SideShift.ai Weekly Report | 6th February - 12th February 2024

Welcome to the ninety-first edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

This week saw SideShift token move within the 7 day range of $0.1228 / $0.1430, and reached the highs of that range as we entered into the weekend. At the time of writing, the price of XAI is sitting near the lower end of that bound at a price of $0.1232, and has a current market cap of $16,068,929 (-7.8%).

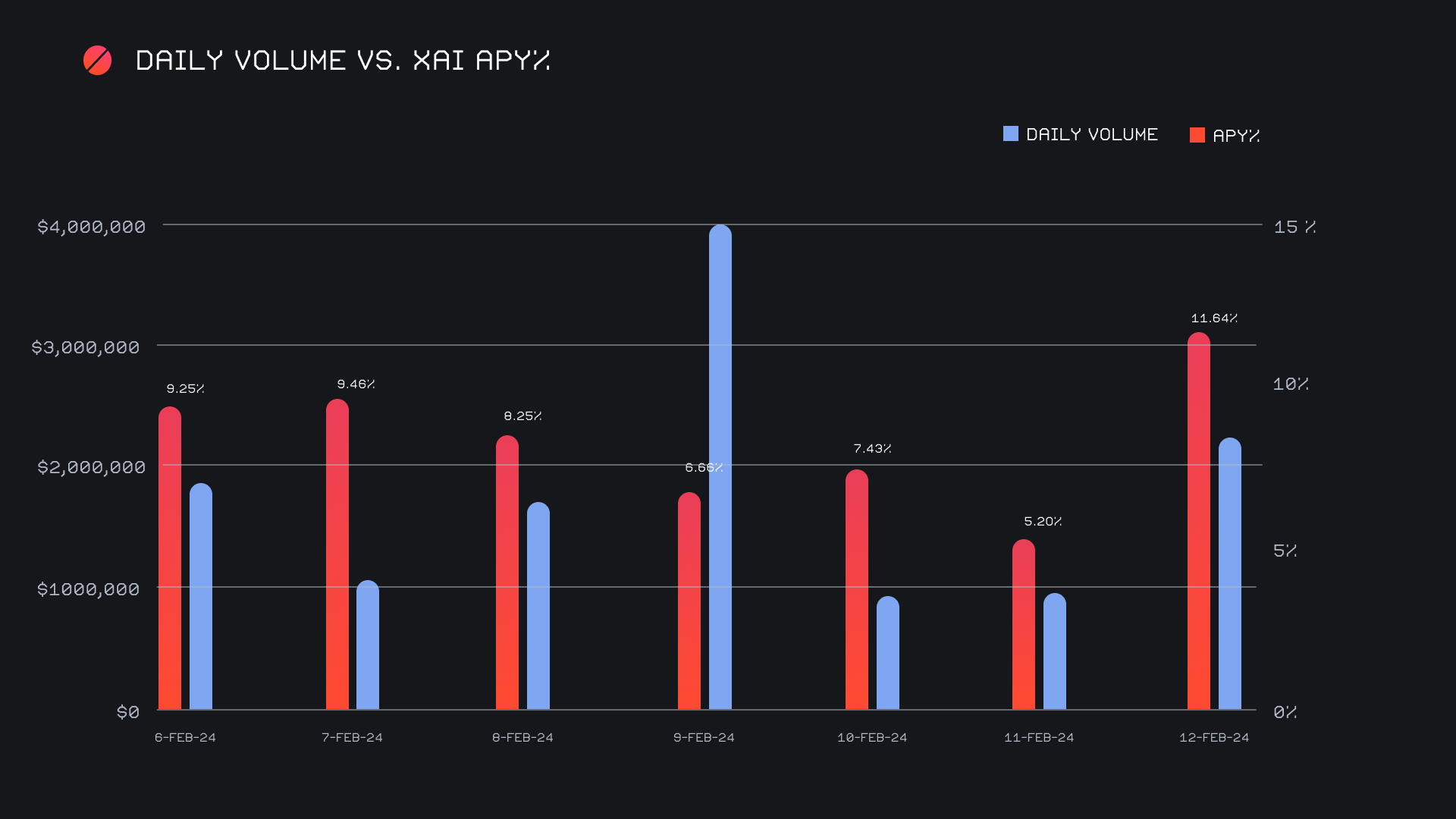

XAI stakers were rewarded with an average APY of 8.27% throughout the week, with a daily rewards high of 35,068 XAI being distributed to our staking vault on February 13th, 2024. This was following a daily volume of $2.4m. This week XAI stakers received a total of 176,599.96 XAI, or $21,757.12 USD.

