SideShift.ai Weekly Report | 4th - 10th February 2025

Welcome to the one hundred and fortieth edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

SideShift token (XAI) spent the week in the $0.16 range, maintaining the gain in price made last week, only to again spike at this week’s end to over $0.19. At the time of writing, XAI is priced at $0.192, reflecting a 12.83% increase from this week’s average price.

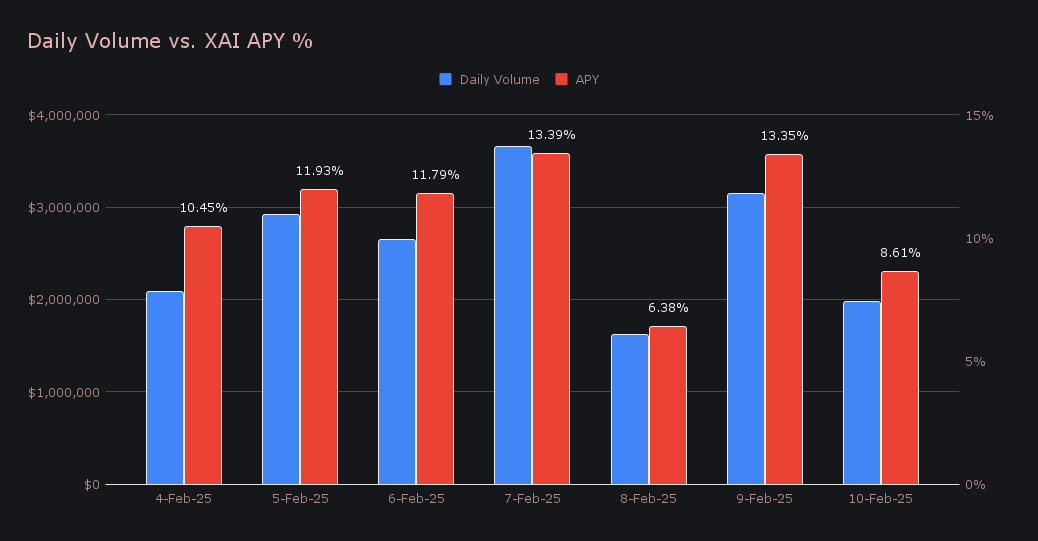

Even with the price increase, XAI stakers continued to see decent returns this week with an average APY of 10.84%. This ranged from a high of 44,848.77 XAI, corresponding to 13.39% earned from $3.6m of volume made on 7th February 2023 down to a low 6.38% from $1.6m volume the following day. It then recovered again to 13.35% the day after that. In total, XAI stakers received 256,512.78 XAI or $42,561.17 USD in rewards throughout the week.

Additional XAI updates:

Total Value Staked: 130,477,190 XAI (+0.2%)

Total Value Locked: $25,066,364 (+16.5%)

General Business News

After the large sell-off witnessed in the previous week, followed by what looked like a spectacular recovery, we saw a lull in price action for the crypto market overall with less dramatic price swings. BTC hovered above $95k, testing $100k on a few occasions. So far it has been unable to find the momentum to stay there once again.

