SideShift.ai Weekly Report | 19th - 25th March 2024

Welcome to the ninety-seventh edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

SideShift token (XAI) spent the week moving within range of $0.1851 / $0.1972, making a slight move lower over the course of the past 7 days. At the time of writing the price of XAI is sitting at the bottom of that range at a price of $0.1822, and has a current market cap of $23,992,281 (-7.9%).

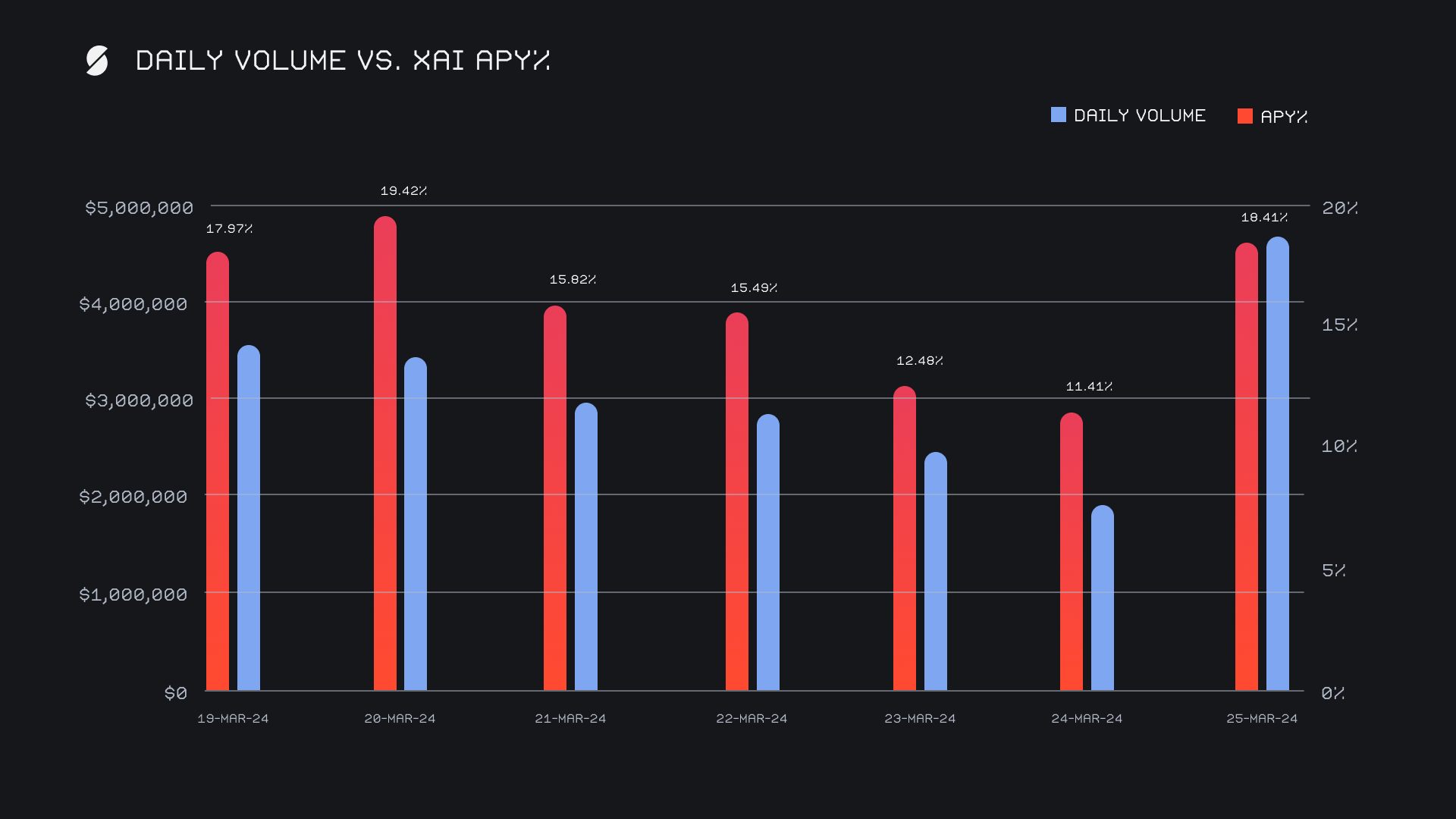

XAI stakers were rewarded with an average APY of 15.86% this week, with a daily rewards high of 57,187.93 XAI (an APY of 19.42%) being distributed to our staking vault on March 21st, 2024. This was following a daily volume of $3.4m. This week XAI stakers received a total of 331,474.62 XAI or $60,394.68 USD in staking rewards.

