SideShift.ai Weekly Report | 20th - 26th January 2026

Welcome to the one hundred and eighty-eighth edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

Highlights

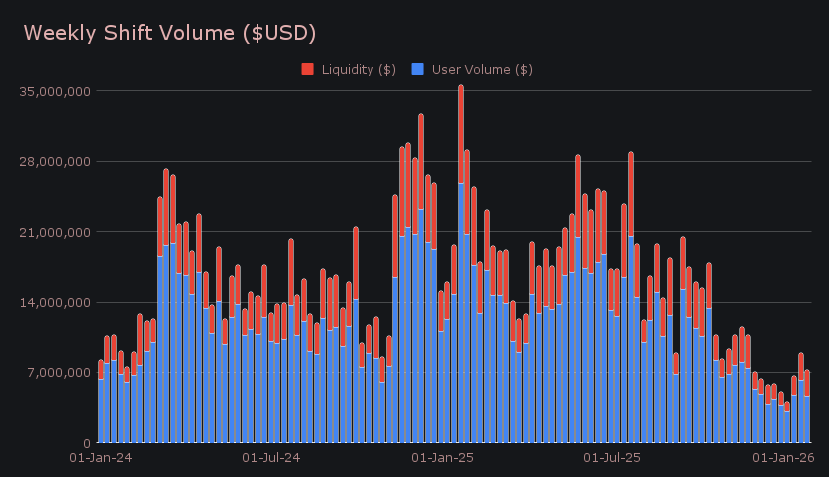

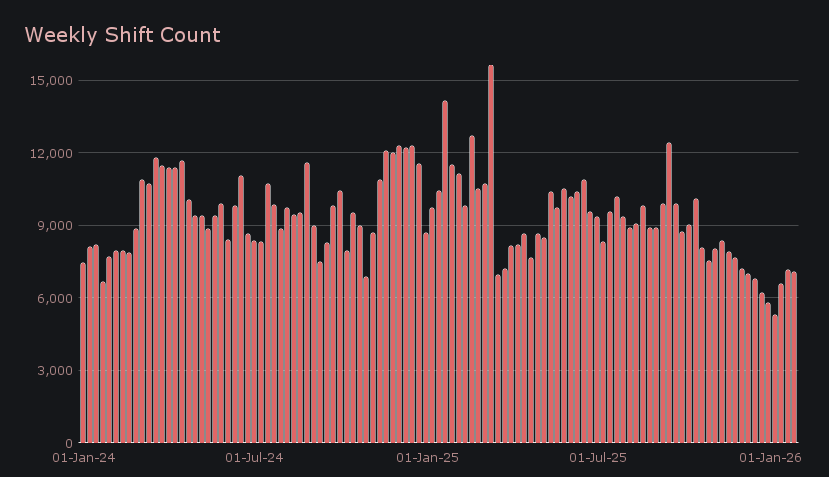

- SideShift processed $7.28m in weekly volume (−18.7%) across 7,073 shifts (−1.2%), keeping activity near ~1,000 shifts per day despite lighter volumes.

- XAI stakers earned 146,409 XAI ($16.2k) at a 5.59% average APY, with rewards peaking on Jan 20 alongside $2.56m in daily volume.

