SideShift.ai Weekly Report | 1st - 7th April 2025

Welcome to the one hundred and forty-eighth edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

This past week, SideShift token (XAI) traded within a narrow range of $0.1399 to $0.1432. Price action was relatively steady, with most of the week spent hovering near the $0.141 mark. XAI has since settled at $0.1408, reflecting a slight drop from its weekly high. Despite the modest movement, market cap edged slightly higher to $20,651,751, a +0.34% increase from last week.

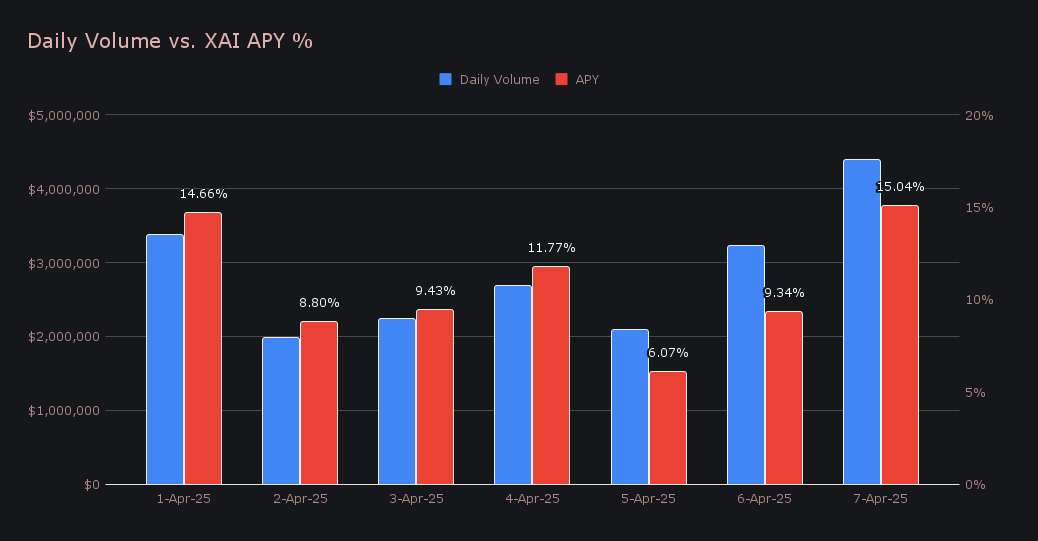

Staking activity remained strong, with XAI stakers earning a weekly APY average of 10.73%. The highest daily reward was recorded on April 7, when a total of 50,644.14 XAI was distributed directly to our staking vault, translating to an APY 15.04%. This occurred alongside a solid $4.39m in daily volume. All together, XAI stakers received a total of 256,701.91 XAI or $36,044.01 USD in rewards throughout the week.

Additional XAI updates:

Total Value Staked: 132,056,330 (+0.2%)

Total Value Locked: $18,551,783 (+0.5%)

General Business News

Markets were rocked this week as President Trump’s sweeping tariffs reignited recession fears and sent crypto prices tumbling. BTC plunged to $75k before recovering to $79.9k (-6.4%), while ETH hit a two-year low at $1,400 and settled at $1,580 (-9.1%). Across the board, altcoins crumbled, with SOL, XRP, and DOGE all down ~20%, as panic selling wiped out over $1.6b in leveraged bets.

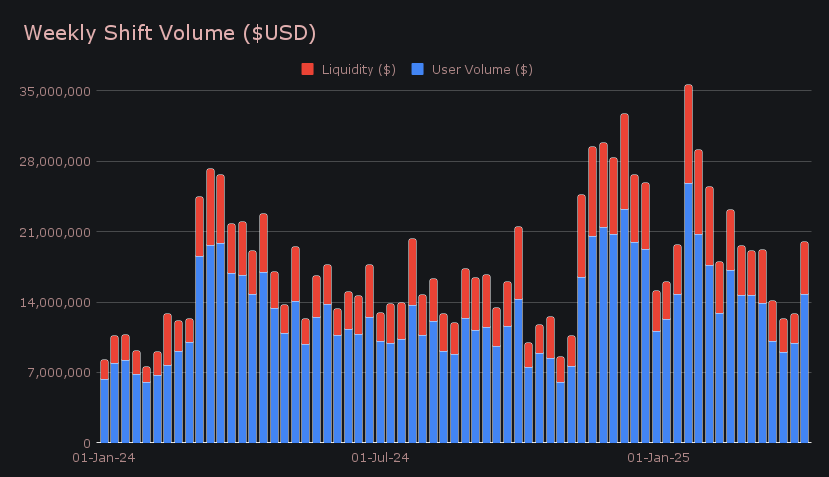

SideShift recorded a strong bounce in activity this past week, with our gross weekly volume rising to $20.0m (+56.1%). This marked a sharp reversal from last week’s lull and represented the highest weekly volume level in the past two months. The week’s rise was driven by $14.8m (+49.3%) in user volume, while liquidity shifting also saw a significant lift to $5.1m (+79.9%) to support directional flows.

