SideShift.ai Weekly Report | 3rd - 9th December 2024

Welcome to the one hundred and thirty-fourth edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

This past week, SideShift token (XAI) saw modest upward movement, trading within the 7-day price range of $0.1501 to $0.1625. After briefly jumping past $0.16 midweek, XAI settled at $0.1575 by week's end. Its market cap now stands at $22,480,892, reflecting a slight increase of +1.98% compared to last week.

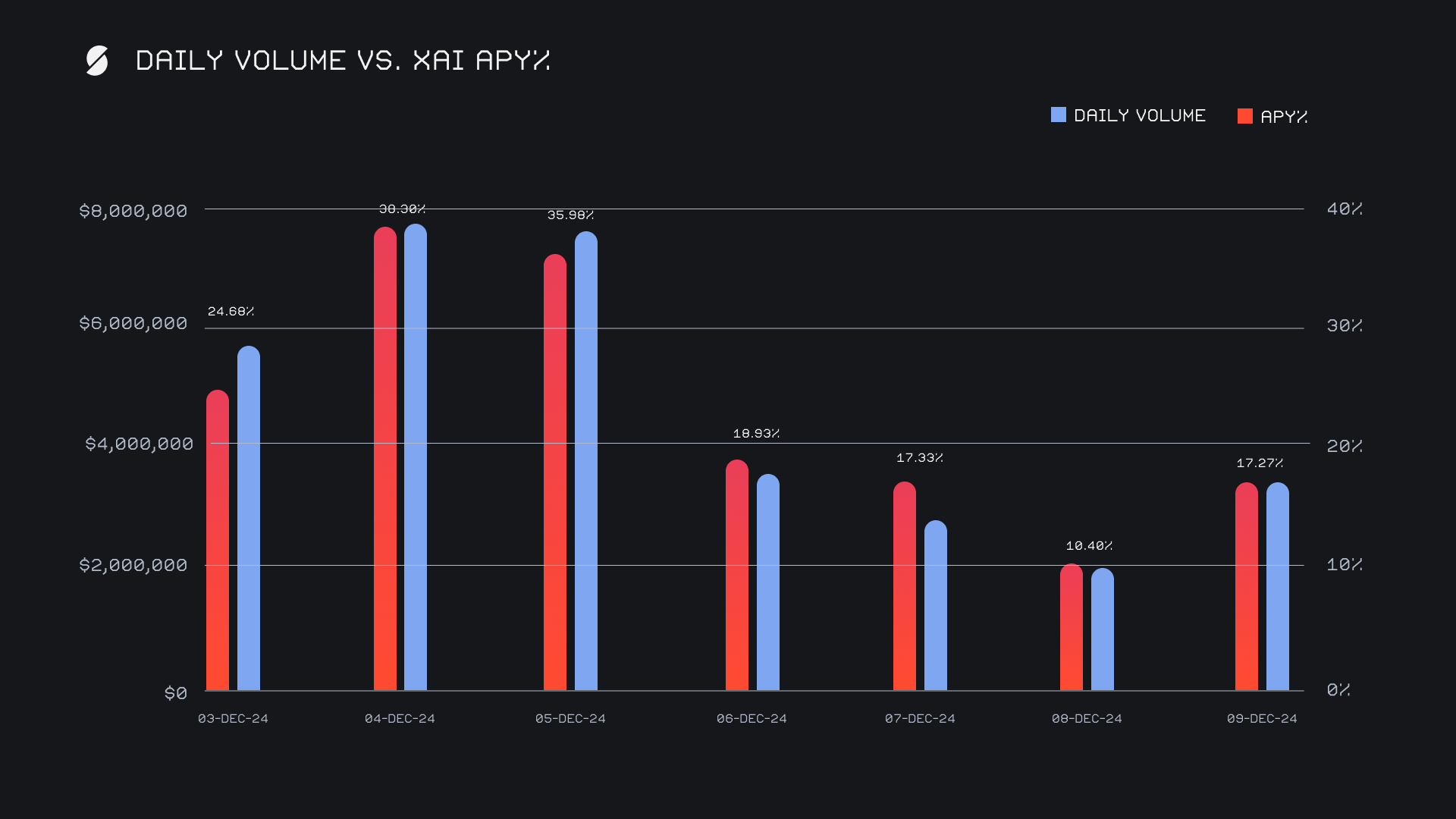

Staking activity on SideShift remained impressive, with a weekly APY average of 23.27% and a significant rewards high of 112,407.1 XAI being distributed directly to our staking vault on December 5th, 2024, corresponding to a peak APY of 38.30%. This spike coincided with yet another record-breaking daily volume of $7.7m, emphasizing the link between platform activity and staking returns. Altogether, XAI stakers received a total of 500,923.36 XAI or $78,895.43 USD in staking rewards over the course of the week.