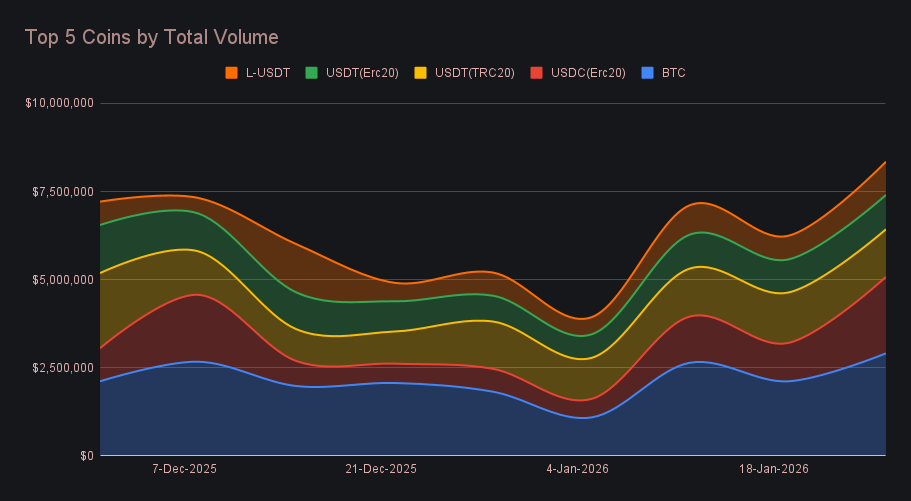

- BTC led all assets with $2.91m in total volume (+37.5%), its strongest performance since late November, driven by $1.25m in user deposits (+55.3%).

- Stablecoins claimed four of the top five spots for the first time in SideShift history, producing $2.94m in weekly total volume (37.4%).

- SideShift listed RIVER on Base and BSC, and SKR on Solana during the week.

XAI Weekly Performance & Staking

XAI spent the week trading just above the $0.11 level before a late move lifted prices into the close. After holding a narrow range through the first half of the period, the 7-day chart shows upward follow-through over the final sessions, placing XAI at $0.1132 at the time of writing. That translated into a market cap of $17.76m, up +2.56% from $17.31m at the time of the last report, and marking a stronger weekly gain than the prior period.

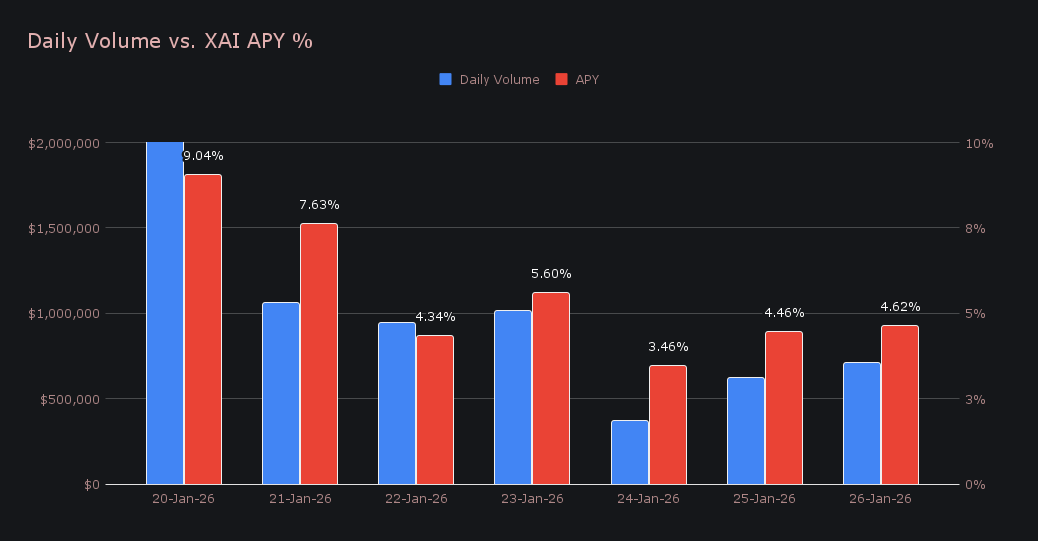

Staking rewards stepped back from last week’s higher payout. A total of 146,409.31 XAI ($16,220.70) was distributed across the week, with the average APY at 5.59%, down from 7.96% previously. The largest daily distribution occurred on January 20th, when 33,330.87 XAI was paid out to the staking vault at a 9.04% APY, coinciding with the highest gross daily SideShift volume at $2.56m. As volumes declined over the remainder of the week, staking rewards and APY followed suit.

