SideShift.ai Weekly Report | 4th - 10th November 2025

Welcome to the one hundred and seventy-ninth edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

Highlights

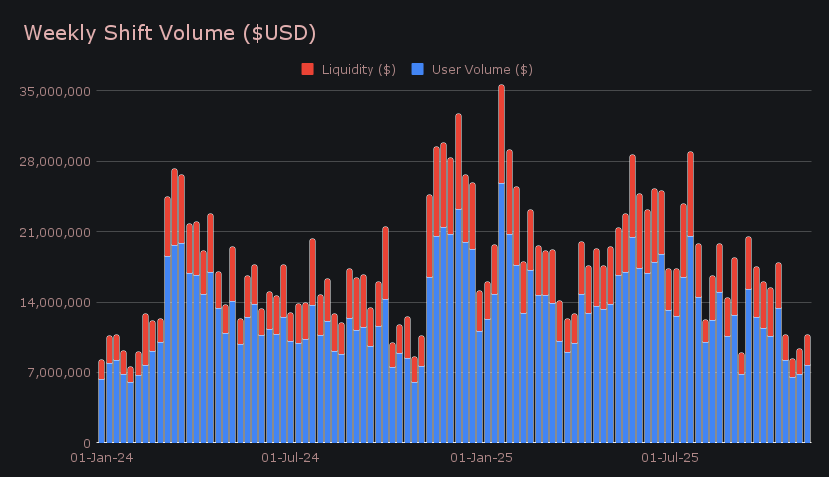

- SideShift volume rose +15.1% to $10.75m, reclaiming the $10m mark after two slower weeks.

- XAI staking rewards reached 225,660.26 XAI ($27,533) at an average APY of 8.82%, a slight uptick from last week.

- BTC led again with $3.84m (+27.4%), extending its dominance for a third straight week.

- Ethereum-based stablecoins totaled $4.68m, outpacing other networks and signaling a clear tilt toward ETH flows.

- ETH gained to $2.01m (+16.4%), while SOL fell −38.0% to $868k, breaking their recent back-and-forth trend.

XAI Weekly Performance & Staking

XAI traded between $0.1172 and $0.1267, closing the week at $0.1188. The token’s market cap stood at $18.33m (−10.07%), down from $20.38m previously. Price action trended lower throughout the week, extending the month-long decline visible on the broader chart as XAI moved away from the $0.14–0.15 area last seen in late October. Despite the drop, intraday movements stayed relatively contained, pointing to a steady rather than volatile descent.

