SideShift.ai Weekly Report | 17th - 23rd September 2024

Welcome to the one hundred and twenty-third edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

This week, SideShift token (XAI) traded within the 7-day range of $0.1490 to $0.1579. At the time of writing, XAI is priced at $0.1590, pushing slightly above the upper boundary of this range. It currently has a market cap of $22,099,290 (+6.73%).

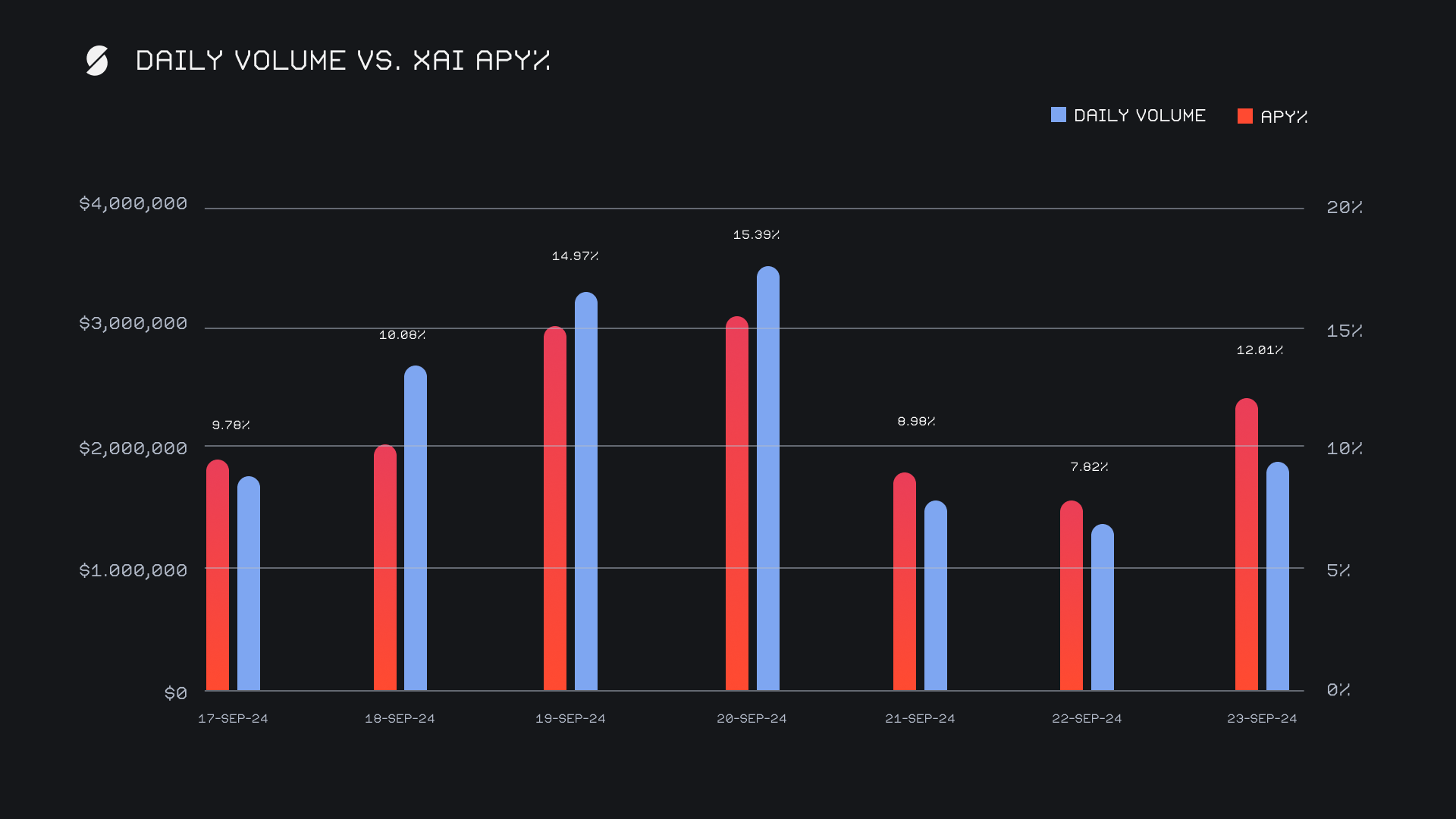

XAI stakers enjoyed a healthy average APY of 11.29%, with a daily rewards high of 48,795.93 XAI (an APY of 15.39%) being distributed directly to our staking vault on September 21, 2024. This was following a daily volume of $3.5m. Over the week, XAI stakers received a total of 254,552.99 XAI or $40,162.41 USD in staking rewards.

