SideShift.ai Weekly Report | 23rd - 29th January 2024

Welcome to the eighty-ninth edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

This week the price action of SideShift token (XAI) was less volatile than the previous, moving within the 7 day trading range of $0.1268 / $0.1458. At the time of writing, the price of XAI is sitting in the middle of that range at a price of $0.1327, and has a current market cap of $17,252,980 (+4.4%).

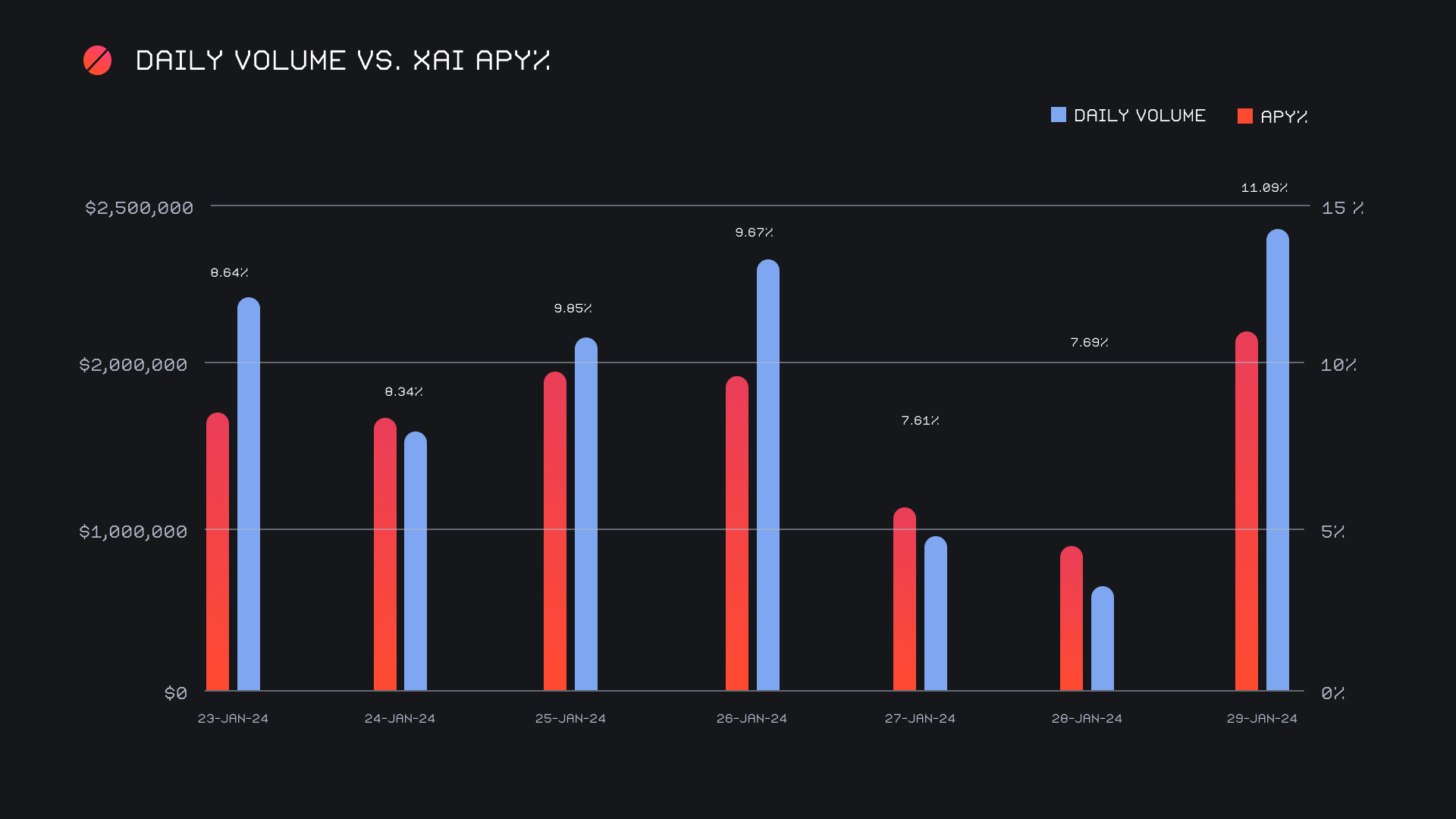

An average APY of 8.98% was earned by XAI stakers throughout the week, with a daily rewards high of 33,340.85 XAI being distributed to our staking vault on January 30th, 2024. This was following a daily volume of $1.4m. This week XAI stakers received a total of 190,550.66 XAI, or $25,286.07 USD.

