SideShift.ai Weekly Report | 3rd - 9th June 2025

Welcome to the one hundred and fifty-seventh edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

Highlights

- XAI gained +16.7%, closing at $0.1584 - its highest level since early March 2025.

- SideShift processed $23.17m across 10,396 shifts, marking five straight weeks above $20m and four of five weeks above 10k shifts.

- Top affiliate set a new all-time record with $7.69m in volume and 1,917 shifts (+24%).

- USDT (ERC-20) jumped +36.8% to $6.57m, overtaking its TRC-20 counterpart to rank 2nd overall.

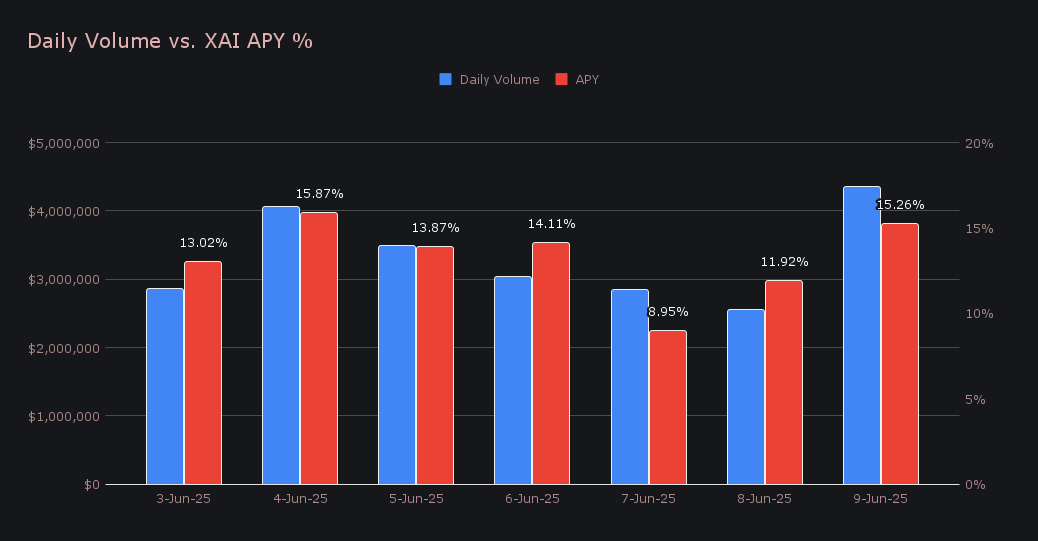

- XAI staking delivered a 13.29% average APY, with 54,383 XAI paid out on June 5th alone.

XAI Weekly Performance & Staking

XAI had a breakout performance this week, charting a strong upward trajectory after multiple sessions of steady trading. Price climbed within the bounds of $0.1352 to $0.1595, closing at $0.1584, near its weekly high. This late-week rally helped push XAI’s market cap up +16.71% to $23,594,606, the highest level observed since the beginning of March 2025.

On the staking side, rewards remained solid, with an average APY of 13.29% across the week. The highest daily reward came on June 5th, when 54,383.46 XAI was distributed directly to our staking vault at an APY of 15.87%, supported by $4.05m in daily shift volume. All together, XAI stakers received a total of 322,185.99 XAI, or $50,521.67 USD in rewards throughout the week.

A total of 200,000 USDC was added to SideShift’s treasury this week, bringing the current estimated total to a value of $24.09m. Users can follow along with live updates at sideshift.ai/treasury.

Additional XAI updates:

Total Value Staked: 135,364,994 XAI (+0.6%)

Total Value Locked: $21,514,256 (+17.1%)

General Business News

Bitcoin reclaimed the spotlight this week, climbing back above $110,000 in a move that nearly matched its recent rally seen just a few weeks ago. The breakout was bolstered by ongoing institutional demand, as BlackRock’s Bitcoin ETF became the fastest in history to surpass $70b in assets. Ethereum followed with a +3.6% weekly gain to trade near $2,680, while HYPE (+10.3%) and AAVE (+13.7%) led among notable altcoins.

