SideShift.ai Weekly Report | 26th March - 1st April 2024

Welcome to the ninety-eighth edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

This week SideShift token (XAI) moved within the 7 day price range of $0.1763 / $0.1852. After falling to the range low over the weekend, XAI rebounded right back to the top to end the period. At the time of writing XAI is sitting right at the upper end of that range at a price of $0.1840, and has a current market cap of $24,538,567 (+2.3%).

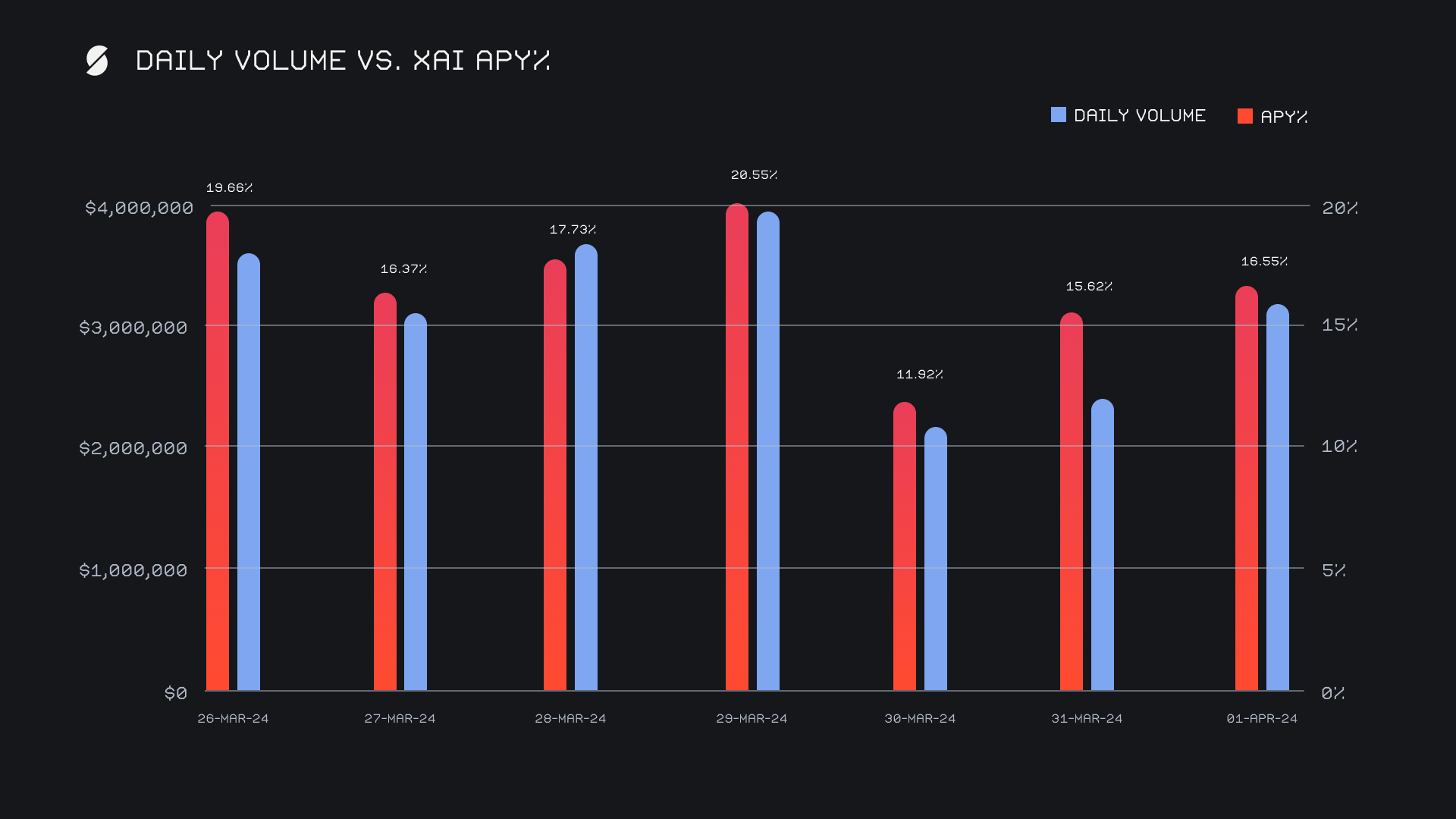

XAI stakers were rewarded with an average APY of 16.91% this week, with a daily rewards high of 60,388.77 XAI (an APY of 20.55%) being distributed to our staking vault on March 30th, 2024. This was following a daily volume of $3.9m. This week XAI stakers received a total of 352,870.78 XAI or $64,928.22 USD in staking rewards.