SideShift’s treasury is currently valued at $8.4m, or 196.4 BTC equivalent, a figure which has continued to grow due to both additional deposits, and sound decisions from our treasurer, Agent Archie Sterling III, “the third in a long line of Sterling men”. Users are encouraged to follow along with direct treasury updates via SideShift.ai/treasury.

Additional XAI updates:

Total Value Staked: 115,765,997 XAI (+0.2%)

Total Value Locked: $15,300,471 (+6.8%)

General Business News

After a gradual descent in the latter half of January 2024, this week saw the general market make a bit of a comeback, with Bitcoin bouncing +10% off of last week’s lows. Other major coins such as Solana and Avalanche rebounded even harder, rising more than +30% over the course of the past 7 days.

A basket of 17 new Solana tokens were listed on SideShift this week, including PYTH, JTO, MNDE, HBB, RAY, ORCA, JITOSOL, MSOL, BSOL, HNT, GMT, WIF, MNGO, LST, SLND, BLZE, and LFNTY. Shifting of all of these tokens is now live, directly to and from any coin of your choice.

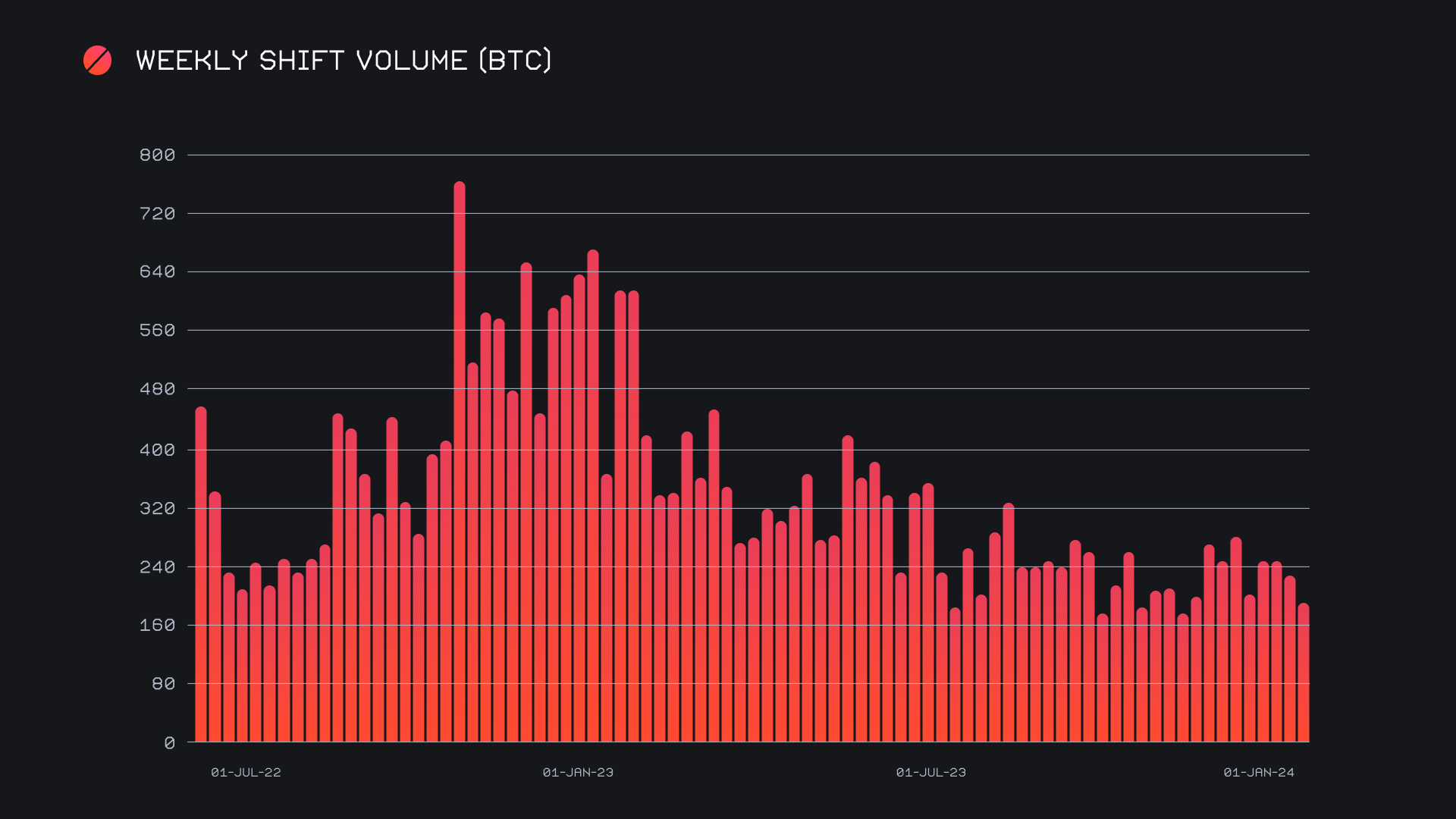

SideShift ended the week with a gross volume of $7.6m, alongside a total shift count which tallied 7,695. Although this weekly volume marked a decrease of approximately -17.1%, it was contrasted by our shift count, which rose by +15.5% to regain the benchmark of 7,000 shifts per week. This week shifts done directly on the site made up the majority of our weekly volume, with integrations playing a lesser role than typically seen. Together, these figures combined to produce daily averages of $1.1m on 1,099 shifts. When denoted in BTC, our weekly volume amounted to 183.13 BTC (-16.8%).

