SideShift.ai Weekly Report | 2nd - 8th September 2025

Welcome to the one hundred and seventieth edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

Highlights

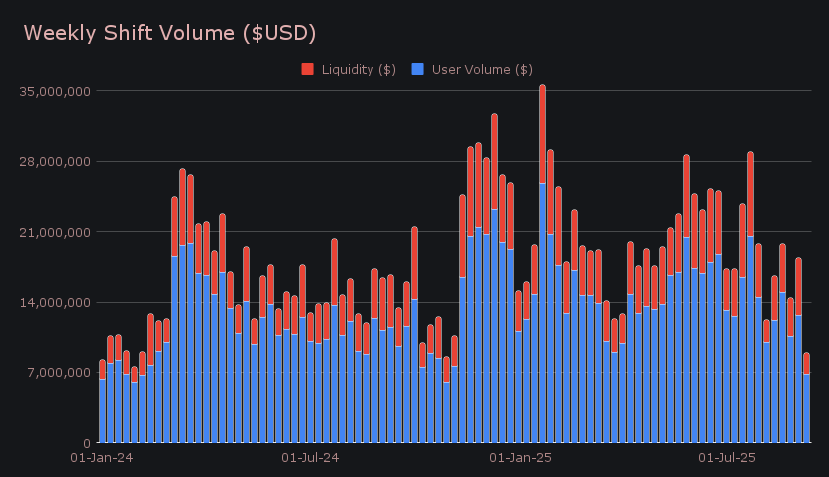

- SideShift recorded $8.96m in weekly volume (−51.3%), a slower week aligning with lower volumes seen across the industry.

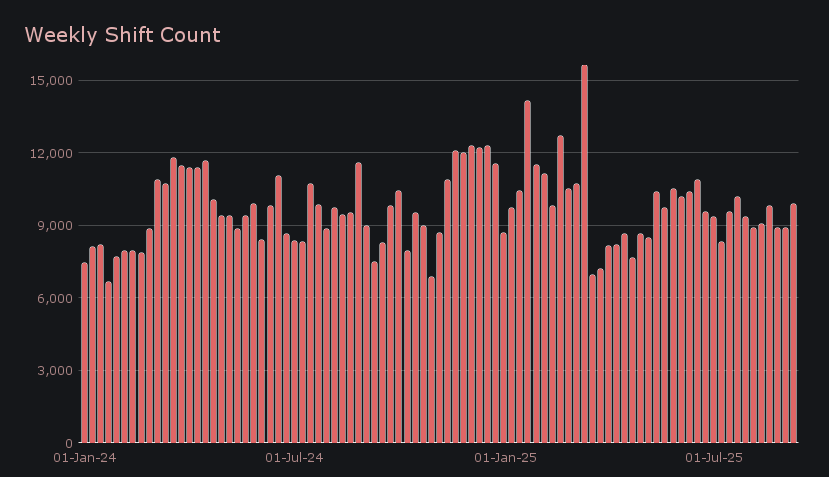

- Shift count rose +11.5% to 9,895, reflecting more activity through integrations despite smaller average sizes.

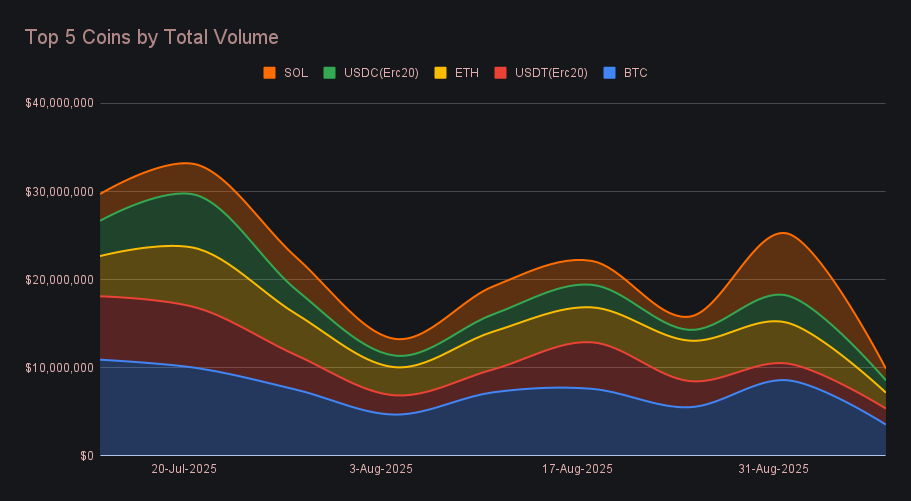

- BTC led at $3.55m (−58.6%), while ETH ($1.80m, −61.0%) and SOL ($1.32m, −81.3%) both eased after stronger totals last week.

- USDT (ERC-20) marked $1.82m (−3.9%), a new yearly low, though settlements increased +15.3% to $1.00m and proved steadier than other stablecoins.

- Affiliate flows totaled $2.31m (−61.3%), the largest decline among site segments, while shift count grew for nearly all top affiliates.