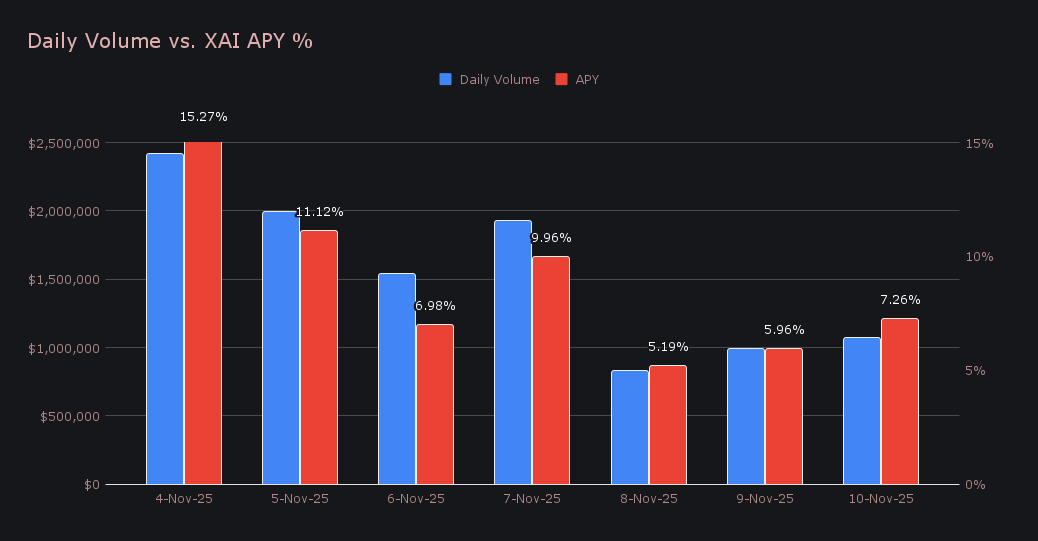

Stakers earned a total of 225,660.26 XAI ($27,533.06) this week, with an average APY of 8.82%. The most active day came on November 4, when 54,458.57 XAI was distributed to the staking vault at 15.27% APY, supported by $2.42m in daily shift volume. Overall rewards rose modestly from last week’s level, helped by increased platform activity and slightly higher staking yields as volume across SideShift ticked up.

Additional XAI updates:

Total Value Staked: 140,270,579 XAI (+0.2%)

Total Value Locked: $16,694,752 (−9.6%)

General Business News

Crypto markets picked up speed this week as BTC climbed from just below $100k to trade near $106k, helped by optimism that the U.S. government shutdown could soon be resolved. ETH moved higher through the $3.4k range, holding steady after a stretch of uneven trading. The real action, though, came from elsewhere, with ZEC extending its remarkable run that saw its price explode from roughly $70 a month ago to highs above $730. It since has cooled to around $500, though the move saw its market cap push beyond $10 billion and well into the top-20. Old-guard names joined in briefly, with FIL and UNI both spiking more than +60%, suggesting the week’s rotation was fast but mostly fleeting.

SideShift reclaimed the $10m mark, recording $10.75m (+15.1%) in total volume after two slower periods. Over the past fifteen weeks, only three instances had seen volume dip below that threshold, making the latest rebound a welcome return above one of the platform’s key benchmarks. User shifting climbed +12.2% to $7.71m, while liquidity shifting reached $3.05m (+23.0%), both of which were partially driven by a sharp imbalance in BTC/USDC (ERC-20) flows, where settlements far outpaced deposits. The pair led with $680k in total volume, followed by BTC/USDT (ERC-20) at $415k and USDT (ERC-20)/ETH at $305k, together showing a clear rise in stablecoin demand.

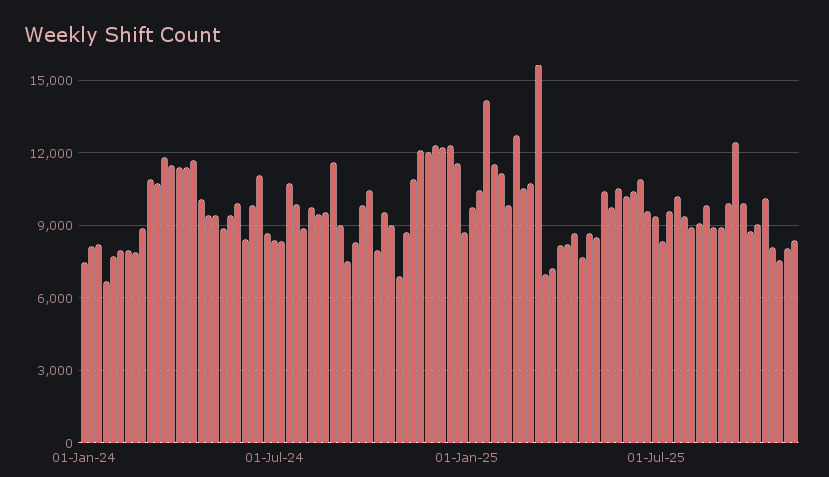

Shift count improved for the second consecutive week, rising +4.0% to 8,353 with a daily average of 1,193. Whale shifts valued above $20k made a clearer return, increasing to 1.7% of total count from 1.3% last week and contributing $4.9m in volume. That share remains below the 2% level often seen during more active market phases but marks an encouraging rise in average shift size as users begin to take on larger shifts again. Average daily volume closed at $1.54m, rounding out a solid week of steady growth across the platform.

BTC led again with $3.84m (+27.4%) in total volume, extending its climb for a third consecutive week. Activity tilted sharply toward deposits, which rose to $1.88m (+84.4%), while settlements fell to $825k (−32.9%), signaling a slowdown in buying despite the broader uptick in market volume. This marks the first clear swing toward net selling after several weeks of relatively balanced flow, though BTC still accounted for more than one third of all shifting activity on the platform.