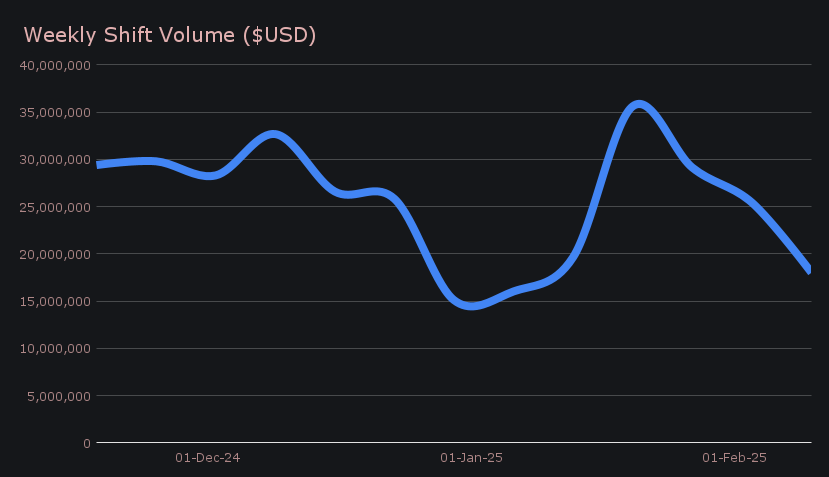

With less market volatility SideShift experienced lower volume generally, finishing the week with $18m gross volume (-29.23%). This included just over $5m (-34.61%) for internal liquidity rebalancing, leaving $12.9m (-26.86%) in user shift volume for the week. The daily average of $2.57m is a -25% drop from our 2025 YTD daily average. This week we saw a peak of $3.65m on 7th February, coinciding with a market rally, while seeing a low of $1.6m the following day.

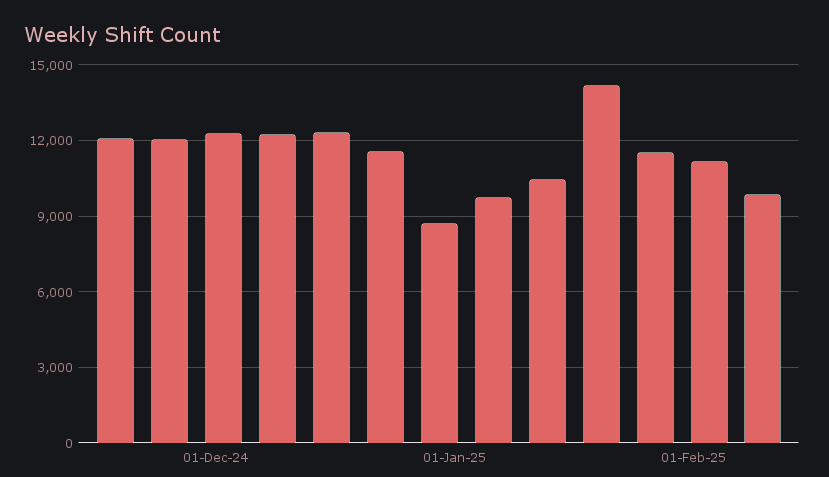

The weekly shift count dipped below our 10k benchmark for the first time in 4 weeks to finish the week with 9,821 (-11.87%). This included a -13.37% drop in the number of shifts involving SOL, -12.99% for Bitcoin related shifts and ETH was less impacted with -7.09% shifts. The BTC/ETH pairing had 350 shifts, making up 23% of all shifts from BTC, albeit only bringing in 9% of the volume ($228,024). A significant 842 shifts were processed for the USDC (SOL)/SOL pairing, which made up 86% of all shifts to SOL. Meanwhile, the BTC/USDT (ERC20) pairing was our most popular by volume and the only to reach the $1m mark. Interestingly, the SOL/ETH pair had the second most volume with $610k, while the opposite ETH/SOL pair saw less volume at $464k. This reversal in trend has been a few weeks in the making as we see users moving back to ETH from SOL.

