SideShift.ai Weekly Report | 7th - 13th January 2025

Welcome to the one hundred and thirty-sixth edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

This past week, XAI showcased strong upward momentum, trading within the 7-day range of $0.1396 to $0.1655. On January 9th, 2025, the price surged past $0.16 in a sharp upward move before settling into a steady consolidation near the upper end of its range, ultimately closing at $0.1655. At the time of writing, it holds a price of $0.1655 with a market cap of $23,789,423, marking a significant rise of +19.2% compared to last week's $19,953,214.

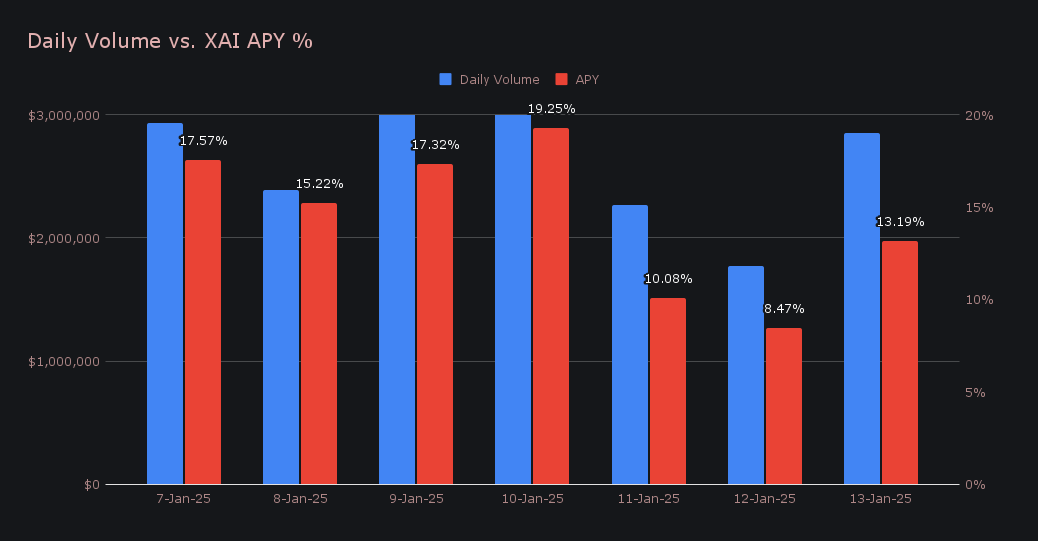

XAI stakers earned an average APY of 14.44% this week, with a daily rewards high of 61,978.78 XAI (an APY of 19.25%) being distributed directly to our staking vault on January 11th, 2025. This peak aligned with a daily volume high of $4.3m, reflecting the strong connection between heightened platform activity and staking rewards. Altogether, XAI stakers received a total of 330,986.78 XAI or $54,534.66 USD in rewards throughout the week.

An additional $100k USDC was sent to SideShift's treasury over the course of the week, bringing the current total to a value of $21,907,521. Users can follow ongoing treasury updates directly via sideshift.ai/treasury.

Additional XAI Updates:

Total Value Staked: 128,860,650 XAI (+0.5%)

Total Value Locked: $21,484,003 (+16.6%)

General Business News

This past week, the crypto market faced renewed pressure as the total crypto market cap slipped to touch its lowest level seen throughout the past 30 days. BTC dipped toward $90k before then recovering +5% to trade around $96k at the time of writing, with BTC.d holding firm as altcoins suffered steeper losses during the pullback. Meanwhile, the Fear and Greed Index fell to 46/100, a level last seen three months ago before BTC’s surge to $100k, and one that reflects growing caution amid the yoyo-ing market.

