SideShift.ai Weekly Report | 14th - 20th January 2025

Welcome to the one hundred and thirty-seventh edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

This past week, SideShift token (XAI) bounced between $0.1528 and $0.1646 throughout the 7-day trading period. XAI initially dipped early in the week but gradually recovered, maintaining a relatively stable trajectory before a swift uptick toward the weekend. At the time of writing, XAI holds a current price of $0.1601, reflecting a market cap of $23,154,246 (-2.7%).

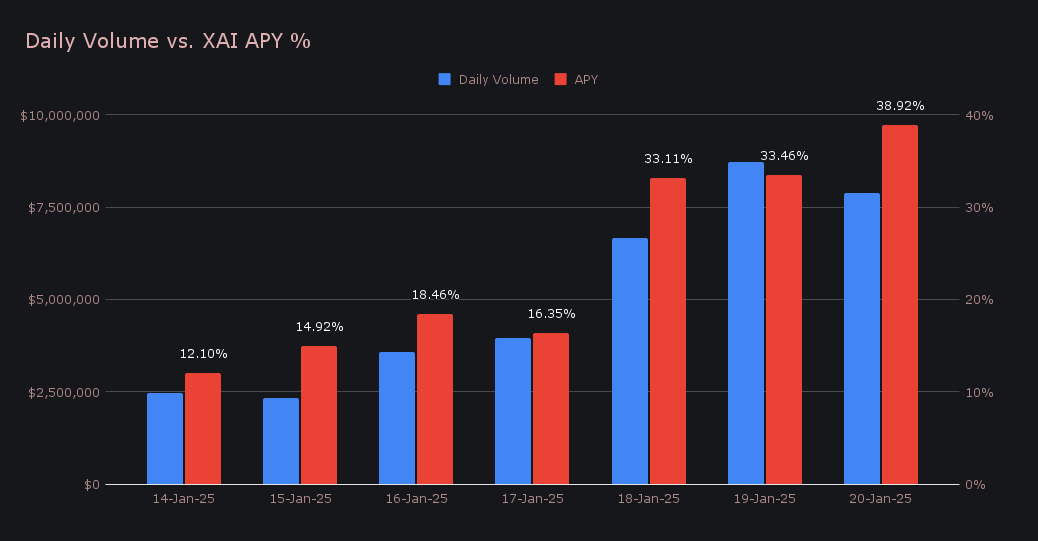

XAI stakers enjoyed a robust average APY of 23.90% throughout the week, with one of our highest ever daily rewards (116,351.36 XAI) being distributed directly to our staking vault on January 21, 2025. This corresponded to a peak APY of 38.92% and was driven by an outstanding daily volume of $7.9m. Notably, this followed a record-setting daily volume of $8.7m on January 19, 2025, thereby achieving consecutive record-breaking days. Altogether, XAI stakers received a total of 521,867.17 XAI or $83,241.65 USD in rewards this week.

An additional 300,000 USDC was sent to SideShift's treasury over the course of the week, bringing the current total to a value of $24.14m. Users are encouraged to follow treasury updates directly via sideshift.ai/treasury.

Additional XAI Updates:

Total Value Staked: 129,342,773 XAI (+0.4%)

Total Value Locked: $20,571,811 (-4.2%)

General Business News

The crypto market had a turbulent week, with BTC soaring to a new all-time high of $109k before easing back toward its current price of $102k (-4.9%) as the market eagerly awaited any mention of Bitcoin during President Trump’s inauguration speech. Additionally, the launch of the TRUMP memecoin created a heated frenzy, rapidly rising to a market cap of nearly $15 billion in the span of just 36 hours, sucking liquidity from the entire market. This remarkable surge sent shockwaves through the industry, driving trading volume to record highs and propelling SOL to an all-time high of $286 before cooling off.