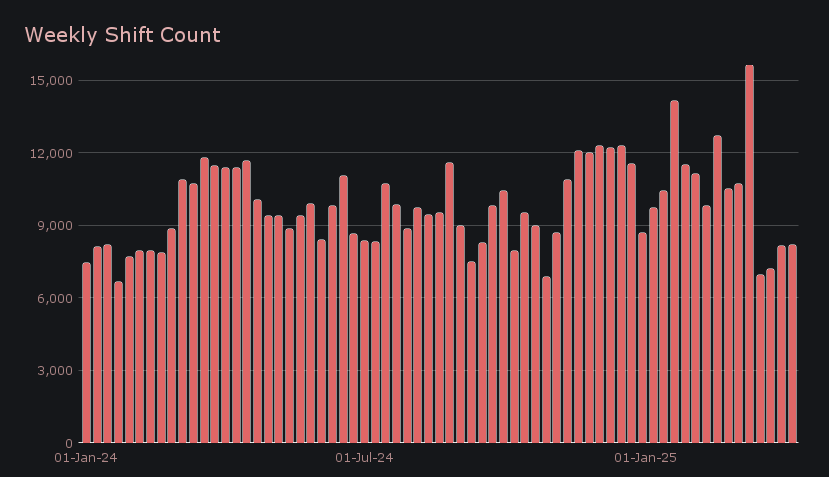

Despite this spike in volume, our gross shift count remained relatively stable, ending at 8,175 shifts (+0.4%). This resulted in an average of 1,168 shifts per day - nearly unchanged from last week - but the jump in volume clearly points to a notable increase in average shift size. That trend was best illustrated by the top weekly user shift pair, BTC/USDT (ERC20), which alone summed $2.0m. Its reverse direction, USDT (ERC20)/BTC, added another $815k, signaling heavy two-way action and a preference among users for moving in and out of BTC as markets tanked.

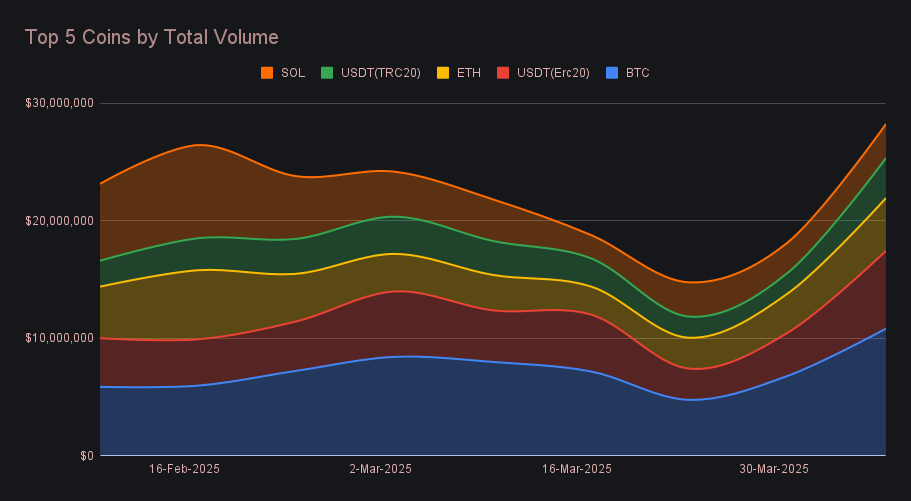

BTC remained in the top spot this week with a total volume of $10.8m (+59.0%), continuing its dominance in user shift activity. User deposit volume surged to $4.6m (+84.5%), showing a notable increase in users offloading BTC amid the week’s price downturn. Settlements also climbed to $3.9m (+33.4%), though the disparity highlights a stronger appetite to exit positions rather than receive. Notably, the average shift size for BTC was significantly larger this week, helping propel it to the highest individual coin volume seen on SideShift so far in 2025.

