SideShift.ai Weekly Report | 26th November - 2nd December 2024

Welcome to the one hundred and thirty-third edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

SideShift token (XAI) maintained stable price action this week, trading within a tight 7-day range of $0.1508 to $0.1545 before closing at $0.1555, a modest rise to the upper end of its range. This consistency resulted in a slight increase in its market cap, which now sits at $22,044,273, up +1.7% from last week’s $21,676,004.

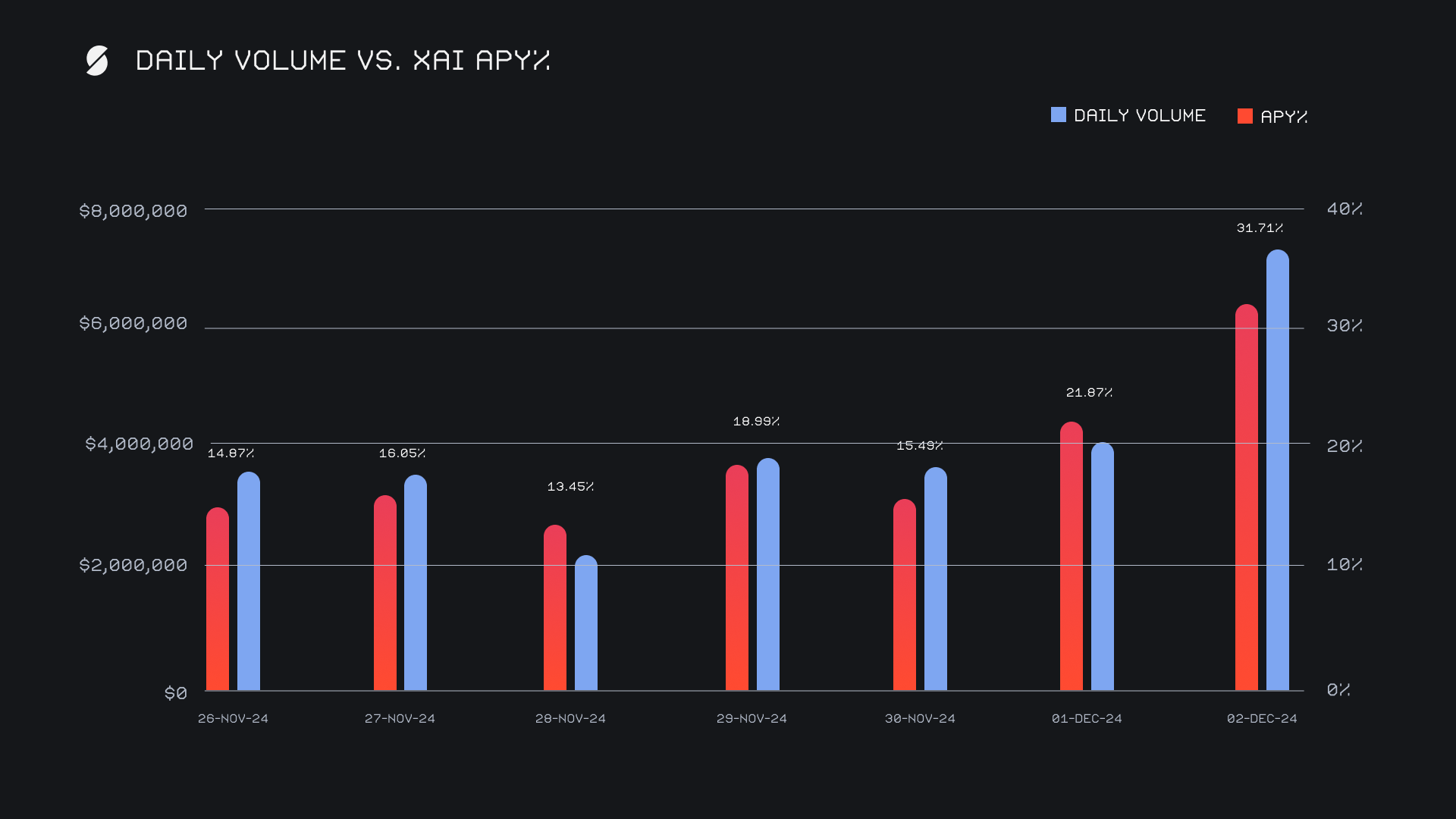

XAI staking continued to deliver strong rewards, with stakers earning an average APY of 18.92%. The week’s standout moment came on December 3, 2024, when a daily rewards high of 95,341.03 XAI was distributed to our staking vault, corresponding to a peak APY of 31.71%. This was fueled by SideShift achieving a new daily volume record of $7.2m, breaking the previous high of $6.4m, which was attained last week. In total, stakers were rewarded with 416,463.10 XAI, equivalent to $64,760.01 USD, further demonstrating the benefits of participating in XAI staking.