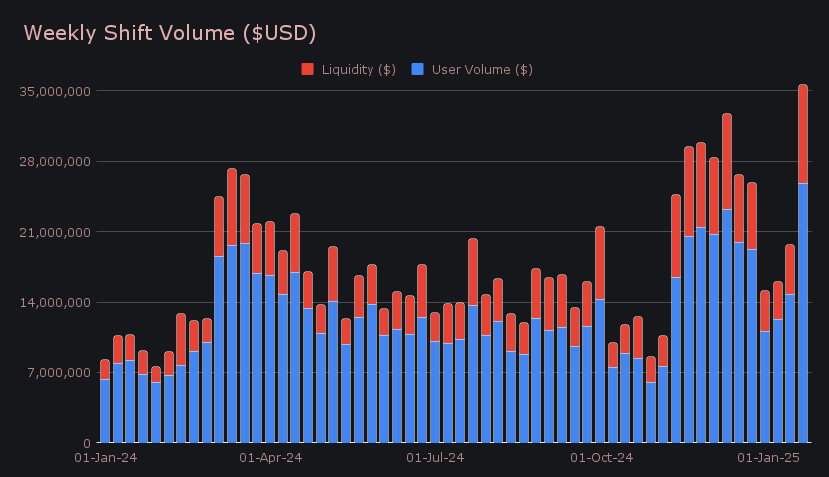

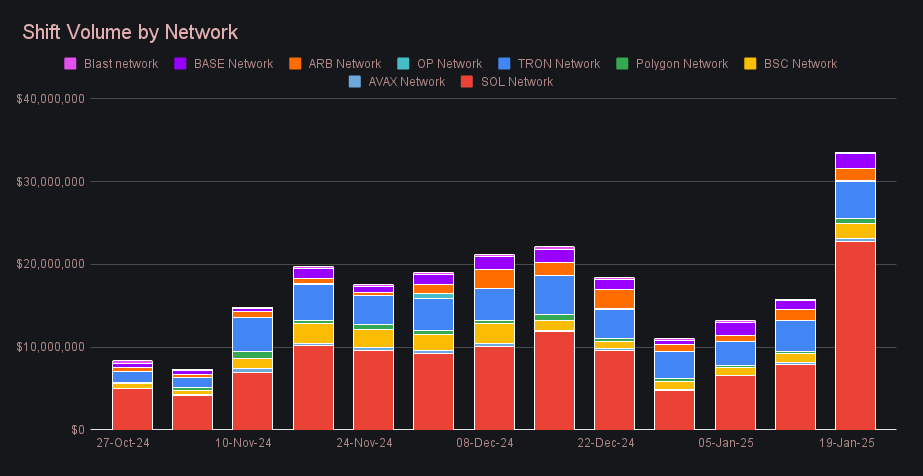

This past week was a monumental one for SideShift, with our gross weekly volume reaching an all-time high of $35.6m (+80.4%). In addition to an already steady performance during the working week, this unprecedented figure was primarily fueled by the aforementioned back-to-back record-setting daily volumes over the weekend, highlighting the growing activity on the platform. User shifting volume saw a significant rise, climbing to $25.8m (+73.8%), while liquidity shifting was also heightened due to intense unidirectional shifting, and doubled to $9.8m to support the elevated demand.

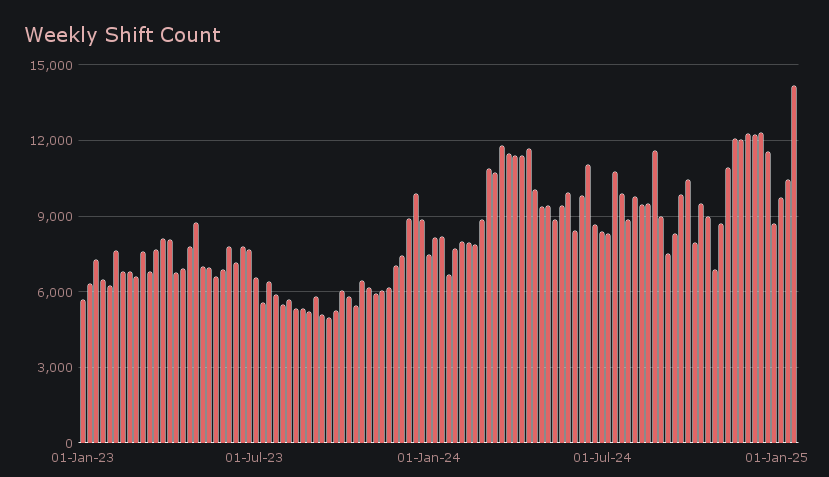

Our weekly shift count followed suit, achieving a new record of 14,160 shifts (+35.5%). Daily averages reflected this historic growth, with an impressive $5.1m in volume processed across 2,023 shifts per day - setting a new benchmark for SideShift's operational scale. The surge in shift activity was heavily influenced by strong interest in SOL, as demonstrated by our week’s top three shift pairs among users: ETH/SOL ($3.3m), SOL/ETH ($1.6m), and BTC/SOL ($1.4m), which collectively generated over $6.2m in user volume and played a key role in the week’s success.

