SideShift.ai Weekly Report | 17th - 23rd June 2025

Welcome to the one hundred and fifty-ninth edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

Highlights

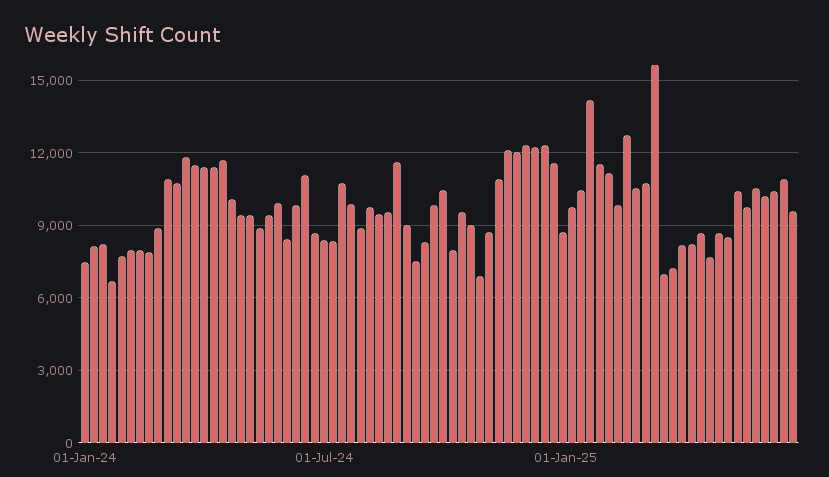

- SideShift processed $25.0m across 9,577 shifts, with higher avg. volume per shift offsetting a -12.1% dip in count.

- USDT (ERC-20) climbed to a 2025 high of $9.84m, its fourth straight weekly gain, while USDT (TRC-20) surged +44.7%.

- BTC/USDT (ERC-20) led user shifts for the 15th time in 20 weeks, cementing its position as the platform’s most consistent pair.

- Whale shifts ($20k+) surged to 312 and 55.5% of volume, one of the highest proportions this year.

- Top affiliate broke their volume record at $8.65m, contributing to $11.7m combined with second place.

XAI Weekly Performance & Staking

XAI slipped slightly this week, closing at $0.1496, a mild drop from last week’s close of $0.1571. Across the 7-day stretch, price action ranged between $0.1484 and $0.1581, with most of the movement clustered around the mid to high $0.15s before dipping lower near the weekend. This slight pullback brought the token’s market cap down to $22.29m, a -4.97% decrease on the week.

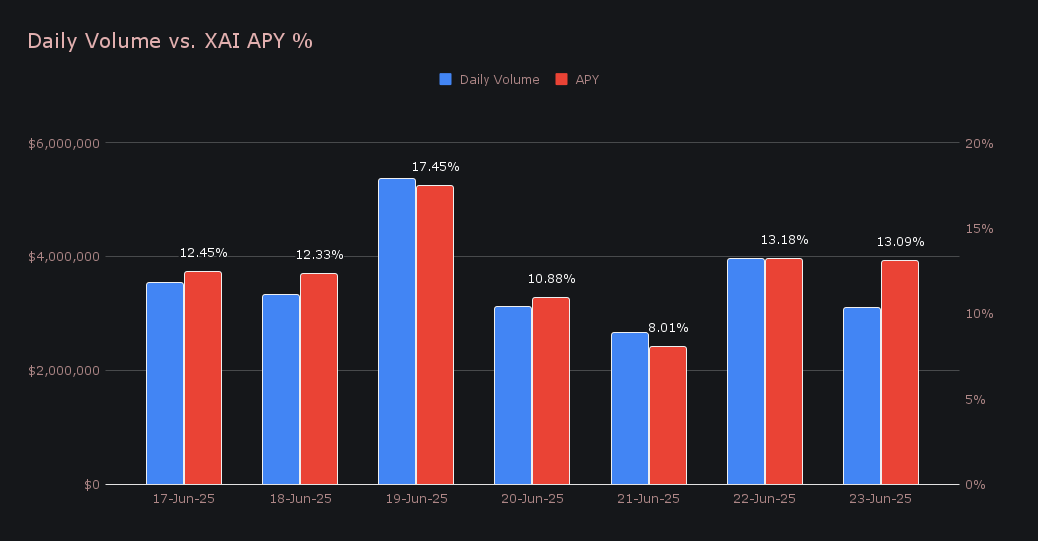

Despite the weekly decline in price, XAI staking continued to deliver reliable returns. The average APY this week was 12.48%, marking another solid stretch for stakers. This week’s highest daily payout occurred on June 20th, when 59,791.86 XAI was distributed to our staking vault at a 17.45% APY, corresponding with $5.36m in daily volume - the highest single-day volume recorded so far in June.