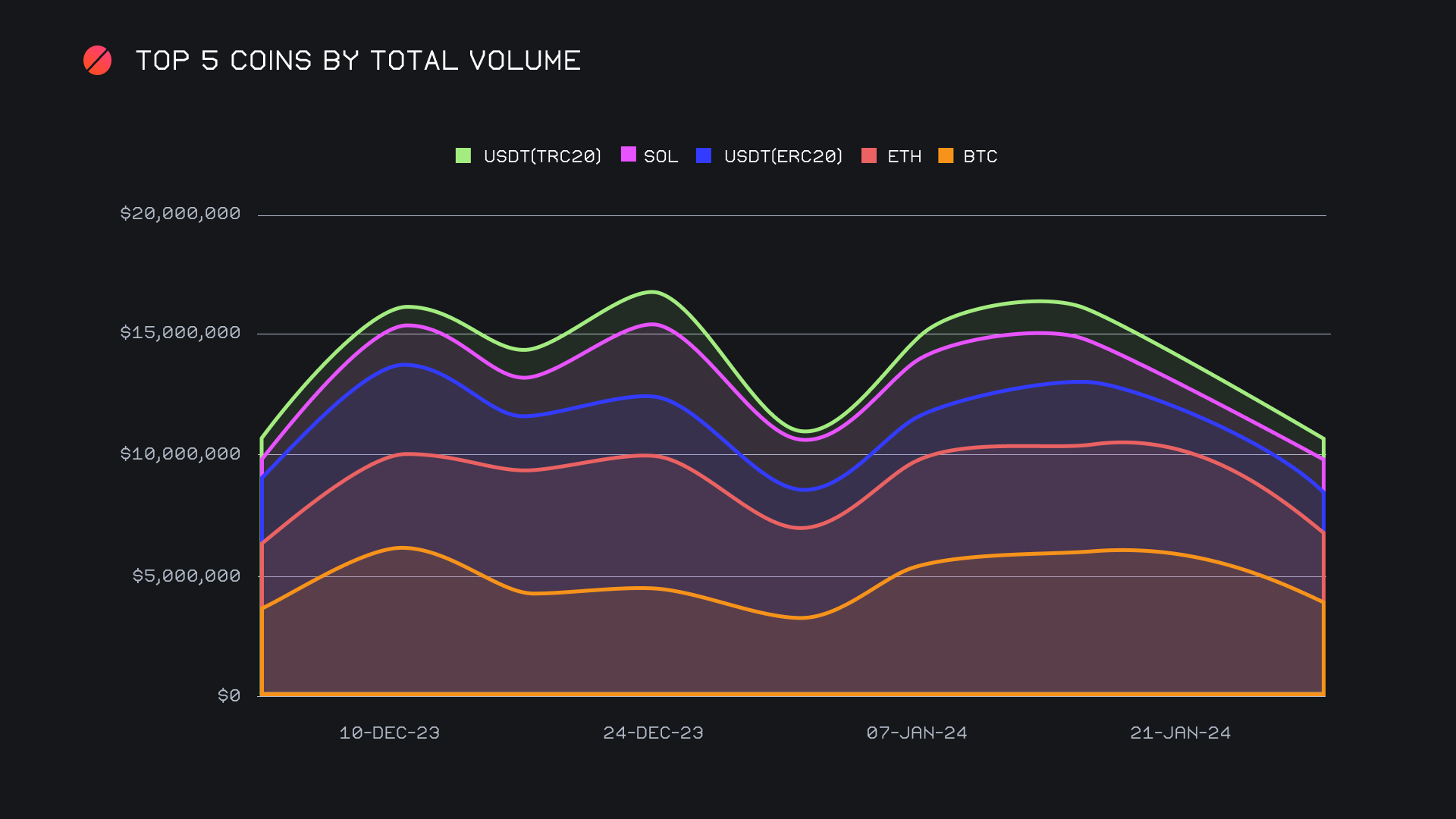

A look at our top weekly coins will reveal a different pattern to that of last week, with our top two seeing a sizable decline in shifting from users. BTC ended as our most popular coin for the week, although doing so with a total volume of just $3.7m. This occurred following 3 consecutive weeks firmly above the $5m threshold, and its weekly decline of -36.5% represented the most significant among our top 10 coins. This was certainly an eye catching drop considering its place as our top coin. In Particular, we observed a halving of user BTC deposit volume, which fell from over $2.9m last week to about $1.4m this week. BTC settlements however trotted along, rising a modest +16% for $1.5m, and just managed to beat out ETH on the way.

Second placed ETH saw its total volume decline nearly as much as BTC, as it fell -32.6% for a sum of $2.9m. Although ETH saw a decline in both deposits and settlements, it was the settlement side which was hit harder. User ETH settlements have been consistently high over the past two months and reached as high as $2.2m just last week. It is constantly edging out other top coins and has established itself as the most demanded coin on SideShift during that timespan. However, a swift decline of -37% saw this figure fall to $1.4m this week, proving to be the primary source of the decline in ETH’s total volume. Additionally, the BTC/ETH pair was dethroned after back-to-back weeks with volume greater than $1m. Instead, it was BTC/USDT (ERC-20) which came out on top, albeit with a weekly sum of just $488k. The nearly $1m decline in BTC/ETH volume and overall lack of concentration for our top pair tells us that the focus of users may be beginning to spread out from our top coins.

