SideShift.ai Weekly Report | 16th - 22nd January 2024

Welcome to the eighty-eighth edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

Throughout the week SideShift token (XAI) moved within the 7 day range $0.1272 / $0.1661. After making a gradual upwards climb for the past three weeks, XAI has now returned to price levels more familiar to the beginning of January 2024. At the time of writing, the price of XAI is sitting at $0.1272 and has a current market cap of $16,524,618 (-23.1%).

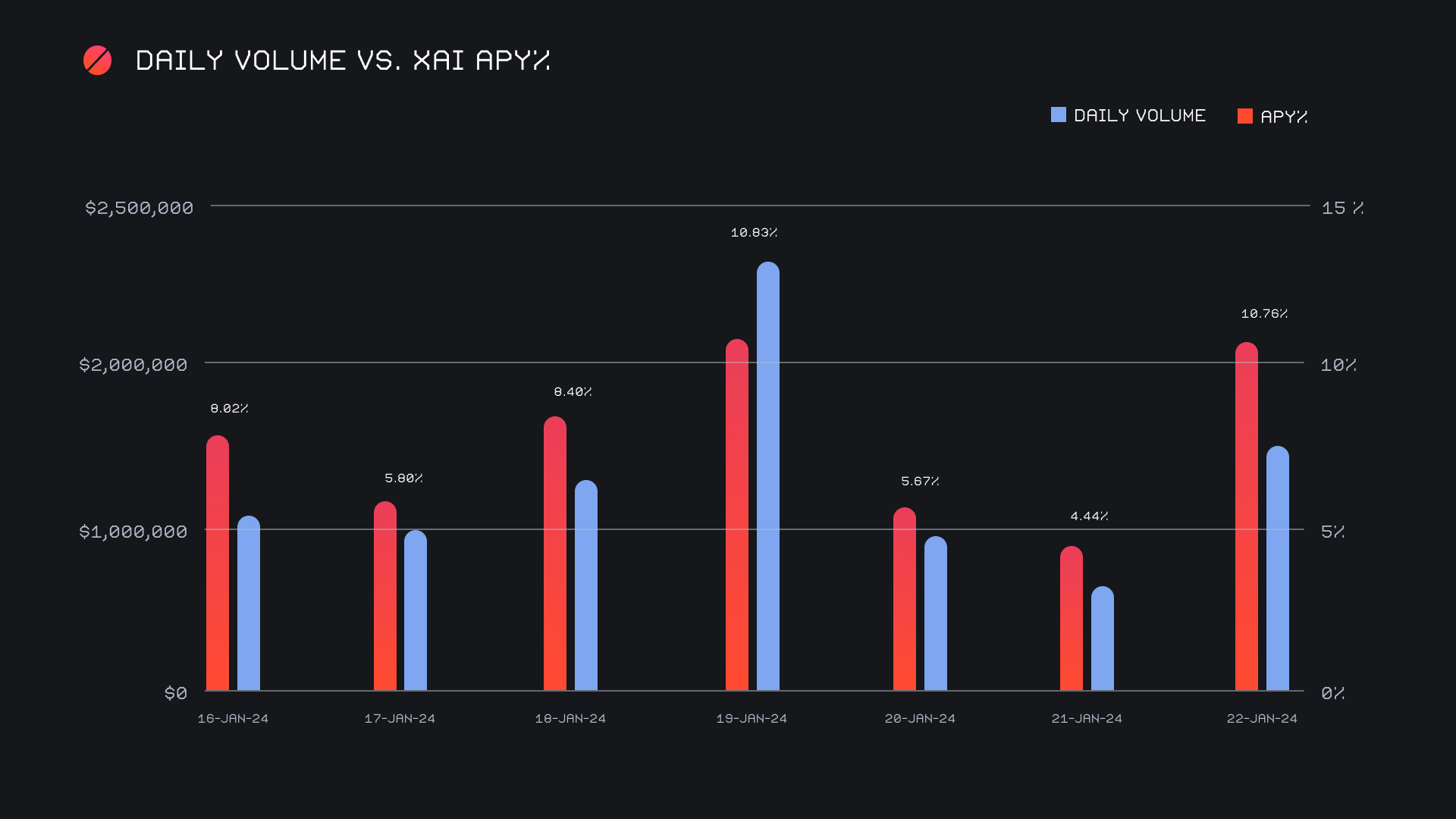

XAI stakers were rewarded with an average APY of 7.7% this week, with a daily rewards high of 32,542.12 XAI being distributed to our staking vault on January 20th, 2024. This was following a daily volume of $2.7m. This week XAI stakers received a total of 163,848.68 XAI, or 20,841.55 USD.

