SideShift.ai Weekly Report | 23rd - 29th July 2024

Welcome to the one hundred and fifteenth edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

This week saw SideShift token (XAI) exhibit some price volatility, moving within the bounds of $0.1486 to $0.1706. XAI took a sharp dip on July 29th, briefly piercing through the $0.13 mark, before rebounding upwards to settle at its current price of $0.1489. This left XAI with a market cap of $20,382,102, a decrease of -10.88% from last week's measurement.

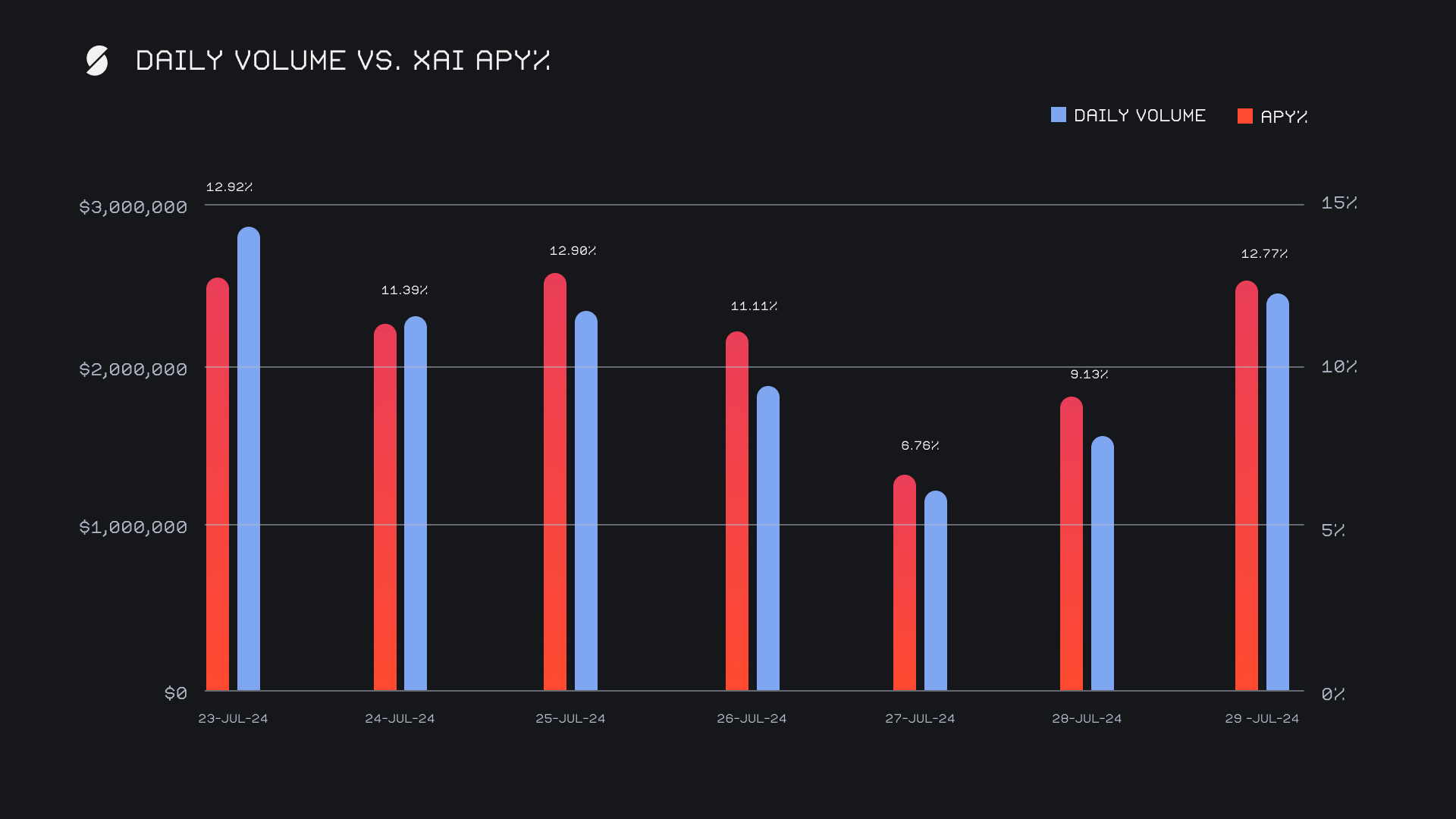

XAI stakers earned an average APY of 11.00% this week. The highest daily reward was recorded on July 23, 2024, and corresponded to an APY of 12.92% with 40,712.38 XAI being distributed. This peak in rewards was supported by a daily volume of $2.9 million. Over the week, XAI stakers were rewarded with a total of 270,822.68 XAI or $45,254.47 USD, highlighting the benefits of participating in the staking program. Users are reminded that the easiest way to participate in XAI staking is to shift directly to svXAI, from any coin of your choice.

Additionally, 2 WBTC were added to SideShift's treasury on July 26, 2024, bringing the total value to $16.47 million. Users can stay updated with the latest treasury details at sideshift.ai/treasury.

Additional XAI updates:

Total value staked: 122,574,009 XAI (+0.2%)

Total value locked: $18,123,179 (-12.4%)

General Business News

This week, BTC’s price dropped below $67K following the U.S. government's move of $2 billion worth of seized 'Silk Road' tokens. Additionally, July 29 marked the 100th day since Bitcoin's latest halving, which reduced block mining rewards to 3.125 BTC from 6.25 BTC, and is fueling optimism for a continued bull market. Lastly, SOL has seen some positive price action, and recently overtook BNB for the fourth largest market cap within the crypto market.