An additional 100k USDC was sent to SideShift's treasury this week, bringing the current total to a value of $23.76m. Users can follow along directly with treasury updates via sideshift.ai/treasury.

Additional XAI Updates:

Total Value Staked: 127,129,378 XAI (+0.5%)

Total Value Locked: $20,139,853 (+1.9%)

General Business News

This past week, Bitcoin briefly dipped below $95k, following the largest liquidation event since December 2021, with total liquidations exceeding $1.6 billion. The broader market suffered sharp losses, though a handful of exceptions, including PEPE, AAVE, and MOG, defied the trend to close the week with solid gains of over +20%. Amid the turbulence, institutional confidence held firm, exemplified by MicroStrategy’s acquisition of 21,550 BTC for $2.1 billion on December 9, 2024.

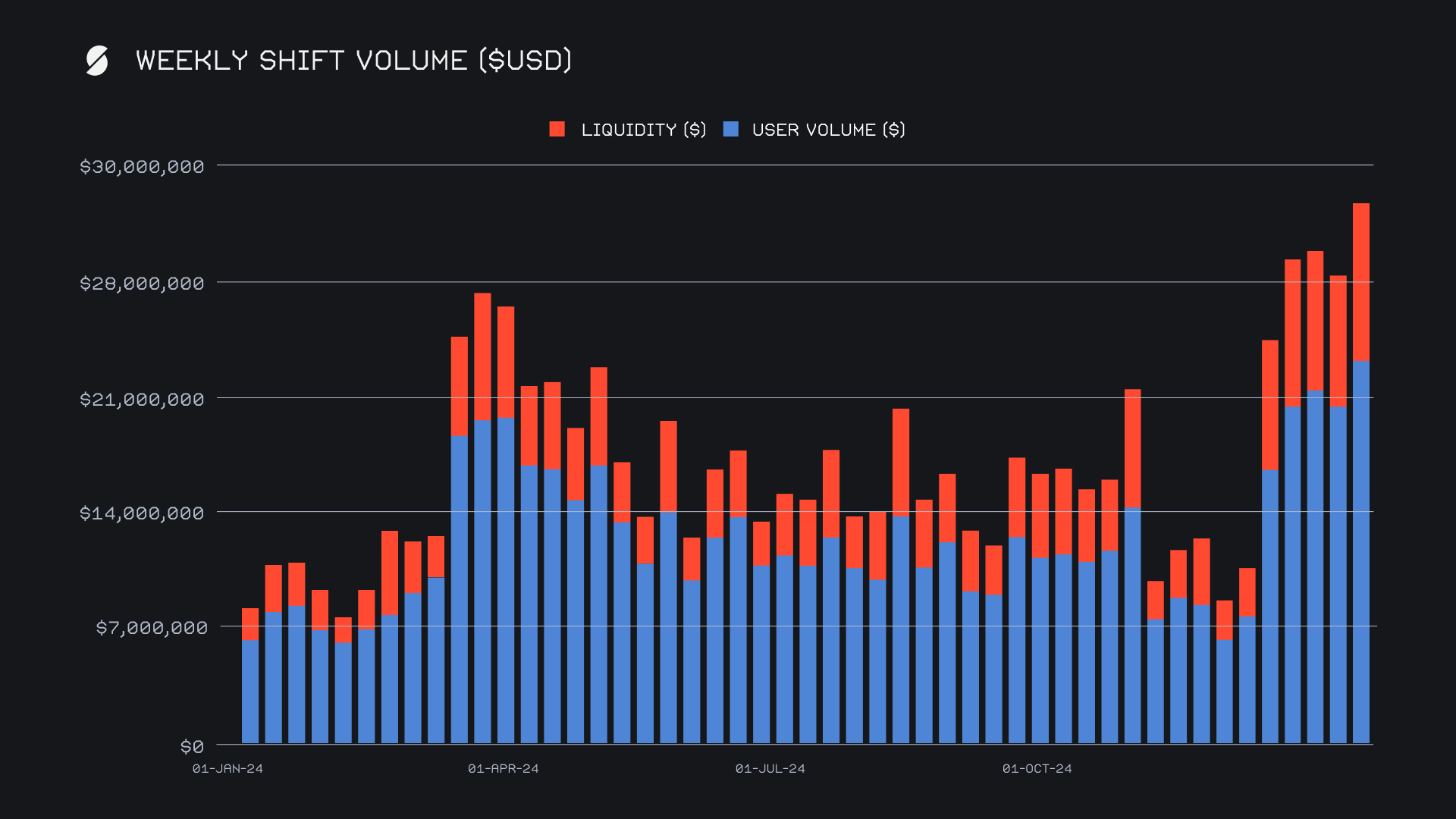

SideShift delivered another record-breaking performance this week, achieving an all-time high weekly volume of $32.7m (+15.4%), nearly double the YTD running average. User shifting contributed the lion’s share with $23.2m (+12.0%), while liquidity shifting climbed at a faster rate, adding $9.5m (+24.9%) to ensure the smooth execution of shifts. December 4th and 5th stood out as particularly exceptional, with volumes peaking at $7.7m and $7.6m, respectively, showcasing SideShift’s ability to seamlessly handle surges in activity.

