SideShift.ai Weekly Report | 15th - 21st April 2025

Welcome to the one hundred and fiftieth edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

Highlights

- BTC led total volume – Weekly volume reached $11.1m (+24.2%), with 36% of all user settlements flowing into BTC.

- ETH saw sharp imbalance – Deposits surged to $2.8m, while settlements dropped to an 18-month low of just $775k.

- Tron overtook Solana – Volume jumped +74.5% to $5.2m, surpassing Solana for the first time this year.

- Whales drove larger shifts – $10.5m was moved in $20k+ transactions, pushing average shift size to $2,520, the highest in 11 weeks.

- Top affiliate set new record – Volume totaled $6.0m, marking the highest ever from a single partner on SideShift.

XAI Weekly Performance & Staking

Last week saw SideShift token (XAI) move lower within the 7-day price range of $0.1335 to $0.1405, ultimately settling at its current price of $0.1342. After climbing above $0.140 on April 16, XAI faced a swift pullback the following day, where it then eased into a new range. This drop contributed to a decline in market cap, which now sits at $19,676,159, marking a -3.9% decrease from last week. Despite the slight downtrend, XAI’s recent activity remained rather stable, with daily closes hovering just above $0.134 for the last several days.

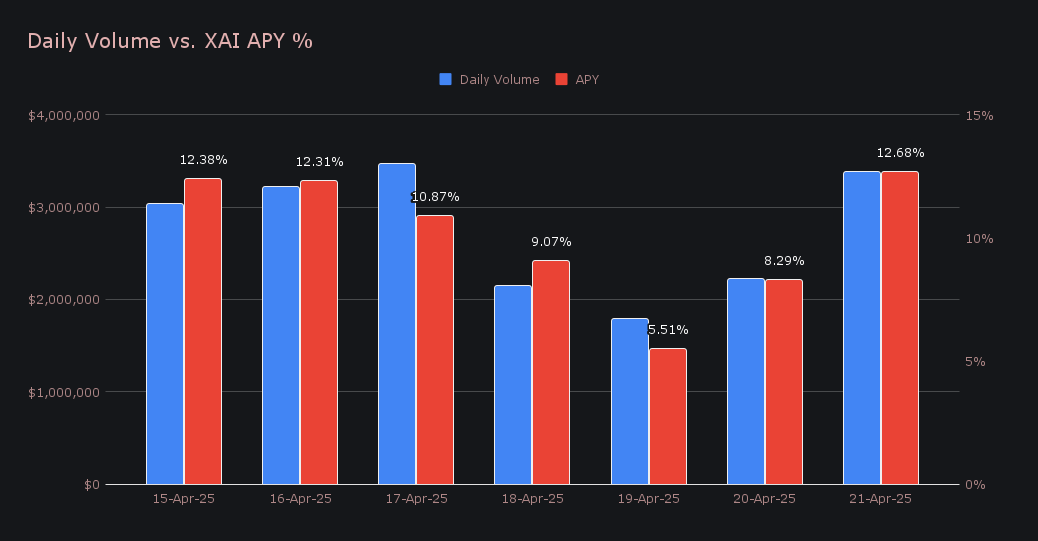

XAI stakers saw consistent returns throughout the week, with the highest daily APY peaking at 12.68% on April 22, when 43,288.97 XAI were distributed directly to our staking vault. This day also recorded the week’s highest daily volume at $3.38m. All together, XAI stakers received a total of 244,751.83 XAI or $32,513.81 USD in rewards throughout the week.

Additional XAI Updates:

Total Value Staked: 132,428,371 (+0.1%)

Total Value Locked: $17,744,158 (-4.9%)