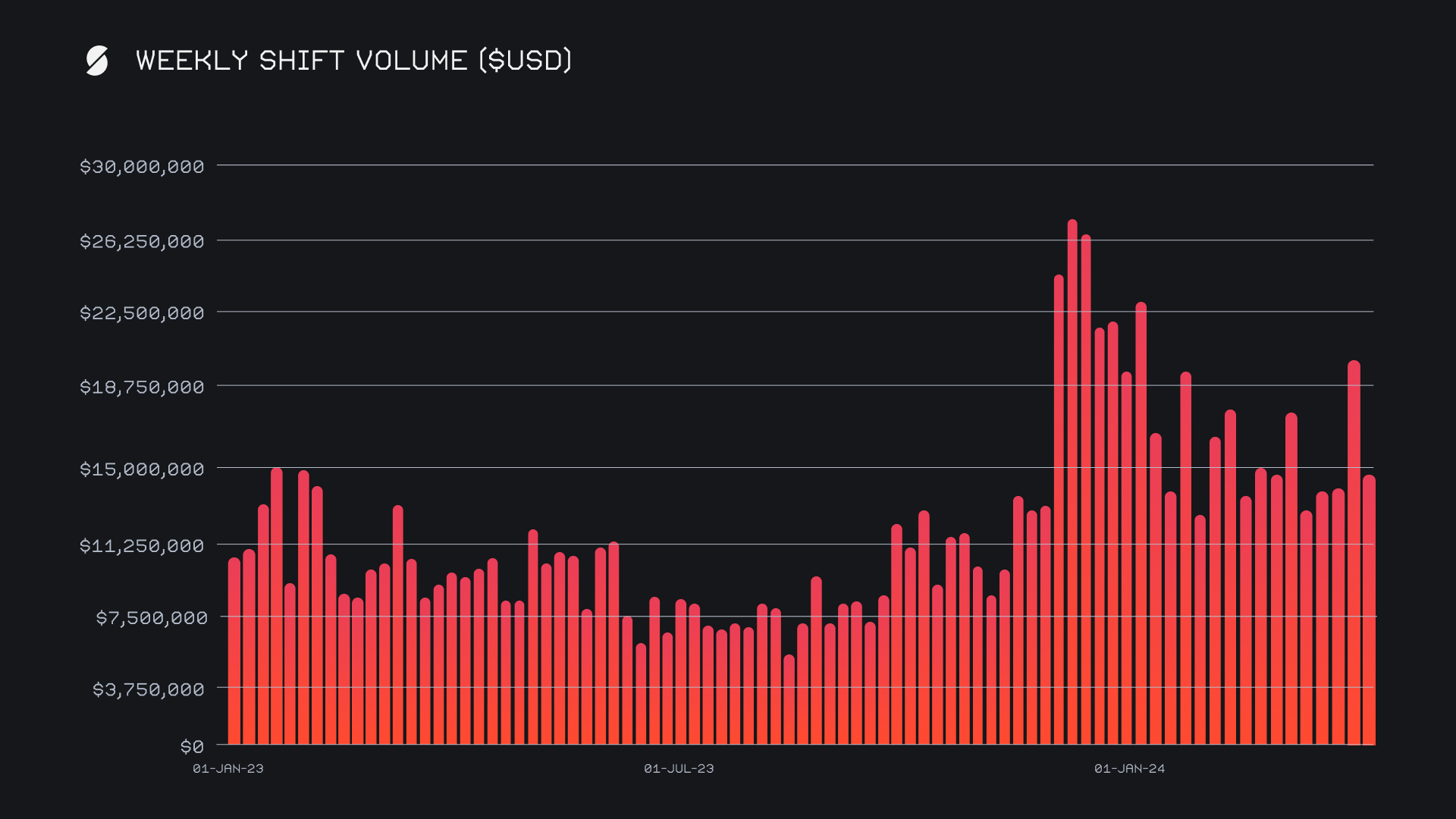

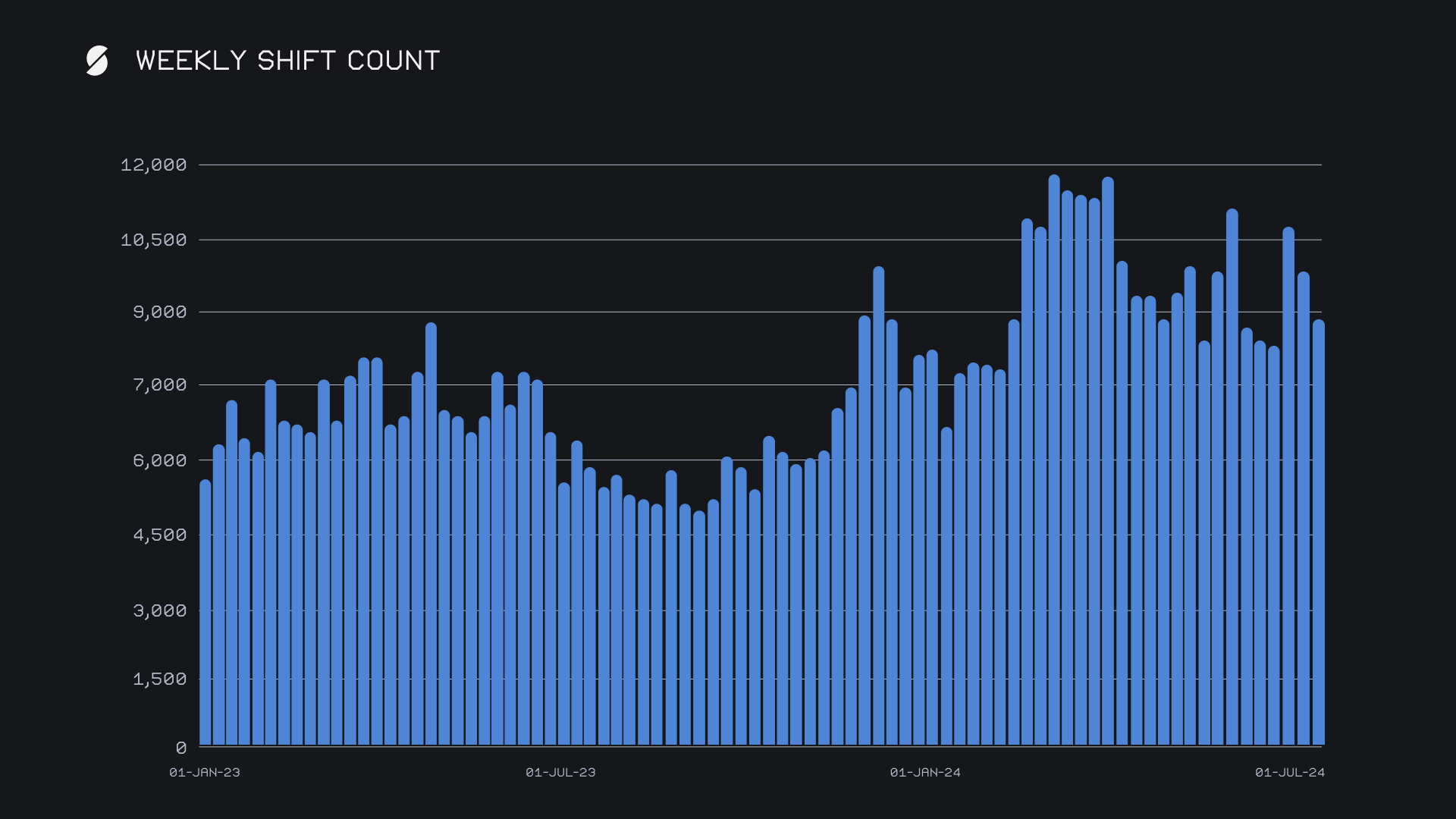

SideShift had a more modest performance this week, closing with a gross volume of $14.7m, a notable decrease of -27.5% from last week's $20.3m. Daily averages came in at $2.1m across 1,262 shifts. This week’s volume did not reach previous highs, but it still reflects steady user activity. The BTC/ETH pair remained a top choice for users with a volume of $1.18m, followed by the resurgence of the ETH/SOL pair, which ended with $907k.

Our weekly shift count also saw a decline, dropping by -10.5% to a total of 8,835 shifts. Despite the reduced shift count, the numbers suggest that users are still engaged with higher-value transactions. This trend of significant transaction values per shift continues to contribute to our overall volume, even if at a lower level compared to last week.