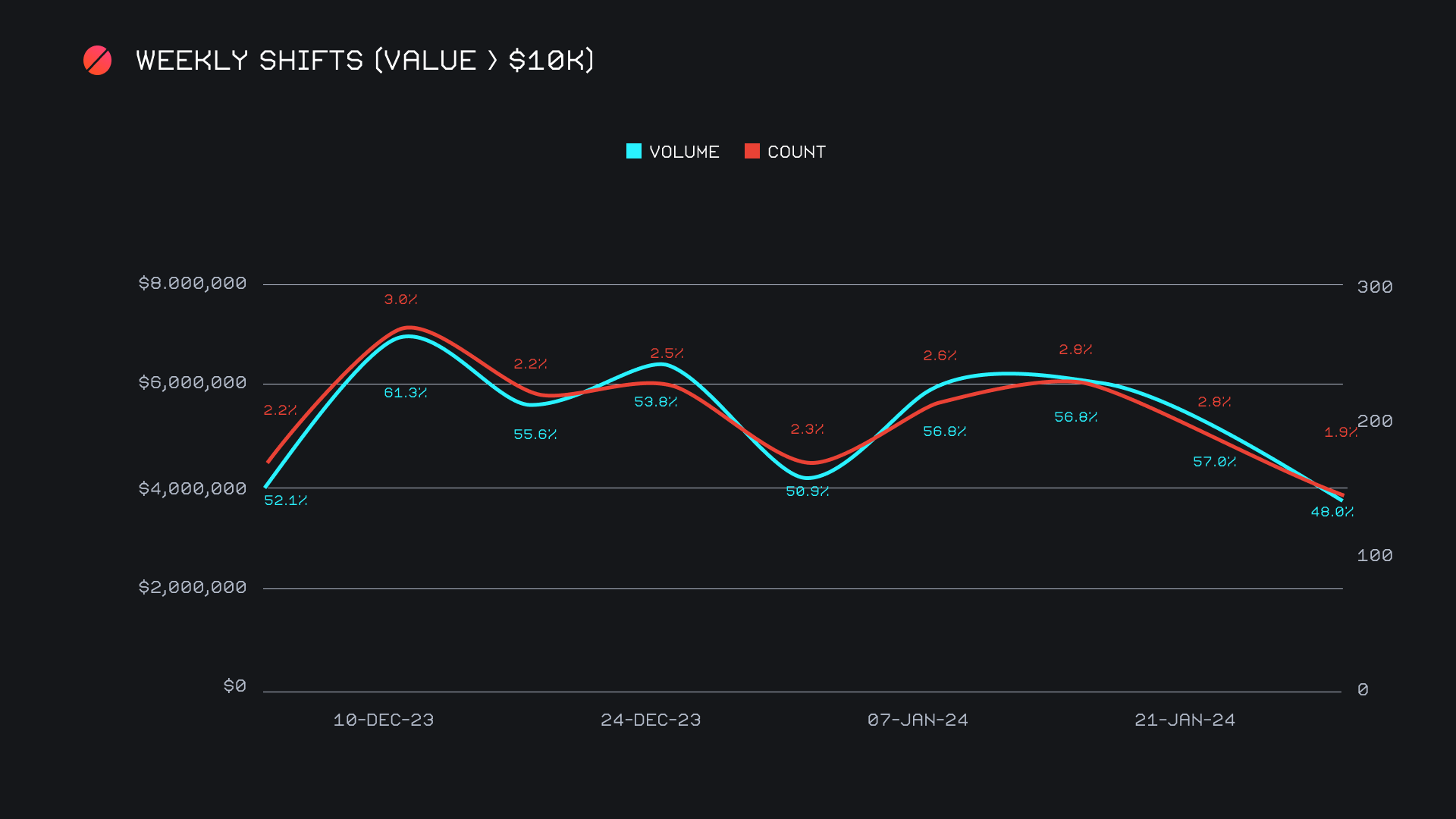

In addition to the overall lesser amount of shifting for our top two coins, we noticed a decrease in whale shifts this week. The line chart below measures both volume and count for shifts with a deposit value exceeding $10k. The percentage labels along the line represent their proportion of our weekly volume. Because these lines are arching downwards, we know that a nominally lower amount of whale shifts (>$10k) occurred this week, aligning with the overall decline in weekly volume. However, the respective shift volume and count proportions of 48% and just 1.9% represent local lows, and are a clearer representation that there were indeed less large-scale shifts taking place. This coincides with the decline in shifting of our top coins (which tend to have larger shift sizes on average) and also contributed to the decline in weekly volume.

