SideShift.ai Weekly Report | 19th - 25th November 2024

Welcome to the one hundred and thirty-second edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

This past week, SideShift token (XAI) traded within the 7-day range of $0.1521 to $0.1675, holding steady until the week’s close, when it experienced a decline alongside the rest of the crypto market. By week's end, XAI settled at $0.1529, reflecting a market cap of $21,676,004, down -6.81% from last week's $23,260,077. Despite the minor pullback, XAI continues to hold steady interest among stakers.

XAI stakers enjoyed an average APY of 16.27% over the week, with the highest daily rewards of 69,645.79 XAI being distributed directly to our staking vault on November 24th, corresponding to a peak APY of 22.37%. This high point followed a new record setting daily volume of $6.4m, emphasizing the strong connection between platform activity and staking returns. Altogether, XAI stakers received a healthy total of 362,944.94 XAI or $55,494.28 USD in staking rewards this week. An additional 2 WBTC were sent to SideShift's treasury over the course of the week, bringing the current total to a value of $21.79m. Users are encouraged to follow treasury updates directly via sideshift.ai/treasury.

Additional XAI updates:

Total Value Staked: 126,038,866 XAI (+0.1%)

Total Value Locked: $19,139,621 (-7.1%)

General Business News

This past week, BTC reached a remarkable $99k, brushing against six-figure territory before retracing to $94k (-4.5%) amid profit-taking and ETF outflows of $438m. SOL also touched its all-time high of $264 last week before cooling off to its current price near $240 (-6.3%) as the broader market consolidated. Institutional interest remains stronger than ever, highlighted by MicroStrategy’s largest-ever BTC acquisition of 55,500 BTC for an astonishing $5.4b, bringing its holdings to 386,700 BTC and reinforcing confidence in the asset’s long-term trajectory.