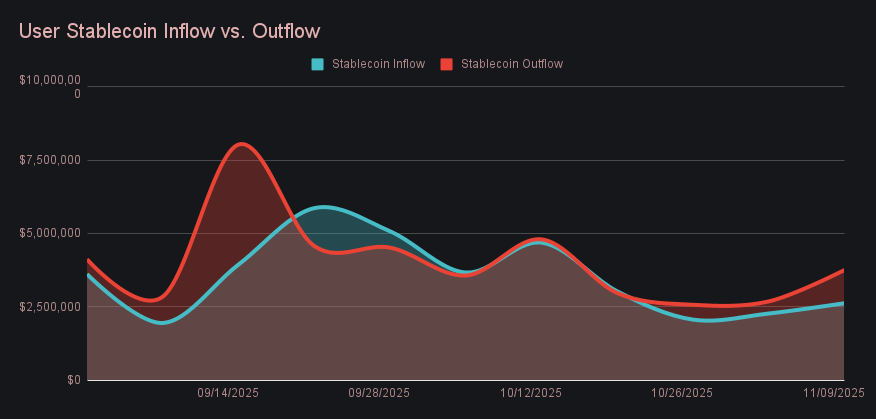

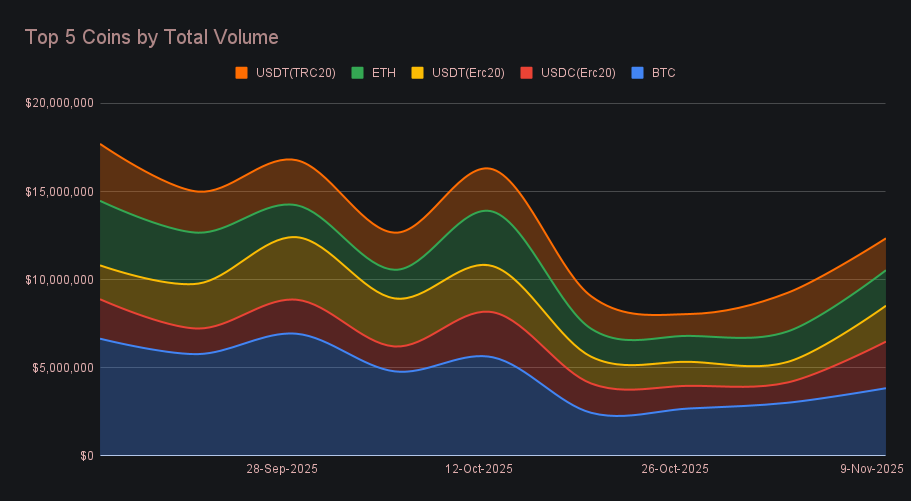

Stablecoins filled much of the middle of the leaderboard, led by USDC (ERC-20) in second with $2.64m (+129.3%) in total volume. That figure exceeded $2.5m for just the second time since early September, with settlements climbing to $1.36m (+126.3%), their highest in that span. The increase was driven by a rather steady stream of well sized user shifts. USDT (ERC-20) followed in fourth at $2.04m (+74.8%), recovering to healthier levels after last week’s low, while USDT (TRC-20) finished fifth at $1.81m (−17.5%), a quieter performance relative to its usual $2m+ range. In total, Ethereum-based stablecoins combined for $4.68m in weekly volume, outpacing those on other networks, including Tron ($1.81m), Solana ($650k), and BSC ($362k). The overall trend of growing outflows is represented in the chart below, where a clear separation from net inflows can be observed over the past seven days.

ETH recorded $2.01m (+16.4%) in total volume, showing sparks of renewed activity after several slower stretches. Deposits reached $837k (+3.9%), while settlements climbed +44.3% to $848k, following the trend of growth seen in consecutive weeks. The steady pickup helped ETH widen its lead over SOL, which slipped to sixth with $868k (−38.0%), the largest drop among any top-ten coin. Both sides of SOL shifting fell sharply, reversing its recent outperformance and breaking the back-and-forth trend the two coins have shared in past weeks. The divergence also points to activity becoming more concentrated among top assets rather than spread across the broader list.