SideShift’s treasury is currently sitting at an estimated total of $23.38m, or 265.78 BTC. Users can follow along directly with live updates and access our address at https://sideshift.ai/treasury.

Additional XAI updates:

Total Value Staked: 140,877,708 XAI (+0.1%)

Total Value Locked: $15,920,906 (+2.5%)

General Business News

Following last week’s push toward $98k, BTC failed to extend higher and spent most of the period retracing, ending the week down roughly −4.6% and trading just under the $90k level. Instead, market attention remained fixed on precious metals. Gold continued its advance past $5k per ounce, while silver pushed beyond $110, extending explosive rallies that have been building for months and lifting silver nearly fourfold since spring. Within crypto, activity concentrated in isolated pockets, led by memecoin runner Nietzschean Penguin, which crossed a $100m market cap in its first five trading days, alongside the launch of Solana mobile’s SKR token, which rallied roughly 4x shortly after debut.

SideShift closed the week with $7.28m (−18.7%) in gross volume, cooling in step with the broader market. User shifting totaled $4.69m (−24.5%), while liquidity shifting added $2.59m (−5.4%) and was largely front-loaded, with most activity concentrated early in the week before tapering off as volumes slowed and trading remained largely two-sided. Stablecoin demand remained a central feature of user shift activity, led by BTC/USDC (ERC-20) at $521k. ETH↔SOL pairs lagged way behind, with a combined sum of $283k, down roughly −76% from the prior report and a clear contrast to last week’s SOL-heavy dominance.

By comparison, shift count remained fairly steady throughout the 7-day stretch. A total of 7,073 shifts were completed (−1.2%), with daily activity clustering around the 1,000-shift mark for most days before dipping to a low of 809 over the weekend. The overall flatter count profile masked a notable slowdown across integrations, many of which recorded double-digit declines in both volume and activity, alongside a near-40% reduction in whale-sized shifts above $10k. Participation held up, but fewer large tickets and lighter integration traffic kept overall activity quieter this week.

BTC moved back to the top of the table with $2.91m in total weekly volume (+37.5%), marking its strongest showing since late November 2025. Activity was heavily skewed toward user deposits, which climbed to $1.25m (+55.3%), while settlements stood in stark opposition and swiftly dropped to $291k (−57.6%). The imbalance clearly stood out within the data, revealing BTC as the primary intake asset for the week rather than a two-way shift vehicle, but still helping it reclaim first place after last week’s altcoins attention pull.

Stablecoins filled the remaining four spots in the top five, collectively defining the shape of weekly activity outside of BTC. USDC (ERC-20) ranked second at $2.17m (+99.7%), driven almost entirely by user settlements, which rose to $754k (+116.3%) even as deposits fell back. USDT (TRC-20) followed with $1.35m (−5.5%), easing modestly across both sides, while USDT (ERC-20) nudged higher to $973k (+3.8%) on the back of steady user demand. L-USDT was the dark horse and rounded out the group at $945k (+40.5%), with deposits jumping to $504k (+62.7%) despite a halving in settlements. These four stablecoins combined for 37.4% of total weekly volume, up from 23.1% a week earlier, and importantly marked the first ever time that stablecoins have occupied every top-five slot outside of BTC.

ETH and SOL fell back to sixth and seventh place, respectively, after posting outsized volumes during last week’s surge. ETH dropped to $923k (−71%) from $3.17m, while SOL slipped to $893k (−72%) from $3.17m, unwinding much of the prior week’s spike and returning both assets to levels more consistent with their December and early January ranges. The pullback underscored how concentrated last week’s burst proved to be, with activity rotating away just as quickly once momentum faded.

