SideShift.ai Weekly Report | 28th November - 4th December 2023

Welcome to the eighty-third edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

This week SideShift token inched its way higher, moving within the 7-day range of $0.0836 / $0.0960. The high of this range was reached just yesterday, after finishing off a consistent climb as the week progressed. At the time of writing, XAI is still pushing against the upper bounds of that range at a current price of $0.0953. The market cap of XAI took a nice jump forward and is currently measured at $11,788,945 (+15.6%).

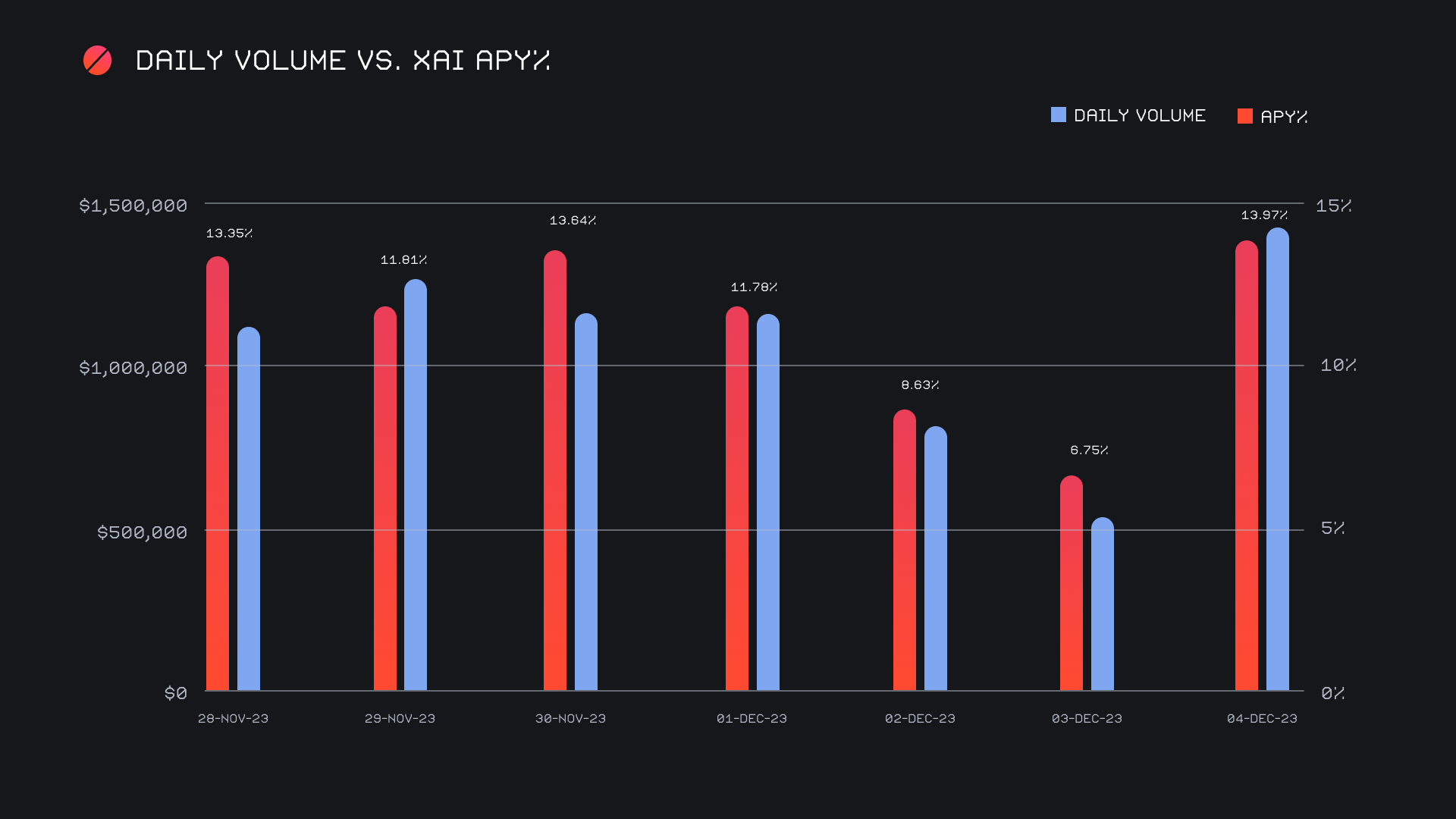

XAI stakers were rewarded with an average APY of 10.99% this week, with a daily rewards high of 40,751.62 XAI being distributed to our staking vault on December 5th, 2023. This was following a daily volume of $1.4m. This week XAI stakers received a total of 234,914.57 XAI or $21,461.33 USD in staking rewards.