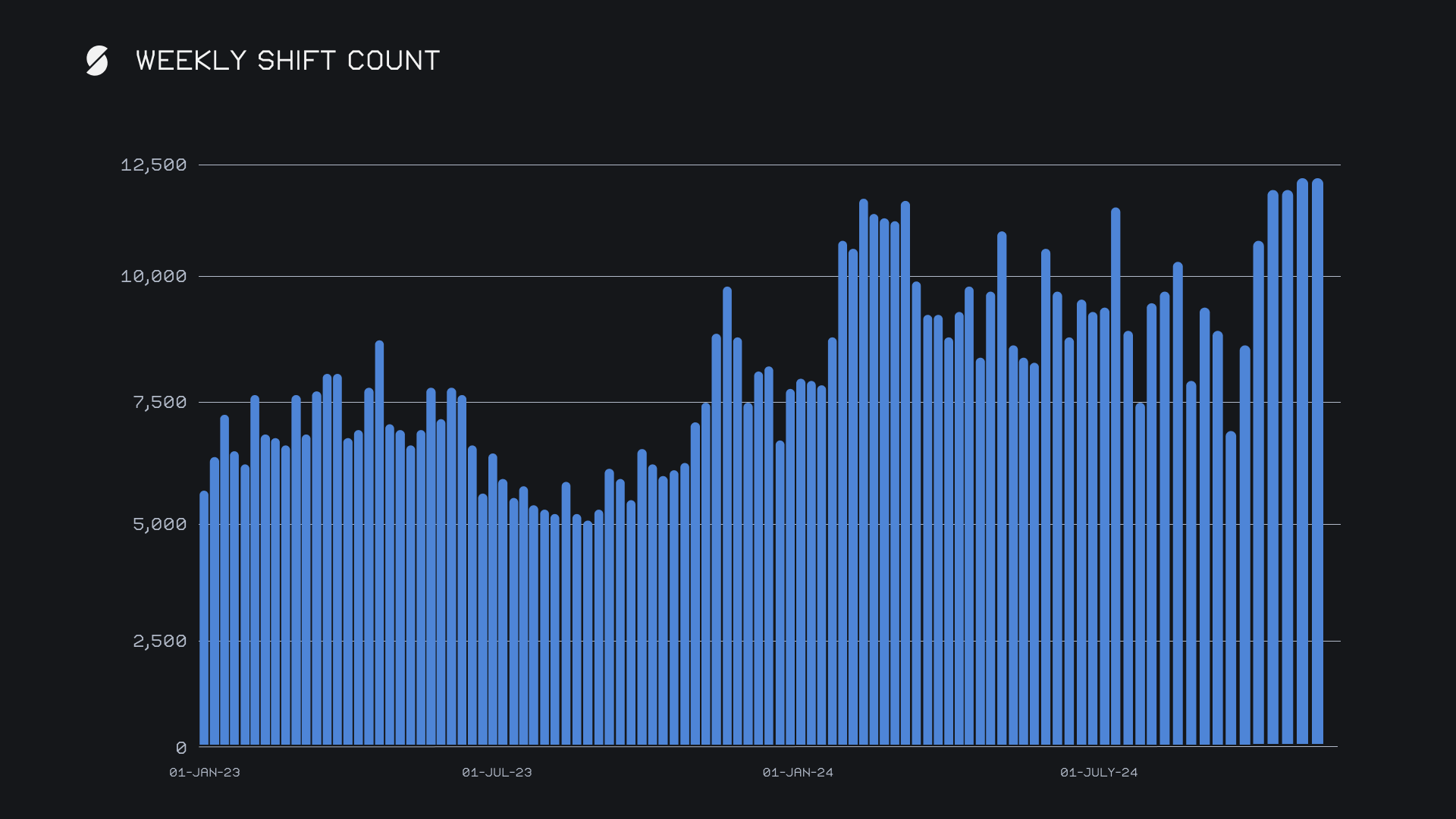

Our weekly shift count remained solid at 12,221 shifts (-0.4%), marking the fourth consecutive week above 12,000 and maintaining a sizable gap of +28% above the YTD average. Together with the record volume, this translated to robust daily averages of $4.67m across 1,746 shifts. BTC/USDT (ERC-20) reclaimed its position as the most popular pair among users, generating $1.7m, closely followed by ETH/BTC with $1.6m, reflecting consistent interest in these high-value pairs. Meanwhile, SOL shift pairs lagged behind the leaders, with activity spread more evenly across various coins, highlighting a more diversified but less concentrated demand for Solana-based shifts this week.