SideShift’s treasury now sits at $22.99m in value. Users are encouraged to follow along with live treasury updates at sideshift.ai/treasury.

Additional XAI updates:

Total Value Staked: 135,831,176 XAI (+0.1%)

Total Value Locked: $20,205,701 (–5.7%)

General Business News

Crypto markets climbed this week as tensions between Iran and Israel eased, injecting some positive momentum back into risk markets. BTC rose +3.5% overnight to reclaim the $106,000 level, while ETH followed with a +7.3% move to $2,410. SEI stood out with an impressive +53.8% weekly gain, marking one of the strongest performances among major altcoins and helping lead a broader bounce across the sector.

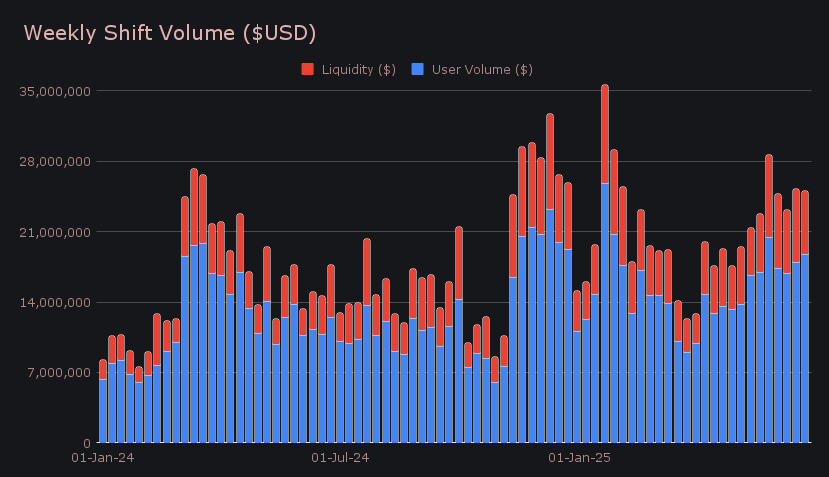

SideShift wrapped up the week with a gross volume of $25.0m, effectively flat despite a -14.3% drop in liquidity shifting. This stability was underpinned by a +4.8% increase in user shifting volume to $18.79m, indicating healthier organic activity. BTC and stablecoins continued to define user flows, with BTC<>USDT (ERC-20) in both directions combining for $4.08m. The pair has now ranked as the top user shift in 15 of the past 20 weeks, cementing its place as one of the platform’s most consistent drivers of volume. The dual stablecoin pair of USDT (ERC-20)/USDC (ERC-20) followed, with a gross $1.45m.

Meanwhile, weekly shift count declined -12.1% to 9,577, snapping a streak of elevated engagement. However, the dip in raw count was balanced by stronger volume per shift, as reflected in the daily volume average of $3.58m, which held steady. SideShift averaged 1,368 shifts per day, with shift activity distributed relatively evenly throughout the week, even as total volume peaked midweek.

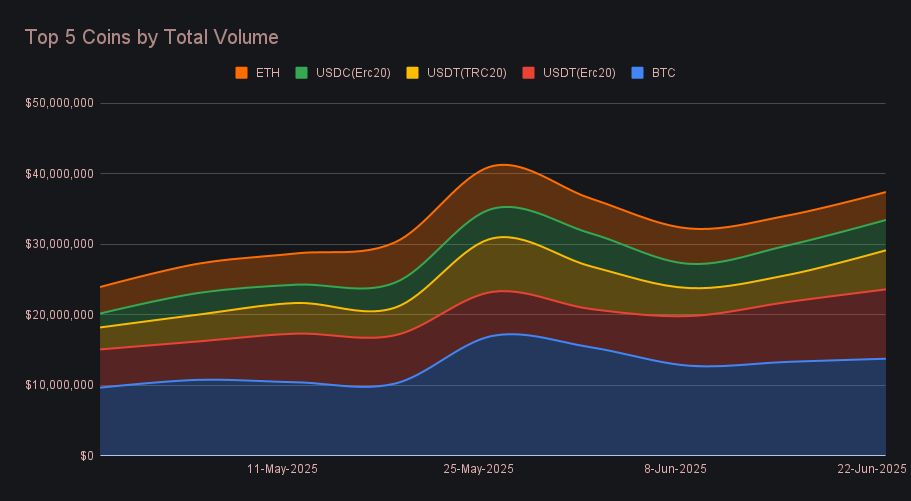

BTC retained its lead with a weekly total volume of $13.79m, climbing +3.4% to remain SideShift’s most shifted coin. While it continued to control the bulk of user flows, its share was less commanding than in prior weeks, particularly as stablecoin volumes picked up. BTC saw $4.92m in user deposits and ended with the week’s highest settlement volume at $5.66m, though this was largely in line with expectations given its consistent top-tier presence. Its steady behaviour over recent weeks can be observed in the below chart.