An additional 50 ETH was sent to SideShift’s treasury on December 4th, 2023, thereby adding $112k to last week’s balance of $6.42m. A significant increase in value of $668k of unrealised gains accrued from the Treasurer's investing activities. This ended the week with a $7.2m Treasury valuation, a very lucrative total increase of $780k (+12%). Users are encouraged to follow along directly with live treasury updates, via sideshift.ai/treasury.

Additional XAI updates:

Total Value Staked: 113,819,085 XAI (+0.3%)

Total Value Locked: $10,602,381 (+11.3%)

General Business News

As we enter the final month of 2023, the crypto markets have picked up some serious steam, with BTC clearly at the forefront. Yesterday saw BTC surge up towards the $42k mark, leading the total crypto market cap past the $1.5t mark for the first time in over a year and a half.

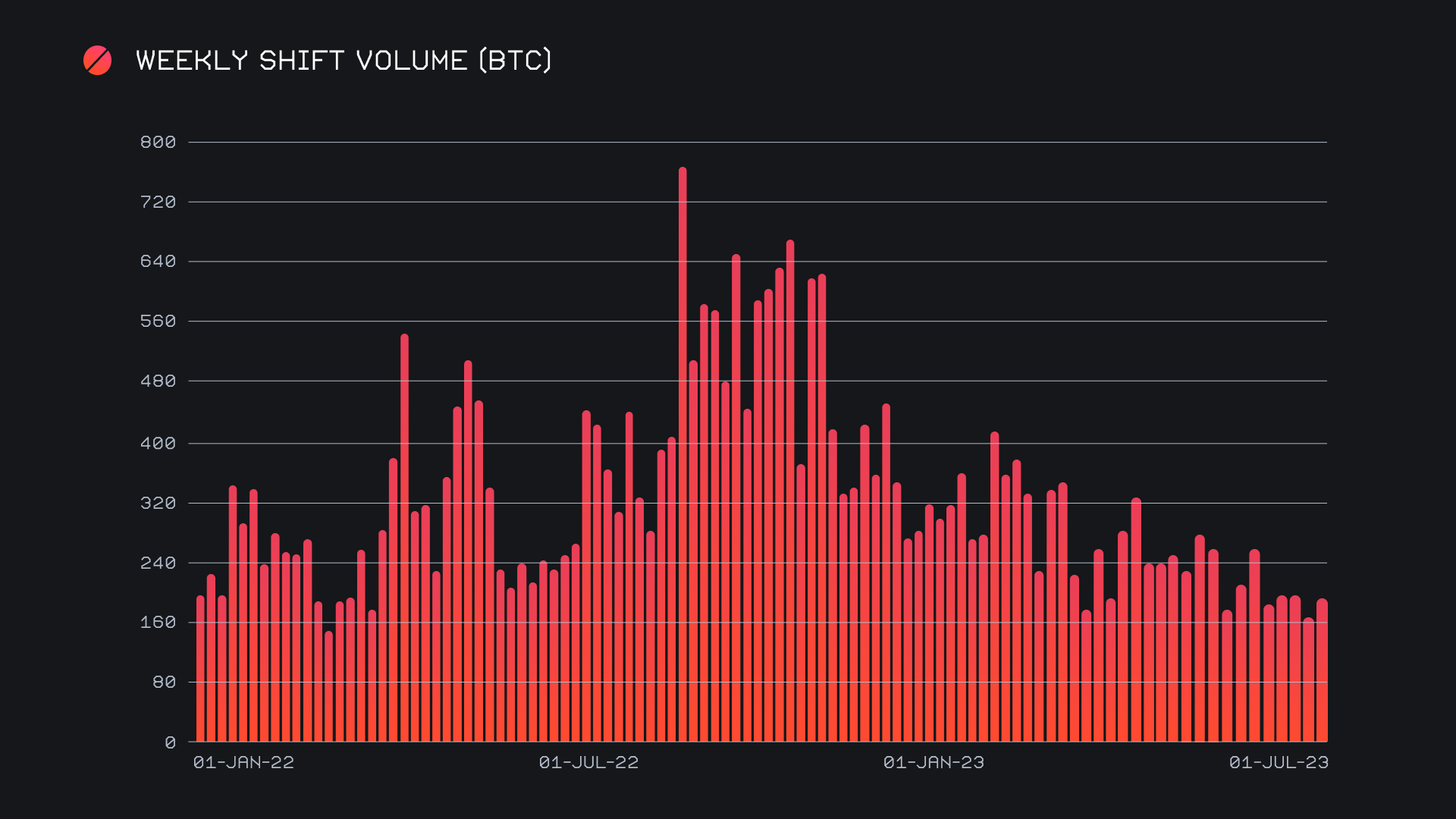

SideShift had a solid performance and rounded off the period with a gross volume of $7.5m (+19.2%) alongside a shift count of 7,405 (+5.3%). Increases were seen across most metrics, with the majority of volume stemming from users shifting on alternative networks to Ethereum, directly on the website. This aligns with the pattern mentioned in last week’s report, which described how the different sources of volume on SideShift tend to fluctuate along with market volatility. Together, the figures above combined to produce daily averages of $1.1m on 1,058 shifts. When denoted in BTC, our weekly volume amounted to 192.38 BTC (+13.9%), slightly less compared to the percentage increase on the dollar amounts, as Bitcoin continues to make gains.