XAI Weekly Performance & Staking

XAI kicked off the week on stronger footing near $0.178 before retracing, ultimately holding between $0.1635 and $0.1779. The close at $0.1672 left the token slightly down on the week, trimming market cap to $25.75m from $27.68m a week ago (−6.97%). The pullback marked a reset from early highs but still leaves the broader one-month trend pointing higher than August levels.

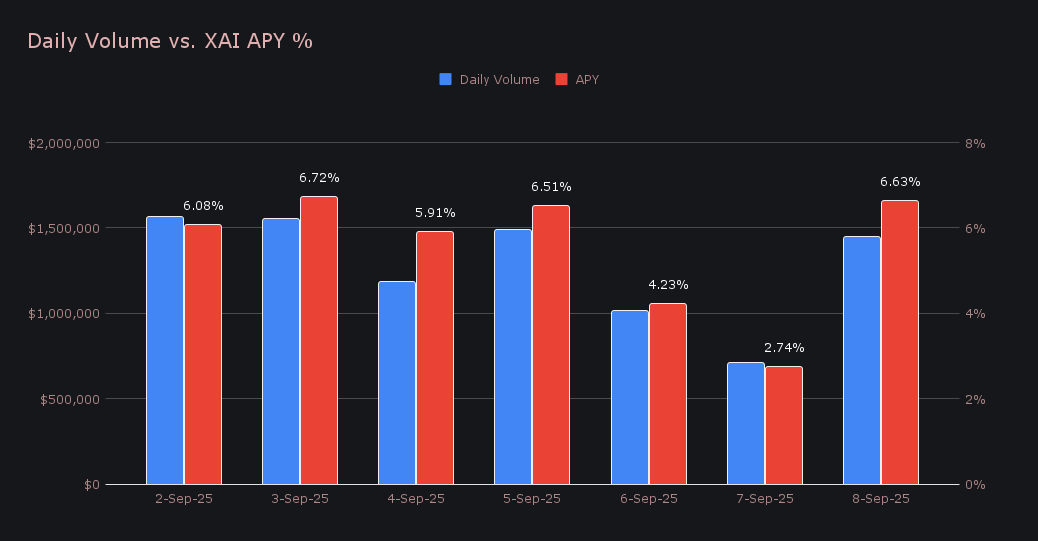

Staking rewards reflected the slower pace on SideShift, with 143,029.14 XAI ($24,232.16) being distributed to our staking vault at an average yield of 5.55% APY. The week’s standout came on September 3rd, when 24,685.29 XAI was paid out at 6.72% APY, backed by $1.55m in daily shift volume. Outside of that day, rewards and yields were dialed down, showing a clear link between lower site volume and reduced staking output as compared to recent weeks.

Additional XAI updates:

Total Value Staked: 138,529,145 XAI (0.0%)

Total Value Locked: $23,034,382 (−7.2%)

General Business News

This week saw BTC hold steady around $112k and ETH linger near $4.3k, with both staying relatively flat even as the spotlights shifted elsewhere. Sentiment remained in neutral territory, with the Fear & Greed Index tracking at 44/100 over the weekend. Meanwhile, HYPE surged roughly 22% week-on-week to breach $54, hitting price discovery and positioning itself as one of the top movers in the market. SOL also climbed 7.5% to trade near $218, bolstered by news of a $1.65B capital raise tied to the network.

SideShift had a slow showing and logged $8.96m in gross weekly volume, down −51.3% from the prior period and thereby marking the lowest seven-day tally of 2025 so far. User shifting made up $6.82m (−46.2%), while liquidity shifting fell more sharply to $2.14m, with shift flows more evenly spread between deposits and settlements and thereby reducing the need for heavy internal rebalancing. The absence of large-scale shifts in more common pairs — such as BTC/USDT (ERC-20) — further weighed on totals, leaving this week’s leaders, TRX/BTC ($299.8k), ETH/USDT (ERC-20) ($283.4k), and BTC/USDC (ERC-20) ($267.7k), relatively small by comparison.

Shift count told a different story, with 9,895 total shifts marking an +11.5% increase from the previous week, or 1,414 per day on average. The rise was driven by a few top integrations, though these shifts typically came with smaller ticket sizes, reinforcing the divergence between higher count and lower volume.

It was red across the board among top coins, with BTC leading at $3.55m in total volume (deposits + settlements), down swiftly from last week’s $8.58m (−58.6%). Deposits fell to $1.47m, a steep drop from the $4.41m logged the prior week (−66.6%), while settlements held steadier at $1.20m compared with $1.21m previously (−1.1%). The contrast to last week’s rush in deposit inflows highlights how quickly BTC’s activity cooled, pulling aggregate volume back below half of the prior period.

Among stablecoins, USDT (ERC-20) rebounded into the top five with $1.82m in total volume, moving -3.9% lower to mark a new yearly low. Even so, it proved more stable than other stablecoins this week, with deposits slipping to a rather low $316k (−55.0%) but settlements rising to $1.00m (+15.3%), making it the only top coin to show growth on one side of flows. USDC (ERC-20), by contrast, fell harder to $1.40m (−54.5%), with deposits easing to $209k (−32.3%) and settlements dropping to $609k (−55.6%).