An additional 50 ETH was sent to SideShift’s treasury on February 13th, 2024, bringing the current total to a sum of $9.6m, or 192.3 BTC equivalent. Users are encouraged to follow along directly with live treasury updates, via SideShift.ai/treasury.

Additional XAI updates:

Total Value Staked: 116,320,464 XAI (+0.3%)

Total Value Locked: $14,386,127 (-6.7%)

General Business News

Following a few weeks of sideways price action, this week saw some promising events unfold, as BTC charged upwards to tag the $50k price level for the first time in over two years. Sectors such as DePin and ERC-404 are creating quite the buzz, and a general optimism is now readily seen circulating throughout the overall market.

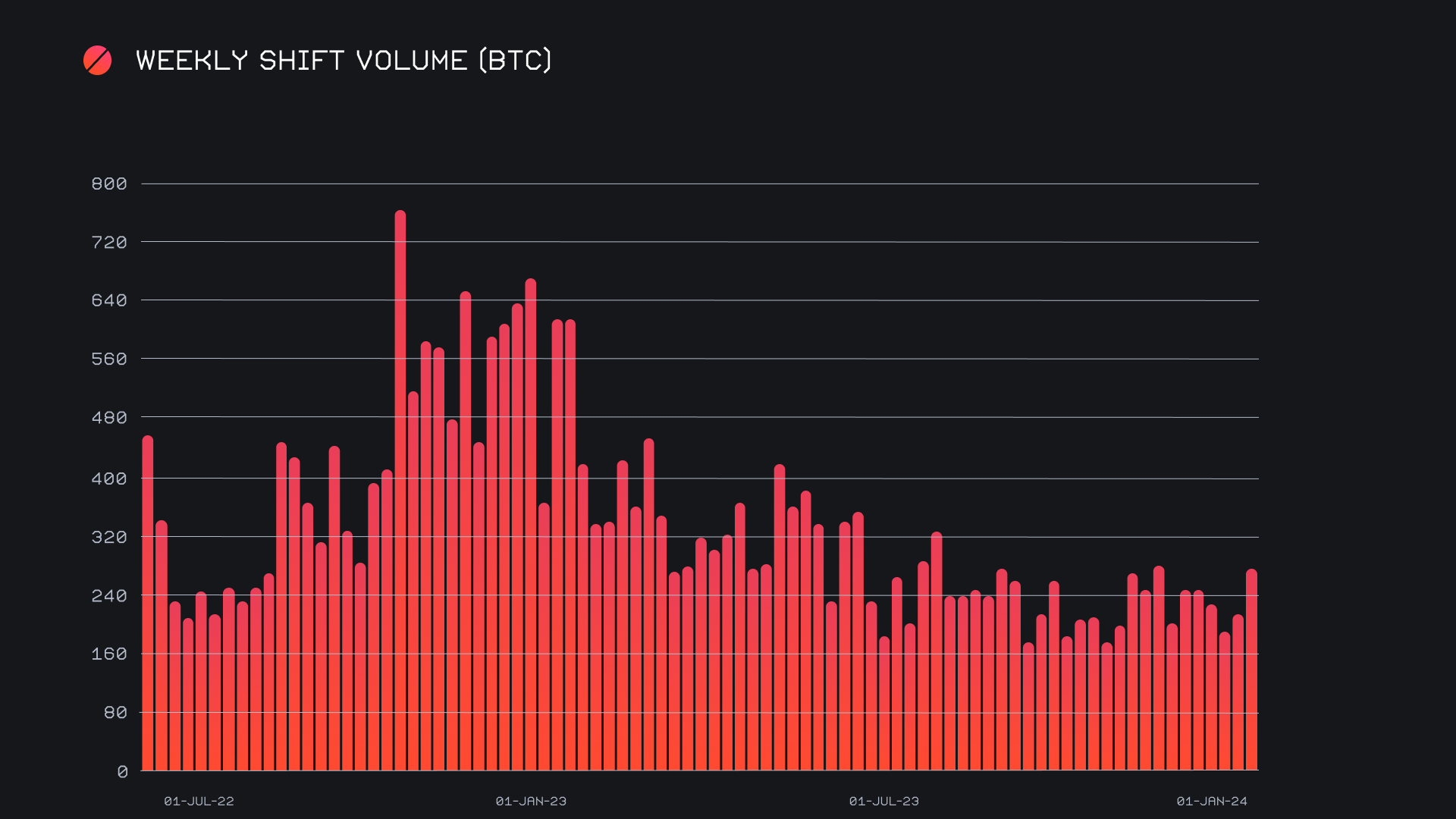

This recent momentum was reflected by positive shift action on SideShift, as we had one of our best performances in recent weeks. We recorded a gross weekly volume of $12.8m (+41%) alongside a shift count which remained rather steady and summed to a total of 7,932 shifts (-0.3%). Although this gross volume measurement indicates a very large jump forward, approximately 40% of this volume was attributed to liquidity shifting, an increase of about ~15% from the typical proportion. Nevertheless, after accounting for this higher amount of liquidity shifting, we still can note overall net volume growth on the week. Together, these gross totals combined to produce daily averages of $1.8m on 1,133 shifts. When denoted in BTC, our weekly volume total amounted to 275.24 BTC (+30.1%).

