SideShift.ai Weekly Report | 25th June - 1st July 2024

Welcome to the one hundred and eleventh edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

This week saw the SideShift token (XAI) move within the 7-day price bounds of $0.1750 / $0.1804. At the time of writing, XAI is sitting at the upper end of that range at $0.1800, with a market cap of $24,496,366 (+1.18%).

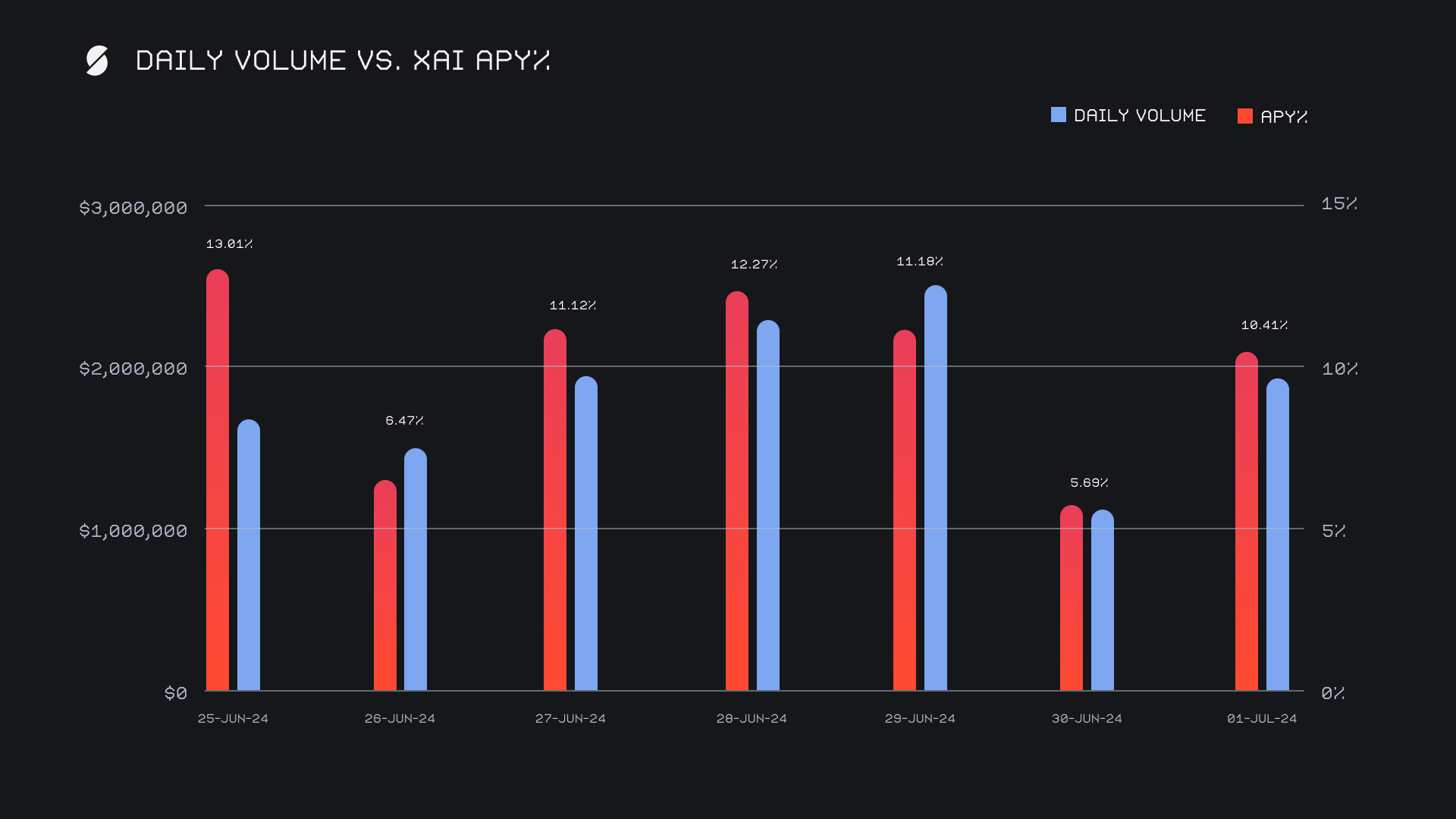

XAI stakers were rewarded with an average APY of 10.02% this week, with a daily rewards high of 40,696.14 XAI (an APY of 13.01%) being distributed to our staking vault on June 26th, 2024. This was following a daily volume of $1.7m. Over the week, XAI stakers received a total of 221,989.68 XAI or $39,958.14 USD in staking rewards.