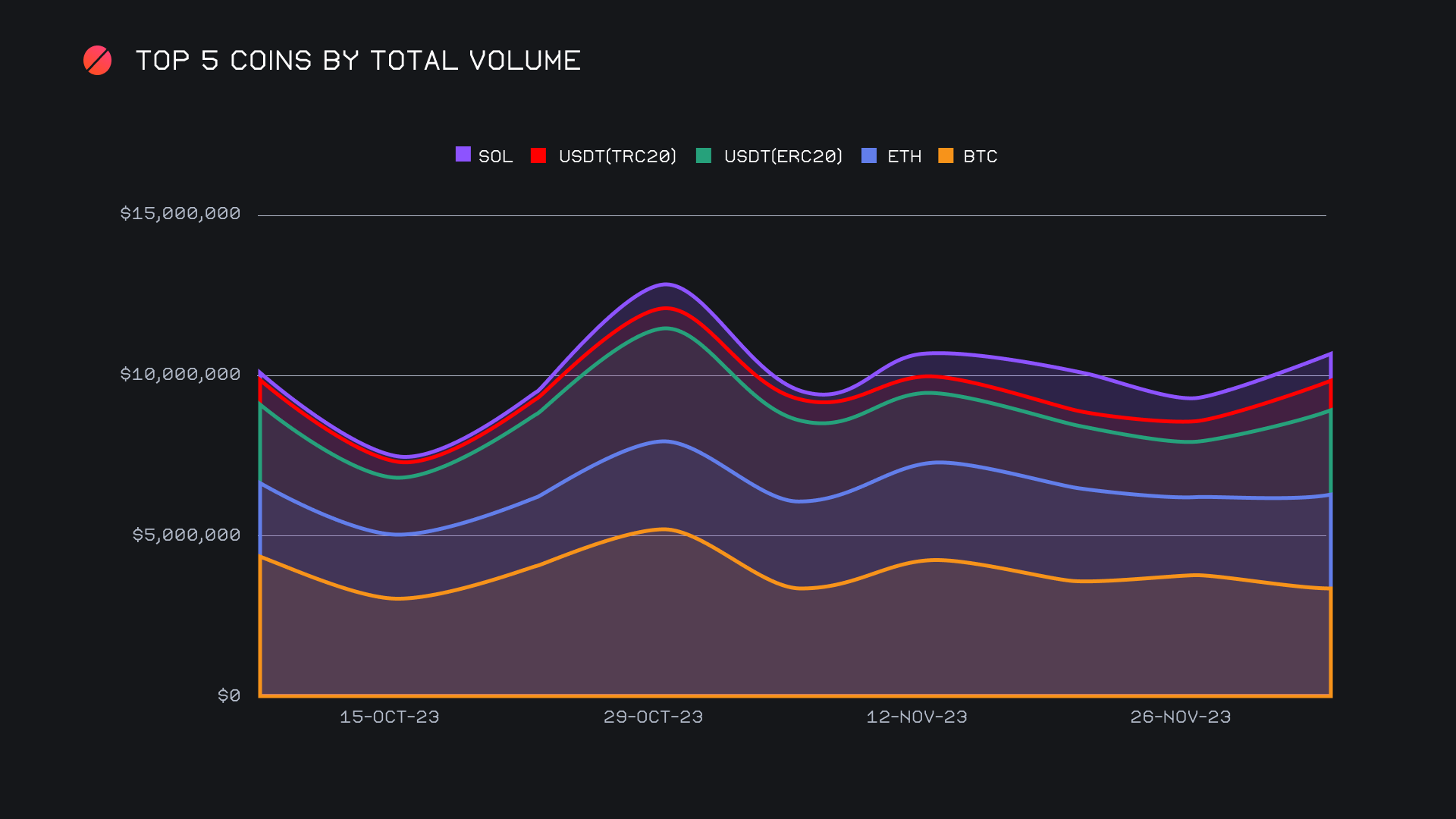

A look at our topline provides some perspective on the breakdown of this week’s volume, and also how this has changed over the past few months. Beginning with our top coin, BTC retained its spot in first, doing so with a total volume (deposits + settlements) of $3.4m. It refused to forfeit its position despite incurring a -8.2% decrease, interestingly being the only coin among our top 10 to see a decline from last week. Less user BTC deposits were mainly responsible for the reduced volume, as BTC actually proved to be the most settled coin among users this week, ending with $1.3m in settlements (+35.2%). This shows that it is still in high demand, but there was simply less BTC shifting taking place overall, possibly a byproduct of higher overall network fees.

Meanwhile, the total volume for ETH enjoyed a nice boost of +15.3% and ended with $2.9m, while USDT (ERC-20) trailed not too far behind with $2.6m. It had an impressive +52.4% increase in total volume shifting, mainly due to a strong jump in user settlements. When analyzing the chart of our top 5 coins by total volume, you will notice the flattish / declining nature of BTC despite the overall increase of the top 5’s collective sum. This provides us with a visualization of how shifting is becoming more varied, with less concentration on BTC alone. What is not seen is the growth of coins ranked 5-10, some of which experienced huge positive deviations from their norms this week. Examples include 9th placed ETH (BASE) with $310k (nearly a 20x increase), and 10th placed AVAX with $243k (an increase of ~7x). The fact that users are branching into altcoins despite BTC market dominance trending upwards is a sign that users are ready for a bullish environment.