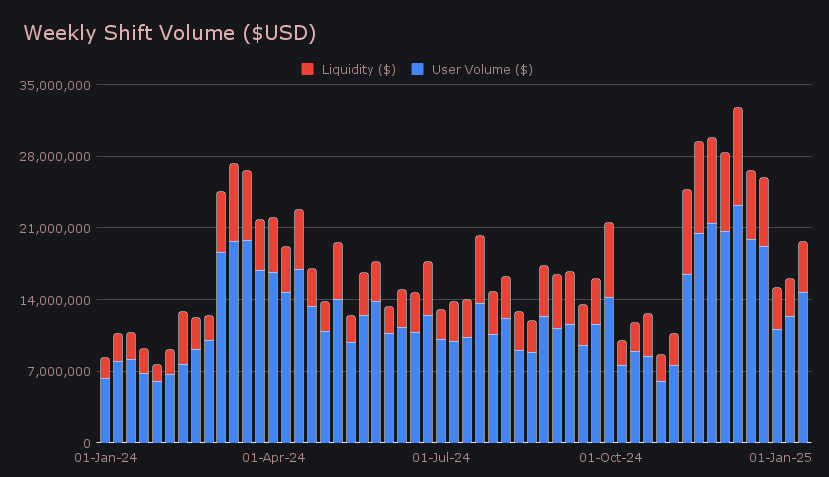

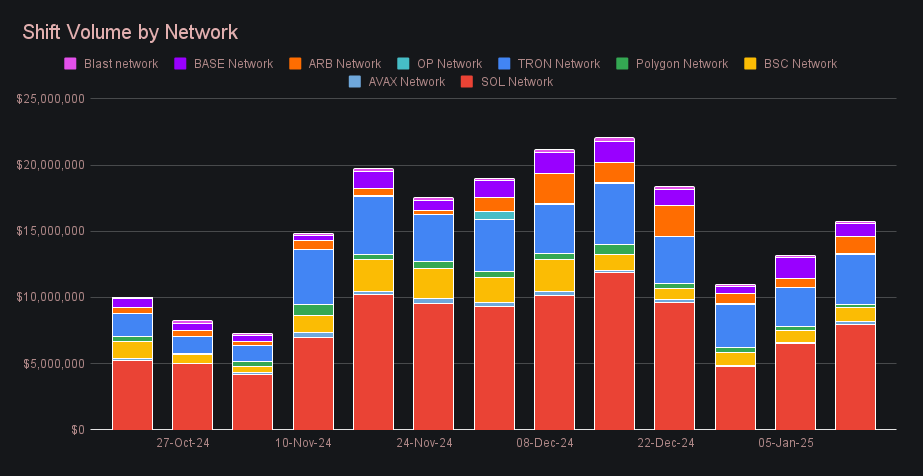

Last week saw SideShift record a notable gross weekly volume of $19.7m, marking a +23.1% increase from the previous period. This rise extends the ongoing growth trend, as our weekly volume has now climbed in consecutive weeks since New Years. This week’s breakdown came from a user shifting volume total which contributed $14.8m (+20.1%), while liquidity shifting grew at a faster rate and added a further $4.9m (+33.5%). A solid portion of this user shifting continues to stem from SOL, and particularly on the demand side, with ETH/SOL standing out as the top user shift pair for the second straight week with $766k. BTC/USDT (ERC-20) followed closely with $631k.

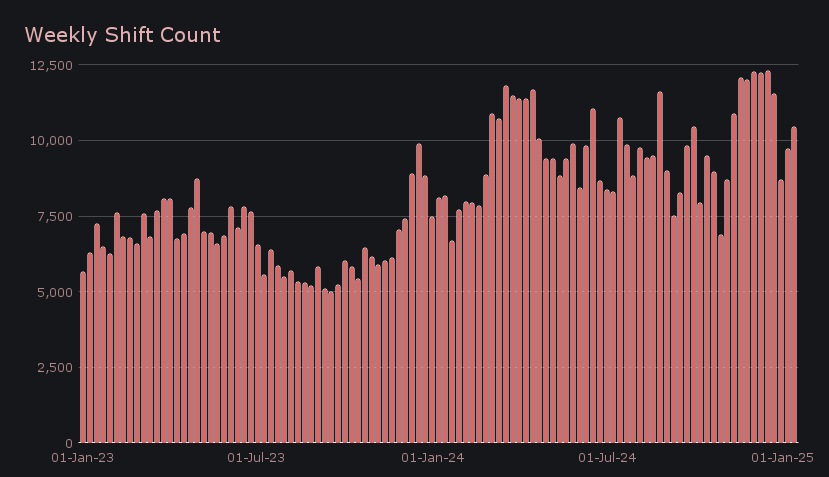

SideShift’s weekly shift count also saw a meaningful rise, reaching 10,447 shifts (+7.6%), regaining the significant 10k shifts per week milestone. This figure combined with our weekly volume to achieve healthy daily averages of $2.8m in volume across 1,492 shifts, highlighting the platform’s steady upwards trajectory to begin the year. This fact that this general uptick has unfolded despite oscillating price action showcases that a volatile market sets perfect conditions for SideShift.

