SideShift.ai Weekly Report | 31st December 2024 - 6th January 2025

Welcome to the one hundred and thirty-fifth edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

To begin the new year, SideShift token (XAI) traded within the 7-day range of $0.1396 to $0.1455, with a steady but modest decline by week’s end. XAI closed at $0.1396, bringing its market cap to $19,881,217, which reflects an approximate decrease of -11% from the time of the last report.

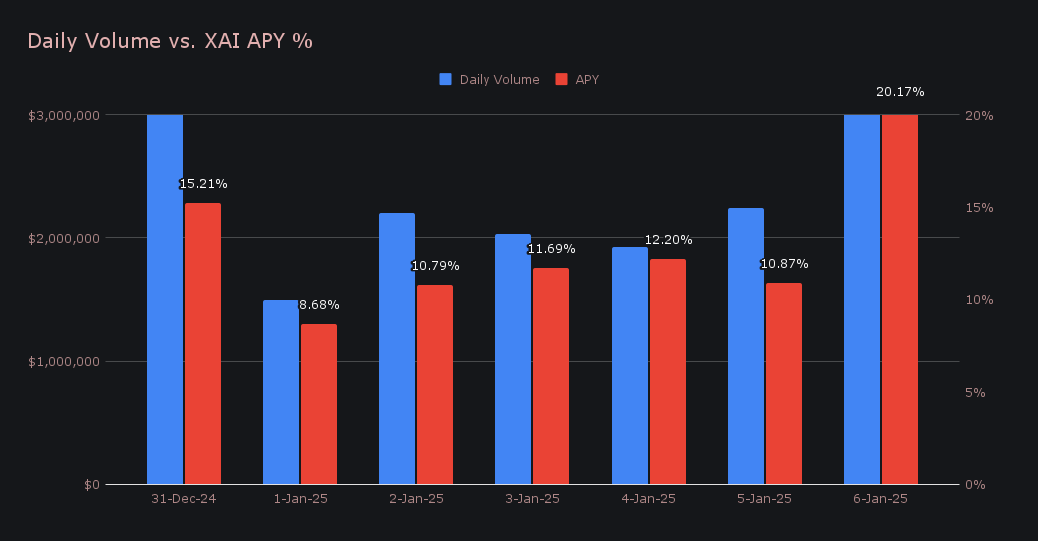

XAI stakers enjoyed an average APY of 12.80% over the week, with the highest daily rewards of 64,492.25 XAI corresponding to a peak APY of 20.17%, and being distributed to our staking vault on January 7th, 2025. Altogether, XAI stakers received a total of 294,554 XAI or $40,667 USD in staking rewards throughout the week.

Additional XAI updates:

Total Value Staked: 128,250,342 XAI (+0.9%)

Total Value Locked: $18,418,307 (+1.5%)

General Business News

This week saw BTC reclaim the six-figure milestone, breaking through $100k after rebounding from the recent dip towards $92k on the final day of 2024. The recovery was driven by strong institutional interest, bolstered by significant inflows into Bitcoin ETFs and Microstrategy’s latest acquisition of 1,070 BTC, valued at $101 million. Alongside the booming AI meta, which has seen coins like ai16z and Fartcoin post explosive gains, SOL also climbed past $220, breaking out of weeks of bearish price action and regaining momentum.