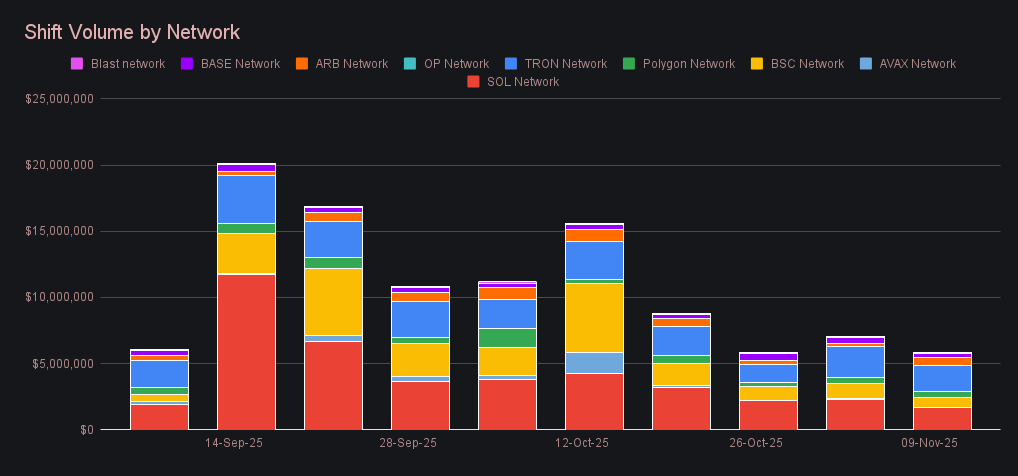

Alternate networks to Ethereum combined for $5.79m (−17.4%) in total volume, marking another week of general weakness across nearly all major chains. Solana led the group with $1.70m (−27.1%), its lowest level in months, as both native and token shifting declined notably. Tron followed at $1.97m (−14.7%), falling below the $2m mark for just the second time since August. BSC placed third with $769k (−35.4%), while Arbitrum rose to $630k (+135.3%), though such sharp swings are typical for the network, whose activity typically stays within the six-figure range. Overall, the pullback across alternate chains highlights a clear pivot in shift activity back toward Ethereum, a trend visible in the steady decline of network volumes shown in the chart below.

Affiliate News

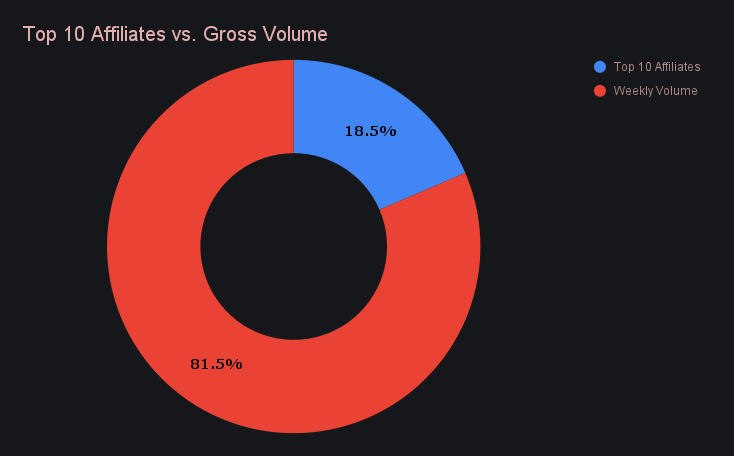

Affiliate activity rose modestly, combining for $1.99m (+6.5%) in total. Our top affiliate remained firmly in first place with $516k (+5.5%), extending what has now become a consistent multi-week streak of leading results. The runners-up also advanced, with second place climbing to $431k (+40.9%) and third to $364k (+27.8%), both notching solid week-on-week growth.

Despite the increase in affiliate volume, their combined share still eased to 18.5% (−1.5%), indicating that affiliates lagged behind the platform’s broader growth this week.

That’s all for now - thanks for reading and happy shifting.