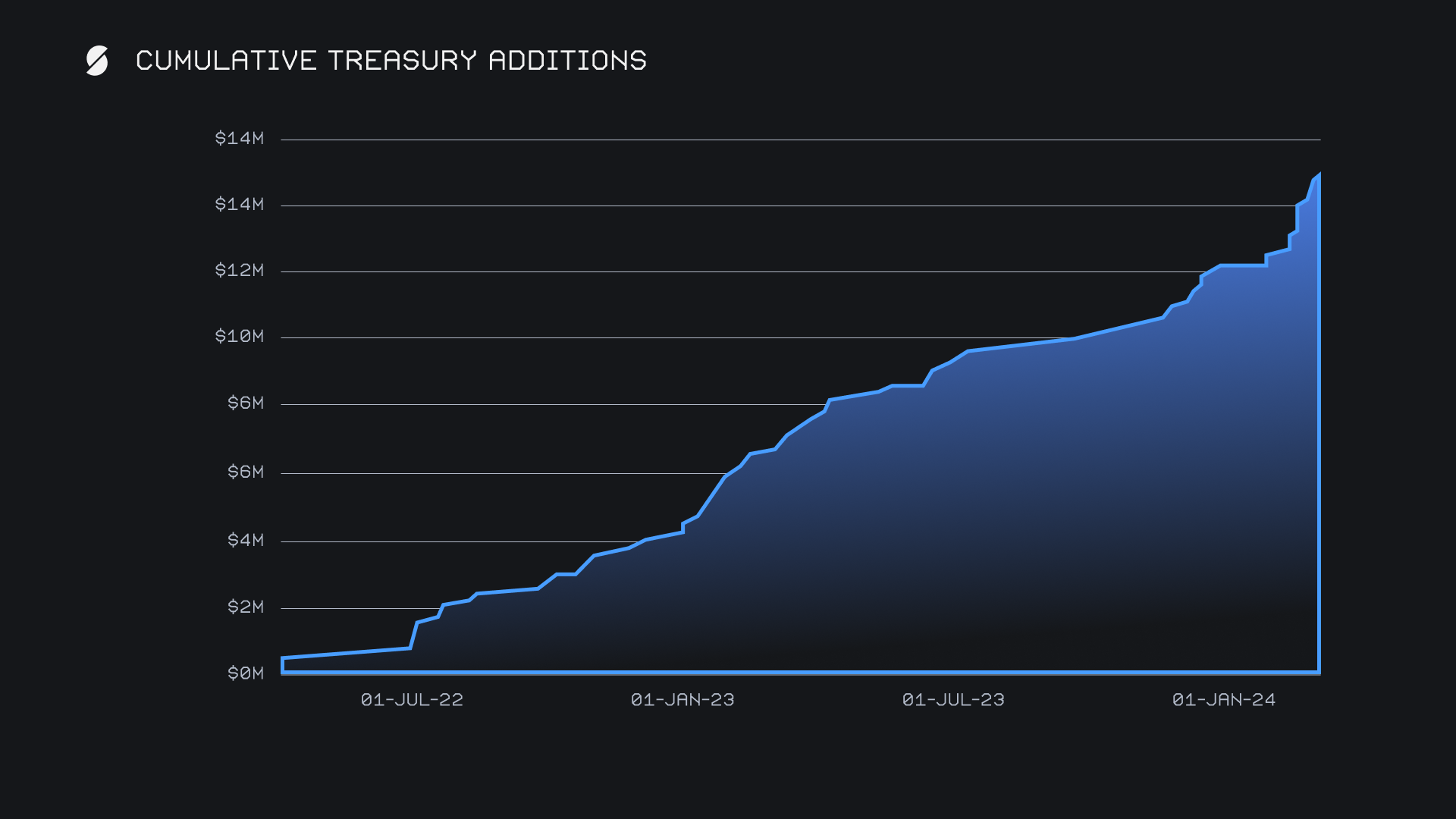

An additional 4 WBTC and 30 ETH was added to SideShift’s treasury throughout the week, bringing the current total to a value of $15.52m. Users are encouraged to follow along directly with live treasury updates, via SideShift.ai/treasury.

