SideShift.ai Weekly Report | 21st - 27th January 2025

Welcome to the one hundred and thirty-eighth edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

While the broader market saw some sizable fluctuations throughout the week, XAI displayed incredible stability, and held firm within the narrow 7-day range of $0.1574 to $0.1609. By the week's end, XAI maintained its position at $0.1592, with a market cap of $23,122,200, reflecting a marginal dip of -0.14% from last week’s $23,154,246.

XAI stakers were rewarded with an average APY of 19.17%, with the highest daily rewards amounting to an notable sum of 86,331.9 XAI, and being distributed directly to our staking vault on January 22, 2025. This corresponded to a 27.6% APY and was the byproduct of a peak daily volume of $5.1m. All together, this week saw XAI stakers receive a total of 433,288.13 XAI, or $69,523.11 USD in staking rewards.

An additional 100,000 USDC was added to SideShift’s treasury this week, bringing the current total to a value of $23.2m. Users are encouraged to follow treasury updates directly via sideshift.ai/treasury.

Additional XAI updates:

Total Value Staked: 129,783,707 XAI (+0.3%)

Total Value Locked: $20,758,054 (+0.9%)

General Business News

This week, Bitcoin slid below $98k as panic over China’s DeepSeek AI launch sent shockwaves through markets, triggering a wave of liquidations. The pullback hit altcoins and memecoins particularly hard, with SOL, DOGE, and XRP all suffering double-digit declines. Meanwhile, MicroStrategy seized the opportunity to accumulate, adding an additional 10.1k BTC to its holdings, valued at $1.1 billion.

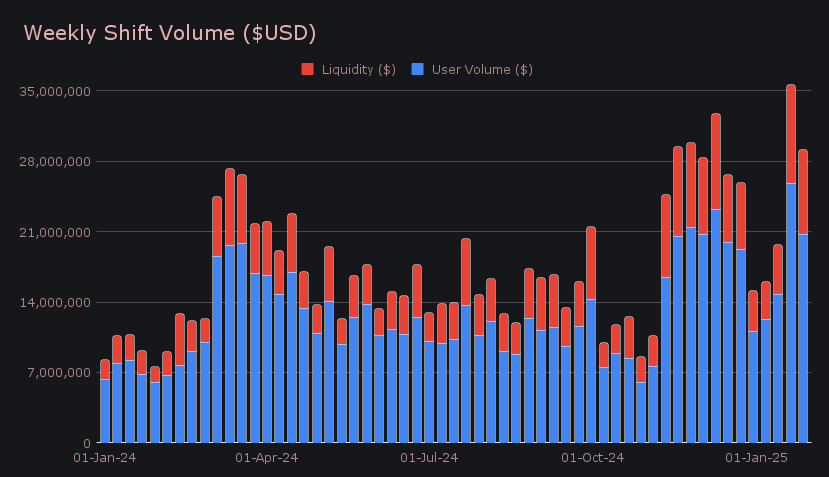

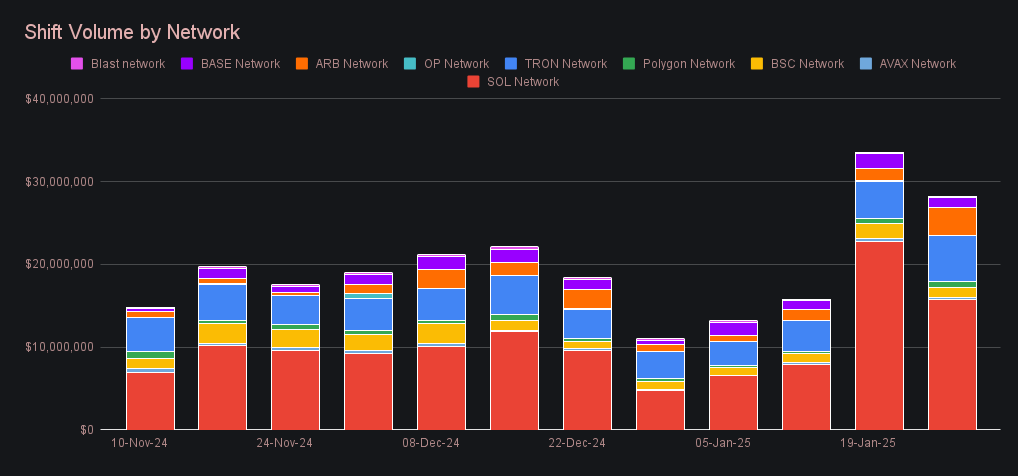

Despite a cooldown from last week’s record-breaking performance, SideShift maintained exceptional activity, processing $29.1m in gross volume. Temporary volatility in the broader market played to our advantage and resulted in a steady flow of user shifts totaling $20.7m, while liquidity shifting accounted for an additional $8.4m, which was required to facilitate demand. Though our overall volume dipped -18.2%, this figure still stands among our highest weekly tallies in recent months, reinforcing SideShift’s strong user engagement to begin 2025.

