SideShift.ai Weekly Report | 1st - 7th July 2025

Welcome to the one hundred and sixty-first edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

Highlights

- $17.27m processed across 8,296 shifts, with volume flat (-0.3%) and count down -11.4%, the lowest since early April.

- BTC led with $7.12m, while ETH rose +35.3% to $5.02m, the only top coin to gain on both deposit and settle sides.

- Top stables fell, but USDT (BSC), L-USDT, and DAI climbed, helping support volume amid broader declines.

- XAI held near $0.1563, with 232,230 XAI ($36.2k) paid to stakers at a 9.41% APY.

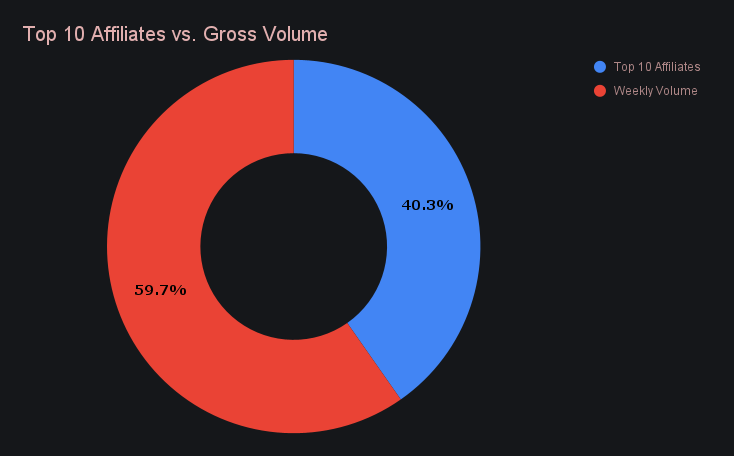

- Affiliates contributed $6.96m, a -17.6% dip that returned their share to a more typical 40.3%.

XAI Weekly Performance & Staking

XAI spent the week largely unchanged, drifting within a razor-thin range of $0.1541 to $0.1574. The price saw a few momentary bumps, but overall movement remained minor. At the time of writing, XAI is priced at $0.1563, a level that pushed its market cap modestly higher to $23,630,749 (+1.43%).

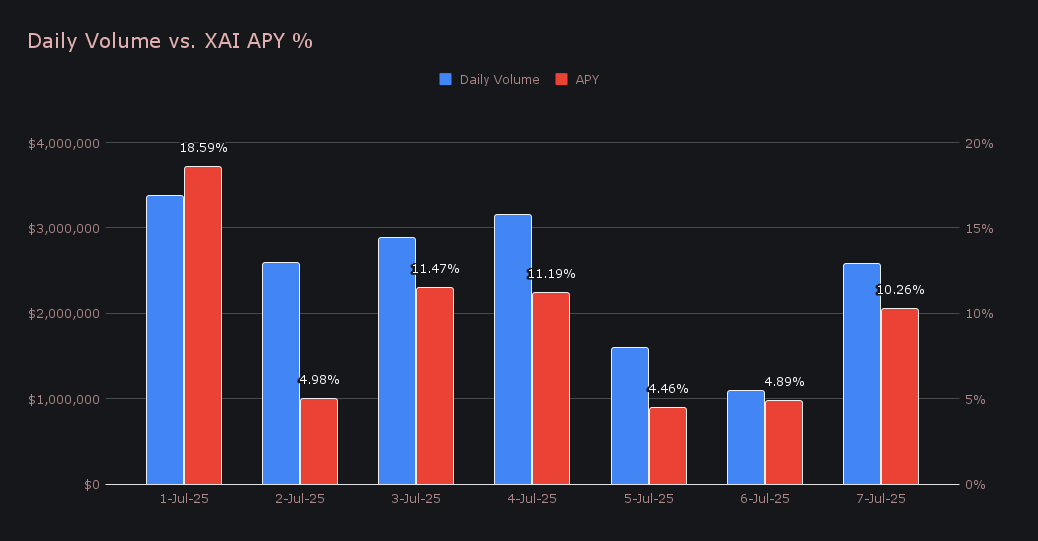

On the staking side, results were steady and on par with the previous week. Stakers earned a total of 232,230.94 XAI ($36,201.78 USD) throughout the period, with the average APY settling at 9.41%. The most active day was July 2nd, when 63,549.01 XAI was distributed to our staking vault at an 18.59% APY, a figure helped along by $3.38m in volume. While not a standout week, yield levels held firm in line with SideShift’s ongoing activity.

SideShift’s treasury received an additional 100,000 USDC this week, bringing its total value to an estimated $23.0m. Users can follow with live treasury updates via sideshift.ai/treasury.

Additional XAI updates:

Total Value Staked: 136,303,839 XAI (+0.2%)

Total Value Locked: $21,273,392 (+3.7%)

General Business News

Crypto markets stayed relatively quiet this week, with Bitcoin trading just shy of its all-time high and holding steady near the $109,000 mark. Most majors followed suit, with coins like ETH and SOL either moving sideways or notching only minor gains. The week’s clearest outlier was Bonk, which led all top 100 coins with a +62% gain as activity across its ecosystem surged.

