SideShift.ai Weekly Report | 15th - 21st July 2025

Welcome to the one hundred and sixty-third edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

Highlights

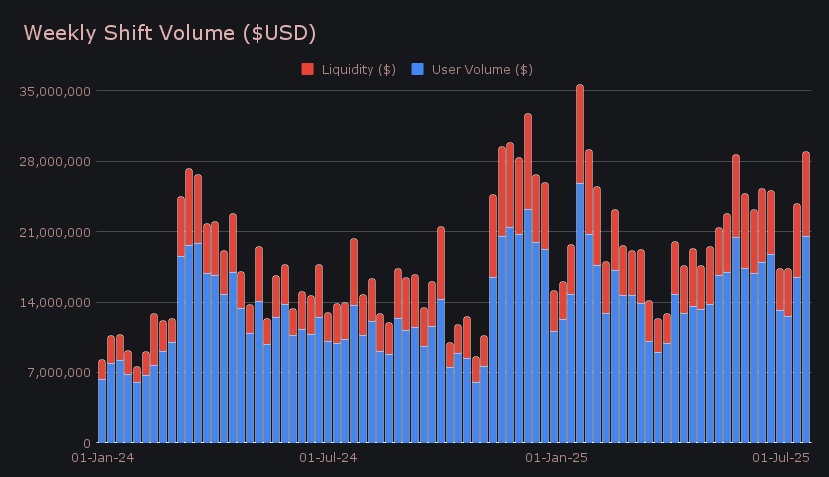

- +22.0% Volume Surge – Total weekly shift volume jumped to $28.95m, marking one of SideShift’s strongest weeks of 2025 and a +36% gain vs the YTD average.

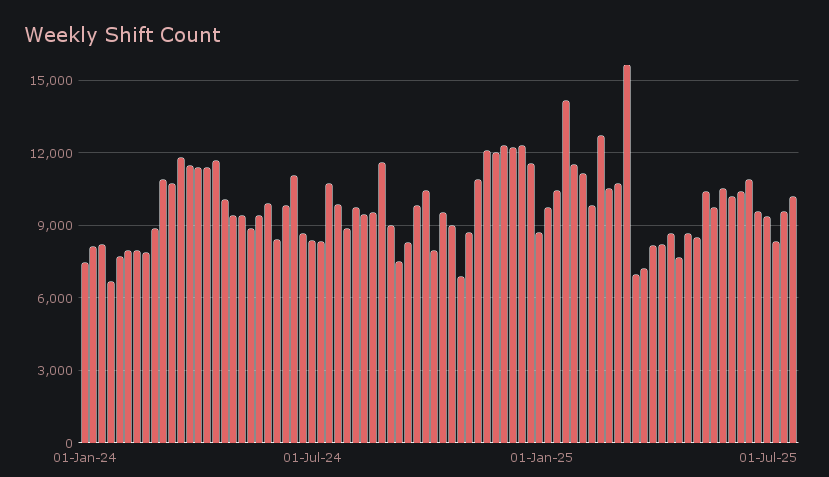

- Shift Count Back Above 10k – Shift count climbed +6.4% to 10,168, returning to five-digit activity for the first time in five weeks and confirming stronger user engagement.

