SideShift.ai Weekly Report | 28th May - 3rd June 2024

Welcome to the one hundred and seventh edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

This week saw SideShift token (XAI) move within the 7-day price bounds of $0.1980 / $0.2025. At the time of writing, XAI is currently priced at $0.1966 with a market cap of $26,475,923, marking a slight decline of -1.6% when compared to the previous week.

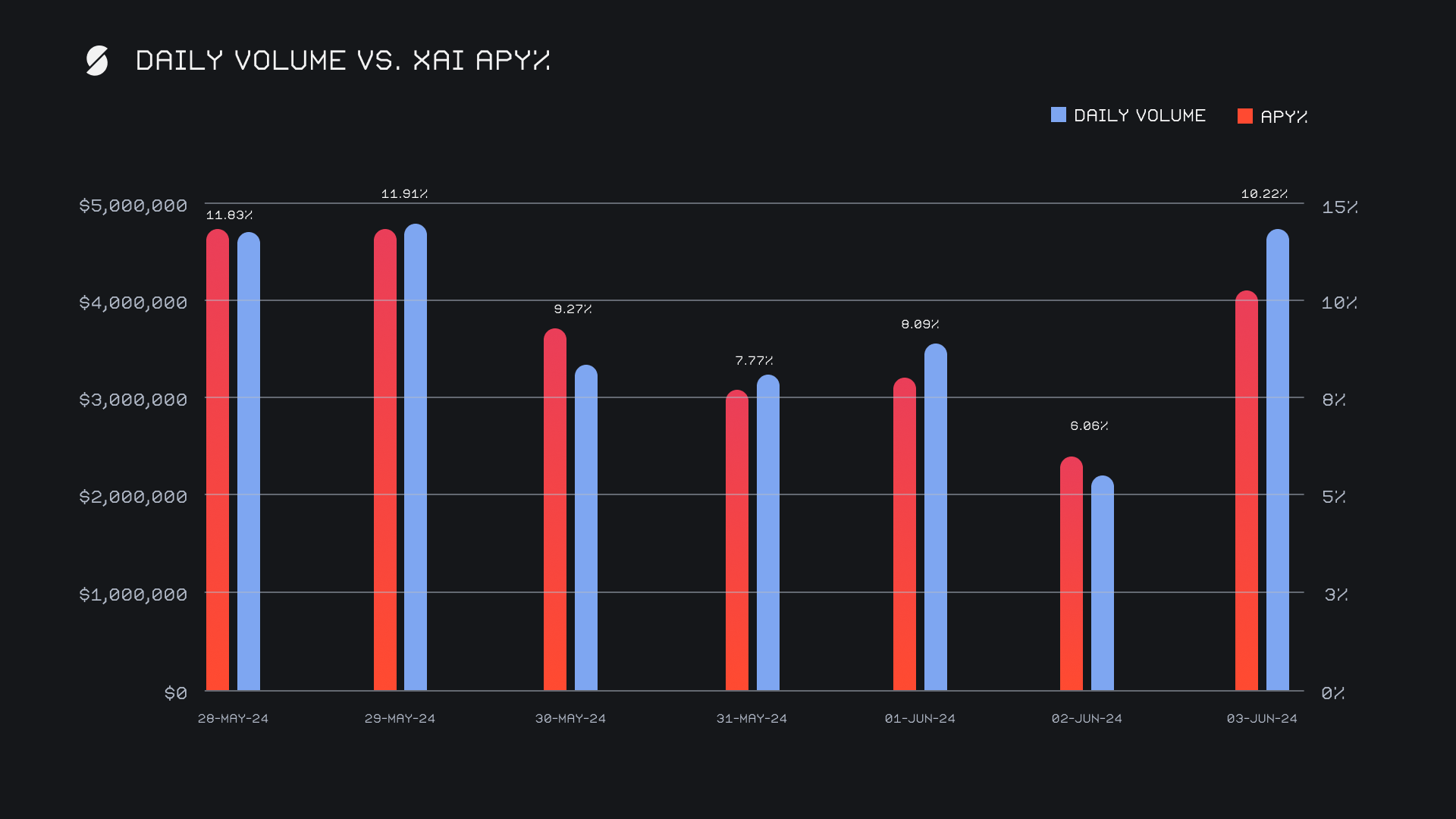

XAI stakers were rewarded with an average APY of 9.31% this week. The highest daily reward was distributed on May 30th, 2024, with 37,136.46 XAI (an APY of 11.91%) being sent directly to our staking vault. This week XAI stakers received a total of 205,259.30 XAI or $40,353.98 USD in staking rewards.

