SideShift.ai Weekly Report | 6th - 12th January 2026

Welcome to the one hundred and eighty-sixth edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

Highlights

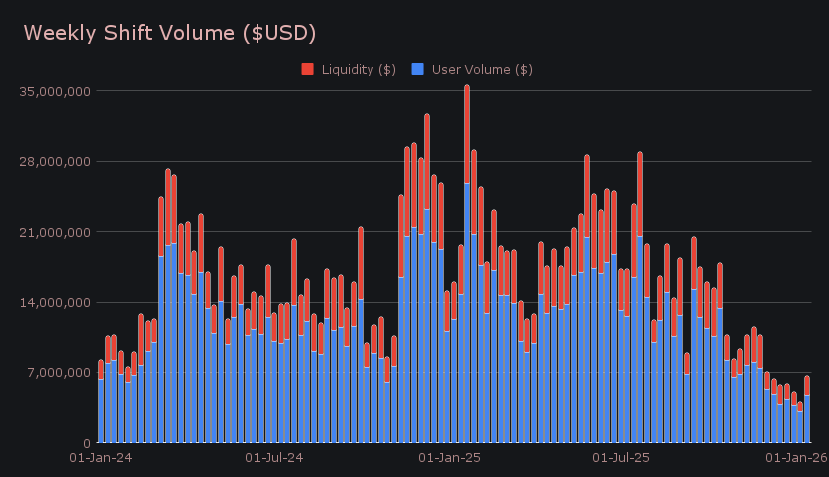

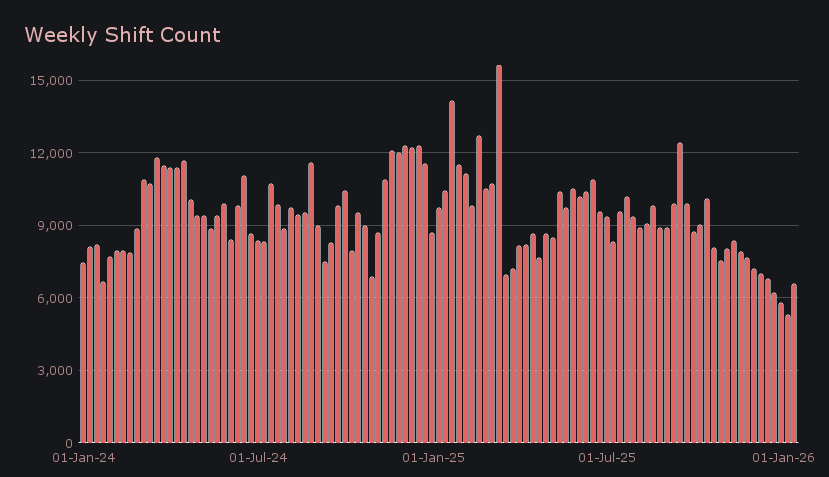

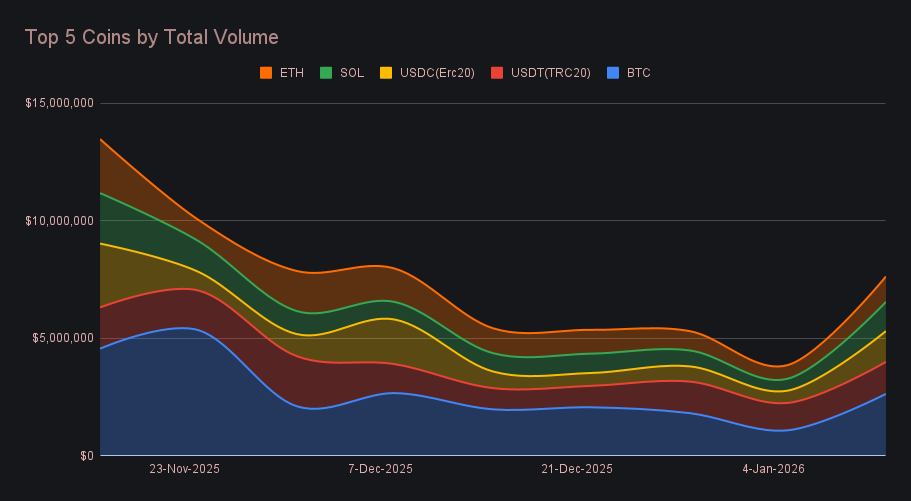

- SideShift processed $6.63m in weekly volume (+62.8%) across 6,596 shifts (+25.0%), signaling a clear rebound in overall activity.

