SideShift.ai Weekly Report | 29th October - 4th November 2024

Welcome to the one hundred and twenty ninth edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

This week, SideShift token (XAI) continued on in a similar fashion, moving within the 7-day price range of $0.1190 to $0.1274. XAI has hovered around the $0.125 mark for the better part of the last three weeks, reflecting a fairly stable trend. At the time of writing, XAI is priced at $0.1234 with a current market cap of $17,348,874, a slight rise of +1.91% from last week’s sum.

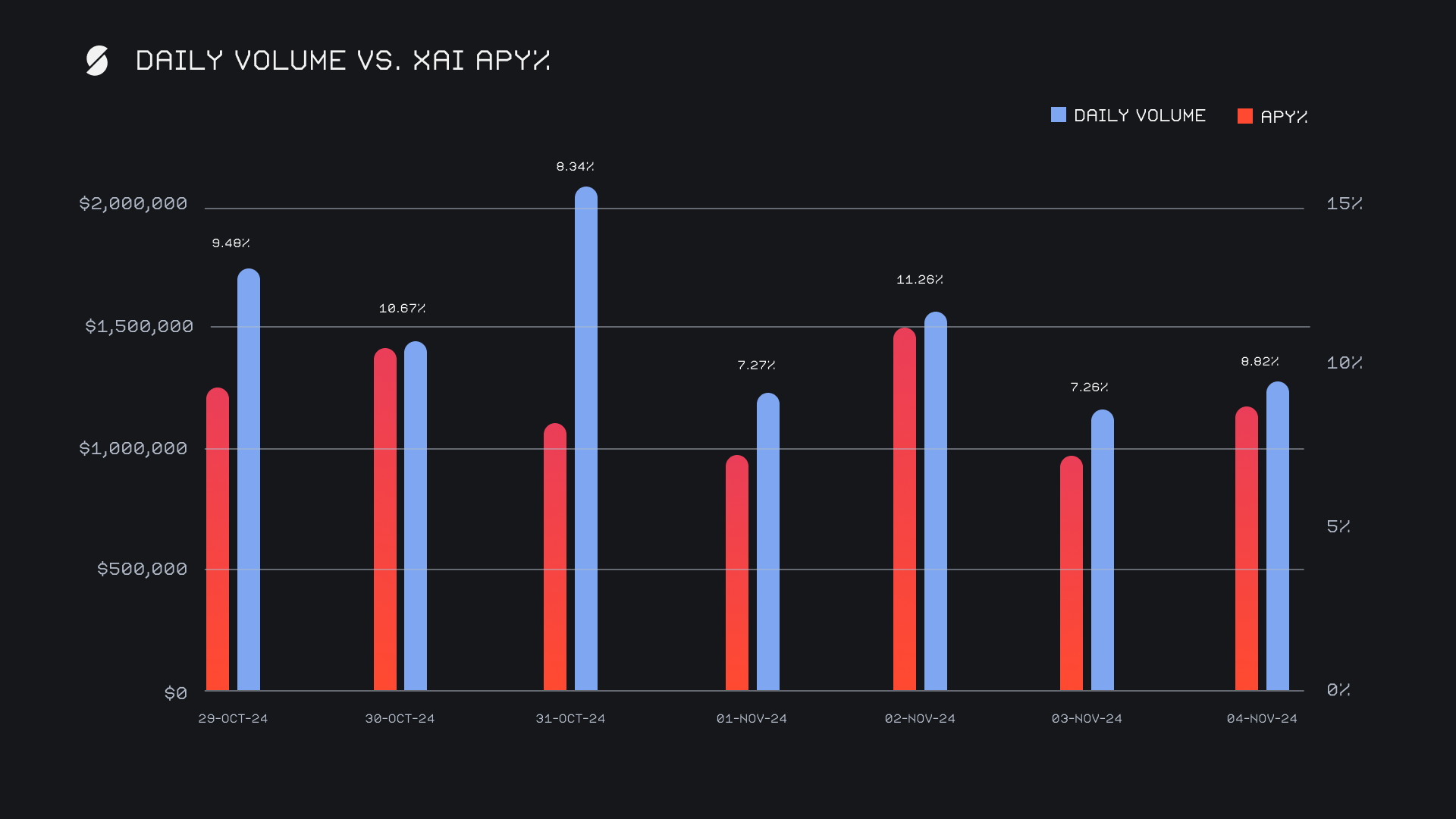

XAI stakers were rewarded with an average APY of 9.01% over the week, with a peak daily reward distribution reaching 36,834.93 XAI on November 3rd, 2024. This daily high corresponded to an APY of 11.26% and was supported by a daily volume of $1.6m. Altogether, XAI stakers received a total of 208,353.58 XAI or $25,710.83 USD in staking rewards this week.

