SideShift.ai Weekly Report | 28th Jan - 3rd Feb 2025

Welcome to the one hundred and thirty-ninth edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

This past week began with SideShift token (XAI) making a swift move above $0.16 and continuing to climb to reach a peak of $0.1681, before easing slightly on February 3rd, 2025. At the time of writing, XAI is priced at $0.1651, with a market cap of $24,069,748, reflecting a +4.1% increase from last week’s total.

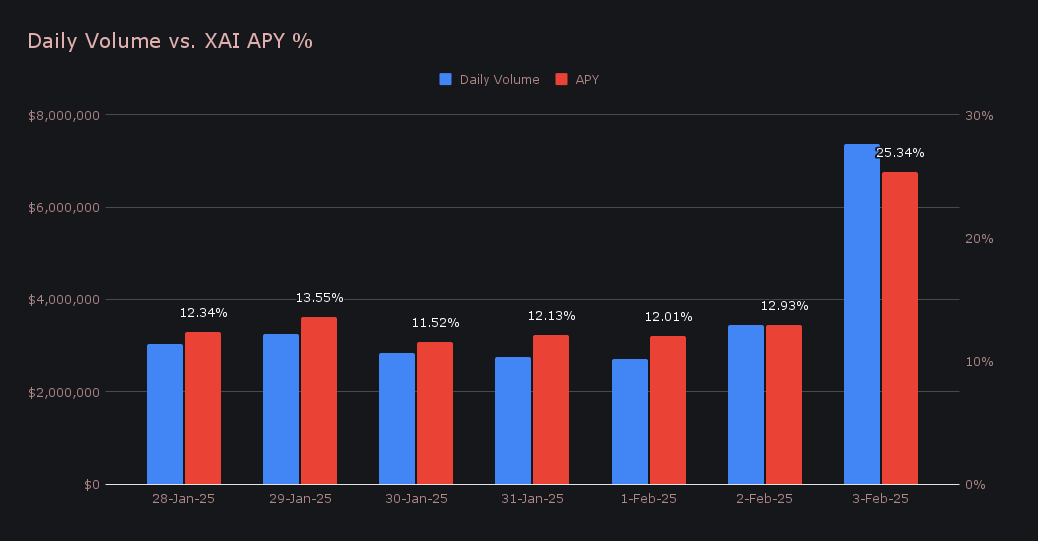

XAI stakers saw solid returns and earned an average APY of 14.26%, with the week’s top staking reward of 80,472.72 XAI occurring on February 4th, driven by a surge in platform activity that saw daily volume reach a lofty $7.4m. This peak also corresponded to a 25.34% daily APY, rewarding those staking as SideShift’s momentum increased. In total, XAI stakers received 330,221.96 XAI or $54,670.90 USD in rewards throughout the week.

Additional XAI updates:

Total Value Staked: 130,173,771 XAI (+0.3%)

Total Value Locked: $21,516,081 (+3.7%)

General Business News

This past week, the crypto market was rocked by multi-billion dollars in liquidations on February 2nd, marking an event larger than both the FTX collapse and the COVID-19 market crash, and making it one of the biggest sell-offs in crypto history. The news sent BTC plummeting below $91k before rebounding to $100k, while ETH collapsed to $2,125, marking its lowest level in months. This move also sent ETH/BTC wicking down to a low not seen since January 2021, highlighting the extent of Ethereum’s relative underperformance amid the major sell-off.

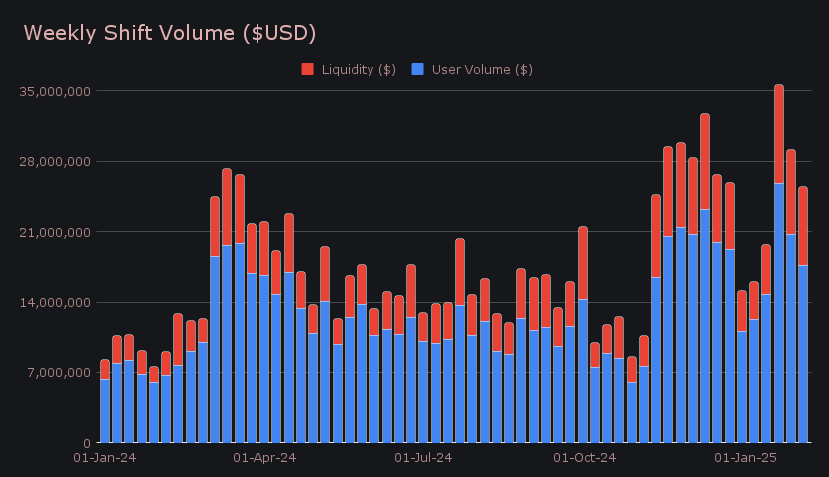

SideShift maintained strong activity throughout the turbulence, processing $25.4m in gross volume, despite seeing a -12.7% decline from last week’s sum. This consisted of $17.6m (-14.9%) in user volume, with a further $7.8m (-7.2%) added in liquidity shifting required for inventory rebalancing. While overall volume dipped, our weekly total remained healthy, largely thanks to the previously mentioned $7.4m recorded on February 3rd, which represented one of our highest ever daily volumes.

