SideShift.ai Weekly Report | 27th September - 3rd October 2022

Welcome to the twenty-second edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

XAI Token Market Update

This week SideShift token (XAI) moved within the bounds of $0.137368 / $0.159558 and at the time of writing is sitting right in the middle of that range, at a price of $0.142663.

Currently the market cap of XAI totals $13,118,793 (-6.1%), which places XAI 28 spots lower than last week, now in position #788.

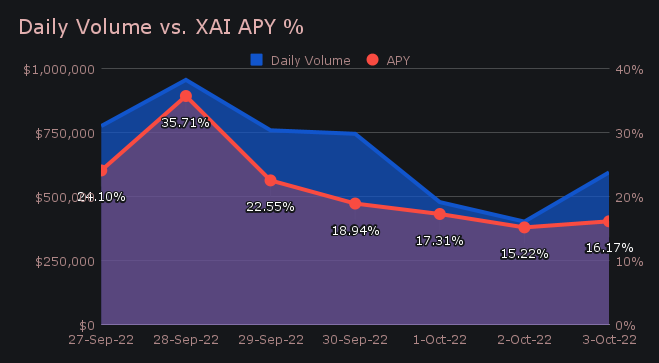

Following a strong performance last week, XAI staking began to cool off. Still, we saw a handful of shifts to svXAI as the week carried on. Nevertheless, XAI stakers were rewarded with a respectable average APY of 20.74%. A weekly rewards high of 31,533.86 XAI was deposited to our staking vault on September 29th, 2022, which generated 35.71% APY. This was following a daily volume of $956k.

Additional XAI updates:

Total Value Staked: 37,844,616 XAI

Total Value Locked: $5,402,859

General Business News

SideShift.ai had a generally slower week, with a net weekly volume of $4.71m (-12.1%) and total shift count of 6,788 (-3%). This resulted in daily averages of $673k on 970 shifts.

As a whole, this shift count is still quite high and encouraging to see, despite lower overall volume. As is normally the case, we had a very quiet weekend, with site action picking up again once we reached Monday.

The narrative for SideShift remains eerily similar as the market continues to consolidate and move sideways. Particularly what this means is a heavy focus on BTC as well as stablecoins, as users seem less interested in branching out into alts.

Just as was the case last week, we saw BTC triumph as the most shifted coin overall. Total BTC volume (deposits + settlements) was $2.69m. While a 6.6% reduction from last week, it remained ~70% higher than second placed XMR, which had a total volume of $1.58m.

BTC action was mainly driven from the deposits side by users shifting into USDT (ERC-20). The BTC/USDT (ERC-20) pair accounted for 16.9% of shift volume ($798k). A majority 53% of deposited BTC volume was shifted to USDT (ERC-20), suggesting a risk-off mentality from users. It has now remained the top shift pair for 5 consecutive weeks. BTC deposits claimed first place with a total of $1.51m (-10% from last week).

Monero (XMR) had our 2nd highest deposit volume with $995k (-14.8%), followed by ETH with $618k (-28.9%). 6 out of our top 10 deposit coins saw decreases in overall deposits. A notable exception was BCH, which increased by 73.4%, but still totalled a relatively small weekly deposit volume of $120k.

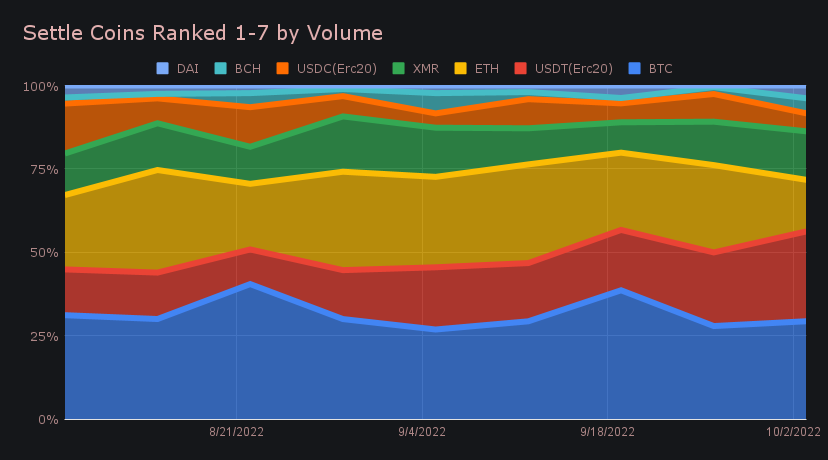

On the settlements side, BTC was also first place with $1.18m in settlements (-1.7%). This was followed by USDT on Ethereum, which saw a 14% gain and netted $1.08m. ETH placed third and continued its decline post merge, as total ETH settlements fell 44.9% to net $620k.

USDT on Ethereum was not the only stablecoin to see increases in settle volume. DAI rose +648% ($154k) to rank as our 7th most settled coin, while BUSD placed 9th, up +51% ($89k) from last week. As noted in the last report, stablecoin settlement popularity as a whole continued its upward trend and accounted for nearly one third of weekly settlements. For context, this is ~11% higher than seen just one month ago. Also worth mentioning is that USDT on Ethereum saw nearly 5x more settlements than deposits this week ($1.08m vs. $190k).

All in all SideShift had a busy week, as our team continued to build and refine. We had a few issues arise which required our operations team to be extra attentive and communicate any problems with our engineers. The main issue was that our ETH processor crashed after SideShift made a release to support a new coin. ETH was briefly disabled as a shift option, and the release was reverted.

Later in the week some users were also unable to create shifts with ERC20 token deposits due to our system not having a unique address available, because of a surge in order requests from one user. This has been resolved and users can now shift ERC-20 tokens as normal. Finally, the SOL network went offline for a period resulting in multiple settlements stuck on this network. This was later resolved once the network was back online a few hours later.

Integration News

Integrations continue to perform very strong, and combined to represent 41% of volume (+5.7% from last week) and 43% of count (+2.5%). A lower overall volume does inflate these numbers slightly, but does not negate the fact that they are remaining very solid, and in some cases, increasing.

Shift count from integrations accounting for 43% of the total is the highest percentage observed so far in 2022. The same can be said about integration volume, as it has now hovered around the ~40% mark for the past few weeks.

That’s all for now. Thanks for reading, happy shifting and we’ll see you next time.