SideShift.ai Weekly Report | 4th - 10th June 2024

Welcome to the one hundred and eighth edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

This week, the SideShift token (XAI) experienced notable fluctuations within the 7-day price range of $0.1545 to $0.1991. The token saw a significant dip mid-week, dropping from approximately $0.199 to $0.154 before gradually recovering to its current price of $0.1708. This price movement had an impact on the market cap, which currently stands at $23,119,361, reflecting a decrease of -12.7% from the previous week's market cap of $26,475,923.

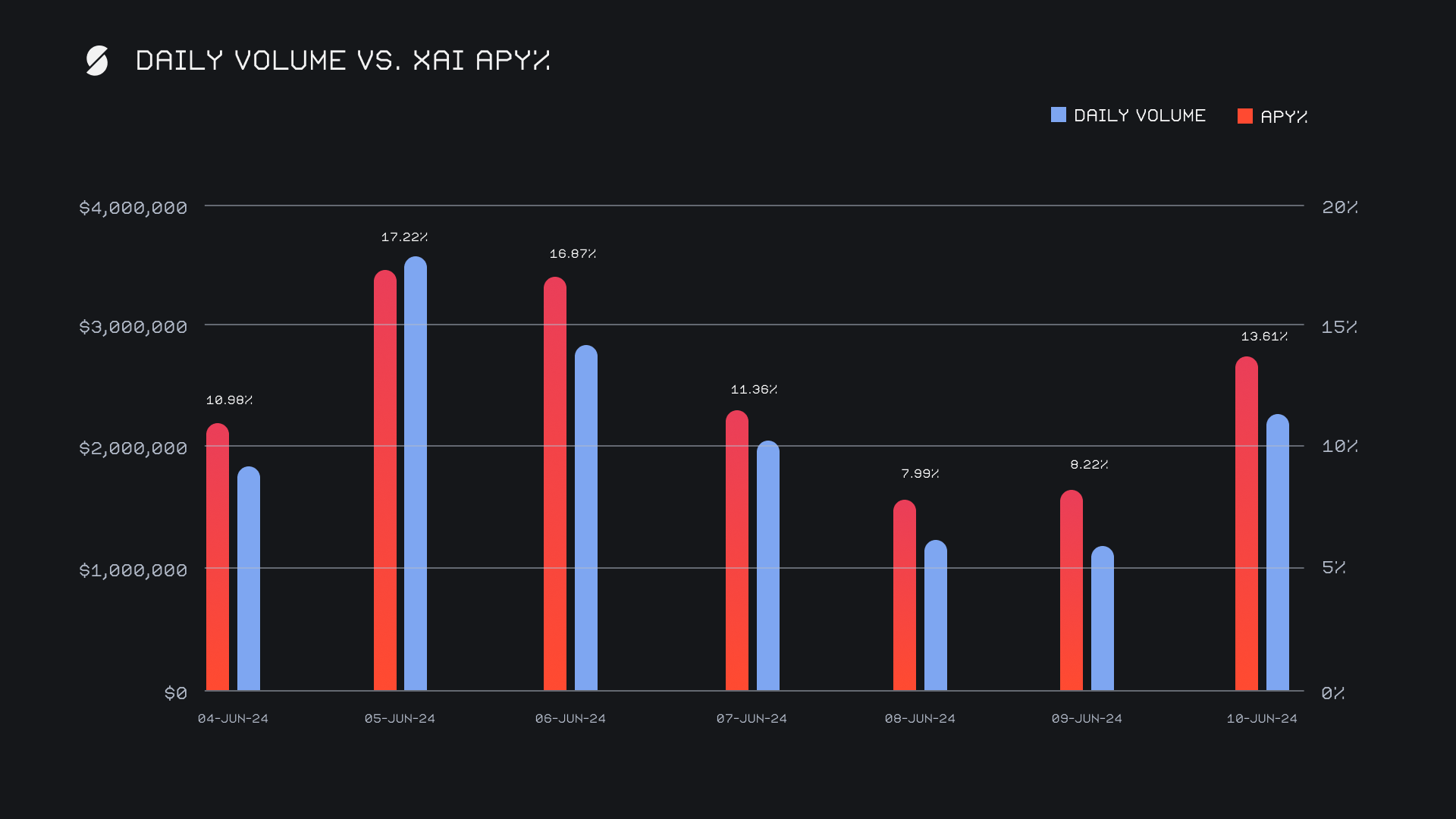

XAI stakers were rewarded with an average APY of 12.32% this week. The highest daily rewards were distributed on June 6th, with 52,564.6 XAI (an APY of 17.22%) being sent directly to the staking vault. This was following a daily volume of $3.6m. This week XAI stakers received a total of 268,128.26 XAI or $45,796.31 USD in staking rewards.