XAI staking stats have temporarily been removed from the SideShift homepage while our engineers continue to work on performance improvements to better handle the increased traffic. Significant progress has already been made, and we expect staking stats to return before the end of the week.

Additional XAI updates:

Total Value Staked: 126,165,742 XAI (+0.2%)

Total Value Locked: $15,566,960 (-3.0%)

General Business News

As the U.S. election draws near, the crypto market is seeing heightened volatility. The Mt. Gox trustee’s movement of $2.2 billion worth of BTC to unmarked wallets added pressure to the market, sending BTC sliding towards $68k. Meanwhile, spot Bitcoin ETFs saw $541m in outflows, marking their second-largest daily outflow since May. Conversely, DOGE was one of the few to move against the grain, and had a solid performance to end up +11% on the week.

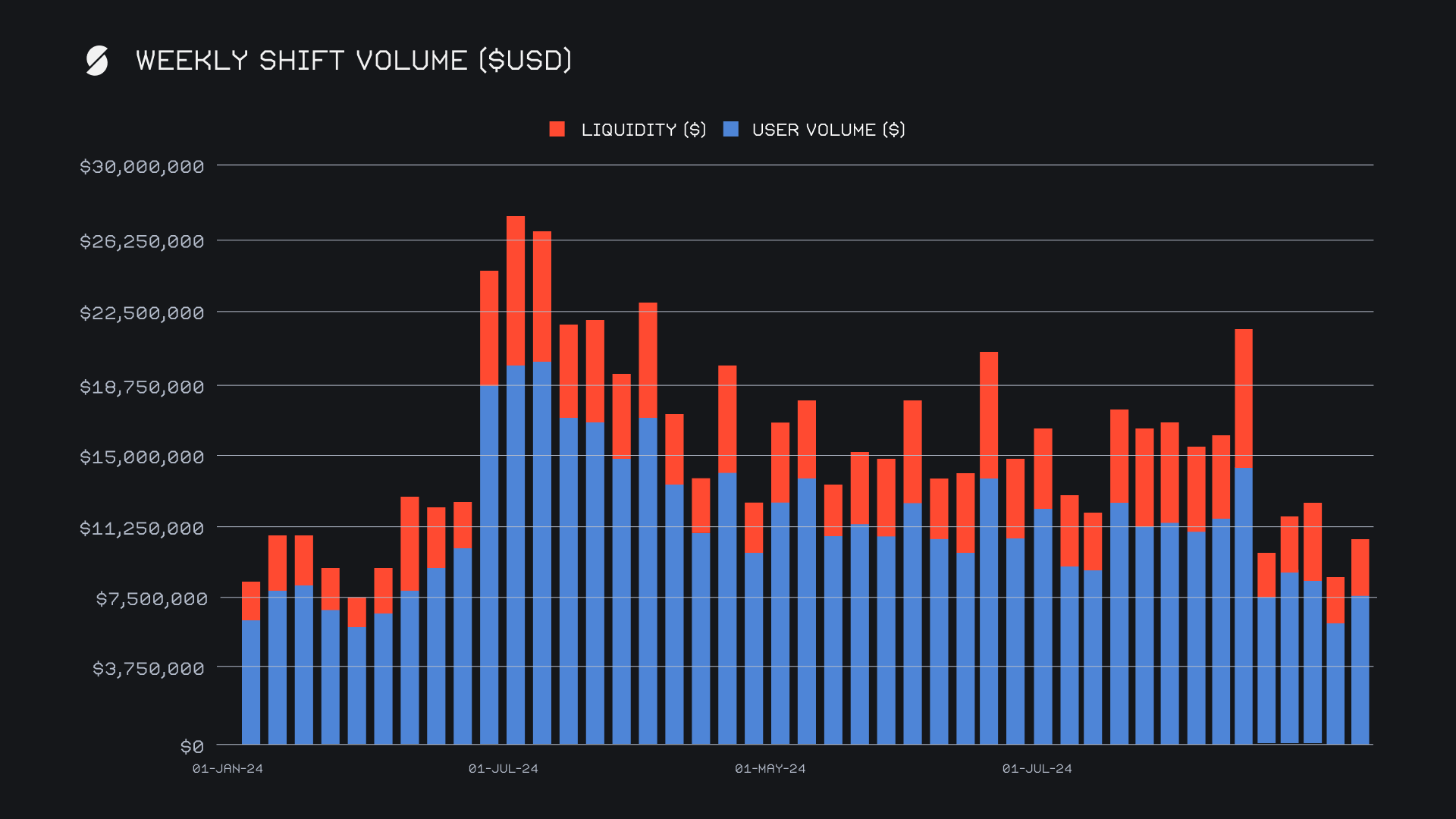

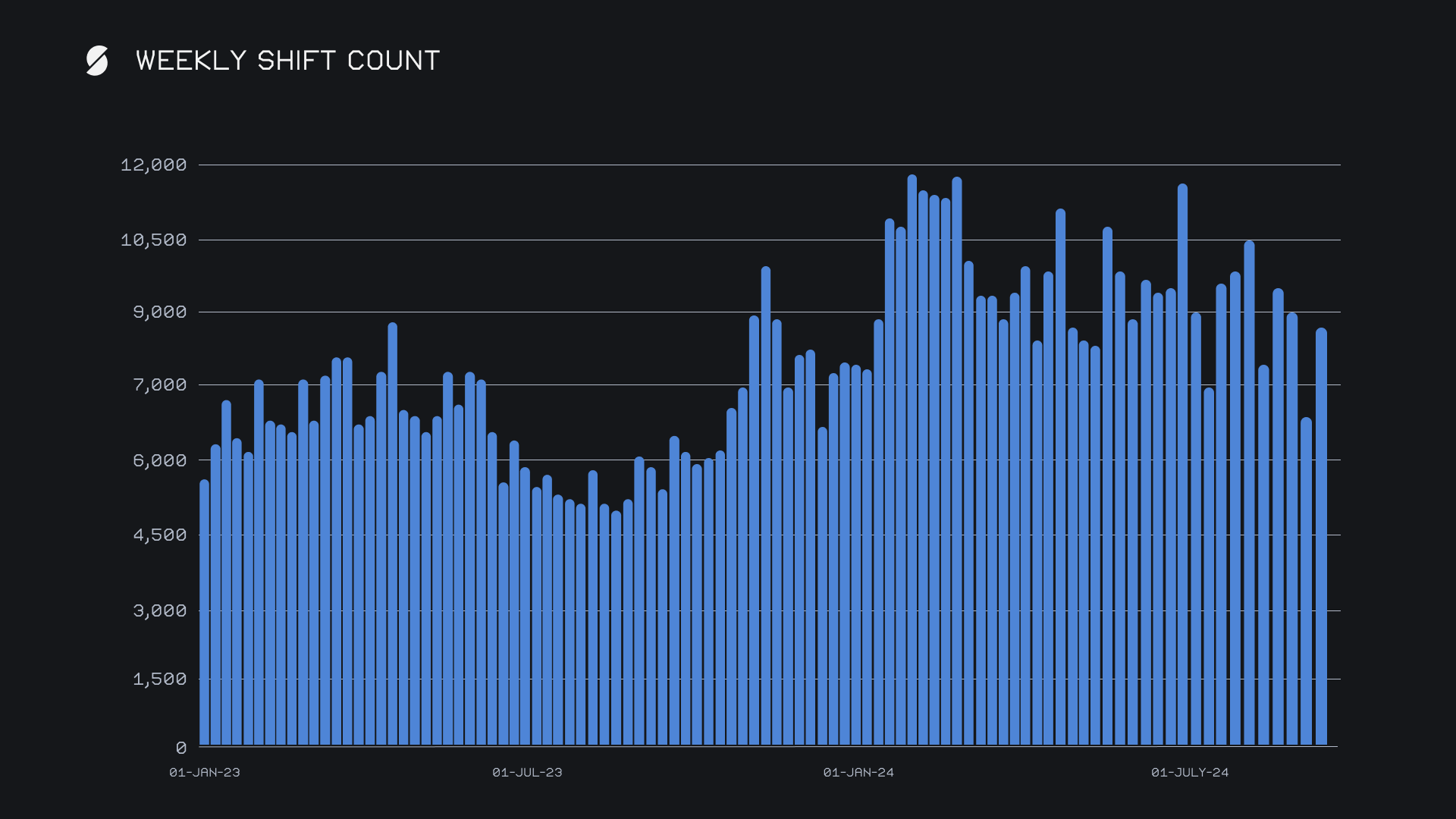

This week, SideShift bounced back with a gross weekly volume of $10.6m, reflecting a +24.1% rise from the previous period. User shifting volume contributed $7.6m, while liquidity shifting volume added $3.0m - this week’s liquidity shifting mainly stemmed from the imbalance of BTC shifting, and the resumption of healthier BTC deposits on SideShift, following a notable lull. Our daily averages ended at $1.5m alongside 1,242 shifts, signaling a welcome shift in momentum after last week’s slower performance.

Our gross weekly shift count saw a similarly robust increase, reaching 8,691 shifts, up +26% from the previous week. This jump brought our weekly count to within ~5% of its YTD running average and displayed a stronger performance than weekly volume, which, despite the rise, still sat about 30% below typical weekly levels seen throughout 2024. SOL and ETH continued to drive user engagement, as users seem to alternate between them, changing the favored pair directionality. This week the SOL/ETH pair took the top spot among users with $766k in volume, dethroning ETH/SOL, which had held the title for the past month.