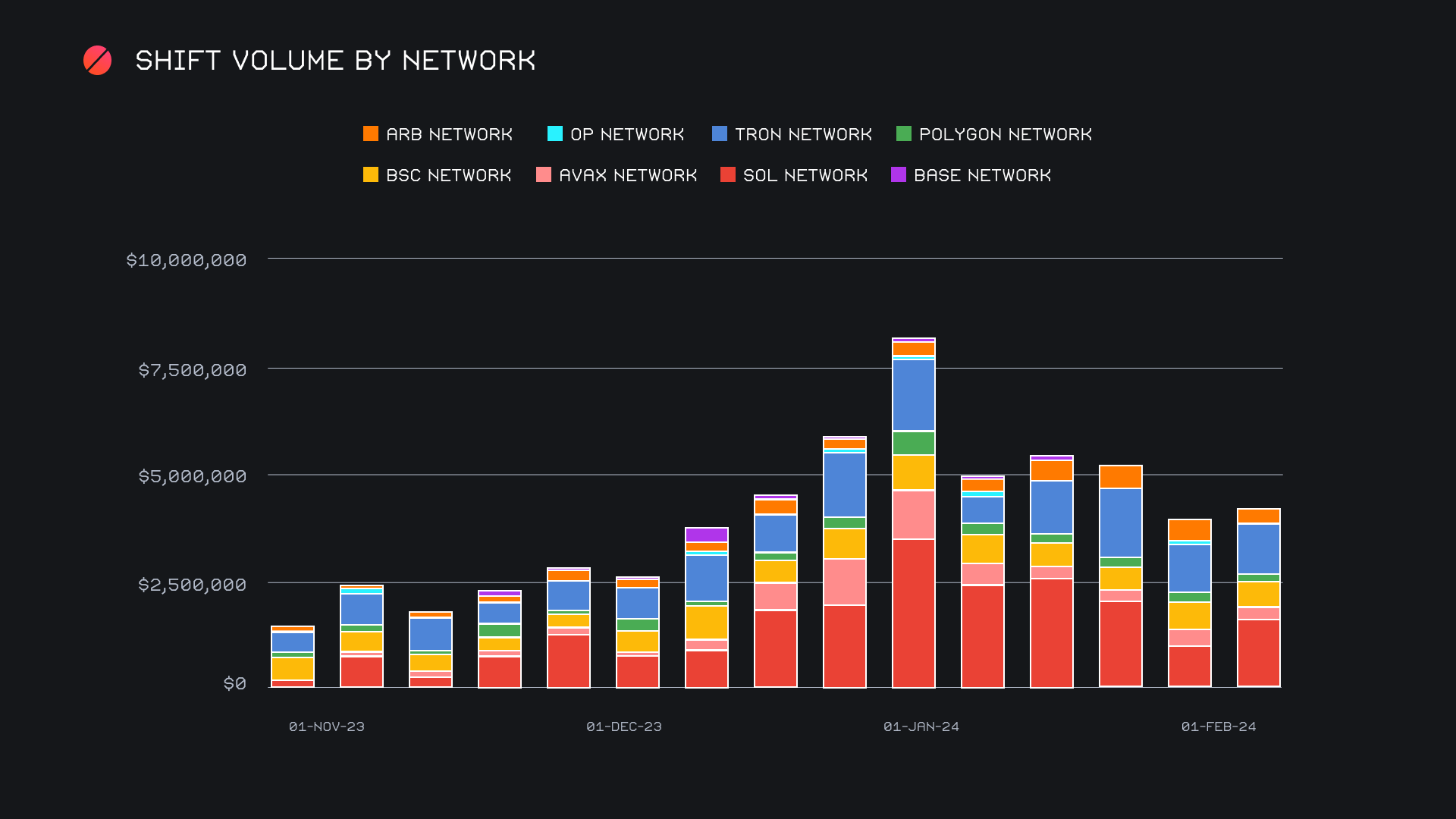

After moving beyond our slower performing top two coins, we noted some positive changes in shift action. Fourth placed SOL boomed after a mediocre performance last week, bouncing back +55.3% for a total $1.5m. This confidently accounted for the bulk of shifting on the Solana network, which ended up growing by a similar +53% to lead all alternate networks to ETH. Uncharacteristically, DOT ended up ranking sixth overall with a total volume of $497k, a far cry from last week’s total of just $7k. Recent listings are also beginning to see some action - SEI rose +88% to sum $69k in its second week since listing, while sETH and others are slowly seeing shifts trickle in.

In addition to the Solana network, the Tron network was one of the few others to see a positive change in weekly volume. Its $1.2m sum represented a weekly change of +2.8% and was enough to secure second place among alternate networks to ETH. Quite a ways behind that sat the Binance Smart Chain (BSC) network with $599k (-6.5%), followed by the Arbitrum network with $316k (-31.3%), and finally the Avalanche network with $286k (-28.5%). Despite most of these networks incurring weekly declines, they still combined for a total $4.3m this week (+6.5%), with about ~28% of our weekly shifts containing a settlement or deposit with a coin on one of these networks.

