SideShift.ai Weekly Report | 18th - 24th June 2024

Welcome to the one hundred and tenth edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

This week, SideShift token (XAI) saw mostly steady price action within the 7-day price range of $0.1726 to $0.1955, with the exception of a quick spike up towards the $0.20 mark on June 23, 2024. At the time of writing, XAI has leveled out at $0.1785, reflecting a current market cap of $24,210,275 (+2.1%).

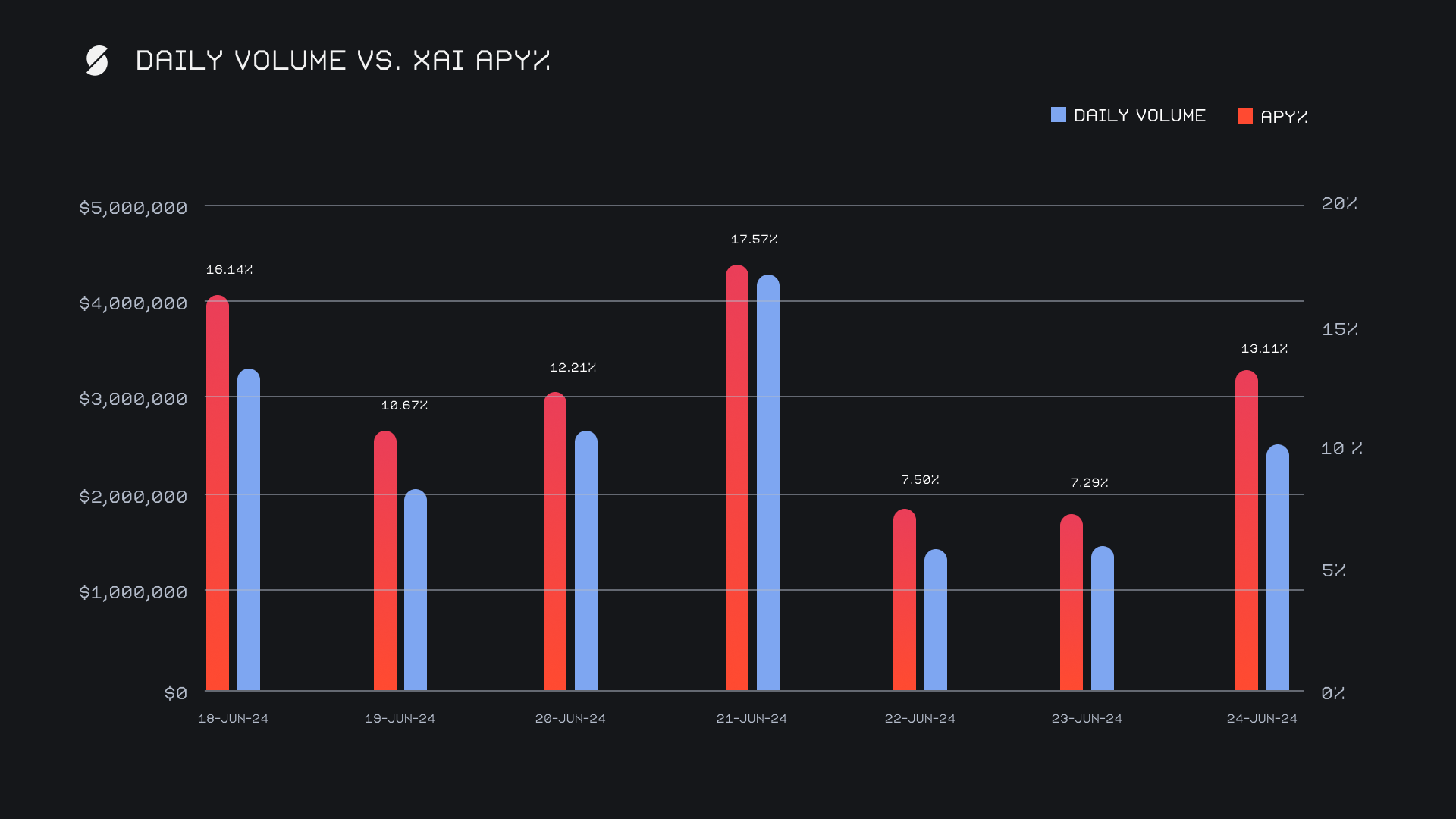

XAI stakers were rewarded with an average APY of 12.07% this week. The highest daily reward was distributed to our staking vault on June 22nd, 2024 and amounted to 53,813.04 XAI (equating to an APY of 17.57%), following a daily volume of $4.3m. This week, XAI stakers received a total of 263,934.66 XAI or $47,112.34 USD.