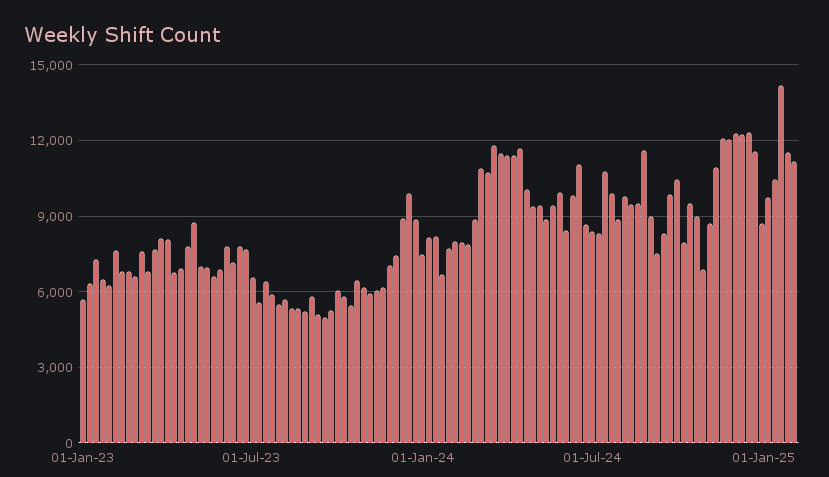

Our weekly shift count landed at 11,142 (-3.0%), continuing its streak of holding above 10,000 shifts for four consecutive weeks. Notably, SideShift has now achieved this level in 10 of the past 12 weeks, establishing a new benchmark for platform activity. Meanwhile, BTC/USDT (ERC20) took over as the most popular shift pair, dethroning ETH/SOL after its four-week reign at the top, and finished the week with $1.3m in total volume. USDC (SOL)/SOL followed with $819k, while SOL/BTC rounded out the top three at $735k, highlighting continued user interest in Solana-based shifts.

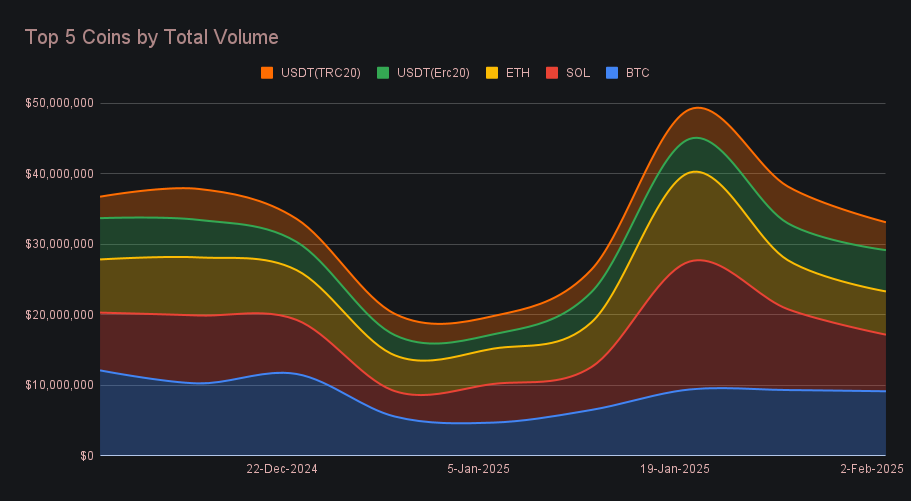

BTC ascended back to the top spot this week with a total volume of $9.2m (-1.9%), overtaking SOL, which had led for the past two weeks. The change was largely driven by a +9.4% rise in BTC deposits, which climbed to $4.1m, making it the only top coin to record an increase in deposit volume. Settlement activity also edged up +1.5% to $3.3m, ending within 3% of our week’s most settled coin, SOL.

