SideShift.ai Weekly Report | 22nd - 28th July 2025

Welcome to the one hundred and sixty-fourth edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

Highlights

- SideShift processed $19.73m across 9,344 shifts, a slowdown from recent weeks but still in line with YTD averages.

- BTC led with $7.51m in total volume, though narrowing gaps show other top coins are catching up in settlements.

- SOL volume climbed to $3.68m (+5.7%), rejoining the top 5 as the only major asset to post gains this week.

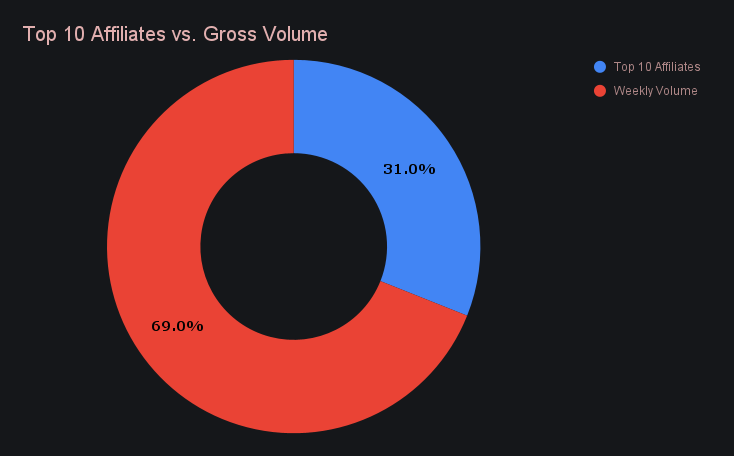

- Affiliates fell to 31.0% of total volume, with third place leading in shift count (1,465) and rising +23.1% to $707k.

- Stablecoin usage broadened to altchains, with Polygon and Arbitrum more than doubling their stablecoin volume.

XAI Weekly Performance & Staking

XAI saw minimal movement this week, with its price largely holding flat within a narrow band of $0.1485 to $0.1526. At the time of writing, it's trading at $0.1517, near the top of this range. Aside from one sharp but short-lived spike visible midweek, price action was mostly subdued - a trend reflected in the horizontal nature of the 7-day chart. Market cap ticked slightly higher to $22,942,976, marking a modest +1.57% climb.

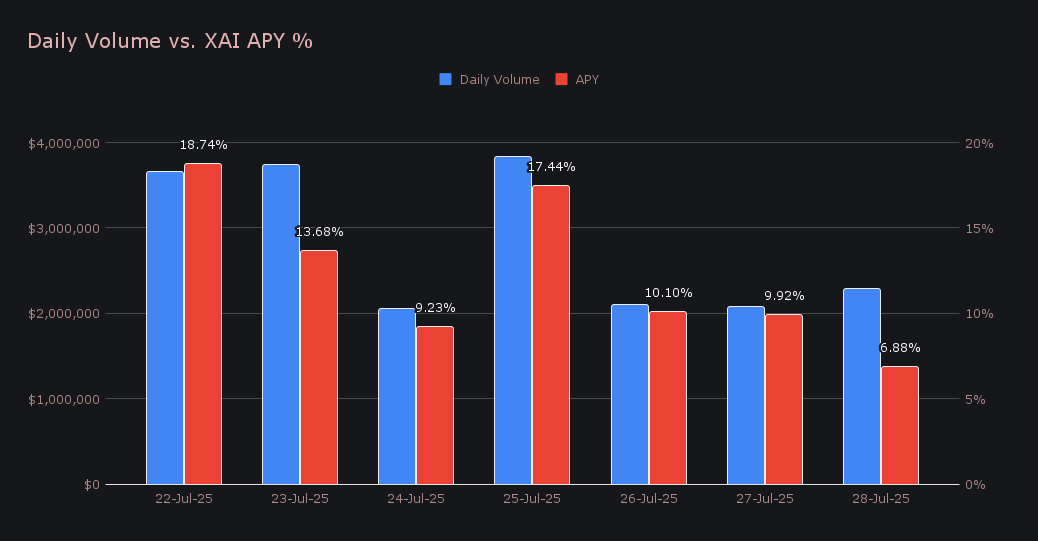

Even with flat price action, XAI staking delivered consistent yields, averaging 12.28% over the week. Daily rates fluctuated from ~7% to ~19%, with the strongest performance arriving on July 23rd, when 64,366.14 XAI was distributed directly to our staking vault at an 18.74% APY. That day also saw a volume of $3.73m, contributing to a weekly total of 302,378.64 XAI, or $45,867.21 USD earned by stakers.