An additional 2 WBTC and $100,000 USDC (ERC-20) was deposited to SideShift's treasury over the course of the week, bringing the current total to a value of $22.89m. Users are encouraged to follow treasury updates directly via sideshift.ai/treasury.

Additional XAI Updates:

Total Value Staked: 126,478,050 XAI (+0.3%)

Total Value Locked: $19,767,830 (+3.3%)

General Business News

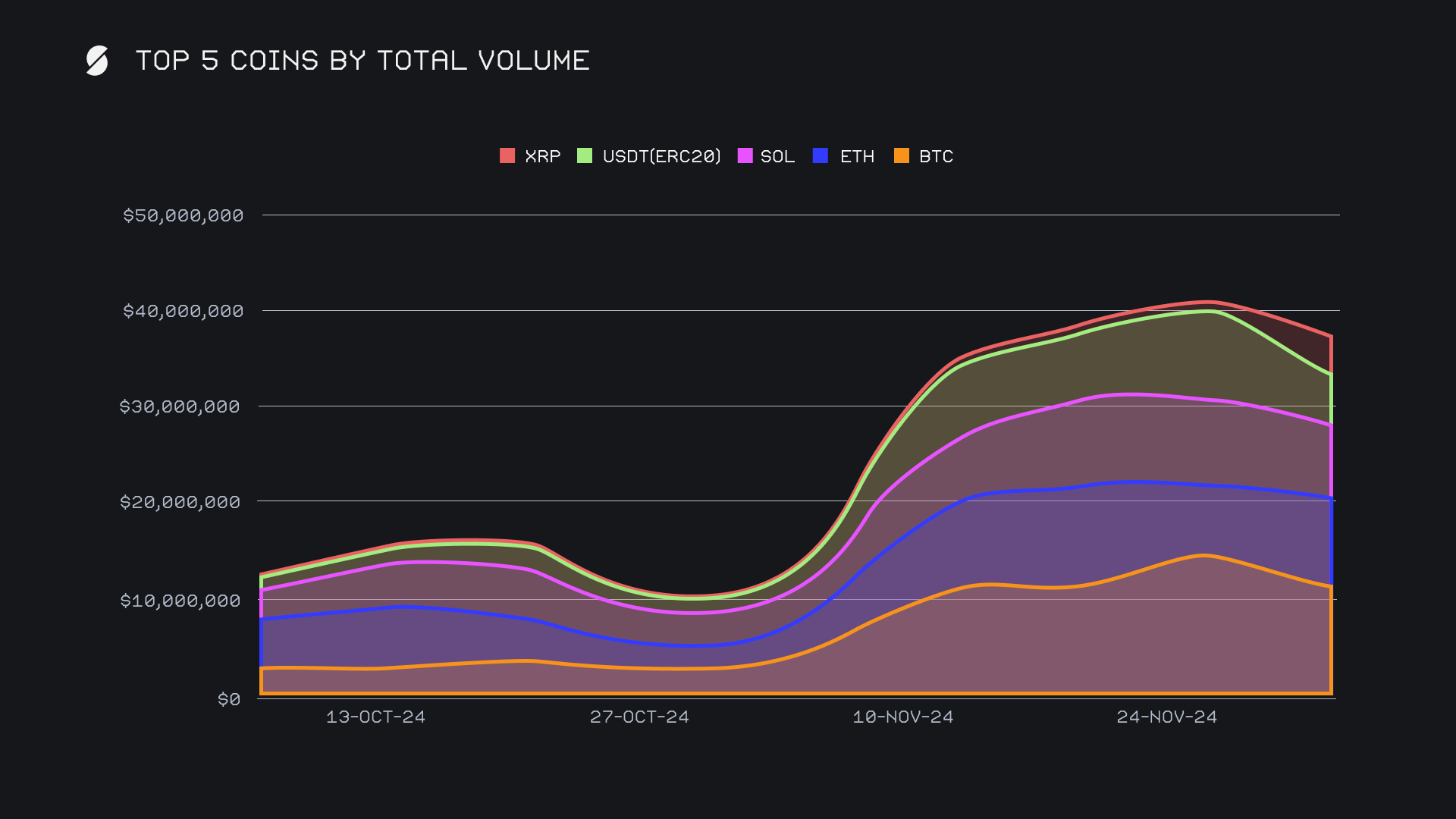

This past week, XRP dominated the headlines by reclaiming its position as the third-largest cryptocurrency by market cap after surpassing Tether. The move came amid a sudden +380% surge over the past month, driven by optimism surrounding its regulatory outlook and broader adoption prospects. Bitcoin ETFs also saw inflows of $6.4 billion in November, while Ethereum investment products hit a record $2.2 billion in annual inflows, signaling growing momentum in altcoin markets alongside Bitcoin’s stability near $100K.

