SideShift.ai Weekly Report | 16th - 22nd August 2022

Welcome to the sixteenth edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

XAI Token Market Update

Throughout the week SideShift Token (XAI) fluctuated between a range of $0.107593 / $0.119718. At the time of writing, the price is sitting at the high end of that spectrum at $0.119059, and a current market cap of $11,015,026 places XAI in position #875. Users are encouraged to follow along with this and other XAI statistics at our Dune Dashboard.

When compared to the previous week, the market cap of XAI has encountered an overall net increase of 10.2%.

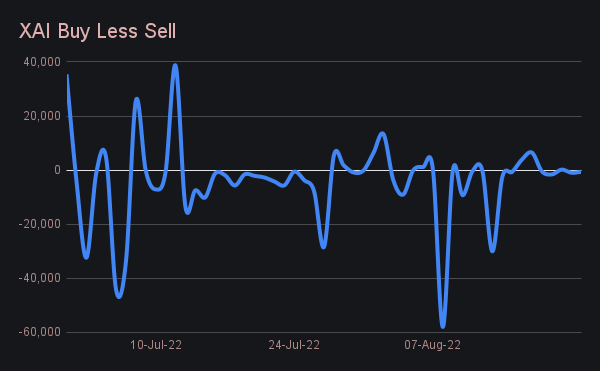

The below chart measures XAI buys versus sells since the on-chain migration that took place at the beginning of July 2022. You can see that initially after the migration took place, more XAI buys were taking place. However, recently it has begun to shift so that on average, XAI sells have exceeded buys. We will continue to track this metric as time carries on to keep you updated.

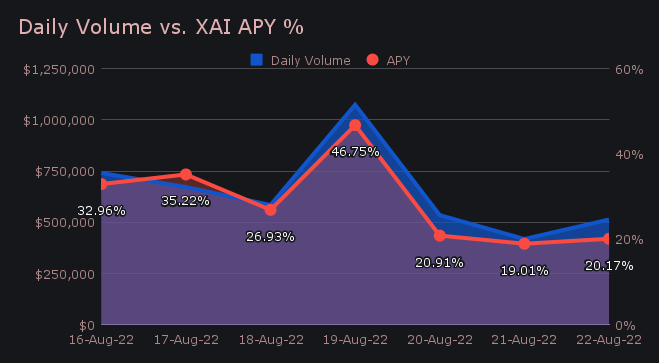

This week SideShift stakers enjoyed an average APY of 28.85%, very much on par with our all time average. On August 20th, a daily rewards high of 38,398.22 XAI (46.75%) was deposited to our staking vault, following a daily volume of $1.07m.

Additional XAI updates:

Total Value Staked: 36,657,786 XAI

Total Value Locked: $4,273,108

General Business News:

This week saw the market pullback following a cascade of liquidations, the highest seen since June 13th. It looks like the continuation of the downtrend resulted in people flocking back into “safer” coins such as BTC and stablecoins - SideShift noted a heavy focus on BTC on both the deposit and settlement sides, indicating its prominence among popular shift pairs.

Over the course of the week SideShift had a net weekly volume of $4.54m (-13.7%) with a total weekly shift count of 5,929 (-1.6%), for daily averages of $649k on 847 shifts.

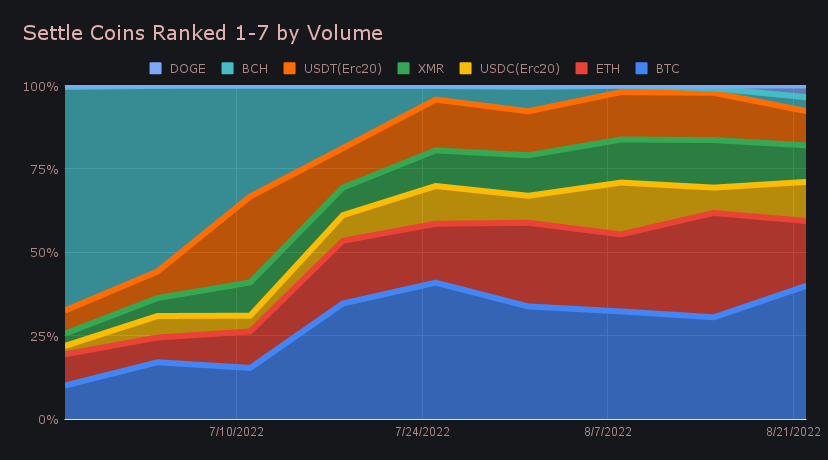

This week saw BTC reclaim its spot as our most popular settlement coin with settlements totalling $1.54m (+20.1%). This represented a dominant 34% of settlement volume, about 10% higher than typically seen for our top settle coin. It was also our most deposited coin this week with $998k, despite incurring a 32% drop in deposit volume from the previous week.

Although the news remains heavily centered around the upcoming Ethereum merge, ETH volume on SideShift seems to have lost some of its steam. Last week’s settlement surge was followed by a substantial 43% drop this week, as ETH settlements finished in second place with $751k.

ETH wasn’t the only coin which saw a trend reversal unfold. BNB and SOL, which have displayed strength in previous consecutive weeks, both slowed this week. Respectively, they totalled $217k (-28%) and $191k (-55%). Conversely, total BCH shifts grew by 87%, as it re-entered our top 7 coins with a net weekly volume of $275k.

Overall, our top 3 coins showed less overall shift volume when compared to the previous week. Total weekly BTC volume (deposits + settlements) summed to $2.54m (-7.4%), followed by ETH with $1.72m (-31.2%), and XMR with $993k (-11.7%). However, some other smaller cap coins were directly affected by current events and saw spikes on SideShift.

Following the release of DogeChain, an EVM compatible blockchain built on Polygon Edge, DOGE volume had a massive weekly growth of 265% with a total volume of $150k. This was majorly from the settle side, as it finished as our 7th most popular settle coin, with $136k.

Various “less popular” stablecoins also saw sizable moves in overall shift volume. Total DAI volume grew by 17.5%, finishing in 6th place overall with $345k. USDC on both the Polygon and Solana networks encountered significant jumps as well, with respective weekly totals of $134k (+187%) and $131k (+36%). Interestingly, the vast majority of this volume came from the deposit side, and also mainly flowed into BTC. Net BTC settlement growth can be observed in the chart below.

Our week’s most popular shift pair was ETH/BTC which represented 8.64% ($392k) of weekly volume and 5.21% of weekly count. 41% of the ETH deposits to SideShift were shifted into BTC. For our top pair, this is a fairly small percentage of total volume, which tells us that shifts occurred among a wider variety of coin pairs this week.

Since its listing last week, TRON (TRX) has shown steady growth and this week finished 12th among our settlement coins with $39k. Although the volume is quite small for now, its total volume (deposits + settlements) grew more than 2.5x, with its shift count doubling in the same period.

In listing news, this week SideShift was happy to add OKB, the native coin of the popular cryptocurrency exchange, OKX. A current market cap of ~$1.04b ranks OKB in 48th place among the industry’s top coins.

Generally speaking, this week was a calm and quiet week for SideShift, with decent volume and good stability. Aside from our Zcash node running a bit slow and needing to catch up, we experienced no downtime and encountered no major issues. We are still focused on building, listing, and growing - don’t forget to check out our available job postings at SideShift.ai/jobs.

Integration News

Integrations finished the week accounting for a healthy 32.64% of weekly volume, and 29.99% of count.

That’s all for now. Thanks for reading, happy shifting and we’ll see you next time.