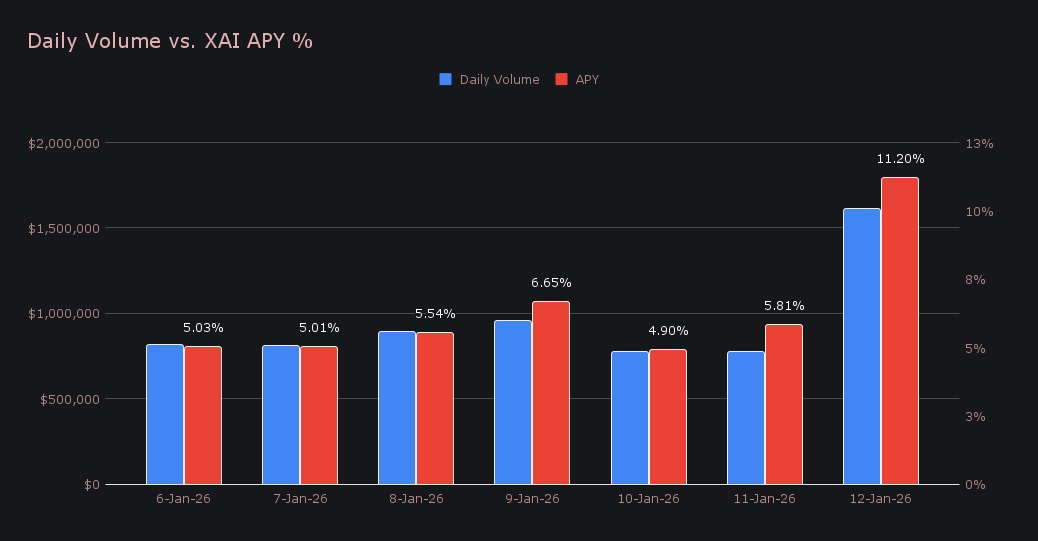

- Stakers earned 164,036 XAI ($18.0k) at a 6.31% average APY, with January 12 marking the most active day for rewards.

- BTC reclaimed the top spot with $2.64m in total volume (+142.0%), driven by a sharp surge in deposits and a pronounced deposit–settlement imbalance.

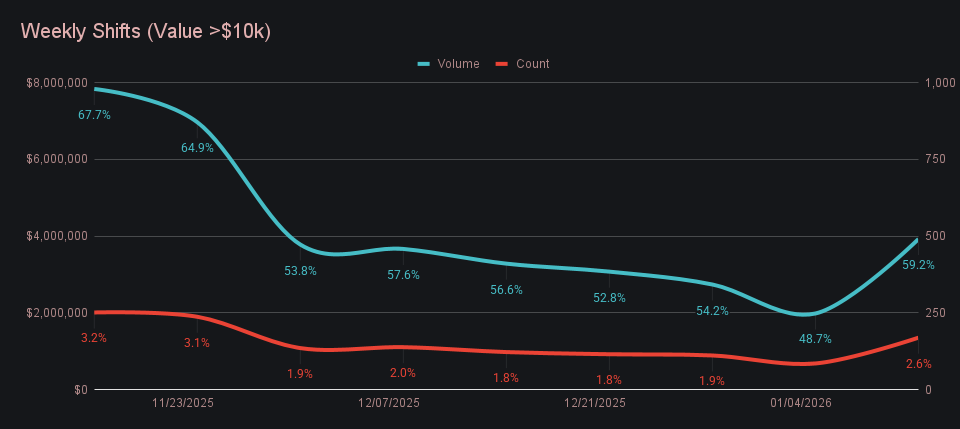

- Large shifts over $10k made up ~59% of total volume, settling mainly into USDC (ERC-20) and USDT (TRC-20).