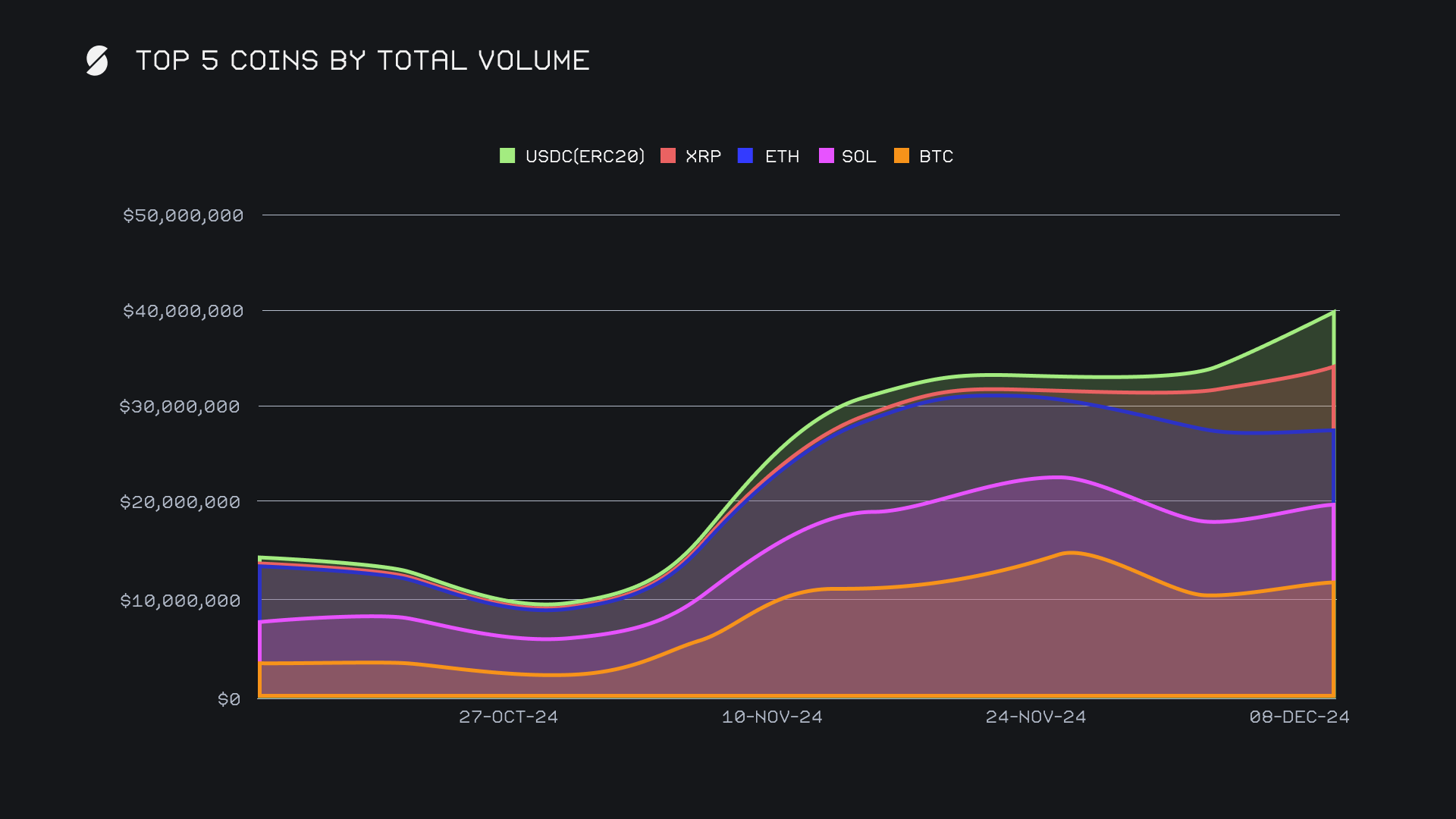

BTC held its position as the most shifted coin this week, reaching a total volume of $12.1m (+14.5%), its second highest figure throughout the past few months. This week highlighted continued overall interest in BTC, but yet another reversal in last week’s trend. User deposits climbed significantly to $5.5m (+22.5%), reflecting increased selling activity, while settlements dipped to $3.9m (-4.3%), showing slightly less demand on the receiving end. These movements reflect a mix of ongoing confidence in short term BTC’s trajectory paired with users taking a more cautious stance.

SOL climbed into second place with a weekly total of $8.2m (+8.5%), marking a modest improvement from the previous period. However, the slight decline in deposit volume to $2.8m (-2.4%) contrasts with a settlement growth of $3.3m (+7.9%), highlighting shifting trends in user behavior as activity leans more toward receiving SOL rather than offloading it. This week’s performance, while consistent, suggests SOL is stabilizing without significant spikes in interest.

ETH followed in third, generating a total of $7.5m (-21.6%), marking the only decline among any top 10 coin this week. Both deposits and settlements fell at a comparable rate, with deposits closing at $3.5m (-14.4%) and settlements totaling $2.7m (-12.8%), reflecting a slowdown in momentum on SideShift for now. In contrast, XRP activity continued to rise, finishing close behind with a total weekly volume of $6.2m (+53.1%). However, this growth was driven almost entirely by deposits, which surged to $3.1m (+126.7%), while settlements plummeted to $559k (-59.4%). The stark contrast underscores a wave of users shifting out of XRP after its impressive price surge last week.