SideShift added an additional 6 WBTC and 60,000 MNT to its treasury over the course of the week, bringing the current total to a value of $15.77m. Users are encouraged to follow along directly with live treasury updates, via SideShift.ai/treasury.

Additional XAI updates:

Total Value Staked: 118,204,030 XAI (+0.3%)

Total Value Locked: $21,310,227 (-1.2%)

General Business News

A mostly sideways moving week in the general market concluded with a quick drawdown, sending BTC back down toward the $66k mark. BTC however was not the only victim, as the vast majority of coins saw their prices plunge by double digit percentages on the weekly timeframe.

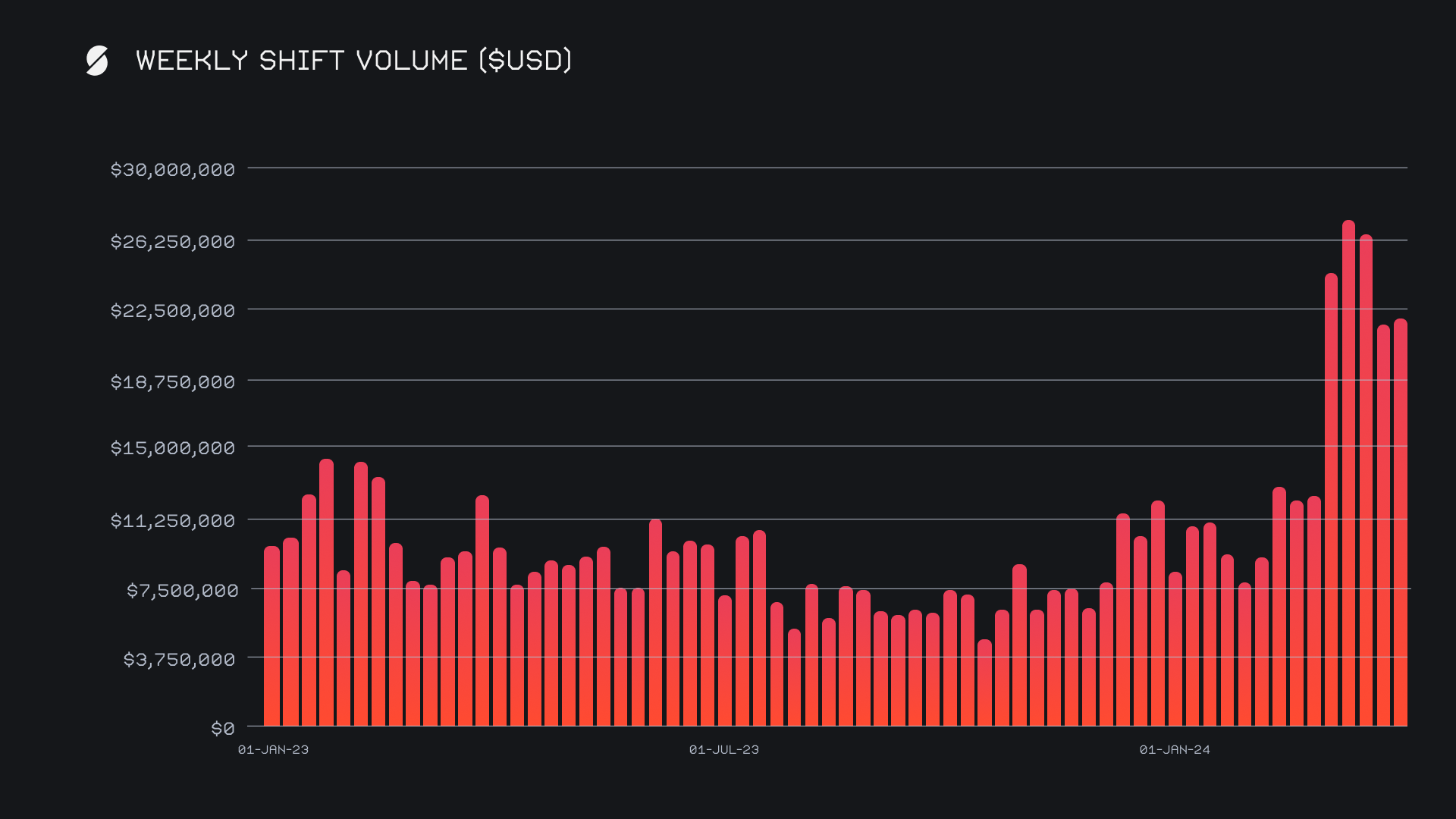

This past week marked the conclusion of SideShift’s strongest month to date, and by a long shot. Beginning with weekly metrics, we ended the period with a healthy gross volume of $21.9m alongside a shift count of 11,368. Both of these figures were incredibly consistent with what we noted in the last report, so much so that they both varied by less than 1%. This steady performance helped to solidify an impressive monthly gross volume of $107.1m for March, 2024 - to provide some scale, this compares to monthly totals of $42.2m in January, and $55.1m in February 2024. A powerful visual of this recent growth is illustrated in the below chart, where we can compare it to the whole of 2023 and really note the significance of the recent uptick in volume. Together, this week’s gross figures combined to produce daily averages of $3.1m on 1,624 shifts.