Additional XAI updates:

Total Value Staked: 117,875,930 XAI (+0.2%)

Total Value Locked: $21,573,014 (-7.5%)

General Business News

Following a brief dip last week, the total crypto market cap climbed back to $2.8 trillion and has its sights set on all time highs. BTC followed the same trend and rose to regain the $70k level, after falling to touch near $61k on March 20th, 2024. Memecoins continue to be a driving narrative across the market and L2s such as Base have exemplified this in recent weeks with its general network activity surging to new highs.

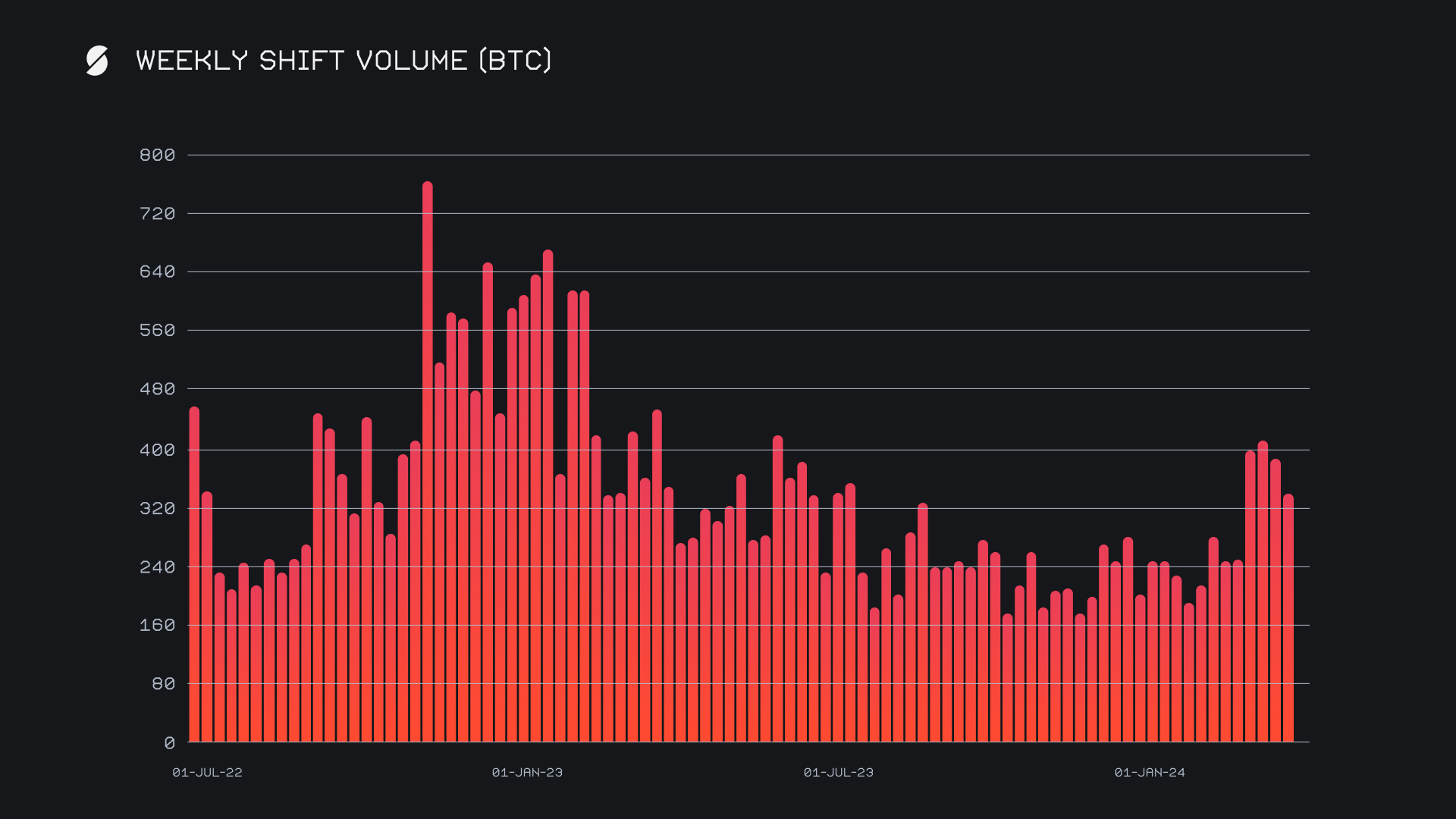

SideShift had another very solid performance, rounding off the period with a gross volume of $21.8m (-18.1%). Following the outstanding previous two weeks that we just had, this week ranked as our third highest overall weekly volume to date. At this current rate, we are on pace to break $100m in monthly volume for March 2024. This week’s volume occurred alongside a shift count which remained extremely strong, and ended with a total shift count of 11,455 (-2.8%). Recall that as mentioned in last week’s report, this sum sits far higher than the average of ~7,000 shifts per week which we have noted over the past couple of years. Together, these figures combined to produce daily averages of $3.1m on 1,636 shifts. When denoted in BTC, our weekly volume amounted to 330.49 (-13.4%).