Stablecoins ranked 2-4 collectively logged $19.64m in total volume this week (combined deposits + settlements), reflecting their growing presence among top-shifted assets. USDT (ERC-20) led the pack with a total $9.84m (+15.8%), marking its highest weekly volume of 2025 and capping off four consecutive weeks of positive gains. Since late May, its volume has risen +81.2%, climbing from $5.43m, a clear sign of sustained and growing demand. This week’s user deposits totaled $3.44m, with settlements at $4.06m, pointing to robust two-way flow.

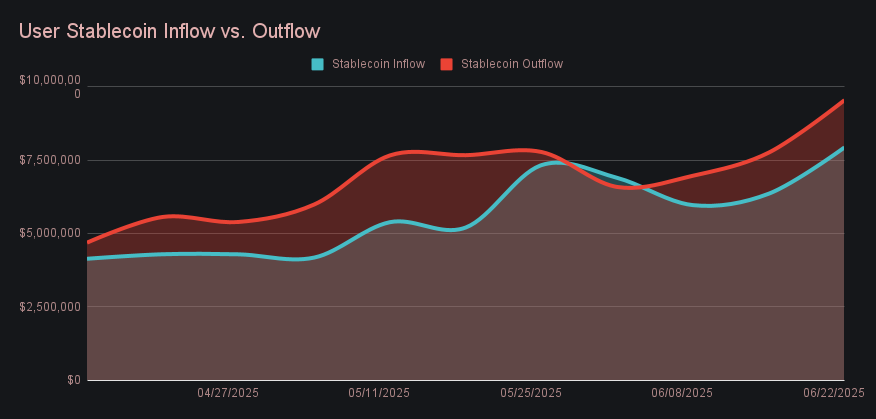

USDT (TRC-20) followed with a comparatively smaller total of $5.55m, but posted the most dramatic percentage gains among stablecoins. Deposits surged +46.2% to $1.91m, while settlements jumped +36.1% to $1.65m, indicating strong user-driven growth. Liquidity shifting activity also rose alongside this, contributing to the coin’s overall volume increase of +44.7%. Together, these sums placed USDT (TRC-20) within reach of its peak levels seen in late May. Meanwhile, USDC (ERC-20) was less prominent but still relevant, with an overall increase of +2.6% to $4.30m, supported by growth in deposits ($637k, +42.8%) and more notably, settlements ($2.53m, +16.2%). The overall rise on both sides of the shift process has pushed stablecoin activity to its highest point in months, helping drive this week’s broader volume growth, but with user flow direction still favoring settlements.

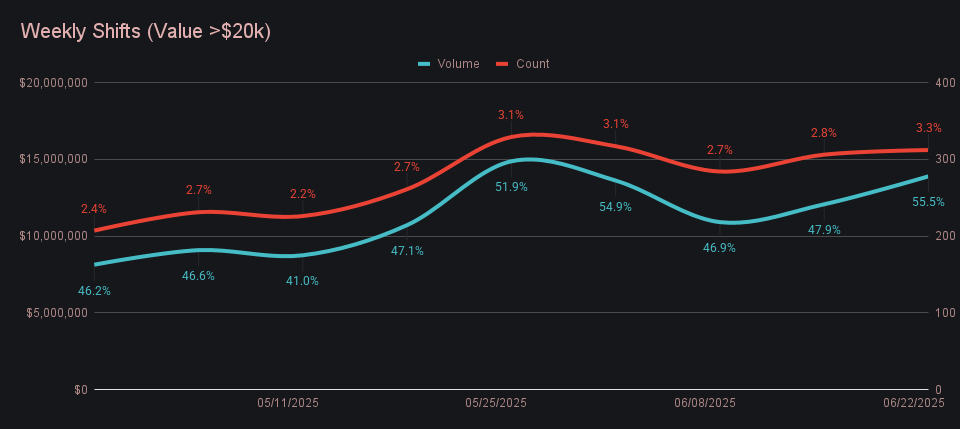

Large-scale shifts exceeding $20k accounted for 55.5% of SideShift’s total volume this week, the highest share in months and closing at the upper end of its recent range. Its nominal sum of $13.89m also stood out as one of the largest totals recorded as of late, reinforcing the dynamic of fewer but higher-value shifts powering overall activity. While total shift count in this tier remained relatively modest at 312, the elevated proportion highlights the continued influence of large individual users on weekly volume.