SideShift’s treasury received an additional 100,000 USDC and is currently sitting just shy of the $30m milestone, at an estimated value of $29.59m. Users can follow with live treasury updates via sideshift.ai/treasury.

Additional XAI updates:

Total Value Staked: 137,119,595 XAI (+0.2%)

Total Value Locked: $20,749,355 (+1.3%)

General Business News

Crypto markets held steady this week as Bitcoin hovered near $119k, consolidating just below its recent highs. Ethereum showed strength, surging to just shy of $4,000 with its price up +58% over the past 30 days, as ETF interest and inflows continue to grow. The Fear and Greed Index clocked in at 63 (Greed) - a figure that reflects measured optimism, and one that stands in contrast to the frenzied 88 (Extreme Greed) reading seen exactly a year ago. On Solana, Jupiter’s JUP Studio flipped Pump.fun to become the #2 token launchpad by market share, claiming 10.2% and intensifying competition in the memecoin creation space.

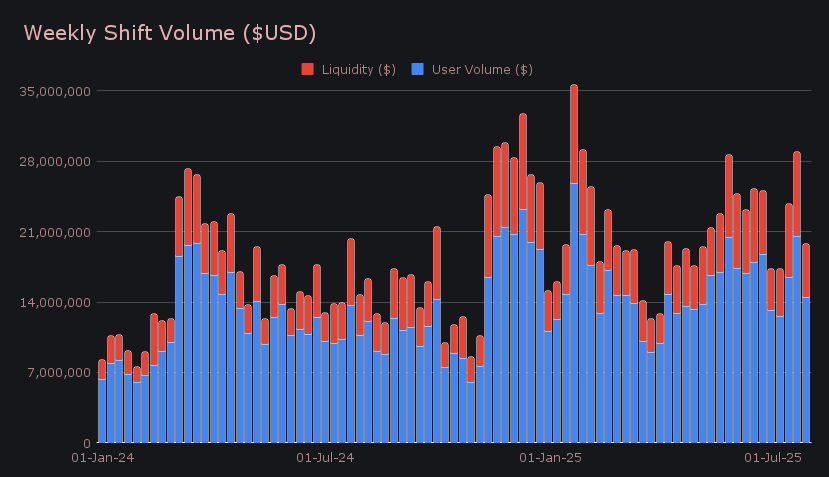

SideShift activity slowed, with gross volume falling to $19.73m (−31.9%), a step down from recent momentum but still hovering near year-to-date averages. While core site volume remained relatively stable, affiliate shifting experienced a pronounced drop, contributing to the broader pullback. User volume dipped −29.2% to $14.53m, while liquidity shifting declined −38.4% to $5.20m, a reflection of both the overall decrease in volume and a more balanced distribution between deposit and settlement sides. The top shift pairs once again remained BTC/stablecoin focused, led by BTC/USDT (ERC-20) at $937k and BTC/USDC (ERC-20) at $829k. Interestingly, XRP/SOL also broke into the top 3, outpacing the usual BTC/ETH pairing by over +50% and adding to Solana’s strength on SideShift this week.

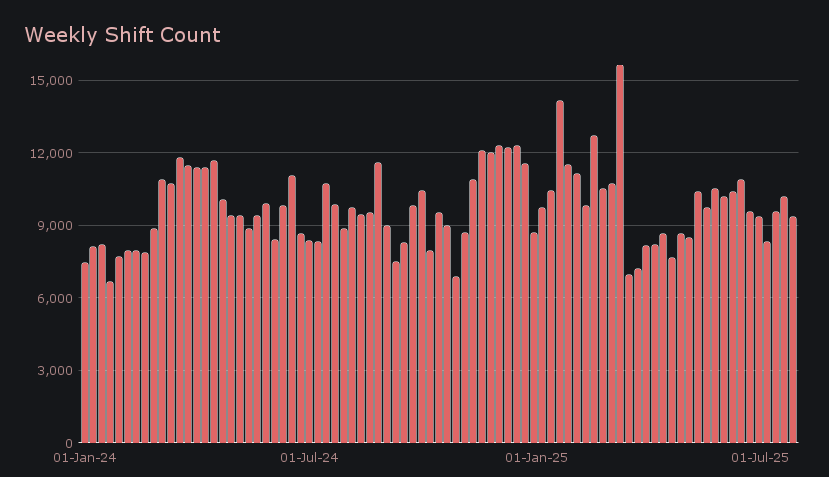

Shift count also saw a mild dip, with the weekly sum landing at 9,344 (−8.1%). That worked out to a daily average of 1,335 shifts, while daily volume came in at $2.82m. The overall decline was in line with the volume slowdown, but from a broader view, shift count has remained steady in the 9,000–10,000 range for much of the past year. This consistency contrasts with the notable rise in weekly volume over the same period, suggesting that the average size of each shift has increased compared to earlier months.