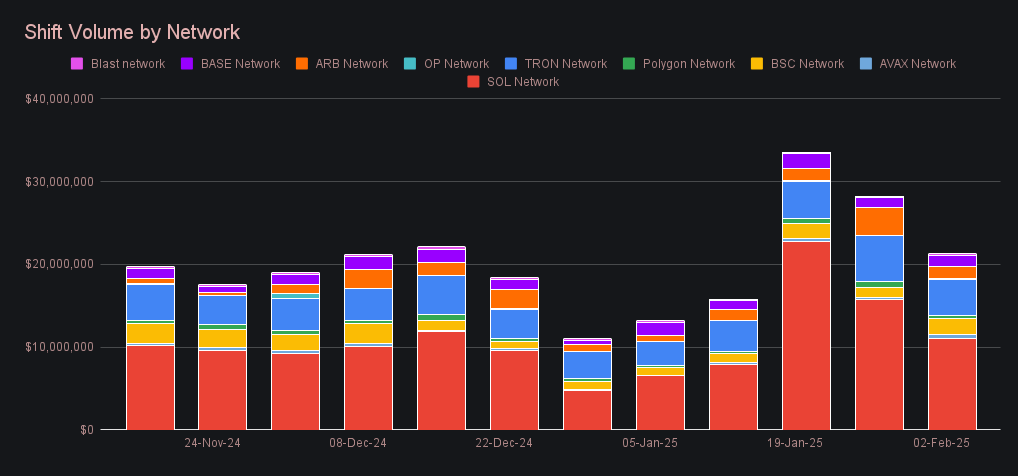

SOL followed in second place with $8.0m (-30.0%), as its volume settled into a more stable range following the huge influx of SOL shifting seen two weeks ago. This cooldown is particularly notable, as shown in the chart below, which highlights the surge in SOL shifting that took place in mid-January. This week saw user deposit volume slow to $2.8m (-22.6%), while settlements underwent a sharper drop of -33.2% to $3.3m. With that, SOL still retained its title as the most demanded coin on SideShift, an achievement that it has held in every week of 2025 so far.

Third-placed ETH closed the week with $6.1m (-11.7%) in total volume, maintaining a steady presence on SideShift despite trailing behind BTC in price performance. User deposit activity declined to $2.5m (-23.6%), while settlements dropped at a faster rate, and fell -27.0% to $1.8m. Interestingly however, during the market flush that occurred on February 3rd, 2025, ETH ended the day as the most settled coin on SideShift with $817k in settlements, signaling that users were keen to scoop the ETH dip.

Alternate networks to ETH combined for a total volume (deposits + settlements) of $21.2m this week, down -24.7%, as many altcoins have broken down in recent weeks relative to BTC. The Solana network remained on top with $11.1m (-29.8%), though its volume has steadily declined from its peak two weeks ago. The Tron network followed with $4.4m (-22.3%), while Binance Smart Chain (BSC) jumped to third place with $2.0m (+72.4%), overtaking the Arbitrum network, which fell to $1.5m (-55.5%) after its sudden surge last week. Among the few networks to see an increase, Base rose +20.6% to $1.4m, while AVAX recorded the largest percentage gain, more than doubling to $406k (+103.3%).

Affiliate News

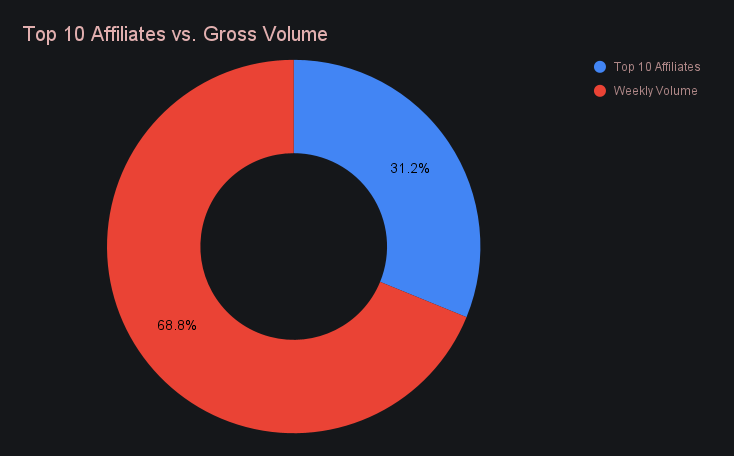

Affiliate-driven volume totaled $7.9m this week, marking a slight increase of +2.0% from last week. The ranking order remained unchanged from the previous period, with all three of our top affiliates maintaining their positions. Our first placed affiliate set a new all-time record with $4.2m (+3.1%), single-handedly contributing 24% of total user volume. Our second placed affiliate also saw a boost, climbing +15.2% to $1.7m, while our third placed affiliate rounded out the week with $878k (+9.1%), alongside an impressive shift count of 1,284.

All together, affiliate contributions accounted for 31.2% of our total volume, with its overall proportion increasing +4.5% as site volume eased.

That’s all for now. Thanks for reading and happy shifting.