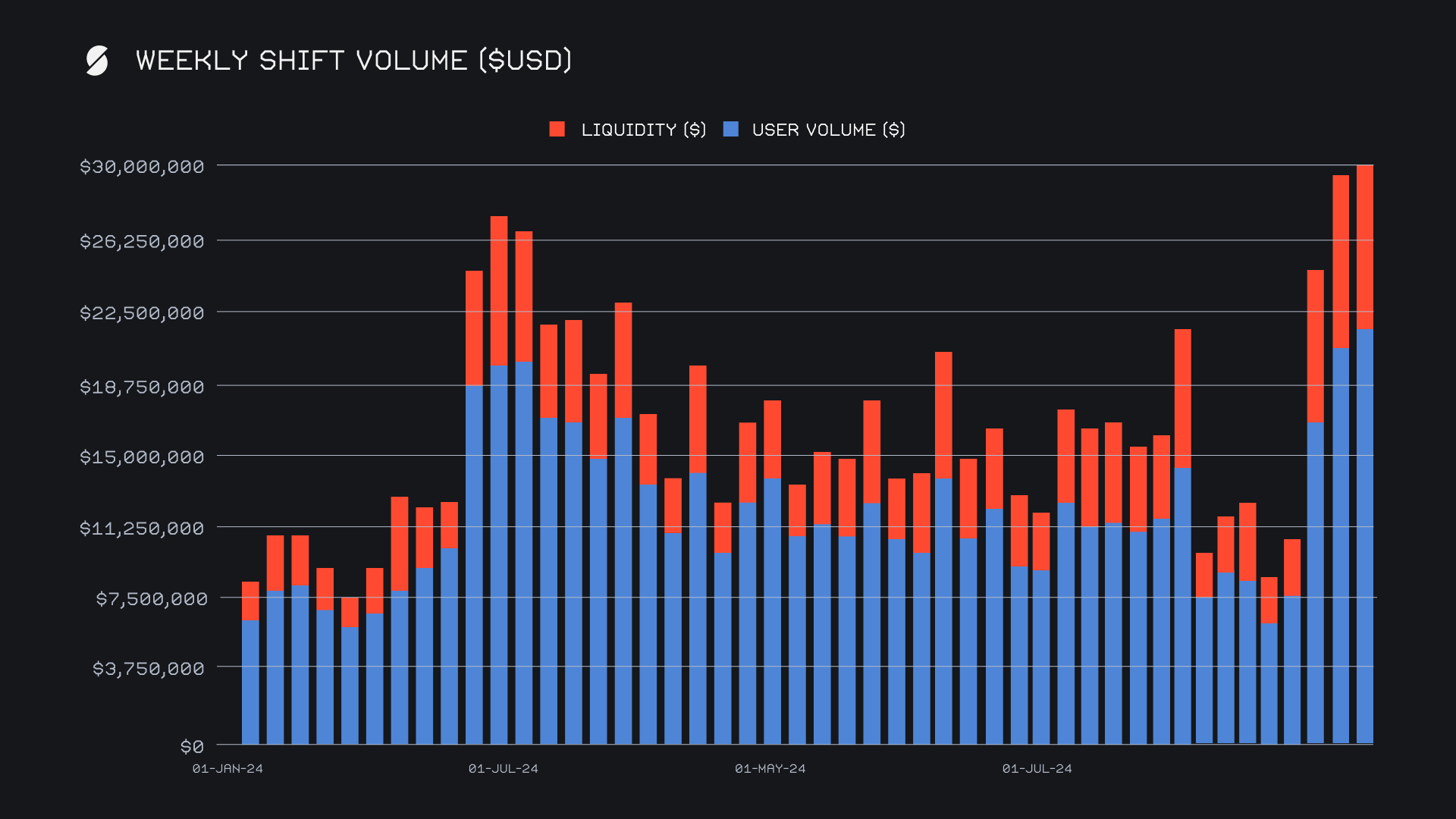

SideShift achieved another record-breaking week, delivering a new all-time high gross weekly volume of $29.8m and marking the second consecutive week of record performance. This week’s sum was a minor +1.4% increase from last week, but ended +86% higher than our running YTD average. User shifting volume climbed to an impressive $21.4m (+4.4%), while $8.4m in liquidity shifting contributed to the overall total. Daily averages reflected this sustained growth, with $4.3m in volume processed across 1,715 shifts per day.