The price of 1 svXAI is now equal to 1.2801 XAI, representing a 28.01% accrual on stakers investments. Users are encouraged to learn more about SideShift staking via our staking FAQ, and can obtain XAI for staking from any coin of their choice.

Additional XAI updates:

Total Value Staked: 115,508,666 XAI (-0.04%)

Total Value Locked: $14,331,193 (-24.5%)

General Business News

Starting off with some listing news, this week SideShift added support for a handful of assets including Sei (SEI), Rocket Pool ETH (rETH), CoinBase Wrapped Staked ETH (cbETH), and Lido Staked ETH (stETH). Shifting of these coins is now live, from any coin of your choice.

A snapshot of the current market shows red across the board, and many fingers are pointed at the Greyscale Bitcoin Trust (GBTC) as the culprit. Heavy selling pressure from GBTC has resulted in billions of dollars worth of outflows, and has sent BTC bleeding -20% from its local top achieved just two weeks ago. Most other coins have followed suit, and are now falling at an even faster rate.

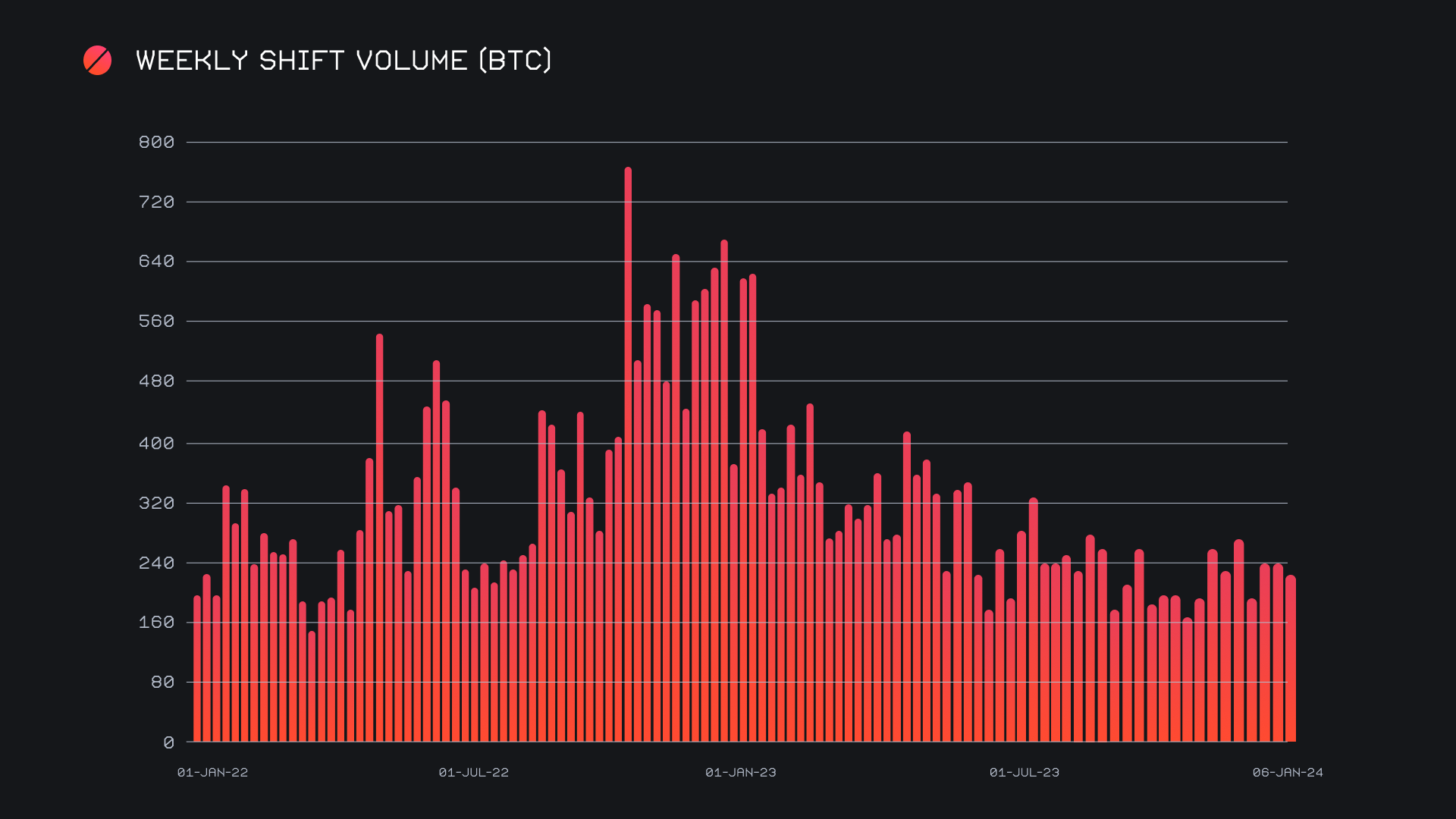

SideShift had a decent week, although also noting slight declines from the strong performances we’ve had to begin the year. We ended the period with a gross volume of $9.1m (-14.9%) alongside a shift count of 6,659 (-18.7%), which marks the first time shift count has dropped below the 7,000 mark in the past 8 weeks. This lower number of shifts was very evenly spread across coins, with only 1 out of our top 15 coins seeing an increase in this metric (USDC on Avalanche). This was contradictory to SideShift’s volume, which was far more concentrated among a select few top coins that proved to be responsible for the decrease. Together, these figures combined to produce daily averages of $1.3m on 951 shifts. When denoted in BTC, our weekly volume amounted to 220.17 BTC (-8.6%), a less dramatic reduction as compared to USD, due to the BTC’s price falling throughout the week.