The price of 1 svXAI is now equal to 1.3489 XAI, representing a 34.89% accrual on stakers investments. A friendly reminder that the easiest way to participate in XAI staking is to shift directly to svXAI, from any coin of your choice.

Additional XAI updates:

Total Value Staked: 121,765,558 XAI (+0.2%)

Total Value Locked: $21,933,755 (+1.7%)

General Business News

General market sentiment has turned rather positive this week, as many are now optimistic for a potentially strong month based on BTC’s positive historical trends for the month of July. ETH is also drawing significant attention ahead of the ETH ETF, something which has certainly been reflected on SideShift over the past several weeks.

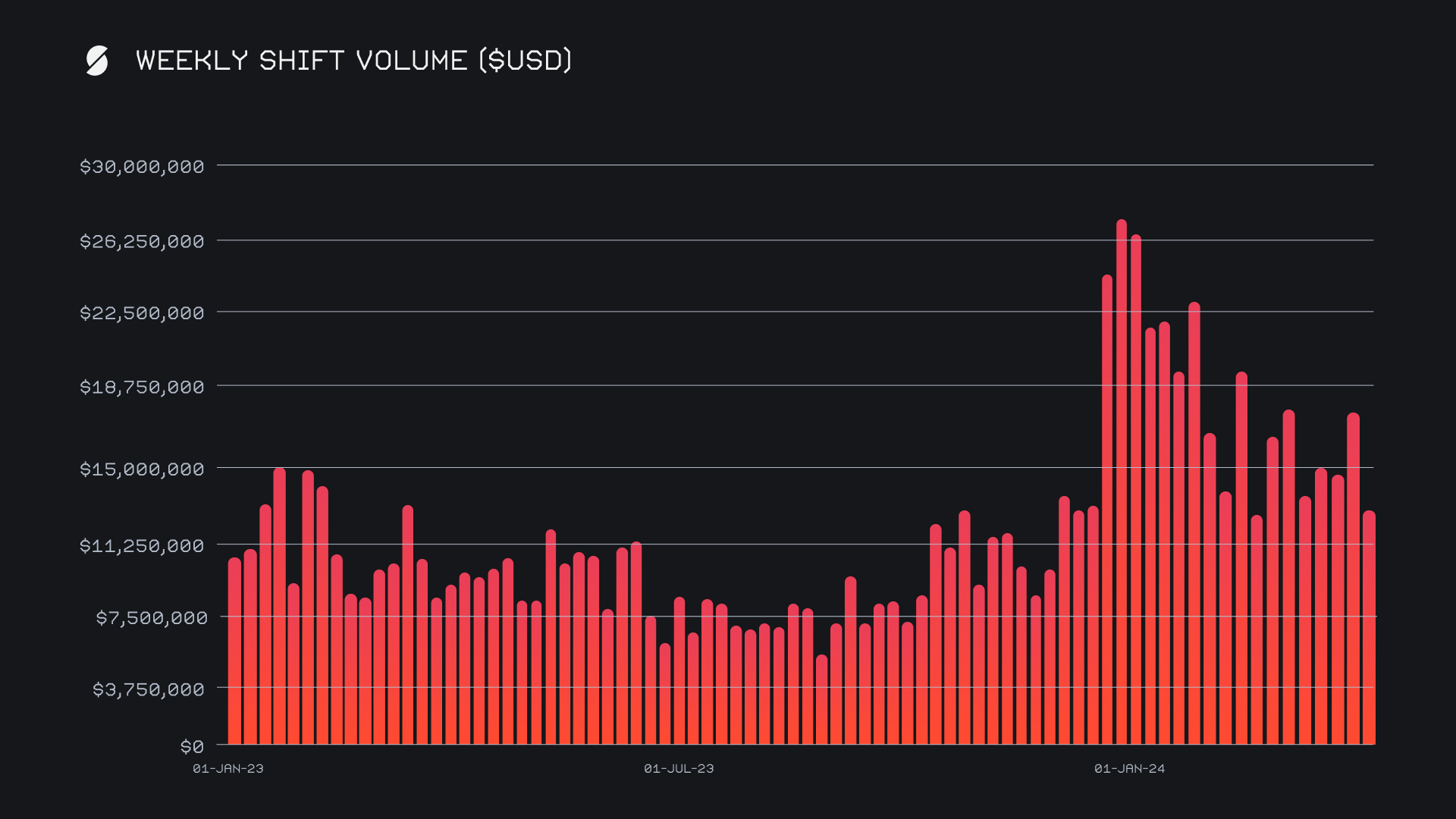

SideShift had a slower performance when compared to the previous week’s strong showing, but still ended with a respectable gross volume of $12.9m (-26.9%). Our volume was impacted by both a sharp decline in weekly SOL shifting, as well as lower valued shifts on average taking place directly on the site. This occurred alongside a shift count which remained mostly unchanged and fell -3.3% for a total 8,383 shifts. Although a minor decrease on the weekly timeframe, this shift count still sits ~10% higher than the running average tracked since the beginning of 2023. Together, these figures combined to produce daily averages of $1.8m on 1,195 shifts.