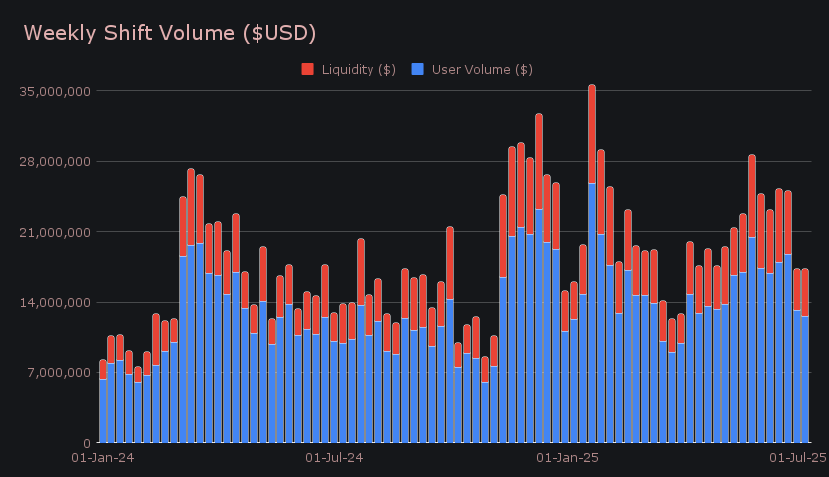

SideShift closed the week with a gross volume of $17.27m, essentially flat (-0.3%) compared to last week’s total. User volume dipped slightly to $12.63m (-4.6%), with the decrease seen across both integrations and shifts made directly on the site, while internal liquidity shifting conversely rose +13.6% to $4.64m. The week’s most active user pairs reflected a shift out of stablecoins into BTC, led by USDT (ERC-20)/BTC with $732k, and USDT (BSC)/BTC with $575k, a reversal from the usual BTC-to-stablecoin flows that have dominated in recent months.

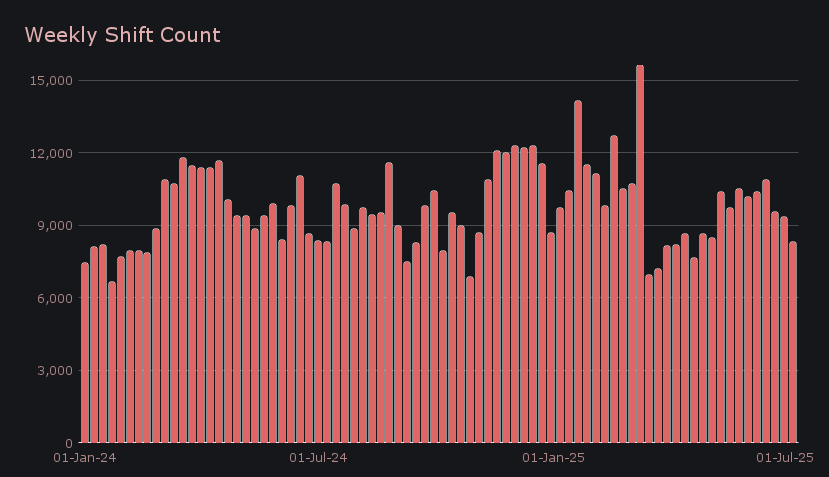

Shift count told a more noticeable story, falling -11.4% to 8,296 - the lowest weekly total since the first week of April, and roughly -17% below our year-to-date average. Even so, overall volume held up relatively well, in part thanks to several large-scale shifts, including the first few on SideShift to exceed $100k in value. These high-value moves helped partially offset the broader slowdown in shift activity, with daily averages finishing at $2.47m across 1,185 shifts.

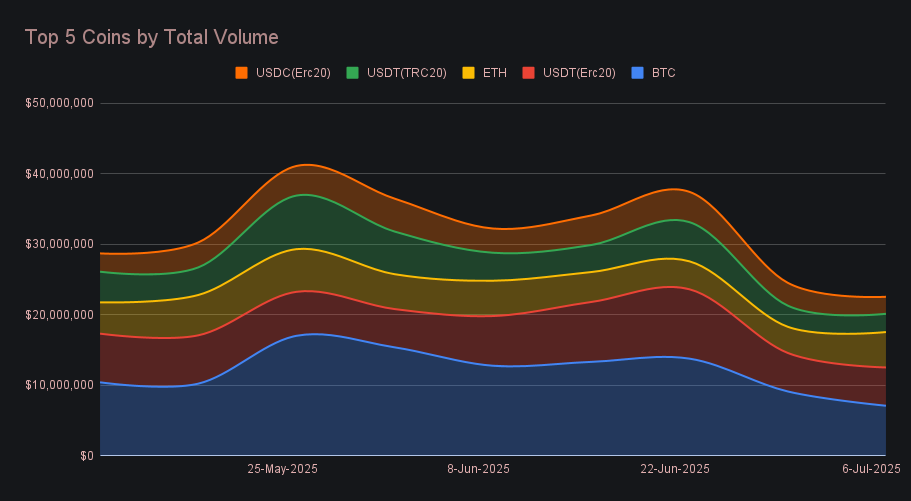

BTC held the top spot with $7.12m in total volume (deposits + settlements), despite a -22.2% decline from last week. Most of this drop came from a sharp reduction in user deposit volume, down -38.0% to $2.61m, but BTC remained popular among users, with the aforementioned stablecoin to BTC flows highlighting continued demand. Its $2.56m settlement volume slipped a milder -13.2%, the most resilient figure among any top coin aside from ETH.