Additional XAI updates:

Total Value Staked: 121,539,158 XAI (+0.21%)

Total Value Locked: $21,565,126 (+2.52%)

General Business News

This past week saw the crypto market trend downwards as BTC briefly dipped below $60k, following the announcement of Mt. Gox repayments scheduled to begin in July. The majority of the market followed suit, with a few select coins such as TRX, NEAR, and FTM going against the grain to close the week on a positive note.

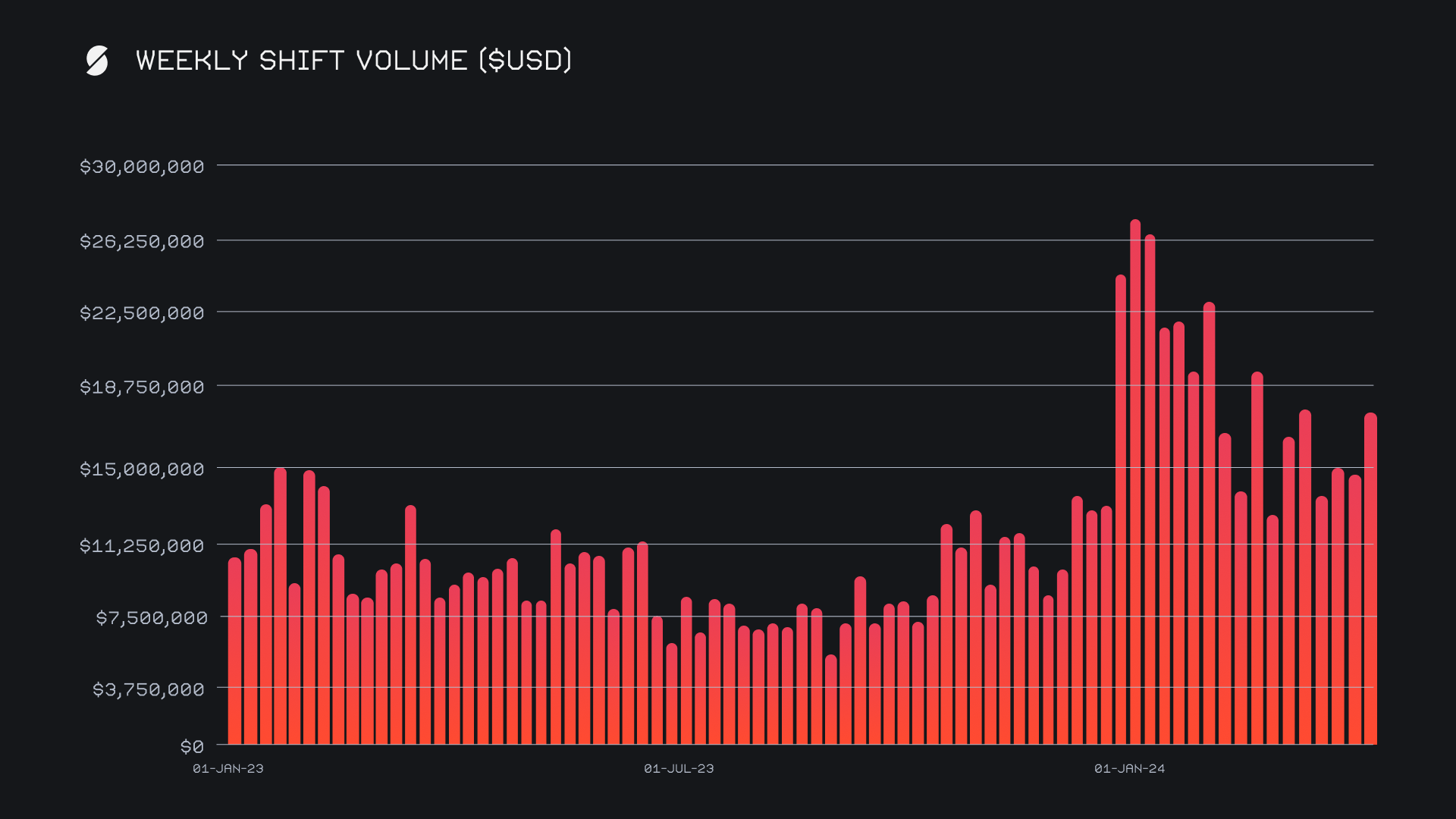

SideShift had a strong performance and rounded off the period with a healthy gross volume of $17.7m, marking a decent increase of +21.1% compared to last week. For some context on growth over time, this week’s volume ended more than double that of the weekly average seen throughout 2023 ($8.6m), something which is visualized and tracked in the chart below. Despite this solid outcome, it was interesting to note that our gross weekly shift count decreased by -21.6%, for a total of 8,650 shifts. This indicates a higher average shift value, which finished with daily averages of $2.5m on 1,236 shifts. A notable proportion of this came from our top shift pair coins, and derived from shifts taking place directly on the site.

ETH retained its position as our top coin for an impressive fifth consecutive week, achieving a total weekly volume of $8.1m (+15.8%). The increase was driven by a substantial rise in deposit volume, which reached $3.0m (+40.3%), although its user settlement volume fell to $2.7m (-11.8%). This influx of ETH deposits also occurred alongside the ETH price trickling downwards, a representation of fear outweighing greed, although the end result was still high overall shift volume. In an additional statement of relative strength, this was the highest weekly total volume achieved by ETH throughout the past three months.

SOL recorded the most outstanding change among any of our top coins and climbed to the second spot on the back of a +66.9% surge, to finish with a total volume of $7.2m. This growth was supported by increases in both user deposit volume, $1.5m (+19.5%), and to a larger extent settlement volume, $3.2m (+58.6%), which comfortably represented the most demanded coin by users and ended with a total more than twice that of the always popular BTC. Shifting between ETH and SOL continues to remain highly popular, although this week the tide shifted to favor ETH/SOL, following nearly a month of SOL/ETH remaining at or near the top. Still, these two pairs claimed the week’s most popular among users, with respective volumes of $1.7m and $997k.