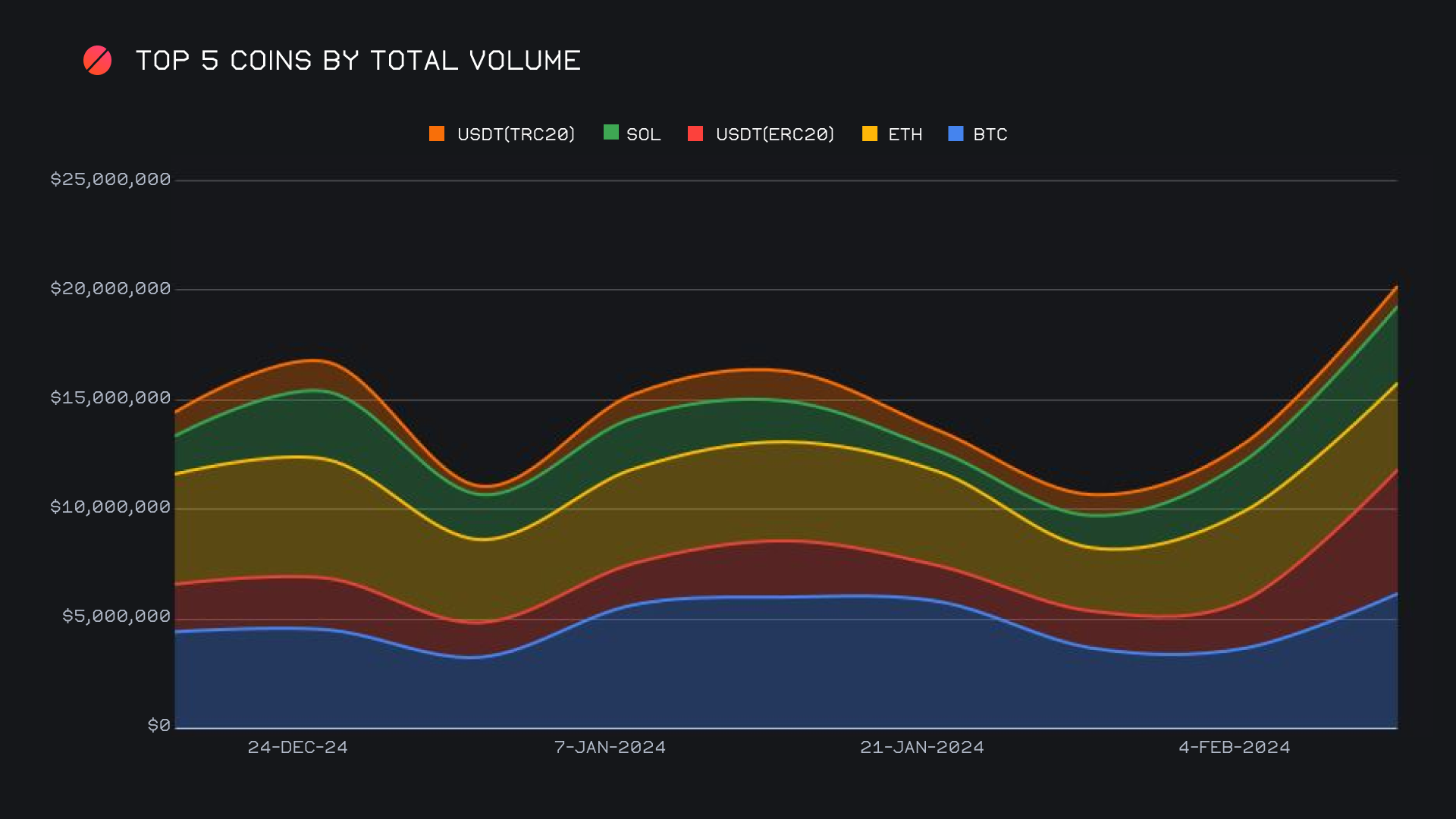

With BTC behaving in such a strong manner, perhaps it is no surprise to see BTC’s total volume on SideShift once again storm to the top of the list. A total volume (deposits + settlements of $6.2m represented a significant increase of +67.4%, and marked a near 10 week high. This came following a few weeks of BTC and ETH flip flopping back and forth from first place. A deeper look reveals that it was quite clearly user BTC deposits which were responsible for this rise, with deposits alone increasing +68% for $3.1m. User BTC settlements rose as well, but were proportionately much smaller, increasing +19.9% for just $1.1m. Regarding strictly user settlements, this was only enough to rank third overall.

Instead, it is clear that a majority of these BTC deposits were shifted to USDT (ERC-20), which had quite the overall surge itself. USDT (ERC-20) saw one of the highest changes in total volume among our top coins and exploded +157.7% for a sum of $5.7m, enough to confidently secure second place. USDT (ERC-20) acted as an inverse to BTC, with the spike in total volume being credited to a large rise in user demand. User USDT (ERC-20) settlements nearly doubled, and increased +96.5% for $2.0m. This is compared to a user deposit sum of merely $426k (+7.2%). With this, it should be no surprise that the BTC/USDT(ERC-20) pair dominated, and was easily the week’s most popular with $1.7m. A majority 58% of deposited BTC volume was shifted to USDT (ERC-20) this week, and was typically done so in large amounts. In the chart below you can note the significance of our top two coins, and the overall positive impact they had this week.