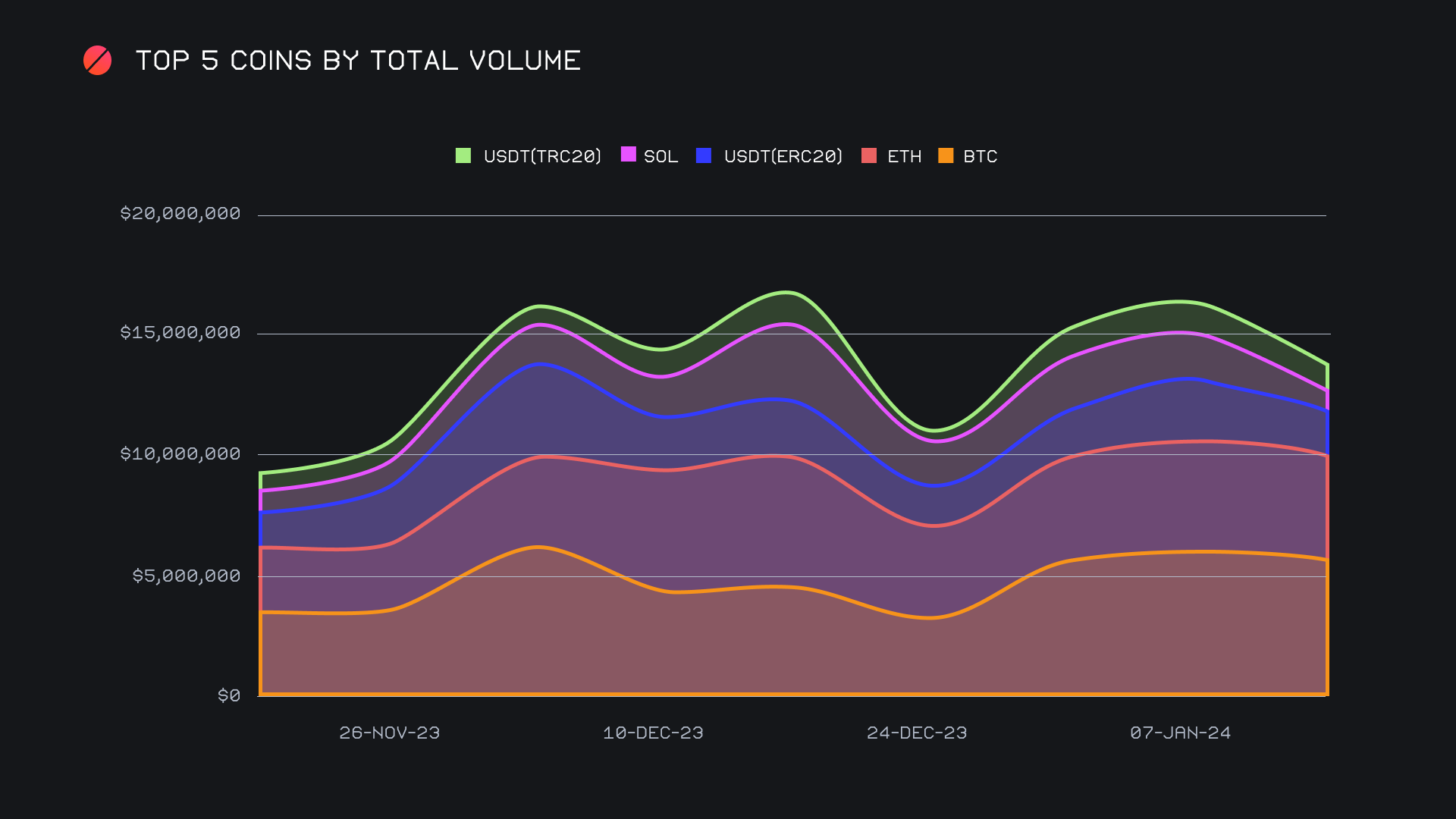

When looking at our most popular coins, we will see that weekly volume decreases occurred among all top 5. However, the extent of these declines varied heavily, with some having a far more impactful role in the broader volume decrease. Prevailing atop the list was once again BTC, which ended with a healthy $5.8m (-3.4%) in total volume (deposits + settlements). This proved to be the least varied change among top coins, although the composition between deposits and settlements was quite skewed. User BTC deposits rose +18.6% for $2.9m, while user BTC settlements swiftly fell -43.3%, to sum just $1.3m. This might be a representation of users feeling fearful and easing off of the BTC buying for now while the current market shake out unfolds. ETH followed in second place with another respectable sum, finishing with $4.3m (-5.1%). Here, the inverse to BTC was seen, with a surge in ETH user demand being evident. In fact, ETH settlements on SideShift have steadily continued their climb for the past four weeks, seemingly unphased by the overarching downward pressure of the general market. With $2.3m in user settlements, ETH sat nearly $1m above the next highest settlement coin sought after by users (BTC with $1.3m). In a confident manner, the BTC/ETH pair clearly asserted itself as the most popular once again, ending with $1.5m on the week. A majority 52% of the deposited BTC volume was shifted to ETH, further outlining the continued strength of ETH.