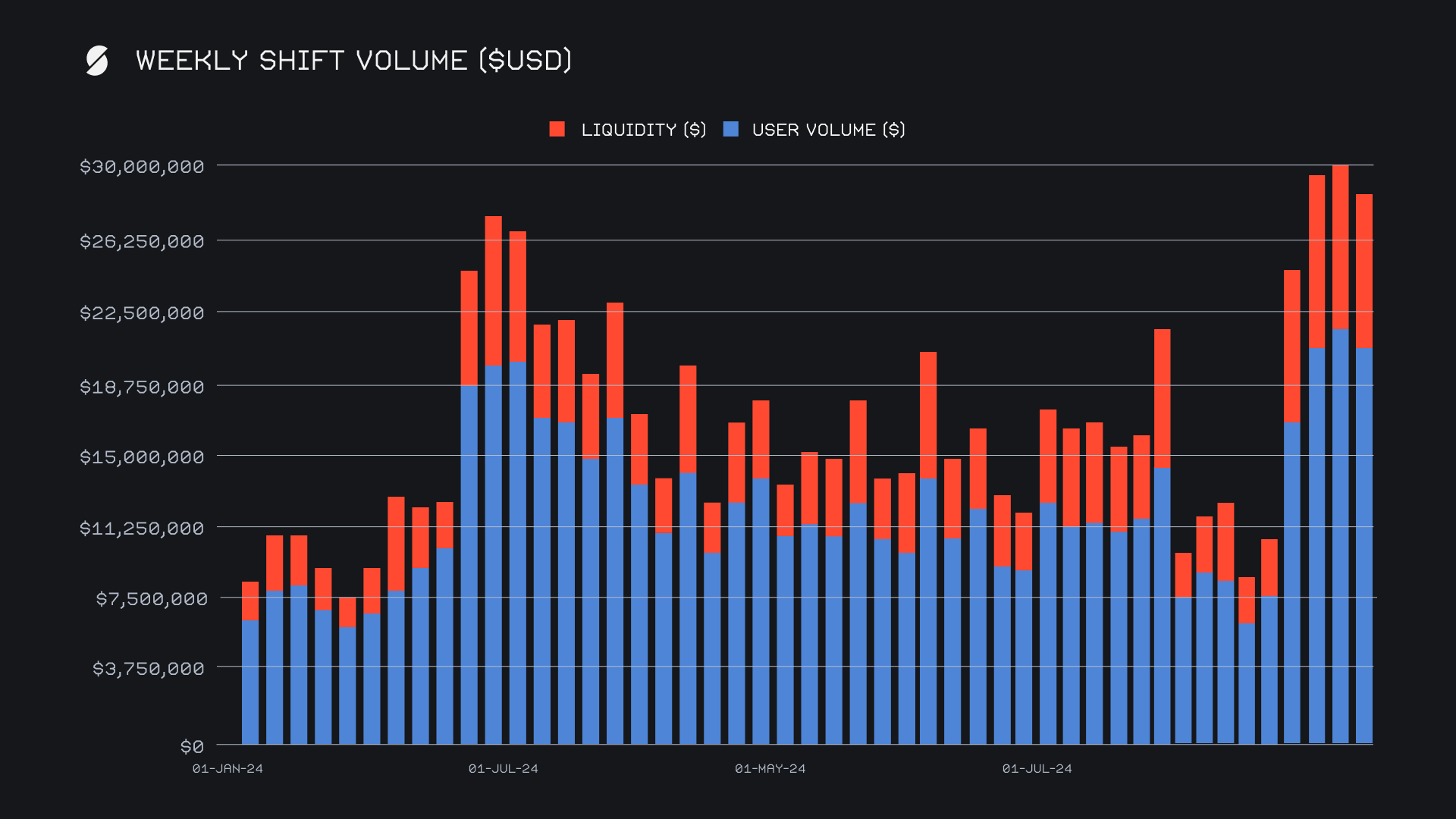

SideShift delivered another strong performance and achieved a handful of firsts, while ending with a gross weekly volume of $28.3m. This week saw user shifting contribute $20.7m (-3.2%), while liquidity shifting added a further $7.6m (-9.6%) to support platform-wide operations. While this sum marked a slight -5.0% decline from last week’s record-setting total, it still reflected SideShift’s remarkable momentum, and contributed to the achievement of a monthly all-time high volume of $103m in November 2024 - this was the first time SideShift’s total volume has breached the $100m level on a monthly timeframe. In addition to the monthly milestone, December 2nd, 2024, stood out with $7.24m in volume processed across 2,302 shifts, setting new daily records for both metrics.