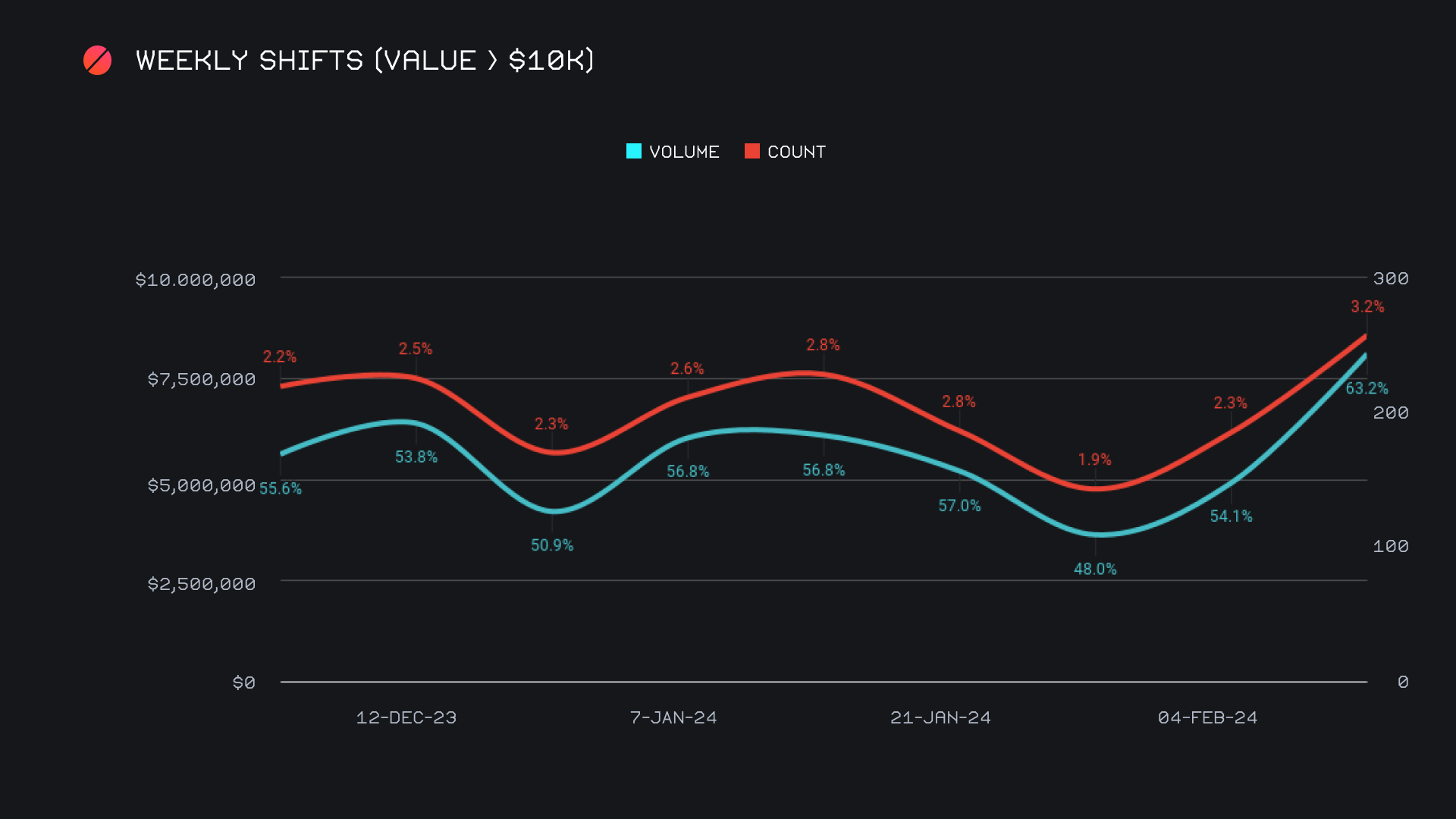

A quick look at shifts with a value greater than $10k can help to support the claim that we saw an increase in generally larger sized shifts this week. Just two weeks ago it was mentioned that whale shifting had significantly slowed, with both volume and account reaching local lows. Fast forward to today, and we can now see that these trends have reversed, now climbing to 10 week highs. Shifts with a value greater than $10k summed to approximately $8.1m, or 63.2% of our weekly total. The BTC/USDT(ERC-20) pair was a key reason for this rise in whale shifting, and in particular saw a surge just yesterday, when BTC was ascending to the $50k mark. February 12th, 2024 alone saw greater than $750k in USDT (ERC-20) settlements, a sign of users capitalizing on some profits due to the recent rise in prices.