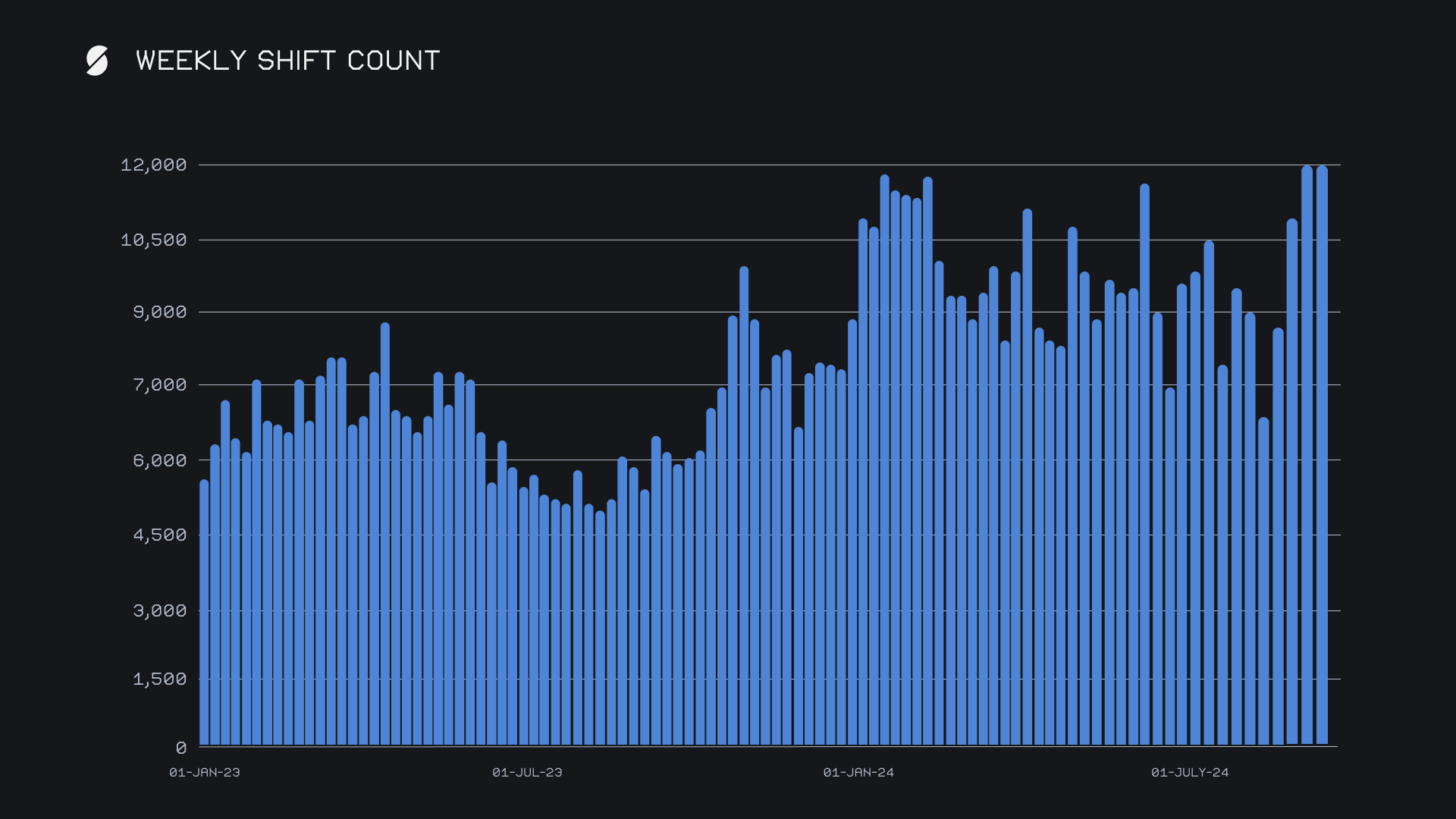

Our gross weekly shift count remained robust, holding steady above the 12,000 mark with a final count of 12,004. This consistency underscores the platform’s growing user engagement and sustained demand for shifting as the bull market continues to heat up. Top-performing pairs this week included BTC/USDT (ERC20), which generated an eye catching $4.1m in volume thanks to strong stablecoin demand, and ETH/SOL, which remained highly popular with $1.7m, and managed to surpass its already solid total from last week.