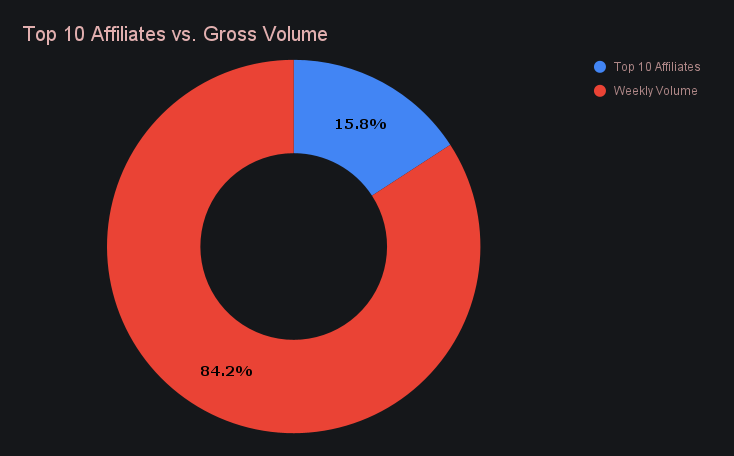

- Affiliate volume totaled $1.06m (−9.9%), pushing shift count up by +56% and accounting for 15.8% of weekly volume.

XAI Weekly Performance & Staking

XAI spent the week trading in a narrow corridor just under $0.11, with little expansion in either direction. The 7-day chart shows a gentle upward lean in recent days after a choppier start to the period, while the past month still reflects the step down from the low-$0.12 range seen in early December before price began to stabilize. At the time of writing, XAI is priced at $0.1099, giving it a market cap of $17.08m, a +0.45% increase from last week.

Staking activity increased compared to the previous update, standing in contrast to the relatively steady price behavior of XAI. Over the week, 164,035.99 XAI was distributed directly to the staking vault at a cumulative sum worth $18,049.56, with the average APY landing at 6.31%. January 12th marked the most active day, when 40,821.77 XAI was paid out at an 11.20% APY, supported by $1.61m in SideShift volume. Overall reward totals were meaningfully higher than last week, reflecting a busier stretch on the platform as compared to the year’s slower opening days.

SideShift’s treasury has now all been converted to BTC, and is currently sitting at a value of 270.94 BTC, or $24,901,662. Users can follow along directly with live treasury updates via sideshift.ai/treasury.

Additional XAI updates:

Total Value Staked: 140,479,712 XAI (+0.1%)

Total Value Locked: $15,364,375 (+0.6%)

General Business News

Crypto markets showed mixed rhythms this week as BTC bounced near ~$92k before pulling back, while ETH held near ~$3.1k, leaving both majors relatively range bound. Privacy-focused asset XMR hit fresh all-time highs near ~$650, leading gains among large caps and continuing to spotlight the privacy narrative, while meme-coin capitalization surged early in the week, as names like PEPE, DOGE and SHIB logged double-digit rebounds. Taken together, the week’s price action reflected selective strength beyond majors, with speculative segments drawing attention.

SideShift saw activity recover, with gross weekly volume rising to $6.63m (+62.8%) from the prior period. User shifting contributed $4.80m (+52.3%), while liquidity shifting climbed to $1.83m (+98.8%), partially reflecting a renewed presence of larger, unidirectional shifts on the platform. Volume growth was driven primarily by site shifting rather than affiliates, with higher-value swaps accounting for much of the increase. On the user side, BTC/PAXG returned as the top pair at $403k, continuing its broader run of strong activity alongside ongoing interest in gold-backed exposure, while BTC/USDC (ERC-20) followed at $355k, reinforcing BTC–stablecoin routes as the current core source of user activity.

Shift count also moved higher, with total weekly shifts reaching 6,596 (+25.0%), averaging 942 shifts per day. This increase however was driven mostly by affiliates, whose combined shift count rose +56% week-on-week, even as their contribution to total volume declined. The divergence between rising transaction count and more concentrated volume points to a clear split in activity, with affiliates bringing more frequent, smaller shifts while site shifting accounted for most of the week’s dollar-denominated growth.

BTC returned to the top this week, finishing with $2.64m in total volume (+142.0%) after sitting behind stablecoins in the prior report. The headline figure was driven almost entirely by user deposits, which surged to $1.27m (+190.7%), while settlements moved in the opposite direction, falling to $386k (−13.8%). That imbalance — heavy inbound BTC with comparatively limited outflow — was one of the clearest contributors to elevated liquidity shifting during the week.

