SideShift.ai Weekly Report | 20th - 26th May 2025

Welcome to the one hundred and fifty-fifth edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

Highlights

- BTC broke records – $17.0m in weekly volume marked its highest in over a year and the second-largest single coin volume on record.

- USDT (TRC-20) surged – Volume soared +94.2% to $7.6m, with deposits jumping +199.5%, powering our top user shift pair.

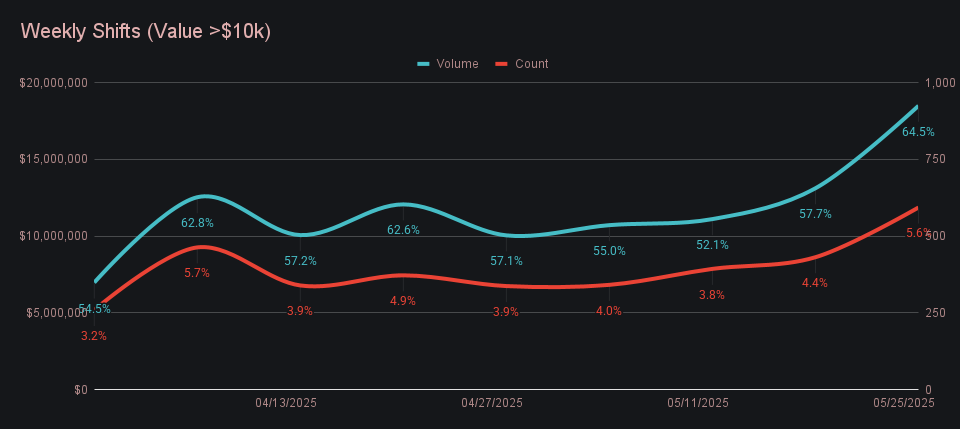

- Whale shifts climbed – $18.5m in shifts >$10k made up 64.5% of total volume, showing a clear link between market heat and whale activity.

- Affiliate and site traffic soared – Affiliate volume rose +41.1% to $13.2m, but direct shifts on SideShift expanded even faster.

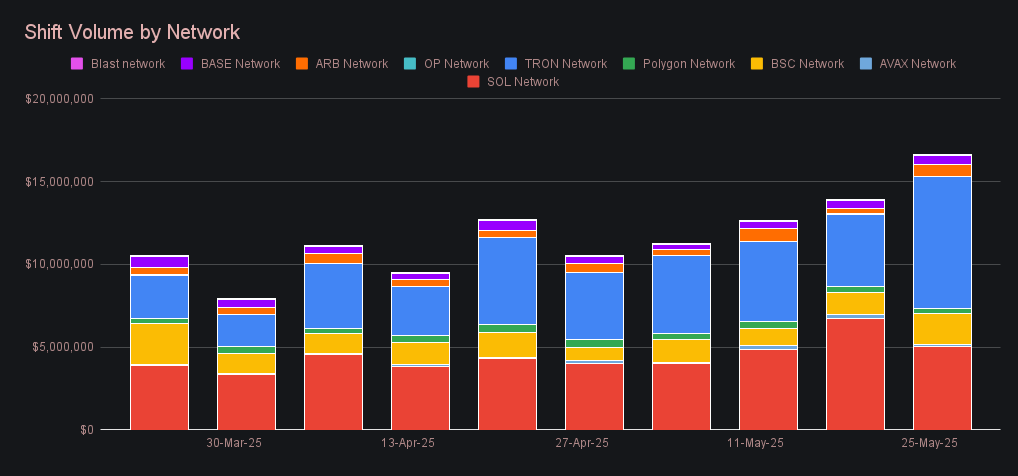

- Alt networks rebounded – Tron led with $7.9m (+81.2%), hitting a multi-month high, while Arbitrum posted the week’s strongest gain at +152.9%.

XAI Weekly Performance & Staking

XAI held steady this week and traded within a relatively compact range of $0.1364 to $0.1409. At the time of writing, it’s priced at $0.1381, a level that sits comfortably within that band. This slow and measured ascent nudged the market cap to $20,570,494, a +1.78% climb and the third consecutive week of forward motion.

