SideShift.ai Weekly Report | 27th January - 2nd February 2026

Welcome to the one hundred and eighty-ninth edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

Highlights

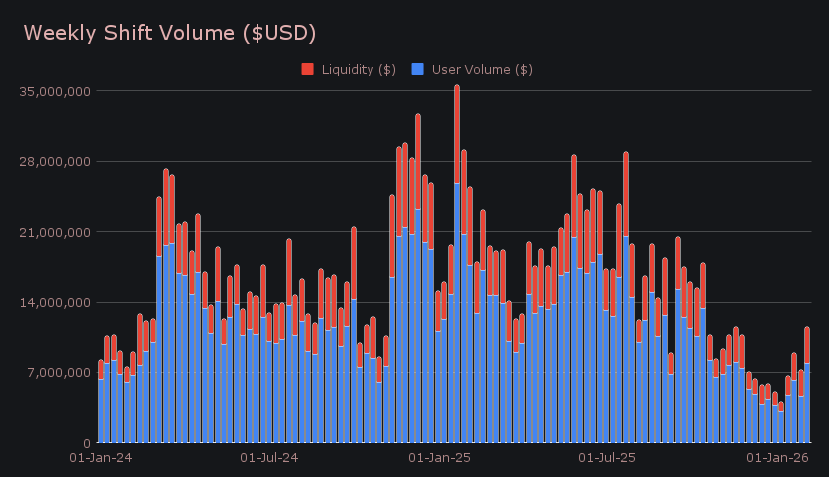

- SideShift volume rebounded to $11.98m (+60.5%), the strongest weekly total since early October, with volume holding above $1m on six of seven days.

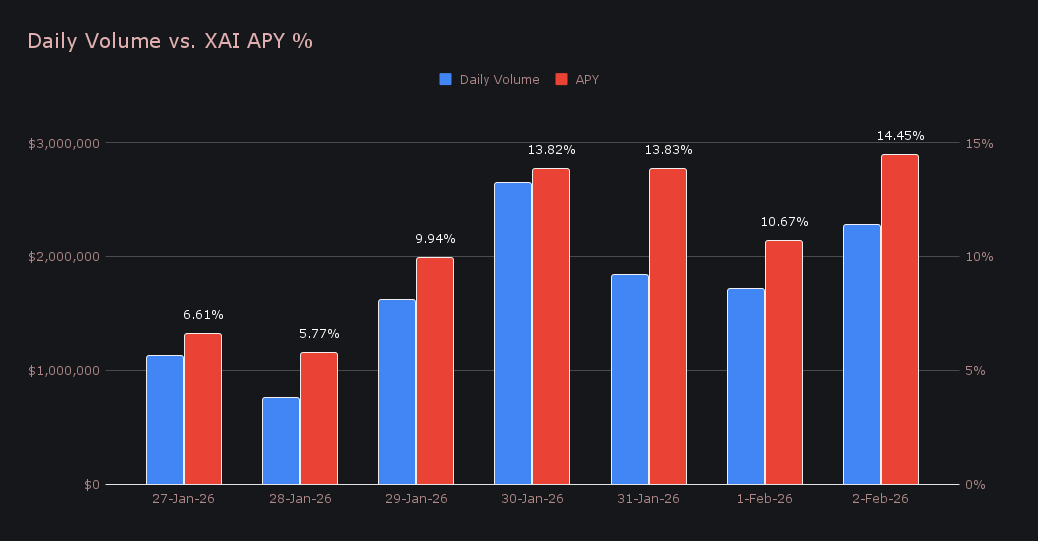

- XAI stakers earned 274,060 XAI ($30.3k) at a 10.73% average APY, with rewards peaking at 14.45% on February 2 alongside $2.28m in daily volume.

- BTC led all assets with $6.81m in total volume (+134.0%), powered by a sharp return of two-way shifting as settlements surged +600.5%.

- Stablecoin behaviour flipped decisively, with net flows of +$801k marking a $1.87m swing from last week as users rotated out of stables during volatility.

- Alternate networks climbed to $6.52m (+42.4%), led by Tron reclaiming $2m and a notable AVAX revival from a near-idle base.

XAI Weekly Performance & Staking

XAI moved through a choppier week on the price front, trading largely between the high-$0.10s and low-$0.11s before settling at $0.1079 at the time of writing. Price action held steady through the early part of the period, before a modest mid-week dip pushed XAI toward the lower end of that range. From there, trading stabilised into the close. Viewed over 30 days, the chart remains largely flat, placing this week’s movement firmly within the same narrow band XAI has respected for most of the past month. Market cap finished at $16.79m, a −3.0% change from last week’s $17.31m.