General Business News

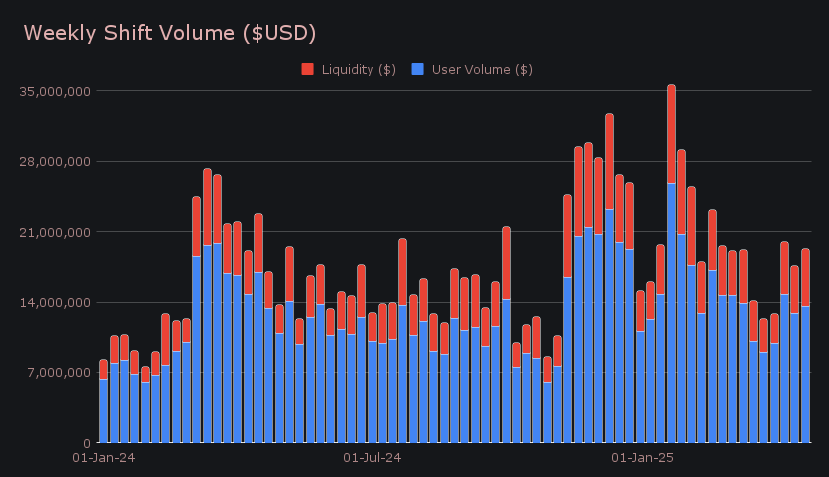

This past week, SideShift recorded a gross weekly volume of $19.3m (+9.5%), finishing comfortably above the previous week’s sum and maintaining the stronger activity levels that have emerged in April. While still -4% below our YTD average, this total stands as a continued improvement from the more subdued volume seen through the end of March. Of the gross total, user volume accounted for $13.6m (+5.8%), while liquidity shifting added a further $5.6m (+19.6%). This overall increase was fueled in large part by unidirectional flows into BTC, which captured the bulk of settlement activity. Among user pairs, ETH/BTC led the way with $1.63m in volume, followed by the always popular BTC/USDT (ERC20) with $1.54m.

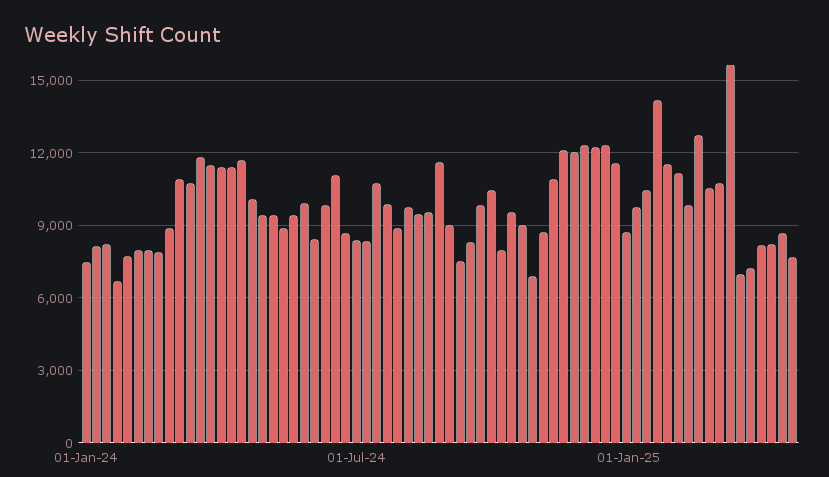

Conversely, our gross shift count dipped to 7,642 (-11.7%), marking the lowest weekly total so far this month and ending -25% below the YTD average. This decline contrasted the consistent volume and resulted in a notable rise in average shift size, which hit $2,520 - the highest of the past 11 weeks. Altogether, SideShift averaged $2.75m in daily volume across 1,092 shifts, pointing to fewer, but significantly larger, shifts throughout the period.