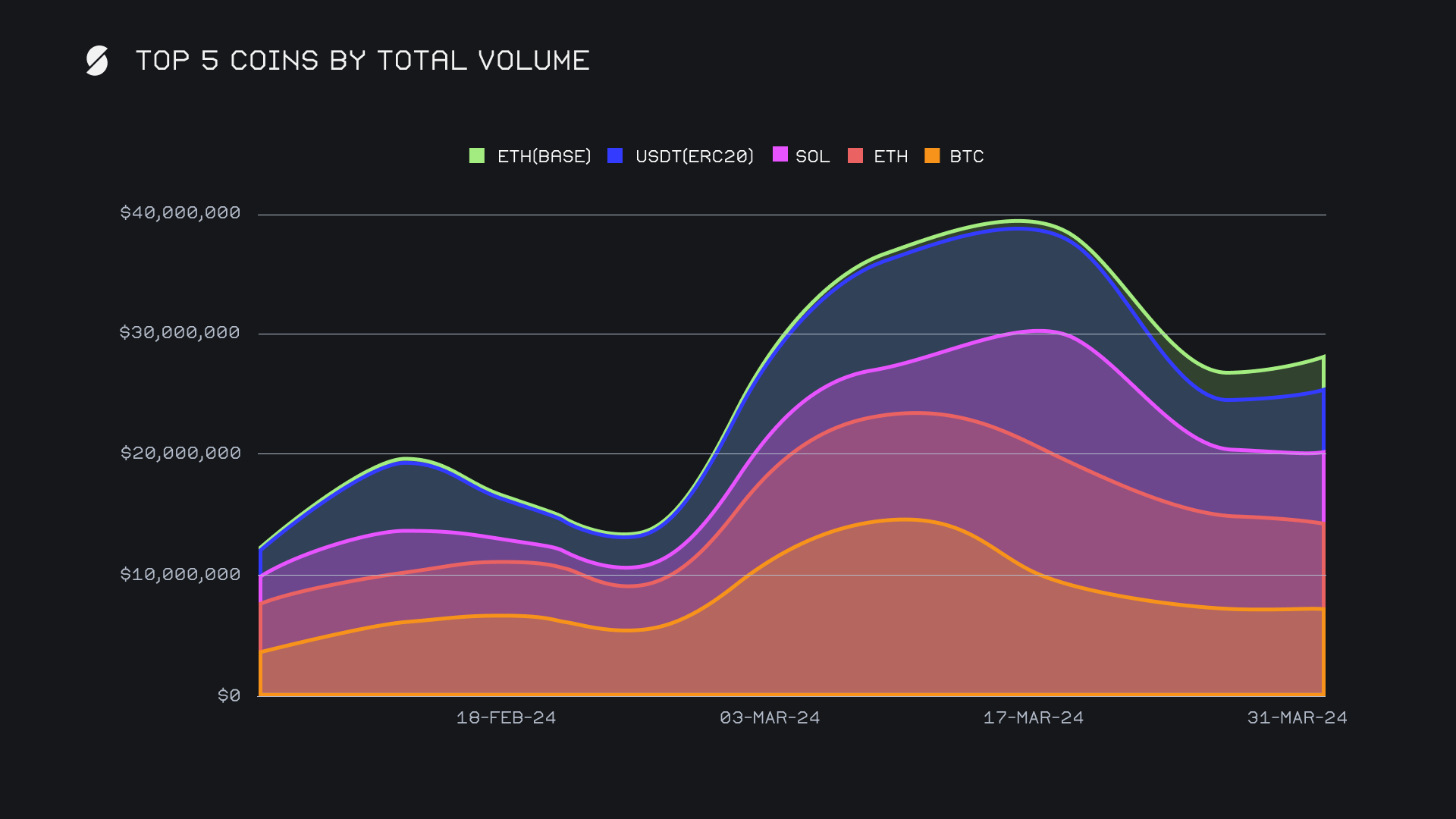

Our top 5 coins by total volume (deposits + settlements) finished with a combined $28.6m, approximately +4% higher than last week’s sum. This amounted to approximately 65% of our weekly total, a proportion regularly seen throughout the past year. The composition of our top 5 remained mostly the same, with the exception of one eager newcomer. Beginning with our top coin - BTC regained the top spot after sitting in either second or third place for the previous two weeks. It did so with a total volume of $7.6m (+3.5%), a breakdown which heavily favored user deposits to settlements by a measure of $3.8m to $2.2m. Over 1/3 of this deposited BTC volume was shifted into USDT (ERC-20), as the BTC/USDT (ERC-20) pair remained the most popular shift pair among users. With that in mind, it is worth mentioning that both SOL/ETH and ETH/SOL continue to see respectable shift volumes, as they finished with respective totals of $845k and $723k. As of late these three coins have been in an ongoing battle for first place, constantly swapping places with each other. Ultimately, it was no surprise to see BTC prevail this week with the market mostly rolling along sideways.

ETH finished in second with a total volume of $6.8m, despite showing the largest decline among any top coin with a drop of -16.2%. Interestingly, this coincided with a spike in shift activity of ETH on other chains. Despite both of these facts, the overall decline in total volume was not a reflection of a lack of interest from users. ETH