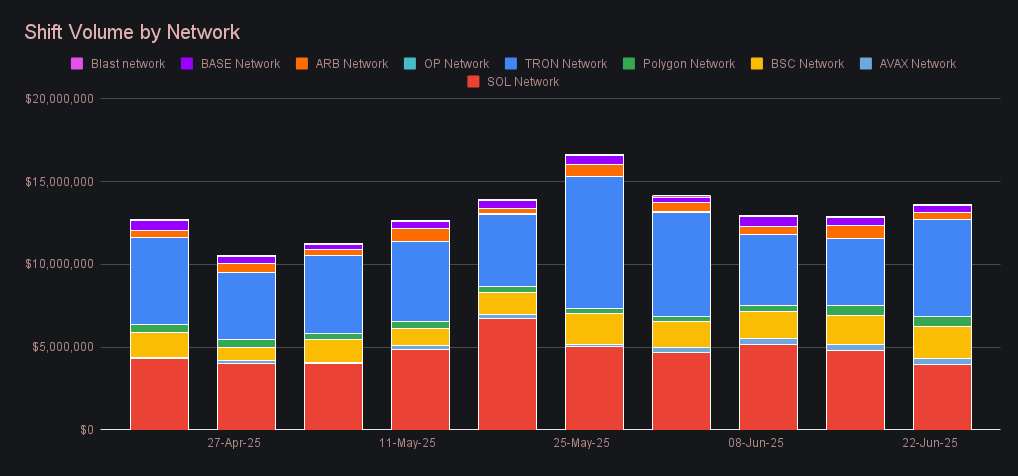

Alternate networks to ETH processed a combined $13.61m this week, a +6.0% gain that marked a mild improvement for the grouping. The Tron network led with $5.83m (+44.5%), surging on the back of stronger stablecoin-related shifting, and overtaking Solana to become the top alt network. The Solana network, by contrast, extended its 3 week downtrend with a -17.2% dip to $3.98m. Together, these two chains have consistently accounted for around ~70% of recent alternate network volume, but this balance is currently tilting toward Tron, suggesting a change in user preference. BSC followed with $1.95m (+13.3%), maintaining a firm hold on third place. Among the remaining group, all other networks saw declines, with Polygon and Arbitrum rounding out the top five at $610k (-1.3%) and $462k (-41.5%), respectively, as activity tapered off across the lower end of the category.

Affiliate News

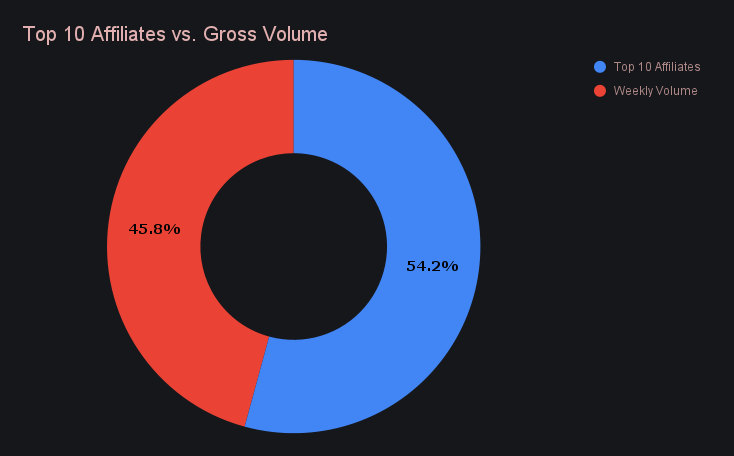

Affiliate volume rose +6.3% to $13.58m this week, with the top three rankings still unchanged. Our top affiliate broke their own record set just last week, reaching a new all-time high of $8.65m (+4.8%) and further reinforcing their lead. Combined with second place’s $3.05m, the top two affiliates cleared $11m in volume for the second straight week, highlighting outstanding consistency at the top. Third place also saw a notable rise to $579k (+26.5%) and wrapped the week with a solid 1,015 shifts.

Together, our top affiliates accounted for 54.2% of total weekly volume, up +3.6% from the prior week.

That’s all for now - thanks for reading and happy shifting.