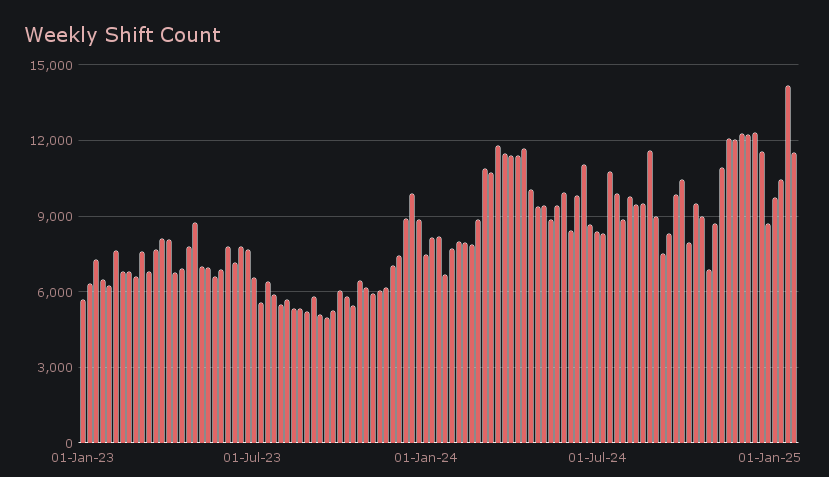

Shift count remained equally impressive, netting a total of 11,491 shifts (-18.9%), and carrying on with a firm upwards trajectory to begin the year. When coupled with our weekly volume, these sums combined for daily averages of $4.2m alongside 1,642 shifts. SOL pairs once again dominated user preferences, with ETH/SOL leading at $1.24m for the fourth consecutive week. The inverse pair of SOL/ETH followed closely at $1.02m, highlighting Solana’s sustained influence on shifting behavior - together, these two pairs added a total 744 shifts to our weekly sum.

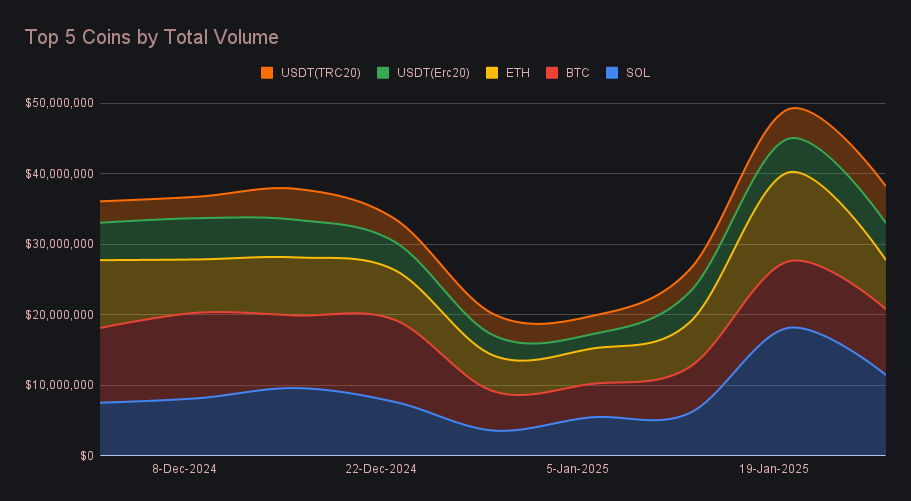

For the second straight week, SOL remained the most shifted asset on SideShift - an uncommon feat given BTC’s usual dominance. It led with $11.5m in total volume (-36.8%), surpassing second place by a comfortable margin of over $2m. While volume eased from last week, demand remained starkly apparent, as SOL has now finished as the most settled user coin on SideShift in every week so far in 2025. Settlements once again easily outpaced deposits despite the sharp decline, with users receiving $4.9m (-42.6%), as compared to a deposit volume of $3.6m (-24.2%).

BTC followed in second place with a total weekly volume of $9.3m (-0.8%), demonstrating exceptional stability compared to other top assets. This consisted of a breakdown of $3.7m (-12.3%) in user deposits and $3.2m (-16.0%) in settlements, both noting declines from the previous week. However, increased liquidity shifting helped offset the drop in user activity, bringing BTC’s gross weekly volume close to net neutral.

Rounding out the top three, ETH recorded a total weekly volume of $6.9m (-44.9%), marking a sharp retracement from last week's frenzied activity. User deposits dropped significantly to $3.3m (-40.1%) following the massive influx seen previously, while settlements, though falling at a slower pace, still saw a notable decline to $2.5m (-23.4%). This overall slowdown mirrors a broader trend for the Ethereum network on SideShift, as total shift activity on the Solana network now sits right on Ethereum's heels when measuring combined volume.