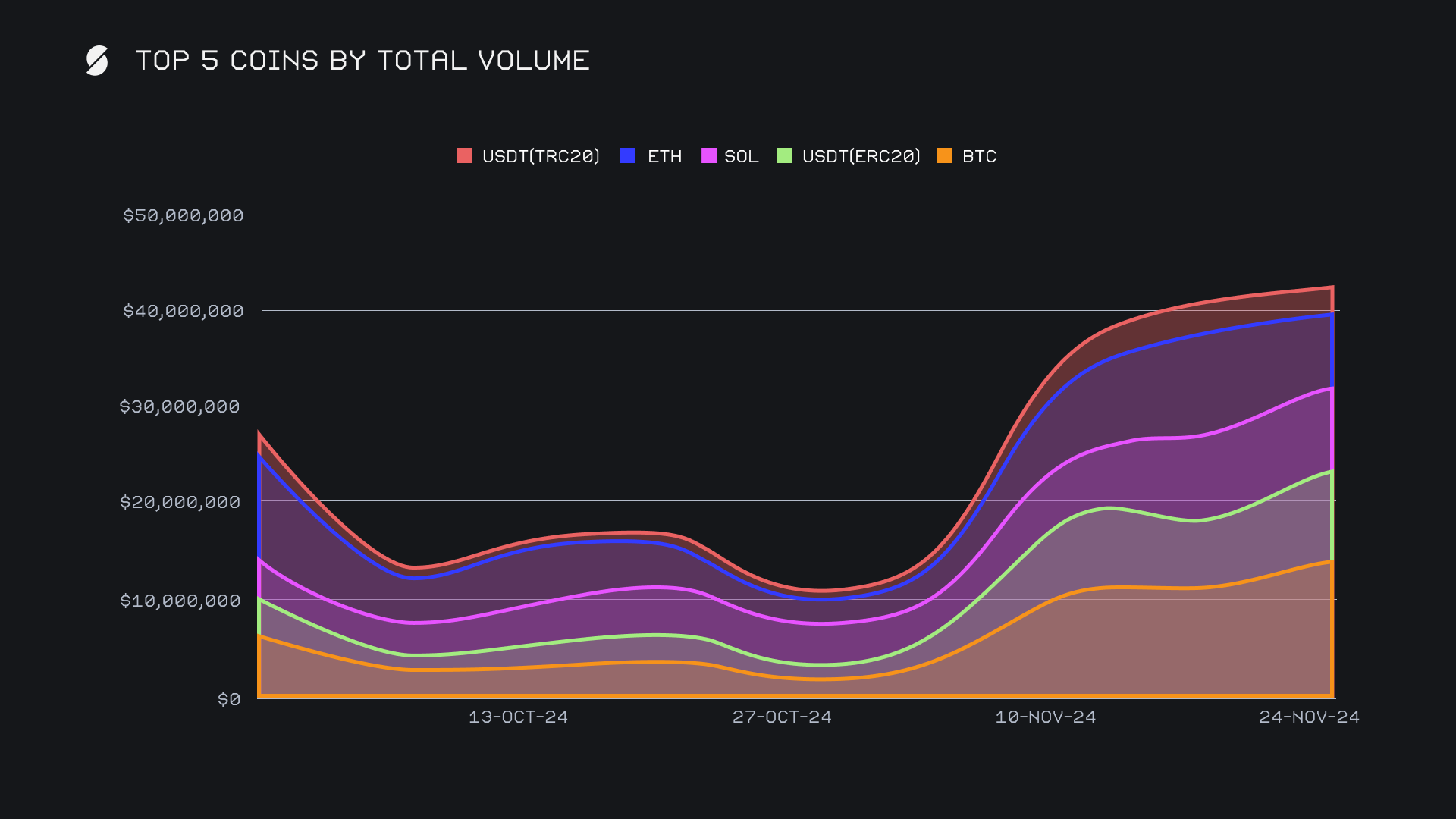

BTC maintained its position as the most shifted coin on SideShift, achieving a weekly volume of $14.5m (+27.9%), a substantial increase from the previous period, and one of the highest weekly total volumes ever achieved by any coin in SideShift’s history. Deposit volume rose sharply to $7.7m (+53.6%), highlighting strong user interest in capitalizing on BTC’s continued price strength as it trades near record levels. Settlement volume, however, slipped to $3.2m (-4.8%), further reflecting shifting activity as users diversified into other assets.