An additional 2 WBTC ($139k) were sent to SideShift’s treasury this week, bringing the current total to a value of $16.9m. Users are encouraged to follow along directly with treasury updates, via sideshift.ai/treasury.

Additional XAI updates:

Total Value Staked: 121,047,627 XAI (+0.3%)

Total Value Locked: $20,622,885 (-14%)

General Business News

After three weeks of sideways price action, Bitcoin experienced a downturn this week, slipping below $67k. Meanwhile, the meme sector saw some sharp sell-offs with notable tokens incurring significant declines. Despite these negative trends, there was some positive news as Bitcoin took on nearly $2 billion in ETF inflows, while Ethereum saw the highest amount of institutional buying since March.

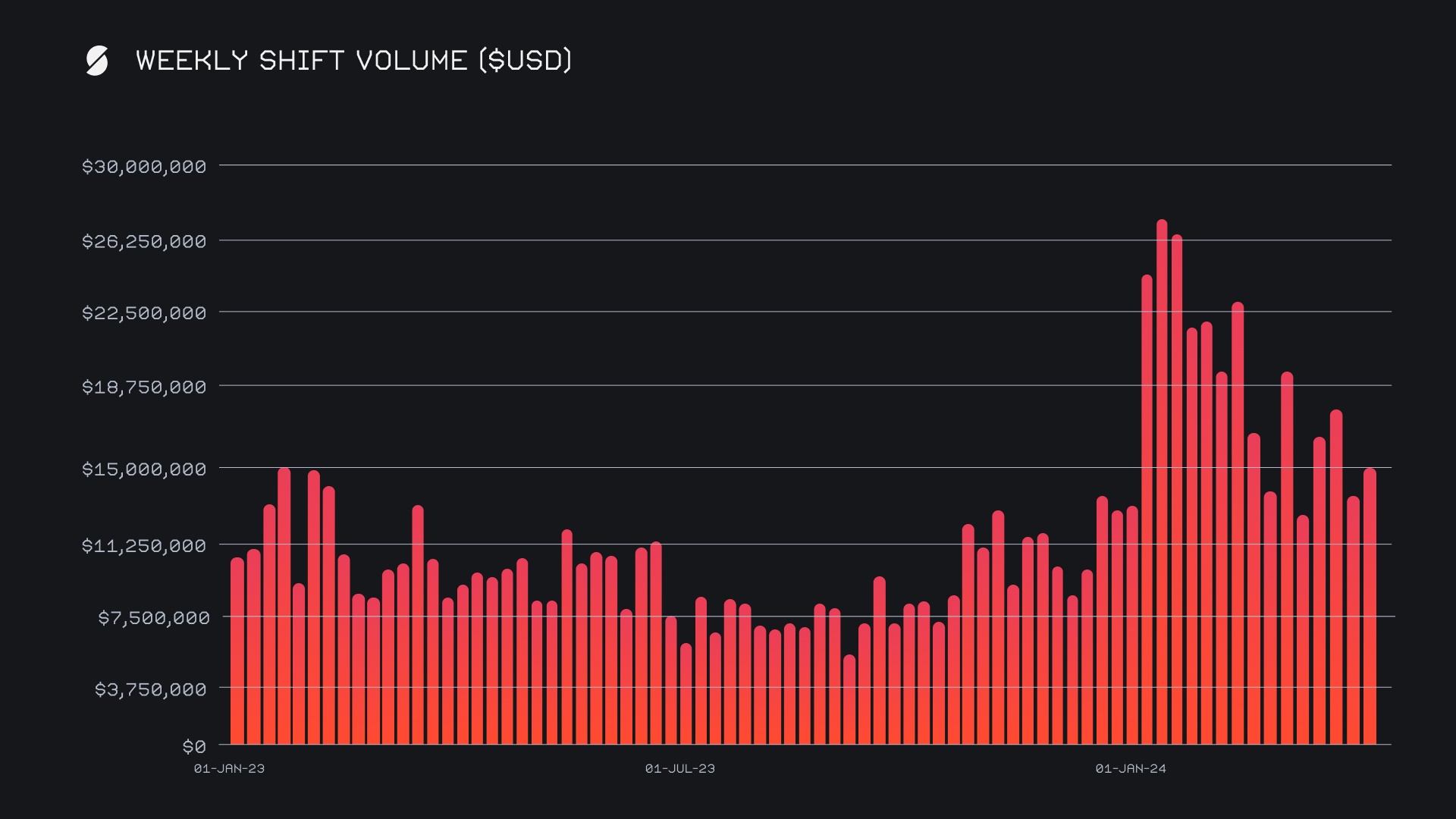

SideShift had a solid performance this week and ended with a gross weekly volume of $15.0m, marking an increase of +12.8% from the previous week. For most of 2024, we have now reached or exceeded peak weekly volume levels recorded in 2023, an indicator of sustained growth. This is visualized in the chart below.