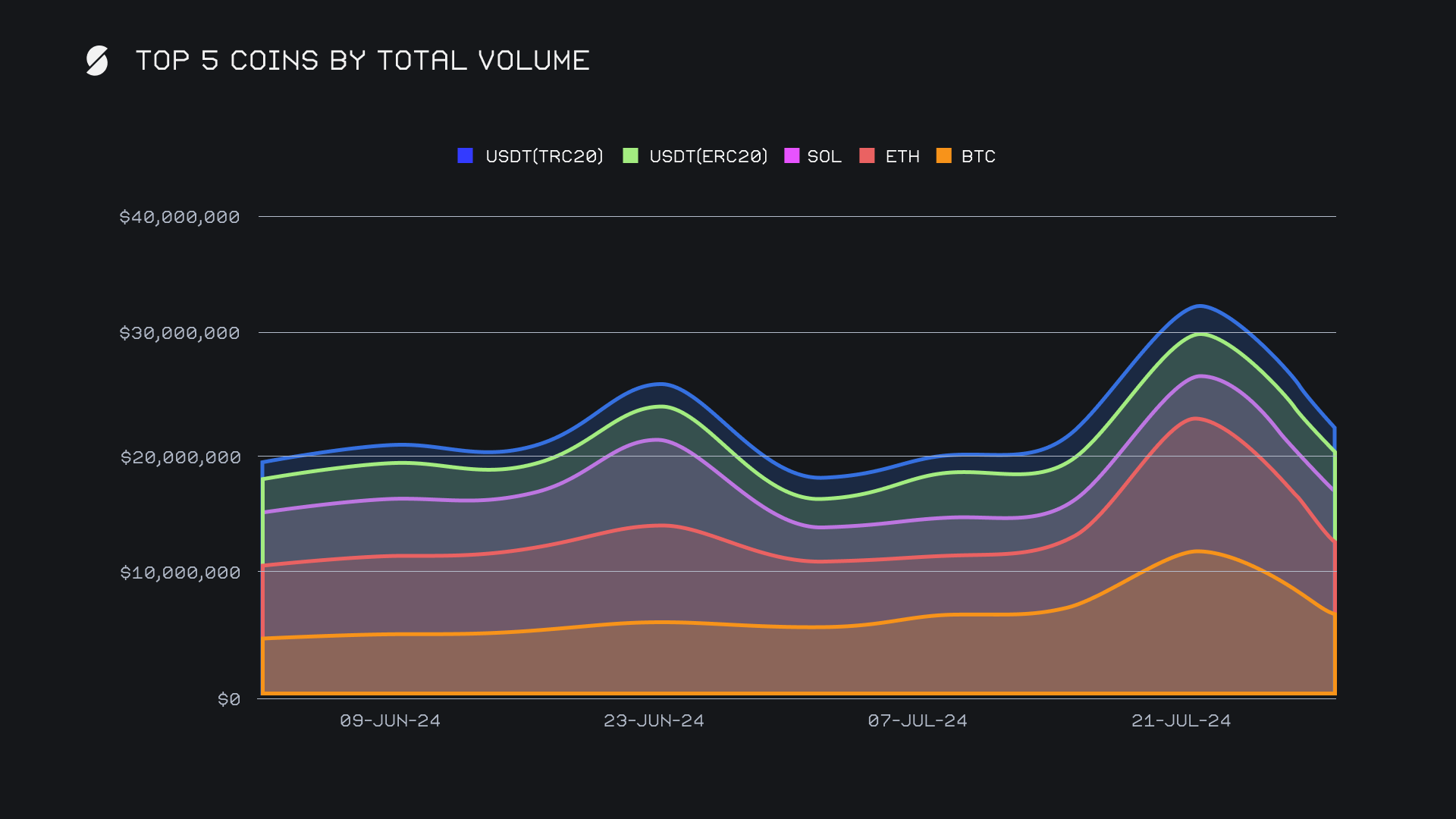

BTC continued to dominate with a total volume (deposits + settlements) of $7.2m, although this represented a sizable decrease of -40.5% from last week's $12.1m. The trend of users preferring to deposit more BTC than receive persisted, with user deposits totaling $3.2m, a steep drop of -43.3%. Settlement volumes also fell slightly to $2.2m, down by -4.2%. Despite these declines, BTC's consistent user engagement underscores its position as the top coin by volume, even in a week of reduced activity.

ETH followed in second place with a total volume of $5.7m, also experiencing a substantial drop of -48.6% from last week's outstanding $11.0m showing. This ended up being the largest negative change among any of our week’s top coins, something which is outlined in the chart below. Deposit volume was relatively stable at $1.9m, down by only -2.9%, while settlement volumes fell sharply to $2.5m, a hefty decrease of -53.1%. This decline in settlement volume suggests a reduced demand for ETH this week, contrasting sharply with the previous week's peak activity. Nevertheless, ETH remained the most settled coin on SideShift this week.

Meanwhile, SOL maintained its third-place position with a total volume of $3.7m, marking an increase of +4.6%. This performance was driven by $1.1m in deposits, down by -18.5%, and a notable rise in settlements to $1.7m, up by +32.1%. The increased settlement volume occurred alongside a rising price of the native SOL token, and is indicative that SOL has peaked the recent interest of users. This was the highest weekly user demand for SOL in July, although it still has some ground to cover to catch levels generated by our top two coins.

Despite most coins having a red week, there were a few which saw some respectable gains on SideShift. The standout performer was XRP, which saw a remarkable increase of +194.3% to end with $909k. This was quite a big jump for XRP, which failed to generate weekly volumes exceeding $100k in any of the first three weeks of July. A handful of other coins also recorded some decent gains this week, with BCH climbing +25.6% for $533k, and ADA shooting up +69% for $465k. Interestingly, the most significant losers among any top coins still prove to be our first and second finishers overall, BTC and ETH.