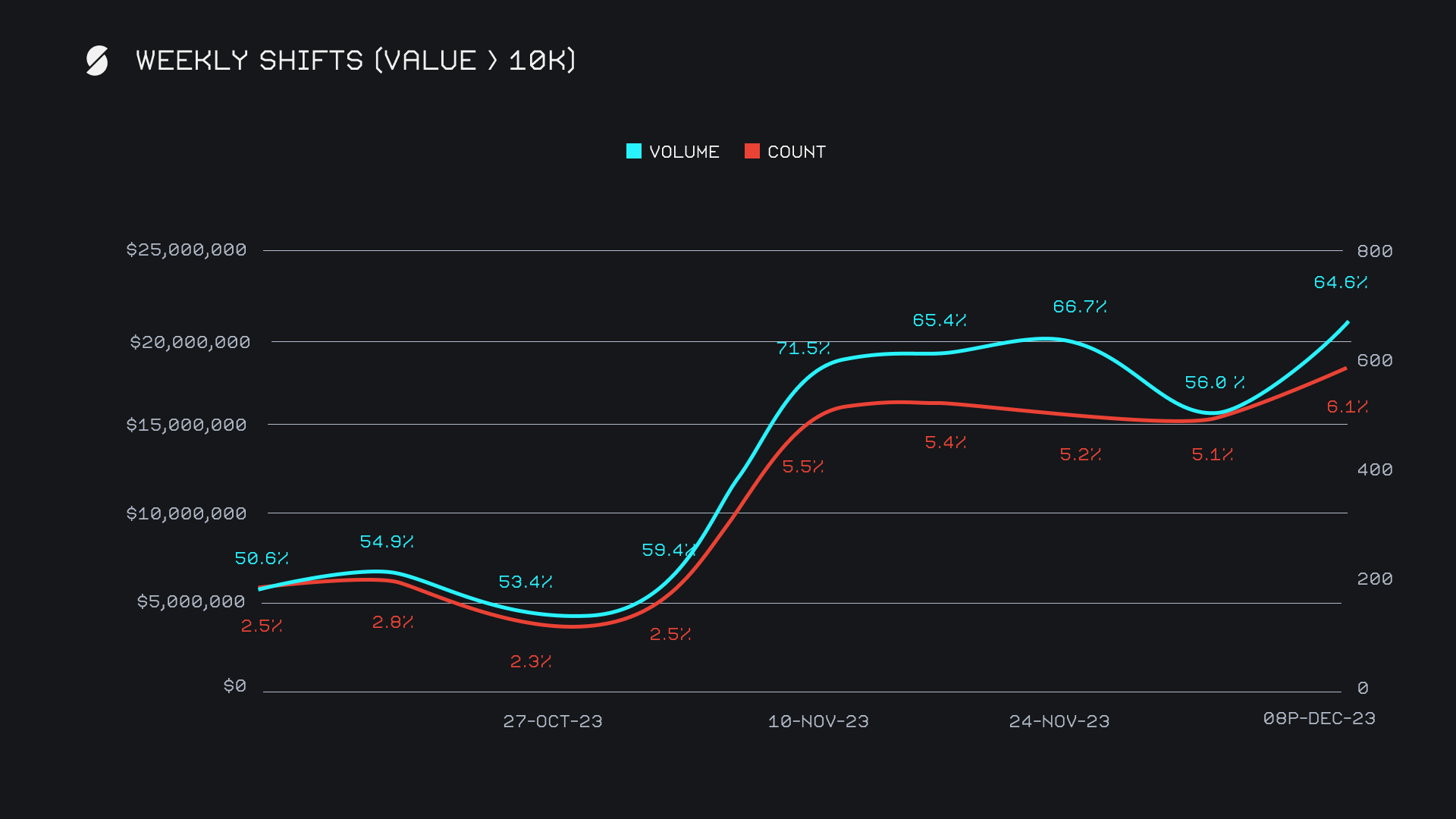

Amid the overall rise in volume and count, this week set new records for whale shift activity on SideShift. A total of 741 large-scale shifts (those exceeding $10k) contributed $21.1m, marking nominal highs for both metrics. As highlighted by the percentages along the lines, whale shifts accounted for 64.4% of the week’s total volume and 6.1% of the total count. The sustained upwards trend in whale shift proportion activity over the past five weeks underscores its significant impact on SideShift's overall performance, driving a substantial portion of the platform's volume.