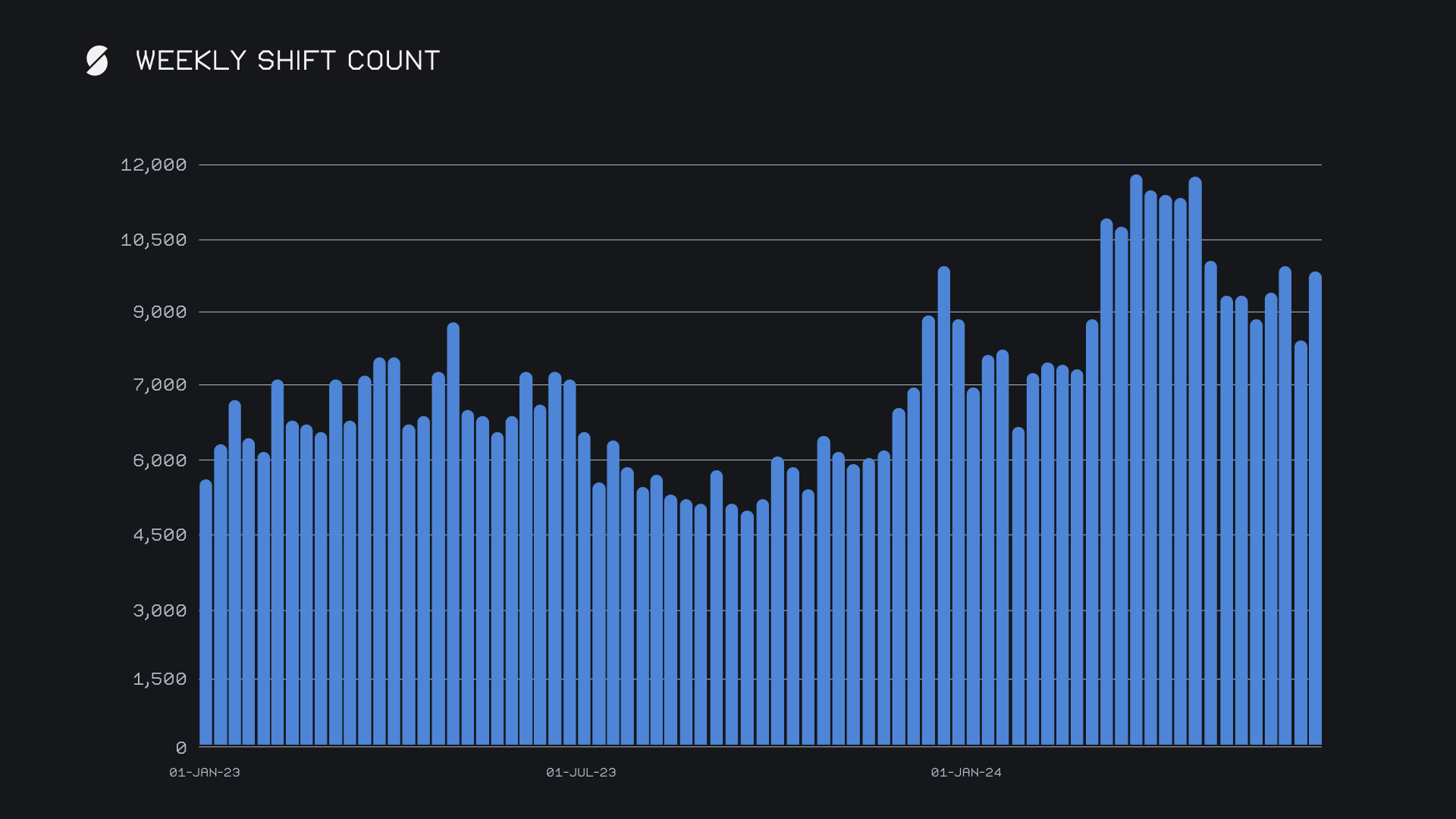

Our weekly shift count also rose to finish just shy of the 10k mark, reaching 9,814 shifts (+16.7%). The rise and strength of the number of shifts on SideShift has been particularly notable since the beginning of the year, reflecting the increase of engagement and activity on SideShift. New coin listings on multiple networks have played a factor here, as supported by the numbers coming from alternate networks to Ethereum. The addition of more coins and networks continues to remain a key focus point for SideShift as we move forward. Together, our weekly volume and count combined to produce daily averages of $2.1m on 1,402 shifts.