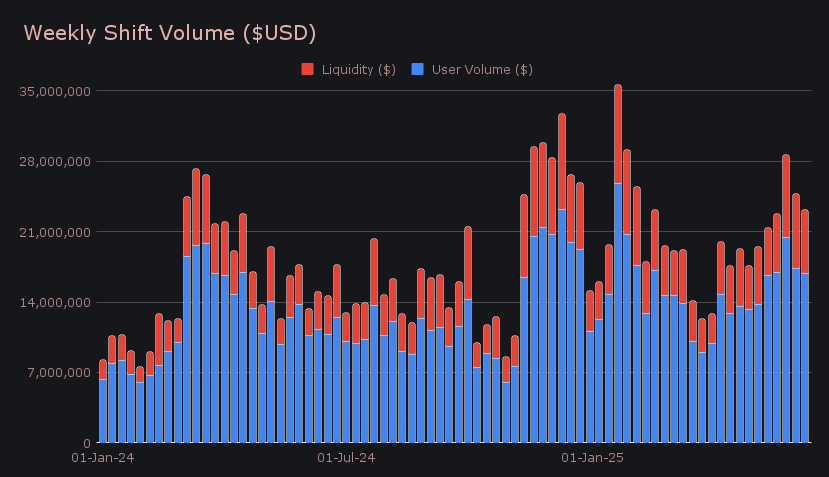

SideShift closed the week with a gross volume of $23.17m, a -6.5% dip from the previous period, but still a firm showing in the broader context. This marks the fifth consecutive week that total volume has remained above the $20m mark, reflecting sustained action despite the minor weekly decline. Liquidity shifting slid -15.4% to $6.24m, a sign that user flows were more naturally balanced and required less internal rebalancing. That trend was echoed by our top two user shift pairs - BTC/USDT (ERC-20) and USDT (ERC-20)/BTC - which posted nearly identical volumes and combined for over $3.3m. ETH/BTC followed as the third most active pair with $1.01m, capping off a week of steady and organic shifting.

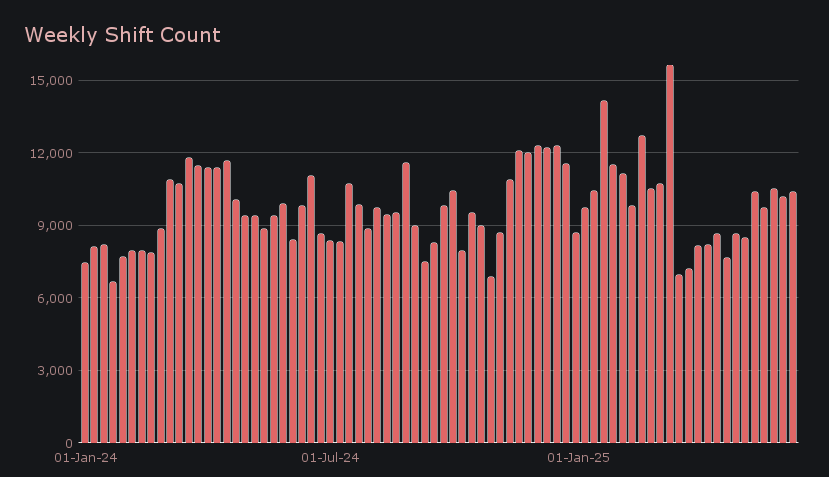

Shift count rose to 10,396 (+2.2%), marking the fourth week out of the past five that SideShift has logged more than 10,000 shifts. Activity averaged 1,485 shifts per day, with daily volume coming in at $3.31m - levels that outpace our YTD averages by +11% and +3%, respectively. While there haven’t been any outsized spikes, shift count has been mostly climbing gradually for the past twelve weeks, returning to the upper end of its recent range and reinforcing the consistency of user engagement.

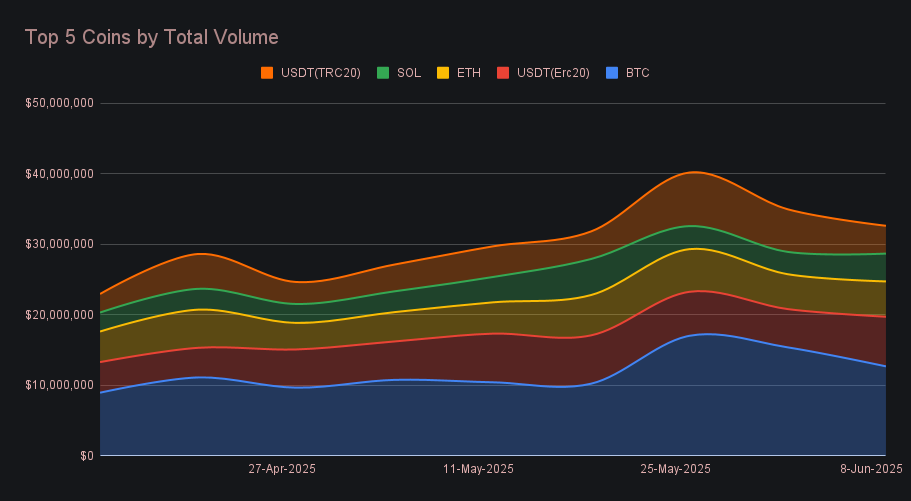

BTC remained the top coin by total weekly volume with $12.7m, though this marked a -17.5% drop from the week prior. User flows leaned slightly toward settlements, with $4.15m in deposits (-17.9%) versus $5.34m in settlements (-15.3%), suggesting users were more often shifting into BTC than out. Still, the sharpest shift in BTC’s dominance came about two weeks ago, when it swelled to a multi-week high on the back of renewed market strength. That concentration has since cooled, but total top 5 coin volume remains relatively elevated, indicating growth in activity elsewhere.