An additional 2 WBTC were added to SideShift's treasury throughout the course of the week, bringing the current total to a value of $14.3m. Users can stay updated on live treasury developments via sideshift.ai/treasury.

Additional XAI updates:

Total Value Staked: 124,644,202 XAI (+0.2%)

Total Value Locked: $19,848,777 (+4.9%)

General Business News

This past week, BTC held its ground, rising a modest +4% to $63,600, showcasing some stability following the recent market surge. ETH was similar and rose approximately +10% to $2,650, although its ETFs experienced their largest outflows since July, reflecting subdued institutional demand despite broader market optimism. Meanwhile, Bittensor’s TAO stood out with an +80% rise, leading an AI token rally amid the market's rebound.

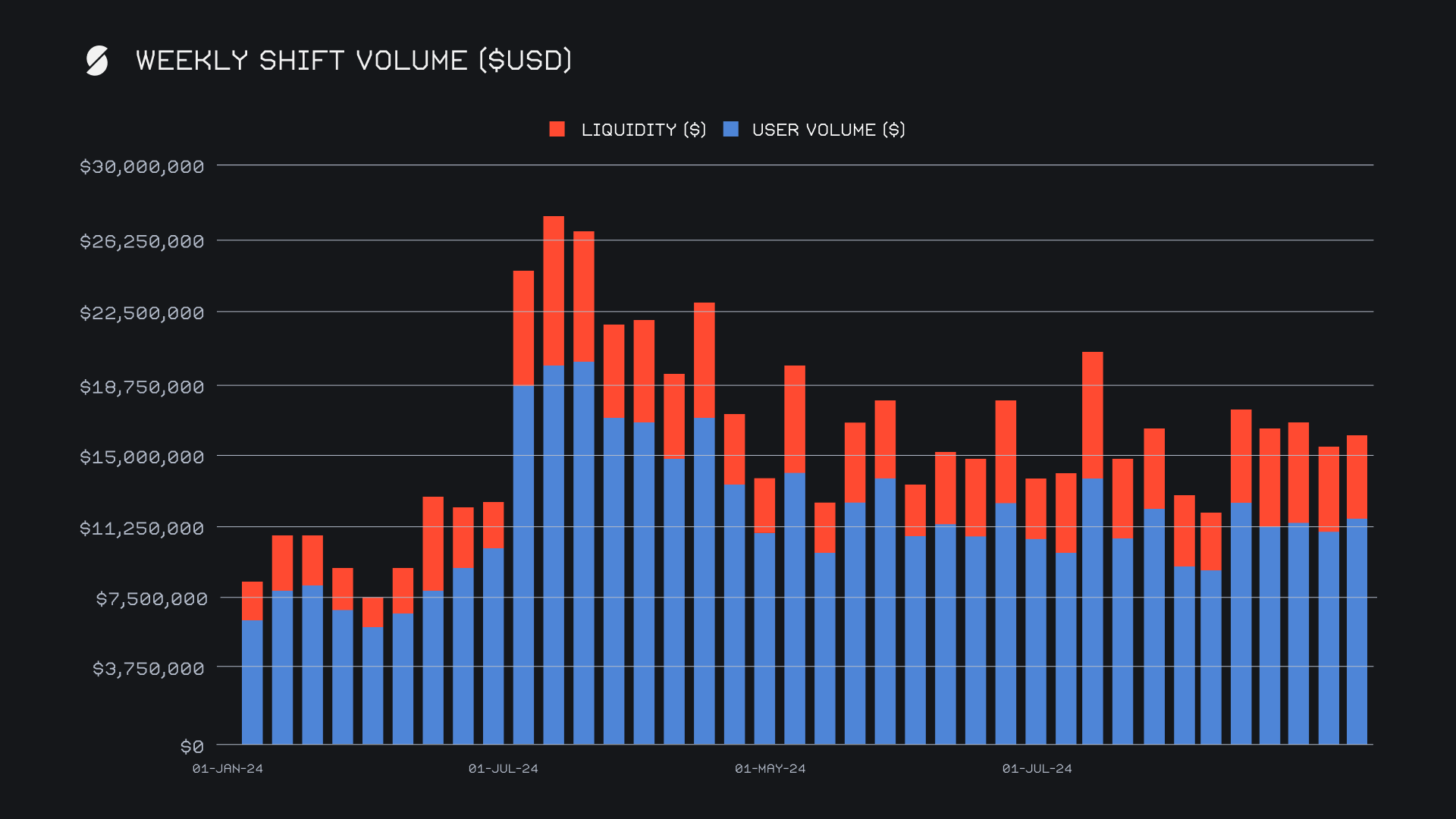

SideShift recorded a solid performance this week, with our gross weekly volume reaching $16.0m (+18.9%), almost exactly on par with the YTD average. This uplift was driven by increased activity across popular pairs, such as BTC/ETH and BTC/USDT (erc20), which contributed $1.4m and $1.3m, respectively. Our daily volume average settled at $2.3m, indicating a stable climb in user engagement across a variety of coins, not just our top 5. The majority of this volume was user shifting, totaling $11.6m (+21.2%), while liquidity shifting added $4.4m (+13.1%).