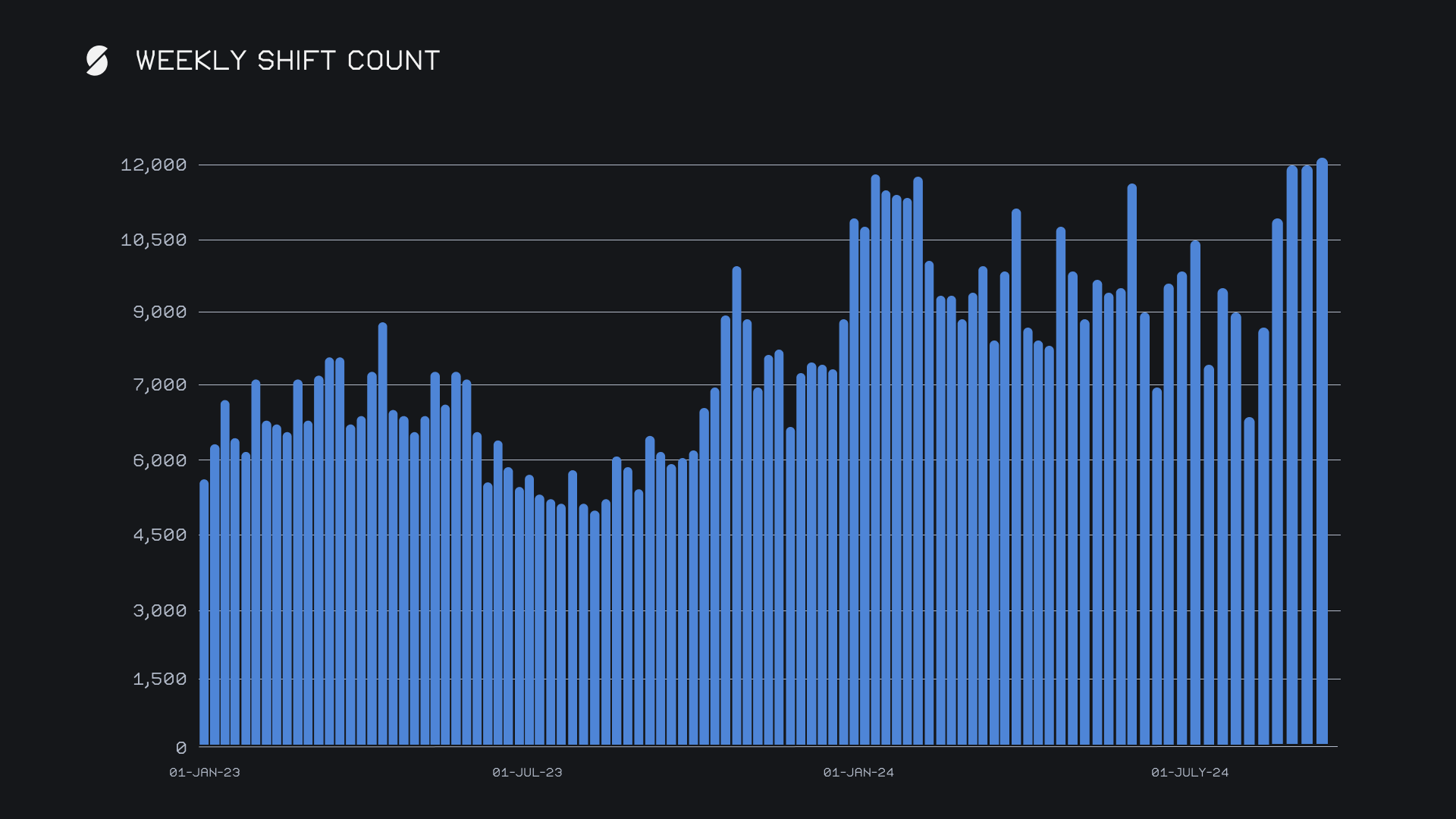

User engagement reached unprecedented levels with a weekly shift count of 12,268, a +2.2% increase from the previous week and the highest total count ever achieved in a single week. This marked the third consecutive week of exceeding 12,000 shifts, underscoring SideShift's sustained demand among users, and use case across a variety of chains. Despite the broad diversity in shifting, the always popular shift pairs of ETH/BTC ($1.42m) and SOL/ETH ($1.20m) re-emerged as the favorites among users, capturing a decent portion of users’ attention this week.

BTC retained its crown as the most shifted coin, delivering a weekly volume of $10.6m (-27.0%). This week marked a notable shift in user behavior, with settlements climbing to $4.0m (+25.8%) while deposits fell significantly to $4.5m (-41.4%), reversing the trend outlined in the previous report. This flip in directionality points to users buying BTC, signaling a sense of confidence in the asset as they position themselves for a hopeful continuation upwards.

ETH made a strong comeback, reclaiming second place with $9.6m in total volume (+25.2%) after slipping to fourth last week. Bolstered by some long-awaited price momentum, user activity increased, with deposits reaching $4.0m (+19.8%) and settlements totaling $3.1m (+18.4%). Its steady growth resulted in ETH achieving one of the highest percentage gains among any top coin, second to only XRP this week.

SOL secured third place with $7.6m in total volume (-9.6%), but seems to be losing its edge, at least for the time being. Settlement volume continued its downward trajectory for the third consecutive week, falling to $3.0m (-17.4%), while deposits climbed to $2.8m (+32.4%), painting a picture of mixed interest. Meanwhile, XRP has taken the spotlight, recently overtaking SOL in market cap - a shift mirrored in its performance on SideShift.

Riding a sudden price surge, XRP vaulted into fifth place with an impressive $4.1m, driven by a staggering +266% increase in total volume, a far cry from what it was achieving just a month ago. On our record setting day of December 2nd, 2024, XRP shifting represented 27.4% of the daily total. Overall, this growth came from a balanced split between deposits and settlements, which totaled $1.3m (+263.9%) and $1.4m (+205.9%), respectively, solidifying its standout week.