An additional 2 WBTC ($138k) were sent to SideShift’s treasury over the course of the week, bringing the current total to a value of $17.4m. Users are encouraged to follow along directly with treasury updates, via sideshift.ai/treasury.

Additional XAI updates:

Total Value Staked: 120,652,283 XAI (+0.2%)

Total Value Locked: $23,972,322 (-0.7%)

General Business News

This week saw BTC hover around the $70k mark amid some strong bullish sentiment, while ETH and SOL noted some minor price fluctuations. Memecoins continue to rage on, with celebrity memecoins on Solana being the latest meta to occupy center stage.

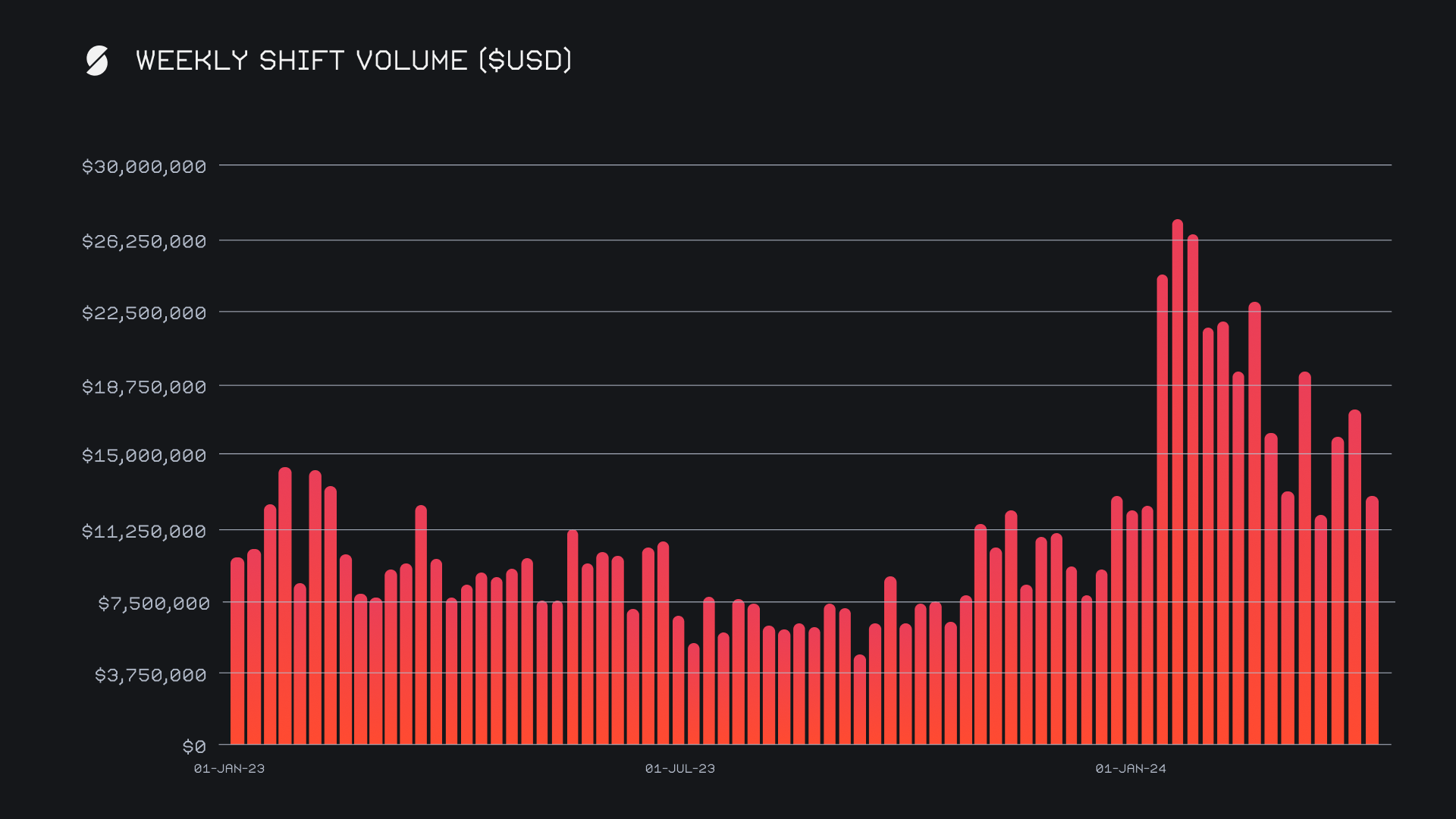

This week, SideShift experienced an overall decrease in activity when compared to the previous period’s strong performance of $17.7m. A weekly gross volume of $13.3m marked a decline of -24.8%, while gross shift count fell by a lesser -15% for a total 8,412 shifts. Particularly, it was our top integrations that were hit hardest this week, with our top two seeing their weekly volumes cut in half. However, even with the downturn, SideShift carried on to maintain respectable daily averages of $1.9m on 1,202 shifts, which contributed to us closing off the month of May with a healthy gross volume of $70.8m.