Across the same stretch, 274,059.64 XAI ($30,334.90) was distributed to stakers, comfortably ahead of last week’s payout and supported by consistent SideShift volume that lifted the average APY to 10.73%. Activity reached its high point on February 2nd, when 52,103.80 XAI was sent to the staking vault at a 14.45% APY alongside $2.28m in daily volume. Rewards were sustained across multiple days rather than concentrated in a single spike, allowing yields to remain elevated even as price action stayed contained.

Additional XAI updates:

Total Value Staked: 141,072,316 XAI (+0.1%)

Total Value Locked: $15,165,886 (−4.7%)

General Business News

Global markets were jolted this week after a sharp selloff in precious metals wiped an estimated $15 trillion from gold and silver, with gold retracing roughly −15% and silver plunging as much as −38% in a single day. The move spilled rapidly into crypto assets, where BTC briefly slipped just below $75k before finding short-term footing around $78k, leaving it down −11% on the week under heavy liquidation pressure. Elsewhere, SOL fell under $100 for the first time since 2024, while ETH absorbed a −20% weekly loss; HYPE stood out as one of the few resilient coins, not only resisting the broader pullback but posting a +30% gain amid the volatility.

SideShift entered February with a decisive rebound, recording $11.98m in gross weekly volume (+60.5%) and marking its strongest showing since early October 2025, supported by steady activity across the period. Daily volume held above the $1m mark on six of the seven days, including through the weekend, a time when shifting almost always slows significantly.

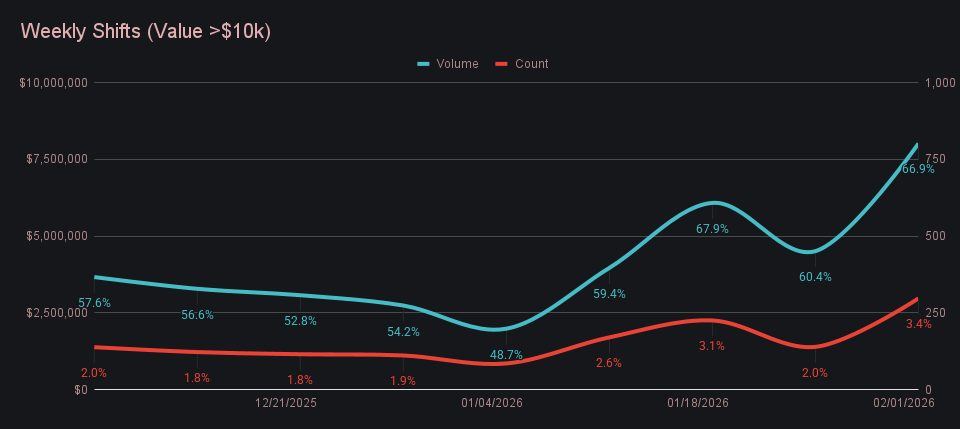

A return of larger, whale-sized shifts was a key driver behind the increase, pushing user volume up to $8.24m (+75.7%), while liquidity shifting rose in tandem to $3.73m (+34.7%). These whale shifts accounted for over two thirds of our weekly volume, more than 18% higher than the proportion at the beginning of the year. Stablecoins remained at the heart of shift volume, but this week broke from the usual pattern. Instead of being dominated by users rotating into stables, activity tilted decisively toward selling them, a shift made clear by USDC (ERC-20)/BTC reclaiming the position of top user pair at $1.23m. This was followed by BTC/ETH ($947k) and BTC/USDT (ERC-20) at $254k.

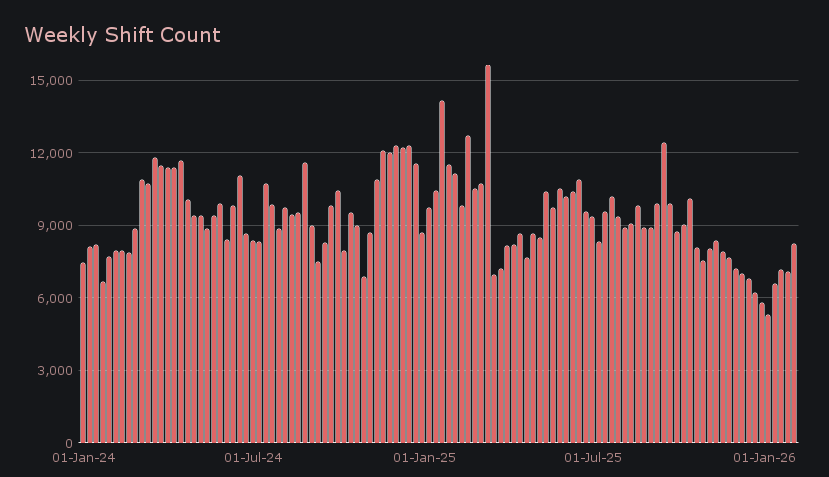

Shift count rose alongside volume, with 8,672 shifts completed over the week (+22.5%), marking the strongest weekly total of the past four months. When paired with the week’s volume, daily averages worked out to $1.71m across 1,239 shifts, keeping totals well above last week’s baseline even as volumes accelerated more quickly. Integrations continued to contribute a steady stream of shifts, but it was website-driven activity that accounted for the bulk of participation and the dominant share of volume, underscoring where this week’s growth was concentrated.