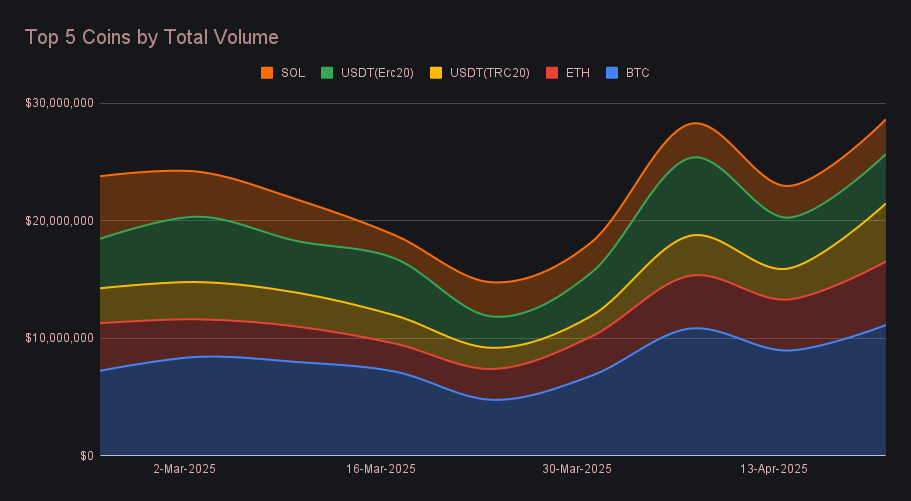

BTC retained the top spot with $11.1m in total volume (+24.2%), backed by dominant settlement activity which climbed to $4.9m (+19.6%). In fact, 36% of total user settlement volume this week was shifted into BTC, triple that of the next closest coin, marking its fifth consecutive weekly rise and one of the largest settlement totals for any single coin in 2025. Deposit volume also grew to $3.3m (+13.7%), reinforcing BTC’s broad-based demand.

ETH followed with $5.4m (+24.8%) in total volume, but its activity was defined by a sharp divergence in user flows. User deposit volume surged to $2.8m (+63.1%), while user settlement volume fell sharply to just $775k (-47.7%), a figure that easily marked ETH’s lowest weekly settlement total throughout the past 18 months. The contrast reflects a clear user stance - ETH is currently being offloaded more than acquired, with users increasingly exiting positions rather than accumulating. This trend was further reinforced by the week’s top user pair, ETH/BTC.

USDT (TRC20) climbed into third place with $4.9m (+87.8%), leapfrogging USDT (ERC20) for the first time this year. The increase came on the back of strong gains on both sides - user deposits rose to $1.4m (+58.8%), while settlements hit $1.7m (+57%). This total marked the second-highest weekly volume for USDT (TRC20) so far in 2025, reflecting a notable rise in stablecoin activity on the Tron network. SOL, meanwhile, appears to have found some stability following a steady decline in volume since January. This week, it finished in fifth with $3.0m (+9.7%), delivering a balanced mix of deposit and settlement flows.

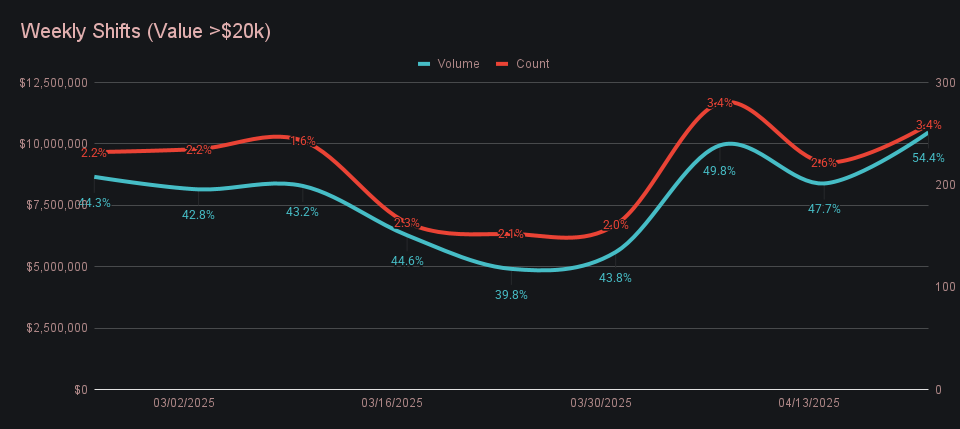

Whale activity gained traction this week, with a gross $10.5m shifted in transactions larger than $20k, the largest sum in recent months. These shifts accounted for 54.4% of our weekly volume, a new high for 2025 and a clear sign that big shifters are becoming increasingly active. The count of whale shifts also stood out, with 259 such shifts making up 3.4% of the total, matching the peak from just two weeks ago. Both of these metrics are now displaying a nice upward trend, after a notable lull in mid to late March.