USDT (ERC-20) followed in second with $6.6m (+80.2%), also continuing to gain momentum across both sides of shift activity. User settlements jumped to $3.0m (+87.6%) and deposits climbed +43.6% to $1.6m, showing that demand for stablecoins thrived amid high volatility. Alongside BTC, USDT dominated user shift flows and anchored top weekly shift pairs.

ETH came in third with $4.5m (+34.5%), backed by a strong +43.4% increase in user deposits to $2.2m. Settlements rose slightly to $1.2m (+3.7%), indicating that users continued to offload ETH throughout the week, though with more moderation. USDT (TRC20) trailed behind in fourth with $3.4m (+93.5%), a result of steady stablecoin demand across multiple networks. Its settlement volume nearly tripled to $1.5m (+195.6%), signaling a wave of users receiving funds via the Tron network. Meanwhile, SOL slipped to fifth with $2.9m overall (+11.9%). Although it saw a minor increase in total volume, this was the lowest gain among our top 10 coins, and notably, it was the only one to record a decline in user settlements (-3.2%).

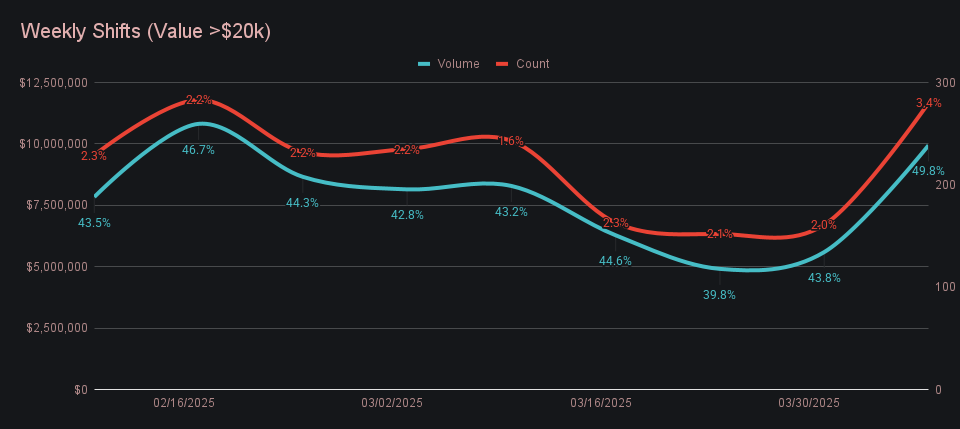

Whales made their presence felt this week, as shifts with a value over $20k jumped to a count of 280, their highest total within the past two months. These hefty moves commanded $9.94m in volume, a +77.7% increase from last week, and made up nearly half (49.8%) of the total. Despite representing just 3.4% of all shifts, their impact was massive - shifts with a value greater than $20k had an average size of $35.5k. Meanwhile, shifts larger than $10k also climbed and accounted for 43% of total volume, marking their highest share since early February and reinforcing the return of large-scale activity.

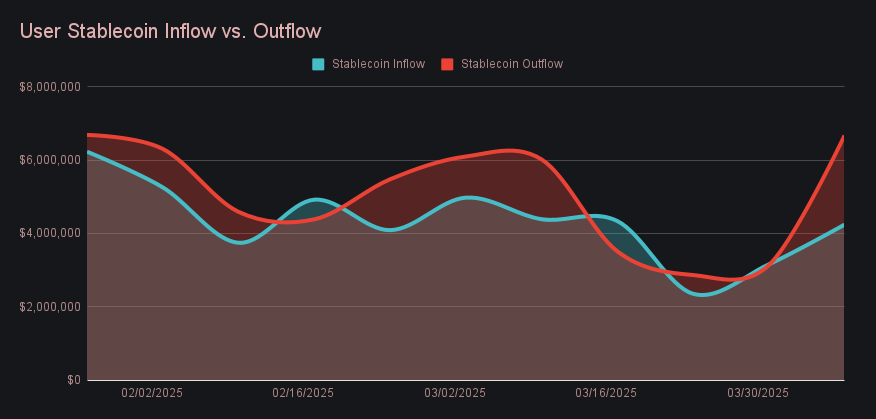

Stablecoin activity surged, with total volume (deposits + settlements) reaching $10.91m - the highest level since mid-March. More notably, user flows flipped decisively negative, with a net shift of -$2.43m into stables. This marks a complete reversal from last week’s modest positive net flow of +$23k and represents the most aggressive move into stablecoins in over a month. The chart clearly shows this sharp divergence, as users rapidly rotated out of risk assets.