actually ended up being the most demanded coin this week, with user settlements ending with a sum of $3.3m (-3%). Instead, it was a far more substantial decline of -27% in user ETH deposits which caused the general drop. In this way, BTC and ETH opposed each other this week, with one coin heavily favoring deposits and the other favoring settlements.

SOL followed in third, with a much more balanced outcome. Although falling nearly -50% from the standout showing seen two weeks ago, SOL has maintained momentum and ended the past two periods with weekly total volumes greater than $5m. This week’s $6.0m (+4.6%) in total volume came from a near dead even split of ~$2.4m in both user deposits and settlements, a testament to SOL’s continued strength on SideShift as of late.

Emerging out of the blue this past month was ETH (base), which managed to rise to join our top 5 coins for the first time since on SideShift. It did so with a total volume of $2.8m (+24.6%), a sum 10x higher than that seen just one month ago. In addition to this, we saw a great showing from ETH (blast) for the second straight week, as it ended with $1.4m (+12.1%). It is true that this week’s top 5 occupied a more concentrated percentage of total volume, but it was still inspiring to see a fairly widespread source of volume as we once again saw all of our top 10 coins exceed the $1m total volume mark. BNB remained in this standout grouping with $1.1m, while a +52% spike in total volume saw BCH with $1.6m, marking the highest positive change among any of our top 10 coins.