Affiliate News

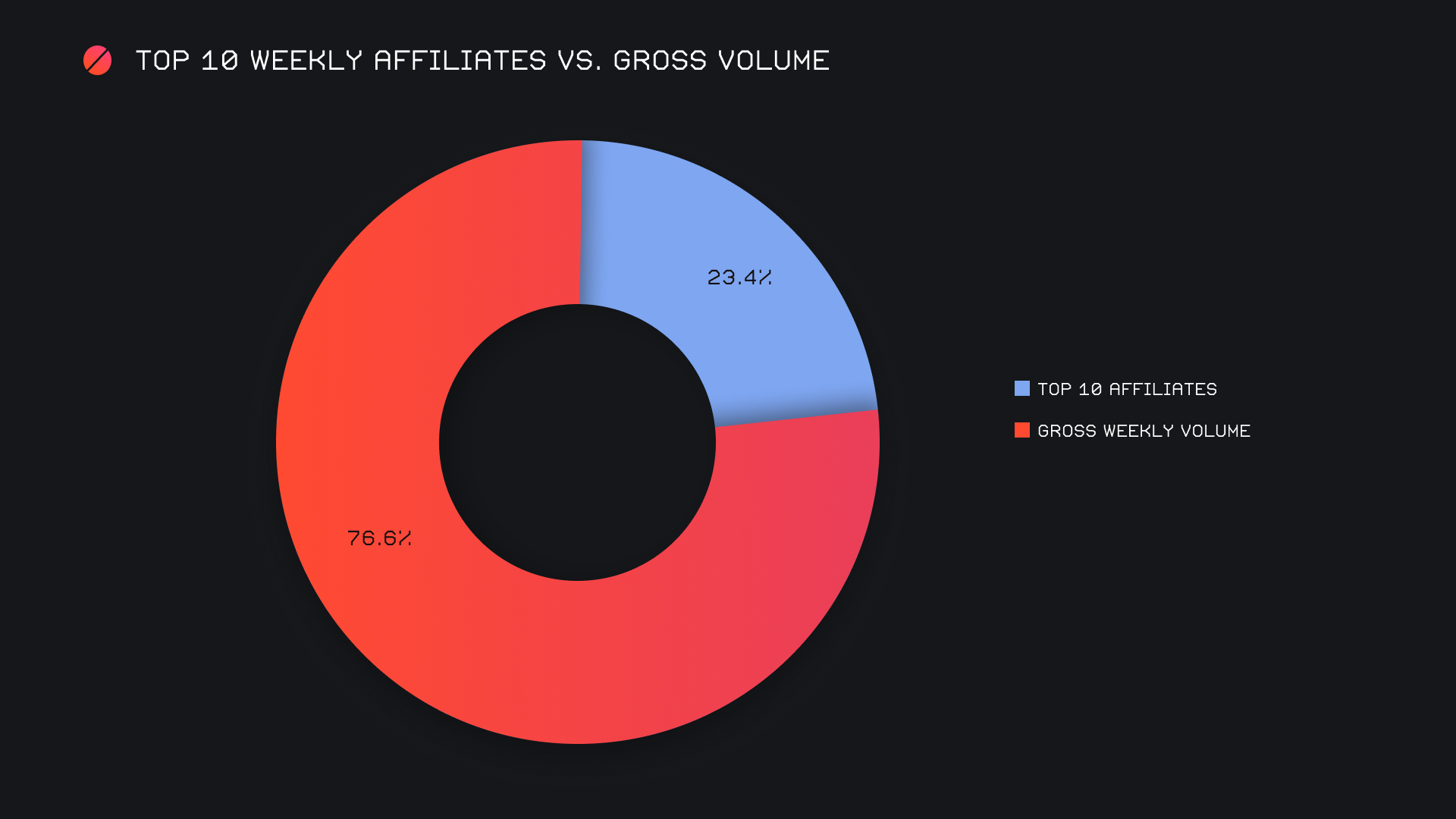

SideShift’s top affiliates combined for ~$1.8m, a fairly significant drop of -46.5% after multiple weeks of strong performances. This came as the result of generally slower showings across most affiliates, as opposed to one being solely responsible for the change. With that in mind, their collective shift count still saw a slight positive gain, and rose +2.4% for a total of 1,728 shifts. Our top affiliate remained unchanged, and this week accounted for 11.4% of our weekly volume.

All together, our top affiliates represented 23.4% of our weekly volume, 12.8% lower than last week’s proportion.

That’s all for now. Thanks for reading and happy shifting.