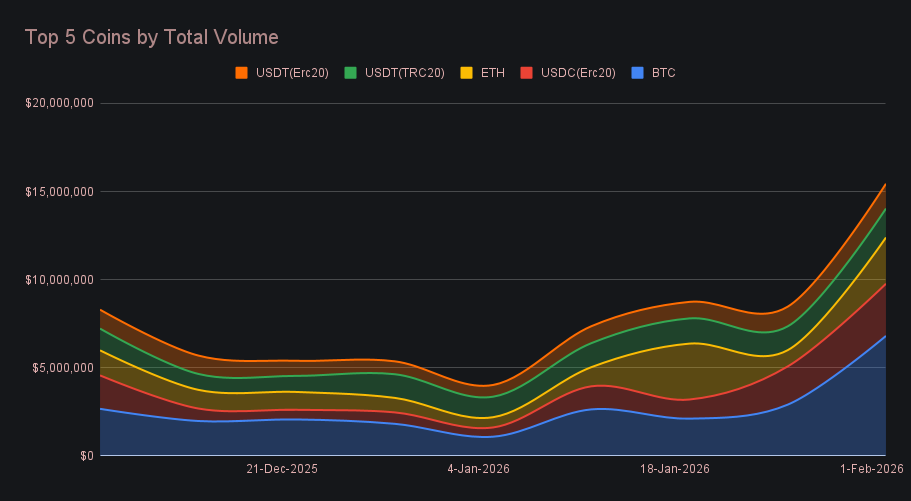

BTC finished the week firmly at the top with $6.81m in total volume (+134.0%), marking its strongest showing since autumn and reasserting its role as the primary engine of shift activity. User deposits climbed to $2.22m (+77.5%), while settlements surged to $2.04m (+600.5%), producing one of the sharpest settlement rallies seen among top assets in recent months. That return of sustained two-way shifting, largely missing in recent weeks, proved decisive and allowed BTC to open clear separation from the rest of the field. In percentage terms, the move placed BTC second only to ETH across the top coins, reinforcing how central BTC was to this week’s growth.

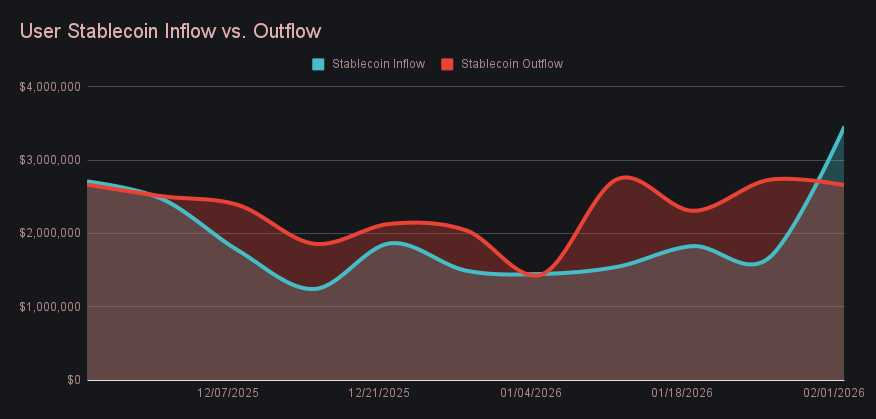

Stablecoins filled much of the top five and remained vital to weekly shifting, with USDC (ERC-20) ranking second overall at $2.96m (+36.5%) on the back of a sharp jump in deposits to $1.31m (+797.3%). USDT (TRC-20) followed at $1.64m (+21.5%) as deposits more than doubled to $720k (+124.6%), while USDT (ERC-20) added $1.41m (+26.1%) with a more balanced split. Against one of the most volatile weeks seen in recent months, marked by sharp drawdowns across major assets, user behaviour shifted decisively. As the chart illustrates, stablecoin inflows pulled sharply ahead of outflows, producing one of the widest gaps on record and leaving net stablecoin flow at +$801k, a drastic $1.87m swing from last week’s −$1.07m reading. The move reflected users rushing to buy assets at a discount, as sharp price swings rippled through the market.