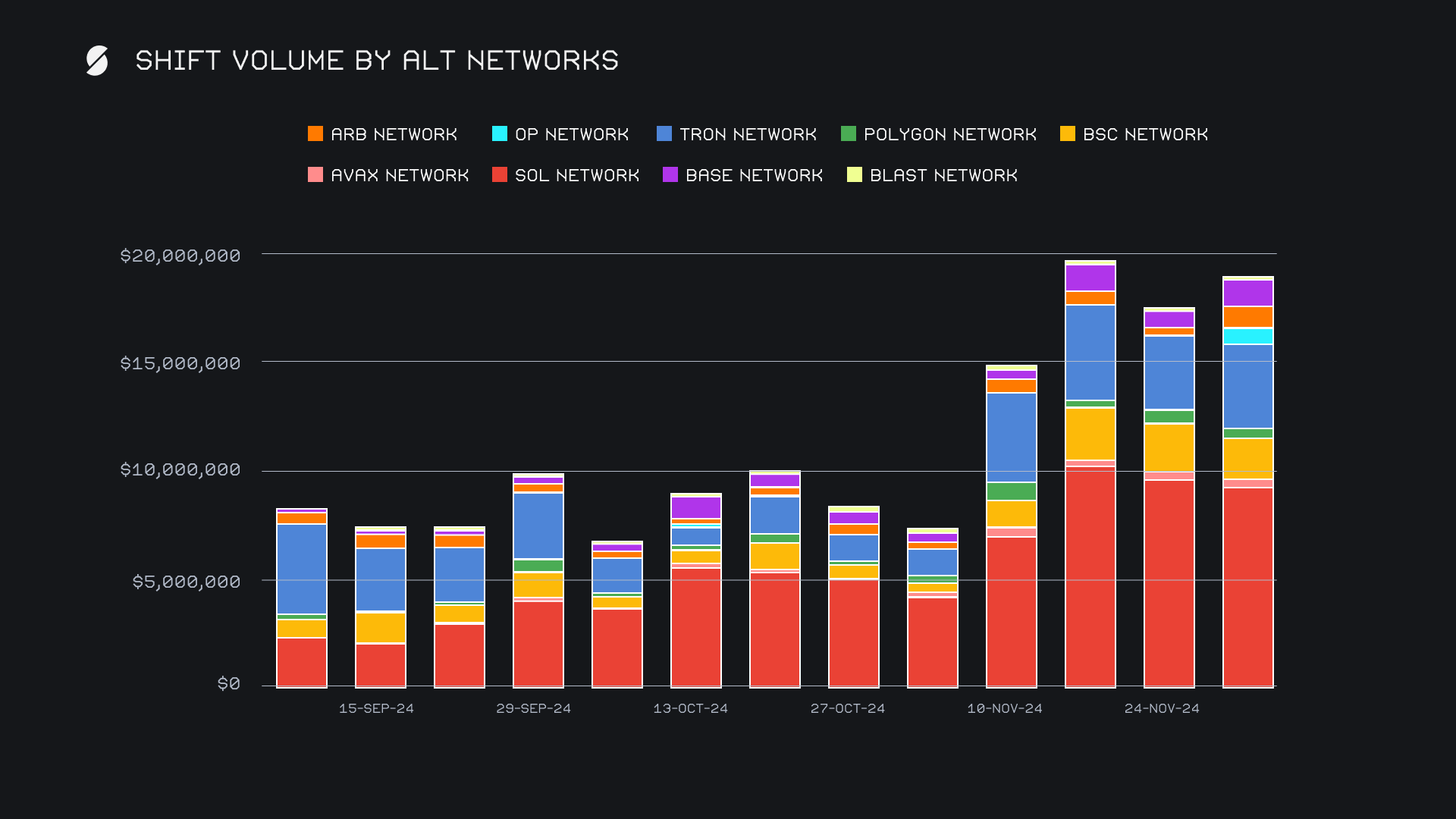

Alternate networks to ETH combined for $19.0m in total volume, rising +8.4% as L2s took the spotlight. The Solana network remained the leader with $9.3m (-2.3%), as shift activity for Solana-based tokens helped to balance out the dip in native SOL demand. The TRON network followed with $3.9m (+11.6%), thanks to the always steady shift action of USDT(TRC20). Meanwhile, Layer 2 networks saw healthy growth among most, with the Base network climbing to $1.2m (+65.1%), the Arbitrum network surging to $1.1m (+215.2%), and the OP network making a dramatic leap to $634k (+5093.5%) - its strongest week on record. In contrast, both the BSC and Polygon networks eased off, finishing at $1.9m (-17.6%) and $463k (-14.1%), respectively, reflecting a broader dispersion of shifting activity across networks.

In listing news, SideShift added support for Solana memecoins PNUT,FWOG and CHILLGUY, Coq Inu on the Avalanche network, Instadapp on the Ethereum network, and Artificial Superintelligence Alliance (FET) on the Fetch network. Shifting of all of these coins is now live, directly from any coin of your choice.