Stablecoins continued to anchor the upper ranks, led by USDT (TRC-20) at $1.36m (+17.0%). Activity leaned decisively toward user settlements, which rose to $681k (+82.2%), as deposits dropped to $247k (−41.4%), reinforcing TRC-20’s usual role as a preferred settlement route. USDC (ERC-20) followed right behind with $1.31m (+149.7%), also standing out for its surge in settlements to $476k (+170.7%) while deposits meanwhile held nearly flat at $259k (+2.2%).

Larger-scale shifts (those valued >$10k) saw a nice move, with their share of total volume rebounding after declining through much of December. These higher-value transactions accounted for ~59% of weekly volume, a notable jump from early January lows, pointing to the return of more capital-intensive activity. A sizable portion of these shifts settled into top stablecoins USDC (ERC-20) and USDT (TRC-20), reinforcing their current use as the primary destination for larger repositioning shifts.

Rounding out the top 5 was SOL and ETH, which had similar overall finishes, but different looking profiles. SOL posted a gross $1.24m (+145.0%), supported by solid gains on both sides, and saw user deposits rise to $322k (+77.7%) and settlements to $628k (+116.7%) after significantly lagging for the better part of 6 weeks. Momentum for SOL on SideShift is currently ongoing at the time of writing. ETH followed at $1.08m (+86.7%), with deposits climbing to $560k (+94.2%) while settlements increased more modestly to $306k (+5.2%). Overall, performance across the leaderboard was broadly positive, with every top-10 asset posting double-digit gains and six of the ten more than doubling their weekly volume.

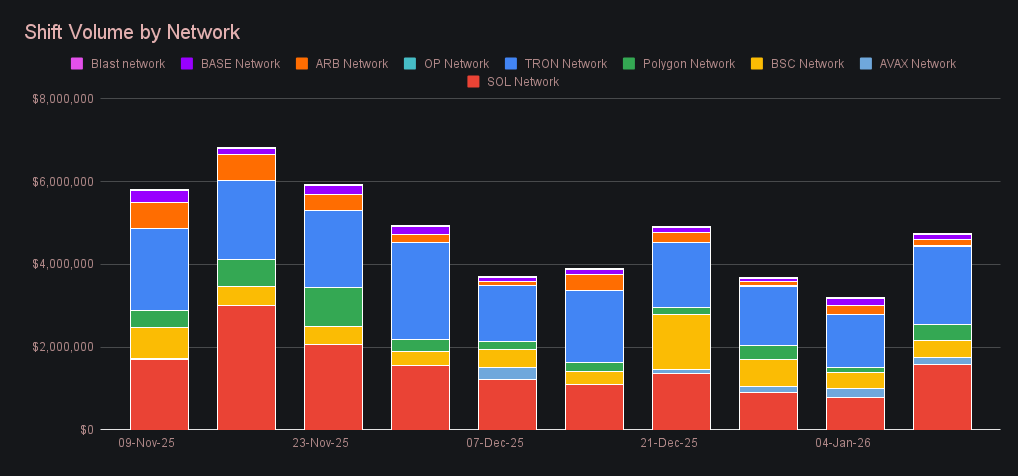

Alternate networks generated $4.74m in total volume (+49.7%), again outpacing activity on the Ethereum network, which finished at $2.48m (+31.2%). The Tron network led the group at $1.91m (+49.1%), maintaining its role as the most consistently active alternate network, followed by Solana at $1.58m (+103.9%), which posted one of the strongest week-on-week rebounds after several slower weeks. BSC followed at $409k (+4.3%), while Polygon stood out further down the list, rising to $390k (+216.9%) after a quiet prior period. Arbitrum and Avalanche both eased back into the mid-$160k range, continuing to lag the leading networks as participation remained uneven outside the top tier.

Affiliate News

Affiliate activity skewed toward higher participation this week, with a larger number of smaller shifts contributing to a total volume of $1.06m (−9.9%). First place extended its lead at $381k (+63.4%), while second place held steady at $253k (+1.1%). Third place was claimed by a newer integration, which posted $124k (+83.3%) and entered the top three for the first time.

In total, affiliates accounted for 15.8% of weekly volume, down from 28.8% last week.

That’s all for now - thanks for reading and happy shifting.