Both USDT versions told very different stories this week. USDT (ERC-20) climbed sharply to $7.04m in total volume (+29.6%), backed by a +72.1% increase in user deposits to $2.47m and a +19.0% boost in settlements to $2.59m. Its TRC-20 counterpart, meanwhile, dropped -34.8% to $3.94m in total user volume, as deposits fell nearly -47% to $1.41m and settlements maintained at $1.32m (+5.3%). The data suggests that most of the stablecoin shift activity flowed to ERC-20 pairs this week. This resulted in a ranking of 2nd and 5th respectively for USDT (ERC-20) and USDT (TRC-20) in our top coins by volume.

ETH and SOL followed, continuing their steady presence among our top coins. ETH climbed to $5.01m in total user volume (+1.3%), driven by $2.25m in deposits (-9.1%) and $1.49m in settlements (+27.9%). SOL kept pace with a total user volume of $3.95m (+24.7%), with deposits rising +41.0% to $1.69m and settlements down -3.7% to $1.29m. While neither coin saw the kind of surging activity that defined weeks seen earlier this year, both maintained consistent flows and showed quiet strength, a theme we’ve seen repeatedly across recent periods.

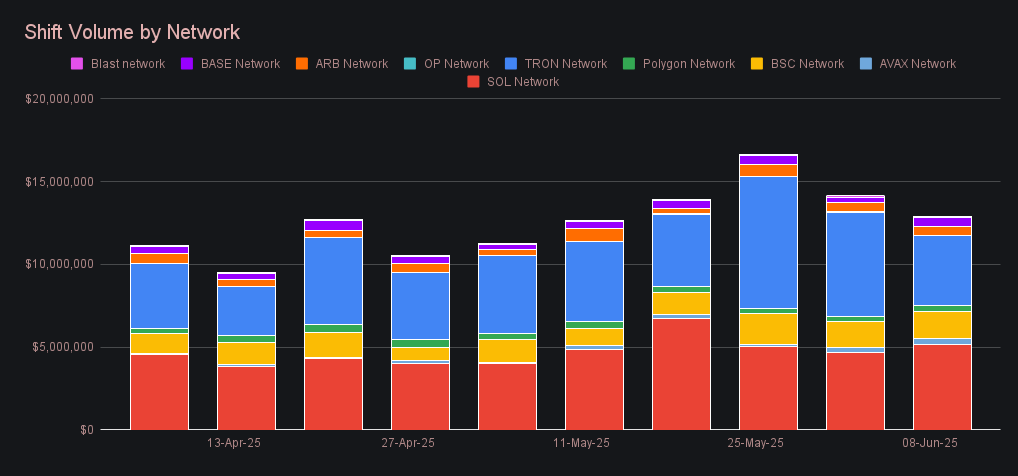

Alternate networks to Ethereum totaled $12.89m this week, down -8.6% from the prior period, as user flows remained largely concentrated on the Ethereum network, which held steady at $15.26m (-0.6%). A significant contributor to the alternate network dip was the Tron network, which fell -32.0% to $4.28m following a brief stint ahead of Solana in recent weeks. The Solana network reclaimed the top spot among this group with $5.16m (+10.2%), as the two continue to trade positions in what appears to be a relatively even contest. The BSC network quietly maintained solid activity with $1.58m (+2.4%), marking the third-highest volume of any alternate chain. The Base network posted the largest percentage increase, rising +69.5% to $560.4k, while Avalanche climbed +31.2% to $424.8k. The Polygon network added $355.2k (+10.0%), while Arbitrum, OP, and Blast all declined, though their combined share remained minimal.

Affiliate News

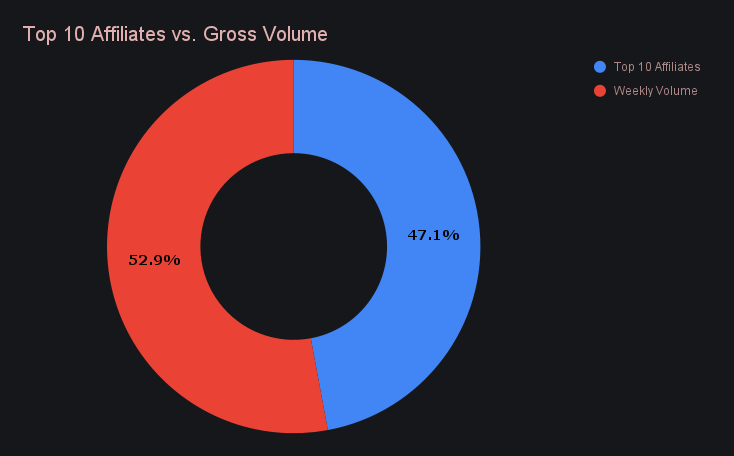

Affiliate activity from top affiliates totalled $10.91m this week, marking a -5.6% decline, though their combined share of total volume ticked up to 47.1%. Our top-ranked affiliate delivered a record-breaking $7.69m (+37.5%), setting a new high for any individual affiliate. This was backed by a surge in usage, with 1,917 completed shifts (+24%), reflecting both sustained traction and growing scale. Our second-place affiliate also had a strong week, closing with $2.16m (-9.5%) alongside a steady shift count of 584 (+5%). Meanwhile, third place remained unchanged, despite a more tempered performance of $401k (-57.6%).

That’s all for now - thanks for reading and happy shifting.