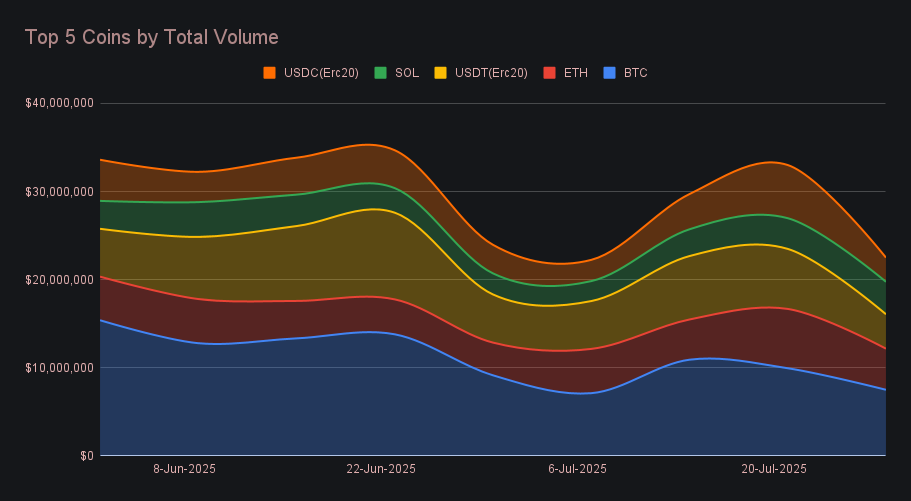

BTC held onto the top spot with $7.51m in total weekly volume (deposits + settlements), though its grip was far from dominant. $3.39m in user deposits accounted for the majority of its flows along the volume split, though this side noted a change of -30.1%. Meanwhile, settlements slid a lesser -13.1%, but for a far lower sum of $1.92m, a figure more in line with other top coins. In essence, users continued to deposit BTC with consistency, but that demand wasn’t equally matched by outgoing shifts.

ETH slipped to second place with $4.67m (−30.7%) in total volume, as both user deposit and settlement flows saw double-digit declines. Meanwhile, SOL re-entered the top 5 for the first time in nearly two months and stood out as the only top coin to post gains in an otherwise red week. Its total volume climbed +5.7% to $3.68m, driven by a modest +7.3% increase in deposits to $767k and a more meaningful +20.0% jump in settlements to $1.82m. This marked a strong showing that contributed to the broader recent strength shown by the Solana network on SideShift.

Stablecoins experienced some of the steepest drops across the leaderboard, with USDT (ERC-20) down −42.7% to $3.91m and USDC (ERC-20) plunging −54.5% to $2.75m in total volume. The drop in USDC was particularly notable on the settlement side, which fell −55.9% after the coin unexpectedly led all settlements last week — making this week’s reversal less surprising. Despite the broader decline among top stablecoins, usage across alternate networks painted a more dynamic picture. Lesser-used options like stablecoins on Arbitrum and Polygon more than doubled their volume week-on-week, each climbing well above $300k. While individually small, these increases spanned multiple assets and chains, contributing to a growing share of total stablecoin shifts outside Ethereum.