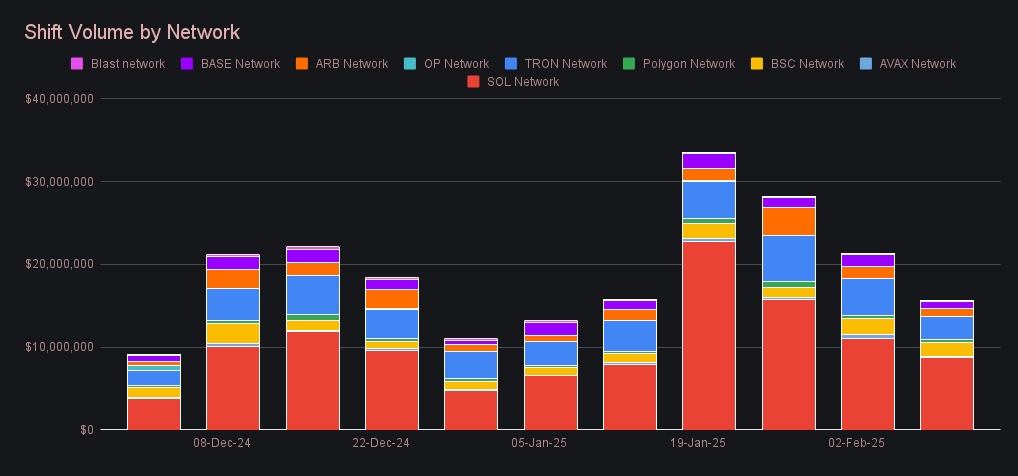

SOL has taken first place once again as our most popular coin by volume, reaching a total of $6.55m (deposits and settlements) despite a -18.47% drop from last week. This meant that BTC, last week’s most popular asset took a bigger hit, declining -35.88% to $5.88m total volume. Other top coins followed this trend with our top 5 coins all seeing declines and averaging -27% from last week. There were some notable exceptions including a slight +4% increase in USDT (ERC20) user deposit volume to $904k, while user settlement volume increased for USDC on Solana by +75% to $460k. BNB was the only coin in the top 10 to see an overall increase from last week as it finished with $400k overall volume (+384.44%).

Shifts involving stablecoins saw similar declines to other major assets with a total volume of $8.33m, a -28% decrease from last week which was evenly distributed between deposits and settlements. There was a relatively high -$845k net stablecoin outflow, with USDT (ERC20) settlements ending up $1m more than deposits. A $360k net inflow of USDC (SOL) due to an increase in user deposit volume wasn’t enough to level out stablecoin shifting.

Alternative networks to ETH had a combined volume of $15.4m (-26.62%) and were hit harder compared to the Ethereum network’s $12.79m (-13.65%). Its dominance increased to 35% of total shifts, up from last week’s 29%. in percentage terms the Avalanche network saw the largest decline by -83.88% to $65k while only Polygon network was able to keep volume at the same level compared to the week prior, with $378k (-0.71%).

Affiliate News

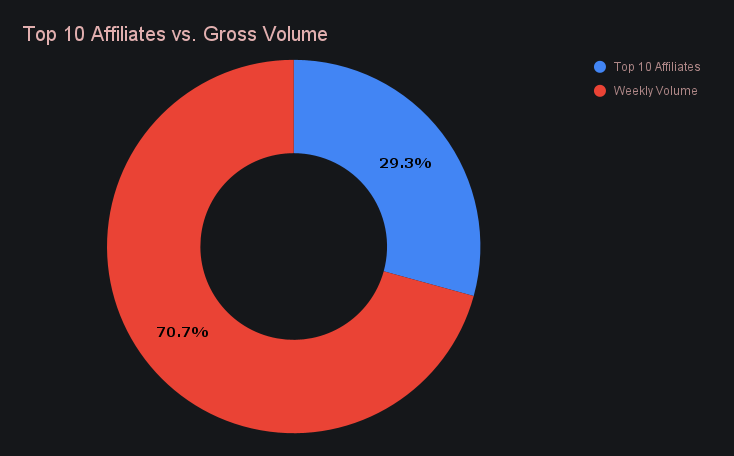

Volume generated from integrations and other affiliates saw a 49% decline in volume to $5.3m, a significant drop compared to shifts made on the website directly. This decline in volume was shared among our top integrations, the worst hit down -58.11%, although one top integrator managed to increase their shift count to 1,317 for the week (+2.57%). All together, volume from affiliates represented 29.27% of the total, which is slightly down from last week.

That’s all for now. Thanks for reading and happy shifting.