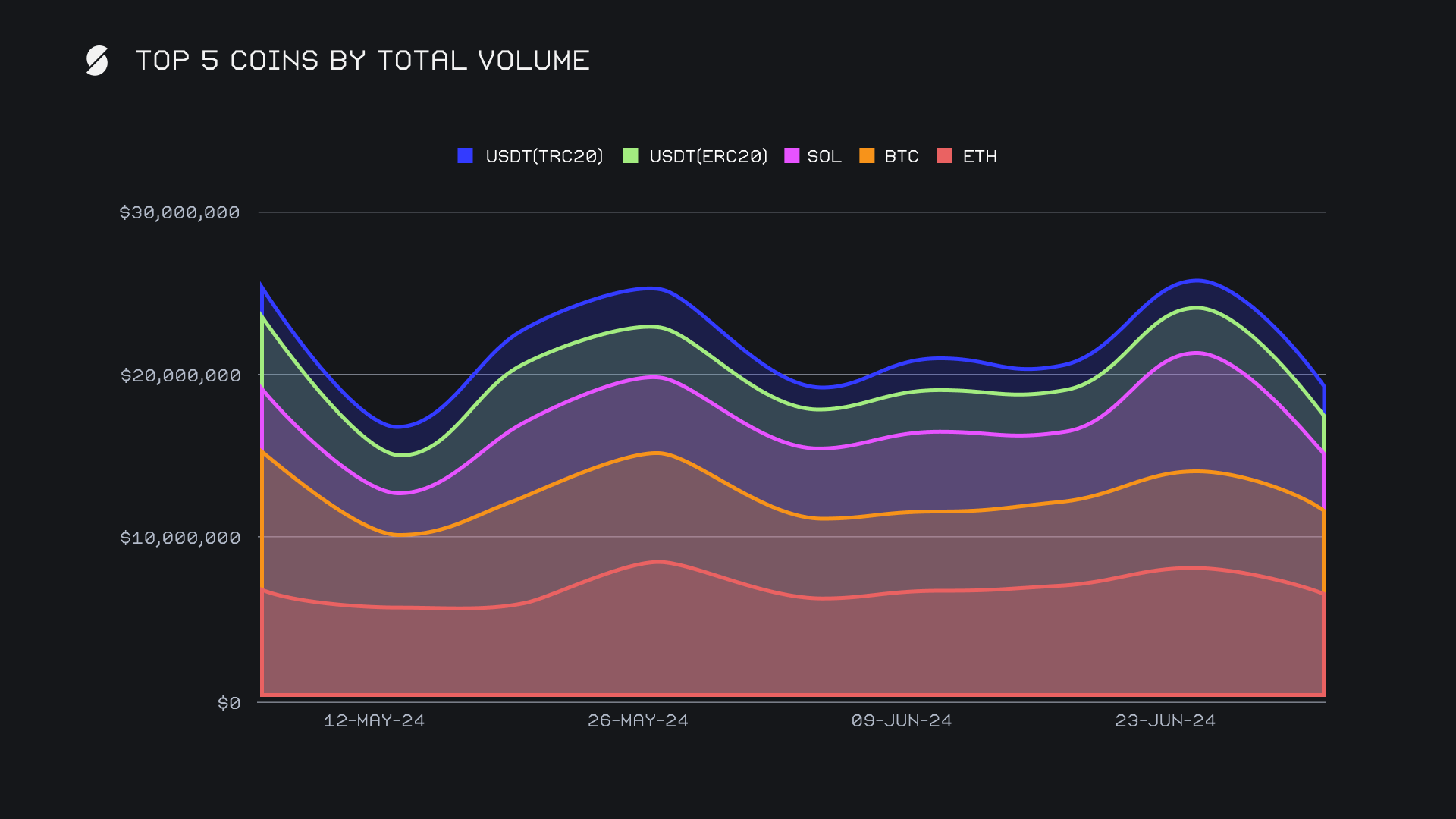

ETH retained its position as our top coin for an impressive sixth straight week and achieved a total weekly volume of $5.9m, though it marked a decline of -27.2%. The decrease was caused by a drop in both deposit volume, which ended with $2.3m (-22.9%), and settlement volume, which fell to $2.4m (-10.4%). Despite the downturn, ETH continues to be a significant part of our volume, reflecting its ongoing popularity among users. This is exemplified by the fact that ETH remained involved in both of our top two shift pairs - BTC/ETH with $897k, followed by ETH/SOL with $794k.

BTC followed closely behind in second place with a total volume of $5.5m, experiencing a slight decrease of -7.4% from the previous week. Nevertheless, this was still the closest BTC has been to reclaiming first place overall since it was surpassed by ETH six weeks ago. This decline was influenced by a reduction in deposit volume to $2.2m (-15.3%), while settlement volume attracted more attention than last week, and rose to $2.0m (+18.7%). The rise in settlements suggests an increased user interest in shifting to BTC, even as its overall volume saw a slight dip.

SOL recorded the most dramatic change among our top coins, dropping to third place with a total volume of $3.2m, down by a hefty -55.8%. This substantial decrease was due to a fall in both deposit volume, which fell to $1.2m (-17.4%), and settlement volume, which plummeted to $1.6m (-50.9%). Interestingly, this total volume decline occurred despite some positive developments in the Solana space, such as a SOL ETF filing and subsequent price appreciation for the native token. This marks a stark contrast to SOL’s previous weeks of high performance with significant demand, which saw $7.2m in total volume, with $1.7m deriving from the ETH/SOL pair alone. Outside of the top 5, our other coins saw varied outcomes. The most notable changes here were the major falloff of BCH, which dropped -72% to $352k, and the +161.7% spike in TON shifting, which finished with a total of $458k. TON also witnessed a +60% jump in user shift count, as its final count of 618 represents the most completed in any week since its listing.