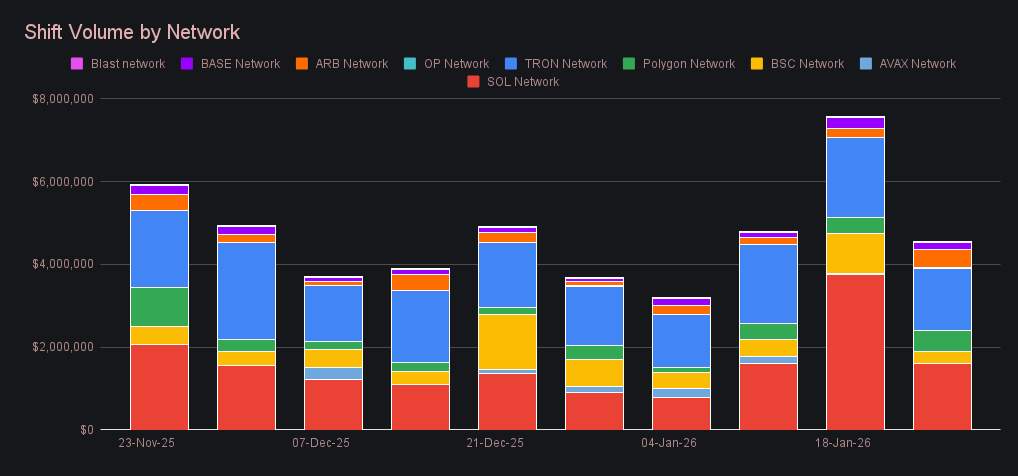

Alternate networks recorded $4.54m in total volume (−40.1%), compared with $4.91m on the Ethereum network itself (−11.8%), with the difference largely explained by the unwind of last week’s SOL-driven spike and a sharp reduction in large shifts. The Solana network remained the largest alternate network at $1.61m but fell −57.2% from the time of our last measurement. Tron followed at $1.52m (−21.2%), while Polygon stood out on the upside at $493k (+24.6%). Elsewhere, Arbitrum nearly doubled to $432k (+97.6%) from a low base, BSC slipped back to $297k (−69.4%) after last week’s BNB-driven move, and Base eased to $175k (−37.7%).

In listing news, SideShift added support for RIVER on both the Base and BSC networks, in addition to SKR on Solana this past week.

Affiliate News

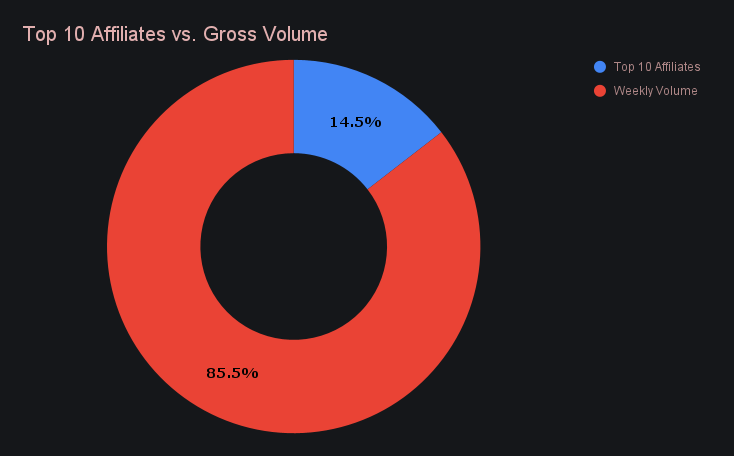

Affiliate activity stepped back, with the top affiliates generating a combined $1.06m (−23.4%). The ranking remained unchanged, though volumes compressed across the board: first place finished at $283k (−42.0%), narrowly ahead of second place at $282k (−28.6%), while third place came in at an even $100k (−1.4%). Movement was limited outside the top two, with little separation emerging lower down the table.

Overall, affiliates accounted for 14.5% of total SideShift volume, an uncharacteristically small share and −0.9% lower than last week’s proportion.

That’s all for now - thanks for reading and happy shifting.