The trio of top stablecoins – USDT (ERC-20), USDT (TRC-20), and USDC (ERC-20) – remained unchanged in composition but all saw declines in total volume. USDT (ERC-20) stood out from the group, with user deposits rising +11.2% to $2.04m - a rise that suggests users were offloading USDT, even as broader stablecoin volumes declined. Still, its total volume fell slightly to $5.43m, down -0.6%, with settlements dropping -24.4% to $1.78m. That reduction was in part driven by lower affiliate shifting, which is commonly linked to a steady flow of stablecoin demand. USDT (ERC-20) followed with a -13.6% drop to $2.59m, while USDC (ERC-20) saw a sharper -25.6% decline to $2.41m.

ETH was the most consistent performer among the top five coins, climbing +35.3% to $5.02m in total volume. It was the only coin in the group to record increases on both sides of the shift, with deposits rising +28.4% to $2.05m and settlements increasing +37.4% to $1.98m. That balance helped it reclaim the third spot and stand out from an otherwise declining set, especially notable given that ETH’s price held firm throughout the week.

While most of the top stablecoins saw volume declines, several typically less popular options posted obvious increases. USDT (BSC) rose +36.9% to $1.61m, L-USDT climbed +13.3% to $557k, and DAI (ERC-20) jumped +824.5% to $480k. More broadly, the vast majority of coins ranked 6-15 logged weekly gains, though none were significant enough to meaningfully reshuffle the top five by total volume. The biggest outlier was ADA, which surged +74.3% to $1.05m and narrowly edged into 8th place. The growth of these coins helped uphold overall weekly volume, offsetting declines from most of the top-ranked assets.

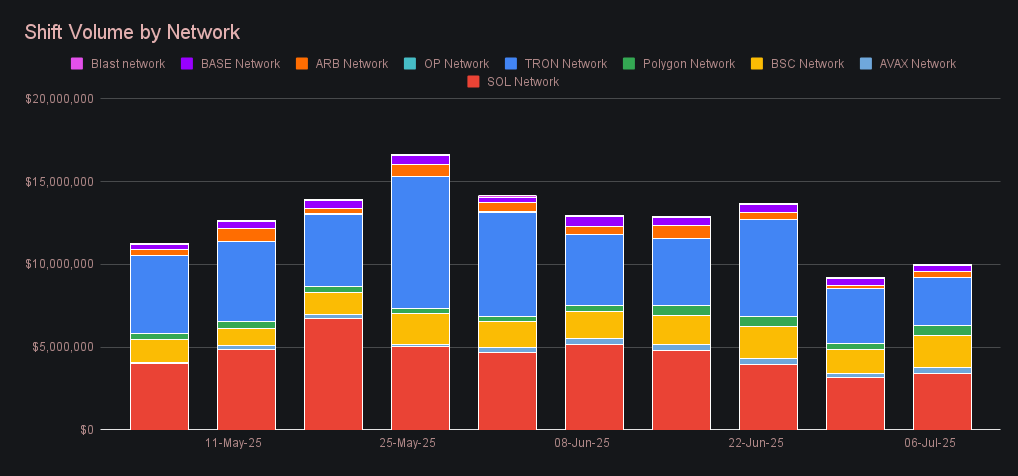

,.Alternate networks to ETH climbed +8.9% this week to a combined $9.98m in total shift volume, with all major chains aside from the Tron network posting gains. Solana led with $3.42m (+8.1%) and 3,492 shifts, far outpacing every other chain in overall activity. Tron followed with $2.85m (-14.5%) and remained the only other network to consistently clear 1,000 weekly shifts, while BSC rose +33.7% to $1.94m and hovered just below that same threshold with a gross 926 shifts. Polygon and Arbitrum both saw meaningful jumps, rising to $635k (+84.2%) and $394k (+83.5%), respectively, driven primarily by stablecoin flows - a trend similarly observed on Tron. Meanwhile, the ETH network added a modest +3.2% to reach $13.04m overall, enough to comfortably preserve its lead for the time being.

In listing news, SideShift recently added support for the native coin of the L1, EVM network, Core.

Affiliate News

Our top affiliates combined for a total of $6.96m this week, a -17.6% drop that brought their overall proportion to 40.3%, down from 48.7% the week prior. The decline brought affiliate contributions back to a more typical share of total volume, following a prolonged stretch in which top affiliates had taken firm hold and commanded a significant share of shift activity. Rankings among our top three remained unchanged, with our first-place affiliate contributing $3.51m (-28.6%), second place holding steady at $1.95m (-0.6%), and third place dipping slightly to $721k (-10.8%).

That’s all for now - thanks for reading and happy shifting.