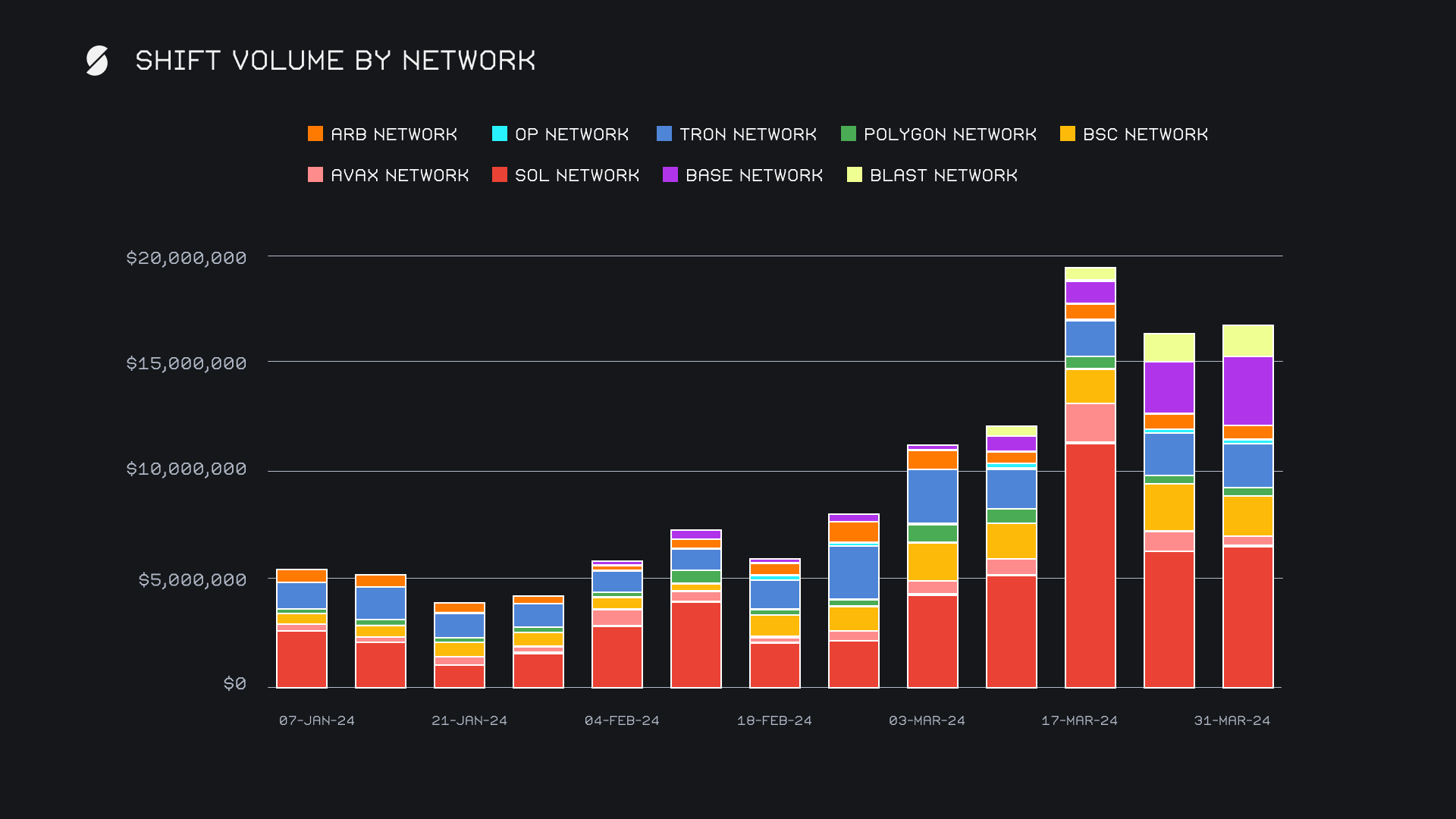

Aside from the native ETH token seeing steady demand, this week users actually preferred to use alternate networks. While the Ethereum network came to account for ~33% of weekly shift volume, all alternate networks combined for a larger ~38%. This is one of only a few instances to date where alternate networks have come to represent a larger volume proportion than Ethereum. Firmly leading this group was the Solana network with $6.8m (+5.4%). This was followed by the Base network with $3.2m (+27.6%), which has moved from near 0 to now second place in the span of 2 months. The Tron network came in third with $2.1m (+8.2%), driven by USDT (TRC-20) shifts as it usually is. Although most alternate networks saw increased shift activity, one of the few that didn’t was the Avalanche network. It dropped a substantial -60.1% to end with a total $359k, after seeing back to back weeks of nearly $1m in shifting of the native AVAX token.