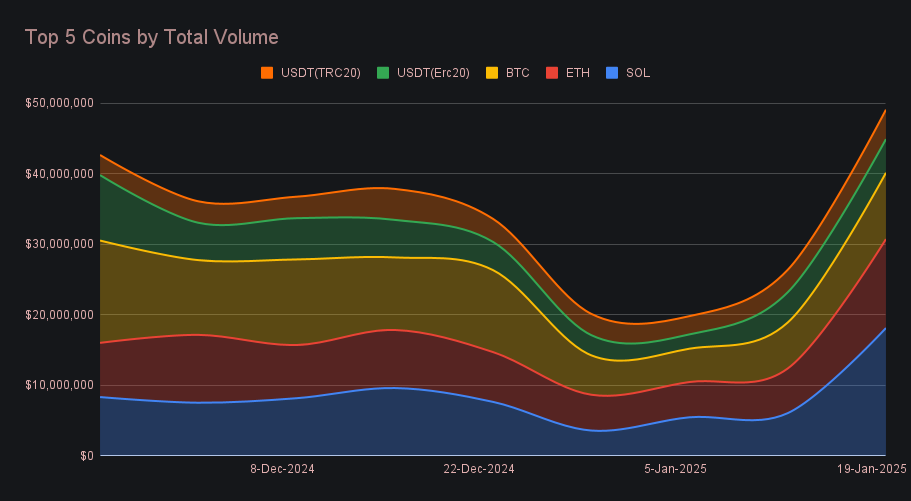

This week, SOL dominated SideShift, achieving an astounding total volume (deposits + settlements) of $18.1m (+198.9%). This marks not only the highest weekly volume ever for Solana but the highest weekly total ever recorded for any single coin on the platform. The demand for SOL was immense, as shown by the stark discrepancy between its deposit volume of $4.8m (+137.4%) and its settlement volume, which surged to $8.6m (+217.9%). This massive wave of activity came as users rushed to buy TRUMP coin, bringing renewed attention to Solana and driving its record-breaking performance.

ETH followed in second place with $12.6m (+99.2%) in total volume. A rising tide lifts all ships, as the broader market excitement and Solana’s momentum also sparked increased ETH shifting on SideShift. As embodied by our week’s top shift pairs, the large portion of this volume derived from users rushing out of ETH and into SOL. A user deposit volume of $5.5m (+121.3%) represented the highest deposit sum among all coins this week, while user ETH settlements totaled a lesser $3.3m (+37.2%).

BTC rounded out the top three with a gross volume of $9.4m (+44.3%). The increase in BTC activity was fairly balanced, with deposits reaching $4.3m (+43.9%) and settlements growing to $3.8m (+72.4%). Despite being outshined by Solana’s extraordinary rise, this week’s total BTC volume still marked its highest achieved in the past four weeks.

This week’s standout volume was bolstered by consistent gains across the board, with all of our top 19 coins recording weekly increases. It wasn’t until TRX, ranked 20th, that we encountered a decline, as it ended the period with $392,698 (-32%). Beyond the top 3 coins, several others delivered noteworthy performances. USDC (SOL) screamed into 6th place with a +131.4% jump, generating $4.0m in weekly volume. Close behind was XRP, which also saw a triple-digit increase, finishing with $2.8m (+134.3%). Another notable mention goes to ETH (BASE), which contributed $1.2m (+31.7%) and maintained steady interest throughout the week.

Alternate networks to ETH had an outstanding showing, combining for $33.4m (+113.7%) in total volume, more than doubling last week’s total. Unsurprisingly, the Solana network led the charge, soaring to $22.8m (+187.3%) and contributing nearly 70% of the total. The Tron network followed with $4.6m (+21.5%), while the Binance Smart Chain (BSC) network added $1.7m (+63.8%) to round out the top three. Other networks also made notable contributions, with Base climbing to $1.8m (+73.3%), and Polygon reaching $591.5k (+133.0%). This collective surge highlights the growing role of alternate networks, with Solana’s dominance amplifying its standing as the clear alternative leader.

Affiliate News

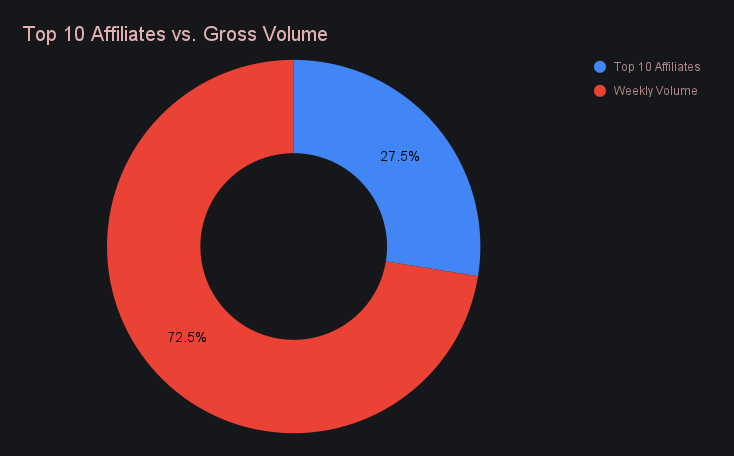

Our top affiliates delivered an exceptional performance and contributed $9.8m (+100.7%) in total volume, a dramatic increase from last week’s total. The leaderboard saw one major shift, as our previous second-placed affiliate climbed to the top, generating $3.6m (+267.1%) alongside 1,214 shifts. Our new second-placed affiliate followed closely with $2.7m (+14.3%), while our third-placed affiliate remained steady at $1.3m (+160.6%) also adding a robust shift count of 1,381. Lastly, this week’s fourth and fifth-ranked affiliates also made impressive gains, recording $642.4k (+481.5%) and $390.3k (+577.7%), respectively.

This week’s strong performance from affiliates pushed their combined proportion of weekly volume slightly higher to 27.5%, +2.7% higher than last week.

That’s all for now. Thanks for reading and happy shifting.