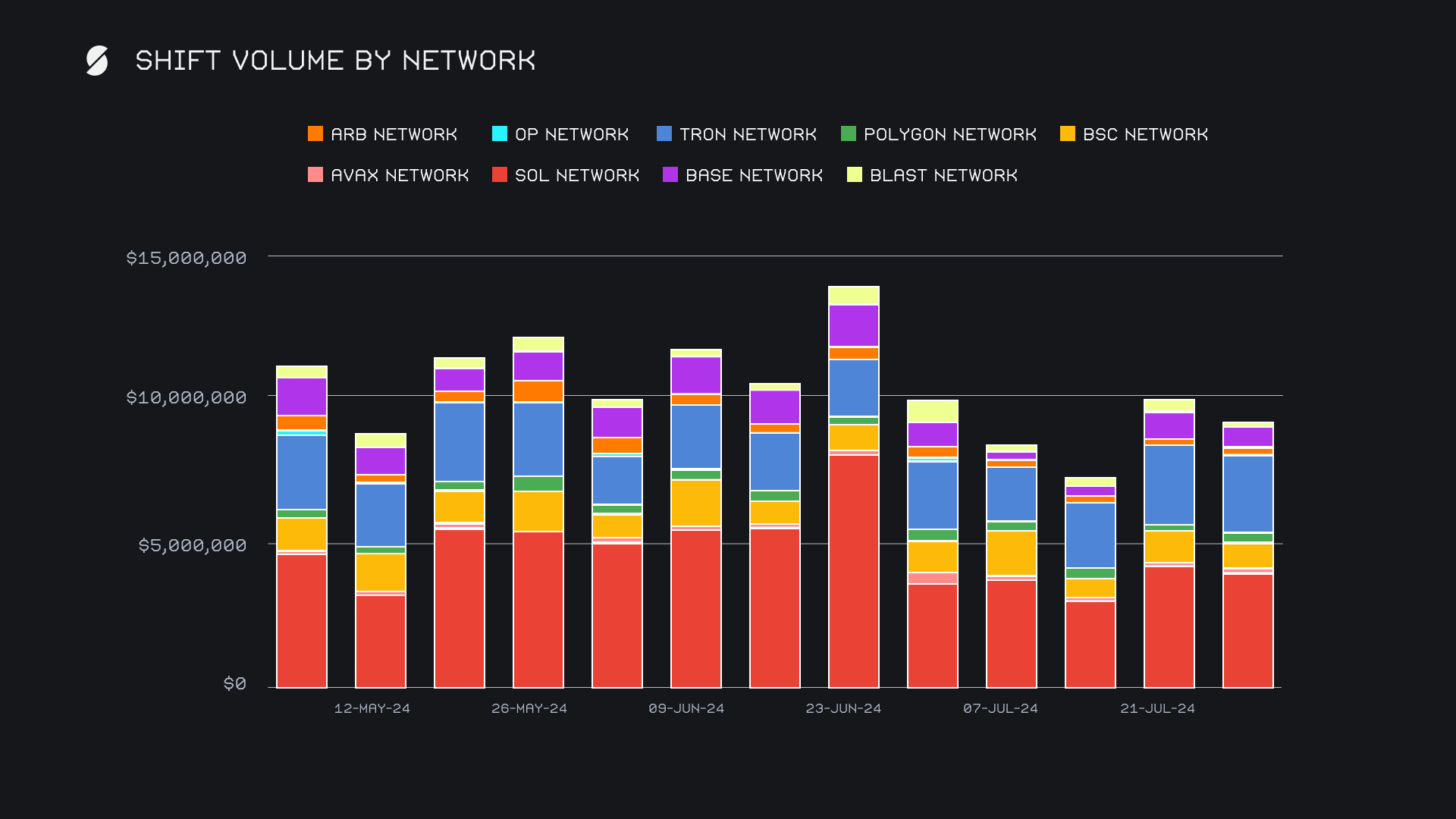

The majority of alternate networks to ETH followed the general downwards trend and saw their volumes decline as compared to last week. With that being said, the Solana network easily retained its top spot, and saw its overall volume fall by a marginal -4.3% for $4.0. The second placed Tron network was a similar story, and only dropped by -3.2% for $2.7m. The Binance Smart Chain (BSC) network fell by a larger -15.6% for $900k, as did the Base network, as it dropped by -21.4% for $719k. The few positive networks this week were Polygon and Arbitrum, which did indeed achieve weekly gains, but with lower overall volumes. They ended with respective totals of $365k (+88.3%) and $263k (+9.4%). All together, alternate networks are still being shown less user attention, as they accounted for ~31% of weekly shift volume. This compares to the Ethereum network's 42.4% proportion, which has remained rather consistent in recent weeks.