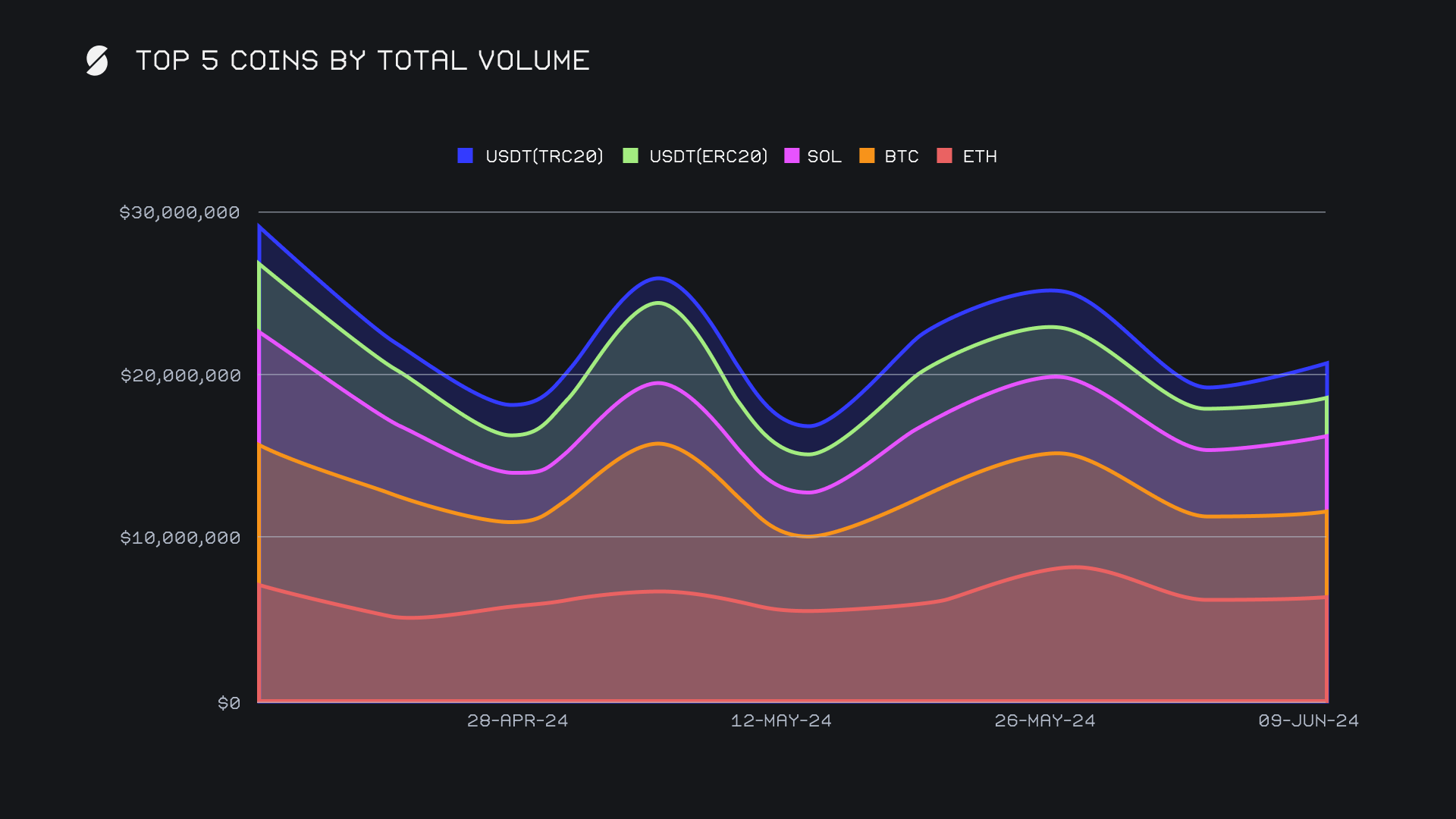

This week, the top 5 coins as grouped by total volume remained the same, with ETH refusing to forfeit the helm. ETH maintained its lead with a total volume of $6.6m, marking a +5.4% increase overall. This derived from a respective deposit to settlement breakdown of $2.3m (-4.1%) to $2.9m (+11.2%). ETH has now remained the most popular coin for 3 consecutive weeks, confidently finishing ahead of BTC. Not only did this week’s ETH user settlement volume sit ~$750k higher than second place, but it also remains the subject of the week’s most popular shift pairs among users. SOL/ETH ended as the top pair with $956k, also for the third week in a row, followed closely by the ETH/SOL pair with $886k.

BTC followed in second place with a total volume of $5.1m, up by a marginal +2.2%. The source of BTC’s total volume continues to come from its deposits as of late, as user BTC deposits surged by +21.8% to end with $2.4m this week and regain its title as the most deposited coin. User BTC settlements however were given less attention, as its volume fell sharply by -30.9% to $1.4m. This might be a reflection of users' preference to hold other top coins such as ETH and even SOL at the moment instead of BTC. The BTC/ETH pair was in contention among our top pairs also, ending the week with a shift volume of $886k.

Third placed SOL showed the highest positive change among our top three, reaching $4.8m in total volume, up +13.4%. Similar to ETH, this came from an influx in user demand for the coin, as we recorded a deposit to settlement breakdown of $1.7m (-14.6%) to $2.2m (+31.7%). All together, our top 3 coins combined to account for 55% of weekly shift volume, a decrease from its usual ~60% proportion, suggesting that we saw proportional increases from alternate sources this week.

We can see some clear examples of this when looking at coins outside of the top 10. 6th placed BNB saw a dramatic improvement, jumping by +146.5% to $1.3m, driven by a hefty rise in user deposits. This coincided with the native BNBs price excelling, which could possibly represent users realizing some profits while shifting to other coins. Additional examples included DOGE, which experienced a substantial upswing in total volume (+98.5% for $238.5k), and TON, which doubled to record a sum of $252k. A majority 16 out of our top 20 coins saw positive changes in their total volumes this week. The sole exceptions were USDC (sol), LTC, USDT (BSC), and ETH (arb).