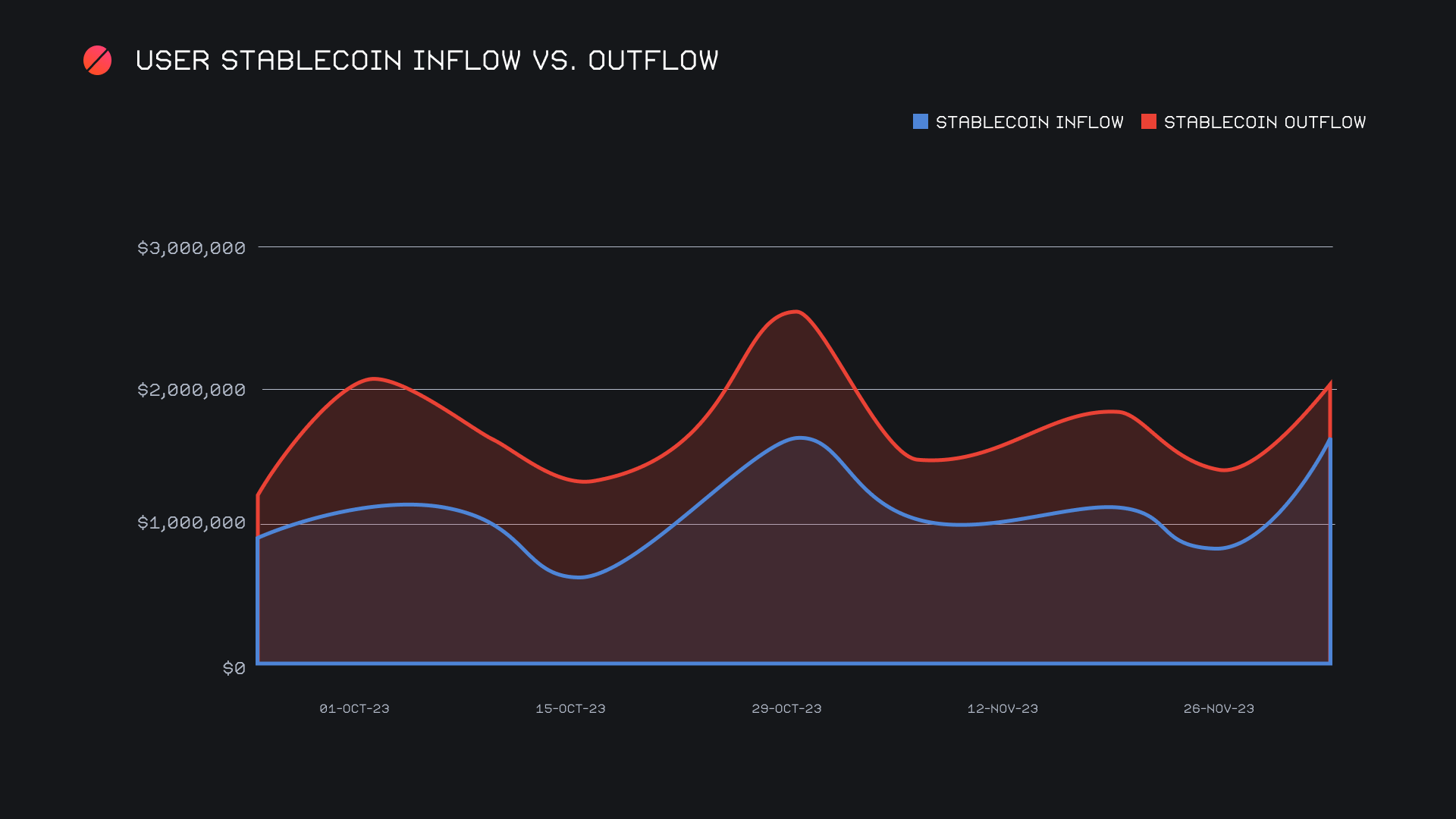

A dive into stablecoins reveals that USDT (ERC-20) was not the only one to experience a spike in shifting this week - in fact, all 4 stablecoins within our top 10 saw a weekly increase that exceeded 35%. In the case of 6th placed USDC (ERC-20), this stretched all the way up to +165.7%, as it summed $793k on the week. Although stablecoin outflow still trumps that of inflow, the gap appears to be tightening. This week saw the highest sum of stablecoin deposits since the beginning of August 2023, with $1.7m being sent by users. For the time being however, the upper hand is still given to stablecoin outflows, as this week we measured a net outflow of -$367k. With that in mind and as bullish sentiment continues to pick up, it would not be surprising to see this gap grow even narrower as the year comes to a close.