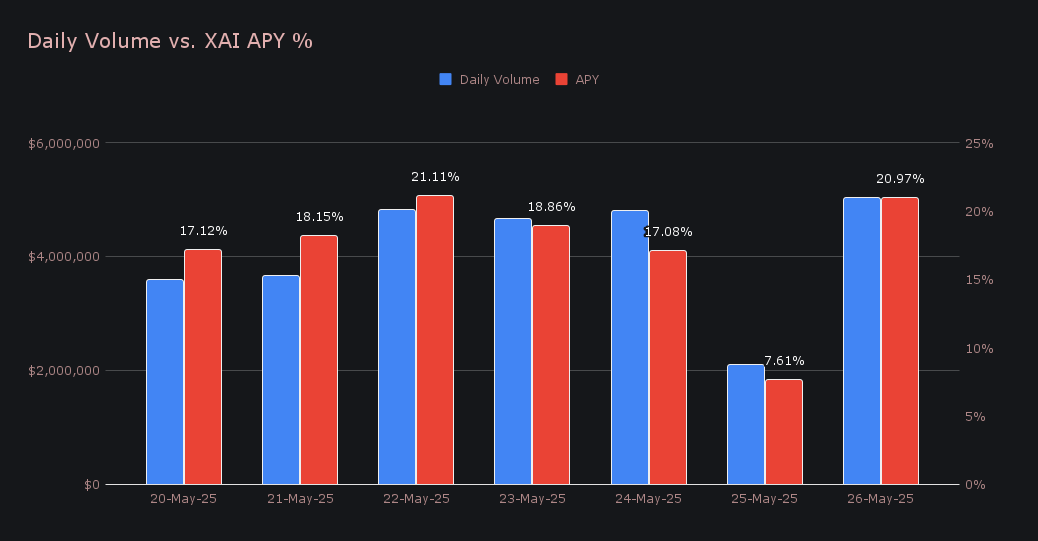

This stretch also delivered some of the strongest staking yields in recent weeks, as the average APY climbed to 17.27%, driven by consistently solid daily volumes. The standout came on May 22nd, when 70,267.86 XAI was deposited directly to our staking vault at a 21.11% APY, alongside a noteworthy $4.82m in volume. In total, stakers earned 407,424.16 XAI, or $56,295.42 USD across the week.

A total of 175,000 USDC was added to SideShift’s treasury this week, bringing the current total to a value of $23.88m. Users can follow along with live treasury updates at sideshift.ai/treasury.

Additional XAI updates:

Total Value Staked: 134,212,927 XAI (+0.3%)

Total Value Locked: $18,529,258 (+1.7%)

General Business News

Crypto markets shifted into high gear as Bitcoin entered price discovery, setting a new all-time high just above $110,000. Strategy (formerly MicroStrategy) added to its already massive stack, which now totals 580,250 BTC, reinforcing its role as the largest corporate holder in the space. Meanwhile, HYPE led among altcoins with a +50% weekly gain, hitting a new peak near $40 amid a surge in Hyperliquid’s trading activity and open interest. Its rapid rise now places it on the cusp of breaking into the top 10 in terms of open interest.

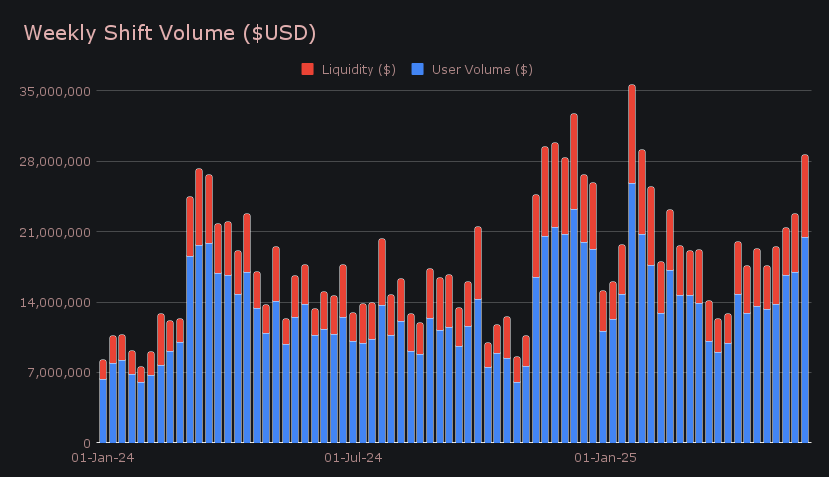

SideShift saw a convincing uptick across the board, with total volume climbing +26% to $28.6m, a figure now sitting nearly +40% above our running YTD average. User shift volume rose +20.3% to $20.5m, particularly fueled by a rise in activity directly on site. Liquidity shifting also jumped +43% to $8.1m, mostly driven by uneven stablecoin flows and elevated BTC demand, which together required increased internal rebalancing.