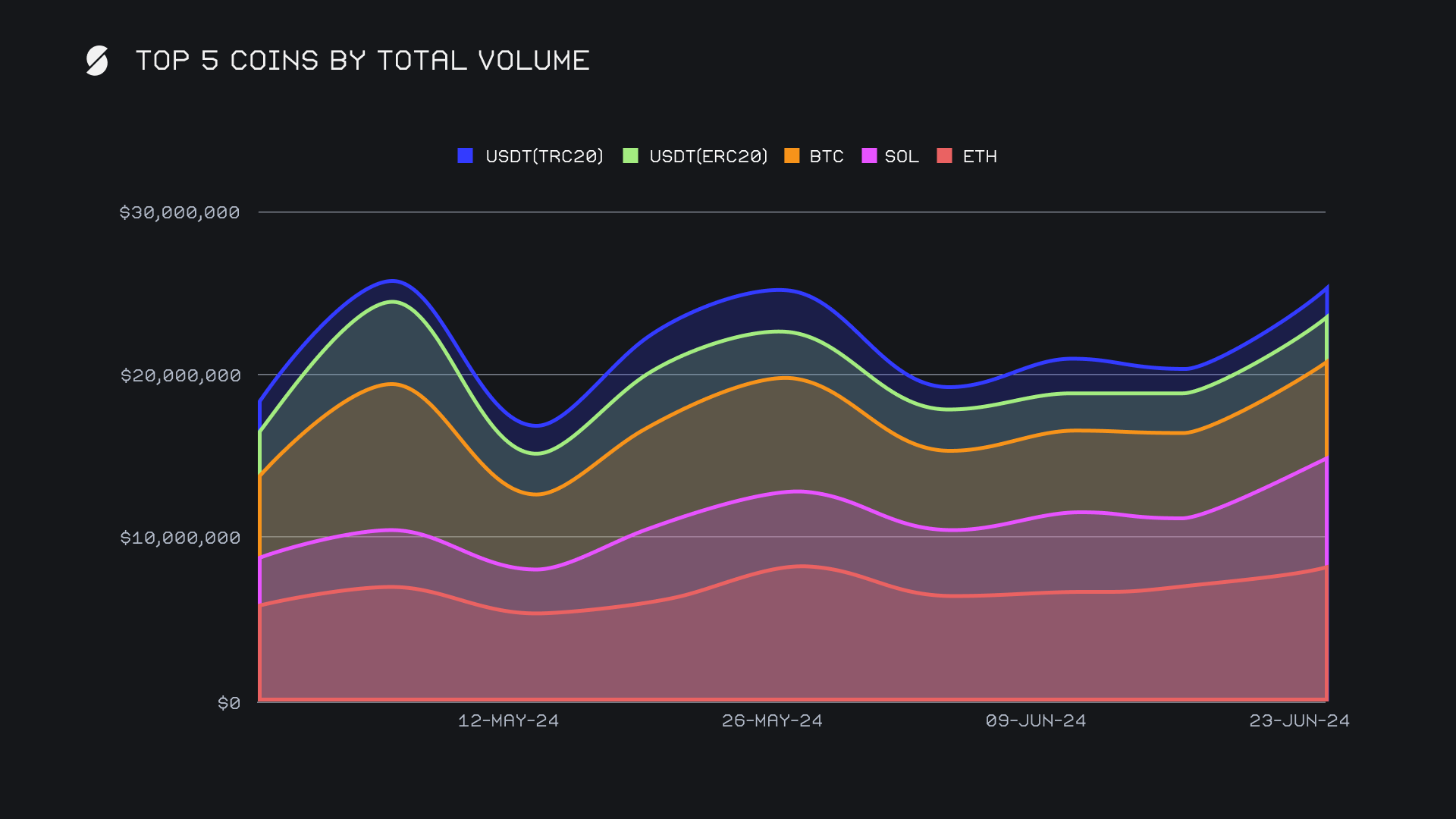

BTC maintained a decent performance and showed less volatility than its counterparts, as is typically the case, however only managed to end in third place, something which is indeed atypical. It closed the week with a total volume of $5.9m (+12.1%), with a breakdown that saw deposits rise to $2.6m (+7.2%), while settlements increased by a larger percentage to $1.7m (+12.5%). The area chart below is a good representation of the growing proportion of both ETH and SOL shifts, eating into a space that was previously occupied by BTC.