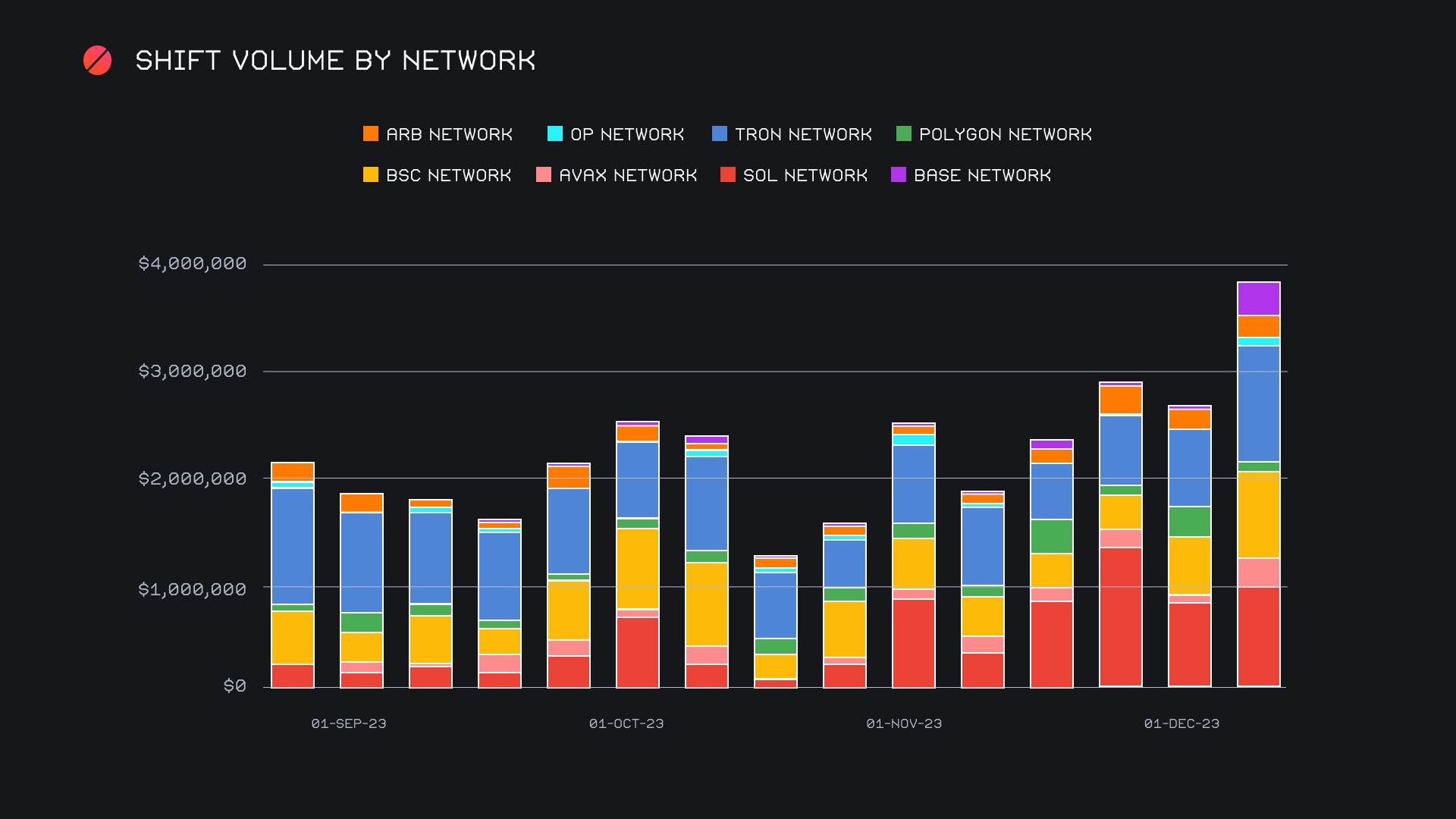

Another good example of the wider distribution of shifting is provided by looking at alternate networks to ETH. As seen in the chart below, these networks have been on a healthy upwards climb over the course of the past few months. This week, their cumulative volume summed to $3.8m, a sizable weekly increase of +43.4%. 7 out of 8 alternate networks saw a weekly gain, with the TRON network leading the charge. It regained first place, rising +52.4% with a total of $1.1m. In second place sat SOL which continues to generate a solid amount of traction, as it ended up with $988k (+13.9%). Third was the Binance Smart Chain (BSC) network, recording a gain of +46.5% for $802k. Other networks measured higher changes, but with lower overall volumes. Ultimately, the growing proportion of alternate networks is a positive sign. This week, a coin on one of these networks was included in 25.3% of shifts (+4.2%), as compared to the Ethereum network's unchanged proportion of 36.5%, which acts as a benchmark.

In listing news, SideShift added support for two more ERC-20 tokens this past week - Illuvium (ILV), and Blur (BLUR). Shifting of these assets is now live, from any coin of your choice.