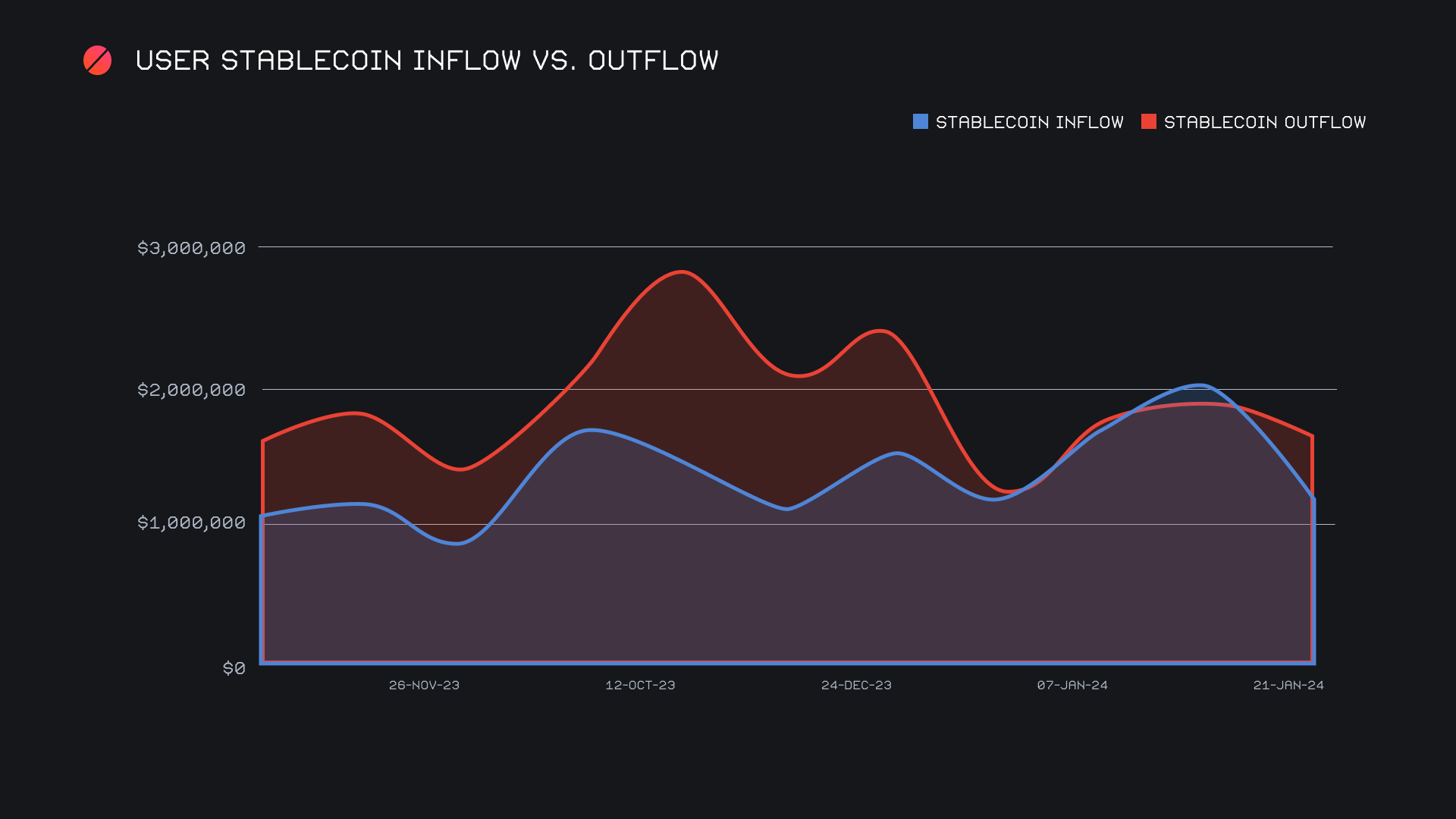

Once we move past our first and second placed coins, we get to the real source of the overall volume change. Third placed USDT (ERC-20) saw its shift volume drop by $936k, and its $1.6m sum represented a -36.6% change on the week. As mentioned in the previous report, last week marked the first time that stablecoin deposits had exceeded that of settlements. This week however netted far fewer stablecoin deposits, particularly, USDT (ERC-20), which fell from $909k last week to $416k this week, a hefty drop of -54.3%. Other stablecoins such as DAI (ERC-20), USDT (SOL), and USDC (SOL) noted the same pattern, all witnessing deposits fall by -50% or greater. A lower overall amount of stablecoin deposits was a contributing factor to the lesser overall volume seen this week. Similar to the lack of BTC buying, it could be that users do not see the current downward momentum ending in the immediate future and are reluctant to attempt to catch a falling knife. In the chart below you can observe the brief bump that stablecoin inflows had last week, before then rolling over this week.

Equally responsible for our lower weekly volume was fourth placed SOL, which saw its total volume cut in half, dipping under the $1m mark for the first time since the beginning of December 2023. With $946k, SOL plummeted a whopping -49.1%, an indication of just how volatile it can be. No doubt, this lesser amount of SOL shifting has been influenced by the sharp decline SOL has been experiencing this past month, with its price dropping nearly -40% from the 2024 highs.