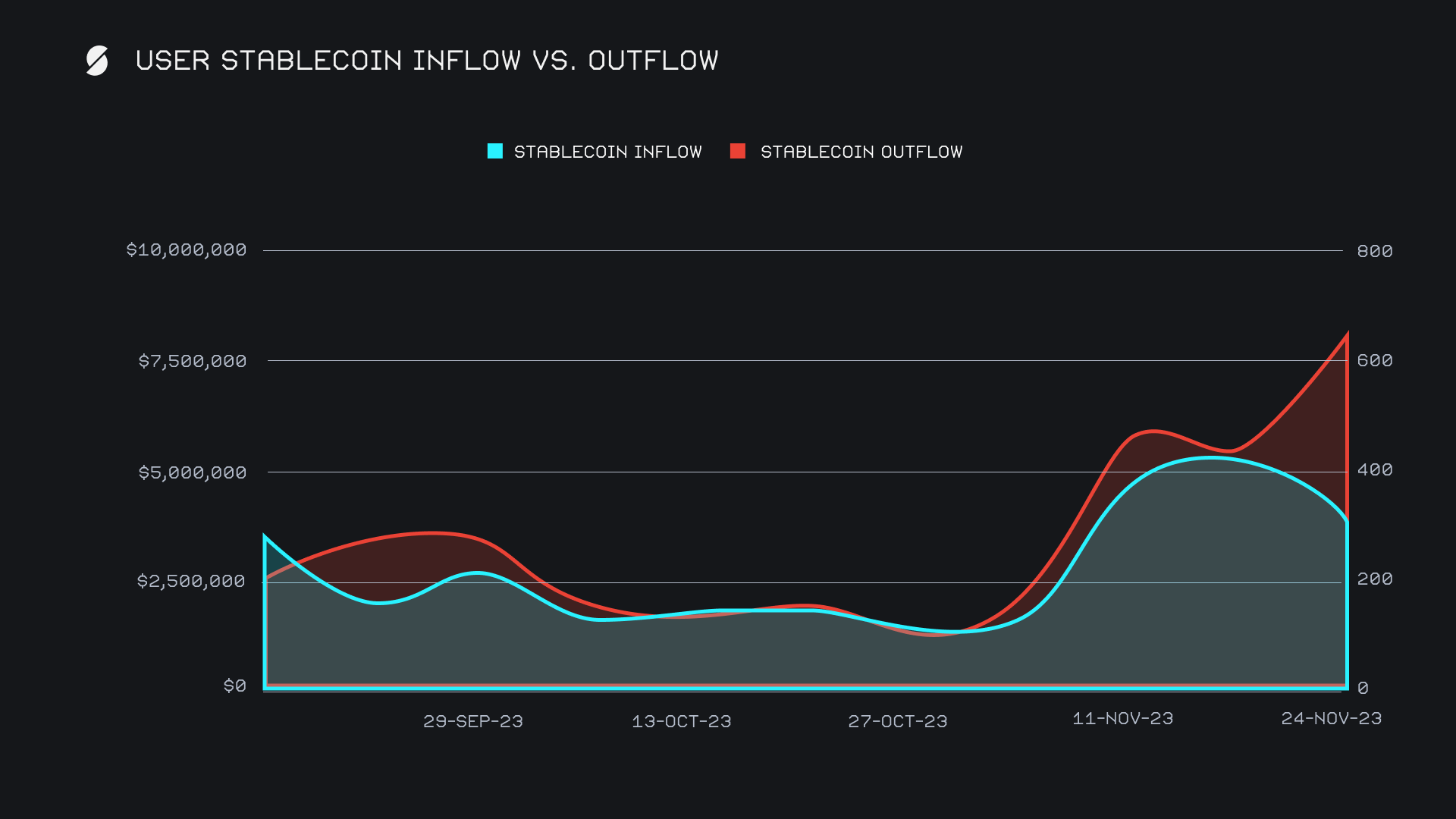

Most notably this shift was into USDT (ERC20), which roared into second place with $9.3m (+34%) in total volume, and was driven by a massive surge in settlement volume to $5.2m (+105.2%). With a deposit volume of $1.2m (-42.2%), it’s clear that the stablecoin’s role this week was primarily as a secure destination for realized gains during the broader market rally. While other stablecoins noted near identical levels of settlement volume this week, the rise in USDT (ERC20) demand resulted in net stablecoin outflows sharply pulling away from inflows. This outlines the change in attitude among SideShift users and follows a week where stablecoin inflow and outflow sat neck and neck, as visualized in the chart below.

SOL remained a key contender this week, ranking third overall with a total weekly volume of $8.4m (-5.8%). While overall activity moderated slightly, demand for SOL remained strong, with its user settlement volume standing $1.1m higher than ETH and second only to USDT (ERC20). Deposits totaled $2.1m (-5.9%), while settlements reached $3.7m (-11.1%), as users continue to show confidence in the asset and network, fueled by its bullish price action throughout the week.

SideShift experienced a notable revival in 'boomer' coins this week, as several old coins which typically sit on the backburners drew significant shifting interest. XLM stood out, climbing to 7th place with $1.1m in total volume - a remarkable +132% increase from last week and a staggering 100x jump compared to its modest $10k average throughout previous months. XRP and ADA also fell into this category, recording $1.1m (+55%) and $989k (+77%), respectively. While these two coins have occasionally drawn shifting attention as of late, their resurgence this week highlights renewed interest in assets that have long gone neglected, but did well in previous cycles.

Alternate networks to ETH had a solid showing this week, combining for $17.5m in total volume, though down -10.7% from the previous period amid heightened focus on Ethereum-based stablecoins. The Solana network once again stood out as the dominant force, contributing a substantial $9.6m (-6.2%) - a figure more than double that of the next closest network. This continued strength was driven by high demand for its native token, reinforcing Solana’s status as the clear leader among alternate networks. The TRON network followed at $3.5m (-20.4%), primarily driven by USDT(TRC20), while the BSC network contributed $2.3m (-3.2%) derived from an even split between BNB and USDT(BSC) shifting.Volume on other alternate networks remains rather volatile, with weekly sums seldom managing to surpass $1m. The Base network was the next closest this week with $754k, despite incurring a -39% drop.