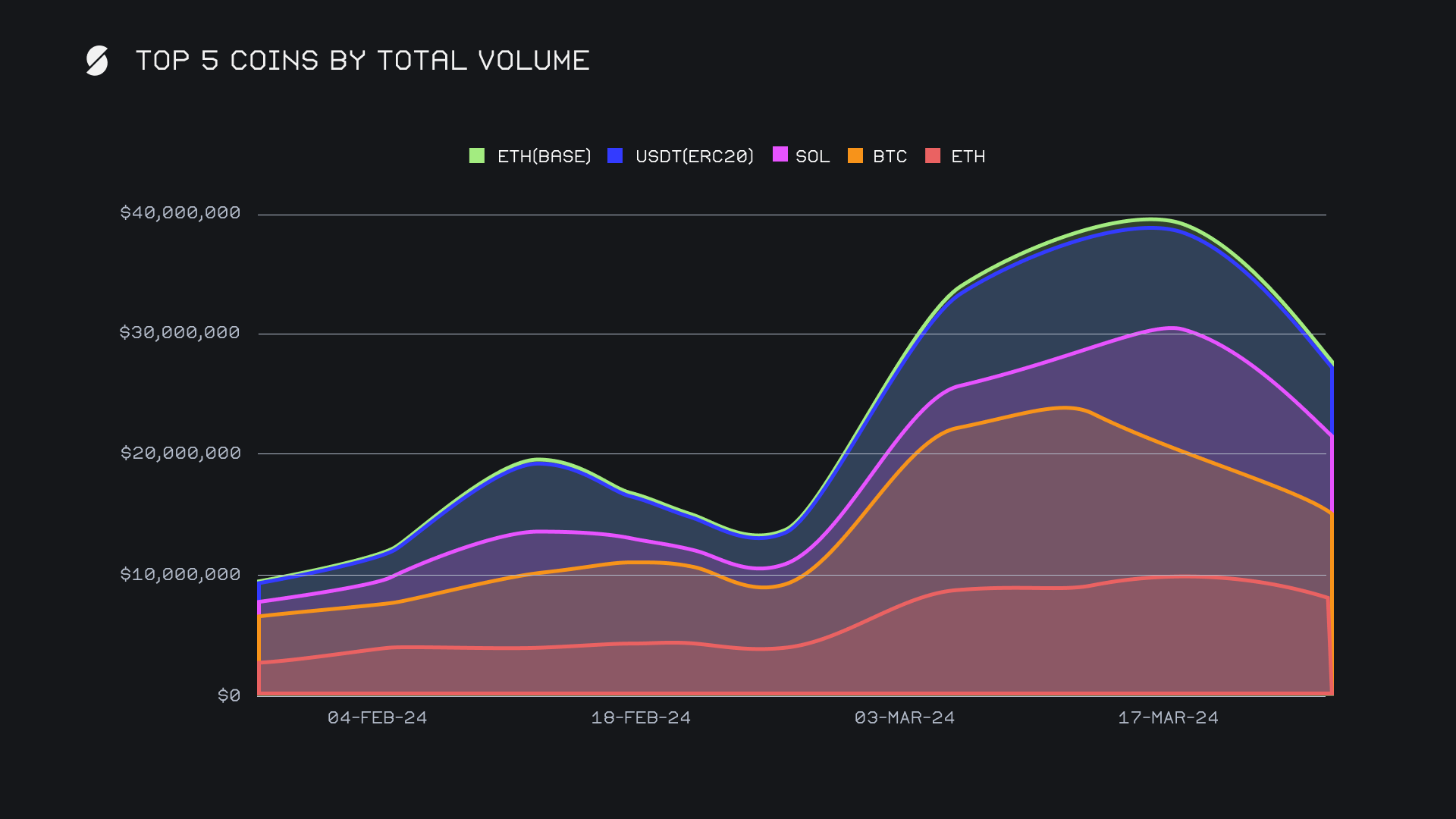

The overall strength in volume continues to stem from a variety of coins, with this week perhaps being the most widespread. Now for the second week in a row, BTC failed to claim the top spot - this week it was ETH which prevailed over all others and grabbed first place with a total volume (deposits + settlements) of $8.1m (-19.8%). This came from a near exact split between user deposits vs. settlements, with respective sums of $3.3m and $3.4m. BTC followed in second place with a total volume of $7.3m (-22.4%), with user deposits outweighing settlements $3.4m to $2.2m. Particularly, this BTC inflow was shifted to USDT (ERC-20), as the BTC/USDT (ERC-20) pair reclaimed the top spot and finished as the week’s most popular with $1.3m. In third place came SOL with $5.7m (-45.3%), which followed the same trend as ETH and also had an almost dead even split between user deposits and settlements, with respective sums of $2.5m vs. $2.4m. ETH and SOL saw quite a bit of overlap this week, with the SOL/ETH pair generating $1.1m and ETH/SOL summing $989k. As our second and third most popular pairs, these coins essentially balanced themselves out this week.

The double digit declines in total volume seen for our top 3 coins is visualized in the above chart, as we can observe how our cumulative top 5 total volume declined by -28.7%. This translated into our top 5 coins representing a fairly low 56% of weekly shift volume, approximately 10% lower than its weekly average. Instead, coins ranked 6-10 saw a significant boost, with several of them recording triple figure gains in total volume. Not only were some of the percentage gains large, but the nominal volumes were also respectable. Examples here include ETH (base) with $2.3m (+132%), BNB with $1.7m (+92%), and ETH (blast) with $1.3m (+140%). Further supporting the notion of the diverse sources of volume is the fact that all top 10 coins exceeded a total volume of $1m, something which has never yet occurred on SideShift.