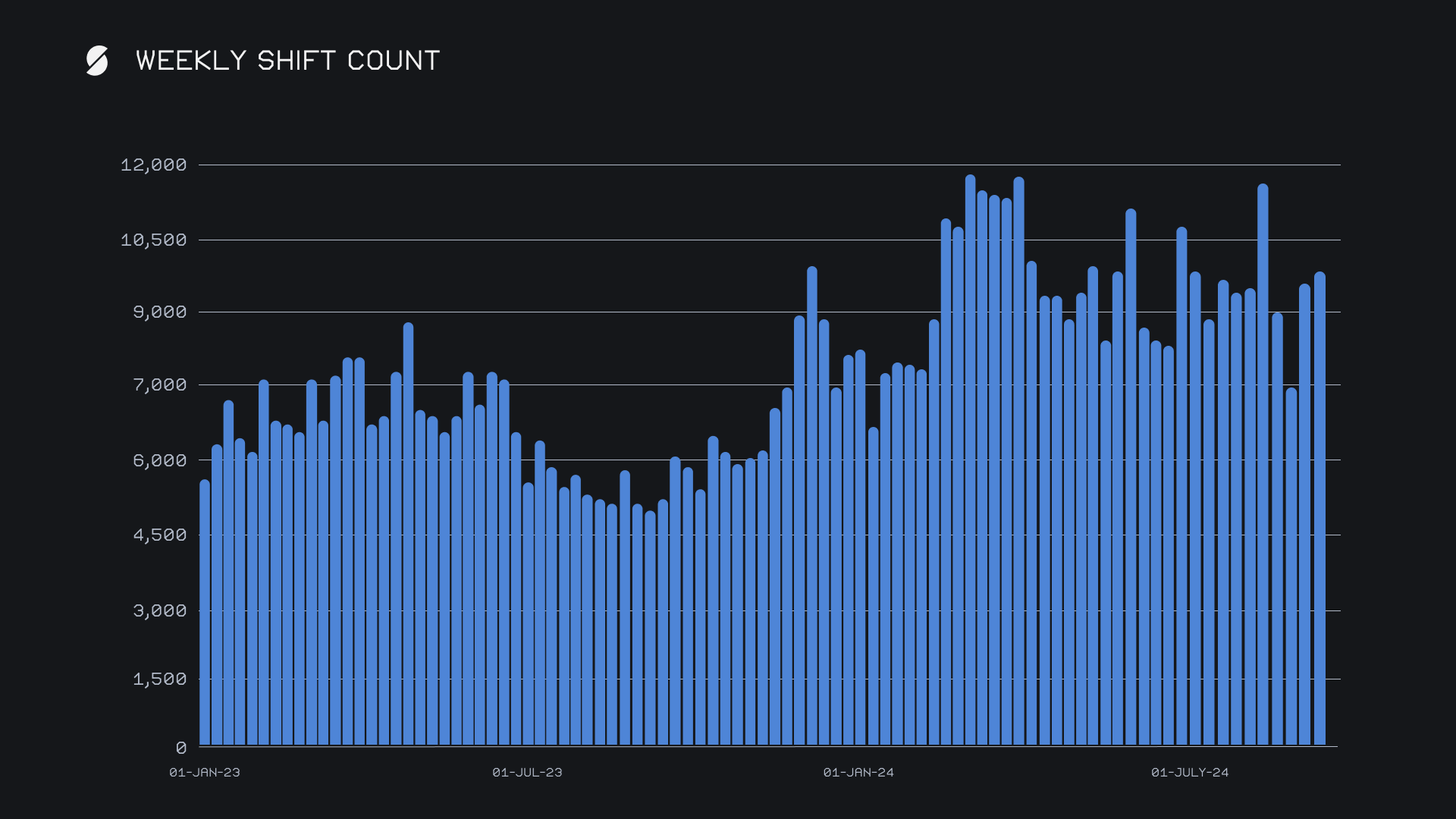

SideShift also noticed a boost in terms of shift count - we completed 9,820 shifts (+18.6%) overall, for a daily average of 1,403 shifts. As outlined in the chart below, this was the highest shift count in the past month, rebounding from a dip recorded at the beginning of September, but still falling shy of the 10k per week marker. Nevertheless, the growth of shift count alongside total volume is a bullish sign - this week’s gross shift count ended +4.3% higher than our YTD average.