Affiliate News

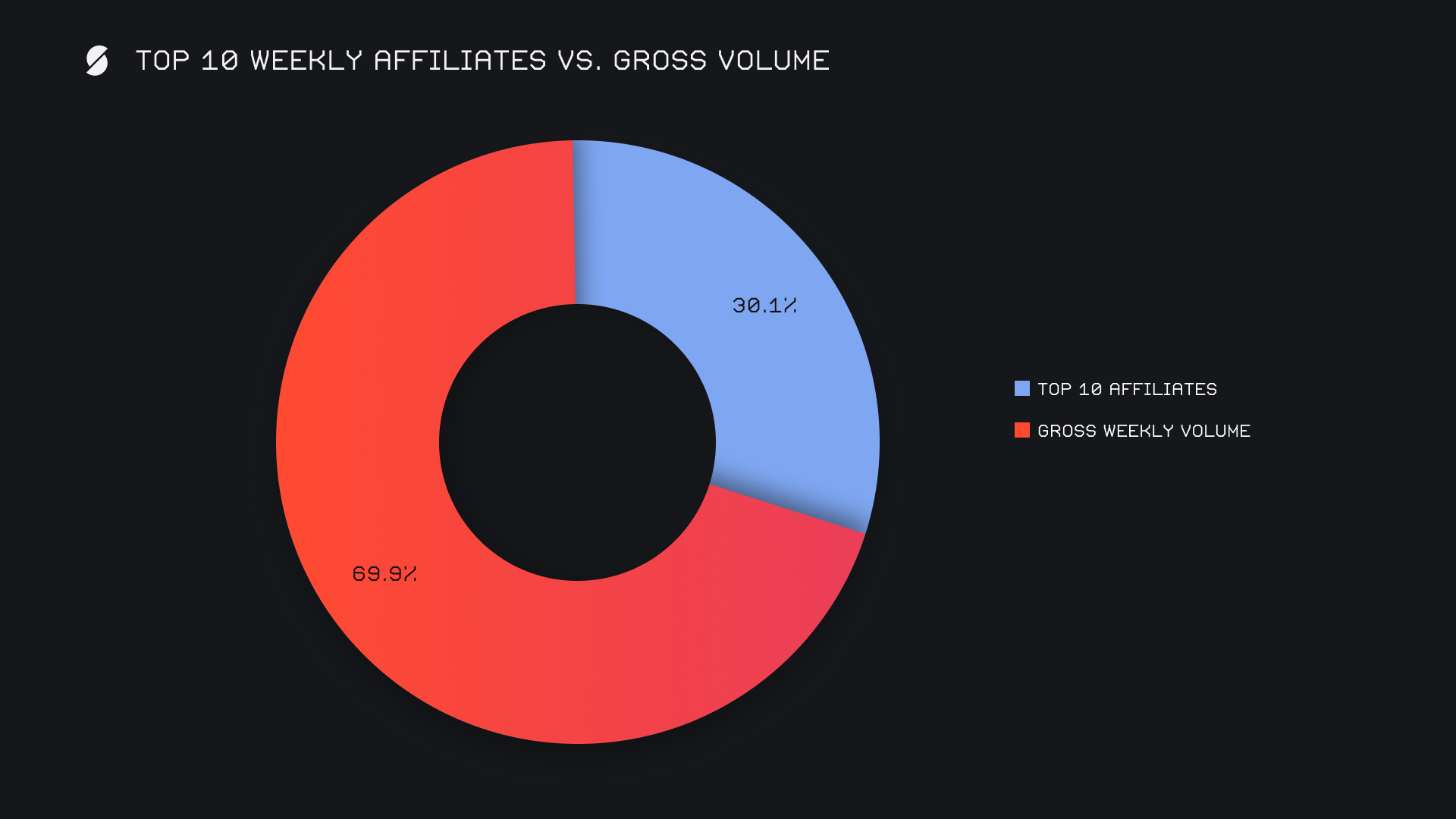

This week, our top affiliates generated a combined total volume of $4.4m, marking a considerable decline of -37.2% from last week's massive sum of $7.0m. Notably, our affiliates experienced a reshuffle in rankings. The first-place affiliate saw a robust performance, increasing its volume by +34.1% to reach $2.3m, overtaking the previous leader. The second-place affiliate, on the other hand, experienced a substantial drop of -74.3%, ending the week with $1.0m. The third-place affiliate also saw a decline, finishing the week with $701k, down by -16.4%.All together, our top affiliates accounted for 30.1% of our total weekly volume, a decrease of -4.6% from last week’s proportion.

That’s all for now. Thanks for reading and happy shifting.