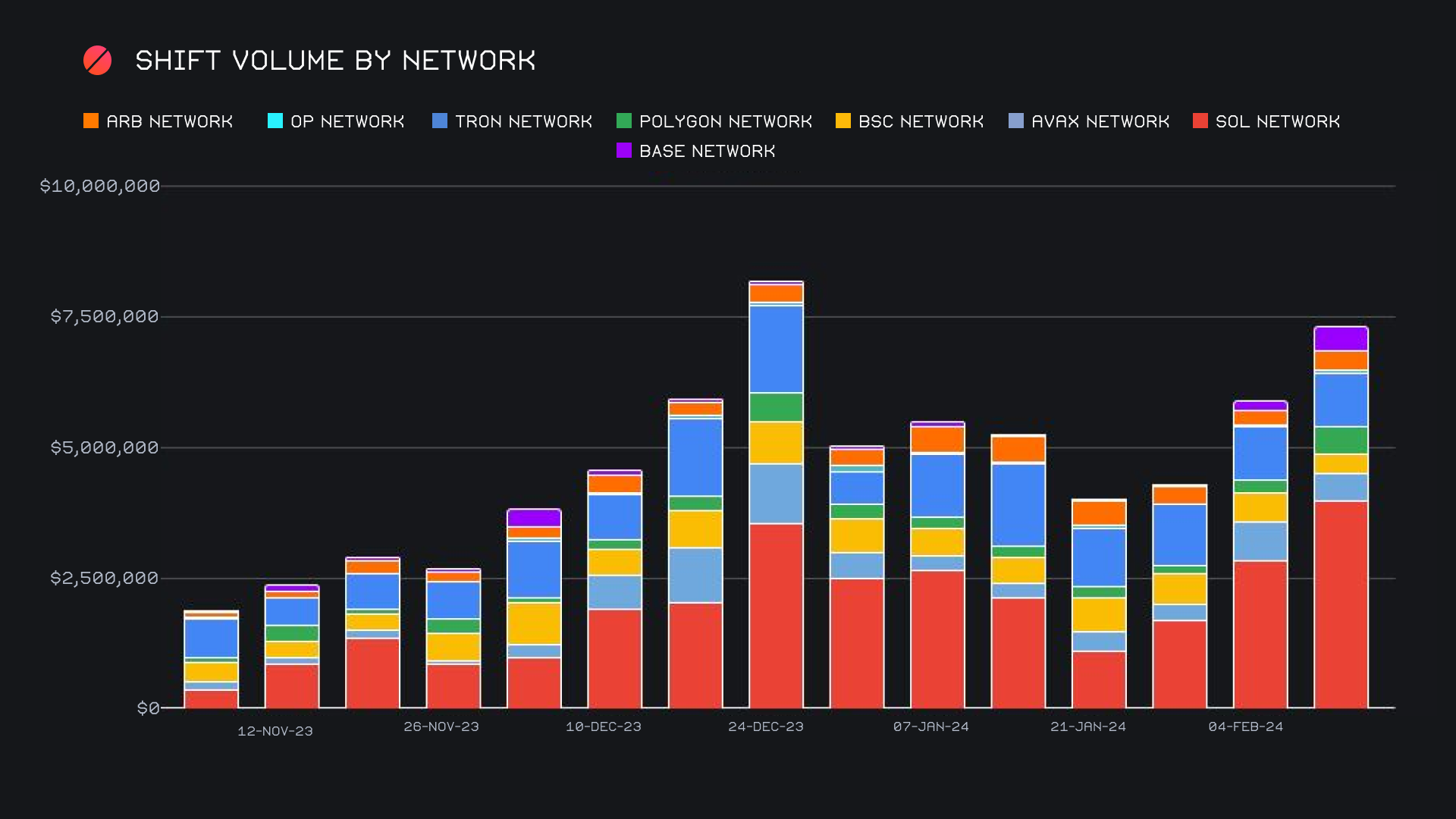

In addition to our top two coins, SOL continues to plug along at a steady pace, this week seeing its total volume increase +52.5% for a third place, $3.5m finish. Overall Solana volume has grown to account for a huge proportion when measuring alternate networks to ETH. When including stablecoins, total Solana network volume summed to $4.0m, nearly 4x higher than the runner up, the Tron network - this discrepancy has only continued to grow and is visible in the bar chart below. With the addition of recent Solana listings on SideShift, it wouldn’t be unlikely to see this pattern continue to unfold.

Although the Solana network prominently sat atop the list of alternate networks to ETH, the majority of these other networks had a solid week and also saw increased shifting. Behind Solana sat the Tron network with $1.04m, a minor rise of +3.2%. This occurred due to the largely consistent demand of USDT (TRC-20). Following Tron was the Avalanche network with $533k (-28.5%), being one of the few to note a week on week decline, but doing so after a surprisingly strong performance last week. Outside of these top 3 alternate networks, we saw two other noteworthy mentions, both of which doubled from the week prior. The Polygon network ended with $523k (+110.9%) thanks to a rush of USDC (POLY) shifting, and ETH (BASE) generated $439k, a sizable jump of +173% from last week. This was mainly thanks to ETH (BASE) growing in popularity - it has now risen in three consecutive weeks, this week even managing to crack our top 8 coins overall.