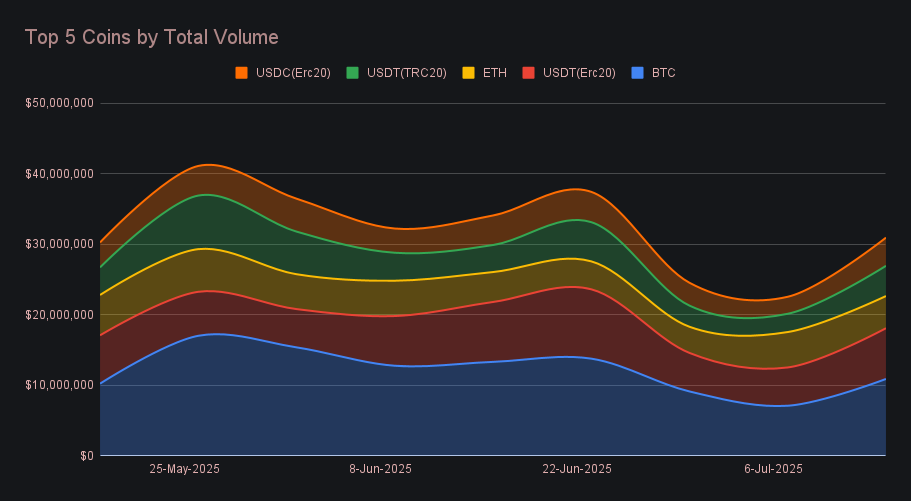

- BTC In, USDC Out – BTC retained its deposit lead, while USDC (ERC-20) became the most settled asset for the first time in months, overtaking ETH and USDT.

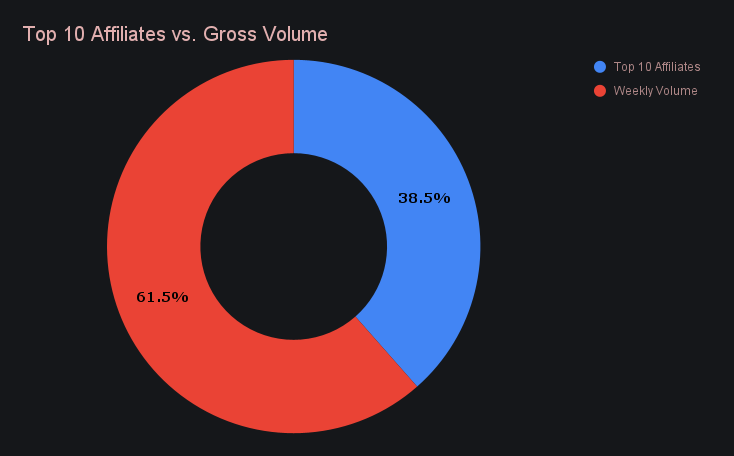

- Affiliate Upset at the Top – One affiliate surged +68.3% to $6.62m, its strongest week to date, helping integrations capture 38.5% of volume despite slower overall share growth.

- Altcoin Rotation Intensifies – XRP and AVAX volumes soared (+149% and +249%), reflecting growing interest in higher-beta names as BTC consolidated near all-time highs.

XAI Weekly Performance & Staking

XAI experienced a gradual pullback this week, with price drifting lower from early highs to close near its weekly bottom. The token moved between $0.1486 and $0.1516 over the 7-day span and is currently priced at $0.1487. This translated to a -4.67% drop in market cap, now sitting at $22,588,727. The broader 30-day chart shows a steady slide from the mid-July local high near $0.162, with levels now having retraced to where they sat toward the end of June.