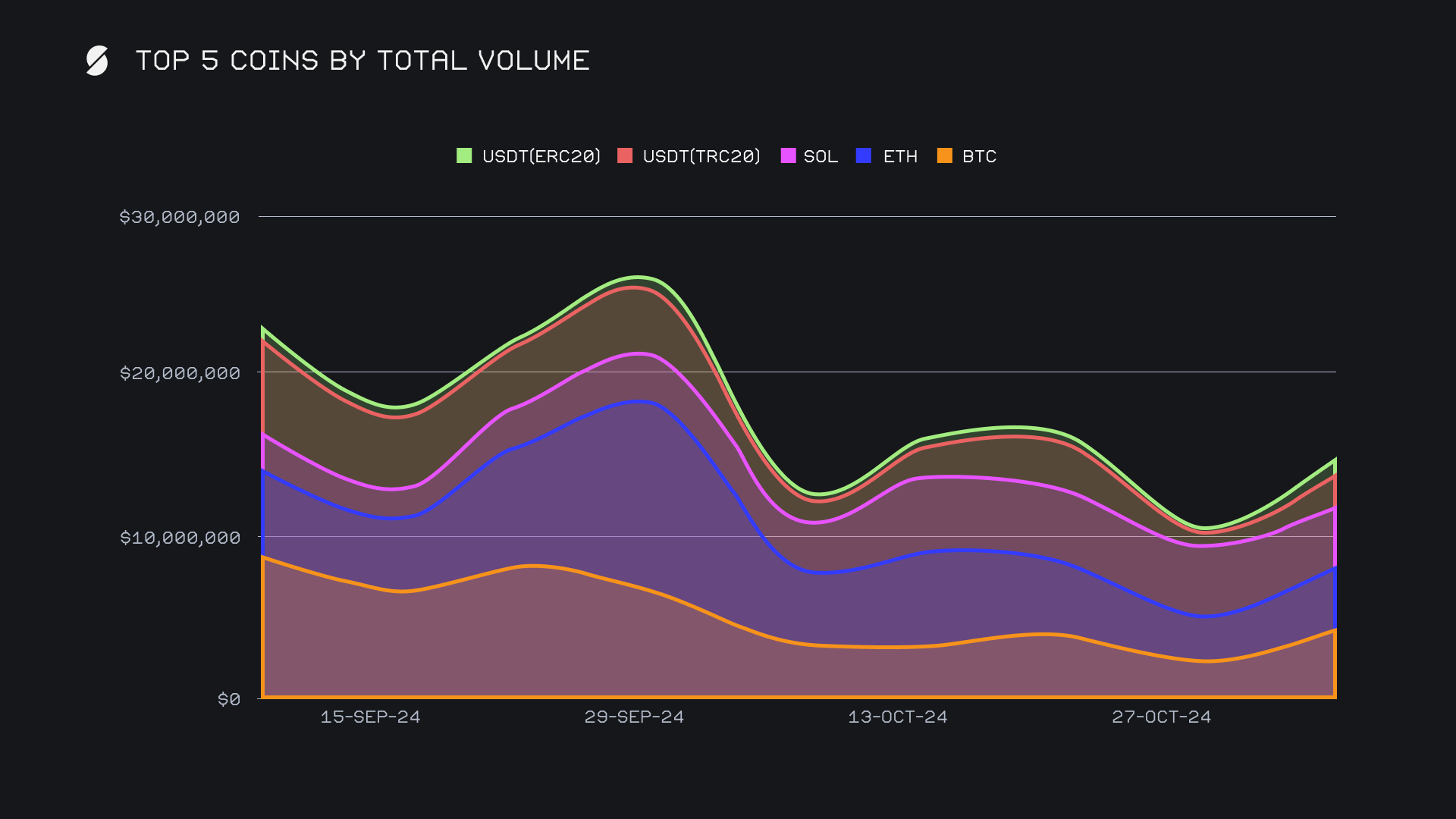

This week, BTC surged back to the top of the rankings for the first time in 5 weeks, reaching a total volume of $4.3m, up by an impressive +90%. This resurgence was aided by recent improvements in SideShift's site performance, which facilitated smoother user activity and likely encouraged greater BTC shifting, particularly on the deposit side. Deposit volume for BTC saw the most significant rise, climbing +136.5% to $1.8m, while settlement volume also increased by +26.6%, totaling $1.1m.

ETH held its ground in second place with a weekly volume of $3.8m, representing a +40.5% increase in total volume. Despite ETH’s price action severely lagging behind the rest of the market, ETH’s shift volume on SideShift continues to remain a contender for top spot each week. Currently, ETH is trading near a 3.5-year low against BTC, yet SideShift users continue to favor ETH as a settlement option, with its $1.6m (+72.7%) settlement total being the highest among users this week. On the other side, deposit volume slightly declined by -10.9% to $1.2m, only enough for third place among deposits. The steady interest in ETH as a shifting asset showcases its resilience on SideShift, even amidst fluctuating market conditions.

SOL saw a considerable drop in interest and slipped to third place with a total volume of $3.7m, down -13.6% from the prior period. Despite maintaining a decent nominal sum, SOL represented the largest decrease among any top 10 coin on SideShift this week. The breakdown however was an even split, with user deposit volume seeing a mild increase of +18.6% to reach $1.5m, and settlement volume falling by -18.8% to also end at $1.5m. This decline was further underscored by a shift in user preference from SOL to ETH, as evidenced by the top user shift pair, which suggests that users are slowly diversifying back into Ethereum.

Stablecoins dominated the list of coins outside the top five, with six of the coins ranked 6 through 15 being stablecoins. Notable among them were Liquid-based coins and EUROC, both of which saw considerable jumps in shift activity. Liquid USDT (L-USDT) in particular, saw a +203% rise to $404k in volume, while EUROC, which had previously shown no volume in recent weeks, recorded $321k. Much of this stablecoin activity came from the settlement side, likely indicating some caution among users as they leaned toward secure assets amidst broader market uncertainties.