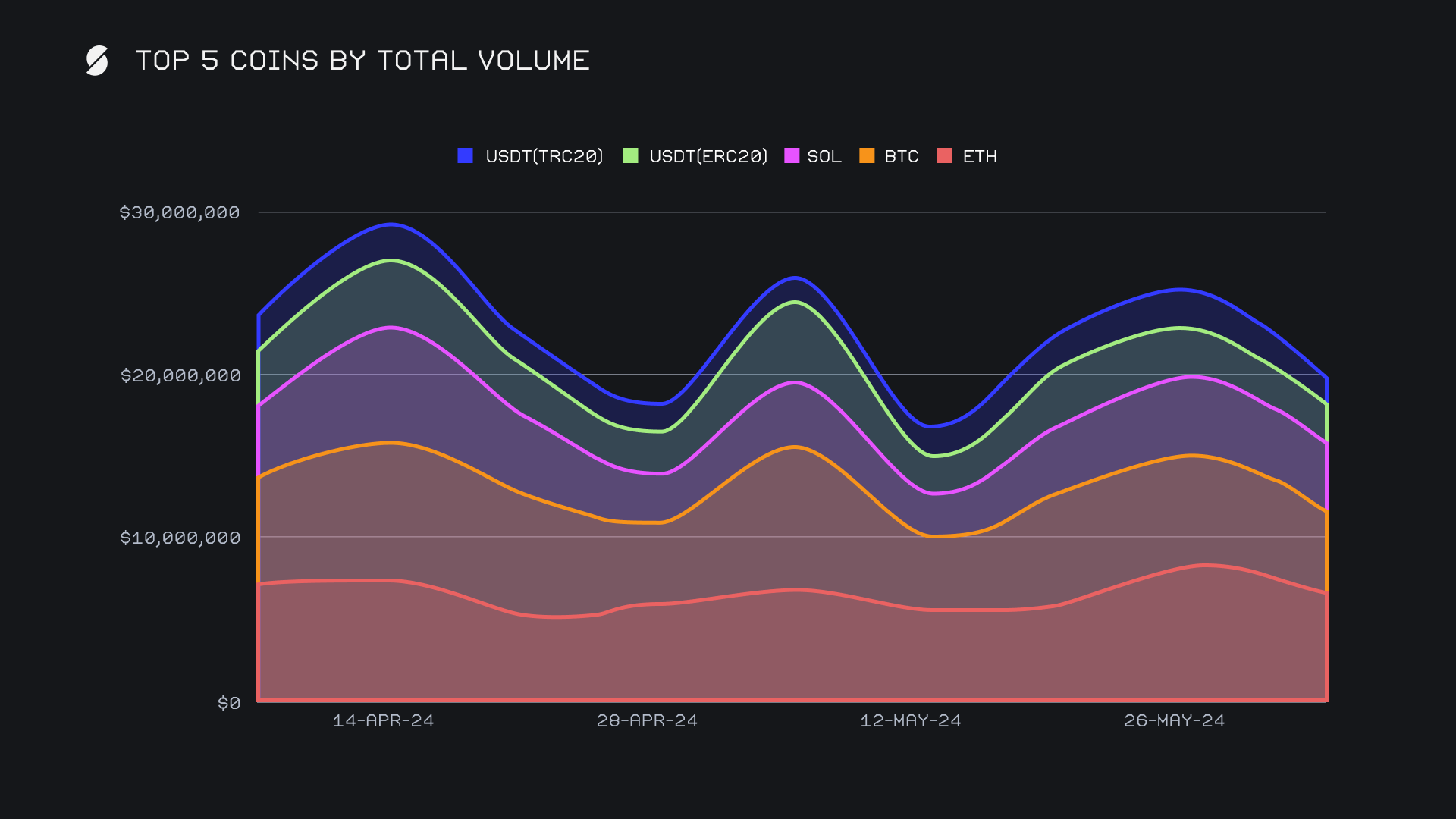

When looking at our top 5 coins by total volume (deposits + settlements) the trend remains fairly similar to what was outlined in the previous report. ETH continued to dominate with a total volume of $6.2m, despite undergoing a decline of -23.7% from last week’s outstanding performance. User deposit volume for ETH stood at $2.4m and showed a decrease of -12.6%, while a user settle volume of $2.6m was impacted harder, falling by -33.6%. This resulted in a much more balanced outcome than last week’s higher demand for shifts to ETH as compared to deposit volume. This reduction in ETH user settlements suggests that user interest in ETH could be cooling off, at least in the immediate short term, following the excitement of the recent ETF announcement.

BTC followed in second place overall with a weekly total volume of $5.0m, reflecting a substantial drop of -28.1%. Although a user deposit volume of $2.0m marked a sharp decline of -42.7%, its settle volume decreased by a much lesser -9.3% for $2.1m. The fact that BTC settlements mostly held steady while mostly everything else fell double digits is an example of the robustness of BTC on SideShift, and represents the continual demand that it generates on a week to week basis. Similarly to ETH, the end result for BTC this week was a fairly balanced outcome of user deposits vs settlements.

SOL proved to be the lone outlier among our top 5 and was the only top coin to see a minor uptick in user volume. This translated into respective user deposit and settlement totals of $2.0m (+3.3%) and $1.7m (+0.5%), possibly representing a growing interest or confidence in SOL. With a total volume of $4.2m on the week, SOL ranked third overall, with the biggest impact on its total volume coming from a decline in liquidity shifting. Among the most popular pairs, SOL/ETH led the pack for the second consecutive period with a volume of $1.2m, followed by ETH/BTC at $766k.