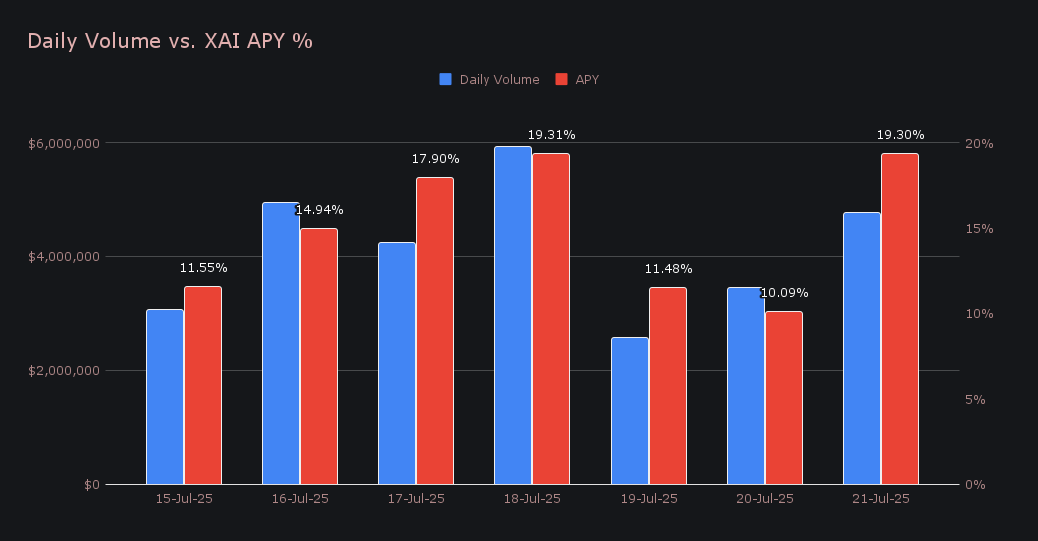

Despite the price dip, staking returns held firm. The average APY came in at a strong 14.94%, with the week’s high arriving on July 22nd when a total of 66,080.92 XAI was distributed to our staking vault at a 19.30% APY, following $4.75m in daily volume. Over the course of the week, stakers earned 363,325.36 XAI or $54,026.49 USD.

SideShift’s treasury received an additional 100,000 USDC last week and is currently sitting at an estimated value of $29.09m. Users can follow with live treasury updates via sideshift.ai/treasury.

Additional XAI updates:

Total Value Staked: 136,820,382 XAI (+0.2%)

Total Value Locked: $20,482,067 (−3.7%)

General Business News

BTC began the week consolidating around $118k, cooling off from recent all-time highs and prompting growing attention toward altcoins. Bitcoin dominance swiftly declined, dropping toward 60% - its lowest since March 2025 and the largest single weekly slide in years - thereby fueling broader market calls that "altseason" has arrived. Additionally, total crypto market cap reclaimed the $4t mark, a +55% gain from the total seen one year ago.

SideShift saw a strong push in activity this week, with gross weekly volume jumping +22.0% to $28.95m - one of the platform’s best performances of 2025 so far and ending +36% above our YTD average. This marked a solid continuation in trading velocity following last week's increase, and came with gains across both user and liquidity sides. User shifting volume surged +24.6% to total $20.51m, while liquidity shifting volume added +16.0% to reach $8.44m. The top pairs were all BTC-based, with BTC/USDC (ERC-20) leading at $1.21m, followed by BTC/ETH ($1.11m) and BTC/USDT (ERC-20) ($1.04m) - highlighting a clear reversal in trend, with BTC now dominating the deposit side rather than settlements.

Meanwhile, weekly shift count also rose +6.4% to 10,168 total shifts. That translated to a daily average of 1,453 shifts, while daily volume averaged $4.14m. The gain in shift count, though more modest than volume, confirmed broader platform engagement and marked a return to five-digit activity for the first time in five weeks. In other words, business is humming together with the broader market momentum.

BTC once again led total volume at $9.95m, driven by a +7.9% increase in deposit volume to $4.85m, while its settlement side fell −26.9% to $2.21m. For the first time in nearly five months, BTC was dethroned as the most settled coin by users - and not narrowly, as it dropped to fourth place overall, signaling a notable shift in usage behavior. ETH followed with $6.73m in total volume, buoyed by a sharp +94.9% jump in deposits to $2.81m, while its settlement volume rose +26.2% to $2.81m for a dead even split, reflecting renewed user interest. Notably, XRP surged +149% to reach $3.73m, and AVAX climbed +249% to $3.15m, reinforcing the trend of capital rotation into higher-beta names as BTC consolidated near all-time highs.