Affiliate News

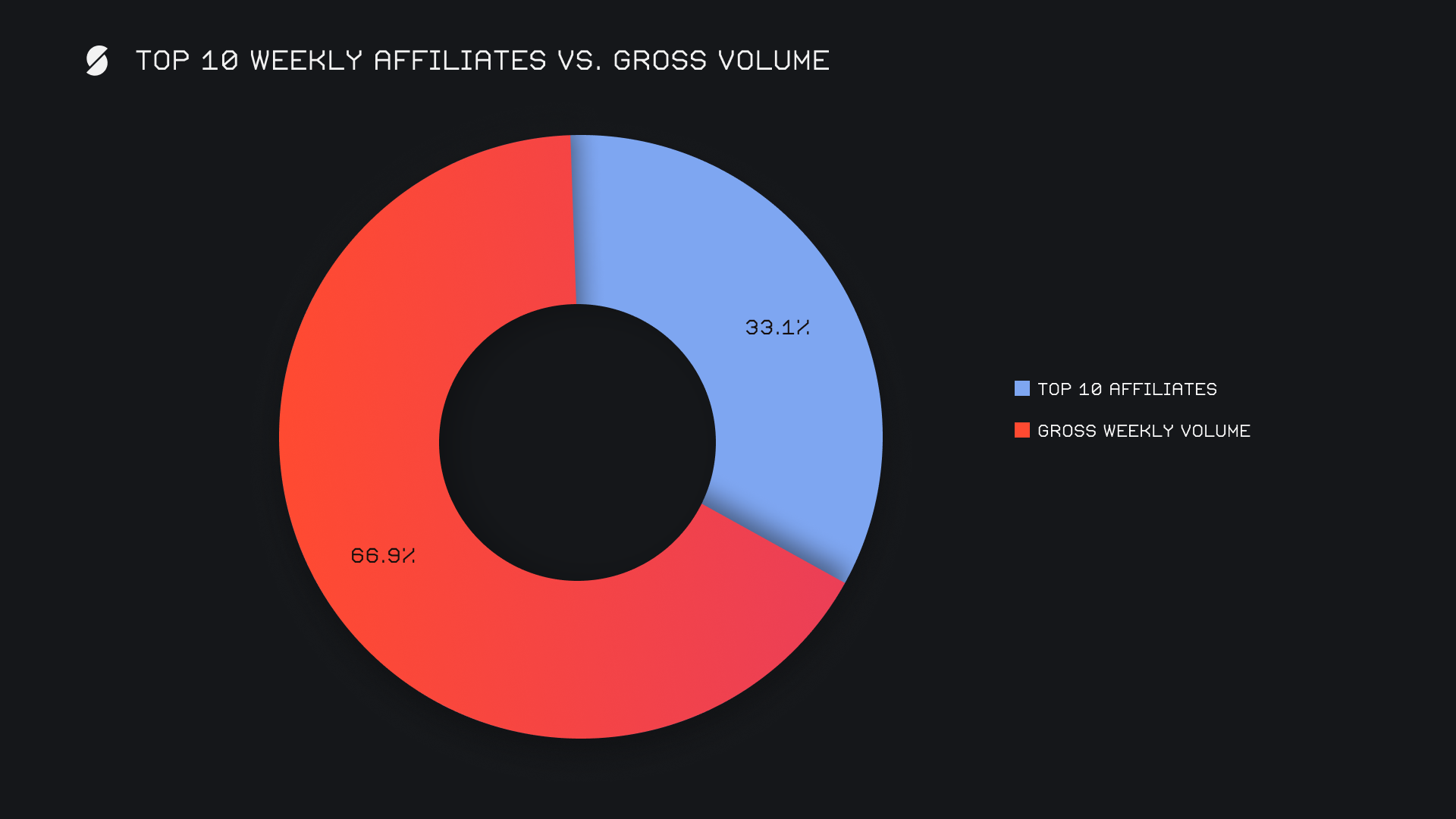

Our top affiliates maintained a strong presence this week, contributing a combined $9.4m in shift volume (-22.6%). Although this was a decline compared to last week’s exceptional total, activity remained solid. Our new first placed affiliate soared to the top on the back of its highest-ever weekly volume, rounding off the period with a commanding $3.8m (+12.1%). Our second placed affiliate remained unchanged, demonstrating consistent shift action with $3.1m (+1.3%). Our former leader slipped to third place with $1.2m (-73.2%), yet it still managed to dominate shift count with a leading total of 1,352 shifts among affiliates.

All together, our top affiliates represented 33.1% of our weekly total, -7.5% lower than last week’s proportion.

That’s all for now. Thanks for reading and happy shifting.