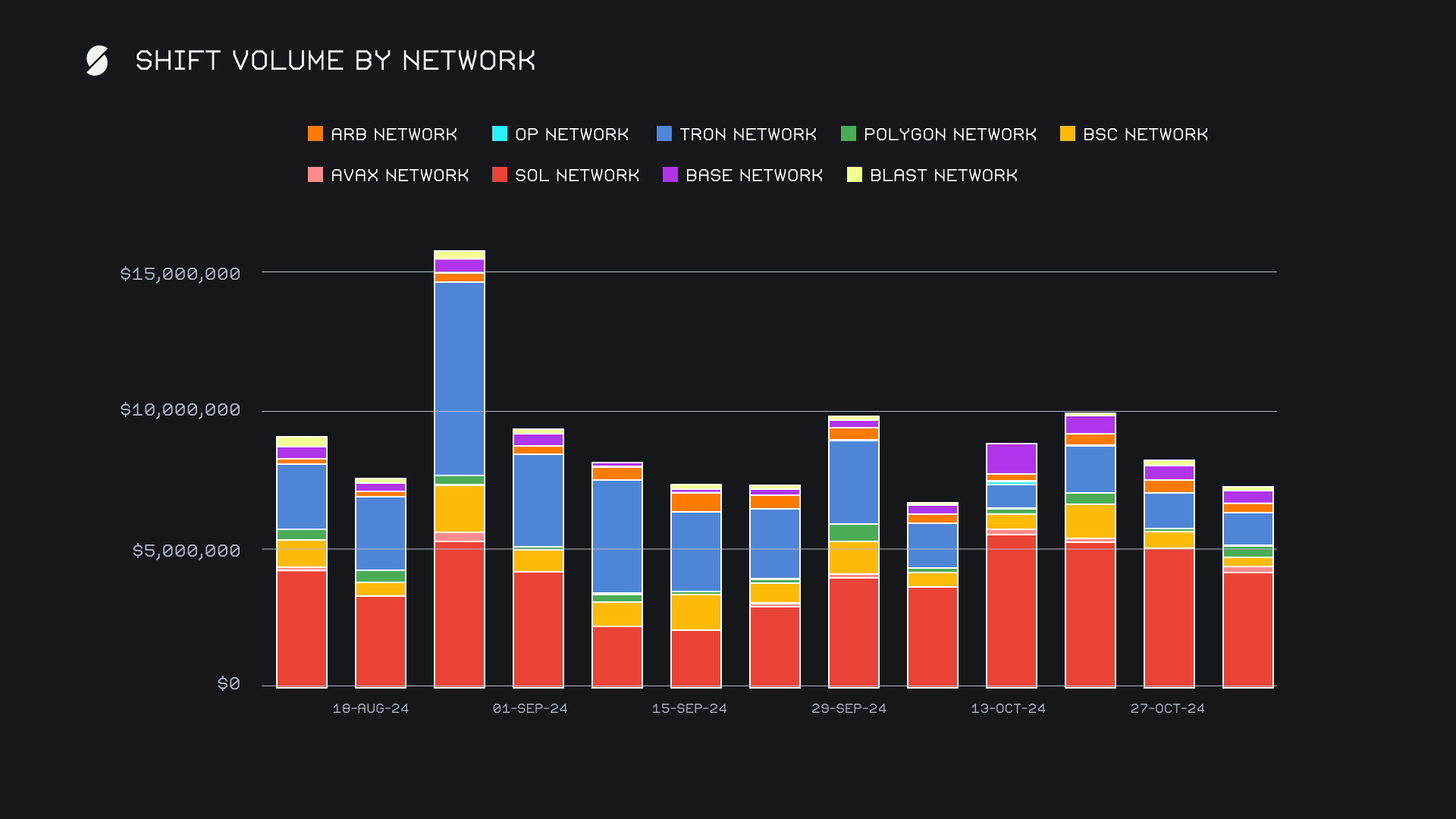

Alternate networks to ETH combined for a total volume of $7.3m, down -11.3%, as user focus remained centered on our top coins, leaving less attention for alternate networks and altcoins. The Solana network continued to lead with $4.2m (-15.6%), capturing the majority of alternate network volume despite a decline in activity. Similar to volume, shift count for the Solana network is dominating, with its 4,576 sum surpassing even that of the Ethereum network. The Tron network followed with $1.2m, showing a more modest drop of -7.7%. The Binance Smart Chain (BSC) network came in third with $431k, marking a -30.5% decrease as stablecoin shifting slowed. The Polygon network stood out as one of the few gainers this week, surging to $413k (+313%), bucking the downtrend observed across most alternative networks.