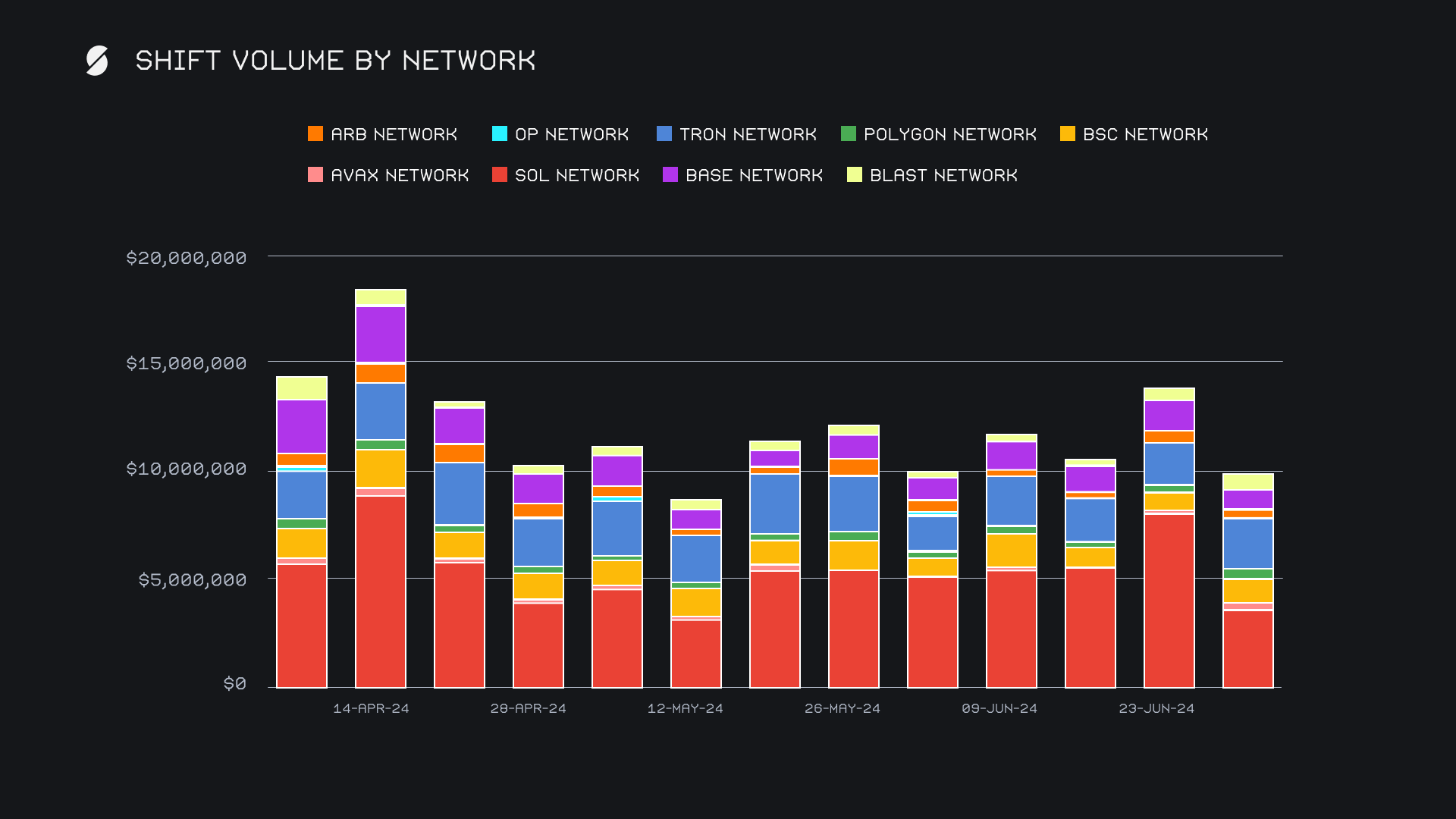

Although still leading alternate networks to ETH, the Solana network was hammered due to the previously mentioned change in demand for the native SOL token. However, it was not solely to blame, as USDC (sol) also incurred a sizable decrease of -63% and ended with $296k, thereby further contributing to the overall decline. All together, the Solana network combined for $3.7m, a drastic -54.6% decrease from last week’s sum. Even though this ended up being the lowest total for the Solana network in more than 3 months, it still comfortably remained atop the alternate networks to ETH grouping. Next came the TRON network, which enjoyed a rise and came in second with $2.3m (+18%), followed by the Binance Smart Chain (BSC) network in third with $1.1m (+24.6%), which rose thanks to a +90% spike in shifting of the native BNB token. Conversely, the Base network dipped -38.2% to round off the week with $882k, after finishing the past 5 weeks with a volume greater than $1m.

In listing news, SideShift added support for Rootstock (rBTC) this week, a project which brings smart contracts to the Bitcoin ecosystem. Shifting to RBTC is now live, directly from any coin of your choice.