Affiliate News

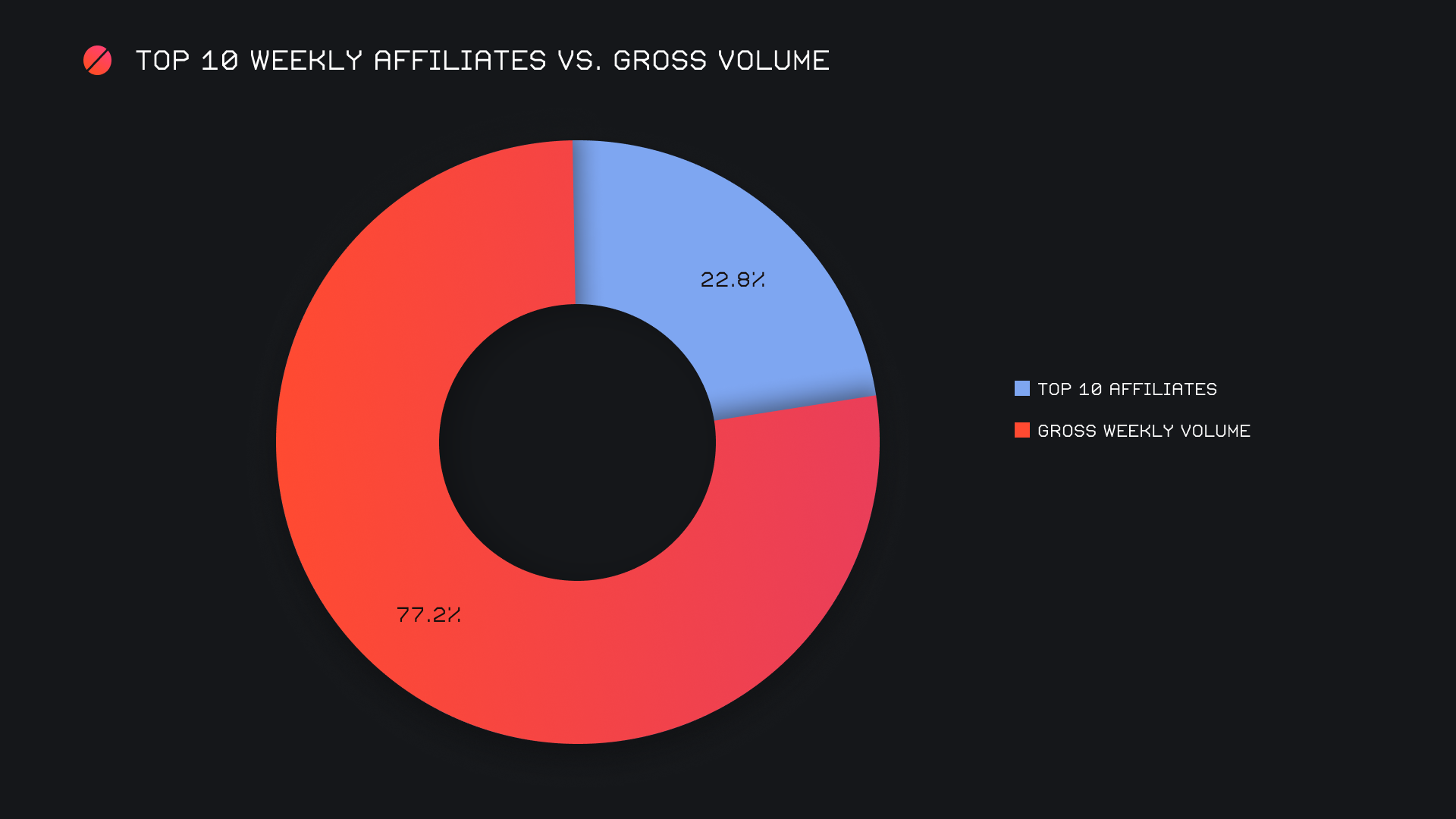

Our top affiliates combined for a total $2.9m, about +42% higher than last week’s nominal sum. As usual, our top two affiliates accounted for a vast majority of this total. The top affiliate hung onto its first placed title, but by a very thin margin. It ended with $1.2m, representing a change of about -0.5% from last week. Instead, it was our second placed affiliate which exploded upwards, rising more than threefold for a gross $1.1m. A final positive note is that the shift count for all of our top 5 affiliates increased, with the highest recording a change greater than 100%. This is a telltale sign that users are shifting more across the board.

All together, our top affiliates represented 22.8% of our weekly volume, just 0.2% higher than last week’s proportion.

That’s all for now. Thanks for reading and happy shifting.