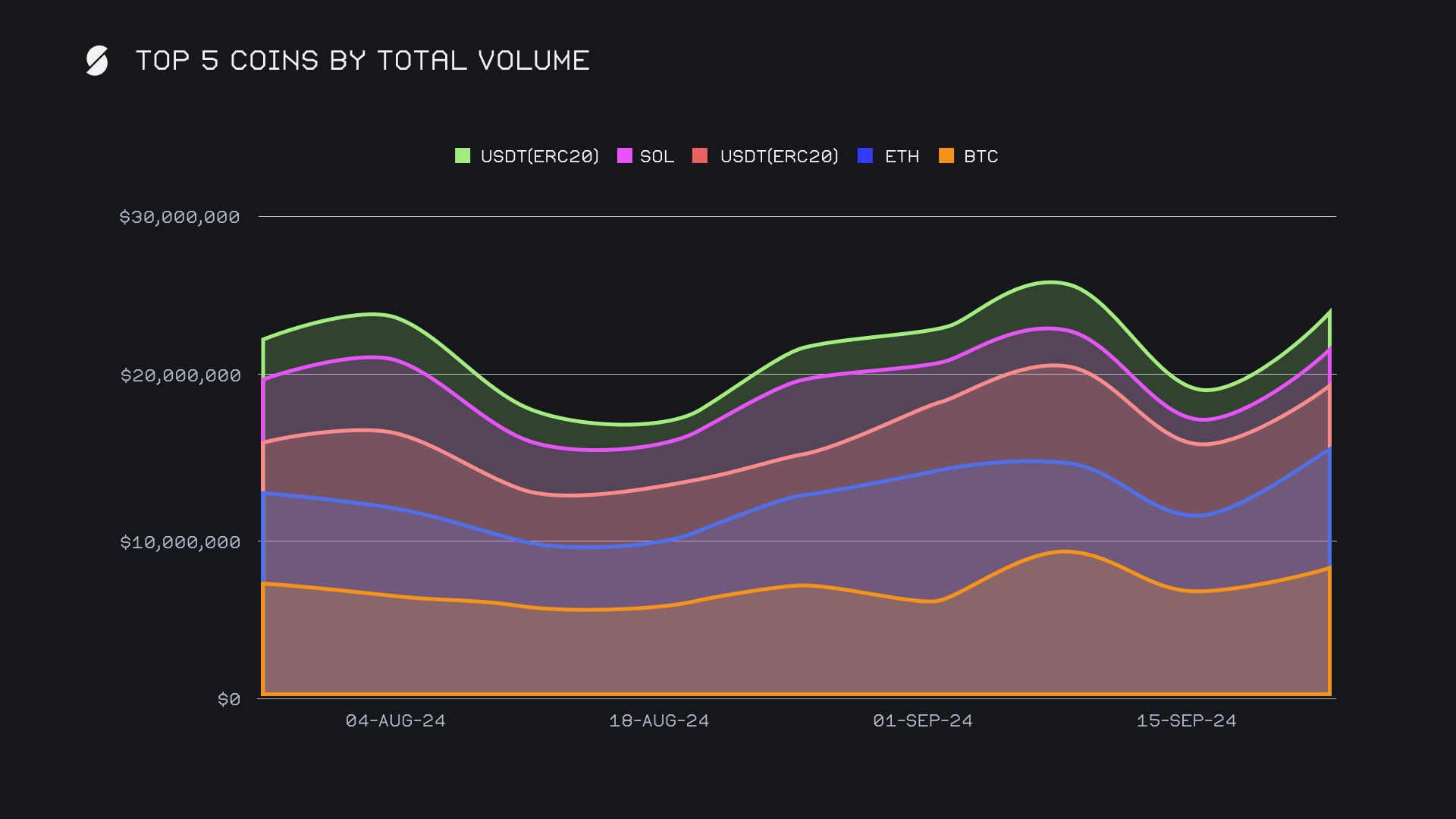

BTC maintained its position as the top coin this week with a total volume of $8.1m (+23.3%). While deposit volume roared upwards to $3.3m (+104.5%), settlement volume dropped significantly by -23.1% to $2.3m. This tells us that users are increasingly depositing BTC but are moving away from shifting to it as a settlement option, after recording back to back weeks with more than $3m in user settlements.

ETH followed closely with $7.8m (+69%), reflecting strong demand across both deposits and settlements, and ending as the highest gainer among our top 5 coins. Deposit volume reached $3.0m (+50%), while settlement volume soared by +87.2% to $3.0m - this also resulted in ETH being our most settled coin this week. Interestingly, this demand came from many sources. Excluding the pairs with our top coins, shifts to ETH totaled a count of nearly 2,000 with a combined volume of $3.2m, far exceeding that of any other coin this week.

USDT(erc20) took third place with a total volume of $3.8m, despite a -14.5% decline from the previous week. The coin saw a significant decrease in deposit volume (-68.3%) to $540k, although settlement demand remained strong at $2.1m (+63.7%). This recent shift away from BTC and towards the Ethereum network is highlighted not only by our top two prominent shift pairs, but also the sheer number of shifts moving towards the Ethereum network.

Outside of our top 5 coins, ADA made a significant comeback this week, multiplying its volume nearly 53x to reach $1.03m, following near-zero activity in the previous period - this was caused by node issues following the recent hard fork. This resurgence marked ADA's highest shift volume in several months, showcasing a sudden sign of renewed user interest. SUI also enjoyed a decent +36.3% gain for $420k, with users riding the ongoing uptrend. Meanwhile, TRX fell sharply from its $1m finish last week, dropping -60.8% for $428k as its demand waned as compared to earlier in the month.