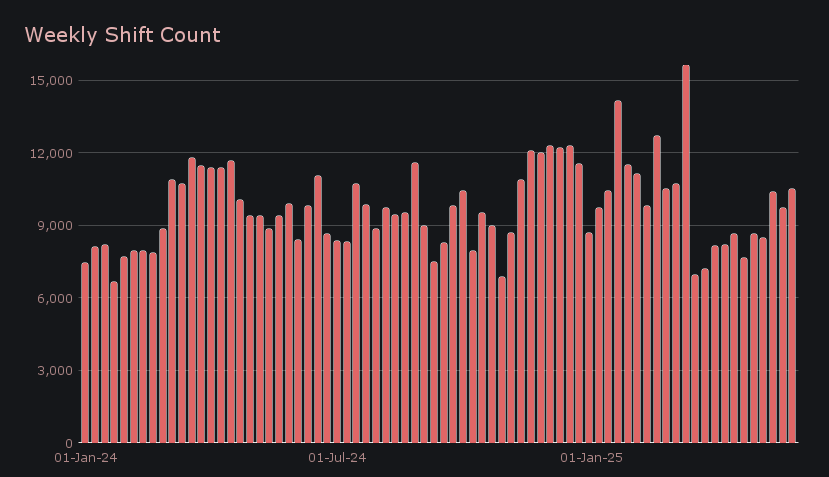

Shift count rose more modestly to 10,522 (+8%), underscoring that this week’s surge was powered by larger average shift sizes, not just more frequent activity. On a daily basis, SideShift averaged $4.09m in volume across 1,503 shifts. Activity remained steady throughout the week and was spread across a broad range of pairs - notably, each of our top three user shift pairs surpassed $1m, led by USDT (TRC-20)/BTC with an impressive $2.57m. Despite the increased load, SideShift handled the week’s throughput smoothly, marking a solid performance amid a wave of user demand.

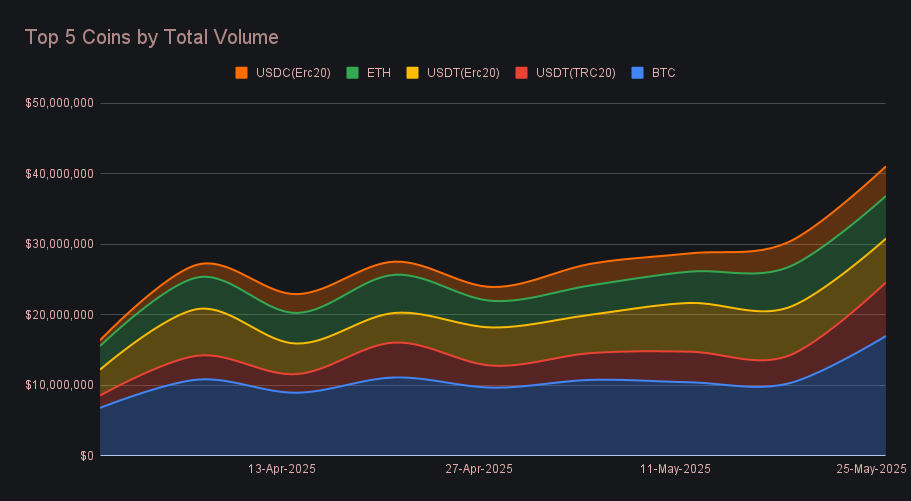

BTC returned with force this week, recording $17.0m in total volume (+66.0%) - not only its highest total of the past year, but also the second highest weekly volume for any coin in that span, trailing only SOL’s $18m+ showing from mid-January. The jump was led by a surge in user settlements, which rocketed +92.7% to $6.7m, while deposits climbed to $5.3m (+13.8%). The sheer scale of activity underscored a decisive swing back toward BTC dominance, as it finished with more volume than the next two coins combined.

Stablecoins followed with contrasting momentum. USDT (TRC-20) ranked second, with $7.6m (+94.2%), buoyed by a +199.5% surge in deposits to $3.3m, one of its strongest user inflows in recent memory. Settlements, however, dipped to $1.4m (-6.8%), outlining the stark imbalance of the two sides, something further highlighted by the asymmetry of the week’s top user shift pair. USDT (ERC-20) followed in third with $6.2m (-9.4%), a still-solid figure, but one that stood out less amid the broader jump in coin activity, as both deposits (-6.1%) and settlements (-15.7%) slid slightly.