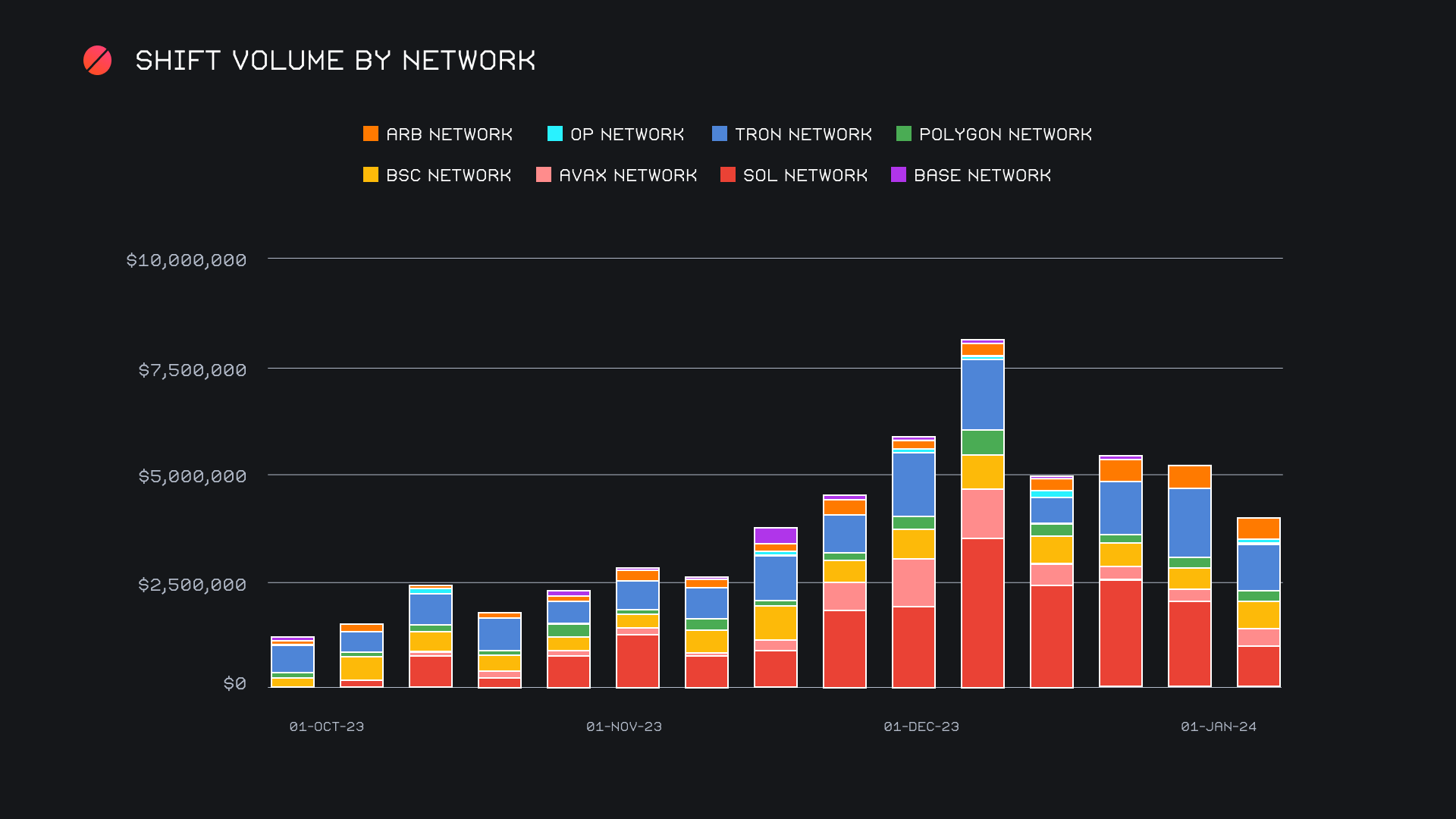

When zooming out slightly, we can note the clear ebb and flow of the entire Solana network on SideShift throughout the past few months. A combined $1.11m (-48.1%) saw the Solana network fall to second place this week, with the Tron network just barely claiming first place with $1.13m (-28.9%). Following in third came the Binance Smart Chain (BSC) network, with $641k (+32%), primarily due to a +75% increase in user BNB settlements. Despite the dwindling behavior of these alternate networks in recent weeks, we can gain some perspective from this zoomed out approach. From here, it’s clear just how quickly these networks can pick up steam, as outlined below with the comparison of October 2023 to December 2023, more than a 6x increase in a matter of just 10 or so weeks.