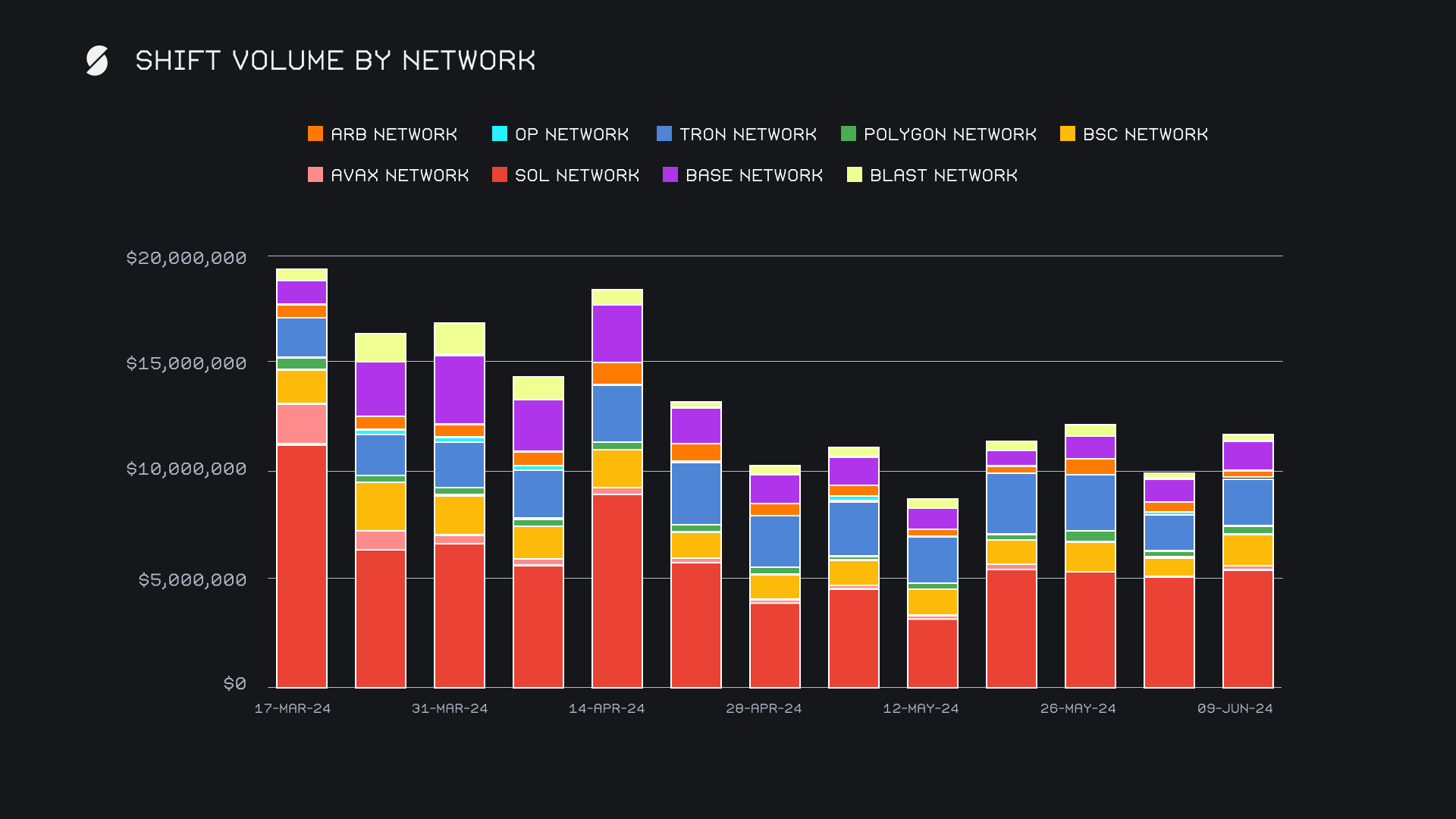

Several alternate networks to ETH also showed noteworthy changes in shift volume this week, with all of our top networks seeing rises greater than +20%. The Solana network led the way with $5.5m of volume, reflecting a +9.8% increase from the previous week. This has been fairly consistent with what the network has seen for the past month or so. The Tron network followed in second with a respectable increase of +30.5%, for $2.2m, although it was our third placed BSC network that experienced the most remarkable growth among any alternate network. It rose +83.6% to reach $1.6m in volume, with the surge in network activity stemming from additional shifting of the aforementioned BNB coin. In contrast, the Optimism network had a sizable decline of -75.3%, dropping to just $23.5k in volume. Similarly, the Arbitrum network saw a decrease of -37.9%, ending the week with a volume of $328k.