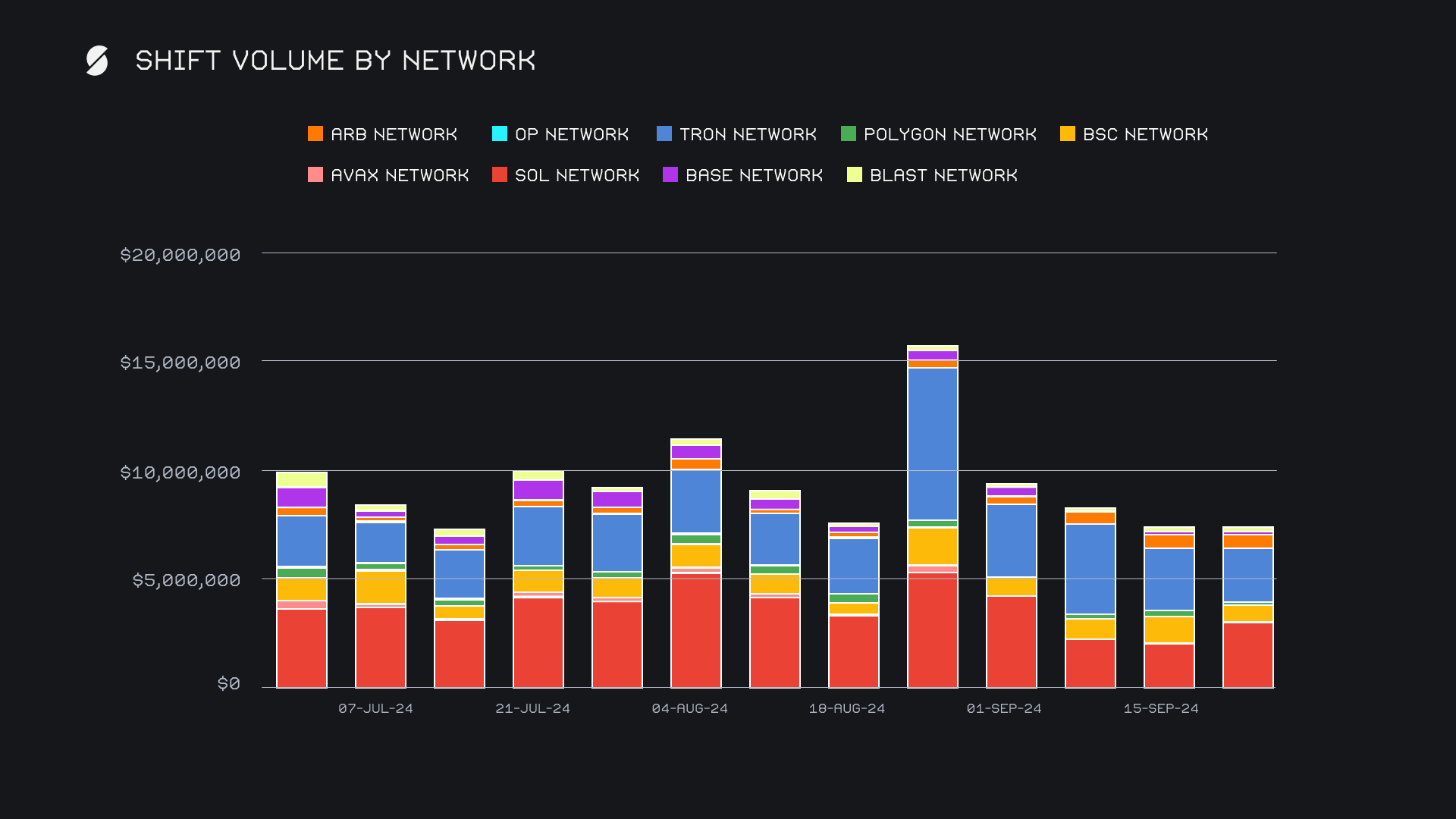

The Solana network reclaimed its top spot among alternate networks, with a near $1m jump in user volume, finishing the week at $3.0m (+45.5%). Although it made a decent bounce from the local lows, gross Solana activity on SideShift still has a ways to go to catch up with numbers seen a few months ago. Meanwhile, the TRON network experienced a decline of -13.6% to $2.5m, primarily due to a lack of demand for its native TRX token, and slipped to second place overall. The Binance Smart Chain (BSC) network also saw a sharp drop, ending the week at $758k (-39.9%), reflecting lower user engagement with its native BNB token. The Arbitrum network was similar, falling -21% for $523k this week. Overall, the focus of users remains heavily on the Ethereum network and top coins, as alternate networks to ETH combined for a total volume of just $7.3m, representing a 10-week low. Notably, the Solana and TRON networks together accounted for three-quarters of this volume, leaving plenty of room for growth for other networks.