Stablecoin flows told a mostly familiar story, with the usual suspects rounding out our top 5 coins and the safety of stables being ever popular. USDT (ERC-20) continued to absorb the most deposits at $2.11m, but also recorded a +25.9% rise in settlements to $2.49m, resulting in slight net outflows overall. USDC (ERC-20) defined itself as the clear standout, with a +42.4% jump in settlement volume to $3.06m, decisively overtaking USDT (ERC-20), ETH, and even BTC to become the most settled asset on the platform. USDT (TRC-20) posted $1.15m in deposits (+27.6%) and $1.37m in settlements (−6.7%), also suggesting marginal net outflows. The takeaway this week was clear: capital continues to shift toward USDC (ERC-20), which rapidly became the preferred stablecoin for settlements.

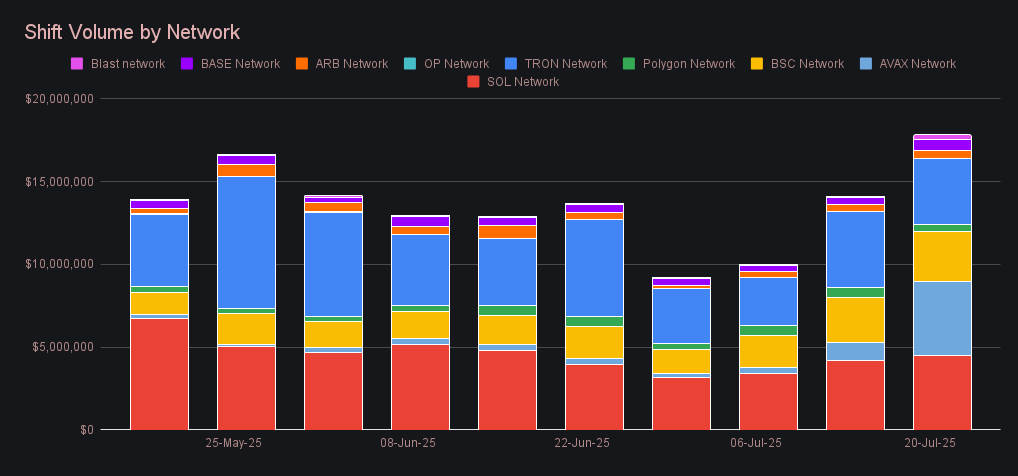

The Ethereum network remained the core liquidity hub aside from BTC, processing a total of $21.4m across both sides (deposits + settlements). That said, alternate networks are heating up fast. The Avalanche network exploded to $4.48m, a +306.7% jump that brought it neck-and-neck with Solana’s $4.50m, while the Tron network cooled slightly to $3.98m. The BSC network saw a moderate +10.3% rise to $3.02m, and the Arbitrum network gained +22.0% to hit $495k. Meanwhile, Base posted a +45.3% uptick to $623k, and Polygon slid −27.0% to $422k. Ethereum still leads in absolute volume, but the gap is narrowing - for the first time in months, alternate networks are within striking distance, backed by a fairly distributed surge across several chains.

SideShift’s Telegram Bot continues to plug away, with ongoing dev efforts focused on refining its workflow and user experience. Quietly, it has processed over $125k in shift volume for consecutive months - a steady sign of utility for users who prefer simple, on-the-go swaps. Feel free to check it out for yourself at https://sideshift.ai/telegram-bot.

In listing news, SideShift added support for two new Solana tokens, the native token of Pump.fun, PUMP, in addition to the trending memecoin USELESS. Shifting of both of these tokens is now live, from any coin of your choice.

Affiliate News

Affiliates combined for a gross $11.15m this week, up +10.6%, and captured 38.5% of total volume. The standout was the previously second placed affiliate, who surged +68.3% to $6.62m to take the top spot - a performance closely linked to the spike in USDC usage and resulting in one of their strongest lifetime weekly performances. The former leader fell to second with $3.15m (-24.2%), while third place remained the same but declined −29.5% to $574k. Despite the broader growth, affiliate share climbed at a slower rate, indicating that direct site volume accelerated even faster.

That’s all for now - thanks for reading and happy shifting.