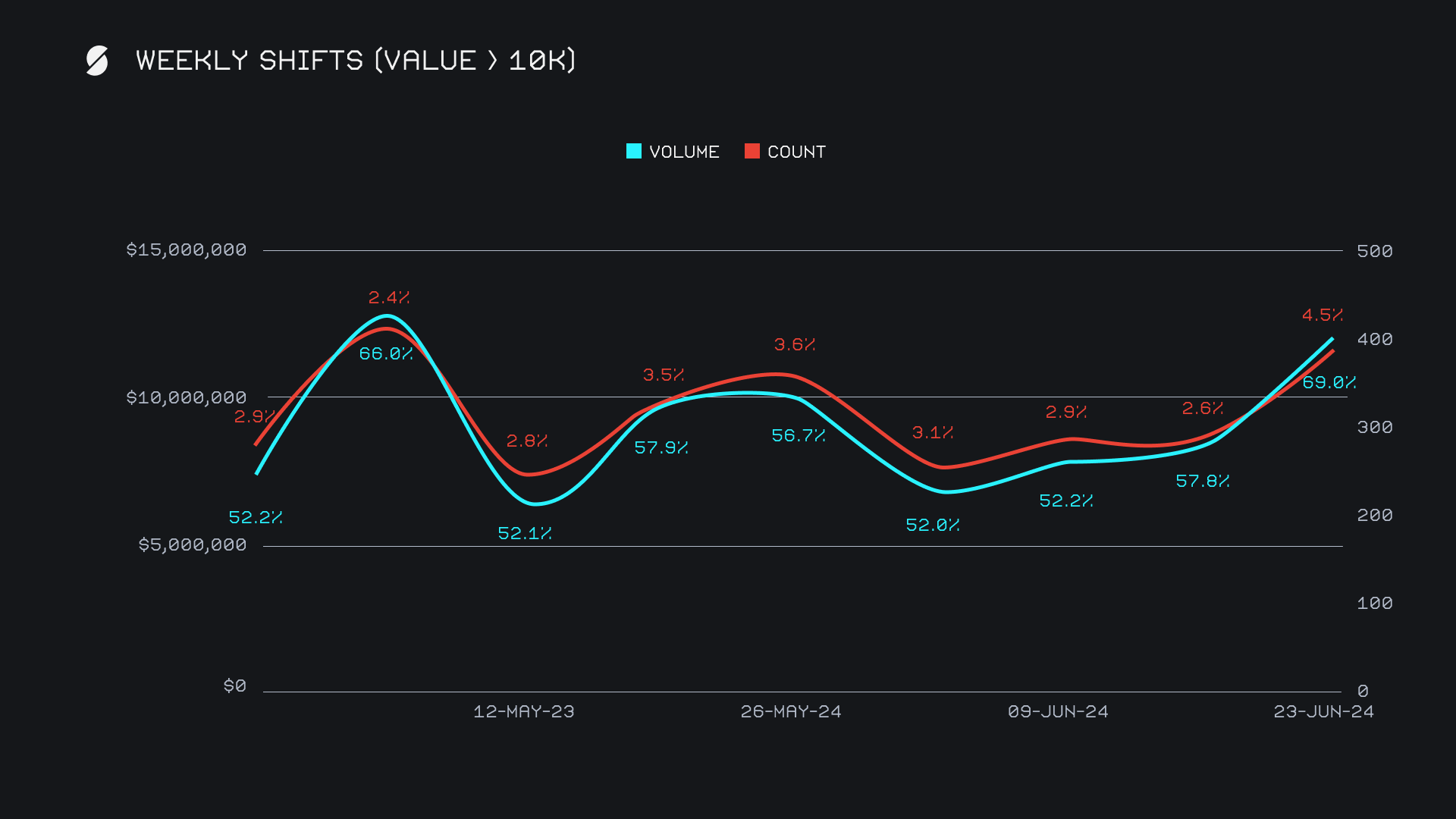

Whale shifting was evident this week, as embodied by our relatively high volume as compared to the lower overall shift count. Shifts with a value exceeding $10k accounted for an astounding 69% ($12.2m) of our weekly shift volume, not only ending as one of the highest proportions of the year, but among our highest ever - this is represented by the blue line below. The proportion of weekly count for this metric also hit a multi-month high at 4.5% (391 shifts), as shown by the red line. Particularly, whale shifting coincided with the week’s most popular shift pairs, with a substantial amount of these shifts stemming from ETH <> SOL.

Although our top 5 grew to account for a more normal ~60% of our weekly total shift volume, noticeable changes were seen in coins outside the top 5. Several of these ended with triple digit gains, on respectable volumes. Most noteworthy here was sixth placed BCH, which grew by a booming 260% to total $1.1m overall to finish just outside of our top coins. Other examples which saw a sudden resurgence include ETH (blast) with $599k (+202.6%), and USDT (BSC) with $480k (+206.8%). Meanwhile, TON incurred the sharpest decline among our top 20 and slid by -54.3% for $175k, in spite of it remaining rather common as a shift option. Its shift count however remained largely unaffected, and declined by a relatively minor -4.9% for 386 shifts.