Affiliate News

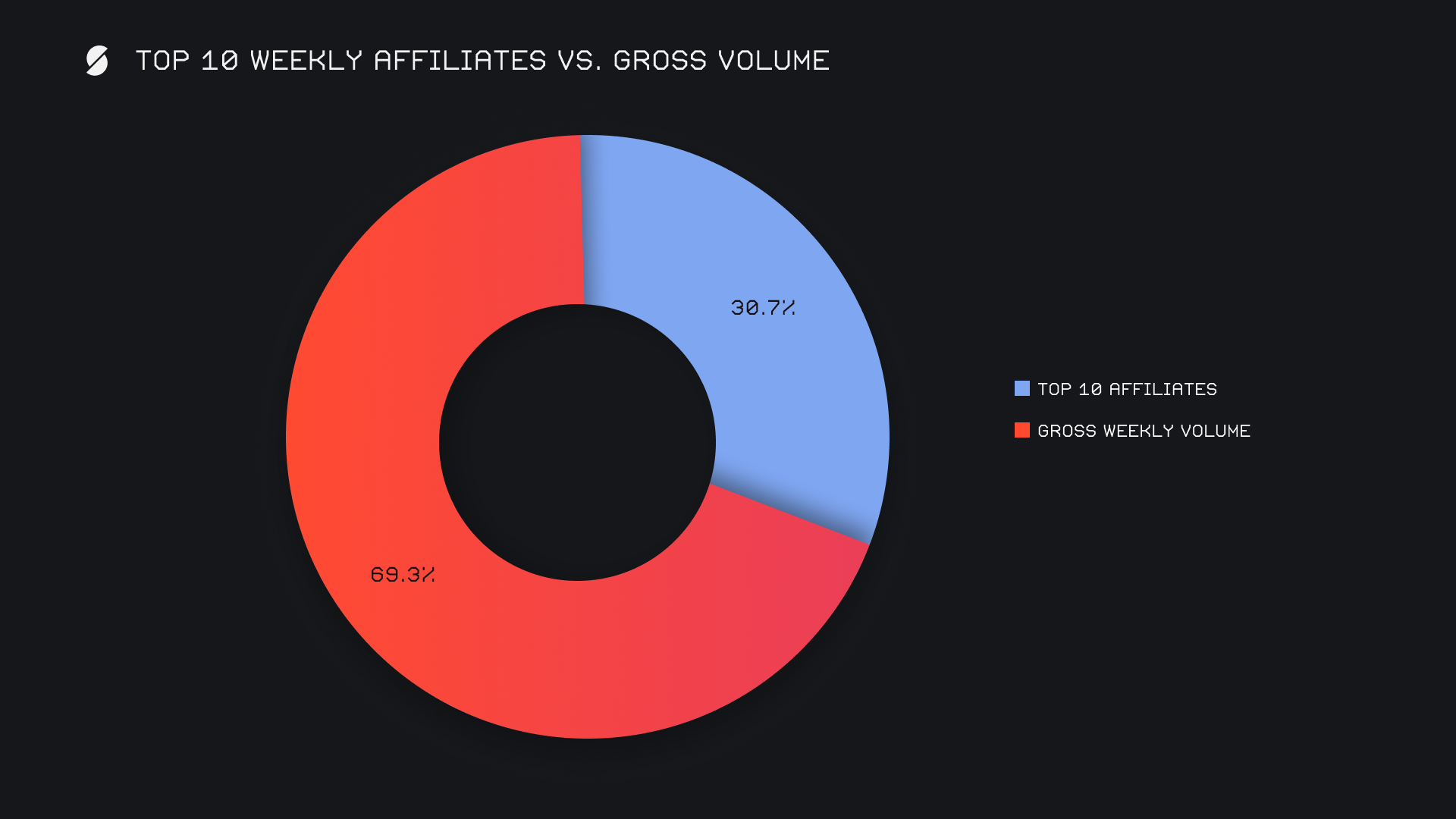

Our top affiliates held their positions this week, with a combined volume of $4.9m (+34.1%). Leading the pack, our first-place affiliate continued to dominate with $2.0m, showing remarkable consistency despite a slight -0.4% dip. It has now been our top affiliate in 9 of the past 10 weeks. Meanwhile, our second-place affiliate had a strong showing, boosting its volume by +61.4% to $1.3m, while our third-place affiliate made an even more impressive leap and nearly tripled its previous total to end at $1.2m (+147%). These increases helped our top affiliates contribute 30.7% of our weekly volume, reinforcing their importance and impact on SideShift.

That’s all for now. Thanks for reading and happy shifting.