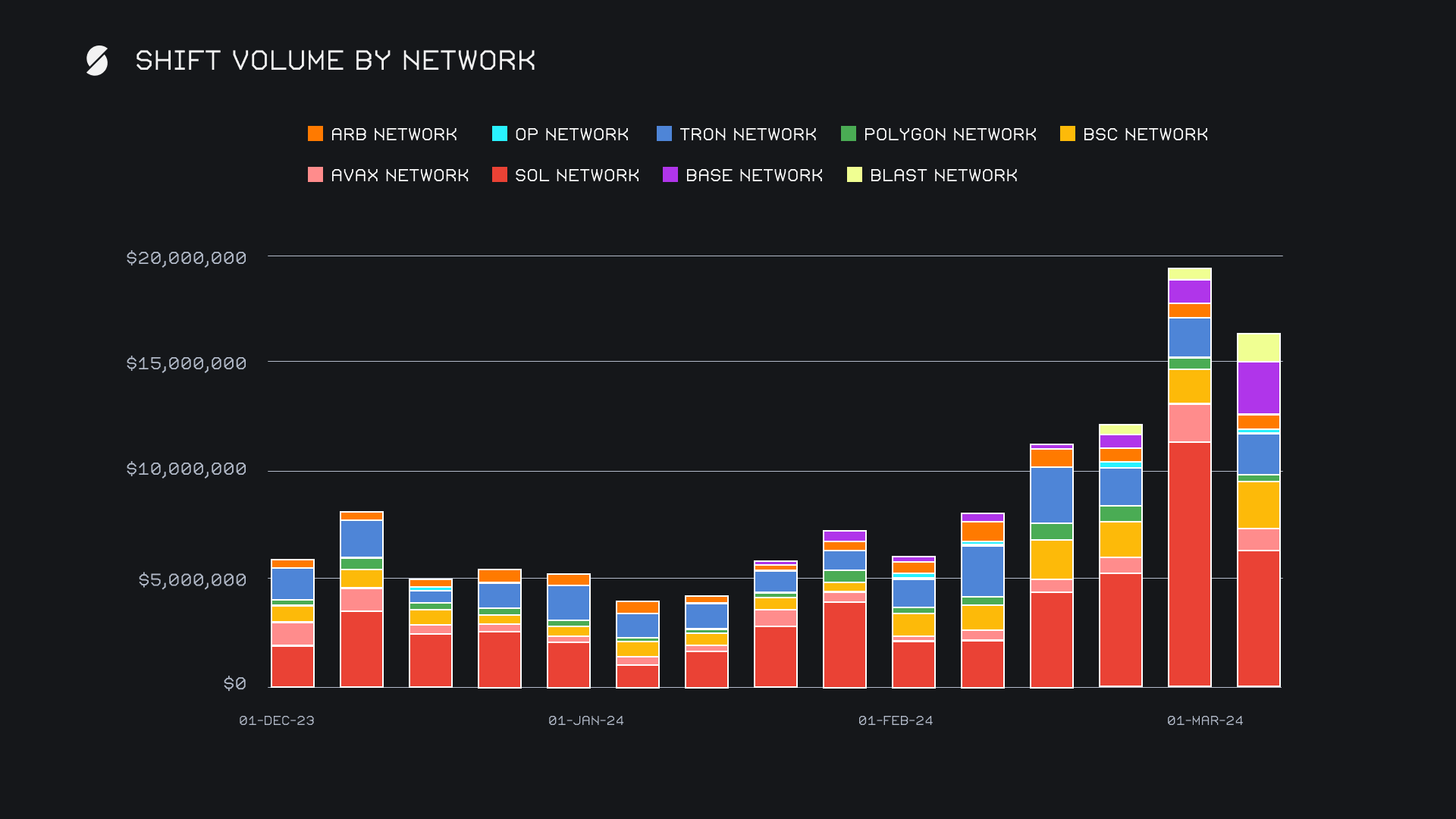

Alternate networks to ETH provide another good example of this distributed volume. All together they summed for an impressive $16.4m, accounting for approximately 38% of our weekly shift volume. Proportionately, this still sits only just behind the Ethereum network, which this week ended up accounting for a slightly larger 40% of shift volume. The Solana network was still the dominant frontrunner among alternate networks to ETH with $6.4m, although it did see a hefty -43.6% decline. Exploding into second place was the Base network with $2.5m (+138%), followed by the Binance Smart Chain (BSC) network with $2.2m (+35.7%). The BSC network has rebounded quite significantly and seen its average weekly volume more than double as compared to last month, a stretch where the network remained quite stagnant. The Tron network carried on as usual with $2.0m (+10.7%), while the Blast network boomed to $1.3m overall in just its third week since listing. Its weekly percentage gain of +140% represented the largest positive change among any alternate network.