Affiliate News

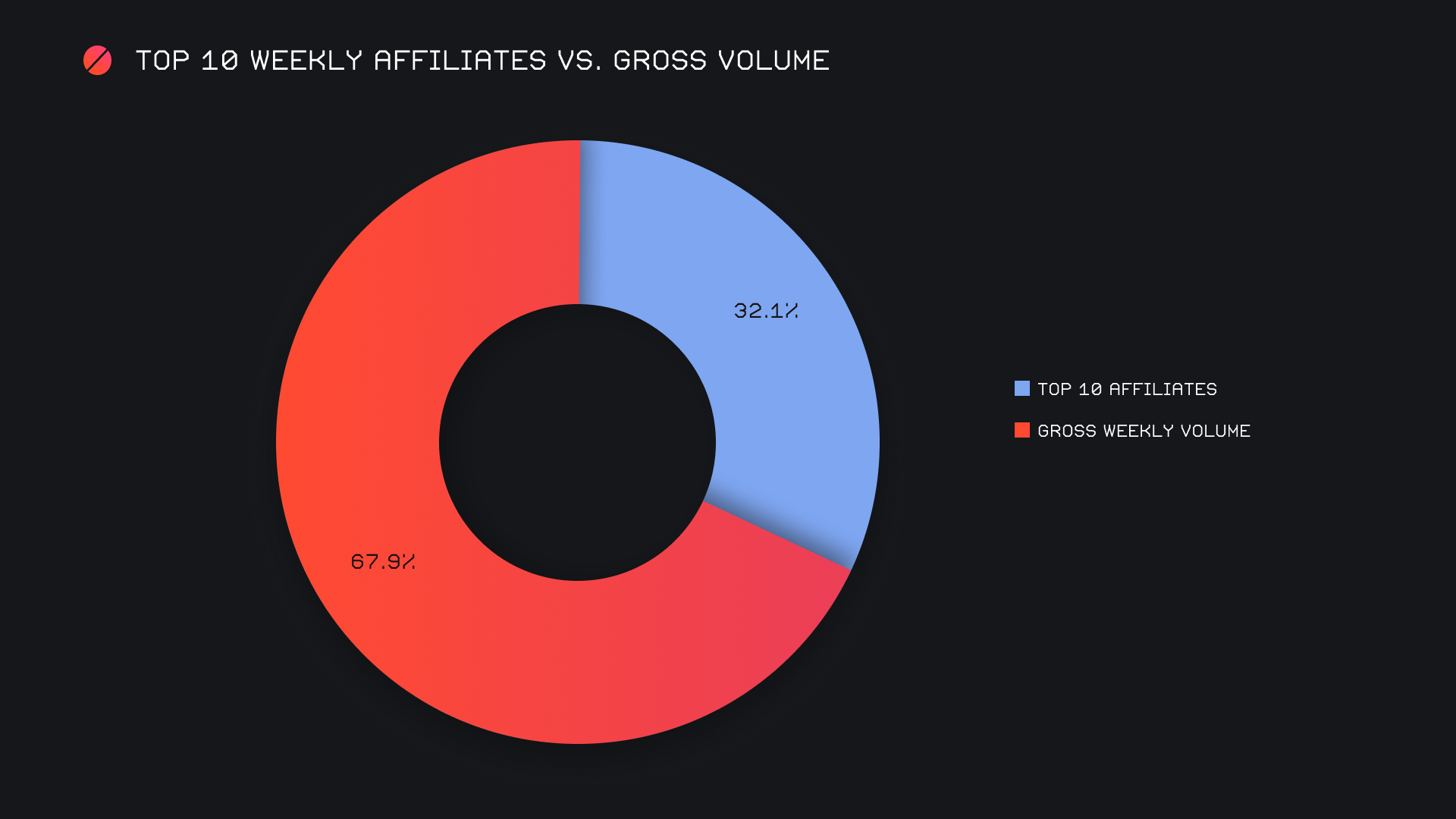

Our top affiliates combined for a total $2.4m this week, representing a weekly increase of +24.3%. Combined shift count rose by an even larger +34.6%, and ended with a total sum of 2,683. Our first placed affiliate remained unchanged, although incurring a volume decline of -19.1% for $873k. Instead, it was the second placed affiliate which made the strongest move this week, booming +124.8% for $853k. Shift count however did not waiver for our top affiliate, and remained dominant as ever. It led the group with 1,113 shifts.

Overall, our top affiliates accounted for 32.1% of our weekly volume, an increase of 1.3% from last week’s proportion.

That’s all for now. Thanks for reading, happy shifting and we’ll see you next time.