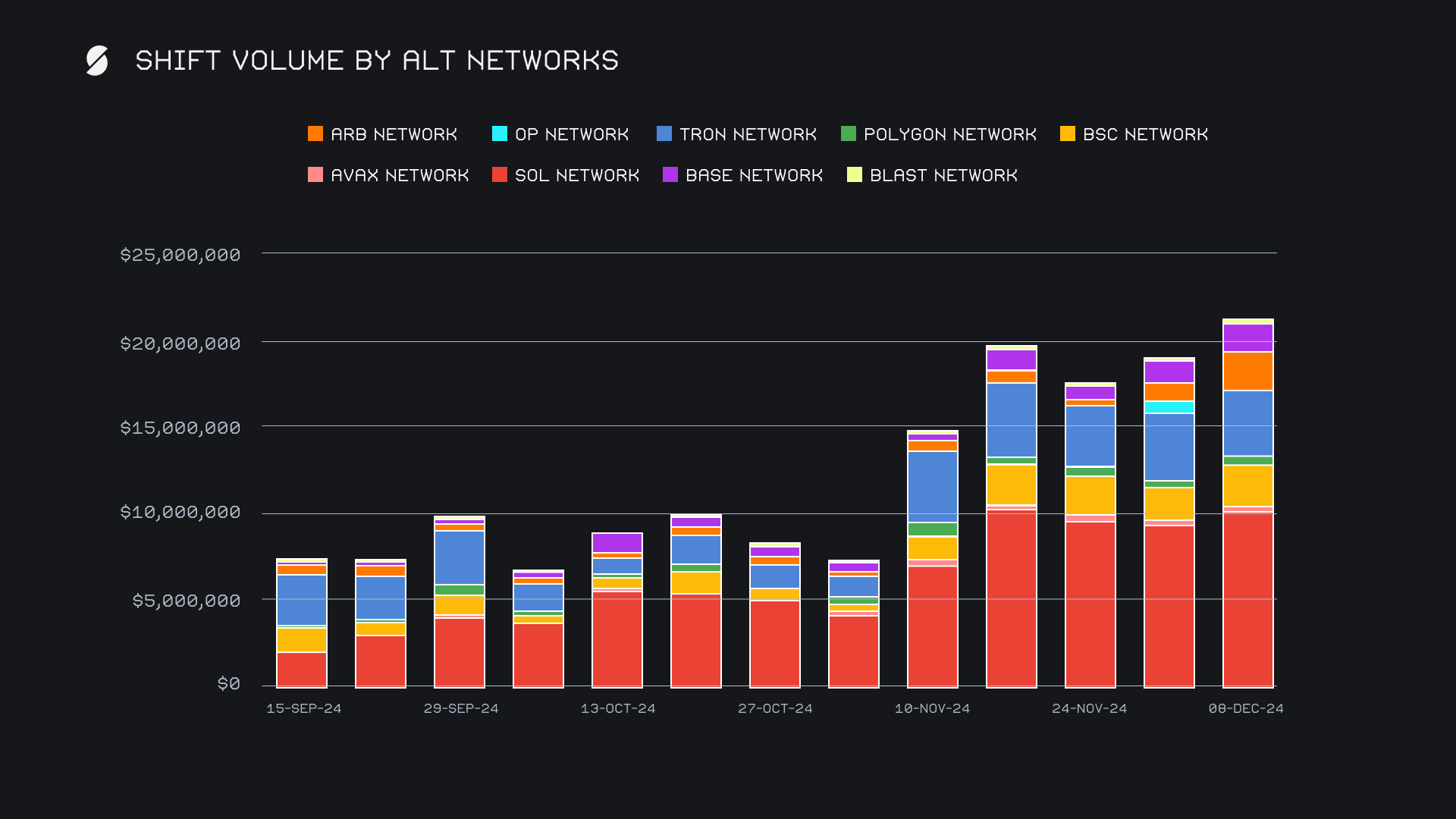

Alternate networks to ETH combined for a total $21.2m this week (deposits + settlements), climbing +11.8% to hit a multi-month high. Collectively, they surpassed the ETH network, which managed to amass a total $18.8m. The Solana network led with $10.2m (+9.0%), maintaining its position as the top alternate network. The TRON network followed at $3.8m (-3.3%), while BSC climbed to $2.4m (+27.2%). Arbitrum saw the largest percentage increase, doubling to $2.3m (+110.2%), and Base rounded out the top five at $1.6m (+28.7%). Other network changes were negligible, with the exception of Optimism, which plummeted -88% to just $75k, after what looks to be a one off performance last week.