Affiliate News

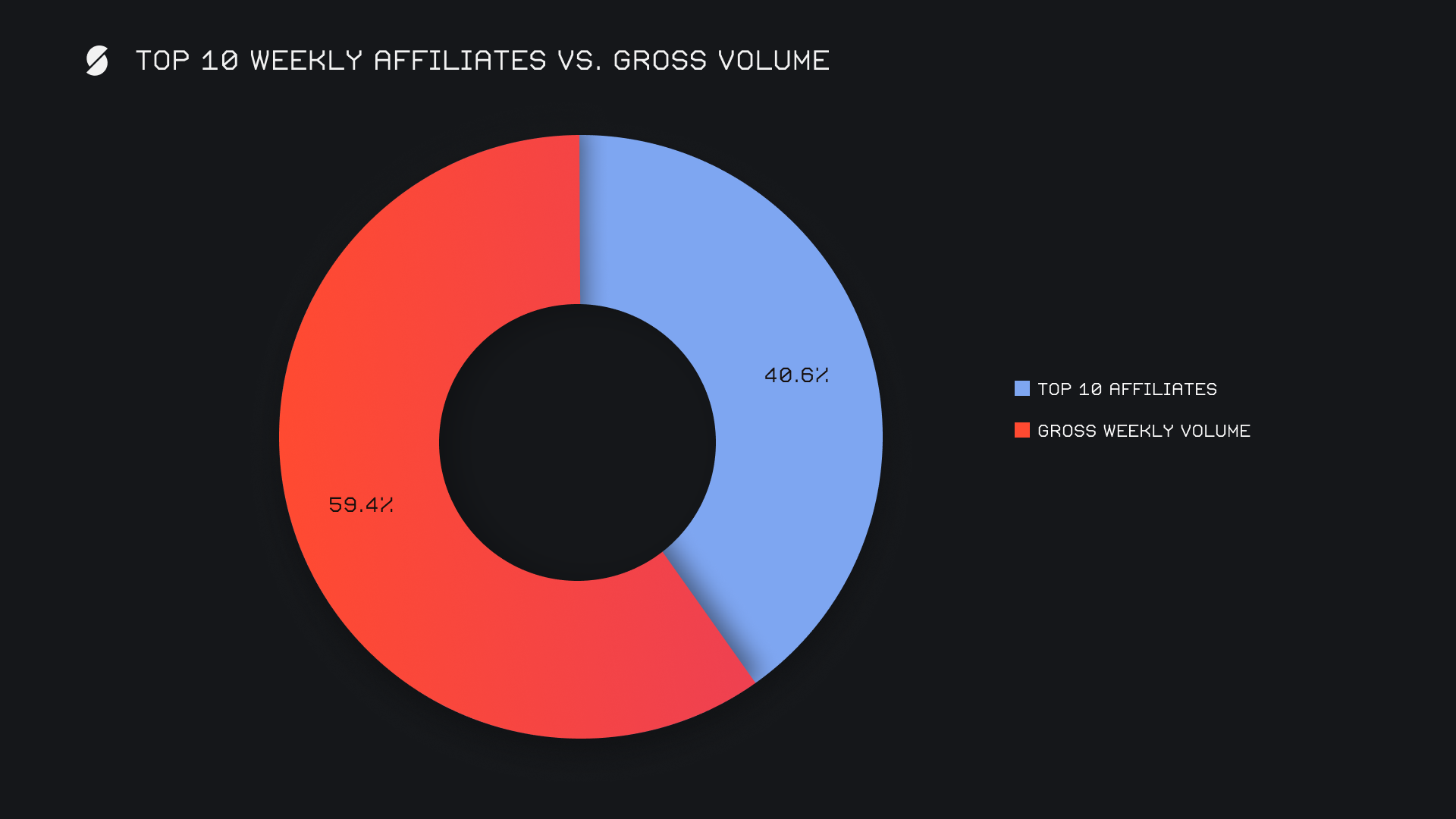

Our affiliate partners delivered a phenomenal performance this week, contributing a combined $12.1m in volume - a stellar +47.9% increase from the prior period. Notably, all top three affiliates switched ranking positions, though the same trio continued to dominate. The standout was this week’s new leader, which surged by +150.5% to reach $4.3m, cementing its place at the top. Second place followed with a solid $3.4m (+22%), while third place rounded things out at $3.1m (+14.2%), reflecting steady growth across the board.

This $12.1m in affiliate-driven volume is an extraordinary milestone and a key driver behind this week’s record total. Affiliates collectively accounted for 40.5% of SideShift’s total weekly volume, a proportion not achieved in multiple months, and thereby further underscoring their critical role in SideShift’s ongoing success.

That’s all for now. Thanks for reading and happy shifting.