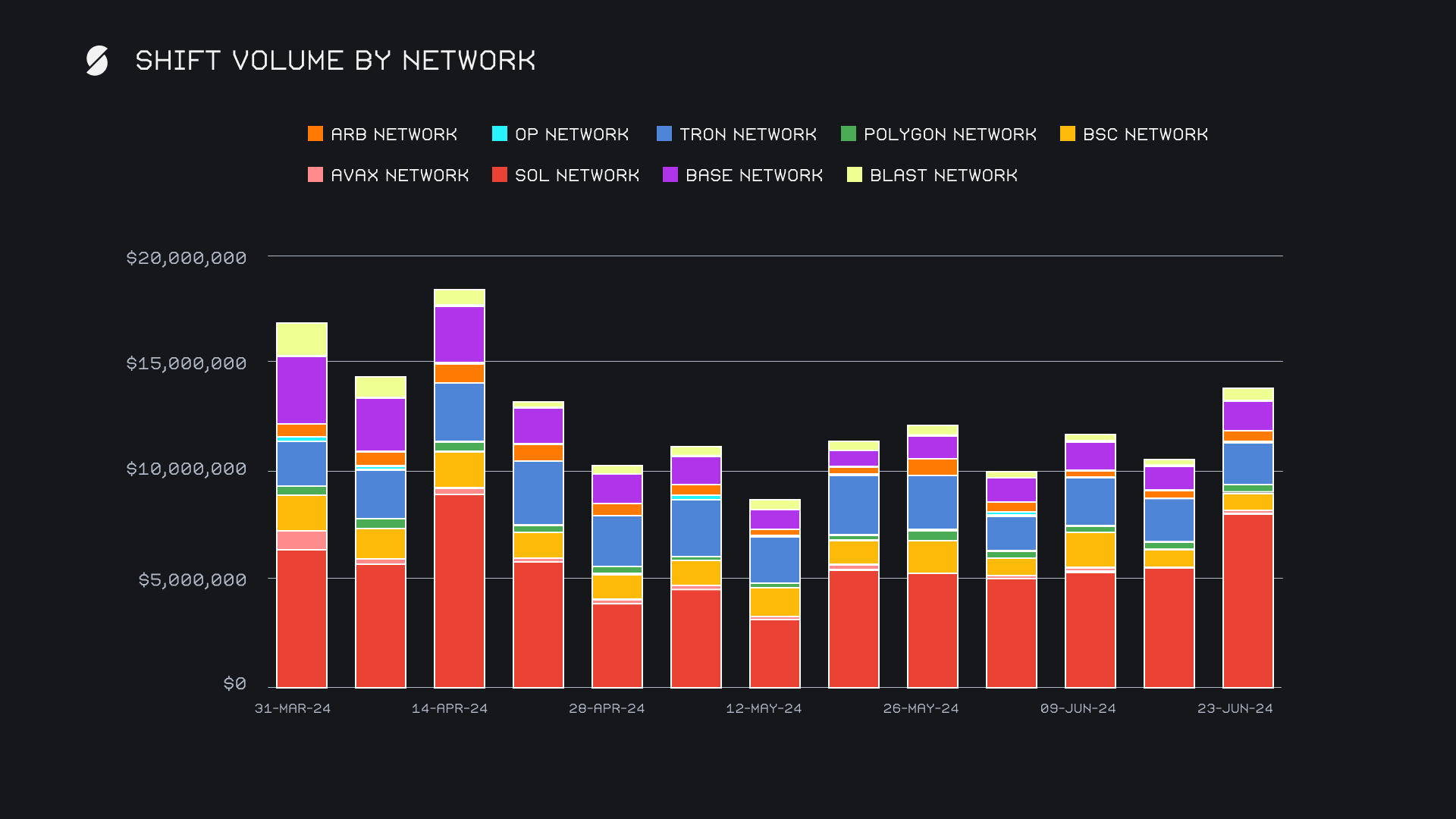

With a rise of +45.7%, the Solana network’s $8.1m sum solidified its position as the leading alternate network to ETH. The native SOL token continues to account for the bulk of shifting, but stablecoins USDC(sol) and USDT(sol) do indeed see flashes of interest from users. The Base network also saw a considerable rise, reaching $1.4m (+23.4%), up from last week’s $1.2m finish. This positioned it third overall, one spot behind the Tron network, which tallied a steady $2.0m (-1.2%) due to its always consistent USDT (trc20) shifting. Among other networks, the Binance Smart Chain (BSC) network summed $876k for a modest +7.7% rise, while shifting on the Blast network tripled, growing to $599k (+202%). These alternate networks to ETH combined to account for 39.2% of weekly shift volume, a confident step ahead of the Ethereum network’s proportion of 31.5%.

In listing news, SideShift added support for ZRO, the native coin of Layer Zero. Shifting of ZRO is now live on both the ETH and ARB chains, directly from any coin of your choice.