Affiliate News

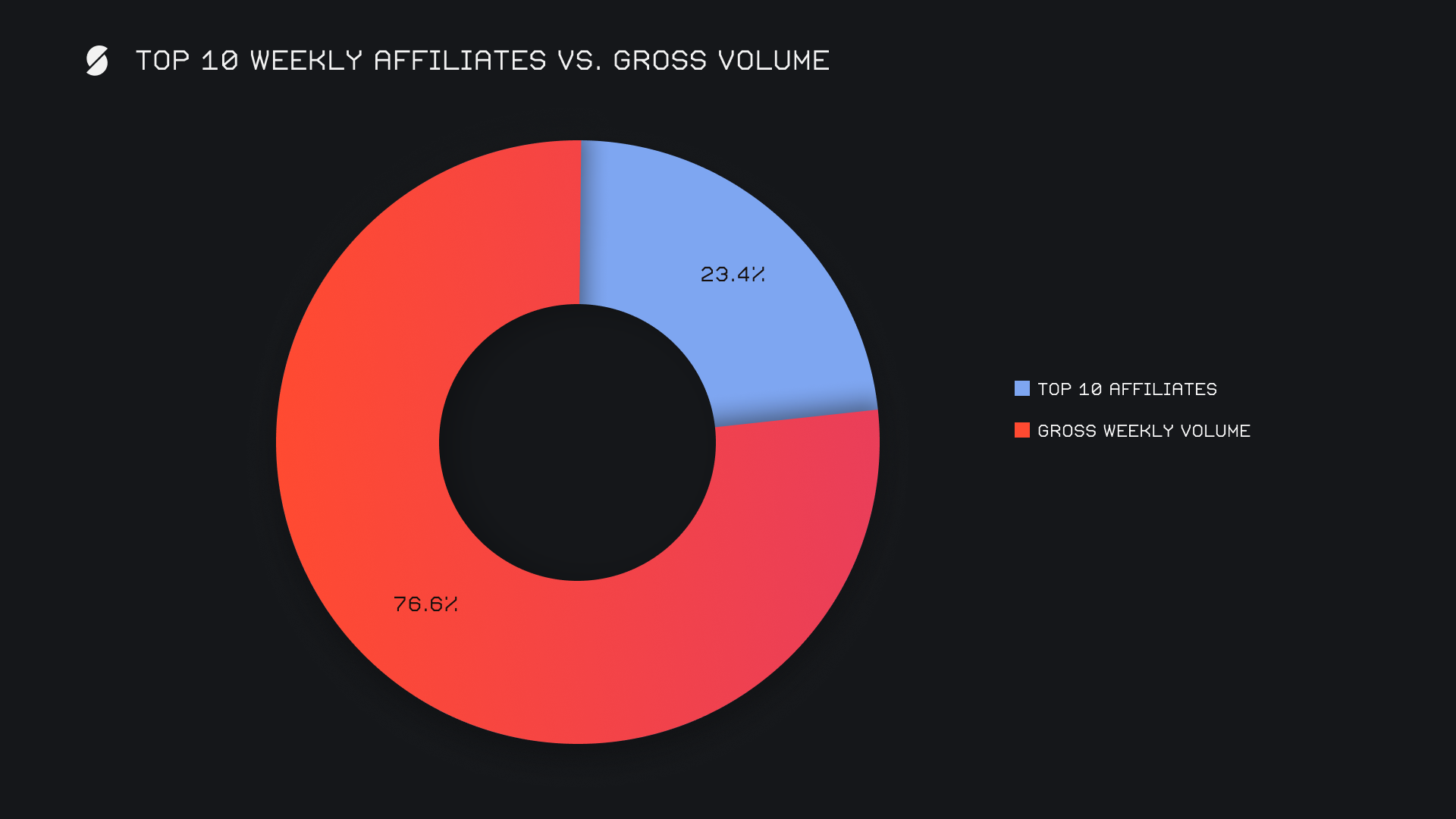

SideShift’s top affiliates combined for $5.1m, -24.4% lower than last week’s sum. The combined count ended with a total 2,218 shifts, representing a smaller decline of -6.9%. Our top affiliate retained its title for the fourth consecutive week, doing so with a volume of $1.9m. This accounted for approximately 9% of our weekly total. Second and third placed affiliates once again had decent weeks and exceeded the $1m mark, with respective volumes of $1.25m and $1.18m. For now, the majority of the shift volume is occurring from shifts made directly on the site.

All together, our top affiliates accounted for 23.4% of our weekly volume, -2% lower than last week’s proportion.

That’s all for now. Thanks for reading and happy shifting.