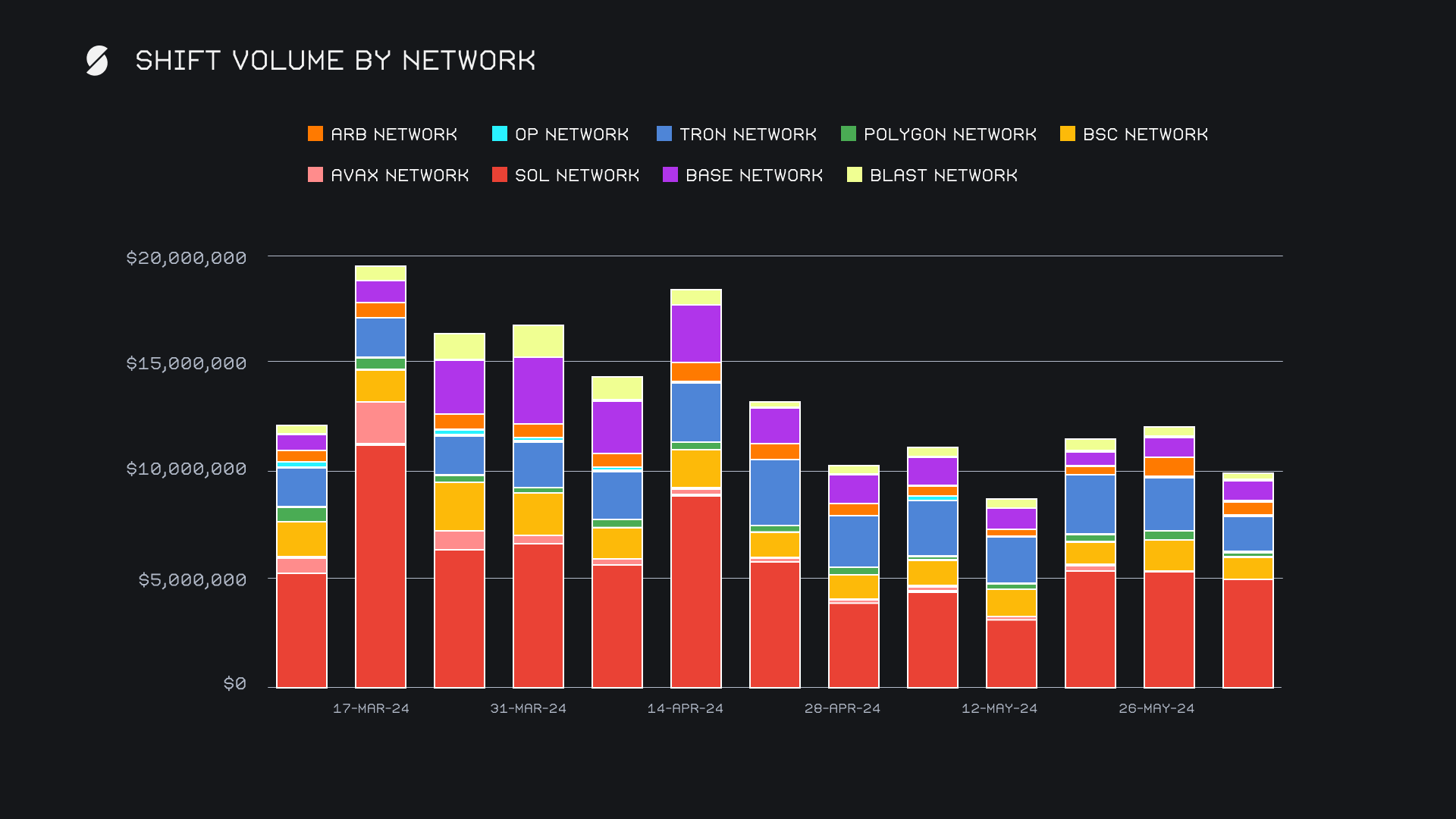

Alternate networks to ETH saw varied performance, however, most of the top networks were not immune to the overall decline in volume, and the outcome was a mostly unchanged ranking. The Solana network finished in first and maintained its strong position with a weekly volume of $5.1m, marking a slight decrease of -5.2%. For the majority of the year Solana has not budged from its position atop the alternate networks to ETH, and it continues to be the dominant alternate choice for users. Although volume is mostly driven by the native SOL token, USDC (sol) continually finishes among our top 8, and sees steady shift action week to week. This week, it recorded a spike of +107.8% for a total volume of $670k, easily ending the period as the highest gainer.

The Tron network was more volatile and followed with a weekly volume of $1.7m, representing a substantial decline of -34%. This was caused by a near $1m decrease in USDT (trc20) shifting, the coin which always drives the bulk of the Tron network’s volume. In third came the BASE network, which opposed this trend and showed some resilience with a weekly volume of $1.1m. The result was an overall increase of +7.5%, which ended as the highest change among any alternate network with significant volume. Meanwhile, the Binance Smart Chain (BSC) network saw its shift volume drop -38.5% for $858k, marking the first time the network has dipped below the $1m mark in over 3 months.