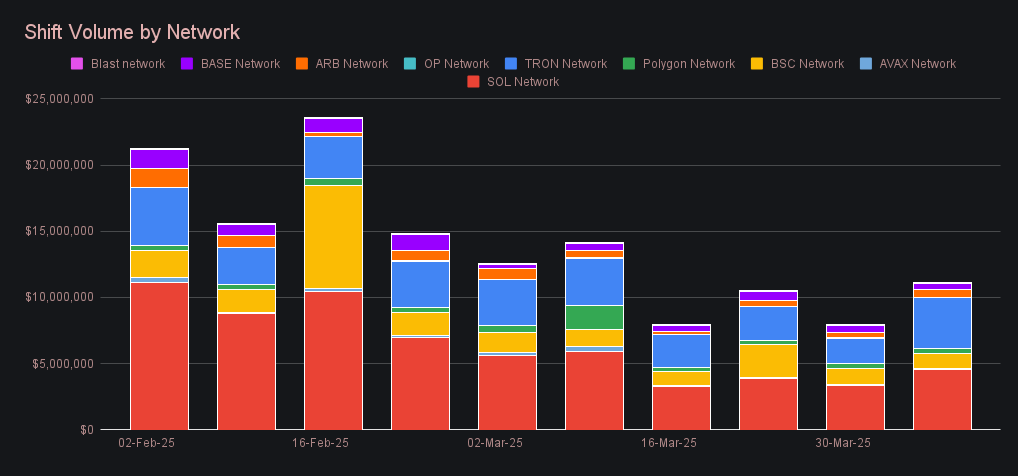

Shift volume across alternate networks to ETH reached a four-week high of $11.1m (+40.3%), driven by notable growth across multiple chains. The Solana network led in total volume with $4.6m (+34.5%), largely thanks to a doubling in shifts involving both USDC (SOL) and USDT (SOL). The Tron network followed with $3.9m, exploding by +104.7% to mark its best week since the beginning of February and more than doubling its share of alternate network activity. Arbitrum also saw healthy gains, climbing to $596k (+40.7%), while BSC held firm with $1.15m in volume despite a slight dip. Avalanche, while still negligible in overall share, posted the largest percentage increase of the group with a +102.9% jump.

Affiliate News

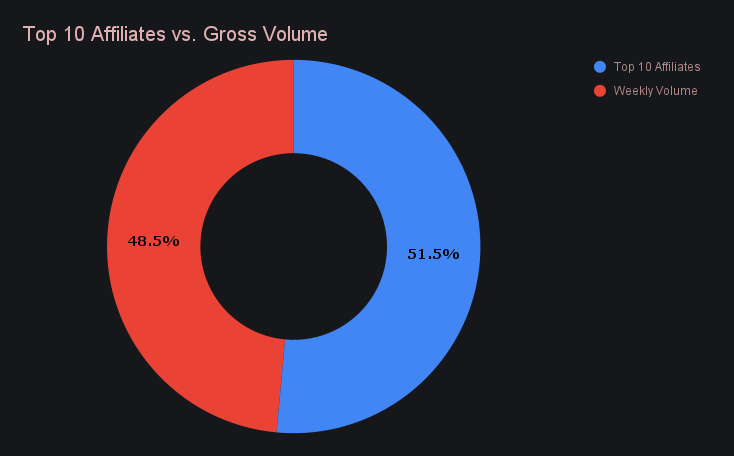

Our top affiliates had a phenomenal week, combining for $10.27m in volume and cracking the $10m mark for the first time since late November, 2024. Leading the charge were our first and second placed affiliates, who together contributed a staggering $8.36m, or over 80% of the affiliate total. The first place affiliate stood out not just in volume, but also in consistency of count, and was the only one to surpass 1,000 shifts. It closed with 1,249 shifts (+92.5%), nearly matching its +109% volume increase. Meanwhile, the third placed affiliate remained relatively static in comparison, finishing the week with $785k in volume (-3.1%).

All together, our top affiliates combined to account for 51.5% of our total weekly volume, +8.5% higher than last week’s proportion.

That’s all for now. Thanks for reading and happy shifting.