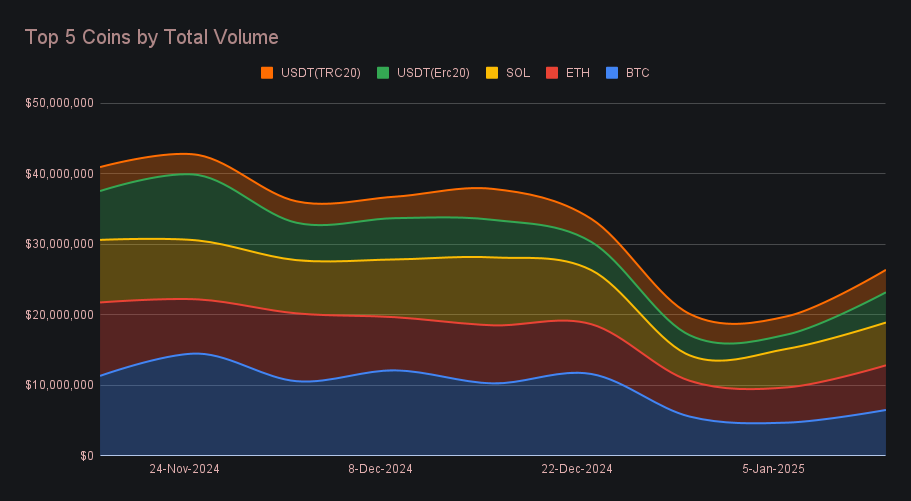

BTC reclaimed the top spot this week with a total volume of $6.5m (+38%), its highest weekly total since the holidays, though it displayed far less dominance than in previous peaks. Notably, this week’s second and third-placed coins followed closely, both finishing within just 8% of BTC’s total volume (deposits + settlements), signaling an increasingly competitive race for the top spot. Supporting its lead, BTC saw deposit volume surge to $3.0m (+61.2%), while settlements grew at a steadier pace of +11.7%, ending at $2.2m.

ETH ended just shy of the top spot with a total volume of $6.3m (+26.5%), marking a notable improvement from last week. User deposits grew to $2.5m (+6.9%), while settlement volume saw an even greater increase to $2.4m (+39.9%), indicating a very balanced flow of ETH shifting on the platform. Steady increases in user deposits continue to reinforce ETH’s relevance on SideShift, though its overall momentum remains challenged by the recent surging interest in SOL.

SOL secured third place with a weekly volume of $6.1m (+10.7%), maintaining its remarkable consistency in SideShift’s top three over recent months. While deposit volume dipped slightly to $2.0m (-5.8%), its settlement volume rose to $2.7m (+12.2%), and secured the title of the most demanded coin on SideShift for the second straight week. SOL’s recent popularity remains undeniable, having outperformed ETH in terms of total volume in six of the past eight weeks.

Following SOL’s strong performance, its impact extended to stablecoin activity on the Solana network, with USDC (SOL) shifting enjoying a +74% increase to finish the week with a gross $1.7m, ranking sixth overall. However, this was overshadowed by an even more striking +111% surge in USDT (ERC-20) volume, which ended with $4.3m, solidifying its position as the most shifted stablecoin on SideShift. In fact, nearly all stablecoins experienced a boost, collectively adding $1.1m to their combined total. Notable standouts included USDT (TRC-20) with $3.2m (+23.1%), USDC (ARB) with $807k (+90.4%), and USDT (BSC) with an impressive $585k (+134.5%). Stablecoins accounted for 44.9% of all shifts this week, up from 38% last week, thanks to increased shifting activity across a variety of networks this week.

Alternate networks to ETH combined for a total of $15.7m this week, increasing by +19.9% and once again surpassing the ETH network, which recorded $10.4m (+24.1%). The Solana network led the pack with $8.0m (+21.6%), cementing its position as the top alternate network for yet another week. The Tron network followed in second with $3.8m (+28.8%), while the Arbitrum network delivered the most impressive change of any network, surging to $1.3m (+82.0%) thanks to the aforementioned rise in USDC (ARB) shifts. In contrast, Base and Polygon saw declines, ending at $1.0m (-32.6%) and $254k (-11.2%), respectively. However, these were two of the only alternate networks to record declines, representing mostly healthy increases across the board.

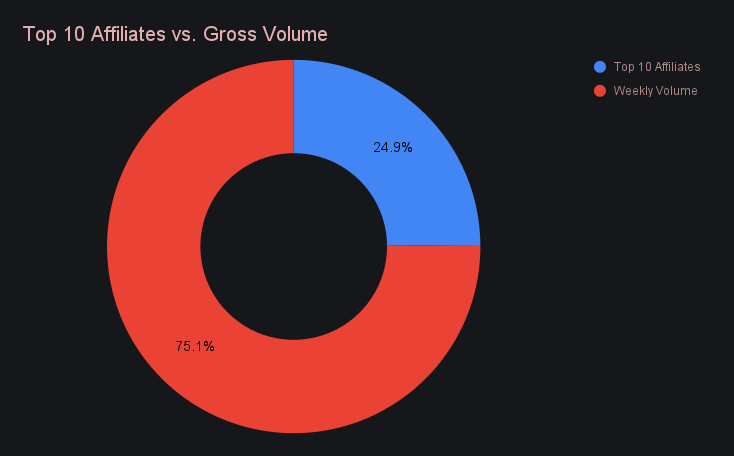

Affiliate News

This week, our top affiliates contributed a combined $4.9m (-2.3%) in shift volume, maintaining a relatively steady performance. However, as SideShift’s site volume increased, their combined proportion of the total fell to 24.9%, down from last week’s measure of 31.2%.

Our first-placed affiliate led the way with $2.3m (-18.7%), retaining the top spot despite a dip in performance. Meanwhile, our second-placed affiliate showed strong growth, climbing to $973k (+72%), and our third-placed affiliate rounded out the leaderboard with $507k (-24.1%). Despite this drop in volume, our third placed affiliate continues to be a steady source of shifts, contributing a solid total of 1,172 shifts (+7.3%) this week.

That’s all for now. Thanks for reading and happy shifting.