Affiliate News

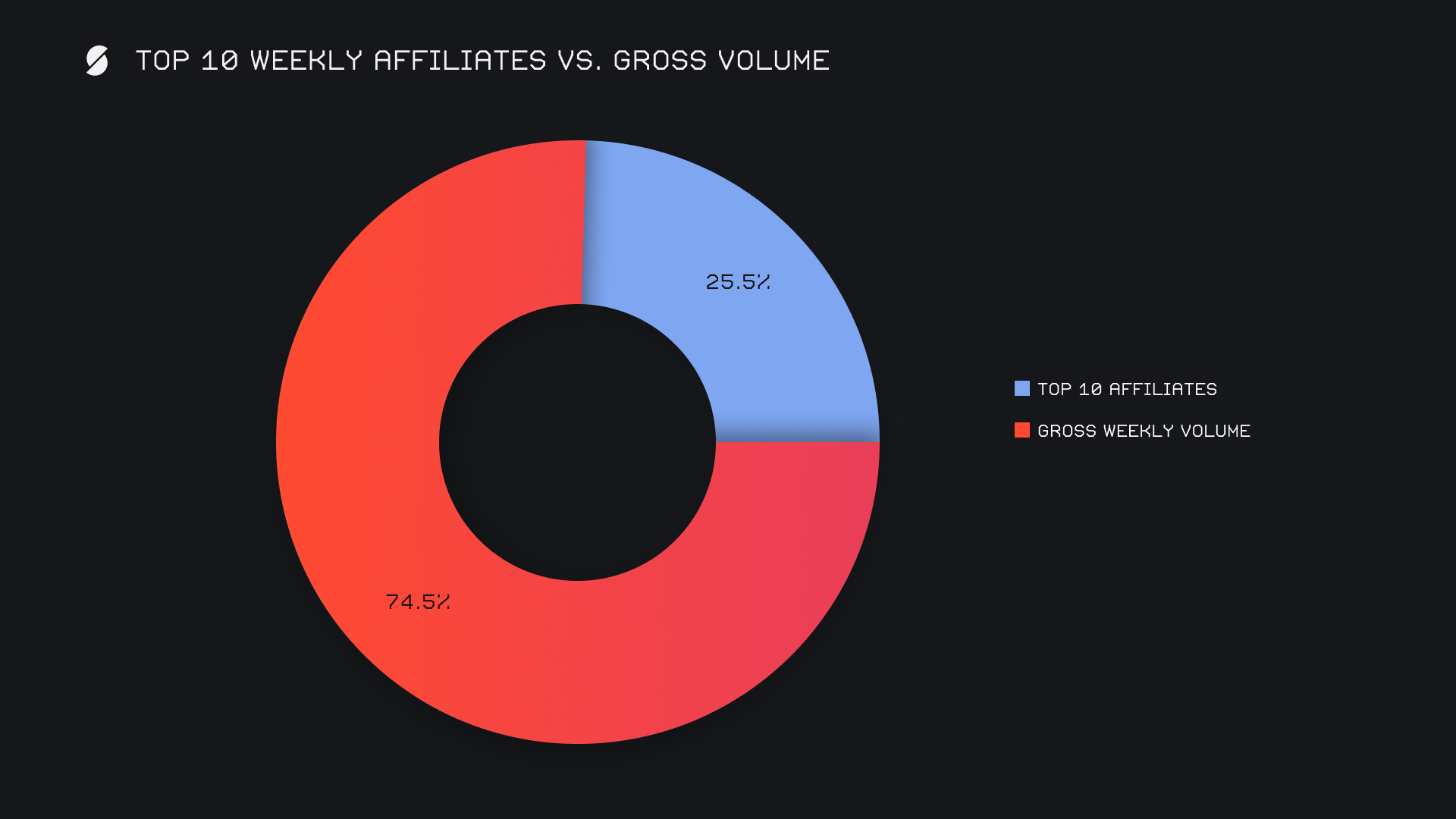

This week, our top affiliates generated a combined total volume of $3.3m, marking a decline of -12.7% from the previous period, but decreasing at a slower rate than our overall volume. Our top affiliate remained unchanged, and rounded off the week with $1.3m (-1.8%). Our second placed affiliate noticed a larger change with volume falling by -12.5% for $1.1m, although it ended with a very respectable count of 792 (+15.3%), easily ending as the highest count among affiliates. Our third placed affiliate saw the most significant decline among the top three, dropping -22.7% for $619k. Despite these declines, our top three affiliates continue to account for the vast majority of affiliate shifting.

Altogether, our top affiliates accounted for 25.5% of our total weekly volume, +4.1% increase from last week’s proportion.

That’s all for now. Thanks for reading and happy shifting.