ETH and SOL both saw heavy reversals after ranking near the top in the prior report. ETH finished the period with a total volume of $1.80m, down from $4.63m (−61.0%). Deposits came in at $1.07m versus $1.76m last week (−39.2%), while settlements dropped more sharply to $548k from $1.58m (−65.2%). SOL was hit hardest, plunging to $1.32m from last week’s $7.05m (−81.3%). Settlements collapsed to $707k from $3.68m (−80.8%), while user deposits fell to $451k (−21.2%). The stark reversal underscored the absence of large settlement flows such as the BTC/SOL pair, which had driven last week’s surge to multi-month highs for the coin.

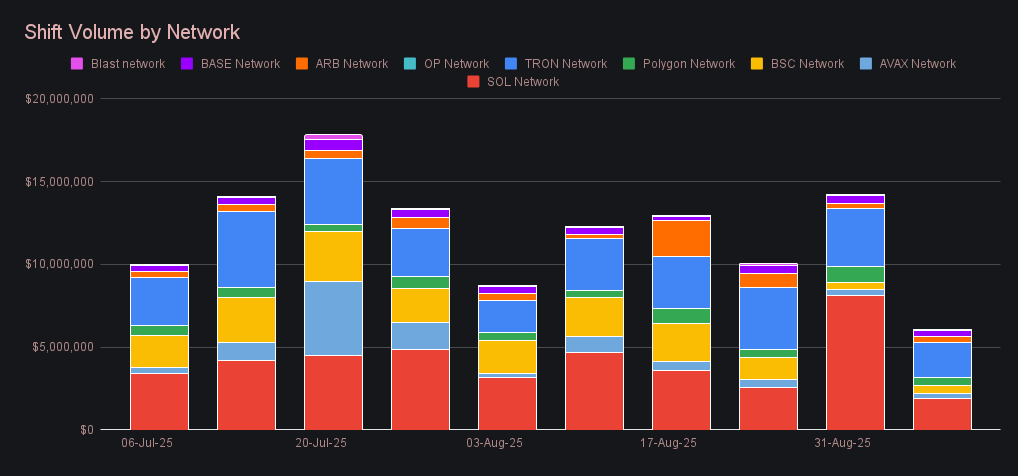

Alternate networks to ETH totaled $6.04m (−57.4%), broadly mirroring the sitewide decline. The Solana network drove the drop, plunging −76.3% to $1.92m as the absence of BTC/SOL shifting cut volumes sharply. The Tron network fell −40.0% to $2.07m, though native TRX managed $790k in volume, finishing just behind USDT (TRC-20) — a rare outcome given that USDT (TRC-20) typically ends more than threefold higher and often sits among the top 3 coins overall. Elsewhere, the Polygon network slipped −47.3% to $510k and Avalanche declined −30.3% to $273k, while the BSC network rose +12.7% to $510k and Arbitrum added +11.6% to $381k, though both remained comparatively small. The Ethereum network finished at $7.78m (−22.5%), as alternate networks, which tend to swing more wildly than ETH, bore the brunt of this week’s overall decline.

In listing news, SideShift recently added support for World Liberty Financial (WLFI) on both the Ethereum and Solana networks. Shifting is now live, directly from any coin of your choice.

Affiliate News

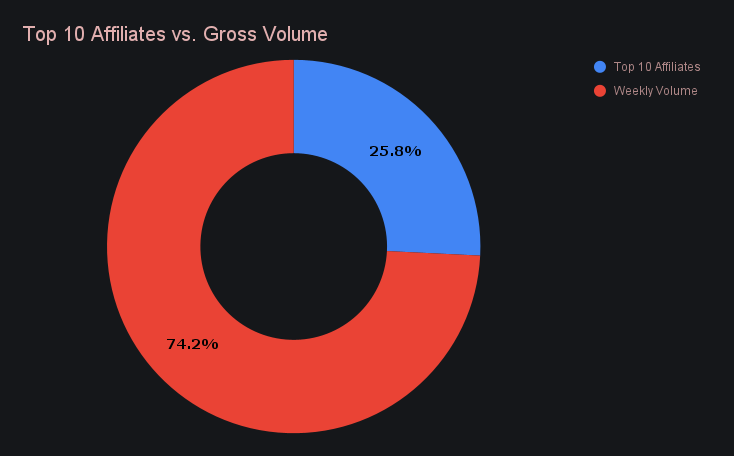

Affiliate flows came to $2.31m (−61.3%), representing the heaviest pullback across the site’s main segments. The leaderboard was reshuffled again, with first place logging $603k (−85.5%) after topping $4.15m last week. Second place followed with $432k (−14.1%), while third place posted $477k (+15.8%) to climb back into the top three. Despite the lower overall totals, gross shift count increased for all but one of our top five affiliates, echoing the sitewide trend of more frequent but smaller shifts.

Collectively, affiliates contributed 25.8% of total SideShift volume, down from 32.5% the week prior.

That’s all for now - thanks for reading and happy shifting.