ETH reclaimed a place near the top of the table, finishing third at $2.62m (+184.3%) and recording the strongest percentage growth among the leading assets. Activity leaned heavily toward settlements, which jumped to $1.22m (+173.2%) thanks to the prevalence of the BTC/ETH pair in particular, while deposits also rose to $511k (+23.2%). SOL followed just outside the top five in sixth place with $1.28m (+43.6%), a decent rise overall but still trailing ETH by a wide margin. Notably, the ETH/SOL pairing that featured prominently just weeks ago has largely vanished, with both assets now appearing mainly alongside stablecoins.

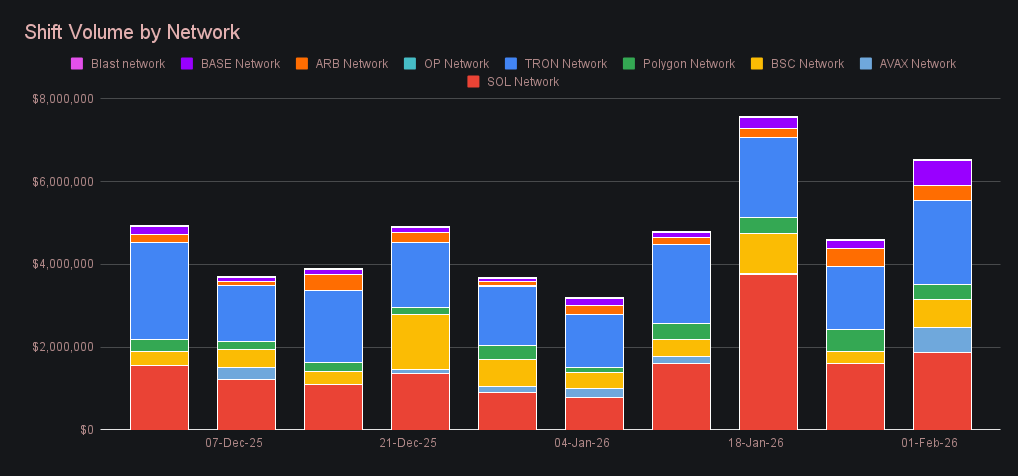

Alternate networks advanced to $6.52m in total volume (+42.4%), slightly outpacing Ethereum’s own growth over the same period. The Tron network reclaimed the $2m mark at $2.03m (+33.7%), reversing last week’s pullback and re-establishing itself as the largest alt network. Solana followed at $1.88m (+16.8%), holding near recent levels without matching the sharper moves seen elsewhere. BSC and Base both posted strong rebounds to $679k (+128.8%) and $582k (+232.2%), respectively, while Avalanche stood out with an exponential move off of a 4 digit floor and generated $599k in total volume after lying dormant over past weeks. Despite the broad increase, volume remained heavily concentrated across the top coins on a small number of networks, leaving the long tail comparatively thin.

Affiliate News

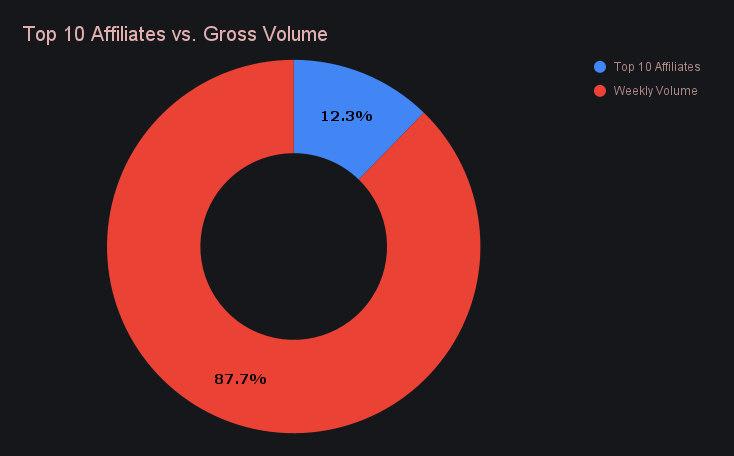

Top affiliate volume moved higher and combined for $1.41m (+33.7%), though the increase lagged the broader jump in platform volume. First place extended its lead with $394k (+39.7%), while second place slipped back to $234k (−17.3%), the only decline among all top affiliates. Third place was the standout, entering the rankings as a newcomer and delivering its strongest performance to date at $145k (+79.5%), continuing a steady upward trajectory that has been building over recent months. Despite the improvement in absolute terms, affiliate growth remained rather restrained as compared to the gross total.

Overall, top affiliates accounted for 12.3% of total SideShift volume, -2.3% lower than last week’s measurement.

That’s all for now - thanks for reading and happy shifting.