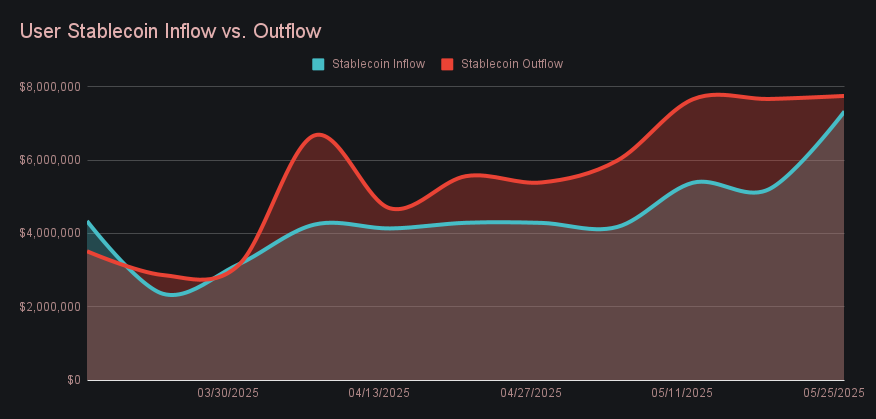

A related shift in stablecoin dynamics came via user flows, which swung upward this week by +$2.04m to produce a net outflow of -$422,010, a significant reversal from last week’s -$2.47m total. This was largely influenced by a series of whale-size USDT (TRC-20) to BTC shifts, and reflects a narrowing spread between inflow and outflow, as shown in the chart below.

ETH ranked fourth this week, finishing with a total volume of $6.1m (+5.8%), comprising $3.0m in user deposits (+6.8%) and $1.9m in settlements (+9.5%). While not as sharp a riser as BTC or TRC-based USDT, ETH quietly maintained its momentum with a second straight week of growth across both metrics. A related detail was the continued ascent of the wrapped version on the same chain, WETH (ERC-20), which contributed $700k (+168%) to this week’s total and has made a substantial leap from the four-digit sums seen just a handful of weeks ago.

Whale-tier activity picked up significantly this week, with shifts over $10k in value climbing to $18.5m, a +41% increase from the previous week and the highest total observed in recent months. These larger shifts made up 64.5% of all volume on SideShift, a noticeable change from last week’s 57.7%. As illustrated in the chart, both the count (red) and volume (blue) of these shifts have accelerated, with the percentages above each point showing their proportion of total weekly volume. It’s a clear pattern that when the market moves, whales move bigger, and the effect on SideShift’s volume is immediate.

Alternate networks to Ethereum climbed to $16.6m this week (+19.9%), marking a fresh local high after laying rather low throughout the spring months. The Tron network led the pack with $7.9m (+81.2%), not only reclaiming the top spot, but also setting a multi-month high for any alternate network. Solana followed with $5.1m (-25.1%) after two weeks of leading among its peers, while the BSC network added $1.9m (+42.1%). Arbitrum meanwhile saw the largest percentage gain of the group, rising +152.9% to $735k, although its volume tends to swing widely week to week. Base also edged up to $549k (+12.4%), while activity on other chains like Polygon and Avalanche tapered off.

Affiliate News

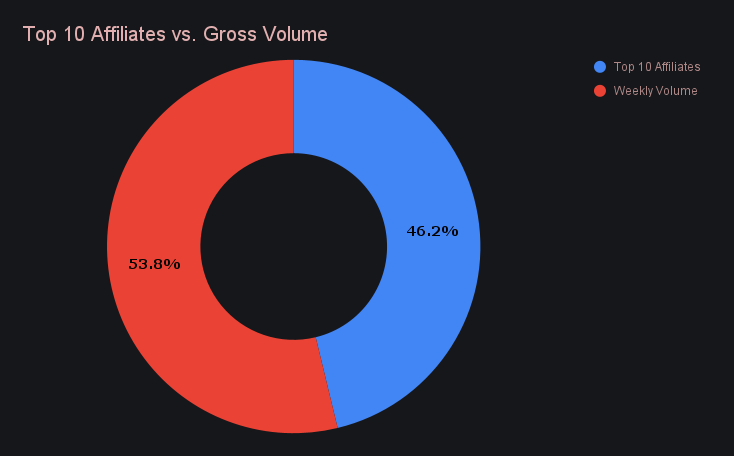

Affiliate activity climbed to a combined $13.2m (+41.1%) this week, lifting its total share of volume to 46.2% (+4.9%). Our top-ranked affiliate remained consistent, logging $6.0m and marking its eighth consecutive week above the $5m threshold, a testament to its steady presence near the top. Second and third place also held their ranks while seeing substantial growth, finishing with $2.8m (+52.8%) and $953k (+58.0%), respectively. Elsewhere, several affiliates outside the top three also saw volume jump by 50% or more, reflecting widespread engagement across the board. Even so, shifts completed directly on SideShift expanded at a faster clip, slightly outpacing affiliate growth this week.

That’s all for now. Thanks for reading and happy shifting.