Affiliate News

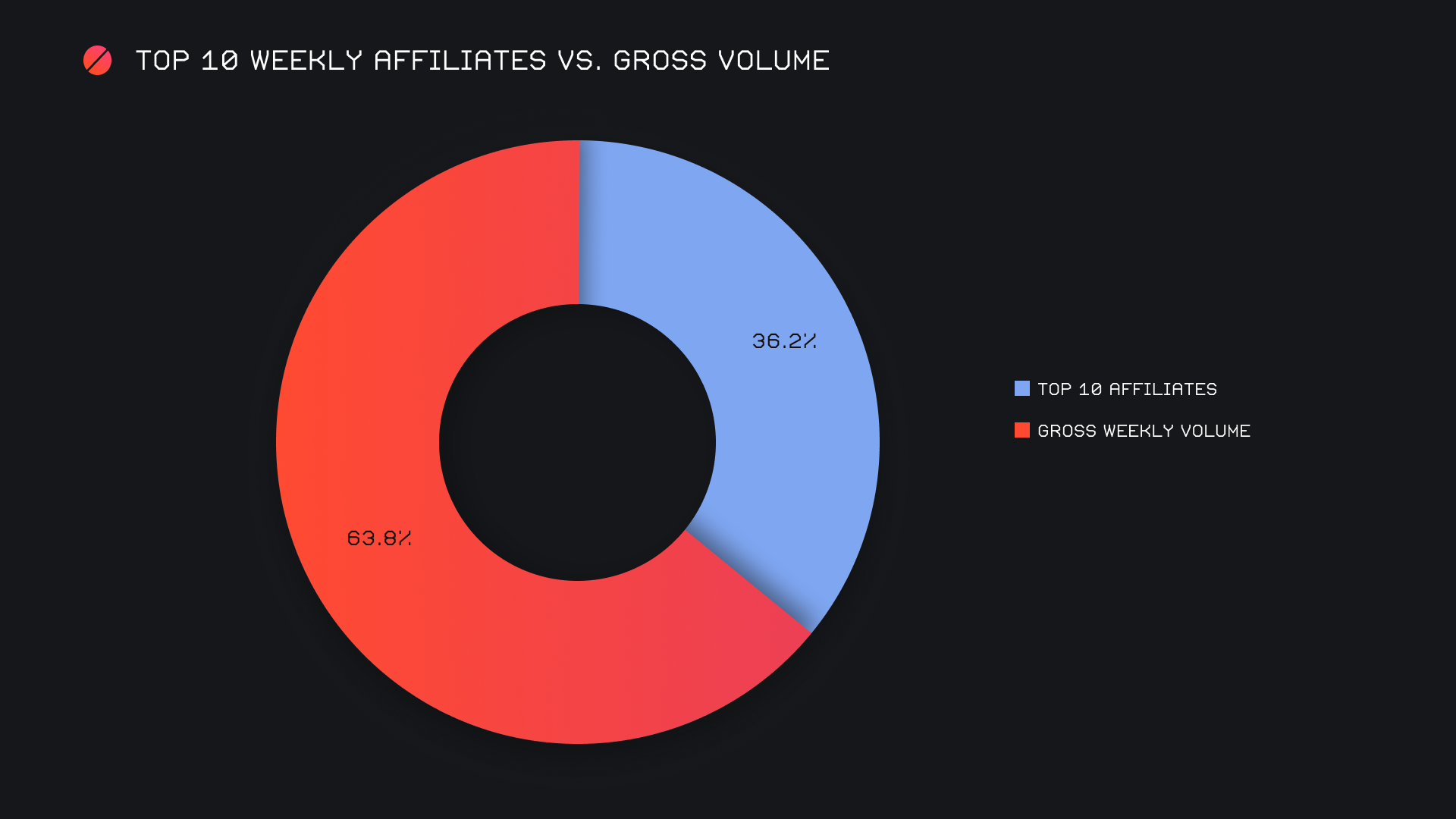

SideShift’s top affiliates came together for another solid showing, totaling a combined $3.3m (+1.3%), but doing so on a lesser overall shift count of 1,687 (-23.8%). Our first placed affiliate in particular shined bright, ending the week with $1.9m, and alone accounted for 21.1% of our weekly volume. The ranking of our top 3 affiliates remains unchanged from last week.

All together, our top affiliates accounted for 36.2% of our weekly volume, 5.7% higher than last week’s proportion.

That’s all for now. Thanks for reading, happy shifting and we’ll see you next time.