Affiliate News

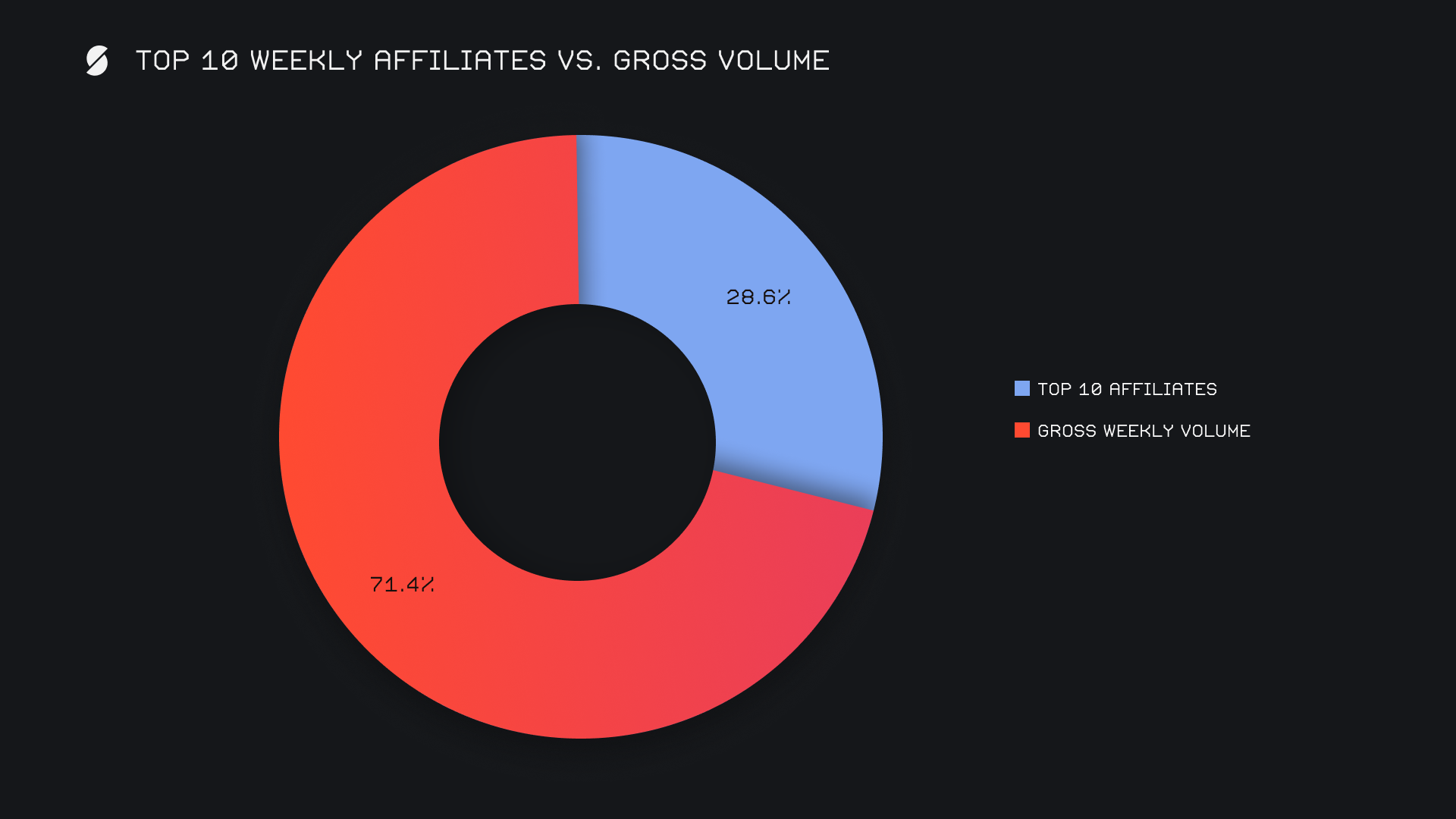

Our top affiliates showcased an extremely steady performance, contributing a combined $9.3m (-0.1%) in shift volume this week. Our first-placed affiliate held its position, closing the week with $3.6m (-5.2%), while our second-placed affiliate followed closely with $3.0m (-3.2%). The most notable performance came from our third-placed affiliate, which rebounded +45.6% to $1.7m alongside a dominant shift count of 1,508. Altogether, our top affiliates accounted for 28.6% of SideShift’s weekly volume, -4.5% lower than last week’s proportion, due to the overall increase in volume.

That’s all for now. Thanks for reading and happy shifting.