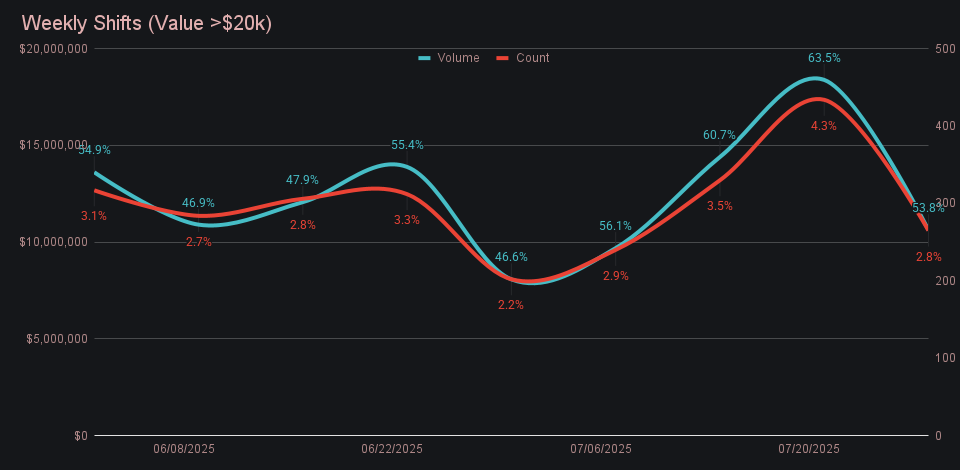

When looking at the periods decline in gross volume, whale shifting offers valuable context. Large shifts valued over $20k totaled $10.6m, marking a steep −42.3% drop from last week’s sum of $18.4m, a reduction of $7.8m. These whales made up 53.8% of this week’s total volume, down from a multi month high of 63.5%, measured 7 days ago. The contrast highlights how last week’s spike was largely whale-driven, whereas the present saw a return to more balanced, retail-dominated flows.

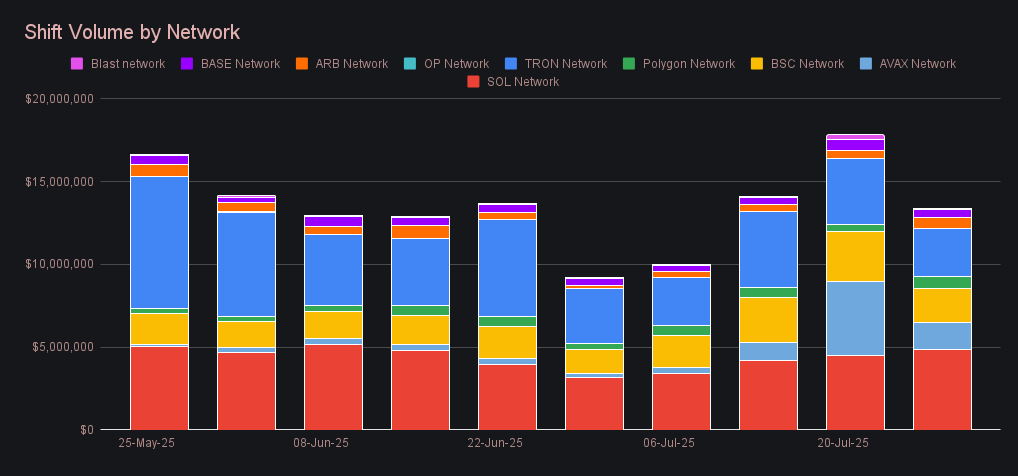

Among alternate networks to Ethereum, the Solana network held the lead for the second consecutive week with $4.86m in total shift volume, rising +9.2%. It also dominated in shift count with 2,881 total shifts, more than double that of the second place Tron network, which netted a gross volume of $2.88m (−27.6%). Next came the BSC network with $2.11m (−30.1%), carried by steady BNB shifts, followed by Avalanche at $1.62m (−63.8%). The sharp drop in Avalanche activity stemmed from a slowdown in the AVAX/WAVAX pair, which saw a rapid influx last week but cooled notably this week, despite still being present. Rounding out the group was the Polygon network, which jumped +67.9% to $708k, narrowly outpacing Arbitrum’s $663k (+33.9%). While this group continues to show pockets of growth, Ethereum still handled the bulk of non-BTC flows, closing the week at $15.7m (−20.6%).

Affiliate News

Affiliate volume fell back to earth this week, totaling $6.12m, a sharp −45.1% drop that marked a return to more average levels following last week’s peak. The top three affiliates remained unchanged, with first place experiencing a striking −62.6% decline to $2.47m, and second place also posting a notable −33.9% slide to $2.08m. Third place broke from the trend, climbing +23.1% to $707k and leading all affiliates in shift count with 1,465 shifts. A fourth affiliate also popped onto the radar with the week’s largest percentage gain, jumping +132% to reach $332k. All together, our top affiliates accounted for just under a third of this week’s volume at 31.0%.

That’s all for now - thanks for reading and happy shifting.