Affiliate News

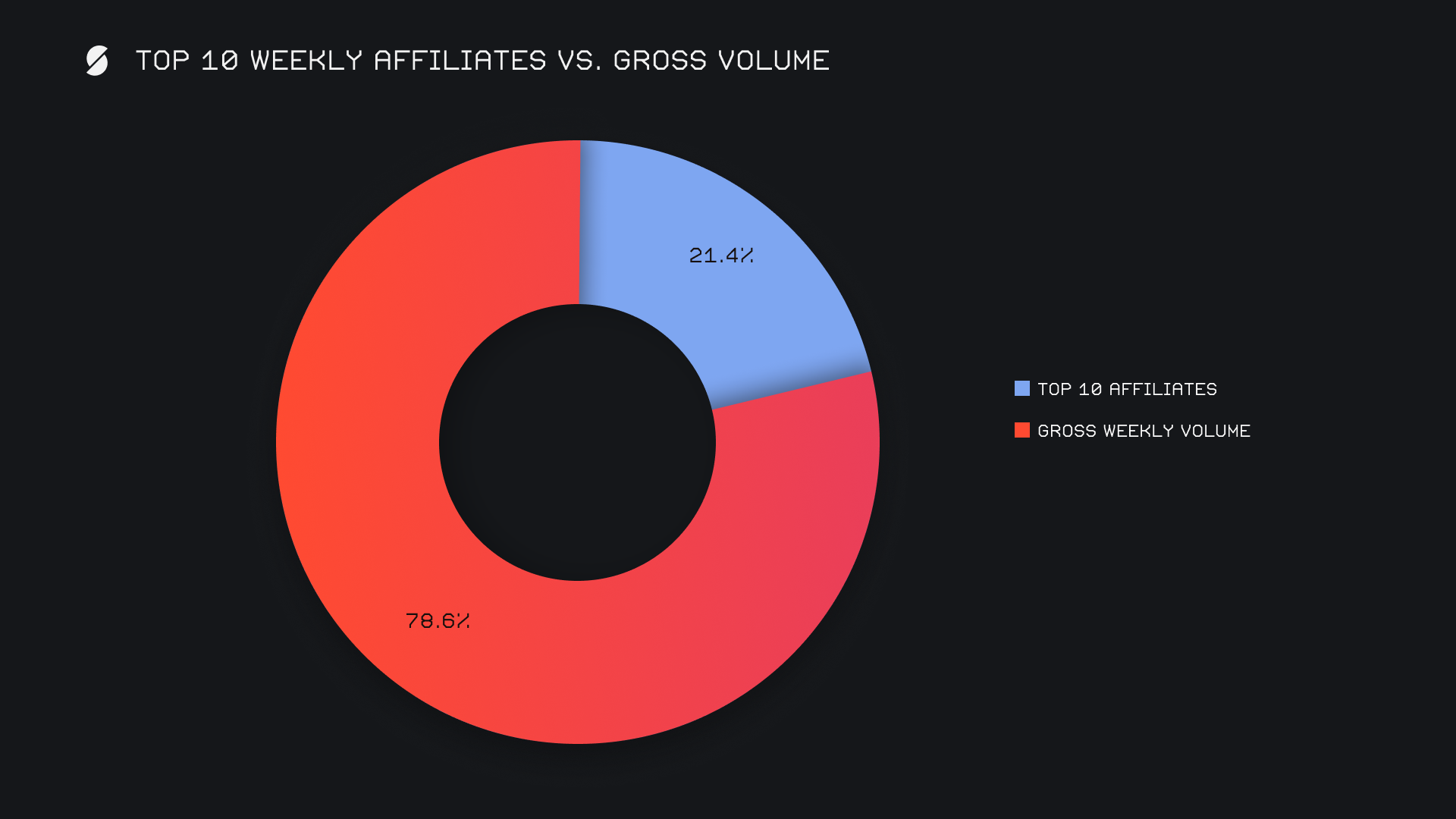

This week, our top affiliates came together for a combined total volume of $3.8m, marking a slight increase of +1.7% from the previous week's $3.7m sum.

Our first-place affiliate had a good showing, with volume rising by +26.8% to $1.3m, and thereby reclaiming the top spot. Meanwhile, our second-place affiliate saw its volume drop -29% to $1.2m, despite having a sturdy shift count of 687. Our third-place affiliate bounced back after a lackluster week, and jumped +100.6% for a total weekly sum of $800k. It is evident that these top three continue to compose the bulk of affiliate shifting, with all other affiliates seeing weekly volumes at just a fraction of those achieved by our top three.

All together, our top affiliates accounted for 21.4% of our total weekly volume, -4.1% lower than last week’s proportion.

That’s all for now. Thanks for reading and happy shifting.