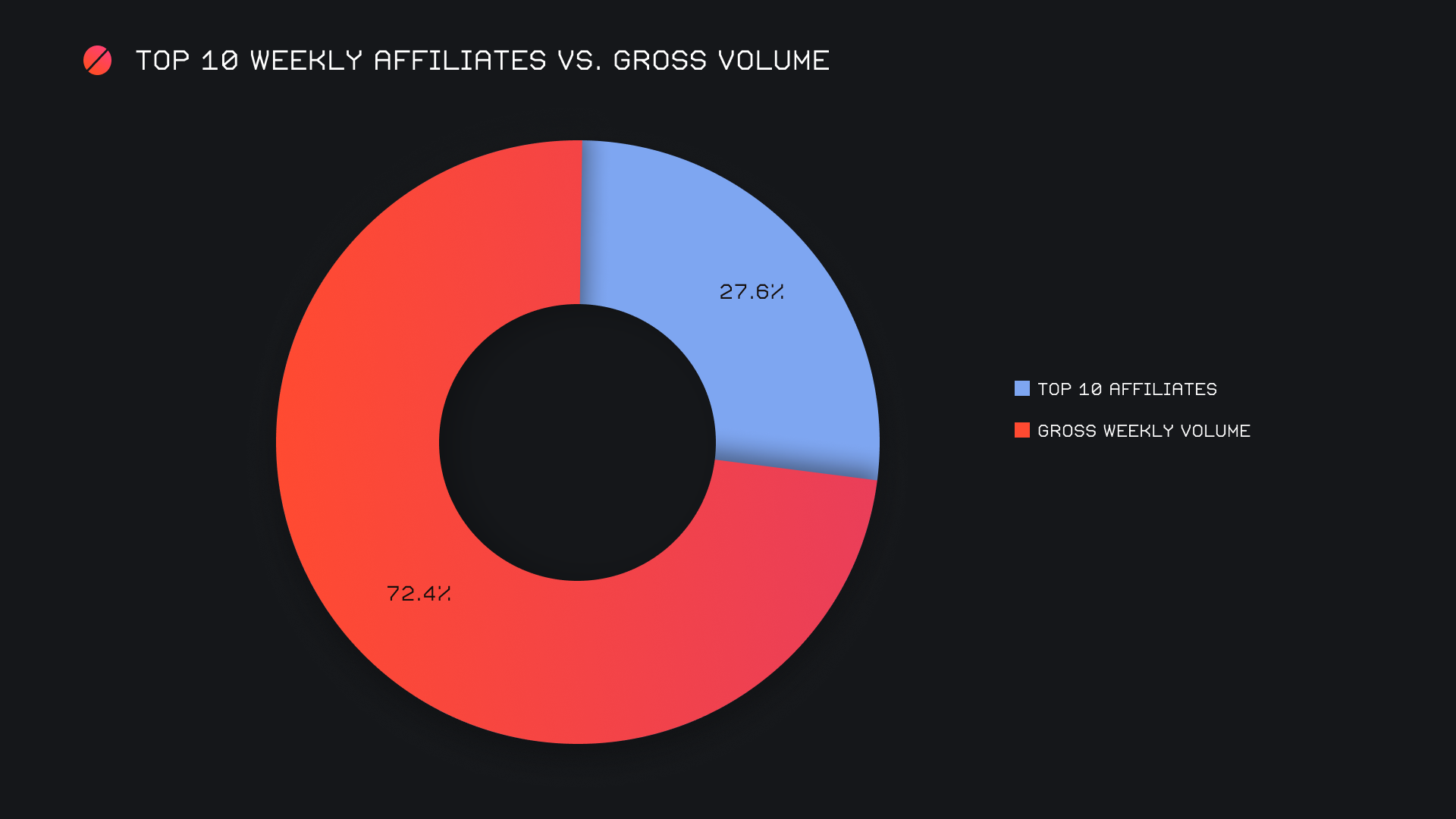

SideShift’s top affiliates ended with a combined total of $3.4m, +14.9% higher than last week’s sum. With a total $1.2m on 951 shifts, our top affiliate remains unchanged and this week represented about 10% of our weekly shift volume. However, it wasn’t the only affiliate to generate respectable sums, with second and third placed affiliates ending with respective totals of $1.03m, and $613k. The affiliate in third place had a notable performance, with its volume rocketing more than 8x from last week. This occurred alongside a shift count which rose nearly twice as fast, and increased more than 15x.

All together, our top affiliates represented 27.6% of our weekly volume, 4.8% higher than last week’s proportion.

That’s all for now. Thanks for reading and happy shifting.