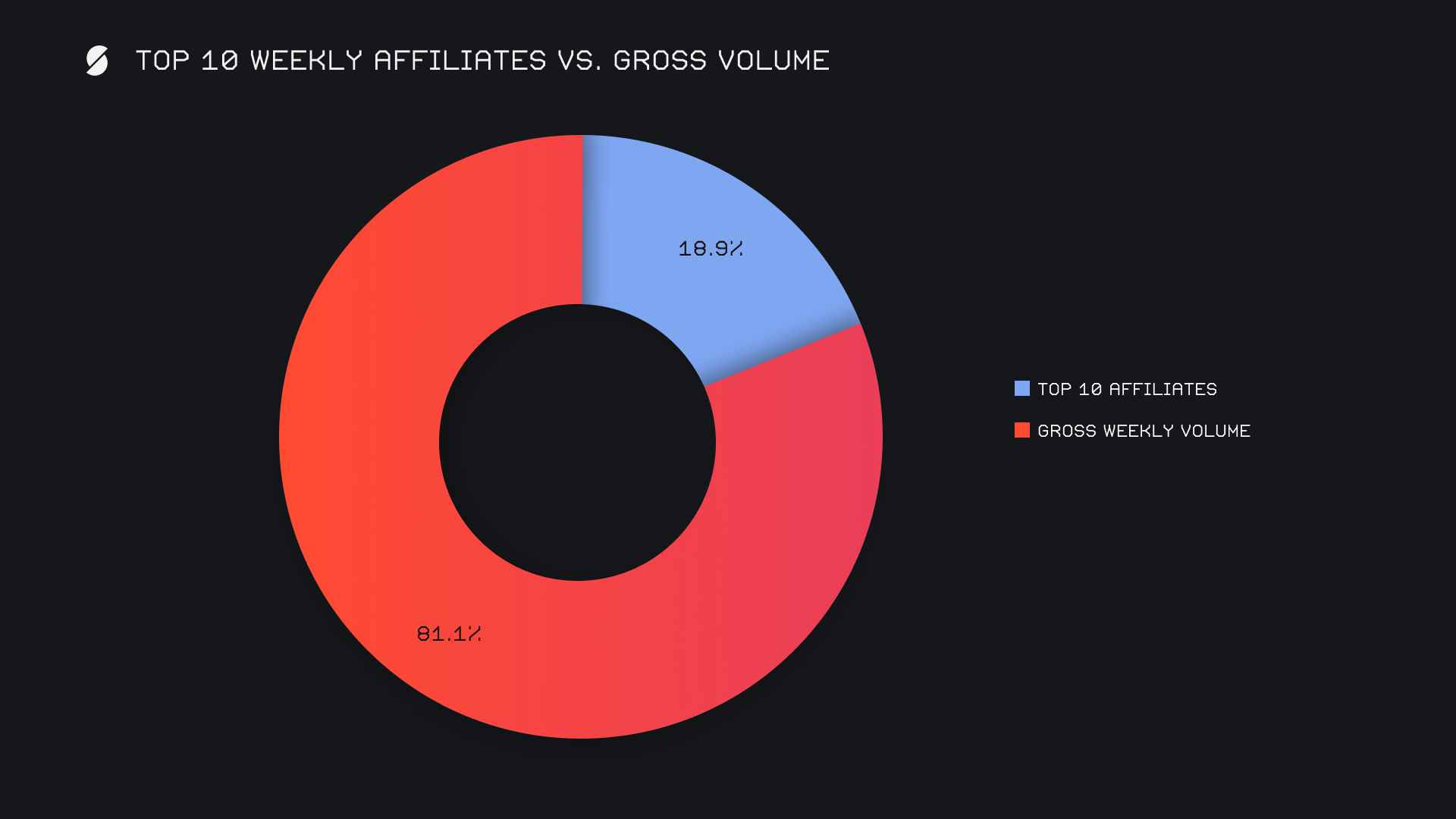

Affiliate News

This week, our top affiliates combined for a total volume of $2.0m, a notable +55.8% increase from the previous week. This growth was led by our first and second-placed affiliates, both of which retained their rankings and saw strong rebounds back toward more familiar volumes, with respective totals of $791k (+103.7%) and $529k (+52.9%). In third place was a newcomer to the top ranks, recording $290k in volume and making its debut in the top three with an impressive +194.2% increase. Altogether, our top affiliates accounted for 18.9% of this week’s total volume, +3.9% higher than last week’s proportion.

That’s all for now. Thanks for reading and happy shifting.