Affiliate News

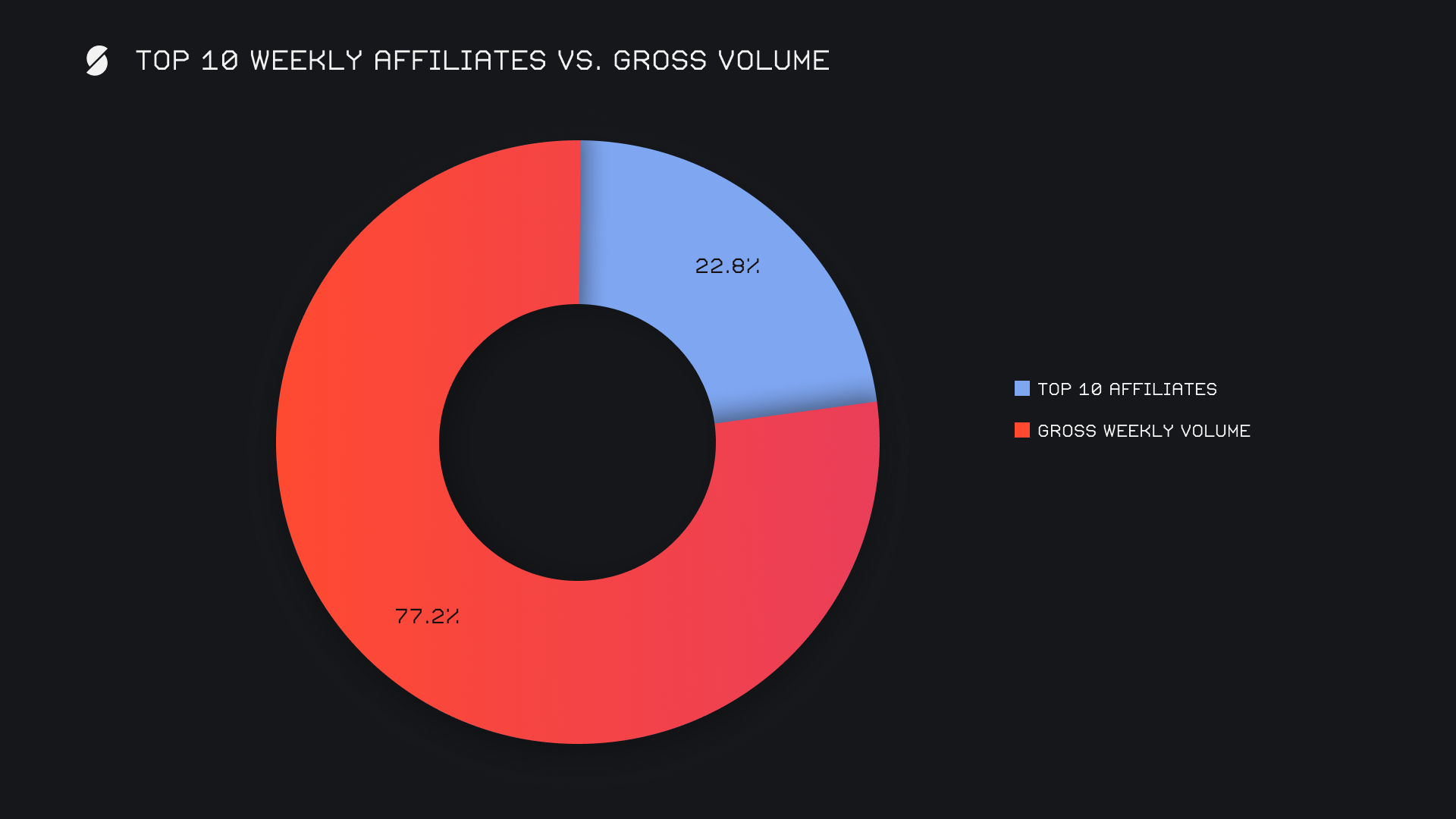

This week, our top affiliates combined for a total volume of $3.4m across 1,352 shifts, marking a nominal volume rise of +5.9% from last week. Our leading affiliate remained unchanged, and this week generated $1.1m (+12.3%) from 374 shifts. Our second-placed affiliate rebounded hard after a quiet performance last week and saw its volume double to $1.1m from 732 shifts, marking an impressive +106.4% increase. Meanwhile, the third-placed affiliate was the only among the top three to decline, as it recorded $727k (-20.9%) from 246 shifts.

All together, our top affiliates accounted for 22.8% of our total weekly volume, -1.5% lower than last week’s proportion.

That’s all for now. Thanks for reading and happy shifting.