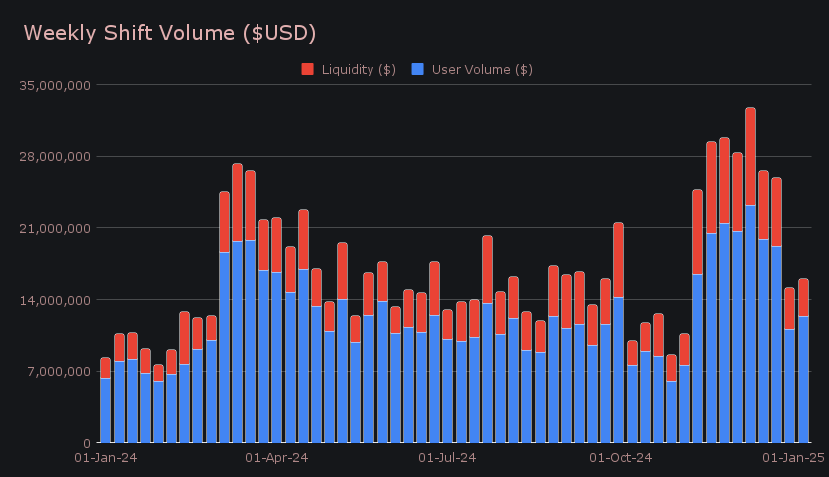

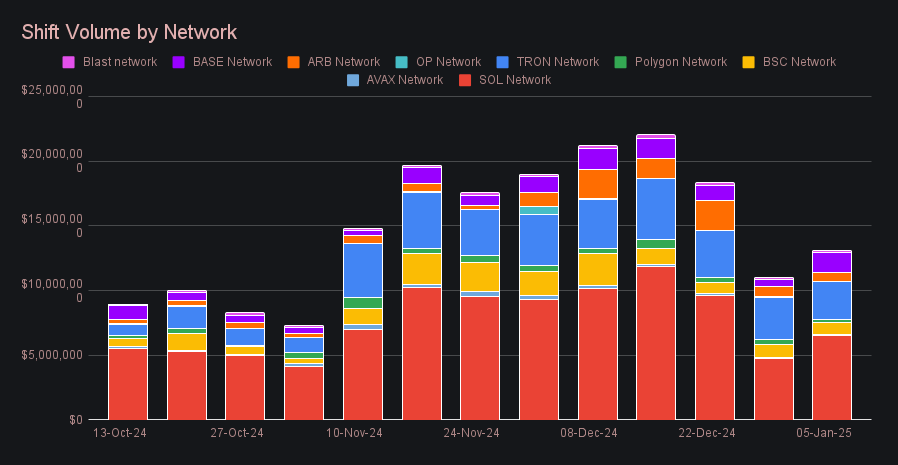

SideShift recorded a gross weekly volume of $16.0m (+6.1%), marking a steady start to 2025. Of this, $12.4m came from user shifting, with the remaining $3.6m stemming from liquidity shifting necessary for internal rebalancing. While this total represents a modest increase from the prior week, it remains approximately -30% lower than the average weekly volume achieved since the beginning of December 2024. Notably, December capped off an incredible run, with SideShift hitting $114.5m in total monthly volume, a new all-time high, following November's impressive $106m milestone. The holiday season did bring some slowdown, as is typical, but the platform still finished the year on an unprecedented streak of back-to-back record-breaking months.

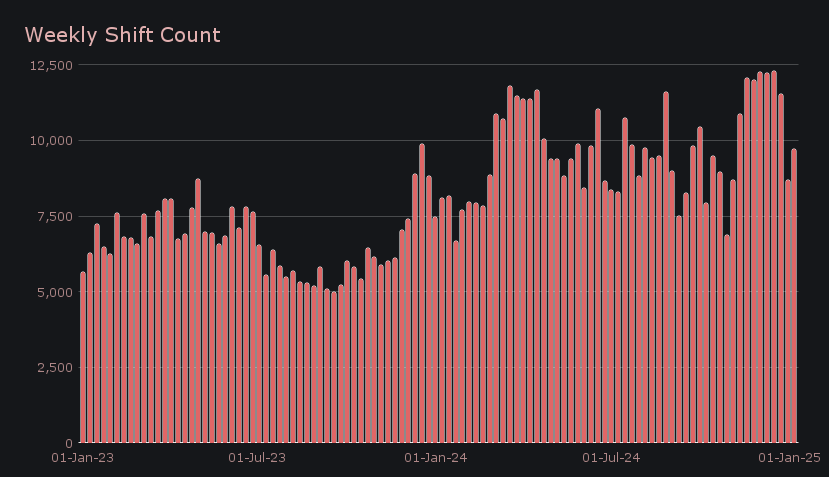

When looking at our weekly shift count we can also observe an increase, as this week's sum ended at 9,706 shifts (+11.5%). This figure combined with our gross volume to produce healthy daily averages of $2.3m alongside 1,387 shifts. While recent shift counts remain below the elevated levels seen in early December, they have shown relative resilience on a weekly basis, and indicate that SideShift is getting back on track as market activity gradually picks up post-holidays.