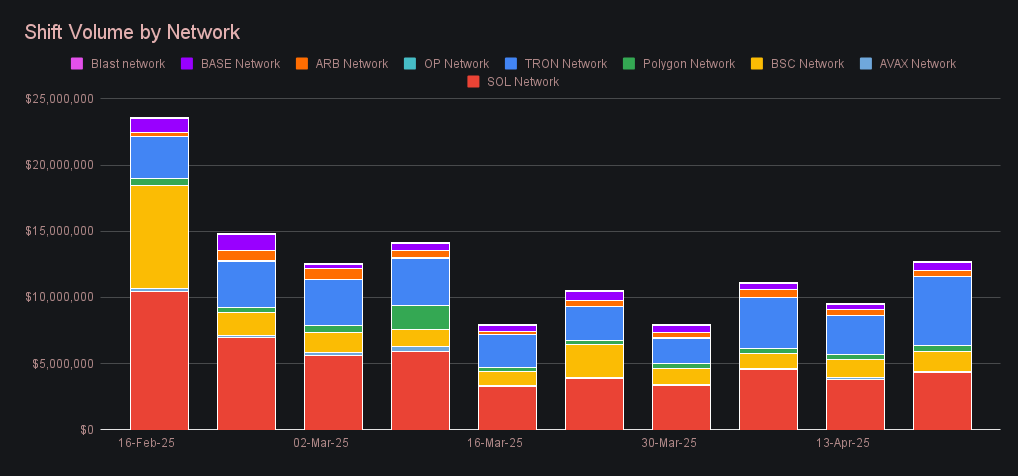

Alternate networks to ETH had a strong showing, with combined volume climbing to $12.7m (+33.6%), the highest total in the past six weeks. Leading the charge was the Tron network, which soared to $5.2m (+74.5%) and overtook Solana for the first time this year, a significant feat given Solana’s multi-month run as the dominant alternate network. Despite being bumped to second, the Solana network still posted a solid +13.7% gain to close with $4.4m. Other networks also trended higher - the Binance Smart Chain rose +13.7% to $1.5m, Base jumped +62% to $566k, Polygon climbed +18.4% to $448k, and Arbitrum saw a more modest +9.2% lift to $448k. Altogether, alternate networks edged ahead of the Ethereum network’s $11.7m (+1.3%) in total volume, a figure which pointed to Ethereum’s more restrained momentum.

Affiliate News

Affiliate shifting remained extremely strong, with our top partner delivering the highest weekly volume ever recorded on SideShift. It ended with $6.0m (+15.7%) and also held a commanding lead in shift count, closing with 1,286 shifts. Their average shift size rose by +22%, playing a key role in this week’s whale activity. Second place followed with a steady $2.1m, marking back-to-back weeks above the $2m mark. Third place, meanwhile, lagged behind the pack this week, closing with $570k (-32.9%).

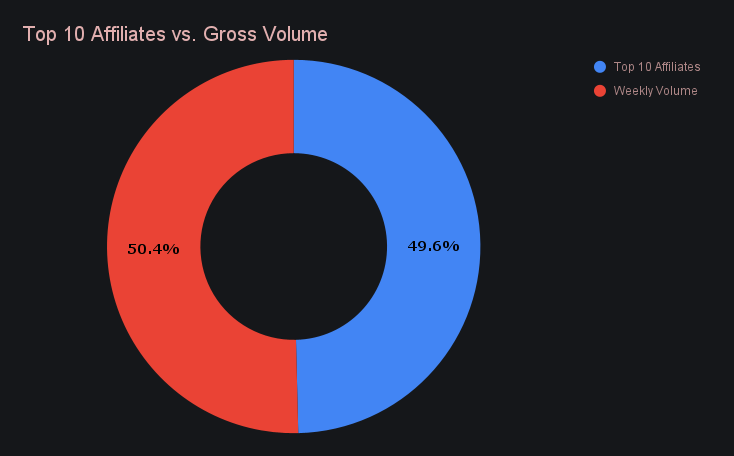

All together, our top affiliates combined to account for 49.6% of our shift volume, a -1.1% change from last week.

That’s all for now. Thanks for reading and happy shifting.