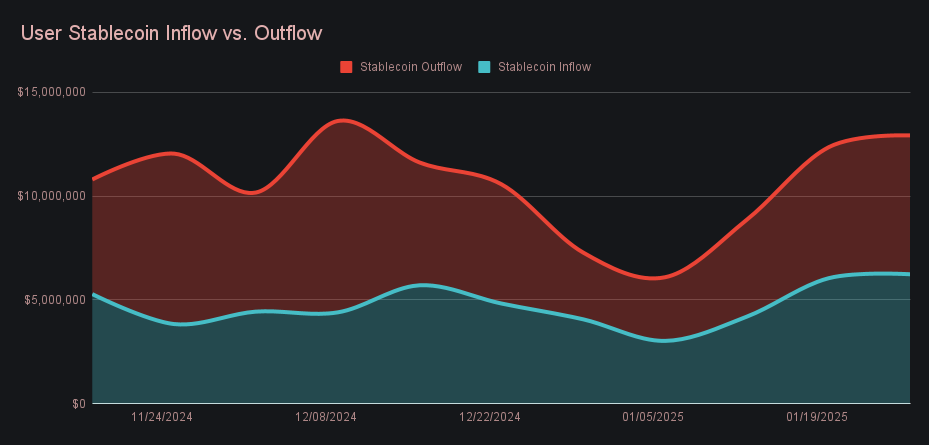

Stablecoins played a pivotal role this week, with several seeing heightened shift activity, including some less commonly featured in the rankings. USDT (ERC20) led the category with $5.24m (+9.8%), narrowly edging out USDT (TRC20) for fourth place overall, which finished just behind at $5.22m (+24.8%). The latter’s sharp rise was fueled by BTC/USDT (TRC20) shifts, which generated $1.16m and ranked as the second most popular shift pair among users. Among USDC variants, USDC (SOL) remained highly relevant with the ongoing increase in Solana based shifting and finished with $4.1m (+3.9%), while USDC (ARB) recorded the sharpest gain at +134.5%, rising to $2.3m, though it remained a smaller contributor in absolute terms. Overall, stablecoin volume has now doubled since the start of January, reflecting their dynamic role in SideShift’s volume.

The Solana network once again led among alternate networks to ETH, generating $15.9m despite a -30.3% drop from last week’s peak. The Tron network followed with a strong $5.6m (+22.6%), propelled by heightened BTC/USDT (TRC20) activity. Arbitrum stood out with the biggest move, more than doubling to $3.4m (+133.9%) as shifting demand surged. Meanwhile, Binance Smart Chain (BSC) and Polygon moved in opposite directions, with BSC sliding -33.2% to $1.2m while Polygon climbed +22.4% to $724k. Although noting a slight decline from last week, the combined sum and relevance of alternate networks to ETH remained highly evident, as reflected by its impressive combined sum this week.

Affiliate News

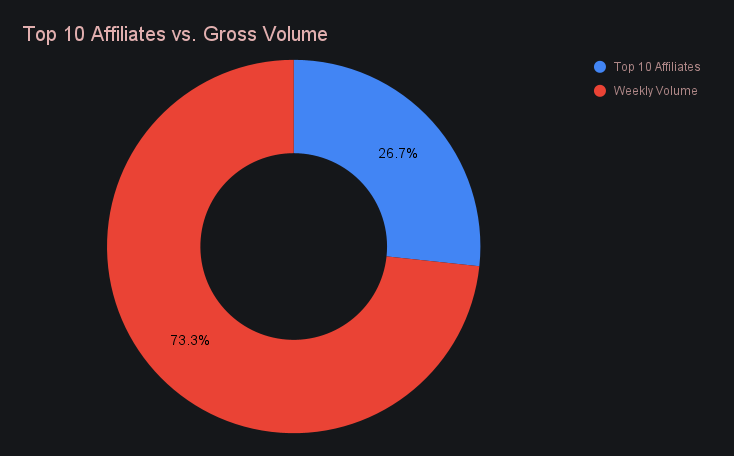

This week saw our top affiliates generate a combined $7.8m, marking a nominal decline of -20.8%. The most significant shift came at the top, as our first-place affiliate surged to $4.1m (+53.8%), sitting on the cusp of record volume. This jump sent last week’s leader down to second, where its volume more than halved to $1.5m (-58.9%). Meanwhile, our third-placed affiliate remained unchanged but trended lower, finishing with $805k (-39.1%).

All together, our top affiliates represented 26.7% of our total volume, a minor change of just -0.8% from last week’s proportion.

That’s all for now. Thanks for reading and happy shifting.