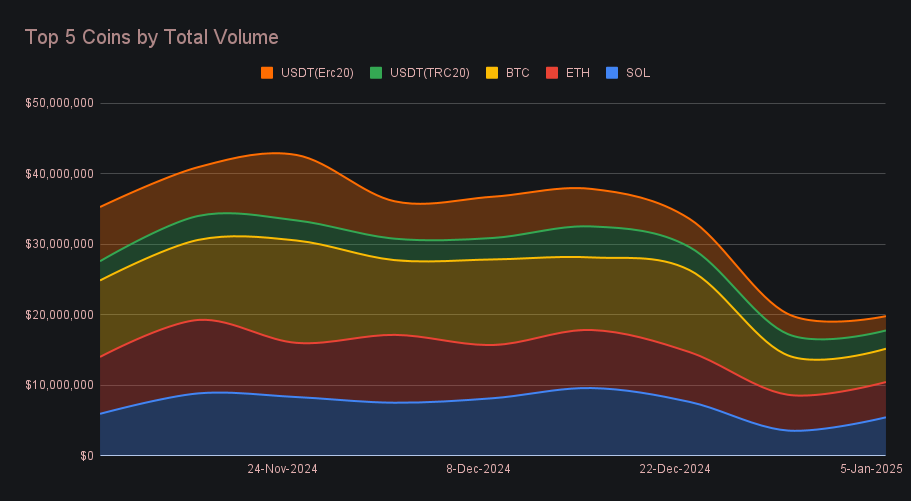

SOL returned to the top spot this week with a total volume of $5.5m (+52.1%), marking its first time as SideShift’s leader in several months. This performance was fueled by sizable increases in both user deposits, which climbed to $2.1m (+65.7%), and user settlements, which rose to $2.4m (+41.5%). Notably, SOL was the only coin among our top three to see its settlement volume increase, reflecting strong user demand for the token. These trends highlight SOL’s resurgence in popularity, supported by its recent price rally, and ongoing interest in both the AI and memecoin metas dominating on Solana.

ETH followed in second place with a total volume of $5.0m (-1.5%), marking its lowest weekly total since the first week of November. Deposit volume increased to $2.3m (+32.8%), while settlements fell to $1.7m (-12.1%), reflecting a clear shift toward users depositing ETH rather than receiving it. This decline in settlements underscores a cooling in ETH demand as users appear to favor other assets, though its overall volume remains steady enough to hold its spot in the top three.

BTC came in third with a total volume of $4.7m (-15.5%), and similar to ETH, marked its lowest weekly total since early November. User deposits rose modestly to $1.8m (+17.5%), while settlements declined sharply to $2.0m (-24.3%). Despite the broader market’s optimism as BTC reclaimed $100k, shifting activity on SideShift suggests that users are more intensely focused on alternative assets, mirroring the interim cooling demand observed for ETH.

In opposition to the majority of our top 5 coins decreasing, a handful outside of the top 5 contributed healthy shift action this week. XRP stood out with a total volume of $1.6m (+26.8%), maintaining its recent positive momentum. ETH (Base) followed with a notable surge to $1.3m (+212.1%), while LTC and BCH also saw respectable totals, reaching $906k (+107.5%), and $452k (+348%), respectively. Overall it was a mixed bag, with 11 of the top 20 seeing increases in total volume, while the remaining 9 noted declines.

Alternate networks to ETH combined for a total of $13.1m this week, increasing by +19.6% and confidently surpassing the ETH network, which recorded a total of $9.1m (-7.7%). The Solana network accounted for the bulk with $6.6m (+37.4%), firmly maintaining its position as the leading alternate network. As usual, the Tron network followed in second place at $2.9m (-11.7%), while the Base network emerged as the standout performer, skyrocketing to $1.6m (+199.1%), and marking the largest percentage gain of any network. In contrast, the BSC and ARB networks saw decreases, ending at $876k (-7.9%) and $700k (-13.7%). Collectively, alternate networks to ETH accounted for 40.8% of shifts this week.

Affiliate News

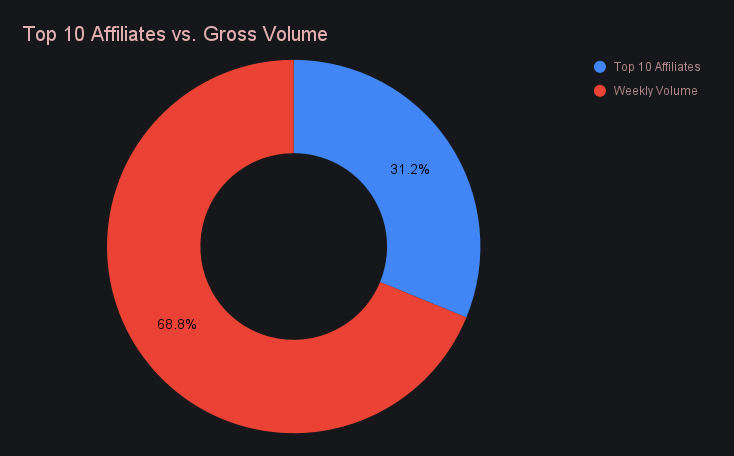

This week, our top affiliates contributed a combined $5.0m (-2.3%) in shift volume, maintaining a steady contribution to SideShift’s total volume. Our first-placed affiliate retained its leading position by a wide margin with $2.9m, despite incurring a slight volume decline of -12.2%. Meanwhile, our previous second-placed affiliate slipped to third, with $566k (+33.4%), while our new second-placed affiliate grew slightly to $668k (+1.0%).

Altogether, our top affiliates accounted for 31.2% of SideShift’s weekly volume, a consistent share compared to the previous period.

That’s all for now. Thanks for reading and happy shifting.