Affiliate News

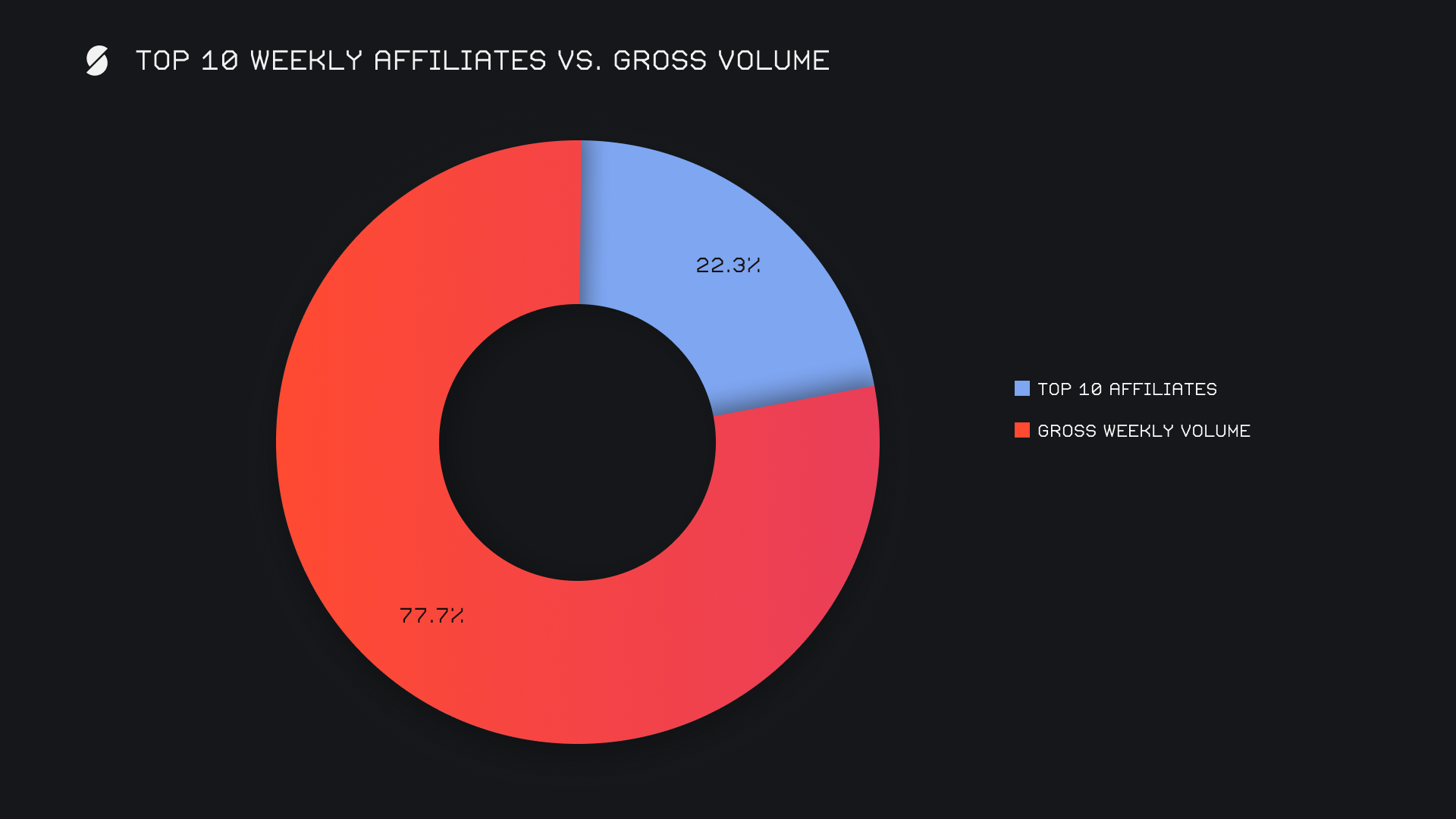

SideShift’s top affiliates came together for a combined $4.9m, a -4.2% change from last week’s sum. Combined shift count however was slightly up, and grew +3.3% for a total 2,291 shifts. This was predominately thanks to our top affiliate this week, which ended with a majority 1,275 shifts. It also reclaimed its place as our top affiliate for the week, doing so with $1.8m (+42.1%). Among our top affiliates, it was the only one to see an increase in weekly volume. Second and third place carried on as normal, with respective volumes of $1.5m and $1.1m.

All together, our top affiliates accounted for 22.3% of our weekly volume, -1.1% lower than last week’s proportion.

That’s all for now. Thanks for reading and happy shifting.