Affiliate News

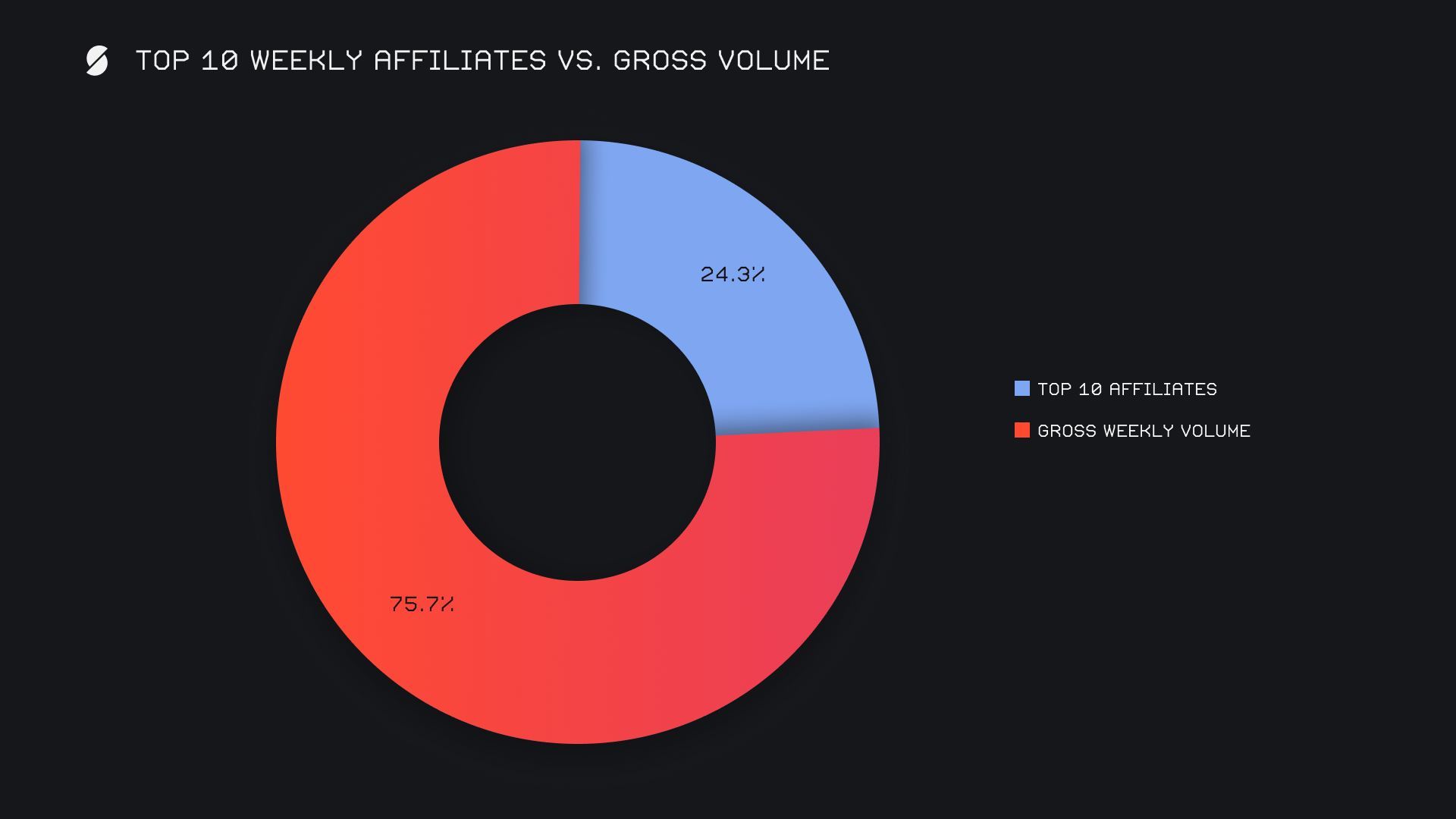

Our top affiliates combined for a total volume of $3.2m across 1,807 shifts, a nominal volume decrease of -38% from last week. Because the former third placed affiliate saw shifting carry on steadily, it was able to secure first place this week with $1.0m over 488 shifts. In contrast, and as previously mentioned, last week’s first and second placed affiliates were impacted quite hard with both seeing a volume decline of -50%. Our second place affiliate followed closely behind first place with $919k (-49.7%), while our third place affiliate generated $538k (-50.2%) through 658 shifts. A positive note was a previously unranked affiliate emerging among our top group - it climbed to fourth place this week with $233k.

All together, our top affiliates accounted for 24.3% of our total weekly volume, -5.3% lower than last week’s proportion.

That’s all for now. Thanks for reading and happy shifting.